Oil prices rebound, maintain bullish attitude

💡Message Strategy

International oil prices continued their upward trend on Thursday, closing higher for the fourth consecutive day, as concerns about growing global supply tightness abounded. Brent crude for September delivery rose 0.4% to $73.51 a barrel, while West Texas Intermediate (WTI) crude for September delivery rose 0.5% to $70.37 a barrel, while the more active Brent October contract rose 0.4% to $72.76 a barrel.

Recently, the market has focused on the statement of US President Trump, who demanded that Russia make "substantial progress" on the situation in Ukraine within 10-12 days, otherwise he would impose 100% secondary tariffs on its trading partners, significantly bringing forward the previous 50-day deadline.

Inventory data suggests a continued struggle between supply and demand. Data from the U.S. Energy Information Administration (EIA) showed that U.S. crude oil inventories unexpectedly rose by 7.7 million barrels to 426.7 million barrels in the week ending July 25, far exceeding expectations for a 1.3 million barrel drop. However, gasoline inventories fell by 2.7 million barrels to 228.4 million barrels, exceeding market expectations for a 600,000 barrel drop.

📊Technical aspects

From a daily perspective, WTI crude oil prices have closed higher for four consecutive days since rebounding from the $66 level. It is currently running stably above the integer mark of $70 per barrel. The short-term moving average system is in a bullish arrangement, and the MACD indicator remains above the zero axis, indicating that the bullish momentum is still strong.

From an hourly perspective, if the price breaks through the previous high of $70.50, it is expected to further rise to the $73.50-$75 range. Conversely, if it continues to fall below the $70 mark, it may trigger short-term profit-taking, and further support will focus on the $68.50 level. Overall, the short-term trend remains bullish.

💰Strategy Package

Long Position:68.00-68.50,SL:67.50,Target:70.50-73.00

WTI (Crude Oil)

Crude oil starts to rise, are you ready?

💡Message Strategy

Oil prices continued their upward trend amid rising geopolitical risks. US President Trump recently issued a tough statement, demanding Russia end the conflict with Ukraine within 10 to 12 days or face secondary sanctions.

Fears that Russian crude oil exports might be disrupted pushed Brent crude oil prices close to $70 per barrel, marking their largest single-day gain in two weeks at 2.3%. Meanwhile, US West Texas Intermediate (WTI) crude oil prices also remained stable around $67.

The intertwined uncertainties of geopolitics and trade policy have complicated market sentiment. Besides the situation between Russia and Ukraine, investors are closely watching the August 1st trade policy deadline set by the United States and the upcoming OPEC+ meeting in early August, which will determine its September crude oil production increase plan.

The industry generally expects that despite tight crude oil inventories in some parts of the world and strong peak season consumption in the Northern Hemisphere, if OPEC+ continues to increase production, oversupply pressure will gradually emerge by the end of the year.

📊Technical aspects

From a technical perspective, the daily chart of US crude oil (WTI) shows a modest upward trend. The current price is trading steadily above its 100-day moving average, indicating continued bullish momentum.

The Relative Strength Index (RSI) remains between 55 and 60, remaining within overbought territory, suggesting further upside potential. A successful break above the key resistance level of $68.50 would open up opportunities towards $70.

