Wickoff

[UPDATE ETH] THE LENGTHENING THEORY SUGGESTS 15K IN APRIL 2022?IT SUCKS, CAUSE IT'S A GOING TO A LONGER TIRING BULL RUN BUT IT MAKES SENSE.

TO SUM UP (SEE RELATED IDEAS) WE HAVE 2 MODELS:

- HALVING CYCLE: ETH TOPS IN OCT-NOV 2021 (10-12K) --> SEE RELATED IDEAS BELOW

- LENGTHENING CYCLE: ETH TOPS IN APR 2022 (14-16K) --> SEE THE CURRENT IDEA

WHAT DO YOU THINK?

STAY SAFE.

Utimate Wickoff Cycle Guide PART 1. ACCUMULATION CYCLE

Wickoff Theory

The Wyckoff theory describes many aspects and rules of trading. The main problem of the theory is the demand/supply balance. It is widely known that this balance is the key reason of some price action on the market. Today we are going to consider the Wickoff Cycle pattern. Let's start with the accumulation one.

WIIckoff Events

Key elements of the theory is the price action, spread and volume. The possible acuumulation cycle Wickoff events are following.

1. Preliminary Support (PS) - price in the downtrend, volume and price spread increase

2. Selling Climax (SC) - price spread is large, all selling volume is absorbed by major investors. Here we can see the long wick bottom

3. Automatic Rally (AR) - when the bearish pressure decreased the bulls became dominant.

4. Secondary Test (ST) - price returns almost to the SC. Used for the bottom confirmation. Volume and spread are much lower than in SC. Can be multiple.

5. Spring - it is optinal event. Occures when the selling pressure is strong but major investors have a greter demand to absorb all this supply

6. Tests - can be multiple. Attempts to re-enter the trading range low. Bullish tests is the less volume with higher lows of the price action

7. Sign of Strength (SOS) - price action along the resistanse usually looks like a triangle or wedge pattern

8. Back-up/Last Point of Support - last low before the uptrend starts

Wyckoff Cycle

Let's consider step-by-step the phases of the Wyckoff cycle.

1. Phase A - the huge downtrend is about to end. We can identify the PS, SC and AR points which form the resistance and support of the trading range.

2. Phase B - price action is in the trading range. The mutiple secondary tests (ST) of the support are possible. During this phase it should be alomost clear that bullish pressure is stronger than bearish.

3. Phase C is optional. There is could be the spring - fake support level breakout, but the price quickly returnes to the trading range forming higher lows.

4. Phase D - the price broke through the resistance and starts consolidate along it.

5. Phase E - massive price pump.

DISCLAMER: Information is provided only for educational purposes. Do your own study before taking any actions or decisions.

GOLD Prediction for @25Nov-Friday#GOLD price movement for @ 25nov-27Nov

still impulsive overnight. just stuck in the RBR area. because there is a daily and weekly divergence. does not rule out the possibility of retrace higher before falling again.

next week target of at least 500 pips = $ 500- $ 5000

-Short-Term: Bullish

-Long-Term: Bearish

CHFJPY - Manipulation IdeaWe may be a little late to the party on this one but I may consider placing a sell limit from the lower time frame order block I have found. What you witnessed was clear manipulation, firstly we saw price drive to the upside gathering liquidity from the resistance sellers, only to convince retail that price was proceeding to the upside, a strong manipulation wick was formed and price died off into its intended direction. We may miss this move completely, I will have to analyze it again on Monday to see how this pair holds over the Asian session tonight.

