ES Futures: Upcoming Mag 7 Earnings and NFP Report

This week, although there was not much market-moving macro newsflow over the weekend, we are approaching month-end. In addition, several key catalysts are on the horizon, including earnings from the Magnificent 7 and the release of Non-Farm Payrolls (NFP) data, which typically arrives on the first Friday of the month.

The Federal Reserve is currently in its blackout period ahead of the interest rate decision scheduled for May 7th, 2025.

As part of our process, we will be reviewing technical levels and drawing a plan based on current market structure. ES futures are currently trading above the March 2025 lows. A “death cross” — where the 50-day moving average crosses below the 200-day moving average on the daily timeframe — was recently observed. This pattern is commonly touted by analysts as a bear market indicator.

However, in a macro-driven environment, this could potentially be a false signal.

Key Levels:

• mCVAL: 5622

• Upper Neutral Zone: 5620 -5585

• March 2025 Low: 5533.75

• 2022 CVAH: 5384.75

• Lower Neutral Zone: 5171.75 -5150.75

Our scenarios are as follows:

Scenario 1: Range-bound price action

A P-shaped micro composite profile suggests resistance at our neutral zone. It is labeled neutral because the price is trading above the March 2025 lows. However, if the level above acts as resistance, we expect further range-bound price action. Markets may trade below the mCVAL for further price discovery and potentially establish a new short-term range, with the 2024 lows acting as downside support.

Scenario 2: Mag 7 and NFP as bullish catalysts

Four of the Magnificent 7 companies are reporting earnings this week. The Mag 7 collectively represent around one-third of the S&P 500 index by market capitalization. Microsoft and Meta are scheduled to report on Wednesday after the close, while Amazon and Apple report on Thursday after the close.

On Friday, the NFP data will be released. This could serve as a fundamentally net-positive catalyst for U.S. markets, especially in light of recent shocks that have weakened sentiment.

In this scenario, we will be closely watching our neutral zone and mCVAL as potential areas to initiate long trades.

Glossary Index for all technical terms used:

Blue Zones: Neutral zones.

C: Composite (prefix before VAL, VAH, VPOC, VP, AVP)

mC: micro-Composite (prefix before VAL, VAH, VPOC, VP, AVP)

VAL: Value Area Low

VAH: Value Area High

VP: Volume Profile

CME_MINI:ES1!

Weeklyoutlook

21/04/25 Weekly OutlookLast weeks high: $86,492.19

Last weeks low: $83,112.72

Midpoint: $84,802.45

Is the market finally showing its hand?

After President Trumps escalation of the tariff trade war, BTC saw huge volatility swings in line with Tradfi, the panic led to de-risking and as a result BTC hit $74,500. Then after a small bounce another revisit of the exact same area resulted in a much more substantial reversal back up into the $80K's. A double bottom and rally despite the tariff situation ongoing suggests huge support/strength in that area on the HTF, I am now satisfied that BTC has closed the area of imbalance caused by the US election pump, confirming support. This event also coincided with SPX bouncing off the 1D 200 EMA.

Since then Bitcoin has rallied back to the upper limit of the downtrend channel (see my previous posts on this structure) which also has the 4H & 1D 200 EMA placed there. For a bullrun to sustain itself these moving averages are important to maintain momentum, time spent under these MA's kill the bullish trend and weaken sentiment around the move.

Last week we saw a very tight trading range of only 4%, that is compared to 15.4% the week previous. My theory was that this compression of price around a key area (4H & 1D 200 EMA + trend channel high) leads to a much bigger impulse move, the only question was in which direction?

The minute the weekly bar closed BTC exploded above both of these MA's and out of the downtrend, so it looks like the question is answered when it comes to direction of the impulse move. The next question is, will it stick?

I do find the timing of the move somewhat suspicious as the majority of Europe are on a public holiday, could this be a MM taking advantage of thin order books? the SPX pre-market is fairly neutral and so I believe tomorrow will tell the true story of where BTC really is.

