WTI OIL Very strong long-term Buy opportunity.WTI Oil (USOIL) hit the last remaining targets as pointed out on our April 24 idea:

In fact, this completed our long-term 3 target approach as presented on our analysis three weeks ago:

That has come after a Double Bottom buy almost 2 months ago (March 16), which falls into our usual long-term swing trading approach that we apply successfully on our activities:

Right now we are on a similar buy opportunity like that idea above almost 2 months ago, as not only did the price bounce aggressively on the 64.50 Support (previous Low) but also the 1D RSI got oversold (30.00) and is rebounding. That has been a common feature on all previous Lower Lows within the long-term (8-month) Channel Down pattern that started on the August 30 2022 High.

Every bullish leg towards the Channel Down Top, has always hit at least the 1D MA50 (blue trend-line). That is currently at 75.66 but declining aggressively and we expect contact to be made at 73.90, which is the top of the 5-month Pivot Zone (that has been a Support for 3 months straight). The previous Lower High (April 13) was made exactly on the 1D MA200 (orange trend-line) which is the long-term Resistance, so it is very likely to hit that level also on the long-term but until then we will have our outlook updated.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI-OIL

USOIL - large downside likely due to increase in retail longsUSOIL has been very volatile in the past 2 weeks due to news surrounding further cuts in oil production by OPEC nations. However there has been a large sudden increase in retail long positions and this likely means we see further downside before any resumption of upside. There is a lot of liquidity to be grabbed around the HKEX:69 - HKEX:70 level (H12 OB). There is also a small probability that new lows could be made given the big imbalance in liquidity.

USDCAD - Tough DayOANDA:USDCAD

Monday and very tempting to jump on a trade, after a weekend of staring at charts.

Uptrend for the UC is at a pause right now, at several highs.

The current RangeSentiment on the 15m is trying to form the first leg of a bearish move, and fighting the overall bull sentiment.

Tough to sit on your hands on this USDCAD.....

WTI. The upward movement is coming.At the moment, the trading instrument is probably in the correction phase, but the correction is nearing completion, as we are told by the formed liquidity pool, upon crossing of which we will break the downtrend.

Based on my vision of the market, I can add the following, in order for the price to start an upward movement, which the formed liquidity pool indicates to us, market participants need to increase the volume of purchases in the discount zone, which starts below the price mark of 74.00, which, I believe, will affect price chart in the form of a price reduction, where we will enter the market to buy.

Entry into positions is carried out only when a confirming pattern is formed.

Dear friends, if you have any questions about the description, please write in the comments.

WTI breaks out of consolidation, $90 up next?WTI broke out of consolidation and closed above its 200-day EMA and resistance zone. The OBV (on balance indicator) confirmed the breakout with a move to a new cycle high, and volumes (whilst below average) are turning higher to show buyers stepping back in.

Furthermore, we saw a gap ahead of the consolidation above HKEX:79 , although using classic definitions it doesn't quite fit into 'breakaway' or 'runaway' gap category. Regardless, we've seen a 30% rally from the March low with a gap along the way, OPEC+ cut oil production, and the trend points higher.

With that said, the 200-day MA is capping as resistance, so bulls may want to wait for a break (or daily close) above the level. But overall, the risks appear skewed to the upside.

- The bias remains bullish above 79 and an initial move to 90, then the 93.60 highs

- Wednesday's low could be used for tighter risk management

WTI Crude - Step 1) $88 --> Step 2) $58.When it comes to oil, it was supposed to do the super moon back to $120 thing when Xi Jinping and his Chinese Communist Party finally stopped welding people in their homes and going full blown technocratic social credit while humans tried to "fight" Wuhan Pneumonia (COVID-19), but for one reason or another, the pump never got off the ground.

Probably because a whole lot more than the 87,468 people Xi and his CCP claim to have died from the disease are actually dead, and so demand is just legit in the toilet and industry can't get going, because China has big time problems stemming from its 23-year-long persecution of Falun Gong, which includes the unprecedented crime of live organ harvesting (they've done it to Uyghurs too), and the Party's outright fetish for human rights, freedom of speech, and freedom of belief abuses.

Being bullish on "China" is a totally separate thing from being bullish on "the Chinese Communist Party." One is extremely wise, while the other is totally moronic.

Totalitarian regimes never last a long time, and the Party has already had more than a century. Clinging to Marxism is like clinging to the Titanic when it's 5/6ths of the way under the water.

When it comes to WTI oil, both the fundamentals and the price action are strange. This is a commodity that you don't want to be very bearish on after it traded at literally $0 during 2020's western COVID pseudopandemic theatre hysterics. Yet, while oil also isn't liking to go down, it isn't liking to go up.

In October, I had a pretty accurate call that WTI would plink the $70 range.

WTI Crude Oil / CL1 - Accumulation Before Global Conflict

And a pretty good call in September too when everyone was convinced oil could never trade low again

WTI Crude / CL - An Intervention: Saving Blind Bulls

But the ultimate endgame of the calls, $50, has not manifested. It seems as if perhaps these prices won't manifest, and it's almost time for the uppy.