💰Strategy Package

Long Position:66.50-67.00,SL:65.50,Target:68.50-69.00

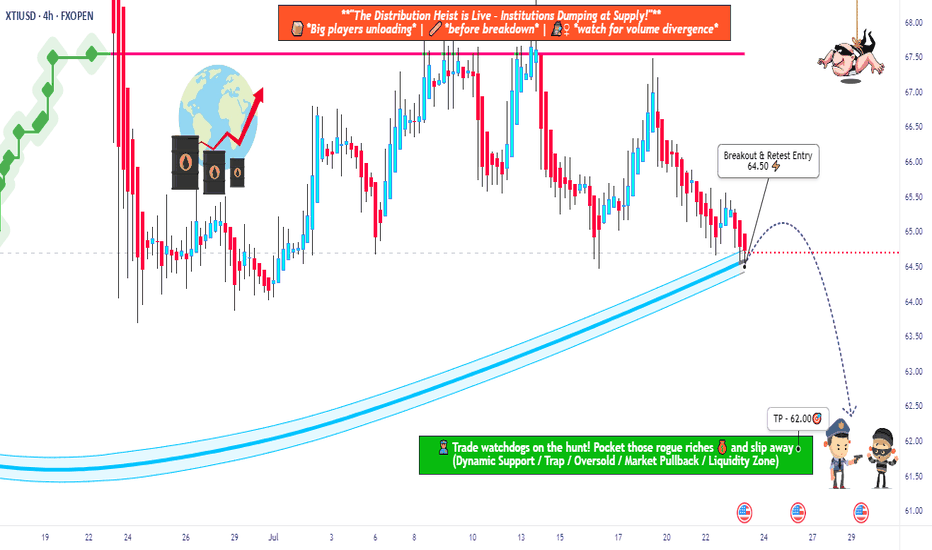

USOIL Robbery Alert! Smart Entry Plan Below Key MA Level🔐💥 “WTI Energy Heist: Thief Trader’s Bearish Master Plan” 💥🔐

The Official Robbery Blueprint for Smart Traders

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

💸 Welcome, Money Makers & Market Robbers! 💸

🚨 Get ready to break into the "US Oil Spot/WTI" market with precision-crafted bearish strategy from the one and only — Thief Trader Style!

📉💣 THE HEIST IS ON: SHORT PLAN LOADED! 💣📉

We’ve analyzed the charts using Thief Technicals + Fundamental Lockpick Tools and spotted a high-risk GREEN zone – a consolidation trap where greedy bulls usually get caught. This is where we strike.

🔑 ENTRY:

"Wait for the Neutral Moving Average to Break — Then Make Your Move!"

🎯 Focus zone: 64.50

☠️ Wait for the breakout – do NOT enter before it happens.

✅ Use sell stop orders above the MA line or place sell limit orders on the pullback after the breakout (target within the 15–30 min candle near swing high/low).

🧠 Thief Tip: Layer in entries using the DCA (layered attack strategy) to catch price on its way down. Set a chart alert so you don’t miss the strike moment.

🛑 STOP LOSS:

"Set it smart or don’t set it at all — you choose the fire you want to play with!"

📍 SL only gets placed AFTER breakout.

🎯 Recommended SL at 66.00 on the 4H swing level.

☠️ DO NOT place any orders or SL before confirmation breakout.

📊 Your SL depends on your risk %, lot size, and number of entries stacked.

🎯 TARGET ZONE: 62.50

💸 Lock profits before the bulls wake up. This level is based on market exhaustion zones and historical bounce areas.

🧠 WHY WE'RE SHORTING THIS?

This isn’t just a chart move — it’s backed by full-scale robbery research:

📰 COT Reports

📈 Macro & Seasonal Trends

🛢️ Crude Oil Inventories

💹 Sentiment & Intermarket Correlation

📉 Supply-Demand Dynamics

📚 Before pulling the trigger, educate yourself with the fundamentals. Dive into COT, Seasonal, and Macro reports. Don’t rob blindly — rob smart.

⚠️ Risk Management Alert:

Major news releases? Step back.

Trailing stops? Lock it in.

Position sizing? Know your risk.

Trade like a professional robber, not a street pickpocket.

💥💖 SUPPORT THE ROBBERY PLAN 💖💥

🧨 Smash that BOOST button to support this trading style and help more traders rob the market clean. Every like, every boost makes this community stronger.

💬 Drop a comment, share your entry levels, or post your winning trades.

This is a trading crew – we rob together, we profit together.

🔔 Stay tuned — more heist plans dropping soon.

