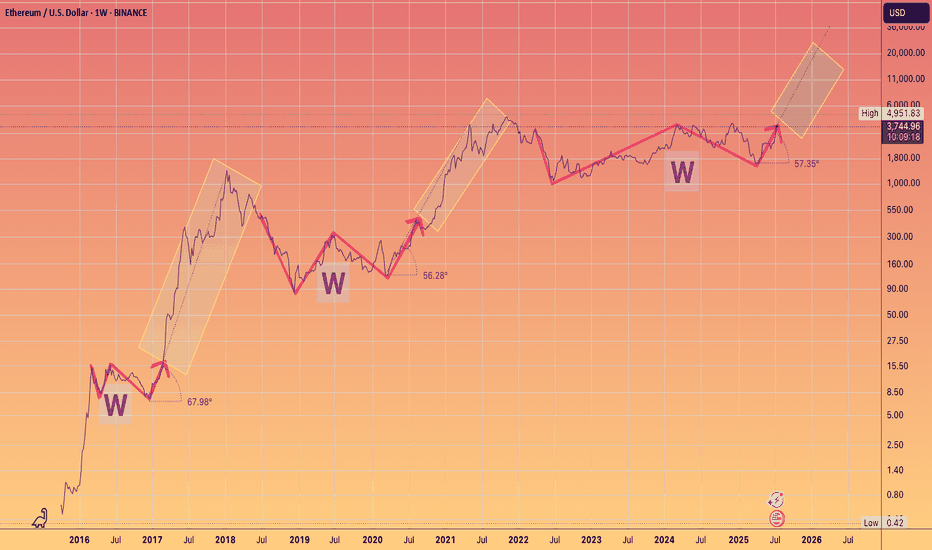

Wpattern

3 Wins to Glory.You guys know my long term Targets for ETH.

What I wanted to highlight is the angle of the Banana zone has been remarkably consistent on the Log chart.

Granted we only have 2 - 2.5 data points

But note how even in 2025 the run is adhering to the approx 60 degree angle of attack, after breaking out of their respective W's.

something to monitor.

KPEL : Breakout stock#KPEL #swingtrade #breakoutstock #Wpattern #patterntrading

KPEL : Swing Trade

>> Trending Stock

>> W Pattern Breakout soon

>> Good Volumes & Strength

>> Good upside potential

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, Comment & Follow for more analysis

Disc : Charts shared are for Learning purpose not a Trade Recommendation, Take postions only after consulting your Financial Advisor or a SEBI Registered Advisor.

Trend Changing Pattern (TCP) in Action: Live ExampleHey traders,

Following up on yesterday’s lesson about the Trend Changing Pattern (TCP), I wanted to share a real-time example using the CADJPY pair in an intraday downtrend.

Today, we spotted a TCP setup where price action gave us a classic reversal signal:

The market manipulated the low of the TCP zone with a single break.

This was followed by a W pattern and a second attempt that failed to make a lower low.

That failure to create a new low acted as our entry confirmation for a long position.

🔹 Entry: 103.71 (Long)

🔹 Stop Loss: 103.28 (Just below the break low for protection)

This trade setup perfectly illustrates how price structure and momentum shifts can help you catch early entries during trend reversals.

Stay sharp, manage your risk — and have a blessed trading day!

$SOL Trying For W Patter ReversalTHE MARKET REALLY WANTS TO GO UP.

Stronger coins, such as CRYPTOCAP:SOL

keep putting in higher lows.

If we close above the EMA9 on the Daily that will be really telling.

A bit premature to call a reversal, but I’ve been speculating on this W reversal pattern forming since Trump announced the Crypto Strategic Reserve.

Perfect setup for that.

The lack of liquidity is the only thing holding back the reversal and reason for the pump n dumps on every bit of news.

TRXUSD - Large Slanted W Pattern IdeaUsing the peak in the middle as the middle of the W pattern we can assume there will be a right hand side of the W implying the bulls are coming

I'm not sure how high it will go but 7 sounds interesting

I often see this pattern and believe we are still waiting for an alt season for these older coins

Daily timeframe

Apple Stock W-Pattern: Another Bullish Entry on the HorizonOver the past few weeks, we’ve repeatedly seen the same W pattern forming in Apple’s stock. I believe the stock is still in an uptrend, and the next good entry point could be during the downswing of the second leg. I’m planning to open a long position.

Whether I’ll close this position at around $260 as a day trade or decide to hold it longer is something I’ll let you know soon. What’s your take on this? Let me know!

Stay tuned, and I’ll catch you in the next one — peace!

Analysis of NBCC (India) Limited ChartOverview:

The daily price chart of NBCC (India) Limited indicates a recovery phase after a significant correction from its 2024 highs. Key support and resistance levels are identified, along with a potential pattern that suggests consolidation followed by a breakout.

Key Observations:

1.Trend Analysis:

The stock was previously trading within an ascending channel, marked by higher highs and higher lows, indicating a bullish trend until August 2024.

Post-August, the stock broke below the channel, resulting in a sharp correction of approximately -30%.

2.Support Levels:

₹84.25: Strong support zone, as highlighted by multiple touches and a bounce from this level. It acted as a demand zone during the correction.

The stock formed a short-term base in the ₹84–₹90 range, leading to the current recovery.

3.Resistance Levels:

₹102.10: Immediate resistance, corresponding to the 100-day moving average (acting as a dynamic resistance).