There's some problems with this narrative, however.

The key factor is that the United States and its vassal states (including Canada) are the world's largest producers of oil, by far. Russia and OPEC combined are really the only challengers, but the US has the advantage in that you need the USD to buy oil, and so ultimately the Biden Administration is the legit market maker.

The problem with the bull thesis is that the SPR was filled at $29.70 over the years while Biden and friends sold half of it off in the $80s and $90s. This inherently tells you not that they're trying to destroy themselves, but just that they're short on crude oil.

The news in December, right after oil wicked the $70 mark, was that the Biden Admin was buying it all back .

But then in January, the tune changed as the US Government said "The bids didn't come in low enough, so we haven't bought yet." Media says they want to buy around $70.

And this brings us to our very strange price action in WTI.

Crude has a gap at $85-86 and combines with a Dec. 1 pivot around $83, while recent trading activity was a triple top of successive lows at $82~.

Then we dumped to $72, but did not make a new low, and have since bounced back to $80.

All of this combines to give us no reason to believe that a hybrid short-killer/breakout trader-crusher play is not about to be made around the $88 level.

This gives us 10% to the upside, which is really quite nice to work with when WTI trades 1,000 barrel lots and you also have access to the leveraged ETFs like UCO and SCO.

But the bottom is not in. Look at the weekly candles.

Oil just hasn't retested the long-term trendline from late 2021, and in combination with the US Government having been unwilling to refill the SPR at $75+, should give you all the reason in the world to be extra cautious with going long as more than a scalp.

Under $60 **combining** with media chatter that Democrats are refilling the SPR is where you want to go long. And if you do it right, you'll get the bottom for what will quickly turn into $180.

2023 is going to be a wild year starting in July. If humanity makes it to 2024, it will be even more of a ride.

TL;DR: Long to $88 --> Short to $55, and start treating Bloomberg's Javier Blass like Jim Cramer. Trade against the narrative. Be patient. It's too early for the next moon, yet $120 in '22 was no top.

This should combine with natural gas being on the cusp of pumping:

Natural Gas? More Like Natural Go. 4-Handle Coming

Be careful, and trade safe.

WTI CRUDE OIL: Major 1D MA200 test after 7 months.WTI Crude Oil is about to hit the 1D MA200 on nearly overbought 1D technicals (RSI = 68.113, MACD = 1.880, ADX = 54.309) for the first time in 7.5 months (August 30th). This is a critical technical junction as 83.50 is also the top of the R1 Zone and the High of December 1st.

With the RSI also approaching the HH trendline, we are going short on WTI and target first the 0.618 Fibonacci level (TP = 72.00). The downtrend can be deeper but this needs to be confirmed. The current bearish signal will get confirmed once the price crosses under the 4H MA50, which has been supporting for 3 weeks.

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

WTI-Oil 2nd April Wti-Oil is another pretty simple setup with a continuous bullish movement up to the nearest supply, we may see a breakdown from that zone but of course if we don't see a breakdown we will look towards the new bullish range that would of been created to make another move higher...

from open iam looking for price to drop down giving us a reason for a shift higher after a small breakdown.

We'll be closely monitoring market openings and price action throughout the week. If you find this analysis useful, let us know in the comments below and hit the boost button to show your support. Here's to a successful week of trading!

WTI CRUDE OIL: One High left before new selling pressure.The WTI Crude Oil is being currently rejected on the 4H MA200 but with 4H technicals naturally bullish still (RSI = 61.154, MACD = 1.320, ADX = 61.771). This is due to the strong 9 day rally since the price made a bottom on the LL trendline of the Channel Down of December.

The 4H RSI also got rejected on the 70.000 overbought level and 5 times out of 6 within this Channel Down, this was an indication that we are either at the top or the last High before the top (LH trendline of the Channel Down). The last three tops were priced on the 1D MA100. We give slightly higher probabilities of this happening again. Sell this and TP = 67.00 (S1).

Prior idea:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

WTI H4 | Fibo confluence?Looking at the H4 chart, the price is currently at our sell entry of 72.56, which is an overlap resistance along with a 50% Fibonacci retracement and 127.20% Fibonacci extension. Our stop loss will be at 74.68, which is slightly above the swing high resistance. The take profit level will be at 71.46 along with a 23.6% Fibonacci retracement

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

USDCAD Outlook 28 March 2023The USDCAD traded strongly to the downside as the price failed to break beyond 1.3745 and fell beyond the support level of 1.3650.

This move lower was due to a combination of the renewed weakness of the DXY but more because of the surge in oil prices.

WTI traded up from the 69 price level, breaking beyond the near term high of 71.40 to reach the round number level of 73. This move is due to increasing supply concerns as Russia's sea-borne crude-oil flows have fallen to 3 million barrels a day and as European natural gas prices are higher due to strikes in France.

