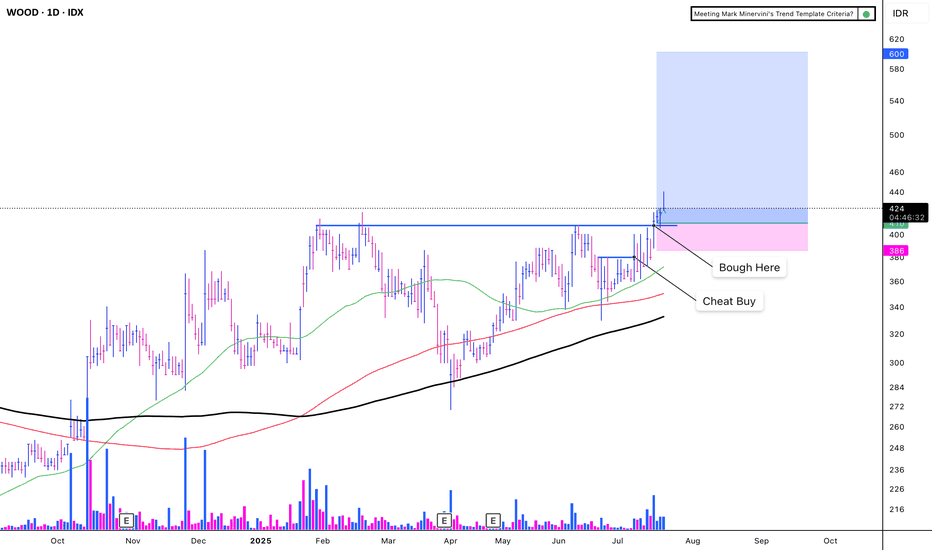

WOOD - CUP WITH HANDLEIDX:WOOD - CUP WITH HANDLE

(+):

1. Low risk entry point

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (85).

8. Carbon sales increase 503%

9. Price breakout with VCP criteria

EPS Growth:

a. Quarterly QoQ: -13.24%.

b. Quarterly YoY: +68.81%.

c. TTM YoY: +49.09%.

d. Annual YoY: +33.27%.

(-)

Trump Implements a 32% Increase in Tariffs on Indonesia

The market is volatile due to the ongoing war

WOOD

#WOO/USDT#WOO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.0870.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.0880

First target: 0.0892

Second target: 0.0905

Third target: 0.0922

#WOO/USDT#WOO

The price has broken the descending channel on the 12-hour frame upwards and is expected to continue

We have a trend to stabilize above the moving average 100 again

We have an upward trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.1350

Entry price 0.1700

First target 0.1870

Second target 0.2324

Third target 0.2746

LOEWS, ARE WE ABOUT TO SEE A LIMBO WORLD RECORD? (EARNINGS)And do you want to buy the dip

These trends are not looking good.

if earnings can't get over 74 and maintain good momentum, it's going to get pushed down to the support trends. Which are quite strong overall.

The downside is huge.

But it's not like there isn't upside.

I'm just not certain the upside to 80 will occur sooner rather than later.

Personally, I see a bearish looking stock, but I'm also not as confident as I sometimes am because there is a possibility it holds support at 69 and really starts to move.

However, I'm fairly certain we'll see $20 at some point within the next year or two. IMO, sooner.

Attaching CAT and APD

#WOO/USDT#WOO/USDT

The price is moving in a head and shoulders pattern from February 2022

We are now at the right shoulder of the model

As well as another bearish triangle pattern that is about to break

Current price 0.2838

The first goal is 0.3542

The second goal is 0.4291

The third goal is 0.5012

Which represents 190% of the current price

Down triangle

ARK: $22 | Cathy getting CAPITULATION 101 lessosif youre an up an coming FundManager that made it Big in the Industry

maybe keep quiet as the Big Bear may teach you a lesson by SHORTiNG your Picks

Discrediting Cathy week after week ..

towards CAPITULATION

==

note:

when a price of a STOCK PUMPS to 4x & 8x (+800%) from it's recent base (eye on Volume Spike)

that's discounting the 5-8year price ...

smart money sells and move on to the next CIRCUS

easier said than done

19/06/2023 Weekly Idea SOXL/WOODWeekly idea of this week is to long SOXL, short WOOD.

With Apple's announcement of vision pro in early June, I expect a rise in demand of semiconductors in the supply chain (and also in upstream industries such as metal mining/battery making). WOOD is least correlated to the upstream industries while also reported being shrinking in the latest ISM report.

Price spread is currently 0.34. We would stop loss at 10% (ie 0.31) and looking for soft 30% profit target at 0.447 (which was in Mar 2022).

DBM is a buy under $6TSX:DBM pays a quarterly dividend of 0.14, which is 9.3% yield.

It has fallen back to its September 2021 low, after retracing 50% of its bearish leg.

It has heavy support (14 weeks worth) at $5.81

Could it fall further than that? Sure, anything can happen.

But I think it is unlikely in the next week, as the ex-dividend date is the end of this week.

Perhaps the dividend will be the catalyst to push it lower.

I will probably accumulate a position if I can get it sub-$6 on Monday or Tuesday.

What is Lumber Signalling?Lumber has been decimated over the last 3 weeks.

