With

SOLUSDT/Cup with handle ideaHello Traders. Cup with Handle pattern is a well-known technical analysis pattern that can be used to identify potential buying opportunities. If you are considering this pattern, you might be looking for a potential target price of $84.

Of course, to play out, Bitcoin must correspond.

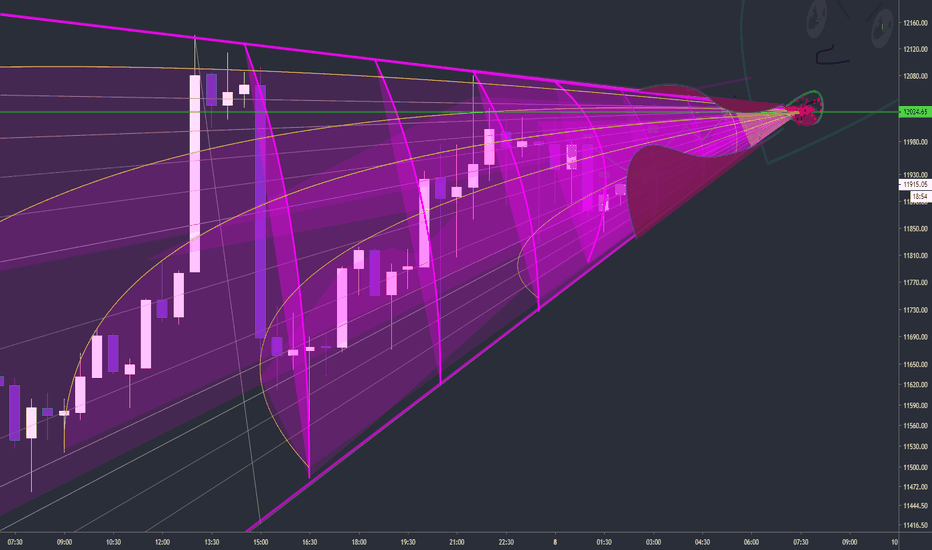

Short BTCShort BTC to 16,000.

Nice strong move down over the 200ema, the ema indicator also now turning down.

16000 aligns beautifully with the 0.5 fib and previous resistance. The move to 0.5 fib has an 85% chance if it clears 16550 area.

Coupled with my Donchain Ribbon showing red throughout and my Heatmap showing lots of red - I like this trade.

Stop at 17100.

bitcoin inverted cup with handle and head and shoulder scenario 1st: bitcoin inverted cup with handle

if holds the white line, high probability will form:

2nd: head and shoulder scenario if and when the white line of support holds and causes a 'right shoulder' from short covering.

stay tune to this 3 month play.

follow for more ideas and updates for invalidations and more

Gold could be entering a price trap Gold has been forming a cup pattern from the 2011 @1920 high to the 2020 high @ 2074. Since it's high in 2020 gold has slowly shed it's value over the course of 7 months it has been a steady decline. This price action has formed

what could be a nice handle. After bottoming out at 1667 it is likely we will see at least a short term reversal. Gold is likely to find resistance at 1765 in the coming weeks. These are two key levels that gold has found it's self trapped between historically for multiple weeks. A break above 1765 or below 1667 could signal a large move in their respective directions

First Analysis - Looking for constructive criticism.Hello,

I am a beginner investor learning about technical analysis through youtube and other free resources. I am using this chart and analysis to put my understandings to the test. Please let me know what you think and share where I can improve.

Analysis: ARKG is trending bullish both long and medium-term and is close to a buy signal as the last closing price was just inside the lower Bollinger band and the RSI was trending to oversold before leveling out around 37. Using Fibb Retracement starting with the low on 12/21 to the 12/23 high, the support level at 38% and the current price are almost in lockstep at $103.25 and $103.10 respectively. If the price breaks down through the 5-day trend line the next level of support is around $99.57 but it appears the overall short-term trend is up and I look for the ETF to bounce off the 5-day trend line to once again push for higher highs.

TradingBeastOB// This source code is subject to the terms of the Mozilla Public License 2.0 at mozilla.org

// © tradingbeasts

// This experimental Indicator helps identifying instituational Order Blocks.

// Often these blocks signal the beginning of a strong move, but there is a significant probability that these price levels will be revisited at a later point in time again.

// Therefore these are interesting levels to place limit orders (Buy Orders for Bullish OB / Sell Orders for Bearish OB).

//

// A Bullish Order block is defined as the last down candle before a sequence of up candles. (Relevant price range "Open" to "Low" is marked) / Optionally full range "High" to "Low"

// A Bearish Order Block is defined as the last up candle before a sequence of down candles. (Relevant price range "Open" to "High" is marked) / Optionally full range "High" to "Low"

//

// In the settings the number of required sequential candles can be adjusted.

// Furthermore a %-threshold can be entered. It defines which %-change the sequential move needs to achieve in order to identify a relevant Order Block.

