Rob the Wheat Market Before the Trend Escapes!🏴☠️Wheat Vault Breach: Sweet Profit Heist in Progress!🍫💰

(Thief Trader’s Swing/Day Plan – Only Bulls Allowed)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

We’ve cracked the code to the 🏉"WHEAT"🏉 Commodities CFD market, and now it’s time to launch a high-stakes heist based on 🔥Thief Trading style technical + fundamental analysis🔥.

🎯 Mission Objective: Infiltrate the overbought zone, where traps are set, robbers are lurking, and the market’s about to turn. The plan? Ride the bullish wave, loot the Red Zone, and vanish with sweet profits. 🏆💸

🔓 Entry Point:

"The vault is wide open!"

Buy at will — loot that bullish treasure!

⏱️ Best tactic: Set buy limits on the 15M or 30M swing low/high zones. Set alerts and stay sharp.

🛑 Stop Loss:

SL = Nearest 6H Swing Low below the MA line (520.00)

🔐 Protect your stash. Use risk-adjusted SL based on trade size and number of entries.

🎯 Target:

575.00 or escape early if the pressure builds!

⚔️ Scalper’s Note:

Only steal on the long side.

💰 Big money = Go direct

💼 Small bags = Team up with swing traders

📉 Use trailing SLs to guard your gains.

🔥Wheat Market is Bullish – Why?

☑️ Fundamentals

☑️ Macroeconomics

☑️ COT Report

☑️ Sentiment Signals

☑️ Intermarket Vibes

☑️ Seasonal Patterns

☑️ Trend Forecasts & Target Levels

👉 Dive into the data: 🔗🔗🔗

⚠️ Trading Alerts:

News releases = Danger zones!

❌ No new entries during news

✅ Trailing SL to protect ongoing raids

💥 Smash the Boost Button 💥

Support this Thief Plan and keep our crew winning daily.

💪 Rob with confidence. Win with consistency.

🎉 Thief Trading Style = Your daily cash machine.

💣Stay tuned for the next robbery blueprint!

— Your Friendly Market Criminal, 🐱👤

Wheatanalysis

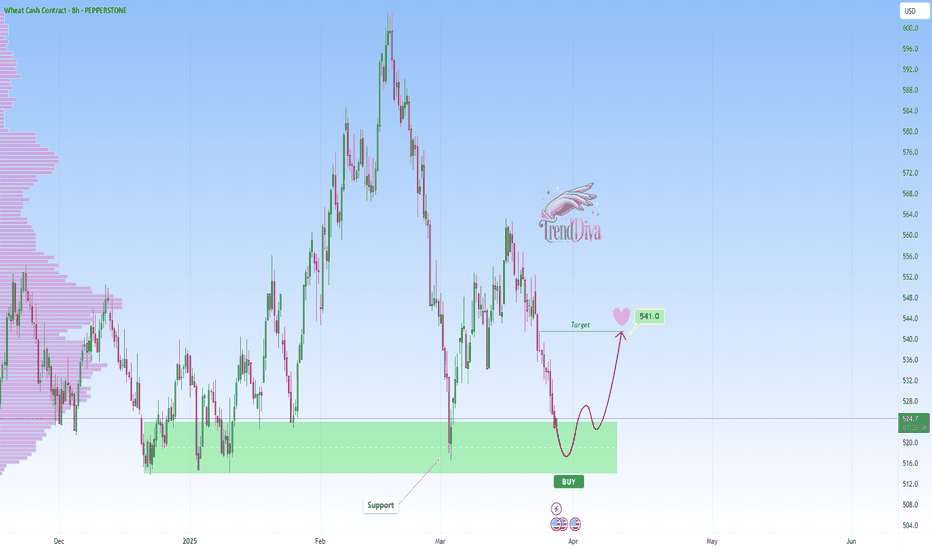

WHEAT at Key Support Level - Will Price Rebound to 541$?PEPPERSTONE:WHEAT has reached a major support level, an area where buyers have previously shown strong interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

A bullish confirmation, such as a strong rejection pattern, bullish engulfing candles, or long lower wicks, would strengthen the case for a move higher. If buyers step in, the price could rally toward the 541$ target. However, a decisive breakdown below this support would invalidate the bullish scenario and could lead to further downside.

