WIRECARD AG 2020 was a hard time for everyone because of Corona , but one of the biggest shock of stock market was Wirecard scandal.

I believe even after all this chaos around Wirecard, it would rise again in future. Of course the time could not be predicted.

Wirecard was a BlueChip stock, they have billions of Euro worth business running still now.

The share fell down because of scandal and closing operations in different countries, but in longer term if there comes the long waited news of selling Wirecard to a new company could push the price upwards. As, it could bring relief and trust among investors once again.

*** Do your own research. This is only my own analysis, not an investment advice.

Wirecard

Wirecard`s lowest lowfrom 200 to 0.51

Almost 400X

63.674M Market Cap

If it doesn`t bounce from here, then when?

The adventures of Wirecard CEO, Bulls, and regulatorsAh, cheap and great investment Wirecard just made a new low.

Now is a perfect time to tell their story.

Massive hordes of "investors" blindly piled on this hyped ponzi based on lies.

And then they laughed at the bears and said they were mad they missed out.

And then the CEO went to jail and it went to zero.

The end.

Thank you for playing.

They say investing should be boring. So wrong. This makes it all worth it.

It is amazing how many independant or amateur investors have been buying and are still interested in buying.

It's always the same with lunatics that think bears are some illuminati or flat earth group making conspiracy theories to drop the price of a perfectly legit company.

Here is one comment that aged well:

Sep 5, 2019

"The #Wirecard $WID bears are doomed! Finally, justice after so many lies."

Entire timeline here:

www.ft.com

Crazy story xd

www.fudzilla.com

Remember the dead stock bounce strategy?

WDI Wirecard insider buy? Why 68% in pre-exchange trading?!First of all Wirecard stock jumps up to 68 percent in pre-exchange trading at the beginning of the week. The reason for this is progress in the search for investors. According to insolvency administrator Michael Jaffé, 77 interested parties have signed confidentiality agreements for the core business: "We are confident that we will find an investor for the core business that offers significant entrepreneurial opportunities in an enormously growing market for an investor."

Second, reports say that someone bought 1 mil euro worth of shares, maybe it was an insider buy who knows the deal Wirecard is about to make.

In third place it`s Angela Merkel, the Chancellor of Germany who promoted Wirecard in China before the scandal, she somehow co-signed for Wirecard by doing that. I think the German government won`t let its people who put their lifetime savings in WDI stock to loose all the money. They also gave money to Lufthansa, they will need to buy part of Wirecard too. For sure they want a piece of that financial working business.

Wirecard has Assets of 5.85Bil Euro and Liabilities of 3.93Bil, so a nice debt to assets of 67%.

We will see a bounce sooner than expected.

Not trading advice.

If you are interested to test some amazing buy and sell indicators, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

Best time to buy Wirecard ?Wirecard is close to a double bottom. The ones who did`t bought at 1.2 euro, now have the second chance at 1.5 euro.

Can easily make a 5x.

Only 200mil market cap.

Not trading advice.

If you are interested to test some amazing buy and sell indicators, which give the signal at the beginning of the candle, not at the end of it, just leave me a message.

Cryptodotcom and wirecard: unlucky timingWhy i think that MCO still has a long way to go down:

If you search the net for some info about Crypto.com you will find a lot of people that really don't trust the company (ponzi scheme) or lost their faith in it.

People (like me) who live in Europe have waited very long for their crypto visa card to arrive. I got mine a few weeks ago. And a lot of people are still waiting.

Recently Wirecard lost about 1.9 Billion (happens to me all the time). Well this is the card provider for crypto.com in Europe and the UK. So the card doesn't work anymore. (Still works in USA, and Singapore and maybe some other Asian countries?)

Before this happened, people were already complaining about the value of MCO and that crypto.com doesn't care about the coin anymore and only about their "newer" coin CRO.

I think this is the main reason why MCO started going downhill. Wirecard was the reason for a bigger drop past days.

But why do i think it will slowly bleed to go down further:

1. People still have some MCO locked for the card that they didn't received, or in the earn function on the app and will probably start selling once they are set free because of recent news.

2. People will probably downgrade their card because it lost most of it's functions (no point on staking 4500MCO for 2% extra interest when a coin goes -20%).

3. Finding a new card provider will take (this is just my guess) at least a couple of months and more people will lose faith.

4. Fewer new interested people will be attracted.

I sold a bunch MCO a couple of weeks ago because of bearish RSI on the daily chart. So i'll dca on the blue target points. first 2 boxes seem very possible. Next 3 will maybe happen if BTC takes a big hit.

