BitCoin - Is it heading for the Fib?This is a classic Entry Short for Weis Wave with Speed Index owners called " Exit from Range with a Plutus Signal" and in this case it was a PS. It looks that it's heading for the Fib, I will wait for some pullback on 1HR to confirm with Speed Index and the waves, as well as getting a better RR.

I

Weiswave

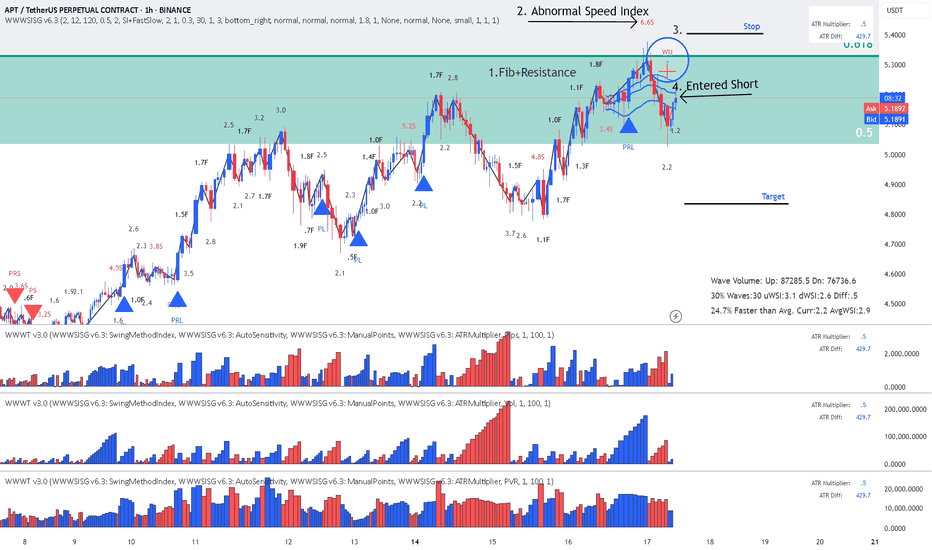

BNB Binance Coin: Lesson 15 methodology did the job again

Lesson 15 methodology (annotations in sync with the chart):

1. Largest up volume wave after a while - sellers might be in there.

2. Placed AVWAP and waited for price to cross downwards and pullback again on AVWAP

3. HTMU (hard to move up) - Abnormal Speed Index 4.6S at the top

4. Entry short signal PRS with abnormal SI 4.8.2 (price has a hard time to move up - absorption)

Simple as that. Enjoy!

TRX - Double signal short Wyckoff Up-Trust + PRS Reading the chart (annotations in sync with chat):

1. Largest Up volume wave

3. Resistance Level coming from Daily chart

3. Fast Up Wave (could be fake)

4. Placed AVWAP on fast wave and

5. Our Entry: Double Plutus signal after the retracement Wyckoff Up- Trhust + PRL

Enjoy reading the waves , speed index and Plutus signals.

ADA- Cardano - Classic Exit from Range with Plutus signalReading the chart :

AVWAP acted as resistance and we started ranging.

This is a classic entry long for the "SI traders" called Exit from Range with a Plutus signal and in this case it was the PRL signal.

ADA is heading for a major Fib I will not advise any entries now.

Enjoy wave and speed index reading!

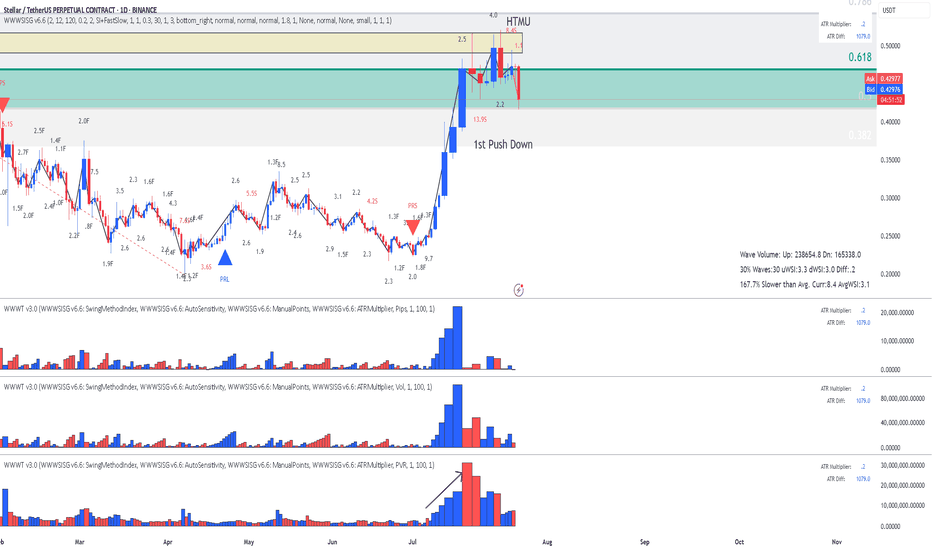

XLM - Stellar - Possible Short coming up - This is Why?Reading the chart (annotations in sync with chart):