// Channels for the last Bullish/Bearish Block can be shown/hidden.

//

// In addition to the upper/lower limits of each Order Block, also the equlibrium (average value) is marked as this is an interesting area for price interaction.

//@version=4

study("BEAST OB Finder", overlay = true)

colors = input(title = "Color Scheme", defval="DARK", options= )

periods = input(5, "Relevant Periods to identify OB") // Required number of subsequent candles in the same direction to identify Order Block

threshold = input(0.0, "Min. Percent move to identify OB", step = 0.1) // Required minimum % move (from potential OB close to last subsequent candle to identify Order Block)

usewicks = input(false, "Use whole range for OB marking?" ) // Display High/Low range for each OB instead of Open/Low for Bullish / Open/High for Bearish

showbull = input(true, "Show latest Bullish Channel?") // Show Channel for latest Bullish OB?

showbear = input(true, "Show latest Bearish Channel?") // Show Channel for latest Bearish OB?

showdocu = input(true, "Show Label for documentation tooltip?") // Show Label which shows documentation as tooltip?

ob_period = periods + 1 // Identify location of relevant Order Block candle

absmove = ((abs(close - close ))/close ) * 100 // Calculate absolute percent move from potential OB to last candle of subsequent candles

relmove = absmove >= threshold // Identify "Relevant move" by comparing the absolute move to the threshold

// Color Scheme

bullcolor = colors == "DARK"? color.white : color.green

bearcolor = colors == "DARK"? color.blue : color.red

// Bullish Order Block Identification

bullishOB = close < open // Determine potential Bullish OB candle (red candle)

int upcandles = 0

for i = 1 to periods

upcandles := upcandles + (close > open ? 1 : 0) // Determine color of subsequent candles (must all be green to identify a valid Bearish OB)

OB_bull = bullishOB and (upcandles == (periods)) and relmove // Identification logic (red OB candle & subsequent green candles)

OB_bull_high = OB_bull? usewicks? high : open : na // Determine OB upper limit (Open or High depending on input)

OB_bull_low = OB_bull? low : na // Determine OB lower limit (Low)

OB_bull_avg = (OB_bull_high + OB_bull_low)/2 // Determine OB middle line

// Bearish Order Block Identification

bearishOB = close > open // Determine potential Bearish OB candle (green candle)

int downcandles = 0

for i = 1 to periods

downcandles := downcandles + (close < open ? 1 : 0) // Determine color of subsequent candles (must all be red to identify a valid Bearish OB)

OB_bear = bearishOB and (downcandles == (periods)) and relmove // Identification logic (green OB candle & subsequent green candles)

OB_bear_high = OB_bear? high : na // Determine OB upper limit (High)

OB_bear_low = OB_bear? usewicks? low : open : na // Determine OB lower limit (Open or Low depending on input)

OB_bear_avg = (OB_bear_low + OB_bear_high)/2 // Determine OB middle line

// Plotting

plotshape(OB_bull, title="Bullish OB", style = shape.triangleup, color = bullcolor, textcolor = bullcolor, size = size.tiny, location = location.belowbar, offset = -ob_period, text = "Bullish OB") // Bullish OB Indicator

bull1 = plot(OB_bull_high, title="Bullish OB open", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 3) // Bullish OB Upper Limit

bull2 = plot(OB_bull_low, title="Bullish OB low", style = plot.style_linebr, color = bullcolor, offset = -ob_period, linewidth = 3) // Bullish OB Lower Limit

fill(bull1, bull2, color=bullcolor, transp = 0, title = "Bullish OB fill") // Fill Bullish OB

plotshape(OB_bull_avg, title="Bullish OB Average", style = shape.cross, color = bullcolor, size = size.normal, location = location.absolute, offset = -ob_period) // Bullish OB Average

plotshape(OB_bear, title="Bearish OB", style = shape.triangledown, color = bearcolor, textcolor = bearcolor, size = size.tiny, location = location.abovebar, offset = -ob_period, text = "Bearish OB") // Bearish OB Indicator

bear1 = plot(OB_bear_low, title="Bearish OB open", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 3) // Bearish OB Lower Limit

bear2 = plot(OB_bear_high, title="Bearish OB high", style = plot.style_linebr, color = bearcolor, offset = -ob_period, linewidth = 3) // Bearish OB Upper Limit

fill(bear1, bear2, color=bearcolor, transp = 0, title = "Bearish OB fill") // Fill Bearish OB

plotshape(OB_bear_avg, title="Bearish OB Average", style = shape.cross, color = bearcolor, size = size.normal, location = location.absolute, offset = -ob_period) // Bullish OB Average

var line linebull1 = na // Bullish OB average

var line linebull2 = na // Bullish OB open

var line linebull3 = na // Bullish OB low

var line linebear1 = na // Bearish OB average

var line linebear2 = na // Bearish OB high

var line linebear3 = na // Bearish OB open

if OB_bull and showbull

line.delete(linebull1)

