WLDUSDT at a Critical Level: Valid Breakout or Just a Fakeout?WLDUSDT is catching traders' attention after successfully breaking above a long-term descending trendline that has capped price since late 2024. But the big question now is — is this the start of a real trend reversal, or just a classic bull trap fakeout?

---

📌 Detailed Technical Breakdown

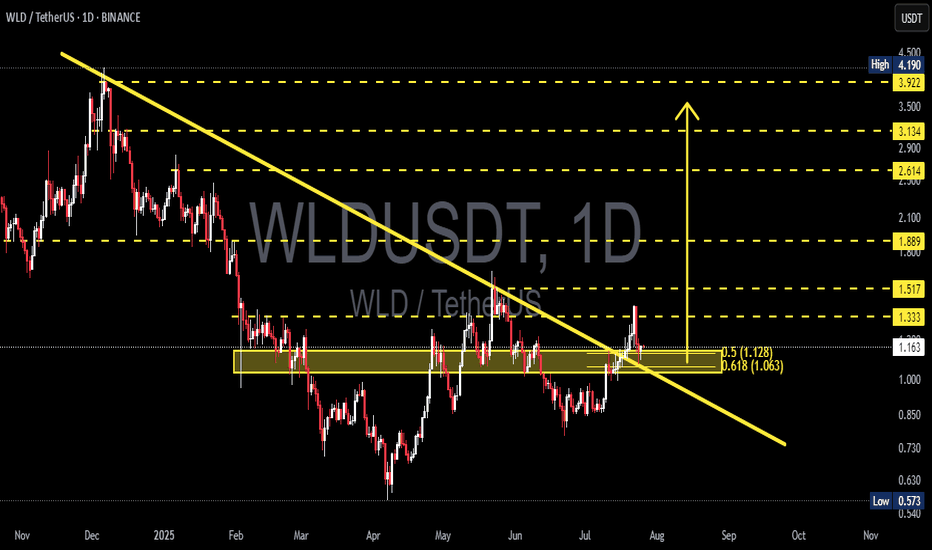

🟡 1. Major Trendline Breakout

The yellow trendline drawn from November 2024 has finally been broken to the upside.

This is a potential signal that bearish momentum is weakening significantly.

🟨 2. Key Demand Zone (Horizontal Yellow Box)

The area between 1.063 – 1.128 USDT has acted as a strong demand/support zone since March 2025.

Price is currently retesting this zone, which makes it a decisive level for validating the breakout.

🔁 3. Fibonacci Retracement Levels

Price is retesting the 0.5 (1.128) and 0.618 (1.063) retracement levels.

These fib levels could serve as a launchpad for a bullish continuation if held.

🧱 4. Layered Resistance Structure

If the bounce holds, WLD could target:

🔹 1.333 – Psychological resistance

🔹 1.517 – Previous structural resistance

🔹 1.889 – Key horizontal level

🔹 2.614 – 3.922 – Medium-term targets based on historical structure and fib extension

---

🟢 Bullish Scenario (Increasing Probability)

Price holds above the 1.063 – 1.128 zone and confirms a rebound.

A daily close above 1.333 would further confirm bullish continuation.

Formation of higher highs and higher lows would validate trend reversal.

🔴 Bearish Scenario (If Breakdown Occurs)

Price loses support at 1.063, invalidating the breakout and retest.

Possible targets to the downside:

Minor support: 0.85 – 0.75

Major support: 0.573 (Previous macro low)

---

📈 Interesting Chart Pattern

Potential formation of an Inverse Head and Shoulders, with the neckline around 1.333.

A confirmed breakout above the neckline could trigger a strong bullish impulse.

---

🎯 Conclusion

WLD is now in a golden zone that will decide its medium-to-long-term trend.

The 1.063 – 1.128 area is make-or-break. If bulls defend this zone, it confirms trend reversal. If it fails, WLD could slide back into a distribution range.

📌 Traders who wait for confirmation at this stage may have the strategic edge.