Until then... Rob Smart. Trade Hard. Take Profits. 💰💪🎯

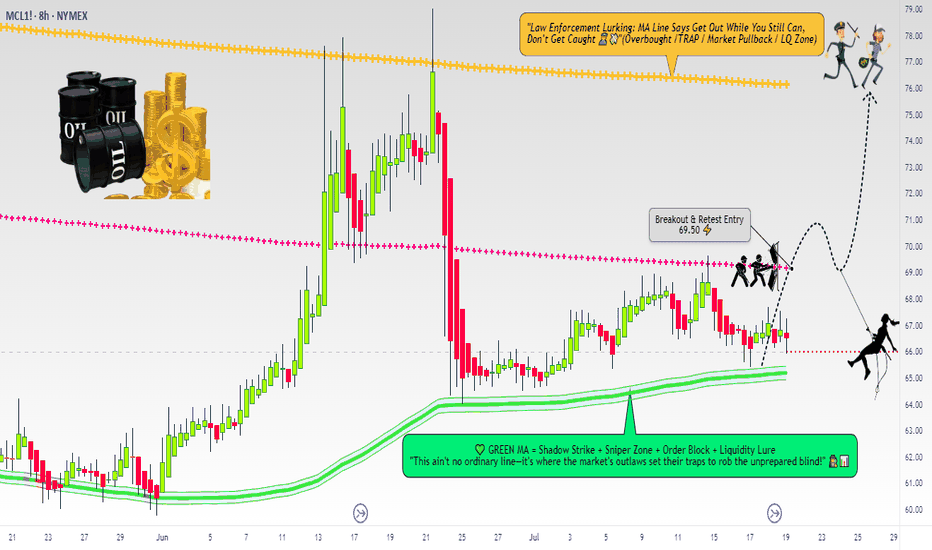

Micro WTI Swing Breakout Setup – Robbing Liquidity the Smart Way🛢️ "Crude Ops: The WTI Energy Vault Breakout Plan" 🛢️

(A Thief Trader Swing Setup | MA Breakout Trap Heist 💰💥)

🌍 Hola! Bonjour! Marhaba! Hallo! Hello Robbers & Market Movers! 🌟

Welcome to another high-voltage heist mission straight from the Thief Trading Den. This ain’t just a chart—this is an Energy Market Extraction Plan based on real smart money footprints 🔎.

🔥 Master Robbery Setup: MICRO WTI CRUDE OIL FUTURES 🎯

We got a bullish breakout alert from the shadows! This is not a drill.

💣 ENTRY STRATEGY

💼 "The Heist Begins Above 68.50"

Watch the Moving Average (MA) zone closely—this is where weak hands get trapped and we slide in with stealth limit or breakout orders:

🛠️ Plan of Entry:

Buy Stop Order: Just above 68.500 (after confirmation of breakout ✅).

Buy Limit Layering (DCA): On pullbacks around 15m/30m swing lows for precision entries.

🧠 Pro Tip: Use alerts to catch the exact entry ignition spark—don't chase, trap with patience like a true thief.

🛑 STOP LOSS (SL)

⚠️ "No SL? That’s a rookie mistake."

SL should only be placed post-breakout using the 8H wick-based swing low (around 66.50).

💡 SL is your personal vault door—set it according to:

Lot size

Risk appetite

Layered entry strategy

📌 Reminder: No SL or order placement before breakout. Let the market show its hand first.

🎯 TARGET ZONE (Take Profit)

Primary Target: 76.00 🏁

But hey... the smartest robbers escape before alarms ring — so trail that stop, secure your profits, and vanish like smoke 🥷.

💥 FUNDAMENTAL & SENTIMENT CATALYSTS

🔥 Current bullish energy comes from:

📉 USD weakness

🏭 Crude inventory drawdowns

⚖️ Geopolitical supply shocks

🐂 Hedge funds scaling long per latest COT data

📊 Intermarket cues from risk-on assets

🧠 Do your diligence: Go check fundamentals, COTs, and macro narratives before entering. Info = Edge.

