WTI(20250723)Today's AnalysisMarket news:

White House officials plan to visit the Federal Reserve headquarters on Thursday local time.

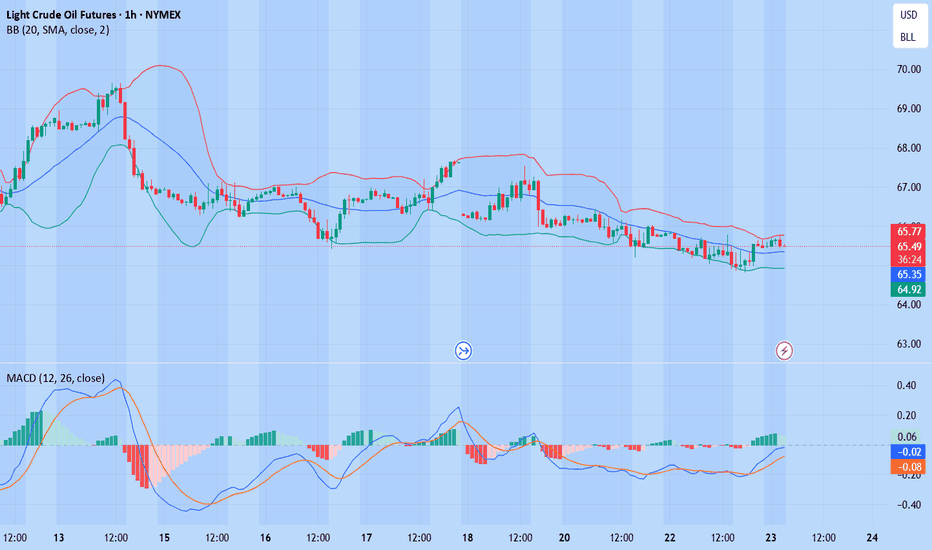

Technical analysis:

Today's buying and selling boundaries:

65.22

Support and resistance levels:

66.22

65.85

65.61

64.84

64.60

64.22

Trading strategy:

If the price breaks through 65.61, consider buying, the first target price is 65.85

If the price breaks through 65.22, consider selling, the first target price is 64.84

Wtioil

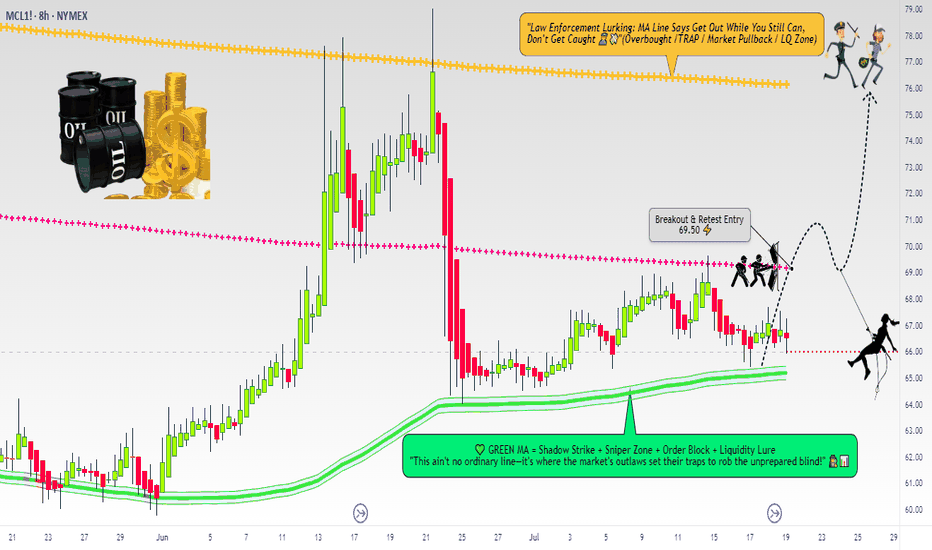

Micro WTI Swing Breakout Setup – Robbing Liquidity the Smart Way🛢️ "Crude Ops: The WTI Energy Vault Breakout Plan" 🛢️

(A Thief Trader Swing Setup | MA Breakout Trap Heist 💰💥)

🌍 Hola! Bonjour! Marhaba! Hallo! Hello Robbers & Market Movers! 🌟

Welcome to another high-voltage heist mission straight from the Thief Trading Den. This ain’t just a chart—this is an Energy Market Extraction Plan based on real smart money footprints 🔎.