#WLDUSDT #WLDAnalysis #CryptoBreakout #TrendlineBreak #TechnicalAnalysis #InverseHeadAndShoulders #FibonacciSupport #AltcoinSetup #CryptoTrading #CryptoUpdate

Wldusdtperp

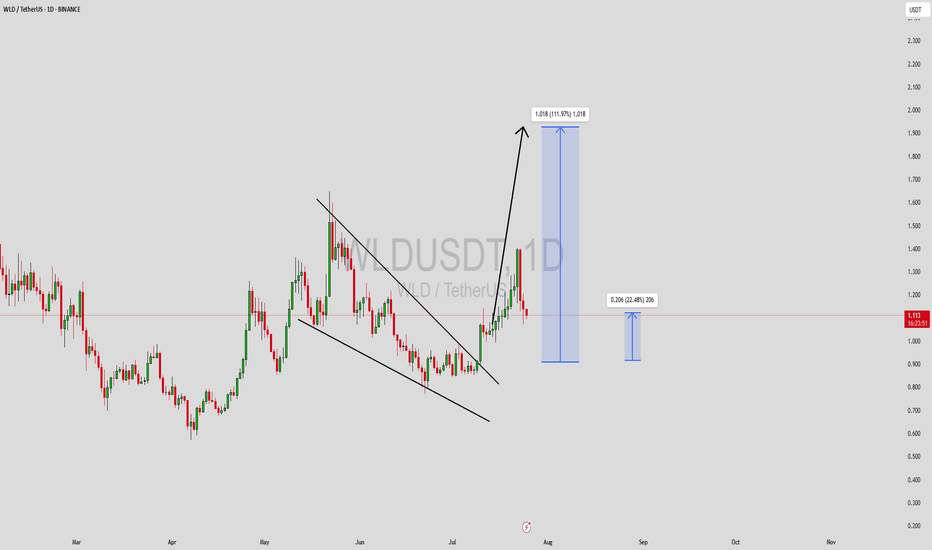

WLDUSDT Forming Falling WedgeWLDUSDT is currently forming a falling wedge pattern, a bullish technical setup known for signaling a potential trend reversal. The narrowing price action within this wedge suggests that sellers are losing strength, while buyers are gradually gaining control. This setup is particularly promising when supported by a rise in volume, and in WLDUSDT’s case, the trading volume has been steadily increasing—an early confirmation of growing investor interest.

Worldcoin (WLD) has attracted major attention due to its unique identity-based ecosystem and backing by high-profile figures in the tech world. The project has recently seen renewed momentum as discussions around digital identity, privacy, and AI integration continue to heat up. The falling wedge pattern, combined with good volume and fundamental strength, increases the probability of an upside breakout. Technical projections point toward a conservative gain of 19% to 20%, making it a suitable target for short- to mid-term traders looking for solid risk-reward setups.

From a technical analysis standpoint, key resistance levels lie near the upper boundary of the wedge, and a breakout with volume confirmation could push prices swiftly toward those targets. Momentum indicators such as RSI and MACD are also showing signs of bullish divergence, hinting at a potential reversal. This setup becomes more favorable in the context of WLD's fundamental narrative and broader market sentiment.

WLD’s long-term vision and growing adoption potential position it as more than just a short-term play. While the immediate gain may be moderate compared to more speculative altcoins, its low-risk technical setup and increasing demand make it an appealing choice for both new and experienced crypto traders.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#WLD/USDT Approaching Breakout After Long-Term Downtrend!#WLD