Market Insights with Gary Thomson: April 14 - 18Market Insights with Gary Thomson: UK & Canada Inflation, BOC & ECB Rates, Corporate Earnings

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

- UK’s Unemployment and Inflation Rates

- Inflation Rate in Canada & BOC Interest Rate Decision

- ECB Interest Rate Decision

- Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

14/04/25 Weekly OutlookLast weeks high: $86,116.94

Last weeks low: $74,520.92

Midpoint: $80.318.93

Did we truly think it would be easy? As Trump targets China the markets panicked in a huge de-risking event that sent BTC down to $74,500, fully retracing the Us election pump 6 months ago. After a double bottom and a tariff pause for 90 days on those countries that played ball, BTC reclaimed the previous weeks bottom and steadily climbed back toward major resistance at $86,000.

Clearly the focus has primarily been on traditional markets like the SPX & DJI, on the SPX the 1D 200 EMA tagged and as usual gave huge support, this is very often a local bottom and so far that is the case. BTC has very quietly flipped the 4H 200 EMA after the 10th time of trying, staying above the $84,000 level would be a confirmed reclaim if the trend can follow and flip bullish. If that is the case then it would seem the flush we've all been dreading is over, however, if Trump escalates the trade war once again then TA takes a back seat to FA once again.

This week I would like to see strong support at 0.75 line, a wick down to that level and a reclaim of the 4H 200 EMA would give me confidence that BTC can target the $91K mini range top. A loss of the 0.75 line and acceptance below I would then target weekly lows once again for a triple bottom.

07/04/25 Weekly Outlook Last weeks high: $88,502.90

Last weeks low: $77,786.89

Midpoint: $83,144.89

Never a dull moment in this game, last week we saw a relatively flat move from Bitcoin as traditional markets continued their heavy sell-offs thanks to the tariff trade war. The high of the week coming from the run up to Trumps tariff announcement, that then retraced as the speech went on and as the week closed a heavy capitulation move down.

As the week begins BTC's price hit as low as $74,500 barely frontrunning the HTF goal of $73,500 to close the inefficiency wick from the US election 6 months ago. For me this is where I start to pay attention to where buyers may be stepping into the market at this HTF support area. Obviously the worry is still in Tradfi, just how low will the SPX, DJI etc go? That's hard to tell but there is certainly a huge amount of fear in the market and fear brings opportunity.

The NY open should be an interesting one and should set the tone for the week, A reclaim of the weekly low sets up yet another SFP long opportunity to then go and test the midpoint, acceptance under the weekly low may provide one last push to close tout the move to $73,000.

The Federal Reserve is having am emergency closed board meeting today too, if an emergency cut to interest rates comes of this to boost growth then BTC will definitely see the benefits of this.

Good luck for the week ahead!

Market Insights with Gary Thomson: April 7 - 11Market Insights with Gary Thomson: FOMC Minutes, US Inflation Rate, US PPI, Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

- FOMC Meeting Minutes

- US Inflation Rate

- US Producer Price Index

- Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Market Insights with Gary Thomson: 31 March - 4 AprilMarket Insights with Gary Thomson: RBA Rates, US and Canada’s Employment Data & Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

