WIKA

Most of Construction Stocks still SidewaysMost of these Construction Sectors are still Sideways. However, there is one stocks that has the best signs of ending its Sideways and that stock is ADHI. Another promising stocks is PTPP then WSKT. WIKA is the least favourite.

ADHI has broken up its Resistance at IDR790. Though it is now below that level, ADHI still maintain Up Trendline from end of May 2022. I see an Uptrend based on Peak and Trough Analysis.

PTPP and WSKT shows the same signs but PTPP has more promising feature of an Uptrend (PTPP once broken up its Resistance at IDR990) while WSKT never break up its Resistance.

WIKA also once broken up its Resistance at IDR1,005 but I don't see Higher Low from end of May 2022 (which I believe is the strong sign of Uptrend).

ADHI - Potential Inverted Head and ShouldersADHI has a potential to make Inverted Head and Shoulders pattern. Buying area = 1000, sell in January. This could be a huge potential since IHSG has rallied pretty damn high in October and November has almost always been a red month for IHSG. Potential buying for other old economy stocks as well, but my eyes is locked on ADHI compared to its peer, such as WIKA, WSKT, PTPP.

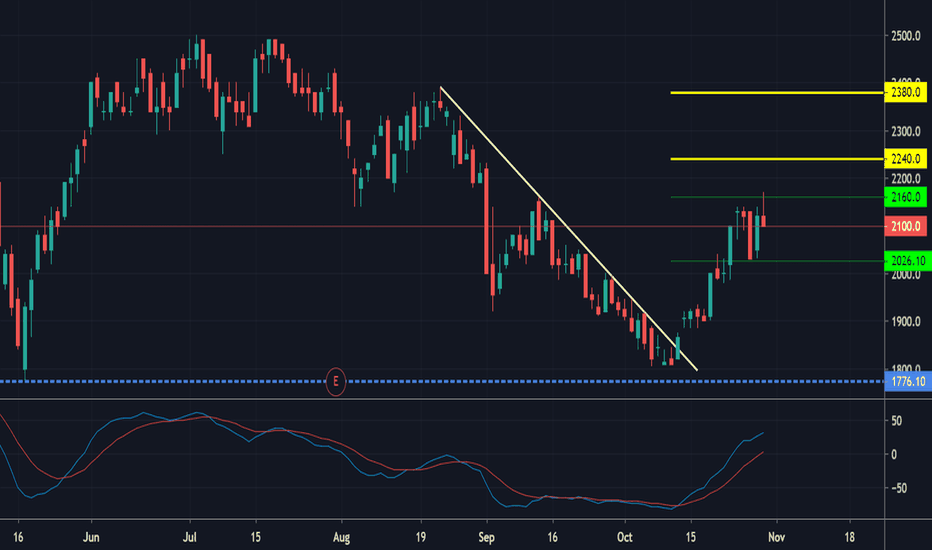

WIKA Mencapai Target - Target Kenaikan Awal. Kembali Rally?Melanjuti ulasan WIKA sebelumnya, saham ini berhasil mencapai 2 target kenaikan di 2025 - 2160 dan berkonsolidasi diantaranya. Dengan kenaikan harga kembali menembus resisten minor konsolidasi di 2140, terbuka ruang bagi saham ini untuk kembali bergerak uptrend menuju 2380 dengan minor target 2240. MACD yang meningkat menunjukkan saham ini berada dalam fase pergerakan positif.

Rekomendasi: Buy. Stoploss level 1980.