#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

We are looking for stability above the 100 moving average.

Entry price: 0.878

First target: 0.946

Second target: 0.984

Third target: 1.03

WLDUSDT

WLD Main trend. Super pump +1118 and decline -95. 09 05 2025Logarithm. Main trend. Time frame 3 days.

Super pump +1118.42% and decline -95.16%.

Smart and stupid money. The legend of the project is quite interesting, it is quite possible that there will be attempts to implement it, but always in the first place in such projects is: "money from nothing". The chart confirms this. After the pump +1118.42%, a huge distribution zone, which formed the upper part of the pattern of one of the varieties of "head and shoulders" at an angle. Which makes it clear that the profit is huge. Even now, with a price decrease below the listing prices, from the peak of the pump by -95.16%, which is normal for assets of such liquidity, the profit of some "investors" is +25 X !! Think about what profit was when pumping +1118% (it is impossible to implement, the pump is done just for the chart, to raise the price, for "false goals" and hype, so that on rollbacks "cheap", in the distribution zone they were not afraid to buy on the conditional hype "whales bought". Although now it is unlikely that they will pour. In order to constantly sell at excess profit "at any prices", you need to make interest, both for traders and for investors, that is, volatility waves. They will pump under the market.

Local trend . Local impulse from the minimum prices. Locally, the price rested against the median, in case of its breakthrough - the implementation of the ascending pennant.

$INJ Breakout Alert!CRYPTOCAP:INJ breakout alert!

-It finally broke above the downtrend line after months of

consolidation.

-Retest and holding the key support zone around $8.50–

$9.00.

-Now, we are aiming for the next leg toward $26, a

Potential 184% move.

-Trend shift confirmed. Watch closely!🚀

DYRO, NFA

Worldcoin WLD price analysisSam Altman has officially launched the World ID project in the United States, a digital identity system based on iris scanning.

Users are scanned using the Orb device and receive a digital ID (World ID) and 14 #WLD tokens

Last time then the price of OKX:WLDUSDT has been actively growing , when more than 12 million people from 100+ countries "sold" their "scanned eye" for a reward in #Worldcoin

Do you believe that history will repeat itself and the price of #WLDUSD will rise, at least to $3.75?

$TRB/USDT Targeted setup $TRB/USDT – Targeted Setup

Clear descending wedge breakout

Retest of the resistance zone holding as support

Bullish structure forming with higher lows

- Entry zone: CMP

- Target: $98

- Stop-loss: $26

This is a clean breakout-retest setup, with momentum favouring bulls.

As long as $29.98 holds,

Eyes are on $97. 👀

DYOR, NFA

WLD Bearish Head and Shoulders Pattern ConfirmedWLD Bearish Head and Shoulders Pattern Confirmed 🚨

WLD has formed a bearish head and shoulders pattern and is currently breaking below the red neckline. The target for this bearish move is the green line level.

📈 Technical Overview:

Pattern: Bearish Head and Shoulders

Neckline: Red level, currently being broken.

🎯 Target: Green line level.

.

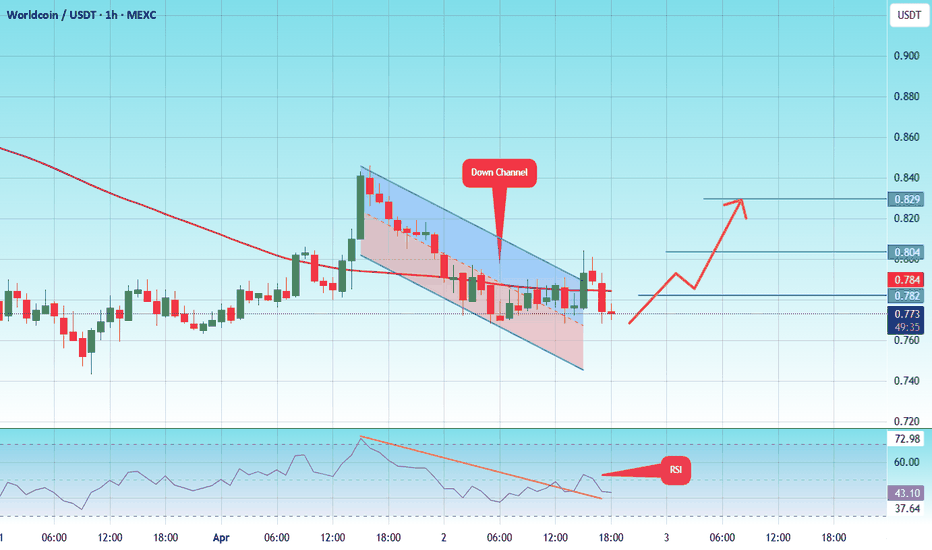

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.750.

