Most of Construction Stocks still SidewaysMost of these Construction Sectors are still Sideways. However, there is one stocks that has the best signs of ending its Sideways and that stock is ADHI. Another promising stocks is PTPP then WSKT. WIKA is the least favourite.

ADHI has broken up its Resistance at IDR790. Though it is now below that level, ADHI still maintain Up Trendline from end of May 2022. I see an Uptrend based on Peak and Trough Analysis.

PTPP and WSKT shows the same signs but PTPP has more promising feature of an Uptrend (PTPP once broken up its Resistance at IDR990) while WSKT never break up its Resistance.

WIKA also once broken up its Resistance at IDR1,005 but I don't see Higher Low from end of May 2022 (which I believe is the strong sign of Uptrend).

WSKT

WSKT Falling WedgeWSKT in the medium term forms a downtrend where the price continues to make lower lows. But here I see that the strength of the weakening trend is decreasing and the price is forming a "falling wedge" pattern where this pattern will bring the price up to the 920 area.

#RiskDisclaimer: Not suggest to buy or sell

ADHI - Potential Inverted Head and ShouldersADHI has a potential to make Inverted Head and Shoulders pattern. Buying area = 1000, sell in January. This could be a huge potential since IHSG has rallied pretty damn high in October and November has almost always been a red month for IHSG. Potential buying for other old economy stocks as well, but my eyes is locked on ADHI compared to its peer, such as WIKA, WSKT, PTPP.

WSKT Crab PatternJust leaving a mark here and let the future me do some throwbacks when i want to in the future, I hope this crab pattern will do a good one for me

2 requirements of crab pattern have been fulfilled:

AB = retrace between 0.382 - 0.618 Fibonacci Retracement of XA leg;

BC = minimum 38.2% and maximum 88.6% Fibonacci retracement of AB leg;

Target price is exactly around 1.6 fib of XA leg

With the recent news: market.bisnis.com

WSBP also shows the same pattern:

Now just waiting for the breakout. Let's see how it goes

Any inputs is very much welcomed

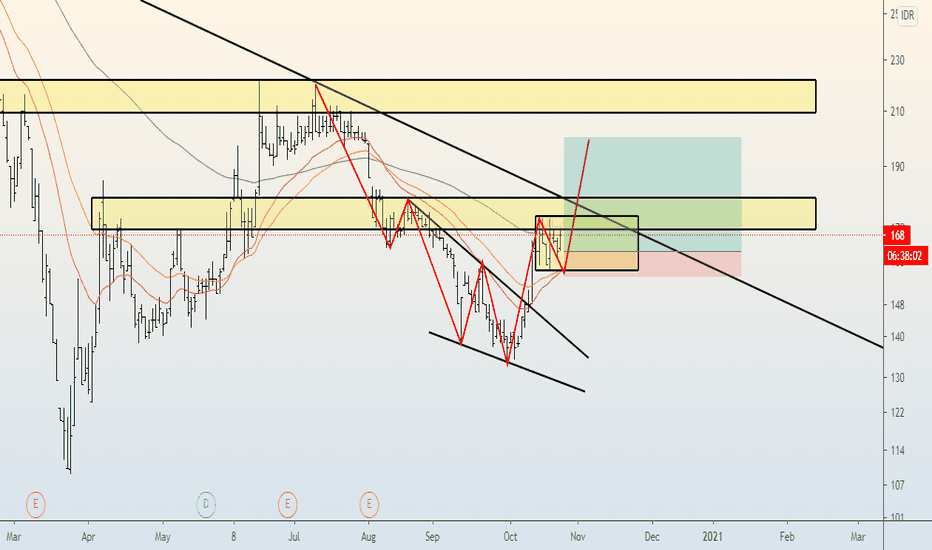

WSKT Mengakhir Fase Downtrend, Buy Jika BreakoutWSKT berkonsolidasi pasca penembusan downtrend resist line (warna kuning). Jika mampu menguat menembus resisten 1675, terbuka ruang kenaikan menuju 1815 dengan minor target 1735. Kenaikan ini bukan merupakan kenaikan fase bullish, namun masih tergolong kenaikan minor semata karena posisi harga masih di bawah MA200. MACD yang meningkat menunjukkan saham ini berada dalam fase pergerakan positif.

Rekomendasi: Buy jika break 1675. Stoploss level 1600.