I pretty sure they will find a new card provider and that MCO will be a succesfull coin, so for me this wirecard bullshit came right on time. They have a very succesful team (more than 200 people), good exchange, popular second coin CRO, syndicates,..

Some other people will also take the opportunity to accumulate MCO cheap for the ICY white card, that seemed impossible a couple of weeks ago. The card program was where it all started, they can't let it die, we must have some patience :)

WCAGY WDI Time to reenter this trade | WirecardWith a Mkt cap of only 262.95M, once the pride of the german fintech, Wirecard has still room to grow if they manage to reestablish trust with a new board.

The indicators show a buy signal at the actual price.

Not trading advice.

If you are interested to test some amazing buy and sell indicators, which give the signal at the beginning of the candle, not at the end of it, like others, just leave me a P.M.

Sorry but all Equity is worthless, they are selling its pieces Wirecard’s new management is seeking to keep the company afloat and may consider the sale of some of the company’s units, which could allow creditors to recover at least some of their investments.

Wirecards’ 500 million euros of bonds due 2024 last traded at 20 cents on the euro. The company’s 900 million euros of convertible notes stood at 12 cents, according to data compiled by Bloomberg.

I don't understand why the new fashion is to gamble with worthless bankrupt companies like LK , Hertz and now Wirecard

This can be a good game for day trader but my advise is to cash your gain at the closure if you are lucky enough to win

Equity is worthless , they won't be enough money to cover the debt-holders already.

This is casino so please know what you are doing

Just for fun: Comparison Bitcoin vs Wirecard, End 2011 - todayRecently I saw a chart of the "rise and fall" of Wirecard (WDI), which for me, as a crypto trader and Bitcoin evangelist, who is bullish for Bitcoin, looked suspicious for long already.

Well, just for fun, I made Bitcoin's and Wirecard's historical data comparable in a single chart layout from the end of 2011 to today. Please be aware of the logarithmic scale and a second Y-axis to make the value appear equal - even in USD and EUR which doesn't matter in this little chart.

I set both All-Time-High (ATH) at the same level which reveals Bitcoin's volatility and its bubble-like peaks at the ends of 2013 and 2017. But this also shows clearly the apart from that parallel rise of Wirecard which had its peak only 10 months later. From the beginning of 2019 on you can see that both assets behaved very similar until April 2020. Probably this is not a Corona-pandemic related issue for Wirecard but a time EY gave more an more pressure to Wirecard to lay its cards on the table.

No matter what, you can learn from this comparison that Bitcoin as an independent community- and public-driven payment processor seems to be by far more scandal-resistant and reliable, and verifiable than any Enterprise conducted and under control of a handful of people with their very own maybe very egoistic motivations.

When it comes to money, wealth and assets you better trust the one on which's public blockchain you control the deposits, funds, and payments. Take back control over your wealth.

Or even better: Don't trust, verify!

buy and hold for longterm investor = put buystop on candel high and hold it long term ,min 6mounth ,,,,it will back to 35euro or even 100!!!! believe me ,,,,,germany GOV will help wirecard soon

my desktop=https://www.tradingview.com/chart/jtsoM2GC/

#Wirecard - To take the cake #WDI #becreative #DAX #DAX30Since Corona,

some life has come back to the House of DAX.

Well, Wirecard CEO Braun has been a red flag to many investors for a long time and so the DAX-listed (till July?) company or the auditors of EY Ernst & Young surprised the market by reporting that 1.9 billion euros in escrow accounts could not be properly verified. After all, that is 1/4 of Wirecard's balance sheet.

Since the balance sheet is unlikely to be ready by mid-July, investors should take care that loans worth EUR 2 billion could then be cancelled (another 1/4 of bs).

This means that the current discount of 50% is ok.

However, if the loans are extended, the situation could become calmer again.

But who knows what surprises CEO Braun will come up with again.

Nothing for cowards.

BUY WDIThe recent crash of wirecard send it to previous low level, in daily chart

the powerfull surge during the global market recovery showed a big bullish force

the recent pull back is finished, as shown by EMA 20

a buy STP can be placed with a tight stop loss

#Wirecard - Is that it now or is there more to come? #WDIYesterday in Hamburg I was welcomed by Wolfgang at 9:20 am as follows:

Hi Stefan, glad you're here, now you missed the WireCard show.

Well, I can't dance at every party either, but WireCard could be interesting again soon.