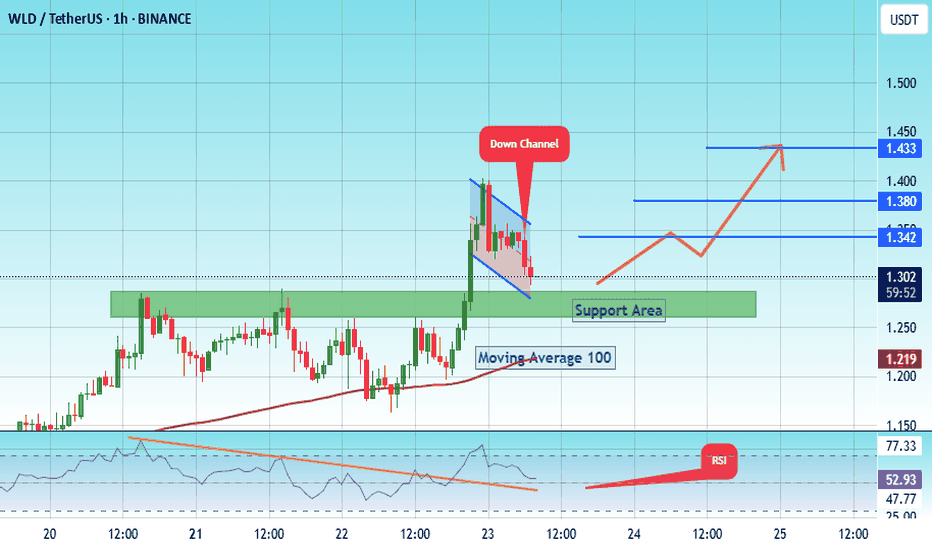

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, this support is at 1.28.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.26, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.30

First target: 1.34

Second target: 1.38

Third target: 1.43

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#WLD/USDT Approaching Breakout After Long-Term Downtrend!#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 1.200.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 1.170, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.250.

First target: 1.288.

Second target: 1.321.

Third target: 1.373.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

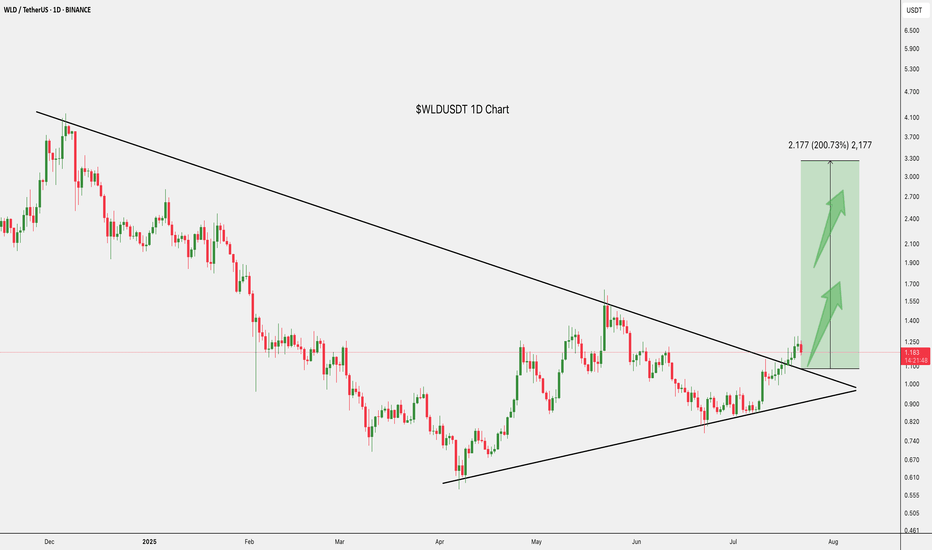

WLDUSDT Approaching Breakout After Long-Term Downtrend!WLD is currently trading inside a descending channel on the 3-day chart. The price has recently shown strong bullish momentum and is approaching the upper boundary of the channel as well as a key resistance zone.

A breakout above this zone could lead to a significant bullish continuation. Volume has started to pick up, indicating increasing interest. If the price manages to flip the resistance into support, we could potentially see a rally towards the $5.00 - $10.00 zone.