With housing data coming out tomorrow along with PCE. Is this weak lumber chart signaling a continuation of yield strength moving up?

Does the market interpret the housing data as negative?

One thing is for sure interest rates should make a move tomorrow off of the data sets.

Lumber & Stocks DivergeLumber is signalling disinflation.

Stocks are signaling inflation.

There has bee a high correlation with stocks and lumber for about 18 months. Is this correlation officially breaking or does it imply we will see some weakness in stocks?

Right now lumber is showing weakness.

Is lumber Spiking?This Lumber Weekly chart clearly shows the unique parallell range that confirmed a breakdown.

Now to determine what likely happens next we wait to see if we get a close above or below the weekly key channel Resistance line.

If rates remain soft we will likely get a continuation move to the upside.

ROKU, a descending triangle for breakout, LONGNASDAQ:ROKU

As seen on the daily chart, ROKU is in a brief uptrend within a descending triangle. Oscillating indicators show the MACD with

the K and D lines crossing underneath the histogram and the RSI candles big and bullish with rising strength towards crossing through

the Ichimoku cloud. I see this as price action consolidating towards a breakout with 30-40% upside in the intermediate term.

Accordingly, a decent long swing setup or a call options contract. Cathie Wood seems to agree.

WOO Network (WOO) formed bullish Cypher for upto 12% pumpHi dear friends, hope you are well and welcome to the new update on WOO Network (WOO) with US Dollar pair.

On a 4-hr frame, WOO has formed a bullish Cypher pattern.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

WOO NetworkWOO/USDT look at this coin what do you think it will Follow trend like Last support downdraw we are looking to make retest on Support updraw and buy it

Disclamer:

We are not financial advisors. The content that we share on this website are for educational purposes and are our own personal opinions

#WOO/USDT 3HOUR UPDATE BY CRYPTOSANDERS Welcome to this quick WOO/USDT analysis.

I have tried my best to bring the best possible outcome in this chart.

Reason for trade:-WOO/USDT symmetrical triangle pattern conforms and break the upper trend line and retest buy the green zone.

Entry:-$0.20,$0.22

Traget:- 50%

Stoploss:- $0.19

with laverage 5x to 10x

Remember:-This is not a piece of financial advice. All investment made by me is at my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Sorry for my English it is not my native language.

Do hit the like button if you like it and share your charts in the comments section.

Thank you...

#WOO/USDT 1HOUR UPDATE BY CRYPTOSANDERS Hello community members welcome to WOO/USDT 1hr chart analysis by CRYPTOSANDERS

I have tried my best to bring the best possible outcome to this chart.

As we can see from the above-mentioned chart that WOO/USDT broke the triangle pattern and retested well.

According to the current scenario, it can move up by almost 20% from the green zone which is also a support zone.

So, here we can take a long position for some short-term profit gains.

Entry:- $0.4757,$0.4863

Traget:- 20%

Stoploss:- $0.4590

Remember:-This is not a piece of financial advice. All investment made by me is at my own risk and I am held responsible for my own profit and losses. So, do your own research before investing in this trade.

Happy trading.

Sorry for my English it is not my native language.

Do hit the like button if you like it and share your charts in the comments section.

Thank you...

Leader of the wood industry $UFPI is giving bullish signsUFP Industries, which makes lumber and other building products has 216 locations in eight countries making wood and wood-alternative products for retail, construction and industrial customers.

After making an ATH at $94 in January, has formed a good cup & handle pattern with a pivot buy above $88.10. The handle shows a good volatility contraction as it has low volume. This is a very good sign and could help the price to have an explosive move up. Also the MACD is been trending up since mid February.

In IBD, NASDAQ:UFPI ranks No. 1 in its building-wood group, with a 89 Relative Strength rating. As you can see above the chart, while the AMEX:SPY has been trending down while NASDAQ:UFPI is making higher lows.

With lumber prices in an uptrend, this leader could give a really good bull run.

$PLTR: Have we finally found our inflection point? (Do or Die)ARKK making a strong name for itself after the Jackson Hole meeting. Are we nearing the breakout point or will we continue to see more waiting and what will ultimately happen with the ARKK index at this juncture? We will see! Good luck traders :)

$ARKK: Cathie vs Burry, Which Side Will You Choose?The 120 level on ARKK continues to act as a very prominent level. What would you do?

ARKK 120 features a prominent low volume node and now we have a chance to meet this level with the falling trendline that starts from the Feb high to the June 2021 lower high. Together these forces will meet and ultimately decision in the coming weeks. I'll let time tell me which way I'll play this one but will the Russell 2000 be a canary in the coal mine or will it successfully squeeze bears like it's been known to do. You may also look to the Fed and forex markets to see how the dollars role may play apart. Good luck traders!

#BTCUPDATE - 22.7.21 B-Word Was Bullish

Looks like some much needed bullish news came and really delivered and at a critical point too. The B-Word went well, as in it didn't sink the market further. Short of Jack Dorsey confirming accepting Crypto payments on Twitter.

We hit the $32.2k resistance and as predicted in the channel we saw a rejection there - ideally we want to get back above $32k to continue on to the next leg up. Long term it looks like a descending wedge and hopefully with a little further push we can see a big break out come.

My play with BTC is I am quite bullish and will wait to get above $32.2k and then long to $36k region.