Clean bullish Wolfe Wave on $UNI.Missed out on the perfect entry on $UNI, but I will start accumulating now (even if we dip a little bit considering Bitcoin has a tendency to misbehave while ranging). Targeting around $8 as a target. Could be worth keeping some for after $8 if the market sentiment turned bullish in general.

Wolfe5signals

EURCAD, BULLISH WOLFE WAVE, #RRR 1:6HI BIG PLAYERS,

I'm back with a Wolfe Wave pattern on the EURCAD 4h-chart.

Hereby the Wolfe Wave are bullish and give you for every invested 1 $ -> 6 $ back.

The reasons for a possible Wolfe Wave are that here was an impulse up and currently a similar range of up and down bars show a correction wave => Wolfe Wave as correction wave has the best income opportunity, because after a correction wave follows always an imulse wave.

King regards

NXT2017

High Probability Setup on NEO Crypto with Volume ProfileVolume profile is commonly used for identifying basic support and resistance levels.

This is a reactive method to identify support and resistance . Unlike proactive methods such as trend lines and moving averages which are based on current price action to predict future price movements.

Reactive methods provide meaningful interpretation to price level where the market has already visited.

Basic technical analysis suggested a support level is a price level which will support a price on its way down and a resistance level will resist price on its way up.

Therefore, one can conclude that a price level near the bottom of the profile which heavily favors the buy side in terms of volume is a good indication of a support level . The opposite is also true. A price level near the top of the profile which heavily favors sell side volume is a good indication of a resistance level .

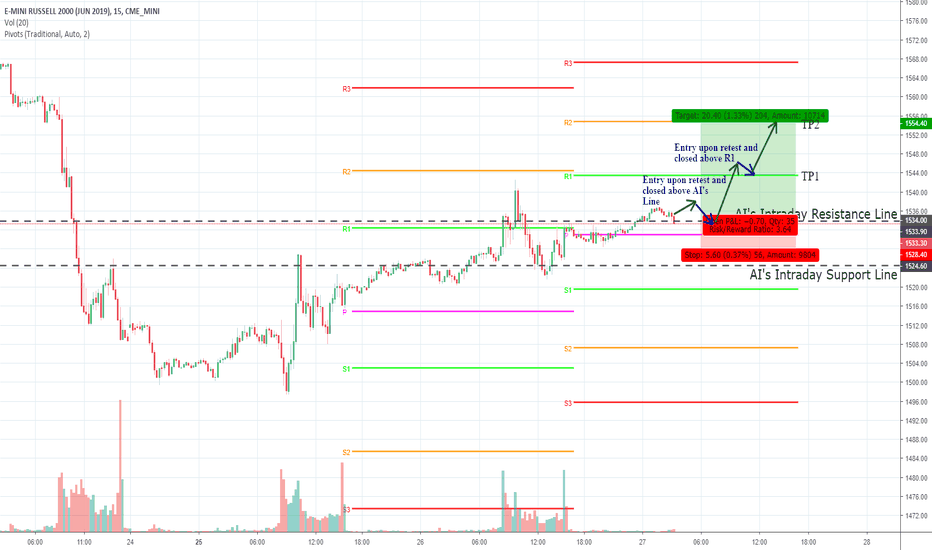

High Probability Intraday Setup for E-MINI RUSSELL 2000 futuresThe following are trades setup ideas in 15 mins chart for E-MINI RUSSELL 2000 futures

There are 2 distinctive dotted lines labeled as (provided by www.decisivealpha.com )

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

[b ]Long Setup

If price action closed above the Pivot Point Line

AND demonstrate bullish sentiment strength by closing above the AI's Intraday Resistance line, the idea is to long and take profit at Pivot Point R1/R2 price region.

Depending on trader's positioning sizing, partial profit could be taken at Pivot Point R1. The remaining position could be utilized to ride the intraday bull sentiment should it continues to approach Pivot Point R2 profit target.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

www.decisivealpha.com

High Probability Intraday Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Range Play setup

If price action closed below the AI's Intraday Resistance line

AND continue to show weakness, the idea is to short and take profit at the AI's Intraday Support line region.