- RBA Interest Rate Decision

- US Nonfarm Payrolls and Unemployment Rate

- Unemployment Rate in Canada

- Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

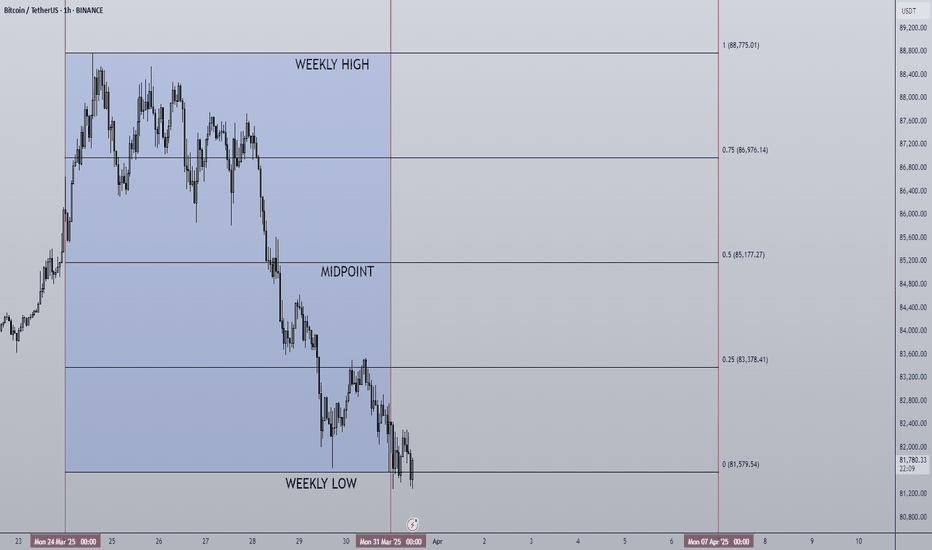

31/03/25 Weekly outlookLast weeks high: $88,775.01

Last weeks low: $81,579.54

Midpoint: $85,177.27

As Q1 2025 draws to a close, last week we saw a mirror image of the March 17th week with a swing fail pattern of the weekly high and a gradual sell=off throughout the week.

The reluctance for buyers to step into the market under the $91,000 resistance is telling me that the bulls are just not confident in current market conditions to bid into resistance. This may be because of the Geo-political factors, ongoing war, tariffs etc. Uncertainty does worry investors and so it's a valid reason.

From a TA standpoint however is a bigger worry in my opinion. Bitcoin failed to flip the 4H 200 EMA after the 8th time of trying since mid February and that is the biggest concern for me. As long as this moving average caps and reversal pattern then the trend is still bearish and should be treated as such.

$73,000 is still the target for a downward move IMO, a further -10% move from current prices. For the bulls a SFP of the weekly low could set up another bounce to weekly highs that have remained in approximately the $88,000 zone for two straight weeks. Major resistance around those levels and of course the dreaded 4H 200 EMA must be flipped too. Currently this is a tall order given how price action has been of late, sentiment is poor and altcoins are completely decimated in most cases. So I can't see the majority wanting to buy in until these criteria are met and we're trading back above $91,000.

This is still a traders environment, not a Hodler/investor.

Market Insights with Gary Thomson: 24 - 28 MarchMarket Insights with Gary Thomson: UK & US Inflation, US Durable Goods Orders, and Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

- UK Inflation Rate

- US Durable Goods Orders

- US PCE Price Index

- Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

24/03/25 Weekly outlookLast weeks high: $87,453.65

Last weeks low: $81,140.91

Midpoint: $84,297.28

Great weekly close for the bulls! A reclaim of the weekly high in the dying hours of the week is a huge win and has spurred on an early run for the weekly high.

The overall goal for this move should be $91,000 in my opinion, and a must not lose area is $86,000 or 0.75 line/ last weeks weekly high.

What happens at $91,000 is yet to be determined and I have an idea many will be tentative around that area. On the high time frames a reclaim of this level unlocks the capability to retest the highs from a TA standpoint as price re-enters the range bound environment. A rejection of that level would make a $73,000 retest a very real possibility.

In terms of altcoins we're seeing some strength returning with some strong gains but relative to their sell-offs it is a a drop in the ocean so far. Currently the market conditions are a traders dream but a long term investor/holders nightmare. No major news is planned to come this week so unless something drastic happens TA should be the driving factor this week.

