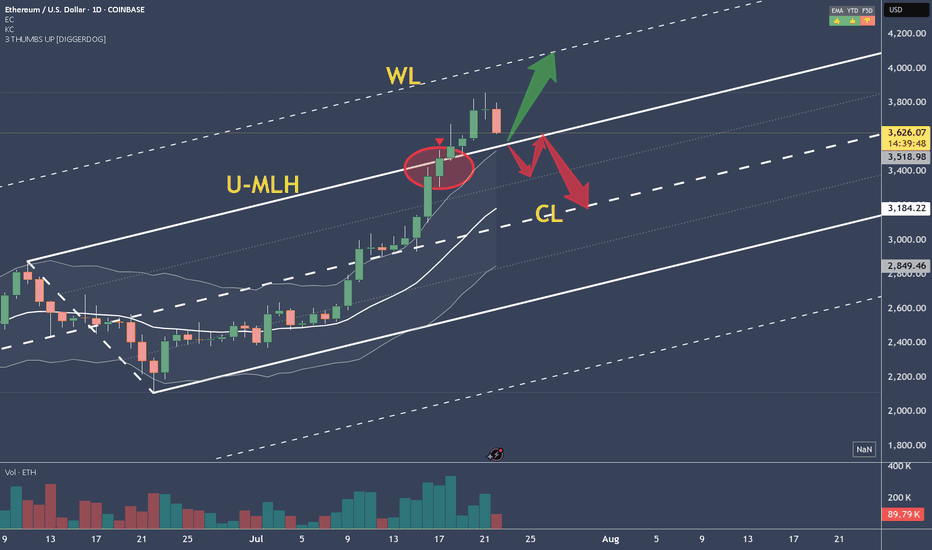

ETHUSD - Decision TimeWhat do make of the current situation?

What if you are long?

Here's what to expect:

a) support at the U-MLH, further advancing up to the WL

b) open & close within the Fork. If so, there's a 95% Chance of price dumping down to the Centerline.

Taking 50% off the table is never bad.

50% money in the pocket if price falls down to the Centerline.

Or if it advances up to the WL, you still have 50% that generates profits.

Either way, you have a winner on your hands.

Don't let it dig into a Looser!

Winner

Today's Market Overview and for Tomorrow Today's Market Overview:

General Trend:

The market seems to be consolidating after breaking key structural levels (BOS and CHoCH). The price is hovering near resistance zones (Premium and EQH) and shows potential for a move toward lower support zones (Discount and Equilibrium).

Key Support and Resistance Levels:

Support Zones (Fibonacci Levels):

The range of $2,690 to $2,684 serves as a critical support area.

Resistance Zones:

The area around $2,718 to $2,725 acts as a strong resistance zone, likely to impede further upward movement.

Scenarios for Tomorrow (January 21, 2025):

If the price breaks above the $2,718 level and sustains, it may target the next resistance at $2,725 or higher.

If the price drops below $2,698, it could retest the support zone between $2,690 and $2,684.

Fibonacci Insights:

Key Retracement Levels:

Based on the chart, critical Fibonacci retracement levels seem to align near $2,705 (0.382) and $2,690 (0.618), making these levels important for potential reversals.

Recommendations for Tomorrow:

For Bullish Traders:

Wait for the price to stabilize above $2,718 and look for buy (long) opportunities targeting $2,725 or beyond.

For Bearish Traders:

If the price breaks below $2,698, short positions targeting the $2,684 support zone could be profitable.

21k before Trump will lose USA elections in November.So it's obvious, that BTC will rally to reach new ATH before November and will collapse miserably after Trump will lose USA election and stock market crash. Also, COVID-19 will create real apocalypse in the USA (I'm talking about riots and shooting in the streets because bastards there have too many guns and not so much brain). But if Russia will help Trump with reelection, bitcoin will pump further to the moon.

#shorttesla

BRO: Entry, Volume, Target, StopEntry: above 106.02

Volume: above 749k

Target: 113.04 area (this is an area, no guarantees, you should be selling on the way up)

Stop: Depending on your risk tolerance; Based on an entry of 106.03, 102.78 gets you 2/1 Reward to Risk Ratio.

This LONG swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not enter a trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

Master the Trading Mindset: Lessons from Trading in the ZoneTrading in the Zone by Mark Douglas is widely regarded as one of the most important books for traders seeking long-term success. The book emphasizes that consistent profitability in trading is not only about mastering strategies or market knowledge but, more importantly, about trading mindset, mastering your own mind. Many traders focus purely on technical or fundamental analysis, but Douglas insists that psychological discipline is what separates successful traders from the rest.