📢 RISK MANAGEMENT NOTE

🚨 Don't go wild. Market is volatile, especially around:

News drops 📉

Fed or OPEC speeches 🎙️

Crude inventory reports 🛢️

Pause entries during news events. Use trailing SLs to lock the vault behind you.

❤️ SUPPORT THE ROBBERY MISSION

💣 Smash that BOOST button if this plan hits your nerve.

Let’s keep robbing liquidity zones together and growing the Thief Trader Brotherhood 🕵️♂️💰.

📡 Stay tuned for the next stealth heist drop. We rob the market with class. 💎🚀

WTI(20250716)Today's AnalysisMarket news:

① The annual rate of the overall CPI in the United States in June rose to 2.7%, the highest since February, in line with market expectations, and the monthly rate was 0.3%, the highest since January, in line with market expectations; the annual rate of the core CPI rose to 2.9%, the highest since February, lower than the expected 3%, but slightly higher than 2.8% last month, and the monthly rate was 0.2%, lower than the market expectation of 0.3%.

② Interest rate futures still show that the Fed is unlikely to cut interest rates this month, but there is a high possibility of a 25 basis point cut in September.

③ Fed mouthpiece: The CPI report will not change the Fed's policy direction.

④ Trump: Consumer prices are low and the federal funds rate should be lowered immediately. The Fed should cut interest rates by 3 percentage points.

⑤ Fed Collins: The core inflation rate is expected to remain at about 3% by the end of the year, and the Fed should maintain active patience.

Technical analysis:

Today's buying and selling boundaries:

65.66

Support and resistance levels:

66.49

66.18

65.98

65.34

65.14

64.83

Trading strategy:

If the price breaks through 65.66, consider buying, the first target price is 65.98

If the price breaks through 65.34, consider selling, the first target price is 65.14

WTI Oil Heist: Bullish Breakout Plan for Big Gains!🚨 Ultimate WTI Oil Heist Plan: Bullish Breakout Strategy for Big Profits! 🚀💰

🌟 Hello, Wealth Chasers & Market Mavericks! 🌟

Hola, Bonjour, Hallo, Marhaba! 🗺️

Get ready to execute the Ultimate WTI / US Oil Spot Heist using our 🔥 Thief Trading Style 🔥, blending sharp technicals with powerful fundamentals! 📈💡 This swing trade plan targets the energy market’s bullish potential, but stay sharp—volatility lurks! 🚨 Follow the chart setup for a long entry, and let’s aim for those juicy profits while dodging the high-risk ATR zone where the market “police” might trap overzealous traders. 🏦⚠️

📊 The Heist Plan: WTI / US Oil Spot (Swing Trade)

Entry 📈:

The breakout is your signal! 🎯 Wait for the Moving Average crossover and a confirmed pullback at $68.00 on the 2H timeframe. Once it triggers, go long and ride the bullish wave! 🐂 Set an alert to catch the breakout in real-time. 🚨

Stop Loss 🛑:

Protect your capital like a pro! 💪 Place your stop loss below the recent swing low at $65.00 (2H timeframe, candle body wick). Adjust based on your risk tolerance, lot size, and number of positions. Rebels, beware—straying too far from this level could burn you! 🔥

Target 🎯:

Aim for $73.80 or exit early if momentum fades. Scalpers, stick to long-side trades and use a trailing stop to lock in gains. 💰 Swing traders, follow the plan and secure profits before the market consolidates or reverses. 🏴☠️

📊 Market Context & Key Drivers

The WTI / US Oil Spot market is currently consolidating with a bullish bias 🐂, driven by:

Fundamentals: Check macroeconomic data, seasonal trends, and intermarket correlations. 📉

COT Report: shows net-long positions increasing, signaling bullish sentiment. 📅

Sentiment & Quantitative Analysis: Market mood leans positive, but overbought risks loom near the ATR zone. ⚠️