🔥 Master Robbery Setup: MICRO WTI CRUDE OIL FUTURES 🎯

We got a bullish breakout alert from the shadows! This is not a drill.

💣 ENTRY STRATEGY

💼 "The Heist Begins Above 68.50"

Watch the Moving Average (MA) zone closely—this is where weak hands get trapped and we slide in with stealth limit or breakout orders:

🛠️ Plan of Entry:

Buy Stop Order: Just above 68.500 (after confirmation of breakout ✅).

Buy Limit Layering (DCA): On pullbacks around 15m/30m swing lows for precision entries.

🧠 Pro Tip: Use alerts to catch the exact entry ignition spark—don't chase, trap with patience like a true thief.

🛑 STOP LOSS (SL)

⚠️ "No SL? That’s a rookie mistake."

SL should only be placed post-breakout using the 8H wick-based swing low (around 66.50).

💡 SL is your personal vault door—set it according to:

Lot size

Risk appetite

Layered entry strategy

📌 Reminder: No SL or order placement before breakout. Let the market show its hand first.

🎯 TARGET ZONE (Take Profit)

Primary Target: 76.00 🏁

But hey... the smartest robbers escape before alarms ring — so trail that stop, secure your profits, and vanish like smoke 🥷.

💥 FUNDAMENTAL & SENTIMENT CATALYSTS

🔥 Current bullish energy comes from:

📉 USD weakness

🏭 Crude inventory drawdowns

⚖️ Geopolitical supply shocks

🐂 Hedge funds scaling long per latest COT data

📊 Intermarket cues from risk-on assets

🧠 Do your diligence: Go check fundamentals, COTs, and macro narratives before entering. Info = Edge.

📢 RISK MANAGEMENT NOTE

🚨 Don't go wild. Market is volatile, especially around:

News drops 📉

Fed or OPEC speeches 🎙️

Crude inventory reports 🛢️

Pause entries during news events. Use trailing SLs to lock the vault behind you.

❤️ SUPPORT THE ROBBERY MISSION

💣 Smash that BOOST button if this plan hits your nerve.

Let’s keep robbing liquidity zones together and growing the Thief Trader Brotherhood 🕵️♂️💰.

📡 Stay tuned for the next stealth heist drop. We rob the market with class. 💎🚀

WTI(20250716)Today's AnalysisMarket news:

① The annual rate of the overall CPI in the United States in June rose to 2.7%, the highest since February, in line with market expectations, and the monthly rate was 0.3%, the highest since January, in line with market expectations; the annual rate of the core CPI rose to 2.9%, the highest since February, lower than the expected 3%, but slightly higher than 2.8% last month, and the monthly rate was 0.2%, lower than the market expectation of 0.3%.

② Interest rate futures still show that the Fed is unlikely to cut interest rates this month, but there is a high possibility of a 25 basis point cut in September.

③ Fed mouthpiece: The CPI report will not change the Fed's policy direction.

④ Trump: Consumer prices are low and the federal funds rate should be lowered immediately. The Fed should cut interest rates by 3 percentage points.

⑤ Fed Collins: The core inflation rate is expected to remain at about 3% by the end of the year, and the Fed should maintain active patience.

Technical analysis:

Today's buying and selling boundaries:

65.66

Support and resistance levels:

66.49

66.18

65.98

65.34

65.14

64.83

Trading strategy:

If the price breaks through 65.66, consider buying, the first target price is 65.98

If the price breaks through 65.34, consider selling, the first target price is 65.14

WTI(20250715)Today's AnalysisMarket news:

Sources said that after Trump's latest trade tax threat, the European Central Bank will discuss a more negative scenario next week than expected in June. The ECB is still expected to keep interest rates unchanged at its meeting on July 24. Discussions on rate cuts are still postponed to September.

Technical analysis:

Today's buying and selling boundaries:

66.63

Support and resistance levels:

69.20

68.24

67.62

65.65

65.02

64.06

Trading strategy:

If it breaks through 66.63, consider buying in, the first target price is 67.62

If it breaks through 65.65, consider selling in, the first target price is 65.02

WTI Oil – From Conflict to StrategyBack on April 24, I marked a short zone. On June 11, price broke above that level, giving a long opportunity — which I took.