By understanding the emotional and mental aspects of trading, you can turn potential obstacles into strengths.

Why Most Traders Struggle: The Illusion of Market Control

One of the core ideas in Trading in the Zone is that many traders enter the market under the false assumption that they can control outcomes if they make the right predictions. This mindset is deeply flawed. The financial markets are inherently unpredictable. Even with the best analysis, there are countless factors influencing price movements that are beyond any trader’s control.

Key Lesson: Embrace Uncertainty

Douglas emphasizes that successful traders must understand that the market is governed by probabilities, not certainties. You will never be able to predict the market with 100% accuracy, and that’s okay. The goal isn’t to be right every time, but to develop an approach that gives you a statistical edge—one that ensures you come out profitable over time, even when some trades fail.

Think of the market as a casino: while the house doesn’t win every game, its edge ensures that over time, it’s consistently profitable. Similarly, traders need to focus on building a system that works across a large number of trades, rather than getting caught up in trying to control individual outcomes.

Building a Winning Attitude: The Process vs. The Outcome

A major theme in Trading in the Zone is the need to shift your mindset from being outcome-driven to being process-driven. Most traders make the mistake of evaluating their performance based on whether they won or lost an individual trade. This creates a dangerous emotional cycle, where wins create overconfidence and losses spark fear or frustration.

Key Lesson: Detach from Individual Results

Douglas teaches that trading is a marathon, not a sprint. Consistent success comes from focusing on the process, not individual trades. You must follow your plan and rules consistently, regardless of the outcome of a single trade. Winning trades don’t always mean you followed your plan, and losing trades don’t necessarily indicate failure. Instead, long-term success comes from disciplined execution of your edge.

By focusing on process over profits, traders can eliminate the emotional highs and lows that lead to inconsistency. This mental shift helps you stay level-headed, even when things don’t go your way.

The Role of Beliefs in Trading: How Your Mindset Shapes Your Actions

Our beliefs influence how we behave in the market. If you have subconscious fears about losing money, or if you believe that being wrong is a sign of failure, these beliefs will manifest in your trading actions. You might hesitate to pull the trigger on a trade, cut winners too early, or hold onto losing positions because you’re afraid to admit defeat.

Key Lesson: Reprogram Your Mindset

In Trading in the Zone, Douglas explains that you must reprogram your mindset to align with the realities of trading. Accept that losses are part of the game. Successful traders understand that losses are inevitable, and they don’t let individual losses affect their confidence. Trading success comes from building a set of beliefs that supports objective decision-making.

For example:

Limiting belief: “I can’t afford to lose money.”

Empowering belief: “Losses are a natural part of trading; my edge will prevail over time.”

By changing these internal beliefs, traders can reduce emotional interference and make rational decisions in line with their strategy.

Thinking in Probabilities: Shifting to a Casino Mindset

Douglas spends considerable time explaining the concept of thinking in probabilities. He uses the metaphor of a casino to illustrate how successful traders operate. A casino doesn’t win every bet, but its edge ensures that over thousands of games, it consistently comes out ahead. Similarly, traders need to think of their trades in terms of probabilities.

Key Lesson: Your Edge is Everything

Your edge is your winning probability over a series of trades, not your ability to predict individual outcomes. Once you accept that losses are part of the game, the emotional attachment to individual trades fades. What matters is sticking to your system and letting the edge play out over time.

In practical terms, this means:

Don’t let a losing trade shake your confidence.

Don’t get overly excited about a winning trade.

Stay committed to your system, knowing that it will be profitable over time if you consistently apply it.

Overcoming the Fear of Losing

One of the biggest challenges traders face is the fear of losing. Fear of losing can cause you to avoid entering trades altogether or exit winning trades too soon. This fear stems from not fully accepting the risks of trading.

Key Lesson: Accept the Risk Before Entering a Trade

Before placing any trade, you must be at peace with the potential loss. Douglas emphasizes that you should only trade when you are completely comfortable with the risk. If you can’t emotionally handle the thought of losing a certain amount of money, you’re risking too much. By accepting the risk upfront, you free yourself from fear and allow yourself to trade objectively.

Douglas advises using smaller position sizes or setting tighter stop-losses until you feel confident about the level of risk you’re taking. Once you accept the risk, you can approach the market with less emotional interference and more discipline.

Consistency is Key: The Power of Discipline

Many traders struggle with inconsistency. They might have periods of great success, followed by periods of undisciplined trading that wipe out their profits. Douglas explains that the secret to long-term success in the markets is consistency—not in your results, but in your actions.