Stay informed! 📰 Monitor news releases, as they can spike volatility. Avoid new trades during major announcements and use trailing stops to protect open positions. 🔒

📊 Pro Tips for the Heist

Scalpers: Go long with tight trailing stops to safeguard profits. 💸

Swing Traders: Stick to the plan, adjust stops based on risk, and exit before the high-risk ATR zone ($73.80+). 🚪

Risk Management: Never risk more than you can afford. Tailor your lot size and stop loss to your account size. 🛡️

Stay Updated: Market conditions shift fast—keep an eye on fundamentals and sentiment to stay ahead. 👀

📊 Why Join the Heist?

This Thief Trading Style plan is your ticket to navigating the WTI market with confidence! 💪 Boost this idea to strengthen our trading crew and share the wealth-making vibe. 🚀💥 Like, follow, and stay tuned for more high-octane strategies! 🤑🐱👤

Disclaimer: This is a general market analysis, not personalized investment advice. Always conduct your own research and consider your risk tolerance before trading. Markets are dynamic—stay vigilant and adapt to new developments. 📡

Let’s make this heist legendary! 🌟💰 See you at the next breakout! 🤝🎉

USOIL HEIST ALERT: Thief Entry Loaded – Target Locked!🚨 The Ultimate US OIL / WTI Heist Plan – Thief Trading Style 🎯💸

Hey Money Makers, Hustlers, Market Bandits! 🌍

Hola, Ola, Bonjour, Hallo, Marhaba! 👋🌟

We’re back with a slick WTI energy market heist based on our 🔥Thief Trading Style🔥—powered by a mix of technical & fundamental strategies. The vault is wide open and the bullish loot awaits!

🗺️ Strategy Brief:

We’re aiming for a clean bullish getaway near the high-risk MA zone—where traps are set and bearish robbers lurk. Watch out for overbought zones, trend reversals, and consolidation ambushes.

📈 Entry Point:

“The vault is open! Enter the bullish heist at will.”

Look to place Buy Limit Orders around swing highs/lows or pullback levels on the 15m–30m timeframe.

🛑 Stop Loss:

Set your Thief SL around the recent swing low using the 3H timeframe (example: 60.300).

Adjust based on your risk appetite, lot size, and number of entries.

🎯 Target: 65.200

That's where we celebrate the score, traders! 🥂💸

📊 Heist Justification (Fundamentals + Sentiment):

The WTI market is currently bullish, fueled by a mix of:

✅ Macro economics

✅ COT data

✅ Seasonal trends

✅ Intermarket signals

✅ Inventory & storage dynamics

📌 For full analysis and future target breakdowns, check the linkk in our profilee 🔗👀

⚠️ Important Alert – Manage Your Risk During News:

🚫 Avoid fresh entries during major news releases

✅ Use trailing stops to protect running gains

Stay sharp, stay safe.

💥 Hit the Boost Button if you support the Thief Strategy!

Join the crew, ride the wave, and let’s rob the market like pros 💼🕶️💰

📅 Stay tuned for the next master plan. Another heist is always around the corner.

Until then – steal smart, win big! 🐱👤🔥

Tariff Panic = Opportunity | WTI Long SetupWTI Oil has finally dipped into my long-watched buy zone, driven by macro fear and an aggressive tariff agenda. The current drop aligned perfectly with my long-term execution plan. I’ve placed this trade based on key historical demand levels with my stop-loss and take-profit clearly defined. I’m prepared for deeper drawdown, but this area remains high-conviction for me. Execution > Prediction.

Technicals:

• Key Level: Price tapped into a major demand zone dating back to 2021 lows, which had been protected ever since.

• Liquidity Sweep: This drop mitigated every low formed post-2021 — clearing out late longs and stop hunts.

• Trendline Break Anticipation: I expect a potential trendline breakout from the long-term descending structure.

• SL/TP Defined: This trade has structure. It’s not a hope-based setup, it’s pre-planned and managed.