1. Location: Fib over-shoot - possible sellers

2. Largest up volume - possible sellers in there

3. Mountain shape PVR - increasing volume as wave progress

4. Abnormal SIs at top (could be closing positions but it also could be sellers absorbing buy orders.

Risky Entry but with better RR enter now. stop above tops, target blue AVWAP

Conservative Entry with worse RR: wait for the break downwards of red AVWAP, target blue AVWAP.

Enjoy, wave and speed index reading!

LTC - Litecoin - After the Short the LongAfter the short Signal on the AVWAP line we found buyers at the bottom.

1. PVR mountain shape is the first indication that buyers are coming in.

2. Abnormal SI 5.6 is what I call 1st Push Up.

Finally the entry Plutus signal PL.

You should be careful now because we are crossing Fib 61.8, get you profits sellers might be in that high volume bar. The reaction later waves will be indication if we are going to continue or reverse.

Enjoy Trading the Volume Wave and Speed Index!

ADA - Cardano - Long - Classic Exit from Range with PRLThis is one of my classic trading strategies called "Exit from Range" with Plutus signal and in this case it was a PRL.

Entered Long on the Exit from range, put my stop and hopping that we might cross Fib. When price reached Fib moved my stop a bit above breakeven to compensate on brokers fees and now we are running a free trade. Currently sellers did show up on the Fib , but let's see who is going to win!

Enjoy!

XLM Stellar - Classic Lesson 15 said Long Lesson 15 methodology (annotations in sync with the chart):

1. Support (this where buyers can come in)

2. Largest dn volume wave after a while - Look left - buyers came in previously at the same location.

3. Placed AVWAP and waited for price to cross upwards and pullback again on AVWAP

4. Entry signal PRL with abnormal SI 11.2 (price has a hard time to move down - absorption) after the pullback and that's our entry.

Enjoy!

SHIB - Lesson 15 this is how to read the chartUsing Lesson 15 to read the chart (annotations in sync with chart):

1. Support (coming from daily chart)

2. Largest down wave (buyers could be in there)

3. Placed AVWAP wait for the price to cross upwards and pull back

4. PFBL Long signal on the pull back and up we go

Enjoy !

AAVE - Lesson 15 said Long and the pull back another LongReading the chart using Lesson 15 and Exit from Range methodology (annotations in sync with the chart)

1. Fib Location (buyers might enter)

2. Largest down volume wave (potential buyers in there) - Placed AVWAP at the beginning of the down wave wait for price to cross upward and pullback

3. Entry Long with PRL signal - first target fib closed with profit

4. Fib was reached and pull back started

5. PRL long on AVWAP acting a resistance

6. This my last Entry using strategy Exit from Range with a Plutus signal.

This is a risky Long since we are on Fib area, but I will take the risk.

Enjoy!

DodgeCoin - Speed Index is telling me ShortReading the chart

1.Location: Fib + touch AVWAP low

2. Speed Index numbers at top on the High side (red numbers) which means Hard to Move Up.

3. PRS Short signal

4. If we do not get stuck into range and break it downwards , it's Short!

Enjoy! Reading the chart with Speed Index!

Wyckoff Up-Thrust - This is how to identify using Speed indexClassic Wyckoff Up-Thrust formation, this is how to read it using Speed Index (annotations in sync with the chart):

1. Fib Area - this is where sellers might come in

2. FU - Fast Up wave with SI 0.4F

3. Next up wave with an abnormal SI of 1.0S while the average speed at 0.5, which means price has a hard time to move up (more sellers on the up move). Following the up wave on the down move we have double Short signals WU-Wyckoff Up-Thrust and PRS-Plutus Reversal Short and this where we enter.

I hope this was helpful. Enjoy!

LTC - This is how a Wyckoff Spring look like when reading SI Reading the chart: Location, Structure, Speed Index and Plutus signals

Annotations in sync with the chart.

1. Major Fib

2. Support

3. Breaking Support with a false break - Fast wave = low Speed Index 1.1

4. Down wave, price has a hard time to move down = high Speed Index 2.9 (buyers absorbing sell orders)

5. Entry a Wyckoff Spring WS signal from Plutus

.... and up we go!!!