This is not financial advice but rather how I approach support/resistance zones. Remember, always wait for confirmation, like a rejection candle or volume spike before jumping in.

Best of luck , TrendDiva

"WHEAT" Cash CFD Commodities Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "WHEAT" Cash CFD Commodities Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (568.0) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 594.0 (or) Escape Before the Target

Final Target - 616.0 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🌾"WHEAT" Cash CFD Commodities Market is currently experiencing a bullish trend,., driven by several key factors.

🌿Fundamental Analysis

Supply and Demand: Global wheat production is expected to increase by 2% in 2025, driven by favorable weather conditions in major producing countries

Weather Conditions: Weather forecasts indicate a high probability of drought in key wheat-producing regions, which could impact yields and support prices

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for wheat, particularly from emerging markets

Trade Policies: The recent trade agreements between major wheat-producing countries are expected to increase global wheat trade and support prices

🌿Macro Economics

Global GDP Growth: The World Bank forecasts global GDP growth to accelerate to 3.4% in 2025, up from 3.2% in 2024

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, driven by increasing demand and supply chain disruptions

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting commodity prices

Unemployment Rate: The global unemployment rate is expected to decline to 5.4% in 2025, driven by job growth in emerging markets.

🌿COT Data

Net Long Positions: Institutional traders have increased their net long positions in wheat to 55%

COT Ratio: The COT ratio has risen to 2.2, indicating a bullish trend

Open Interest: Open interest in wheat futures has increased by 10% over the past month, indicating growing investor interest

🌿Sentimental Outlook

Institutional Sentiment: 60% bullish, 40% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +30

🌿Technical Analysis

Moving Averages: 50-period SMA: 565.0, 200-period SMA: 540.0.

Relative Strength Index (RSI): 4-hour chart: 62.21, daily chart: 58.14.

Bollinger Bands: 4-hour chart: 580.0 (upper band), 560.0 (lower band).

🌿Next Move Prediction

Bullish Move: Potential upside to 600.0-620.0.

Key Support Levels: 565.0, 540.0.

Key Resistance Levels: 600.0, 620.0.

🌿Overall Outlook

The overall outlook for wheat is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global wheat demand, favorable weather conditions, and low interest rates are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global trade policies and unexpected weather events.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"WHEAT" Commodity CFD Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "WHEAT" Commodity CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : Traders & Thieves with New Entry A bull trade can be initiated at any price level.

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Target 🎯: 5.700 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Fundamental Outlook 📰🗞️

Based on the current market situation and fundamental analysis, the outlook for Wheat is bullish in the short term. Prices are expected to continue rising due to supply and demand imbalances, weather-related issues, and geopolitical tensions. However, traders should be cautious of potential price volatility and keep a close eye on upcoming events that may impact wheat prices.

CURRENT FUNDAMENTALS:

Supply and Demand: The global wheat supply is currently outpacing demand, which has put downward pressure on prices. The International Grains Council (IGC) estimates that global wheat production will reach 765 million tons in 2023, up from 758 million tons in 2022.

Weather Conditions: Weather conditions in major wheat-producing countries such as the United States, Russia, and Ukraine have been favorable, which has supported wheat yields and production.

Government Policies: The US government's trade policies, including tariffs on Chinese goods, have impacted the wheat market. The US is a major wheat exporter, and trade tensions have reduced demand for US wheat.

Competition from Other Grains: Wheat is competing with other grains such as corn and soybeans for market share. The price of corn and soybeans has been relatively high, which has made wheat less attractive to buyers.