Market Insights with Gary Thomson: 17 - 21 MarchMarket Insights with Gary Thomson: Canada’s Inflation, Fed and BoE Interest Rates, Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

— Canada’s Inflation Rate

— Fed Interest Rate Decision

— BoE Interest Rate Decision

— Corporate Earnings Reports

Don’t miss out—gain insights to stay ahead in your trading journey.

🌐 FXOpen official website: www.fxopen.com

CFDs are complex instruments and come with a high risk of losing your money.

17/03/25 Weekly outlookLast weeks high: $85,306.40

Last weeks low: $76,622.98

Midpoint: $80,964.69

It's FOMC week again! Last week it was CPI week and inflation numbers came in under forecast signaling the Tradfi market sell-off and implementation of tariffs have at least had a positive impact on the consumer price index, a 2.8% print 0.1% lower than forecast. As this relates to FOMC the forecast is a non mover with interest rates staying at 4.5%.

However this does not necessarily mean that FOMC will be a non event in terms of the markets, volatility is always expected and with a suspected Trump insider opening a $380m 40x short position on BTC with a liquidation price of $86,600. I expect this price to be hit at some point this week purely because CT is targeting this account that has had a perfect 8/8 trade record to stop hunt it, I think FOMC could proved the volatility to do it.

The general structure of BTC as a whole despite this stop hunt narrative is bearish, after losing $91k support and a retest confirming the level as new resistance structurally it makes sense to revisit FWB:73K to retest it as support. This would be horrible for the broader altcoin market that has suffered greatly so far this year but it would eliminate the need to fill the FVG in the future.

This week I am keeping a close eye on that stop hunt and FOMC as I feel that will dictate if we retest $91K or $73K.

10/03/25 Weekly outlookLast weeks high: $93,745.25

Last weeks low: $80,029.90

Midpoint: $86,887.58

Last week in crypto saw the first White House Digital Assets Summit. An event that only as recently as the last bull cycle we could only dream of taking place. In the summit that hosted the biggest names in the space a vow was made by the US Gov never to sell their BTC, to establish stablecoin regulatory clarity and to stockpile various US made altcoins. A historic moment but how did that relate to the chart?

Well BTC dropped 14.6% from weekly high set at the beginning of the week to weekly low set at the end of the week. The most important aspect is how this now looks on the higher time frames, the once strong support level of $91K has now been confirmed as new resistance as BTC tried several times to reclaim it and in the end fell away. This now puts BTC in the FVG area from $91-73K. With no real support until the $73,000 level this is knife catching territory and with the SP:SPX rolling over too I would need a lot more evidence that BTC will turn around before going long with any real size.

This week I anticipate further sell-off, now I would be happy to be proven wrong on that however it does look like we are heading towards FWB:73K where I would like to see buyers stepping up and start to dominate the orderbooks. Structurally that would fill a large inefficiency area with an eye to bounce off support and move back towards currently levels ~ GETTEX:82K as that would be the midpoint of the FVG although that is a few steps in the future.

CPI takes place this week and so volatility may be expected but unless the result is wildly different to the forecast numbers the whipsaw PA should level out fairly neutral.

Invalidation on this idea would be a successful reclaim of $91K which is previous mini range low & 4H 200 EMA resistance.

Market Insights with Gary Thomson: 10 - 14 MarchMarket Insights with Gary Thomson: US Inflation Rate and Producer Price Index, BoC Interest Rate

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode, we discuss:

— US Inflation Rate

— BoC Interest Rate Decision

— US Producer Price Index

Don’t miss out—gain insights to stay ahead in your trading journey.

🌐 FXOpen official website: fxopen.com/

CFDs are complex instruments and come with a high risk of losing your money.

USD | USD INDEX Weekly FOREX Forecast: March 10 - 14thIn this video, we will analyze the USD through the USD INDEX (DXY). We'll determine the bias for the upcoming week, and look for the best setups to take.

The USD is bearish, and there is plenty of economic news coming up this week. Should be plenty of opportunities from Tues through Friday.