Key Lesson: Follow Your Rules

The most important trait of successful traders is that they follow their trading rules every single time. When you deviate from your rules because of fear, greed, or frustration, you open yourself up to unnecessary risk and losses. On the other hand, by consistently following your edge and your system, you guarantee that you will capitalize on your strategy’s strengths over time.

Consistency in following your plan leads to consistent results. Discipline becomes the foundation of a successful trading career.

The Psychological Barriers in Trading: Recognizing and Managing Emotions

Emotions such as fear, greed, impatience, and overconfidence are often the biggest roadblocks to successful trading. Douglas emphasizes that the key to overcoming these barriers is self-awareness. Traders must learn to recognize when their emotions are influencing their decisions and develop strategies for managing these emotions.

Key Lesson: Mindfulness and Emotional Control

By practicing mindfulness, traders can learn to separate their emotional responses from their actions. For example, when the market moves against you, instead of reacting impulsively, take a moment to assess the situation objectively. Is this a market move you’ve anticipated in your plan, or is it an emotional reaction to an unexpected event?

Douglas encourages traders to develop emotional control strategies, such as:

Journaling your trades to reflect on your emotional state during each trade.

Setting clear, predefined exit strategies to avoid emotional decision-making.

Practicing visualization and breathing techniques to stay calm during high-stress moments.

Developing a Rules-Based Trading System

Another crucial concept in Trading in the Zone is the importance of having a rules-based trading system. Many traders enter the market without a clear plan or rules, relying on gut feeling or market sentiment. This lack of structure leads to inconsistent results and poor decision-making.

Key Lesson: Create and Follow a Solid Trading Plan

To achieve success, Douglas emphasizes the need to create a trading plan that outlines:

Your entry and exit criteria.

How much you are willing to risk per trade.

The market conditions under which you will or won’t trade.

Having a plan allows you to remove emotion from your decision-making process. When you have clear rules in place, you don’t have to guess or second-guess your actions. Instead, you follow your plan with discipline and consistency, leading to more predictable results.

Trusting Yourself and Your System

One of the final messages in Trading in the Zone is the need to trust yourself and your system. Many traders fall into the trap of doubting their strategy after a few losses, even if the strategy has worked well over time. This lack of trust leads to system hopping, where traders jump from one strategy to the next, never giving any single approach enough time to prove its worth.

Key Lesson: Confidence and Commitment

Douglas emphasizes that once you’ve developed a solid trading system, you must commit to it fully. Trust that your system will work over a large number of trades, and resist the temptation to abandon it after a few losing trades. Confidence in yourself and your strategy is essential for long-term success.

The Zone: Peak Performance in Trading

Douglas describes the ultimate goal of every trader as achieving “the zone.” This is a mental state of peak performance, where you are fully in tune with the market, your emotions are under control, and you are executing your trades with clarity and confidence. Traders in the zone are not fixated on individual outcomes but are fully present and focused on following their process.

Key Lesson: Reaching “The Zone” in Trading: Achieving Peak Performance

In Trading in the Zone, Douglas introduces the idea of “the zone” — a state of peak performance where a trader is completely in sync with the market. In this mindset, emotional distractions are minimized, allowing you to make clear, confident, and unbiased decisions. When traders enter the zone, they’re fully focused on their process and not concerned with individual wins or losses.

Key Lesson: How to Achieve the Zone

Getting into the zone requires practice, emotional control, and mental discipline. By focusing on your trading process and minimizing emotional responses, you will begin to trade with precision and without hesitation. Some key steps include:

Mastering Emotional Control: Remove attachment to individual outcomes.

Focusing on the Process: Commit fully to your strategy and trading plan.

Trusting Your System: Develop unwavering confidence in your edge over time.

When you’ve trained your mind to operate in the zone, trading becomes a fluid experience, and you are better equipped to handle the challenges of the market.

Final Thoughts: The Psychology Behind Trading Success

Trading in the Zone offers profound insights into how the mind shapes success in the financial markets. The key takeaway from Douglas’ work is that mastering the mental game is essential for consistent, long-term profitability. Successful traders learn to think in probabilities, accept risk, and develop the discipline to follow their edge consistently.

Key Takeaways:

Embrace Uncertainty: Focus on probabilities rather than certainties.

Reprogram Limiting Beliefs: Accept that losses are part of trading.

Focus on Process Over Outcome: Build and trust your trading system, and don’t be swayed by short-term results.

Master Emotional Discipline: Be aware of how emotions like fear and greed impact your trading decisions.

Strive for Consistency: Following your rules consistently will lead to consistent profits over time.

By focusing on mindset and emotional control, traders can overcome common pitfalls and achieve the level of discipline required to succeed in the highly competitive world of trading. Through Trading in the Zone, Mark Douglas offers a blueprint for developing the mental resilience needed to thrive in any market environment.