COT Data - 65% Short

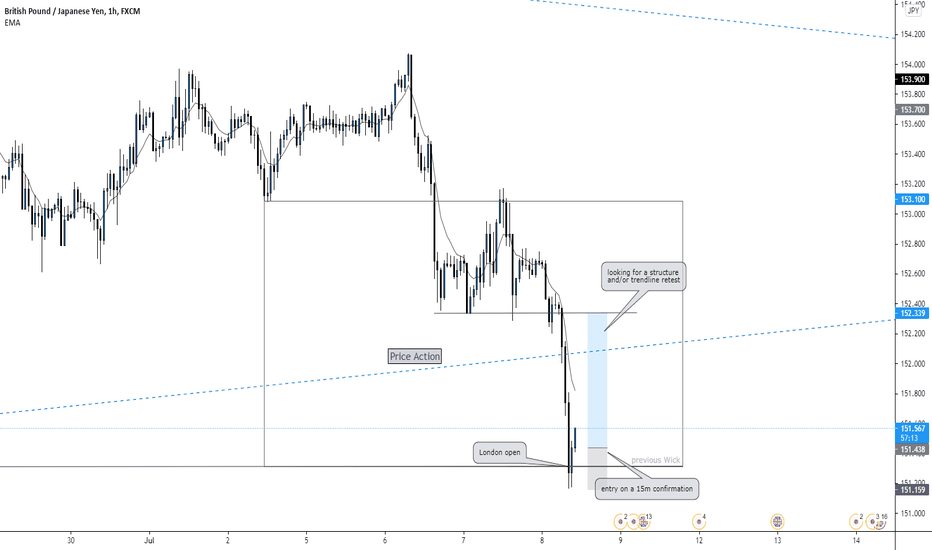

GBPJPY - Get that Wick EntryWe managed to pull off an amazing stunt last week with that lovely wick entry on GJ, we are now looking for more potential buying opportunities. I have marked out a zone in which I think price will tap into before continuing to the upside, you may want to consider setting some orders at that region if it fits your analysis.

GBP is proving to be very tough to trade recently giving us a yo-yo of price action movement so make sure you tread carefully when trading it.

COT Data - 53% Short

IG Client Sentiment - 53% Long

BTC/USD - Distribution before collapseShort term is grim for bitcoin, which looks like to follow a distribution pattern.

I expect a drop until 9k but if it's not absorbed, then we will go to 8.2k or lower before trending bullish again for halving(assuming is not priced in).

A golden cross has happened and historically bitcoin has dropped signficantly after such event just to rise stronger and reach new highs.

EURUSD - ex. of WICKOFF ACCUMULATION for DISTRIBUTION 4/10/2019HELLO TRADERS!

EXAMPLE HOW SMARTMONEY ACCUMULATE TO DISTRIBUTE MORE.. AS U CAN NOTICE WICKOFF ACCUMULATION SCHEMATIC WAS IN THIS PLAY..

ALL LIQUIDITY AS ABOVE SO BELOW WAS PICKED UP BY SMART MONEY ON WAY DOWN, NOW SINCE WE START OCTOBER, AND DXY HAS DROPPED, THEY PUSHING PRICE HIGHER TO ACCUMULATE TO DISTRIBUTE MORE...

CHECK OUT LAST EURUSD MARKUPS WITH SM CONCEPTS ATTACHED BELOW... THERE IS STILL A GAP FROM 2017 WHICH WE EXPECTING TO BE FILLED IN NEAR FUTURE..

GOD BLESS U ALL!

EURGBP - POTENCIAL WICKOFF DISTRIBUTION SCHEMATIC 10/2019Hello Traders,

it looks like we are on higher TF in distribution phase on this particular pair, so we gonna expect long term bearish movement.

Hopefully this example will help u identify Wickoff schematics on chart, cause they keep printing over and over again on all time frames..

Understanding market structure is the key so we are focusing on this type of analyses.

God bless u all !

CAD/CHF Nice short opportunityWEEKLY: Price on downtrend making LH & LL since aug 2017

Nice price rejection at 0.76 with double doji

DAILY: Price broke the trendline with nice double top

Rejected off support & fib 61.8

4HOUR: Downtrend

CONCLUSION: I will be looking to short this pair if we can

manage to break through first support and the second one

which is also the neckline. Previous low will be the target