Unfortunately, it coincided with the tragic military strike by Israel on Iran, pushing oil sharply higher. I’ve pinned that analysis.

Following the ceasefire, price dropped again — just a reminder that geopolitics can shake the charts.

As traders, we stay prepared to act, even while acknowledging the deep sadness of lives lost.

Now I wait for price to reach my marked level again. If I get a valid signal, I’ll short.

But if price breaks and holds above, I’ll buy the pullback — with no bias, just pure execution.

Risk-managed. Emotion-neutral. Opportunity-focused.

CRUDE OIL (WTI): Will It Rise More?

Quick update for my yesterday's analysis for WTI Crude Oil.

As I predicted yesterday, the price went up to the target.

We got one more strong bullish confirmation after a New York

session opening:

the price violated a resistance of a horizontal range on a 4H time frame.

I think that the market may rise even more and reach 69.25 level.

❤️Please, support my work with like, thank you!❤️

CRUDE OIL (WTI): Consolidation is Over

Crude Oil was consolidating for 6 trading days in a row

after a test of a key daily support.

The yesterday's Crude Oil Inventories data made the market bullish

and the price successfully violated a minor resistance of a sideways movement.

We can expect that the market will grow more.

Next resistance - 69.27

❤️Please, support my work with like, thank you!❤️

Crude oil continues to correct, short-term ideas

💡Message Strategy

WTI crude oil prices recovered from a two-week low but remained about $12 below the previous Monday's high as upside was limited by Middle East peace and expectations that OPEC+ countries will agree to increase supply again this week.

📊Technical aspects

From the daily chart level, crude oil fluctuates upward in the medium term and tests around 75. The K-line closes with a large real negative line, which has not yet destroyed the moving average system and is still supported. The medium-term objective upward trend remains unchanged.

However, from the perspective of momentum, the MACD indicator crosses downward above the zero axis, indicating that the bullish momentum is weakening. It is expected that the medium-term trend of crude oil will fall into a high-level oscillation pattern.

The short-term trend of crude oil (1H) continues to fluctuate in a narrow range, and the oil price falls back to the lower edge of the range. Pay attention to the support strength of 64. In terms of momentum, the MACD indicator is at the zero axis position, and the long and short forces are equal. It is expected that the trend of crude oil will maintain a fluctuating consolidation pattern during the day.

💰Strategy Package

Short Position:65.50-66.50,SL:67.50,Target: 64.00-63.00

Bullish momentum to extend?WTI Oil (XTI/USD) has bounced off the pivot and could potentially rise to the 1st resistance.

Pivot: 73.40

1st Support: 71.46

1st Resistance: 76.64

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

WTI(20250618)Today's AnalysisMarket news:

World Gold Council: 95% of central banks expect gold reserves to rise in the next 12 months.

Technical analysis:

Today's buying and selling boundaries:

72.29

Support and resistance levels:

76.53

74.95

73.92

70.66

69.63

68.04

Trading strategy:

If the price breaks through 73.92, consider buying, the first target price is 74.95

If the price breaks through 72.29, consider selling, the first target price is 70.66

WTI(20250613)Today's AnalysisMarket news:

The number of initial jobless claims in the United States for the week ending June 7 was 248,000, higher than the expected 240,000, the highest since the week of October 5, 2024. The monthly rate of the core PPI in the United States in May was 0.1%, lower than the expected 0.30%. Traders once again fully priced in the Fed's two interest rate cuts this year.

Technical analysis:

Today's buying and selling boundaries:

66.96

Support and resistance levels:

69.10

68.30

67.78

66.13

65.61

64.81

Trading strategy:

If the price breaks through 67.78, consider buying in, and the first target price is 68.30

If the price breaks through 66.96, consider selling in, and the first target price is 66.13

CRUDE OIL (WTI): Pullback From Key Level

WTI Crude Oil looks overbought after a test of key daily horizontal resistance level.

A violation of a minor horizontal support on an hourly time frame after its test

provides a strong intraday confirmation.

I expect a retracement to 66.33 level.

❤️Please, support my work with like, thank you!❤️

WTI(20250609)Today's AnalysisMarket news:

Fed Harker: Amid uncertainty, the Fed may still cut interest rates later this year. Musallem: There is a 50% chance that the trade war will lead to a sustained inflation outbreak. Tariffs may push up inflation within one or two quarters. The ECB cut three key interest rates by 25 basis points. Lagarde hinted that the rate cut cycle will end, and the market is no longer fully pricing in another 25 basis point rate cut this year.