If you’re looking to elevate your trading performance, internalize these lessons and put them into practice. The market may be unpredictable, but with the right mindset, you can navigate it with confidence and discipline.

AUD/USD: 15/05: Short term signal todayOANDA:AUDUSD AUD/USD refreshes the intraday high near 0.6666 as it bounces off key short-term support to record its first daily gain in three days early Monday. In doing so, the Aussie pair also justifies the recovery of the RSI line (14) from the oversold zone.

It is worth noting that the bullish MACD signals also support a reversal from the two-week-old horizontal support zone around 0.6645.

Even if the AUD/USD pair surges past 0.6685, the 200-HMA and the horizontal zone comprising multiple levels marked since May 5, close to 0.6756, could challenge buyers. before giving them control.

Alternatively, a downside break of the aforementioned horizontal support near 0.6645 will not hesitate to challenge the late-April swing low around 0.6570.

The RSI has now broken out of the oversold zone. At the same time, the MACD line has started to cross the Sinal line. These are the factors that are currently supporting the AUD/USD rally.

Gold price next week?: Falling out of the 2000 zoneOANDA:XAUUSD Gold remained stagnant throughout the week, closing within the same price range as last week due to a $2,048 resistance and $2,001 support. There are concerns about the US debt ceiling expiration as talks have been postponed to next week. Additionally, there are worries about an economic slowdown as bank deposits in the US decrease.

A sustained Buy Breakout move above $2,022 will help gold regain its position at $2,032-$2,038.

Buy Sell Breakout at 2000 when the market shows signs of breaking through and close below this price range, stop loss at near 2011 resistance. Nearest target: 1995 - 1990 - 1983

BUY GOLD zone 1983 - 1980

Stoploss: 1975

Take profit 1: 1987

Take profit 2: 1992

Take profit 3: 2002

TRADE UPDATE: 12R has now been achieved on the front sideEIGHTCAP:BTCUSD

Price moved aggressively to our target and I manually exited my positions with a solid 12R gain. I've now entered the backside short position with a 1 R risk, knowing that I will walk away in the worst case with an 11R trade here.

In profit,

The Meditrader

US30 ANALYSIS *MUST SEE*1. overall we are in an UPTREND, because of the HIGHER HIGHS and HIGHER LOWS

2. but now we are at a level of RESISTANCE, on the M30 there were 4 REJECTIONS and a LOWER HIGH was formed afterwards

3. at the current market price, a DOUBLE TOP has formed so I am taking trades which i will not hold for a long period of time or until 35061

4. i stand to be corrected, please share your inputs, God bless!

:)

NAS100 BUY ANALYSIS +1000 PIPS1. so first things first we are in an UPTREND because of the series of HIGHER HIGHS and HIGHER LOWS

2. a level of RESISTANCE was BROKEN and is now our SUPPORT, and market is currently RETESTING this level

3. entry will be the formation of a DOUBLE BOTTOM or INVERTED HEAD AND SHOULDERS after a CLEAR OFF/STOP HUNT

4.if my dark blue zone is broken and a LOWER HIGH is formed then i will short NAS100

5. but these are the financial markets anything can happen i stand to be corrected, please share your inputs, God bless!

Extremely Clean Aud/Jpy Re-cap Please see our above trade on Aud/Jpy posted on 21st November 2021 link below.

Lets break down why we took this trade and how you could have identified this the same.

Starting from the Daily timeframe we identified a daily descending channel which was broken and retested on September 21st. We then started a bullish move towards the previous swing high made on the 10th May 2021. This area was clearly rejected on the daily time frame and then exhaustion followed.

Moving down onto the 4hr chart.

We identified the 4hr ascending trend line that was keeping the bullish move alive and one which we would then use to give ourselves confluence that the bullish move had ended and we could be looking for short positions. After our ascending trend was broken this gave us more confluence and we then moved on to identifying so key market structure and some exhaustion.

This all took place straight out the textbook and we then used the EMA's and descending trend to capatilise on this move to the downside.

To see more set ups like this in advance give the page a follow and if you agree with our ideas hit the thumbs up. If you have a different view point leave a comment below, after all everyday is a learning day.

Have a wonderful weekend.

The Fx Chartist

EURUSD BUYhere is what i see on this pair...

1. price just broke out of my downward trendline on the H1 i'm waiting to see if it closes above it

2. and then again a mini upward trendline formed from the previous low up until now with about 3 touches or so

3. so only if price retests the broken trendline and tests the upward trendline only will i place buy trades on this pair

thanks for your time hope you have a blue week!!!!

