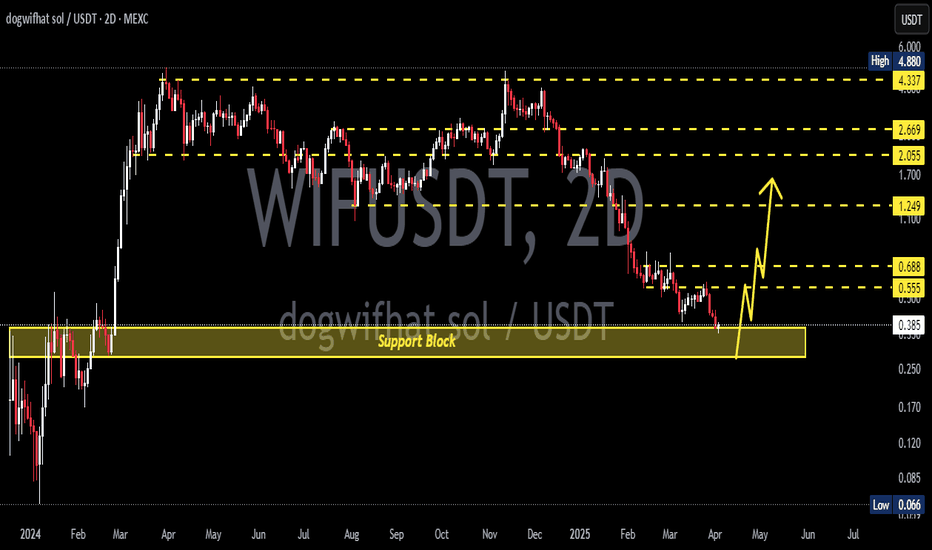

WIF/USDT - Fresh meme coin. Trading setup in chanal. Popular fresh meme coin – Dogwifhat

📊 CoinMarketCap Rank: #102

🐦 Twitter (X) : 152K followers

💬 Telegram : 50K members

✅ Highly liquid meme coin – traded on many major exchanges, including Binance.

After the hype phase , the coin is now declining along with the overall crypto market —no exceptions. Essentially, it broke below multiple channel supports , and the price is now sitting at the support of the outer channel.

I also notice a non-textbook Head & Shoulders pattern, which suggests a potential -64% breakdown . The last squeeze happened around this level.

Currently, we are seeing consolidation with increased volume , along with high-wick price action in this zone.

I've marked potential downside support zones as well as upside resistance targets on the chart. Consider this in your trading strategy!

WIFUSDT

#WIF/USDT#WIF

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.650

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.671

First target 0.716

Second target 0.751

Third target 0.800

Waiting for a Perfect Entry! 🚀 SEED_WANDERIN_JIMZIP900:WIF in Uptrend – Waiting for a Perfect Entry! 📈

SEED_WANDERIN_JIMZIP900:WIF is currently in an uptrend! If you missed the entry, you can wait for a correction. Once the price comes back to the green zone, keep an eye out for confirmation to enter long! 🔥

Let’s catch the next opportunity together! 💼💸

When Moving Averages Meet the Demand ZoneOne of the simplest ways to identify the market trend is by using the moving average (MA) indicator.

When price moves above the MA, it's generally considered an uptrend.

When price moves below the MA, it's seen as a downtrend.

Aside from showing the trend, moving averages can also act as dynamic support and resistance:

In an uptrend, the MA acts as support — meaning if price retraces into the MA, it often bounces back and continues upward.

In a downtrend, the MA acts as resistance — price tends to reject the MA and move lower.

In BINANCE:WIFUSDT , the moving average is currently acting as support, and price is pulling back into a confluence zone between 0.584 – 0.558, where the MA meets a demand zone. This setup increases the probability of the pullback ending and the uptrend continuing.

The confirmation for a bullish continuation would be a break and close above 0.620.

If that happens, the next target zone is between 0.763 – 0.789.

Keep a close eye when price approaches the previous high. The ideal scenario is a strong impulsive breakout. The worst-case scenario would be a rejection or false breakout from that level.

Alright, what's your take on BINANCE:WIFUSDT ?

$WIF Breakout Confirmed 🚨 SEED_WANDERIN_JIMZIP900:WIF Breakout Confirmed?