Short term bullishness, in the form of a pullback, is potentially there. But longer term bearishness is likely to continue.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

03/03/25 Weekly outlookLast weeks high: $96,500

Last weeks low: $78,297.13

Midpoint: $87,398.56

What a week! In my last weekly outlook I proposed the idea that BTC was coiling up for a big move, the question was "which direction will the move be?" Well we got our answer, after, multiple weeks hovering around the $96K level bitcoin sold off a massive 18% to a low of $78.2k. This sell-off broke the weekly support area of $91K after a full 3 months of holding.

Now that we answered last weeks question I propose a new one, is $91K now a HTF resistance level? To answer that question a look at the weekly chart, despite such a severe sell-off this is not unusual in a bull market, 25-25% corrections happen multiple times during a large bullish trend. To add to that, the weekly close still managed to be above the $91K mini range floor, in essence a giant SFP on the weekly candle and therefore a continuation high would make sense from a TA point of view.

For the bulls the worry would be the inevitable backfilling of the wick on the weekly, for me this comes into play if we have acceptance back below $91K, entirely possible.

On Friday 7th March President Trump is holding a Cryptocurrency summit at the white house, this will include David Sacks (crypto & AI czar), Founders, CEOs and members of the digital assets group. This comes off the back of confirmation of the "Crypto Strategic Reserve" that will contain BTC, ETH, SOL, XRP & ADA and was announced yesterday. I do not believe in coincidences so the timing of this is very interesting to me, to announce this on a weekend with very thin orderbooks and low volume after such a big sell-off had to be done on purpose IMO. The timing would guarantee a swift rally, I also believe the sell-off could be related to this announcement too, if a market maker like the US government has the means to create a more optimal entry, they will do just that.

I could see the market being very cautious up until Friday, the $91K is a key S/R level and will determine if bitcoin backfills the weekly wick or moves up to weekly high.

24/02/25 Weekly outlookLast weeks high: $99,474.13

Last weeks low: $93,399.17

Midpoint: $96,436.65

Fear & Greed Index: 49

Despite dull price action there is never a dull moment in crypto... BYBIT exchange was the victim of the largest crypto hack in history with $1.4B worth of ETH being stolen.

How does this event relate to price? On the grand scheme of things not much, which is surprising but what this sell-off does in terms of structure could be much more harmful IMO. Just as ETH broke through a key S/R level of $2780 the hack occurred sending ETH back under that level and a market sell off due to fear and risking-off. Had Ethereum accepted above that key level structurally the setup looked primed for a move to $3200. Not only that but BTC has broken above weekly high and looked to flip the 4H 200 EMA. These levels are so important to both coins and the timing of the hack cannot be understated.

Looking at this weeks chart we find ourselves in the same spot for the 3rd week in a row, $96,000 has been the starting point and midpoint emphasizing the choppy nature of the market and compression of price. The question is which way will BTC expand once this trend breaks, to the upside or to the downside?

17/02/25 Weekly outlookLast weeks high: $98,823.86

Last weeks low: $94,093.81

Midpoint: $96,458.84

Not a whole lot to comment on for this weekly outlook, we had a tighter weekly range last week ( EUROTLX:4K instead of $11K) however the midpoints were both $96K and both weeks started at their respective midpoints. For me this suggests a coiling of bitcoins price with anticipation for a larger move in a given direction, this could be either bullish or bearish we are yet to see.

Since last weeks CPI inflation print of a hotter than forecast 3.0%, a dollar that is finally rolling over and tariffs put on hold until April 1st, these factors should all play into the hands of the bulls but the chart needs to reflect this.

For this week I am anticipating more chop, if the pattern of tightening weekly ranges continues with no real idea of direction then the opportunity for credible trades reduces until we get an idea of trend direction. Right now there is no trend direction and so bitcoin should be treated as such.