GBPJPY BUY• basically the opposite of my YEN BASKET analysis it has formed a downward trendline which is respected for the 4th time last week and tanked down after doing so

• as it reached a significant support level it lost momentum and formed hammers/dojis by that level

• and also formed a downward corrective move which signals a change in direction which is up

• once this mini channel breaks to the upside we going all in with buy orders

• and take profits will be by the trendline

GREAT SUCCESS

AUDUSD BUY• market broke out of the downward trendline, so we looking for BUYS

• a doji formed on the D1 so loss of momentum i'll then be looking for market to reach my upward trendline where i'll place my buys

• or market could be retesting the broken trendline which is still a buy trade w more pips :)

• if market violates that trendline then i'll enter a sell but i'm still strong on a bullish movement on this pair

DXY LONG TERM SELL • market reached a major trendline (weekly)

• for the past two days of last week price has been indecisive resulting in two reversal candlestick patterns (drawn and highlighted) which show a slow down in momentum and possible market reversal.

• so i'll be looking to sell the dollar as of now and reach that support level, but we wait and see what the market does next week and then we adapt to whatever it does and seek opportunity.

please do share your opinions and input :)

5 Steps to Success: Serial Winner!💪Hey! Who wanna get a portion of motivation?🧐

I recently read a book "5 Steps to Success: Serial Winner" -

by Larry Weidel. 💪 This book served me as a great kick'n ass!

You know... sometimes a huge pile of difficulties falls on your head, when usual daily routine becomes unbearable - there are two options - give in and continue suffering or STRUGGLE!

The choice is yours, but I prefer to fight!🤜🏼

I'll briefly share the conclusions, that I made after reading this book, I'll be glad if it will become a drop of motivation for someone!

📌 Don't doubt - decide

Any victories are preceded by decisions. On the way, we always encounter with the main enemies of our aspirations - hesitation, detailing and excuses. Therefore, in order to decide on your fateful decision, you need:

a) do not rely on myths about the advantages of real winners and understand that " advantage is not a guarantee of victory. ”;

b) create a plan sufficient to start working on achieving the goal and stop striving for the PERFECT plan, because this simply doesn't exist;

c) determine the starting point of your movement, following your natural interest - to finally understand your true motives and desires and give yourself a chance to try.

📌Don't just do - overfulfill

Just doing a thing is not enough. In the beginning, we always set too low expectations regarding the energy and resources that need to be invested in achieving a new goal. Of course, we cannot look into the future.

However, it's underestimation often leads to defeat

The best way to prevent that is to overdo it or overfulfill. Put in extra effort - beyond what was planned - and work more than you think you need to. Not looking for easy ways, but giving everything that you have to a new undertaking. That's the only way to avoid the trap of underestimation and not fail at the beginning of the journey.

📌Don't quit - adjust

Difficulties on the way to victory are inevitable. There are two options: quit business and forget your dreams, or meet defeat with dignity this time and do everything possible to win in the future. Any effort has a cumulative effect. Only with time can you see the results of your work - it will be a shame to give up everything before the first signs of success. (That's not a desperate struggle for the impossible.)

Victory is a matter carried through to the end. Don't quit your deal, just adjust your unproductive goals. It's even possible to change direction. The main thing is never give up hard work and progressive work.

📌 Don't just start - follow through

When you come close to the finish line, various obstacles may arise. But winning is not about preparing, making adjustments, or talking about previous successes. !!!!! Victory is a completely completed business.

No matter how insurmountable these obstacles may seem, it's necessary to reach the victorious end. Leaving the goal, almost reaching the top, means losing all the resources that have already been invested along the way, and ruining your reputation due to the loss of trust of others. And don't be surprised, that the last steps on the path require a little more resilience, they are really hard.

“98% of what has been done is not done yet. Only the winners overcome the last 2%, ”!

📌Don't calm down - constantly improve

After receiving the first victories, it seems to someone, that they can already rest. They reduce the rate of their acceleration and development. However, winning is not a one-time action, but a constant movement. Serial winners recognize how much more can be achieved and are committed to it. They are constantly improving. The best time for it - the moment of "exit" from another victory. That's the perfect time to reflect on mistakes and start working on your weaknesses, try to master a new field and succeed in it, or to learn from even more successful ones.

Serial winners get a taste of life in the question "what's next?" That's what distinguishes them from everyone else.

WHO ARE YOU???? ARE YOU A SIREAL WINNER?or JUST WANNA BECOME?

Share with me in the comments♥️

Thanks for Your attention🙏🏻

Stay in touch🧡

Sincerely yours Rocket Bomb🚀💣

Some of my last similar posts👇