Dogwifhat has officially broken out of the descending channel and is trading above key resistance with strong momentum.

If bulls hold this zone, we could be eyeing major upside moves.

Key targets:-

• $0.774

• $1.474

• $3.006

• $4.659

SL: $0.305 | Entry: CMP

Is this the start of SEED_WANDERIN_JIMZIP900:WIF ’s next moon mission? 🌕

DRYO, NFA

WIF Bulls Charge After Breakout – Can It Hit $2?SEED_WANDERIN_JIMZIP900:WIF has broken above the descending trendline, a key structure that had been capping price for several weeks. This breakout, paired with today’s nearly +10% surge, suggests bullish momentum is building.

The price is now approaching the 50 EMA, which may act as short-term resistance. A clean breakout and close above this level could trigger a strong upside move toward higher zones, as marked on the chart.

Targets remain open toward $0.80, $1.30, and possibly $1.97 if momentum holds.

DYOR, NFA

WIFUSDT 4H (92% Long Probability Printed)Trend & Structure

Price appears to be forming higher lows (as shown by the ascending trendline).

The 50 EMA (red line) is now below the price, suggesting a potential shift in momentum.

92 % Probability signal indicating bullish momentum building up.

Key Levels

Support: Around the ascending trendline near 0.54–0.56.

Resistance: Notable resistance levels near 0.60–0.62 and higher at 0.65–0.70.

Proposed Long Entry

🚀 Entry (Long): Consider entering around the current price (0.56–0.57) or on a small pullback toward the trendline (if it retests around 0.55–0.56).

Stop Loss

🛑 Stop Loss: Place a stop below the ascending trendline or a recent swing low to protect against a breakdown.

An example might be near 0.53 or slightly lower, depending on your risk tolerance.

Profit Targets

🎯 Target 1: 0.60–0.62 (near recent highs / local resistance).

🎯 Target 2: 0.65–0.70 (if momentum continues and breaks through the first resistance zone).

Risk Management

Use position sizing that limits your account risk to 1–2% (or your preferred level).

Consider moving your stop loss to breakeven once price reaches the first target or forms a new higher low.

WIF (SPOT)BINANCE:WIFUSDT

WIF / USDT

4H time frame

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

WIF Preparing to storm 0.79 ready to grow by 50%The WIFUSDT coin has been at the bottom for a long time, having accumulated a decent amount of short-term liquidity. Apparently, it is ready to grow by 50%. This is more of an intuition than a clear trading idea, but if you want, you can enter an amount that you don't mind losing. The target is 0.79

Do you think we'll take off? 🚀

WIF/USDTHello friends

According to the market cycle, the price decline is ongoing and is expected to continue.

Now the only important support is the green area, which the price reaches there and we will see what reaction we get from the buyers.

Will they support the price or will the decline continue...

If you want to be with us in this alt season, send us a message.

*Trade safely with us*

WIF /USDT Long SL -14.12%WIF/USDT Long Setup ( Retake )

Reason:

Breakout and Confirmation done in Internal Structure.

Strong Bullish bullish momentum with high Volume.

All technical Parameters suggesting a strong Bullish Wave.

After Successfully breakout from wedge, we can Expect a 40% bullish wave.

Pro Tips:

After Target 2, Move Stoploss to breakeven

HODL

Best Regards,

The Panda

BINANCE:WIFUSDT

MEXC:WIFUSDT

BINANCE:WIFUSDT.P

KUCOIN:WIFUSDT

BITGET:WIFUSDT.P

BINGX:WIFUSDT.P

Breaking: Dogwifhat Tanks 13% TodayBuilt on the solana ecosystem, a token embroidering the dog with a hat narrative saw its price tank 13% today amidst general crypto dip.

With the RSI at 39 could more dip be looming ahead. For now the asset is in a steep falling wedge pattern so a reversal could be feasible. Given that SEED_WANDERIN_JIMZIP900:WIF once had an All-time-high of $4.85 rising from an all time low of $0.00002344 representing a whooping +2452405.65% gains, SEED_WANDERIN_JIMZIP900:WIF could pull out such fit again with a market cap of $564.14M this adds more credence to the bullish comeback of $WIF.

dogwifhat Price Live Data

The live dogwifhat price today is $0.574867 USD with a 24-hour trading volume of $627,598,272 USD. We update our WIF to USD price in real-time. dogwifhat is down 12.29% in the last 24 hours. The current CoinMarketCap ranking is #98, with a live market cap of $574,200,548 USD. It has a circulating supply of 998,841,059 WIF coins and the max. supply is not available.