21.10.2018

11.02.2019

20.03.2019

25.10.2019

25.04.2020

Greating from Hannover

Stefan Bode

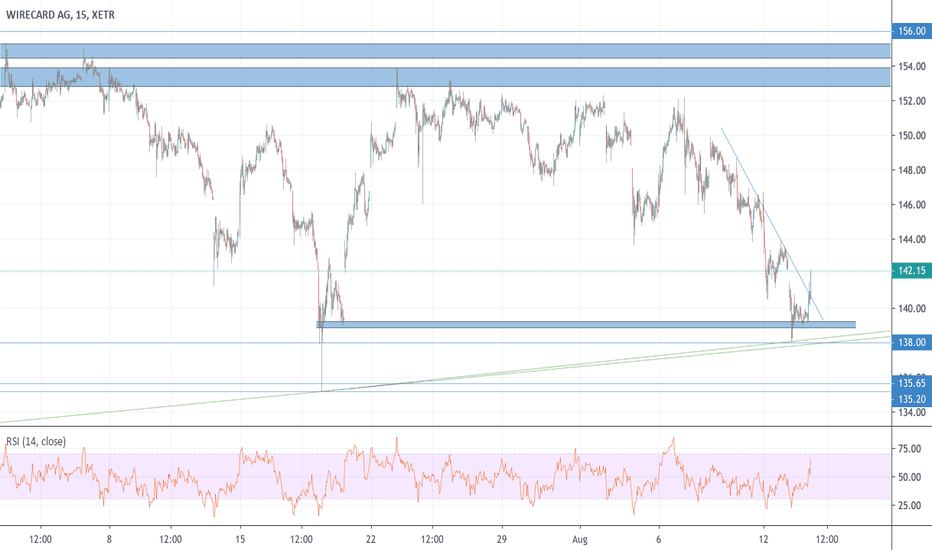

Wirecard | in a macro bull trend - but obstacles ahead! In the first month of 2020 XETR:WDI showed some real momentum which lead the stock close to the border of the purple triangle. As expected the stock then started to consolidate in a small range which is actually a sign of strength.

When we take a look from a further point of view - we can see, that the stock is still in a channel which started somewhere back in the year 2009. This macro trend is still valid whereby the upper border of this channel is between 160€ and 170€.

By taking this fact into account - the next bullish target would be 160€ where the stock then should start to consolidate again. If the stock does not manage to break the triangle, we would expect an extended consolidation which might lead to another buy opportunity.

Wirecard is still a Buy!Most recently, Wirecard showed an increase of 4.10 percent to 134.45€. After a recovery of around a quarter in the course of the year so far, the papers also made the jump over the 200-day line at currently EUR 134.18, which can give shares additional momentum. The eyes are now on the course gap just under 140€.

Wirecard stock in Buy zone after October's 13% fallHello Traders! Wirecard stock fell 13% on the middle of October 2019 after an article on FT with title "Wirecard’s suspect accounting practices revealed". Now after a breakout on both trendline resistances its a good opportunity to buy some shares. Watch the video for more.

Wirecard - not long until bullrunthere are some technical resistances, but we got extreme support areas and an "long" term uptrend. the fundamentals are extreme bullish, we got an growth company with solid financials here. Im sure it will outperform the DAX(Germany 30) this year by a lot.

Wirecard AG: Up-move looses its momentumRecent bullish tendencies on wirecard seem to be near exhaustion, enabling a possible short selling. Resistant fractals and lower highs indicate that a consolidation and bearish move could be coming. Shorting would result in a low risk trade, since the recent swing highs are close to the current price, thus providing an excellent SL level, that would invalidate the setup should price move above it.

Softbank: Trading at top of megaphone patternSoftbank has come under increasing scrutiny for its eye-popping investments and corporate governance practices. Investing almost a billion into a company embroiled in a massive accounting fraud scandal (Wirecard) is not what I would characterize as best use of shareholders' capital.

Starting from the 2009 trough, the stock has completed 5-waves up with the price action over the last 5 years culminating in a bearish megaphone pattern.

Wirecard - ConsolidationFollowing a strong bull market that has been ongoing since March 2016, the share has entered the necessary phase of consolidation since September. This will still prevail at least until the end of 2018.

Currently, the wave (b) of (4) should run.

Depending on the length of (b), the (c) should find its place in the €134 range.

There would also be a re-entry into the stock to consider, because there would be the complete movement (3) corrected to 38.2%. Often there is a trend change in this area. At €94 this (3) would be corrected to 61.8%.

Therefore, I set an alarm clock at €135 to look again to this share.

Greetings from an Eichsfelder from Lower Saxony

Stefan Bode