BULLISH SENTIMENT:

Weather Risks: 20% of traders and investors believe that adverse weather conditions in major wheat-producing countries could reduce wheat yields and production, which could support prices.

Trade Deals: 15% of traders and investors believe that a resolution to the US-China trade dispute could increase demand for US wheat and support prices.

Strong Demand from Importers: 10% of traders and investors believe that strong demand from importers such as Egypt and Turkey could support prices.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

The Wheat Revelation: A Privilege to See the CodeThe Wheat Revelation: A Privilege to See the Code

"You’ve always felt it—the hum of something deeper beneath the markets, the unseen forces at play. Today, you are invited to glimpse the truth."

The Commitment of Traders (COT) strategy has unveiled another red pill: the Wheat market is primed for a bullish move. This is no ordinary signal; it is a rare alignment of forces, a convergence of codes that point to a potential market shift. But we do not act blindly. We do not rush headlong into the storm. Instead, we wait for the signal—a confirmed bullish trend change on the daily timeframe. Patience will unlock the reward.

Let me show you the code:

CODE 1: The COT Index

The commercials, the smartest players in the market, are very long relative to the 26-week index lookback. This positioning is not noise; it’s a whisper from those who understand the market’s heartbeat better than anyone else.

CODE 2: Net Positioning Extremes

Commercials are hovering around their maximum long positioning since December 2023. But it gets better: we see the "Bubble Up" phenomenon between the net positions of Commercials and Large Specs. This divergence is a hallmark of major market turning points.

CODE 3: Open Interest

The recent multi-week downtrend has coincided with a large increase in Open Interest. The question is: who is driving this increase? The answer is as bullish as it is clear—Commercials are loading up, signaling a seismic shift beneath the surface.

CODE 4: Valuation

Wheat is undervalued relative to US Treasuries. This imbalance cannot persist indefinitely. Markets correct, and when they do, the opportunity to ride the wave is immense.

CODE 5: True Seasonal Strength

Seasonality is on our side. History tells us that Wheat often exhibits strength until May, and this year appears no different.

CODE 6: Accumulation

The code is crystal clear:

Bullish spread divergence between front and next-month contracts.

Indicators like POIV, Insider Accumulation Index, and ProGo point to heavy accumulation by smart money.

CODE 7: Large Speculators Moving to Buy Side

In this week’s COT data, we see the Large Speculators reducing their shorts. The Large Specs are the ones that will drive a trend. It appears that maybe, the large specs see what you and I see, and are preparing for an impending bullish move.

Other Signals of Strength

Technical indicators like %R, Ultimate Oscillator, and Stochastic all converge, painting a picture of imminent bullish potential.

What Does This Mean for Us?

We do not jump into the market simply because the conditions are ripe. Instead, we wait for confirmation. A bullish trend change on the daily timeframe is the key that unlocks the door. Until then, we prepare. We watch. We wait.

Are you ready to see beyond the noise of the markets? To decode the signals others overlook? Follow me for more insights, and if you’re ready to take the red pill, join me on this journey to uncover the truth behind the markets. The choice is yours.

Unlocking the Wheat Matrix: The Code to Dominating CommoditiesUnlocking the Wheat Matrix: The Code to Dominating Commodities

What if I told you there is a way to see the hidden signals of the market? To move not with the herd but ahead of it, where clarity reigns and profits follow. This week, we delve into Wheat (ZW) — a market where the COT strategy reveals its secrets. The choice is yours: read on and learn, or remain blind to the patterns all around you.

Decoding the Setup

Understand this: this is not an invitation to blindly leap into the market. No, we wait. Patience is the cornerstone of mastery. When the technical tools confirm the market’s strength, only then do we act. Now, let’s break down the wheat matrix:

Code 1: Commercial and Small Speculator Positioning

The Commercial COT Index, using a 26-week lookback, reveals that commercials are at an extreme in long positioning. At the same time, the Small Speculator COT Index shows small specs aligning at a similar extreme. In the wheat market, unlike others, we follow the small specs rather than fading them. A deviation from the norm—an anomaly in the matrix.