WIF USDT Long SL -14.8%WIF/USDT Long

Reason:

Tested the bottom Trend of falling wedge and confirmed.

Breakout and Confirmation done in Internal Structure.

Strong Bullish bullish momentum with high Volume.

All technical Parameters suggesting a strong Bullish Wave.

After Successfully breakout from wedge, we can Expect a 40% bullish wave.

Pro Tips:

After Target 2, Move Stoploss to breakeven

Best Regards,

The Panda

BINANCE:WIFUSDT

MEXC:WIFUSDT

BITGET:WIFUSDT.P

BLOFIN:WIFUSDT.P

WIF / USDT : Retesting Trendline after breakout WIF/USDT: Retesting Trendline Support After Breakout – Bullish Continuation Ahead?

WIF/USDT is in a crucial phase 📈 as it successfully broke above a key trendline resistance and is now undergoing a retest 📊. This retest could confirm the breakout’s strength, paving the way for further bullish momentum 🚀. If buyers step in at this support level, we could see an explosive move to the upside. Keep a close watch 👀 on how the price reacts to this level.

Key Insights:

1️⃣ Trendline Retest: WIF/USDT has broken out and is now testing the previous resistance as support. Holding this level is critical for confirming a sustained bullish move.

2️⃣ Volume Confirmation: A strong bounce with increasing volume 🔥 would indicate renewed buyer interest and validate the breakout.

3️⃣ Bullish Indicators: RSI and MACD remain in bullish territory ⚡, supporting the potential for further upside if the retest holds.

Steps to Confirm the Retest:

✅ Look for a strong 4H or daily candle bounce from the trendline support.

✅ A surge in volume at the retest level strengthens the bullish case.

✅ If WIF/USDT flips the trendline into solid support, it could trigger a strong upward push.

⚠️ Be wary of failed retests or price closing back below the trendline, which could indicate weakness.

Risk Management Strategies:

🔒 Use stop-loss orders to protect against unexpected reversals.

🎯 Adjust position sizing based on overall risk tolerance.

This analysis is for educational purposes only and not financial advice. Always DYOR 🔍 before making investment decisions.

TradeCityPro | WIF: Diving into the Dynamics of a Popular Meme👋 Welcome to TradeCityPro!

In this analysis, I want to examine the coin WIF, which you requested in the comments. This project is one of the famous meme coins in the crypto world, operating on the Solana network, and it has a market cap of $655 million, ranking it 105th on CoinMarketCap.

📅 Daily Timeframe

In the daily timeframe, we are witnessing a downward trend that started from a high of 3.9560 and has continued down to 0.5852. The market volume has also converged with the trend, indicating that the selling pressure has been much stronger than buying.

❌ If you previously purchased this coin, you should have set a stop-loss after the price stabilized below 1.3886. However, if you haven’t done this yet, I cannot specify a stop-loss area for you now because there's a significant support area at 0.4464, and we need to see how the price reacts to this area.

🛒 If you're looking to buy this coin, first of all, I should mention that purchasing meme coins is very risky, and I personally neither buy meme coins nor recommend buying them. But if you want to buy this coin, you should wait for a trend reversal. For a trend change, we need a new structure to form and a suitable trigger to confirm the trend change.

🔼 If the price breaks 0.5852 and the RSI enters the oversold area, we could open a very good long-term position. A break of 34.36 in this indicator gives us the first confirmation of entering bullish momentum, but this confirmation is not reliable at all and only serves to confirm futures triggers.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, I want to specify the futures triggers for you. We also have an interesting ascending channel, to which the price has reacted very well so far, and breaking this channel from any side could provide a good position.

🔍 Currently, it seems there's a range box between 0.5734 and 0.7803, which has timed the price's move from the box's floor to its ceiling.

📈 For a long position after the channel break, you can enter with a trigger of 0.7803 targeting 1.0411 and 1.345, but keep in mind that we've had a very strong downtrend, and this position is against the trend.