• Consolidation + Accumulation: This is where strong hands prepare, and I’m joining in.

Fundamentals:

• Tight supply, rising global demand, and structural underinvestment in oil exploration.

• Chinese reopening + Russian ban tighten market availability.

• Central banks expected to support demand via easing cycles.

• Oil Bearish Catalyst (Short-Term):

• US tariff wave: Trump announced a total 54% tariff on China and baseline tariffs on all trading partners.

• Escalating fears of global economic slowdown pushed prices to $58.80, a 4-year low.

The bearish panic gave bulls like us a gift. This is how real trades are born - not in euphoria, but in blood.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

XTI/USD "WTI LIGHT CRUDE OIL" Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI LIGHT CRUDE OIL" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (64.00) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (59.00) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 68.70

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢️ XTI/USD "WTI LIGHT CRUDE OIL" Energy Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. ☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend targets and Overall outlook score..., Go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Analysis of oil prices in the next six months to one yearThe oil chart indicates that prices are likely to see lower numbers. The United States may intend to take a series of actions to keep oil prices down in order to alleviate some inflationary pressure, which could stem from the trade war and also from military conflicts involving the U.S.

From the chart, it can be inferred that in the medium term, prices might fluctuate between $55 and $69, but there is also the possibility of a correction down to around $43. This would benefit industrialized countries that consume oil, helping their economies become somewhat more resilient to the impending stagflationary shock worldwide.

XTI/USD "WTI Crude Oil" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI Light Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (71.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (68.500) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 73.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥XTI/USD "WTI Light Crude Oil" Energy Market Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

WTI Oil Short: Bearish Setup After Sharp RallyOil prices have surged impressively, fueled by recent fundamental-driven market moves. However, this swift upside has led WTI crude to my point of interest, offering a prime opportunity to short against the trend. My trade strategy includes taking partials at the $74 price zone. Here’s why this setup is supported by bearish fundamentals:

1. Rising U.S. Fuel Inventories

Recent data shows significant growth in U.S. gasoline and distillate stockpiles, hinting at a potential oversupply in the market.

2. Strengthening U.S. Dollar

A stronger dollar makes oil more expensive for holders of other currencies, reducing global demand and weighing on prices.

3. Increased Non-OPEC Supply

With rising production levels from non-OPEC countries, analysts expect an oversupplied market in 2025, adding further pressure on oil prices.

4. Weakening Global Demand

Economic growth concerns in major markets like China and Germany are fostering expectations of reduced oil demand, reinforcing a bearish outlook.

These combined factors strongly support a short position on WTI crude oil. Stay strategic, take profits along the way, and manage your risk carefully in this volatile environment!

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

"WTI / US OIL SPOT" Energy Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "WTI / USOIL SPOT" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 76.00

Sell Entry below 72.00

Stop Loss 🛑:

Thief SL placed at 74.00 (swing Trade) for Bullish Trade

Thief SL placed at 74.00 (swing Trade) for Bearish Trade

Using the 4H period, the recent / nearest low or high level.

SL is based on your risk of the trade, lot size and how many orders you have to take.

Target 🎯:

-Bullish Robbers TP 81.50 (or) Escape Before the Target

-Bearish Robbers TP 67.00 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

"WTI / USOIL SPOT" Energy market is currently experiencing a Neutral trend (there is a higher chance for Bearish)., driven by several key factors.

♻ Fundamental Analysis:

Supply and Demand: Neutral, with growing demand for oil offset by rising US oil production.

OPEC Production: Neutral, with OPEC's production cuts offset by rising US oil production.

Global Economic Growth: Neutral, with a slow global economic recovery expected.

♻ Macro Economics:

Global Economic Growth: Neutral, with a slow global economic recovery expected.

Inflation: Neutral, with low inflation expected in major economies.

Interest Rates: Neutral, with interest rates expected to remain stable.

♻ COT Report:

Non-Commercial Traders: Bearish, with 55% of non-commercial traders holding short positions.