Code 2: Commercial Extremes in Net Positioning

Commercial entities are nearing their most bullish stance in three years. History whispers a truth: when commercials move like this, the market often follows.

Code 3: Contrarian Signal from Investment Advisors

The masses of investment advisors are overwhelmingly bearish. Against this backdrop, the extreme bullish positioning of commercials sends a powerful contrarian signal. The matrix is showing its hand.

Code 4: Valuation Metrics

Wheat stands undervalued against U.S. Treasuries. When value aligns with positioning, the code becomes clearer.

Code 5: Seasonal Patterns

Seasonal truths tell us that wheat’s true bottom often forms in early January. This aligns perfectly with the cyclical and technical signals currently emerging.

Additional Signs in the Matrix

Spread Divergence: Bullish spread divergence between front and next month contracts.

Accumulation Indicators: Insider Accumulation Index and Williams ProGo confirm accumulation.

Technical Tools: %R is in the buy zone, and Weekly Ultimate Oscillator Divergence further supports the bullish narrative.

Cycles: The Recurring Patterns

44-Month Cycle: A major bottom forms now.

830-Day Cycle: Signals an upward move into March.

151/154-Day Cycles: Align with a cyclical bottom occurring now, projecting strength into March.

The Red Pill of Action

With these signals converging, the urge to act immediately can feel irresistible. Don’t. The matrix requires patience. Let the market reveal its strength. When the time comes, you’ll ride the wave with confidence.

The Path to Mastery

Trading isn’t merely a series of moves; it’s a philosophy. The COT strategy is a key, but only those who seek mastery will unlock its full potential. If you’re ready to see the market for what it truly is, join Tradius Trades. Here, we don’t just navigate the matrix of commodities—we redefine it. Are you ready to free your mind?

Wheat Futures Are at a Crossroads – Here’s What I’m SeeingAlright, here’s where things stand with wheat futures, and this one feels like it’s balancing on a knife’s edge. We’re sitting right around 571, and honestly, the chart could break either way. Moments like these can be exciting, but they’re also where preparation makes all the difference—whether you catch the right move or get left chasing after it.

If the price drops below 564, we could see it slide down to 554, 543, and maybe even 535. This kind of move would likely mean that supplies are holding strong, or demand is weaker than expected. It might not happen all at once, but once that first level breaks, sellers could pile on, and each support level below becomes the next stop on the way down. It’s like the market testing where buyers are willing to step back in.

But if the bulls get their act together and push above 600, the game changes. That’s the kind of breakout that could attract a lot of momentum and send prices heading toward 620. It wouldn’t take much—maybe bad weather affecting crops or surprising export numbers—and suddenly, we’d see buyers jump back in with force. When a psychological level like 600 cracks, traders love to pile on, and things can move quickly.

This is one of those trades where you’ll want to stay sharp. Just watch the levels, have a plan, and let the market show you the way. Whether it’s a slide down or a breakout higher, there’s opportunity either way. If this breakdown helped, like, boost, follow, and drop a comment—always better when we trade together.

Mindbloome Trader

WHEATF | Wheat Poised for a Rebound!👋 Good day, traders!

📈 After a two-month decline on the D1 chart, WHEATF has found support at the 540 level. Given its month-long accumulation phase and the completion of its downtrend, a breakout above the 587.75 resistance level could signal a rally towards target levels of 615.00, 660.00, 695.00, and 732.00. Consider buying entries around the 595.00-600.00 range, targeting potential profits of 3.3% to 23.0%, with a SL set at ~565.00.

✅ Give a 👍 if you're keen on more insightful and profitable trading ideas❗️

❓ I'd love to hear your thoughts. What's your take on this?