OR

If price action closed above the AI's Intraday Support line

AND continue to show strength, the idea is to long and take profit at the AI's Intraday Resistance line region.

Long Setup

If price action closed above the AI's Intraday Resistance line

AND continue to show strength above the AI's Intraday Resistance line, the idea is to long and take profit at Pivot Point R1/R2 price region.

Depending on trader's positioning sizing, partial profit could be taken at Pivot Point R1. The remaining position could be utilized to ride the intraday bull sentiment should it continues.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for GOLD Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Short Setup

If price action closed below the AI's Intraday support line,

AND continue to show weakness below Pivot Point S1 line,

AND eventually retested/closed below the Pivot Point S1 line, the idea is to short and take profit at Pivot Point S2.

Long Setup

If price action closed above the AI's Intraday Resistance line,

AND continue to show strength above the Pivot Point R1 line,

AND eventually retested/closed above the Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2/R3 price region.

Depending on trader's positioning sizing, partial profit could be taken at Pivot Point R2.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Short Setup

If price action closed below the AI's Intraday support line

AND continue to show weakness below Pivot Point S1 line

AND eventually retested/closed below the Pivot Point S1 line , the idea is to short and take profit at Pivot Point S2/S3 price region.

Long Setup

If price action closed above the AI's INtraday Resistance line

AND continue to show strength above the Pivot Point R1 line

AND eventually retested/closed above the Pivot Point R1 line , the idea is to long and take profit at Pivot Point R2/R3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Short Setup

If price action closed below the AI's Intraday Resistance line

AND continue to show weakness below Pivot Point S1 line

AND eventually retested/closed below the Pivot Point S1 line, the idea is to short and take profit at Pivot Point S2/S3 price region .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Natural Gas FuturesThe following are trades setup ideas in 15 mins chart for Natural Gas Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI's Intraday Resistance line

AND above Pivot Point R1 line

AND continue to demonstrate strength by retesting and closed above Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 price region.

And/Or

Short Setup

If price action closed below the AI's Intraday Support line

AND show weakness by not able to close above the Pivot Point Line

AND eventually demonstrate weakness below AI's Intraday Support line, the ideas is to short and take profit at Pivot Point S1 price region.

Traders may wish to apply advanced technique to take partial profits and continue the short position to Pivot Point S2 price region too.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Short Setup

If price action closed below the AI's Intraday Resistance line

AND continue to show weakness below the AI's Intraday Resistance line AND Pivot Point R1 line

AND eventually retested/ closed below the AI's Intraday Resistance line, the idea is to short and take profit at Pivot Point S2 price region.

And/Or

Range Setup

If price action closed below the AI's Intraday Resistance line

AND continue to demonstrate weakness below the AI's Intraday Resistance line, the idea is to short and take profit at AI's Intraday Support line region.

Traders that took the Short setup could use the Range play setup as partial profit taking .

Traders could play a reversal intraday trade should price action rejected the low price at the AI's Intraday Support line by either an inverted hammerhead candle pattern or a bullish engulfing candle by taking a long trade. Profit target could be at the AI's Intraday Resistance line.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI's Intraday Resistance line

AND above Pivot Point R1 line

AND continue to demonstrate strength by retesting and closed above Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 or/and R3 price region.

And/Or

Range Setup

If price action closed below the AI's Intraday Resistance line

AND continue to demonstrate weakness below the AI's Intraday Resistance line , the idea is to short and take profit at AI's Intraday Support line region.

Traders could play a reversal intraday trade should price action rejected the low price at the AI's Intraday Support line by either an inverted hammerhead candle pattern or a bullish engulfing candle by taking a long trade. Profit target could be at the AI's Intraday Resistance line.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI's Intraday Resistance line

AND

demonstrate strength after testing the AI's Intraday Resistance line

AND

eventually closed above Pivot Point R1 line , the idea is to long and take profit at Pivot Point R2 and/or R3 price region .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI's Intraday Resistance line, demonstrates strength throughout the Asia & European trading hours AND closed above Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 or/and R3 pr ice region.