Altcoins continue to suffer across the board and IMO this will not change until we see a bullish move in BTC. This environment is for short term traders as it stands.

10/02/25 Weekly outlookLast weeks high: $102,496.97

Last weeks low: $91,204.00

Midpoint: $96,850.48

Another week of Bitcoin within the range and another one begins. With a very familiar low of ~$91K holding for the 10th week running (since the end of NOV '24), with a weekly high of $102,500 (last weekly outlooks midpoint) capping off the highs, will this weeks midpoint also act as the pivatol level? So far the midpoint has been reclaimed, a retest should add confluence to this.

We have a midweek CPI data release with a forecast 0.0% change remaining at 2.9%. These data events often cause LTF volatility and so that should be taken into account, the same is true for PPI on Friday.

Currently the market sentiment is pretty dire, the fear & greed index is at 43, the lowest since before the US Presidential Election.

Altcoins are struggling across the board, with the exception of some CEX coins all large-midcaps are below the 4H 200 EMA. I think that will change if BTC has a strong rally back above the weekly high and reclaims it, that will give the bulls the chance to finally break the $106K brick wall and flip from a rangebound environment into a trending environment again, altcoins would rally very well if this were to happen.

On the other hand is the midpoint is lost then the weekly low will need to hold for the 11th week running.

Good luck traders!

03/02/25 Weekly outlookLast weeks high: $106,485.24

Last weeks low: $100,995.99

Midpoint: $95,506.74

As the US begins a tariff trade war on the world, BTC ends the previous week with a weekend selloff back into the range low of $91,000. Despite the crypto world being everchanging this range low level has held strong for nearly 3 months now.

Because of this strong support level we have seen many weekly outlooks follow the pattern of an early break below weekly low, then reclaim and rally back up the range throughout the week. Could this be the case once again?

Currently sentiment is terrible, probably bear market levels of depression despite Bitcoin being above $100K most of the time. I think this is largely due to the state of altcoins as they are at pre-US election lows, in some cases bear market levels... This plays havoc mentally which so much was promised in terms of alt season potential now that Bitcoin is a new highs. In reality the market will do what hurts the most, max pain.

Having said that, generally a weekend dump can be misleading due to low volume and the absence

of institutional buying making any manipulated move much easier to pull off from a market makers point of view.

There are some nice 4H TF setups emerging, now the macro environment is definitely calling the shots in the Tradfi world but as long as the $91,000 holds the rangebound move is still in play.

Market Insights with Gary Thomson: 27 - 31 JanuaryMarket Insights with Gary Thomson: BoC, Fed & ECB Interest Rates, PCE Price Index, Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode:

- BoC Interest Rate Decision

- Fed Interest Rate Decision

- ECB Interest Rate Decision

- US PCE Price Index

- Corporate Earnings Statements

Don’t miss out—gain insights to stay ahead in your trading journey.

🌐 FXOpen official website: www.fxopen.com

CFDs are complex instruments and come with a high risk of losing your money.

27/01/25 Weekly outlookLast weeks high: $109,555.48

Last weeks low: $99,643.66

Midpoint: $104,599.57

A new Bitcoin ATH as President Trumps second term officially begins! Just shy of $110K with a much tighter range of $10k from range low to high leaves Bitcoin in a very interesting place going into what has been called the first "pro-crypto" administration.

Now the weekly close is an interesting one as there is a clear sell-off that has continued at time of writing bringing the price down below the weekly low. This has been a common theme in recent weeks as either a bearish SFP of the weekly high early in the week resulting in a sell-off for the remaining days. Or the opposite were a sweep of the weekly low early on results in a recover rally for the rest of the week. As of right now the later is in play but what is causing this sell-off this time?

The AI issue:

The recent headlines have been that the US wants to win the AI war and be the dominant force in what is possibly the most important product of the future. OpenAI, Grok, Meta etc all have AI products and services and the US government hope that by backing these companies the US can be the victors of this race. However, the game has changed with the release of "DeepSeek R1" a chinese AI competitor with some remarkable attributes that has the US stock market very worried as reflected in the pre-market.