DISCLAIMER:

This idea is purely informational and educational. It's not a trading recommendation. Each trader should analyze and make decisions based on this information independently.

Wheat: Time for the turning point ⤴️🚀The recent downward movement has brought the wheat price into our blue trading zone and thus the minimum requirement of the current blue corrective wave (b) has been fulfilled. We expect it to go a little lower, but gradually the price should now form the end of the wave, allowing long entries. In the further sequence, we see the price rising above the resistance at USX 807.25, where we locate the high of the turquoise wave A. However, if the bears dominate and push the price lower, there is a 25% chance that the price will fall below the USX 611.25 support level, which buyers may want to keep in mind.

Wheat (World) - Short Bias; Cheap Ukrainian wheat everywhere!Sure, it is winter in the northern hemisphere so why even bother with the grains at all? ...

... Because cheap Ukrainian wheat had absolutely flooded European markets, so much so that very soon they will have to start dumping some of it into the ocean! (Right now, they are trying to air out these mountains of grain, so it wouldn't mold, but that will go only so far.)

Normally, this time of the year, 55-60 ships per week get loaded with Ukrainian wheat, headed for Africa and Asia.

As of last week, these numbers are down to 19 ships .

Russia closed the Bosporus to Ukrainian wheat (and oil seed) shipments.

As an alternative solution, Ukraine is shipping most of its harvest to the EU - mostly Poland & Germany - to load it on ships in those ports. - But guess what ...

... shipping it all to Europe AND THEN load it onto ships makes the whole proposition economically non-viable. (Well below producer cost.)

So now, the endless trainloads of grains, continuously pouring into the EU, gets dumped all over EU markets (at 40%-60% discounts!) because long empty local silos are all filled to capacity. There is now zero (0) storage capacity left anywhere in Europe! (... and the endless trainloads just keep on coming.)

... making this trade - not a monster - rather a no-brainer. (Like free beer)

Sell wheat everyday 🐻🍞Who sells wheat everyday? It’s the price-reducing wheat bears who want to provide us all with a cheap basic supply of food. "Affordable wheat for all," chant they, offering reduced-price bushels of wheat to anyone who comes their way. At the moment, they are not to be restrained in their sell-off ecstasy, however, we already see the low of the blue wave (v) lying shortly before us, which means that this sell-off should soon come to its end. The wheat price is already in our green target zone here (between USX 662 and USX 472), where we expect a trend reversal. The bulls should therefore report back before too long and point to the need for higher wheat prices. It should be noted that with the end of said blue (v) wave, an overarching and relatively long-lasting correction should also come to its end. Therefore, our green highlighted target zone can serve as an excellent entry opportunity for speculations on the long side.

Wheat price attempts to recover – AnalysisWheat price decline stopped around 740.00 areas, to start rising and hint heading to achieve expected gains in the upcoming sessions, on its way to visit 778.10 mainly.

Therefore, the bullish bias will be suggested for today, and breaching 758.50 will ease the mission of achieving the mentioned target, while breaking 745.00 will stop the expected rise and press on the price to resume the bearish track.

It’s trading wheaty (pretty) high now...Continuing the topic of spreads between related commodities, the Hard Red Winter Wheat – Soft Red Winter Wheat spread is another one trading at an extreme level now.

A brief explanation on the different types of wheat we are referring to here:

1) The Hard Red Winter Wheat (HRW) is the most widely grown class of wheat. A high protein product, used for breads, some types of Asian noodles and general-purpose flour.

2) The Soft Red Winter Wheat (SRW) is the third largest class of wheat variety grown in the US, lower protein wheat used in producing confectionary products such as cookies, crackers, and other bread products.

Generally, the HRW Wheat Futures (KE) trades at a premium to the SRW Wheat Futures (ZW) due to the higher protein content, however other factors such as production levels and supply demand dynamics may disrupt this spread, as seen from the wide range it has been trading since 1977.