Commercial Traders: Bullish, with 60% of commercial traders holding long positions.

Levieraged Funds: Bearish, with 58% of leveraged funds holding short positions.

♻ Sentimental Analysis:

Market Sentiment: Bearish, with 52% of traders holding short positions.

Retail Trader Sentiment: Bullish, with 65% of retail traders holding long positions.

Institutional Trader Sentiment: Bearish, with 60% of institutional traders holding short positions.

♻ Overall Outlook:

Bearish: 52%

Bullish: 30%

Neutral: 18%

Based on the overall analysis, the outlook for WTI Commodity CFD is bearish, with a target price of around $60-$62 per barrel.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

MY TV COMPETITION WTICOUSD LONG IDEA 01/11/2024Direction: Long

SL: 66.862

Indicators:

1. MA (20,50,100,200)

2. Trendline - Algo

3. Support and Resistance

4. Fib Level

5. I also use MT5 - Tradingcentral tools

Technical:

1. MA 20 Yellow is below the MA 100 and 200 (Purple and Red) but looking for it to reverse and go up and above the 50,100, and 200.

2. Green Trendline was broken recently.

3. Price bounced off from a support zone.

4. FIB level at 0.382.

5. Tradingcentral tool signaling Rise on Time frames 15m,1h,and 4h but it is bearish and signaling DECLINE on daily time frame at the moment.

Fundamental and economic:

1. Geopolitical tension is adding some volatility to OIL prices.

2. I use Edgefinder tool which shows me a score of -3 "bearish" on USOIL but I think this trade idea is for short term and more of a "I predict that this might go to xyz based on the technical and fundamental insights".

3. We are in Q4 and usually there is alot of volatility mostly bearish but I'm going against it since we have US elections coming up.

Texas Oil to continue in the downward move at market price?WTI - 24h expiry

Our short term bias remains negative.

Our bespoke support of 77.06 has been clearly broken.

Previous support at 77.50 now becomes resistance.

We look for a temporary move higher.

We look for losses to be extended today.

We look to Sell at 77.50 (stop at 78.30)

Our profit targets will be 75.50 and 75.15

Resistance: 77.13 / 77.50 / 78.00

Support: 76.60 / 75.80 / 75.4

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

WTI support continues to attract buyers.WTI - 24h expiry

Bespoke support is located at 80.70.

Offers ample risk/reward to buy at the market.

Our short term bias remains positive.

50 4hour EMA is at 80.73.

80.59 has been pivotal.

We look to Buy at 80.75 (stop at 79.95)

Our profit targets will be 82.75 and 83.25

Resistance: 81.50 / 82.24 / 83.00

Support: 80.50 / 79.50 / 79.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Brent Crude Oil Demand Spike(WTICOUSD, too)Looking forward to entering Long on BCOUSD after NFP today.

Am not too eager to enter, if it happens, its good. If it doesn't happen, I am fine too, since today is Friday, and I have to hold my positions over the weekends.

I am used to holding trades over the weekends, however I prefer the weekdays. Therefore, when Mondays roll around, I thank God its Monday!

Anyway, our discounted price zone is the 10EMA based on previous Black Friday Sale discounts offered.

Price made a kink in the 10EMA discount by offering 20EMA discount yesterday or so, however, I do not believe it would continue giving 20EMA discounts which is bigger discounts, because, the Flag Pole is very big and long, while the flag is minute.

As usual, I am very aggressive at cutting losses, and moving my stop loss towards Breakeven and into profits. Once the trade is in, I will immediately shift my stoploss upwards by one tenth of the SL size, because my intention is never to price hit my full R loss. I am wrong many a times, by being too aggressive at cutting losses, moving my stop loss forward, etc and price continues to go in my favour after I am out of the trade, however, the results does show that I am profitable, and so, I will continue with my new ways.

I began doing such aggressive SL shifting earlier this year at around February, and it has been profits for me ever since, week on week.

2002SGT

05042024