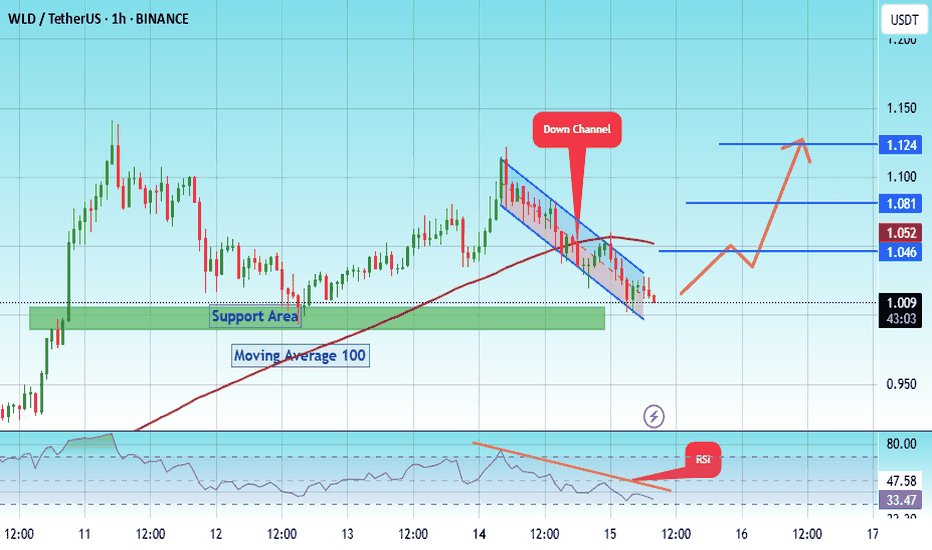

#WLD/USDT Builds Pressure Inside Long-Term Range#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 1.00.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.990, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 1.01

First target: 1.04

Second target: 1.08

Third target: 1.12

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#WLD/USDT Builds Pressure Inside Long-Term Range#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.992, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.930.

Entry price: 1.00

First target: 1.036

Second target: 1.073

Third target: 1.111

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.08.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.143

First target: 1.190

Second target: 1.236

Third target: 1.300

#WLD/USDT , How Long Will It Take For A $ 1.14 Target?#WLD

The price is moving within a descending channel on the 15-minute frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 Moving Average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 1.06, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 1.05.

Entry price: 1.08

First target: 1.09

Second target: 1.117

Third target: 1.14

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.950.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.20

First target: 1.04

Second target: 1.07

Third target: 1.10

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.900, acting as strong support from which the price can rebound.

Entry price: 0.913

First target: 0.944

Second target: 0.971

Third target: 1.004

Worldcoin (WLD/USDT) Breakout Potential – Bullish Setup in PlayThis chart illustrates a potential breakout setup for Worldcoin (WLD) against USDT on the 2-day timeframe (2D), published on June 25, 2025. Key technical insights are as follows:

🔍 Technical Structure:

Strong support zone (accumulation area): Formed in the range of $0.9300 – $0.5728 (highlighted in yellow box). Price is currently consolidating within this zone, which has been tested multiple times and held, indicating a potential bottom formation.

Descending trendline: Has been broken with a bullish candle, suggesting an early signal of a potential trend reversal from bearish to bullish.

Key resistance levels (potential targets):

$1.4824 – initial breakout validation level

$2.4242 – mid-term resistance

$3.8198 – psychological and previous distribution zone

$6.0189 – major resistance before ATH

$10.7997 – $11.9650 – All Time High zone

📈 Projected Price Movement:

Bullish scenario depicted:

1. A possible retest of the breakout zone around $0.93

2. Gradual price rally toward $1.48 and $2.42 as initial targets

3. If momentum and volume support the move, a further rally toward $3.81 and $6.01 is possible

4. Ultimate long-term target lies near previous highs at $10.79–$11.96

💡 Additional Notes:

This setup is still unconfirmed and requires further breakout confirmation and supporting volume for reliability.

Trade remains high risk, as price is still near the final support zone before potential breakdown.

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.825, acting as strong support from which the price can rebound.

Entry price: 0.846

First target: 0.871

Second target: 0.898

Third target: 0.926

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 0.410, acting as strong support from which the price can rebound.

Entry price: 0.500

First target: 1.568

Second target: 1.691

Third target: 1.818

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 1.15, which acts as strong support from which the price can rebound.

Entry price: 1.16

First target: 1.19

Second target: 1.23

Third target: 1.28

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.18.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 1.26

First target: 1.316

Second target: 1.36

Third target: 1.408

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 1.03.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 1.12

First target: 1.15

Second target: 1.19

Third target: 1.250

$WLD Dips Into Key Support – Next Move Loading!MIL:WLD is currently pulling back into a strong confluence support zone aligning with the 100EMA, 200EMA, and ascending trendline on the 6H chart.

Price is hovering just above the 0.382 Fib level (~$1.06), which previously acted as a pivot. Holding this level could spark the next bullish leg toward $1.30+.

But if this zone cracks, we might revisit the trendline near $1.02 before any meaningful bounce.

📌 Eyes on price action, this structure still favours higher highs unless invalidated.

#WLD #cryptocurrency

#WLD/USDT#WLD

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

We are looking for stability above the 100 moving average.

Entry price: 0.878

First target: 0.946

Second target: 0.984

Third target: 1.03