Currently, this spread is trading close to 132 cents, with only one instance where it has traded higher, which was in March 2011 when this spread reached an all-time high of 164.

We attribute the spread trading at a high now due to the following 2 reasons:

1) The 2022 HRW production is currently the lowest on record since 1963, due to widespread droughts across many of the HRW production regions.

2) The average protein content of the 2022 yield is higher than last year, as well as the average of the past 5 years, resulting in a higher quality crop.

As a result, HRW is trading at a premium as supply shortage and a higher quality product pushes the price higher, while SRW sees average production and quality.

While it is challenging to assess the production levels and quality for the next season, from a risk reward perspective, we see an opportunity here. The past few spread peaks have been clearly marked out by Relative Strength Index (RSI) pointing oversold. With the 10-year average for the spread at 6.3 cents and the RSI now oversold, we lean bearish on the spread.

Referencing the average of the past 3 declines at 150 cents and lasting 511 days, we could set out trade levels.

If the historical pattern holds this time, a conservative target of 120 cents and a trade length of 500 days points us to the 15-cent level. We see the current set-up as an opportunistic one, with similar episodes in the past pointing lower. CME also has the synthetic KC HRW Wheat-Wheat Intercommodity Spread, which can be used to express the same view and is financially settled.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios.

Sources:

www.uswheat.org

www.cmegroup.com

www.cmegroup.com

www.usda.gov

Wheat Heading back to $700-800 range, supply surpassed demandWheat Heading back to $700-800 range, supply has now surpassed the demand.

Ukraine is now shipping wheat from Moldova and shipping out via train etc

Russia is supplying Ukraine wheat from Mauripol

Russia is supplying wheat to Bandladesh and a number of African countries

Australia has had 20% bumper record crop being on the top 3 wheat producers

Price will go back to normal now it has almost been 6 months since the war has started

DeGRAM | Wheat buy opportunityThe price of wheat rapidly rose and is currently pulling back to previous support levels.

A pullback creates an ideal opportunity to buy, considering fundamental factors.

-------------------

Share your opinion in the comments and support the idea with like. Thanks for your support!

WHEAT LONGS ACTIVE 📉📉📉📉 Expecting bullish price action on WHEAT during those times of STAGFLATION on the long term premise i see wheat price going higher making a new ath. Commodity price should rise during those times of ,,incoming reccession,, .

What do you think ? Comment below..

ridethepig | Wheat for the Yearly Close📌 @ridethepig ZW1! Market Commentary 17.12.2020

For buyers the breakout creates the typical starting point, one we have seen many many times before. The fact it is happening on the monthly chart is very telling, this is threatening to impulsive explode to the topside via shortages on the supply side from lockdowns and contractions in globalisation.

Whatever may be the case on the climate side (and I am certainly no expert here) it has been one of the biggest crops on year for Russia. Fertile farming at its best... Tracking closely the 600 support, for a move towards 900 and 1350 ... watch out for any battle against this in the coming weeks as we enter into a commodity cycle.

Thanks as usual for keeping the feedback coming 👍 or 👎

WHEAT SHORTS 📉📉📉📉 Expecting bearish price action on WHEAT as price should retrace back to fill the BULLISH GAP'S, we are in a bullish market strucutre on a HTF but right now i expect the retracement

What do you think? Comment below..

Mar 7, 22 Wheat back up - BUY OppWheat came down for the first time in over 5 sessions so I was looking for a pullback and then I could hopefully get into a Buy Order. I did put in a Buy order at 1250 less than an hour ago.

Markets are crazy wild with prices moving a lot. Like I have said all day today, I believe over the next 2 weeks Wheat and Corn will continue to go up. Definately there will be some volatility, but I think price will go up and I will make some money.

I will keep as close an eye as I can on these trades (I have to sleep sometime), but I will keep my stops further away for these trades so I don't get caught.

Trade well and stay safe.

Heiko