Technical analysis:

Today's buying and selling boundaries:

63.43

Support and resistance levels:

65.29

64.60

64.14

62.71

62.26

61.56

Trading strategy:

If the price breaks through 64.14, consider buying in, with the first target price of 64.60

If the price breaks through 63.43, consider selling in, with the first target price of 62.71

WTI(20250606)Today's AnalysisMarket news:

The European Central Bank cut three key interest rates by 25 basis points. Lagarde hinted that the rate cut cycle will end, and the market is no longer fully pricing in another 25 basis point rate cut this year.

Technical analysis:

Today's buying and selling boundaries:

62.58

Support and resistance levels:

63.97

63.45

63.12

62.05

61.71

61.19

Trading strategy:

If the price breaks through 63.12, consider buying, and the first target price is 63.45

If the price breaks through 62.58, consider selling, and the first target price is 62.05

WTI OIL Rejection on 1D MA50 aims at $56.50.WTI Oil (USOIL) has been trading within a 13-month Channel Down pattern and is currently under heavy pressure by multiple Resistance levels.

The immediate one is the 1D MA50 (blue trend-line), which has its most recent rejection last Wednesday (May 21) and as you can see, the price has failed to break above it, even though it's been trading directly below it.

As long as the 1D MA50 holds, we expect a test of the lower Support Zone at $56.50, similar to the September - December 2024 Support Zone, which was tested continuously after several 1D MA50 rejections.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oil Price Reversal? Why I’m Bullish on WTI Right Now! 🛢️ WTI crude oil is showing renewed bullish momentum. This move is backed by a shift in sentiment following the recent U.S.–China tariff truce and positive trade headlines. While OPEC+ supply increases and elevated inventories remain headwinds, surprise U.S. crude draws and strong jet fuel demand are tightening the market. I’m watching the current retrace. As always, keep risk tight—oil can turn fast! 🚀🛢️📈

WTI OIL May be closer to $50 and below than a recovery.WTI Oil (USOIL) is having a strong green 1W candle but remains on a strong selling sequence since the January 13 2025 rejection on its 1W MA200 (orange trend-line). So far this is technically the Bearish Leg of the Channel Down that started after the March 07 2022 market top.

The Bearish Leg that was initiated then, declined by -48.60% so if the current one repeats this we are looking at prices close to $41 by the end of the year or beginning of 2026. Technically, as long as the 1W MA50 (blue trend-line) holds, the immediate Targets within a 3-month horizon are $50 and $46.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Oil - Looking To Sell Pullbacks In The Short TermH4 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

OIL go UPWTI crude oil has recently shown signs of stabilizing after a period of volatility driven by geopolitical tensions and shifting demand expectations. While supply concerns and OPEC+ decisions continue to influence price movements, the broader macroeconomic indicators—such as signs of a soft landing in the U.S. economy and resilient global demand—are starting to create a more bullish environment.

In my view, WTI is likely to start strengthening from current levels. The technical setup suggests a potential reversal, with support holding and momentum indicators turning upward. If prices break above key resistance zones, we could see a sustained move higher.

Overall, I believe it's a good time to consider a long position on WTI.

XTI/USD "WTI Crude Oil" Energy Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI Light Crude Oil" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (71.000) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (68.500) Day / scalping trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 73.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢🔥XTI/USD "WTI Light Crude Oil" Energy Market Heist Plan (Day/Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Inventory and Storage Analysis, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

WTI Crude Oil (XTIUSD) – H4 SELL SetupWTI Crude Oil (XTIUSD) – H4 SELL Setup

Price has reacted from a key H4 supply zone after taking out previous highs. A clean bearish shift suggests continuation to the downside.

🔹 Entry: At supply zone

🔹 SL: Above mitigation zone

🔹 TPs:

First support

Equal lows

Extended swing low

Bias: Bearish

Reasoning: Liquidity sweep + market structure shift + imbalance

Oil - Short Term Buy Idea Update!!!Hi Traders, on March 25th I shared this "Oil - Expecting Retraces and Further Continuation Higher"

I expected to see retraces and further continuation higher. You can read the full post using the link above.

The bullish move delivered as expected!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.