And/Or

Short Setup

If price action was below the AI's Intraday Support line AND continue to demonstrate weakness AND eventually closed below the Pivot Point S1 line, the idea is to short and take profit at Pivot Point S2 and/or S3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for S&P 500 E-mini FuturesThe following are trades setup ideas in 15 mins chart for S&P 500 E-mini Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI's Intraday Resistance line AND above Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 or/and R3 price region.

And/Or

Short Setup

If price action was below the AI's Intraday Support line AND continue to demonstrate weakness below the Pivot Point S1 line, the idea is to short and take profit at Pivot Point S2 price region .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI Daily Resistance line AND above Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 price region .

And/Or

Short Setup

If price action was below the Pivot Point line AND continue to demonstrate weakness below the Pivot Point line, the idea is to short and take profit at AI's Intraday support price region .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for British Pound FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI Daily support line AND above Pivot Point S1 line, the idea is to long and take profit at the AI's Intraday Resistance line .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Setup on Monero Crypto with Volume ProfileVolume profile is commonly used for identifying basic support and resistance levels.

This is a reactive method to identify support and resistance. Unlike proactive methods such as trend lines and moving averages which are based on current price action to predict future price movements.

Reactive methods provide meaningful interpretation to price level where the market has already visited.

Basic technical analysis suggested a support level is a price level which will support a price on its way down and a resistance level will resist price on its way up.

Therefore, one can conclude that a price level near the bottom of the profile which heavily favors the buy side in terms of volume is a good indication of a support level. The opposite is also true. A price level near the top of the profile which heavily favors sell side volume is a good indication of a resistance level.

High Probability Intraday Setup for Natural Gas FuturesThe following are trades setup ideas in 15 mins chart for Natural Gas Futures .

There are 2 distinctive dotted lines labelled as

1. AI's Intraday Resistance line

2. AI's Intraday Support line

Long Play Probability Setup

If price is above AI's Intraday Resistance line and price action continue to closed above the Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 and/or R3. Traders may choose to take partial profit at Pivot Point R2 (instead of closing entire position) and depending if bullish sentiment continues, remaining position could be closed when price approaches below between Pivot point R2 and R3 region. This is dependent on his/her position sizing to lock profits and to maintain an existing open position as risk-free.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

While it is optional, it is a good practice, in general, to trade this product during the US Future Market Session when there are higher volume and liquidity.

High Probability Setup on Silver Futures with Volume ProfileVolume profile is commonly used for identifying basic support and resistance levels.

This is a reactive method to identify support and resistance. Unlike proactive methods such as trend lines and moving averages which are based on current price action to predict future price movements.

Reactive methods provide meaningful interpretation to price level where the market has already visited.

Basic technical analysis suggested a support level is a price level which will support a price on its way down and a resistance level will resist price on its way up.

Therefore, one can conclude that a price level near the bottom of the profile which heavily favors the buy side in terms of volume is a good indication of a support level. The opposite is also true. A price level near the top of the profile which heavily favors sell side volume is a good indication of a resistance level.

High Probability Intraday Trade Setup for Silver FutureThe following are trades setup ideas in 15 mins chart for Silver Futures .

There are 2 distinctive dotted lines labelled as

1. AI's Intraday Resistance line

2. AI's Intraday Support line

Short Play Probability Setup

If price is below Pivot Point line and price action closed below the AI's Intraday Support Line, the idea is to short and take profit at Pivot Point S1 or S2 . Traders may choose to take partial profit at Pivot Point S1 (instead of closing entire position) and depending if bearish sentiment continues, remaining position could be closed when price approaches below between Pivot point S1 and S2 region. This is dependent on his/her position sizing to lock profits and to maintain an existing open position as risk-free.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

While it is optional, it is a good practice, in general, to trade this product during the US Future Market Session when there are higher volume and liquidity.

High Probability Intraday Trade Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

If price action was below the AI Daily support line AND price closed below Pivot Point S1 line , the idea is to short and take profit at Pivot S2-S3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.