🔽 For a short position, our trigger is very clear, and if 0.5734 is broken, you can enter, and your target could be the bottom of the channel.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Bitcoin and altcoin overview (February 18-19)The Bitcoin scenario hasn't changed since yesterday—we are still expecting a test of key support zones, from which a full-fledged upward movement is likely to develop.

Primary target for growth: $102,000.

Sell zone:

$107,000–$109,000 (volume anomalies).

Buy zones:

Around $95,000 (strong buyer reaction, volume anomalies).

$94,000–$93,000 (volume anomalies).

$89,000–$86,300 (accumulated volumes).

Interesting Altcoins

For WIF , the trend has shifted to long on the 4H timeframe. We are waiting for a test of the $0.57 and $0.55 levels, and if there is a false breakout with a strong buyer reaction, we expect an upward movement.

WIF ANALYSIS (2H)After pumping, changing CH, and clearing a supply zone, the price is now pulling back to lower order blocks.

In the lower zone, there is an overlap between the flip line and the QM level, which appears to be a strong area.

Additionally, the upper order blocks have been consumed, and if the price intends to continue its upward movement, there are no significant sell orders ahead.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

WIF/USDT – Was That a Fake Breakdown? WIF/USDT – Was That a Fake Breakdown?

WIF showed signs of a breakdown, but it might have been a fake move.

I expect the price to rise soon for the short term. No need to wait for dips, buy and hold. WIF is ready to break out of this zone.

DYOR and trade accordingly.

WIFUSDT: Is This the Last Stand Before a Breakout?A Critical Moment for WIFUSDT: Buyers or Sellers—Who Wins?

WIFUSDT is teetering at a pivotal point, currently priced at $0.9981, reflecting a staggering -79.56% deviation from its all-time high of $4.8848 just 81 days ago. Meanwhile, the asset remains a massive 486% above its absolute low recorded nearly a year ago, underscoring its extreme volatility.

Technical indicators are flashing mixed signals:

📉 RSI14 is hovering around 32.19, signaling that WIFUSDT is approaching oversold conditions, but not quite there yet.

📊 Moving Averages are still bearish, with MA50, MA100, and MA200 sitting well above the current price, reflecting lingering downside pressure.

However, the latest candle patterns suggest growing instability:

✅ Buyers attempted a takeover in the last session, driving prices from $0.9807 to $0.9981 with a high of $1.0194.

❌ Prior bearish volume dominance, where increased selling pressure pulled the price down from $0.9966 to $0.9807, remains a concern.

So, what’s next? Is WIFUSDT on the brink of reclaiming key resistance levels at $1.2916 and beyond, or will it succumb to seller dominance and revisit its lower support zones? Your move, traders.

WIFUSDT Roadmap: Tracking the Market's Next Big Move

VSA Manipulation Sell Pattern 3rd (Jan 31, 18:00 UTC)

Heavy sell-off triggered a sharp decline $1.2625 → $1.1371, with a low at $1.1082. A textbook VSA manipulation move, where weak hands were shaken out. The key question: will buyers step in at this level, or is more downside ahead?

Increased Buy Volumes (Jan 31, 19:00 UTC)

Buyers made an aggressive comeback, pushing the price $1.1371 → $1.1813. A solid confirmation of demand, but resistance at $1.1990 remains a critical barrier. Will this be a continuation or just a liquidity grab before another dump?

VSA Manipulation Buy Pattern 3rd (Feb 1, 10:00 UTC)

This was the true test of bullish strength. Price surged from $1.0916 → $1.1021, closing above the trigger point—a classic signal for an extended move. But will bulls hold their ground, or will sellers take over again?

Increased Sell Volumes (Feb 2, 03:00 UTC)

Trap alert! After a brief rally, sellers stepped back in, pushing the price down $0.9966 → $0.9807. Bears are showing dominance, but they failed to break below the key level of $0.9773.

Sell Volumes Takeover (Feb 2, 04:00 UTC)

This was the moment of truth—bears tried to push lower, but bulls fought back, sending the price $0.9807 → $0.9981. This reversal hints at potential upside, but confirmation is needed with a break above $1.0194.