As WTI consolidates just below 73, if the upward move continues toward the next resistance are of 75, further downside could be anticipated for the USDCAD, with the next key support level at 1.3560.

However, watch out for a potential hesitation of the downside at the 1.36 price level.

WTI OIL Channel Up aiming at the 1D MA50.WTI Oil (USOIL) transitioned from the Inverse Head and Shoulders (IH&S) pattern we described last week to a Channel Up:

Our target remains 74.50 on the medium-term which makes both a Higher High on the Channel Up while filling a 2.0 Fibonacci extension, which is the technical target for the IH&S.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI H4 | Potential reversal from 38.2%?Looking at the H4 chart, price has reached our sell entry at 70.380 along with a 38.2% Fibonacci retracement. If the price were to reverse from here, it could potentially drop to our take profit level at 67.02, which is an overlap support. The stop loss will be at 72.80, which is just slightly above the swing high resistance.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

WTI OIL Inverse Head and Shoulders cementing the bottom.WTI Oil (USOIL) is forming an Inverse Head and Shoulders (IH&S) pattern on the 4H time-frame, which is a technical bottom and bullish reversal formation. The 4H RSI is on a Higher Lows trend-line, indicating an uptrend and already above the 50.00 neutral mark. One last pull-back to the 65.70 Symmetrical Support is possible, before a strong rally targeting the 1D MA50 (blue trend-line). Our target is 74.50.

This is an update to our last week analysis:

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI CRUDE OIL Bottom is near. Start buying.WTI Crude Oil is at the bottom of a Channel Down pattern.

Comparison with the November 22nd fractal shows there might be one last Low left but already the Risk/Reward is appealing going long.

Trading Plan:

1. Buy on the current market price.

Targets:

1. 72.00 (on Fibonacci 0.5 and Pivot 2).

Tips:

1. RSI (4h) is forming similar bottom pattern as November's.

Please like, follow and comment!!

WTI BEARISH OUTLOOKWTI had fallen for 3 consecutive days in Wednesday. The bank crisis is calling banks to deleverage their positions, pulling back on their exposure on oil and causing the price to fall.

International Energy Agency (IEA) is also reporting that the current situation in the oil market is a situation of oversupply, while Russia is looking for buyers for its oil.

The price of WTI broke the support of the rising wedge pattern and continues to drop. Both MACD and RSI indicators are confirming the pattern as well.

If the current scenario continues, the price might reach levels of 62 or even 54.

In the opposite scenario the price might reach levels of 77.5 and pivot into an uptrend.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

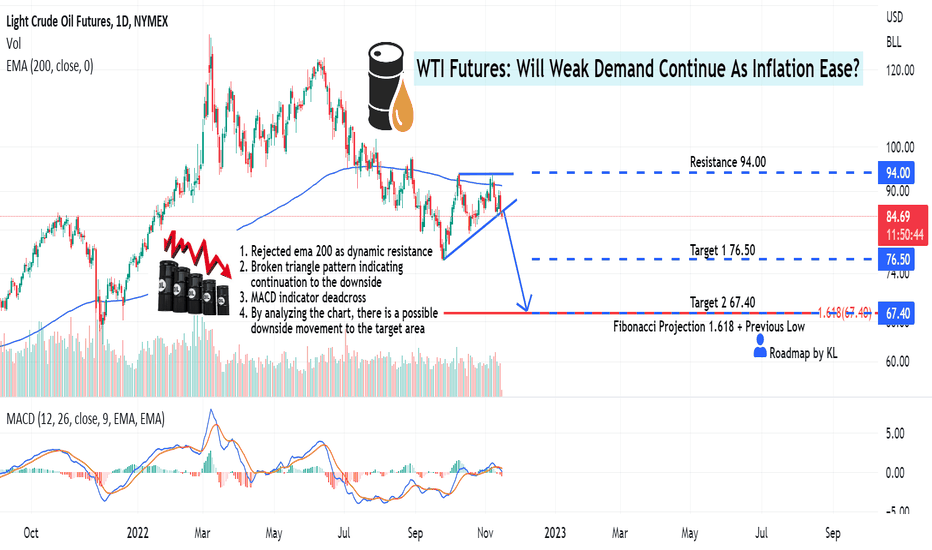

WTI Futures: Will Weak Demand Continue As Inflation Ease?Hello Fellow Oil Futures Trader, Here's a Technical outlook on WTI Futures!

Support the channel by giving us thumbs up and sharing your opinions in the comment section below!

Chart Perspective

WTI Futures is breaking out of the neckline of a triangle pattern. Breaking out of this pattern indicates a potential trend continuation from previous bearish bias. The MACD Indicator already made the death cross. The death cross signals a possibility of downside movement to the target area ahead.

Macroeconomic:

1. Rate Hikes across the globe slowed down the economy, weaken commodity demand

2. China manufacturing slowdown

All other explanations are presented on the chart.

The roadmap will be invalid after reaching the target/ resistance area .

"Disclaimer: The outlook is only for educational purposes, not a recommendation to put a long or short position on the WTI Futures"