linebull1 := line.new(x1 = bar_index, y1 = OB_bull_avg, x2 = bar_index - 1, y2 = OB_bull_avg, extend = extend.left, color = bullcolor, style = line.style_solid, width = 1)

line.delete(linebull2)

linebull2 := line.new(x1 = bar_index, y1 = OB_bull_high, x2 = bar_index - 1, y2 = OB_bull_high, extend = extend.left, color = bullcolor, style = line.style_dashed, width = 1)

line.delete(linebull3)

linebull3 := line.new(x1 = bar_index, y1 = OB_bull_low, x2 = bar_index - 1, y2 = OB_bull_low, extend = extend.left, color = bullcolor, style = line.style_dashed, width = 1)

if OB_bear and showbear

line.delete(linebear1)

linebear1 := line.new(x1 = bar_index, y1 = OB_bear_avg, x2 = bar_index - 1, y2 = OB_bear_avg, extend = extend.left, color = bearcolor, style = line.style_solid, width = 1)

line.delete(linebear2)

linebear2 := line.new(x1 = bar_index, y1 = OB_bear_high, x2 = bar_index - 1, y2 = OB_bear_high, extend = extend.left, color = bearcolor, style = line.style_dashed, width = 1)

line.delete(linebear3)

linebear3 := line.new(x1 = bar_index, y1 = OB_bear_low, x2 = bar_index - 1, y2 = OB_bear_low, extend = extend.left, color = bearcolor, style = line.style_dashed, width = 1)

// === Label for Documentation/Tooltip ===

chper = time - time

chper := change(chper) > 0 ? chper : chper

// === Tooltip text ===

var vartooltip = "Indicator to help identifying instituational Order Blocks. Often these blocks signal the beginning of a strong move, but there is a high probability, that these prices will be revisited at a later point in time again and therefore are interesting levels to place limit orders. Bullish Order block is the last down candle before a sequence of up candles. Bearish Order Block is the last up candle before a sequence of down candles. In the settings the number of required sequential candles can be adjusted. Furthermore a %-threshold can be entered which the sequential move needs to achieve in order to validate a relevant Order Block. Channels for the last Bullish/Bearish Block can be shown/hidden."

// === Print Label ===

var label l_docu = na

label.delete(l_docu)

if showdocu

l_docu := label.new(x = time + chper * 35, y = close, text = "DOCU OB", color=color.gray, textcolor=color.white, style=label.style_label_center, xloc = xloc.bar_time, yloc=yloc.price, size=size.tiny, textalign = text.align_left, tooltip = vartooltip)

//plot(OB_bull ? 1.0 : OB_bear ? -1.0 : 0.0, "Output", transp=100)

Climbing abilities of Bulls EUR/JPY We are expecting price to come back at one of the strong Supports (Daily Fibo Retr. 38,2 and 50) most likely to bounce back. I wouldn't bet on a bulls ability to climb, but I would like to see a bull climbing with its hooves on a ladder. Quite literally. Anyway, buyers have a good chance of winning after price reached the Fibo 38,2.

USDCAD both directions, let's get paid.Hello ladies & gentleman, I wanted to show my perspective on USDCAD

As I Illustrate in this video, I'm expecting USDCAD to breakout of this next level and retest it, to take a trade all the way up to the next level that confluences to the trendline.

Whenever price get to that area I'd like to see some good impulsive movement to the down side, expecting a bearish flag, flat flag, whatever continuation pattern comes up first, to take a trade and capitalize all the way down.

I'd like to see / know what you guys are expecting from this pair, any commentary will be well received.

Hope you enjoyed the idea!.

BYEEEEEEE BITCOIN! so this is my proFezonal analisis! if you want to buy btc lower then go all in your net worth 100x short. use my BITMEX reflink too! SO YE GUYS, REMEMBER, 100X SHORT HERE!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

NO RED WOJAKS AFTER WE WIN THIS TRADE GUYSSSSSSSSSSS! THIS IS NOT A DRILL!!!!!!!

Total Market Cap: Cup with handleSo I have had this idea that the total market cap itself might be forming a cup with handle pattern. At the very most i can see the rounding bottom and now it seems we have begun to retrace.

Typically we don't like to see too much of a retrace on the way down something around a 50 percent retrace from the low to high is preferred.

On the chart i have noted that right now we are at the 61.8% retrace from the low to high but that's only on linear scale if we check log scale you would see that we are sitting near the 50 percent retrace.

Log scale does however ruin the left side of our rounded bottom which is why i have kept the basis of this trade on the linear scale.

A measured move if we ever did break out bullishly would bring the Crypto market cap very close to all time highs which would be a great time for any of the cryptocurrencies worth their weight.

Too deep of a retrace downwards could ruin this set up but it's still worth looking at.

Ignore the trendline i plotted on the MACD it was drawn on a smaller timeframe. *