₹111.44: The next major resistance from previous highs and the upper boundary of the consolidation zone.

4.Potential Pattern Formation:

A possible W-shaped reversal pattern is forming. If the stock sustains above ₹93.09 (mid-level support) and breaks ₹102.10, the next target could be ₹111.44.

The pattern suggests a consolidation phase before a potential breakout above ₹111.44.

5.Volume and RSI Analysis:

Volume: Increased buying interest near the ₹84 zone, indicating accumulation.

RSI: Currently recovering from oversold levels, indicating improving bullish momentum.

6.News Catalysts:

The Housing and Urban Development tie-up to develop a land parcel in Noida could provide a fundamental boost, aiding positive price action.

Projection and Strategy:

Bullish Scenario: Sustained breakout above ₹102.10 may lead to ₹111.44 and beyond. Traders could consider this level as a pivot point for long positions.

Bearish Scenario: Failure to hold ₹93.09 may lead to a retest of ₹84.25, where buyers could step in again.

Conclusion:

The stock is in a recovery phase, supported by strong fundamentals and technical patterns. Traders and investors should monitor key levels like ₹93.09 (support) and ₹102.10 (resistance) for confirmation of further trends.

AUDUSD Long- day tradingForgot to post this trade earlier!

FX:AUDUSD

Let's see if it reaches the buy-side liquidity: we've got a W pattern, swing low, FVG, discount array, and buy-side liquidity in play.

Honestly, it looks poised to go higher if today’s level holds; otherwise, more downside ahead. EUR/USD has recovered well, but tomorrow will bring a new challenge.

UCAL - 6 YEARS OF "W" PATTERN BREAKOUT6 Years of "W" Pattern Breakout breakout

BUY PRICE : 190

SL : 150 (only for swing traders)

TARGET : 250, 330 (72%)

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

AUDUSD W pattern completion - Can FallAUDUSD has reached an area where it has completed a complex W pattern. There are a few levels and zones (as on the chart) to be watched.

When W pattern completes, a correction comes. This idea is on the daily time frame, so wait for a confirmation on smaller time frame to execute trades.

If you found this interesting please consider supporting this analysis by liking, commenting, and sharing with friends, colleagues, traders, and trading communities. Thanks👍🙂

SWING IDEA - PBCLA potential swing trade opportunity in PCBL (Phillips Carbon Black Limited), the largest carbon black manufacturer in India.

Reasons are listed below:

Strong Support at 230-240 Zone : PCBL is rebounding from a robust support level, reflecting market confidence in the company's leading position and expertise in the carbon black industry.

'W' Pattern : A 'W' pattern observed in the daily timeframe indicates a potential reversal and bullish continuation pattern, showcasing PCBL's ability to navigate market fluctuations effectively.

Bullish Marubozu Candle : The appearance of a bullish Marubozu candle on the daily timeframe signals strong buying pressure and potential upward momentum, underscoring positive market sentiment towards PCBL's prospects.

200 EMA Support : The 200-period Exponential Moving Average (EMA) on the daily chart acts as reliable support, highlighting PCBL's consistent performance and stability in the industry.

0.5 Fibonacci Support : Finding support at the 0.5 Fibonacci level reinforces PCBL's solid fundamentals and growth potential, providing a strong foundation for potential upward movement.

Target - 300 // 333

Stoploss - Daily close below 229

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

SWING IDEA - HINDUSTAN PETROLThis presents an attractive opportunity for swing traders to capitalize on the potential uptrend in Hindustan Petroleum Corporation Limited ,a leading energy company in India engaged in the refining and marketing of petroleum products.

Reasons are listed below :

Strong Support at 450 Level : HPCL has established a robust support level at 450, indicating strong buying interest and potential reversal points.

Double Bottom Pattern : The formation of a double bottom pattern suggests a potential trend reversal and bullish continuation, indicating a shift in market sentiment.

Bullish Marubozu Candle : A bullish Marubozu candlestick pattern indicates strong buying momentum and potential upward movement in HPCL's stock price.

0.382 Fibonacci Support : Finding support at the 0.382 Fibonacci level strengthens the bullish case, providing a solid foundation for potential upward movement.

Engulfed 11 Daily Candles : The bullish engulfing pattern, engulfing 11 previous daily candles, reinforces the bullish sentiment and indicates potential for a significant uptrend.

Higher Highs : Consistent formation of higher highs reflects increasing bullish momentum and reinforces the potential for further gains in HPCL.

Target - 530 // 595

Stoploss - weekly close below 449

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

ICON #ICX Double BottomFrom the class of 2017 ICO boom

Showing signs of a recovery pump

should you participate ?

You should always lean into fresh altcoins with a strong narrative when you can.

But sometimes the older coins can provide action in the dull moments when other coins are consolidating ..

ORAIUSDT - Big W Pattern A W pattern leading to bullish continuation

I expect a rejection (small one) at the red line but a prompt recovery.

This allows completion of the larger overall pattern

I'm not sure how high it will go but I do think it will turn bullish after the small rejection.

Daily Chart

CQTUSDT - W Pattern CompletionCQTUSD is in the bull phase of its structure.

A larger overarching W structure can be observed if a bars pattern is plotted to the previous high (Horizontal line)

I expect this W pattern to be completed.

Bullish AI coin.