Conclusion: The market has been heavily manipulated by both sides, but the last pattern suggests sellers are losing steam. If $1.0194 is broken, expect further upside momentum. However, a drop below $0.9773 could signal another bearish wave. Time to watch closely!

Technical & Price Action Analysis

When it comes to trading WIFUSDT, key levels are everything. If buyers can’t hold support, those same levels will flip into resistance—classic market behavior. Here’s the roadmap:

Resistance Levels:

$1.2916 – First real test for bulls, flipping this opens the door for momentum plays.

$1.3355 – A historical supply zone; break and hold above confirms bullish intent.

$1.5553 – Major liquidity level; failure here could mean distribution.

$1.8968 – If price gets here, it’s game on for breakout traders.

$2.0384 – Last known battleground before an aggressive trend shift.

Powerful Support Levels:

$1.4167 – Critical bounce zone; failure turns it into a major resistance.

$2.0848 – If this gets tested, expect big bids or a deep dive.

Powerful Resistance Levels:**

$0.8363 – The biggest wall for any dip buyers; reclaiming flips the script.

$0.35 – If price ever touches this, it’s bargain-bin shopping or full collapse mode.

Smart money watches these levels closely. If support holds, it’s a dip-buying opportunity. If not, those same levels will act as ceilings, trapping breakout traders. Play it right, and don’t get caught on the wrong side of the move.

Trading Strategies Based on Rays

Concept of Rays:

My analysis method is based on VSA Rays, constructed using Fibonacci principles. These dynamic levels define movement channels, allowing us to track price behavior at key zones. The price will either bounce or break through these rays, signaling a reversal or continuation, but only after confirming with volume dynamics and key patterns.

Instead of guessing exact price levels, we focus on probability zones where price interaction with rays gives us trading opportunities. The Moving Averages (MA50, MA100, MA200, MA233) serve as dynamic resistance/support, interacting with these rays and enhancing trade setups.

Optimistic Scenario (Bullish Playbook):

If price confirms interaction with a bullish VSA Ray, we enter long positions targeting the next resistance level. Each new level serves as a potential profit zone or a point of reevaluation.

Entry: Above $0.9981 (confirmed breakout from VSA Ray + bullish candle close)

Target 1: $1.2916 (first ray extension)

Target 2: $1.3355 (higher liquidity zone)

Target 3: $1.5553 (major supply area, strong resistance)

Invalidation: If price drops below $0.9773 and confirms with volume shift

Pessimistic Scenario (Bearish Playbook):

If price rejects from a bearish VSA Ray or fails to hold above dynamic support, shorting opportunities emerge with key downside targets.

Entry: Below $0.9807 (confirmed rejection + bearish volume surge)

Target 1: $0.8363 (first support level, possible bounce)

Target 2: $0.3500 (strong liquidity absorption zone)

Target 3: Below $0.1702 (if major breakdown occurs)

Invalidation: If price reclaims $1.0194 with strong bullish volume

Key Takeaways:

Trade only after confirmation of interaction with rays

Expect movement from one ray to the next—each level acts as a stepping stone

Use MAs for additional confluence—failure to break a moving average signals continuation

Volume always matters—no volume = no conviction, wait for a real move

The market is dynamic, but VSA Rays + Key Levels give us the edge to stay ahead. Watch for interaction and execute with precision.

Let’s Talk Trading—Drop Your Thoughts Below!

Got questions? Want to dive deeper into the setups? Drop a comment! I always check and reply, so let’s discuss the best trading opportunities together.

If this breakdown helped you, hit Boost and save this idea—watch how price respects these levels over time. Trading is all about understanding key reaction zones, and this analysis gives you the exact roadmap.

By the way, my custom VSA Ray indicator automatically maps all these levels and updates in real-time. It’s private, but if you want access—DM me and we’ll talk.

Need analysis for another asset? I can chart anything! Some breakdowns I share publicly, but if you want something private and exclusive—we can arrange that too. Just let me know in the comments what you need.

My rays work on all markets—crypto, forex, stocks—you name it. If you want a custom markup for your asset, just Boost this post and comment below, and I’ll do my best to make it happen.

Most importantly—follow me on TradingView to stay ahead of the market moves. Let’s trade smart, not blind! 🚀