DeepSeek R1 was reportedly built for $6m, now this is a Chinese company and therefor any numbers should be taken with a pinch of salt but OpenAI has raised $17.9B for ChatGPT and many now see DeepSeek as a superior product in many ways:

- Less GPU intensive due to a more efficient and streamlined model, this is mainly why NVIDIA pre-market is down 11% at time of writing, investors are seeing that perhaps US companies have overblown the demand for GPU's as the product they are making is not optimised in comparison.

- Considerably cheaper due to this streamlined approach, personally this is a symptom of how America has been operating as a nation since the pandemic, a severe lack of efficiency made up for by throwing insane amounts of capital at the problem with no thought as to where the money comes from (printed via QE & tax payer funding). DeepSeek just proved why Trumps planned approach of getting value for money and increasing efficiency is a winning formula, anything else is unsustainable.

- Open source code, we would expect the company called OpenAI that was founded on the basis of transparency and the mission to do good as a non-profit would be the product that has publicly available code, but no that would be DeepSeek... This further compounds just how out of touch the US based AI companies have got, the quest for revenue has taken over as the mission goal, which in the case of AI is very dangerous.

To conclude the AI problem, the Chinese AI product is cheaper, more efficient and more transparent that current US based products and that is why indirectly BTC took a tumble.

On the data news this week FOMC is on Wednesday, the forecast is for interest rates to remain unchanged however the volatility of FOMC often leads to interesting price action, this could be another reason for the sell-off as de-risking takes place.

For this week I am looking at using the chaos to find goo d long entries, I still think that Feb-March looks good until I have reason to think otherwise. Weekly low is a key S/R level that will determine by bias in the short term until then.

TL;DR

- DeepSeek R1 worrying investors of US AI companies as the Chinese AI product is far cheaper, more efficient and more transparent. US stocks down on pre-market.

- FOMC midweek, first of Trump admin, volatility expected.

- Weekly low key S/R level for BTC

20/01/25 Weekly outlookLast weeks high: $106,467.97

Last weeks low: $89,292.15

Midpoint: $97,880.06

The Trump era begins...

January 20th 2025 is the date in which America sees its new Republican administration take office. An administration that has promised to embrace crypto instead of demonise it, one that wants the future of crypto to be built in the US, so far Trumps picks for SEC chairman and other important related roles have reflected that pro-crypto belief.

However, launching a $TRUMP memecoin and the subsequent $MELANIA memecoins just moments before inauguration in my opinion is a very bad start. Not only did the launch of TRUMP draw out liquidity from the altcoin market, it also damages the broader market just from an optics point of view. The general publics perception of crypto is it's full of scams, pump and dumps etc so to try and change the general publics mind the answer is to... Launch a memecoin...

Now I'm fully aware Donald Trump himself probably has very little to do with this, just like most celebrity memecoins but I just don't see how this is a positive start for the administration in proving their pro-crypto stance.

Bitcoin did have its highest weekly close of all time @ $106,500, which was $2000 higher than the previous ATH. +20% move from weekly low to high in anticipation for the potential Bitcoin strategic reserve announcement. Avoiding a SFP similar to that of week commencing January 6th will be a priority for BTC, we are in a rangebound environment so a SFP can have the potential to drop back down and undo a lot of the previous weeks progress. Until BTC breaks the rangebound environment and begins a trending move I will treat it as such.

For this week I'm keeping a close eye on the Liberty Financial portfolio (ETH,AAVE,LINK,ONDO,ENS) & US based majors (SOL,SUI,AVAX, ADA, STX,INJ) etc. The play is definitely coins that will be directly influenced by this new US administration, at least for now I cannot see any liquidity go towards any other coins for the time being.