Entry price: 0.0764

First target: 0.0782

Second target: 0.800

Third target: 0.829

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.725.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.747

First target: 0.769

Second target: 0.788

Third target: 0.812

TradeCityPro | WLD: Waiting for Reversal in Altman’s Web3 Coin👋 Welcome to TradeCity Pro!

In this analysis, I want to review the WLD coin for you. This project is one of the notable Web3 and Identity projects, founded by Sam Altman, who is also the CEO of OpenAI — and that adds a layer of trust to the project.

🔍 Currently, this coin has a market cap of $984 million, placing it at rank 64 on CoinMarketCap.

📅 Daily Time Frame

As you can see in the daily time frame, the price has dropped significantly since the previous analysis. After breaking below the 1.349 level, the main bearish leg began, and the price fell to the 0.603 area.

🧩 Currently, the price is in a correction phase, moving slowly upward on low volume, and has broken above the SMA25, now trading above this moving average.

🎲 Keep in mind: even though the price is above the SMA25, the slope of the moving average is still downward, which indicates that bearish momentum is still present in the market. However, since the price is now above the SMA, bearish strength is weakening.

📈 To confirm a bullish reversal for WLD, the key trigger right now is the breakout of the 0.947 level. If the price stabilizes above this level, we can say the trend has shifted to bullish.

✔️ A sooner confirmation of the trend change would be a positive slope on the SMA25 combined with increasing volume and green candles — this would be an early sign of a reversal.

🛒 For spot buying, the first trigger is the break of 0.947, and if the price holds above that, the bullish trend could begin.

🔽 The next resistance levels — which could act as targets or secondary buy triggers — are at 1.349 and 2.5776 respectively.

📊 If you already hold this coin and are looking to set a stop-loss, a break and confirmation below 0.603 would be a good level to activate your stop.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

$FLM/USDT Breakout AlertAfter a strong accumulation phase, CSE:FLM just broke out of a descending trendline with volume confirmation!

Entry: 0.0154

SL: 0.0137

Target: 0.0269

Price broke above the trendline + 50ema, signalling a potential trend reversal.

Bullish momentum is building; eyes are on the next key level!

Are you riding this breakout? 👀

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.600.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.640

First target: 0.660

Second target: 0.680

Third target: 0.700

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a support area at the upper limit of the channel at 0.844.

Entry price: 0.838

First target: 0.828

Second target: 0.809

Third target: 0.789

WLD (SPOT)BINANCE:WLDUSDT

WLD / USDT

4H time frame

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.807.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.835

First target: 0.858

Second target: 0.884

Third target: 0.915

WLDUSDT: Is This the Last Chance Before a Major Breakdown?Yello Paradisers, are you prepared for what could be a textbook bearish opportunity on WLDUSDT? Because based on current price action and key confluences, this chart is screaming caution — and the next move might be much sharper than most expect.

💎WLDUSDT has broke down from a rising wedge pattern — a classic bearish signal that often leads to aggressive downside continuation. Alongside this, we’ve identified a clear internal Change of Character (I-CHoCH), followed by the formation of Fair Value Gaps (FVGs). These developments alone raise the probability of a bearish continuation, but that’s not all. The price structure is now forming a Head & Shoulders pattern — another strong reversal signal — increasing the bearish bias with multiple layers of confirmation.

💎If WLDUSDT pulls back from its current level and fills the FVG, we will be watching closely for a bearish candlestick pattern right around our defined resistance zone. This level also aligns perfectly with the Fibonacci golden pocket, adding even more weight to the area as a high-probability short entry. Should this setup form, the reward-to-risk (RR) potential becomes extremely favorable, providing an optimal entry for those waiting patiently.

💎On the other hand, for those considering entries from the current level — while the bearish probability still exists — the RR is much less attractive, hovering around 1:1 or even below. That’s not ideal, especially when managing risk like a pro. The probability of a pullback into the resistance area is still high, so it’s far better to wait for price to come to you. Only then will you have the proper setup to ensure a well-managed trade.

💎However, if WLDUSDT breaks above the resistance zone and we get a candle close above it, that would invalidate this bearish scenario entirely. In that case, it’s best to step aside and wait for better price action to develop. No need to force trades when the market is giving mixed signals — patience always pays.

🎖This is the only way you will make it far in your crypto trading journey. Be a PRO

MyCryptoParadise

iFeel the success🌴

WLD looks bearish in the mid-term (1D)It appears that a Wave A lasting 502 days has completed, and a wave of the same degree 502 days (or even larger) is expected to form on the chart, indicating that WLD is bearish in the mid-term.

Over the next 502 days, any pump is expected to be a selling opportunity. To enter a position, a proper trading setup is required.

A daily candle closing above the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You