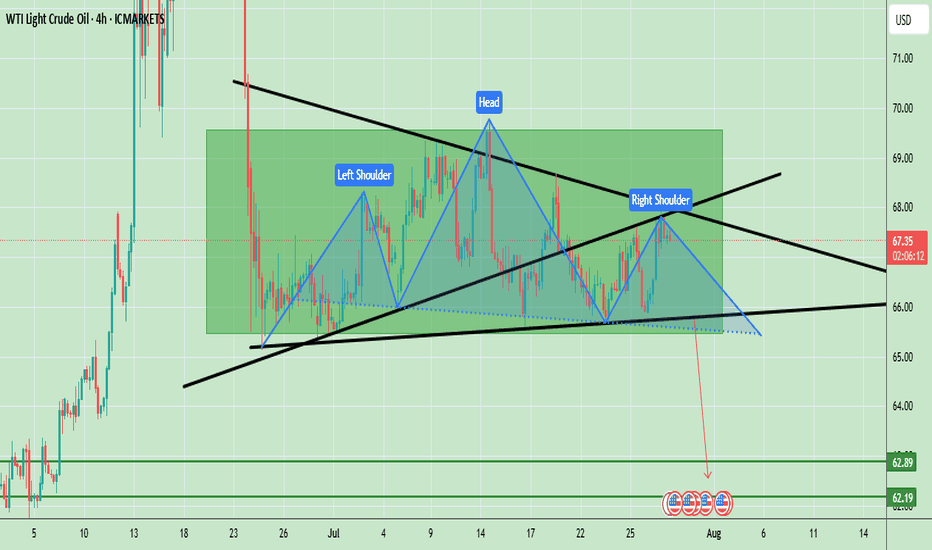

Oil Prices Form Bearish Head & Shoulders – Key Neckline in FocusWTI crude oil is showing a clear Head and Shoulders (H&S) pattern, which is a strong bearish reversal signal. The left shoulder formed in early July, followed by a higher peak forming the head in mid-July, and finally the right shoulder near the current levels, which is lower than the head. The neckline is positioned around $66.00, acting as a key support level. Currently, the price is trading at $67.34, hovering slightly above this neckline, indicating that the market is at a critical decision point. A confirmed break below the neckline could accelerate bearish momentum, targeting the $62.20 – $62.80 zone based on the pattern’s measured move. However, if the neckline holds, a possible bounce toward $68.50 – $69.00 could occur, but overall bias remains bearish unless the price can break and sustain above $69.00.

Key Price Levels:

- Resistance: $68.50 – $69.00

- Neckline Support: $66.00

- Bearish Target (if confirmed): $62.20 – $62.80

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Wtishort

WTI(20250717)Today's AnalysisMarket news:

The annual rate of PPI in the United States in June was 2.3%, lower than the expected 2.5%, the lowest since September 2024, and the previous value was revised up from 2.6% to 2.7%. Federal Reserve Beige Book: The economic outlook is neutral to slightly pessimistic. Manufacturing activity declined slightly, and corporate recruitment remained cautious.

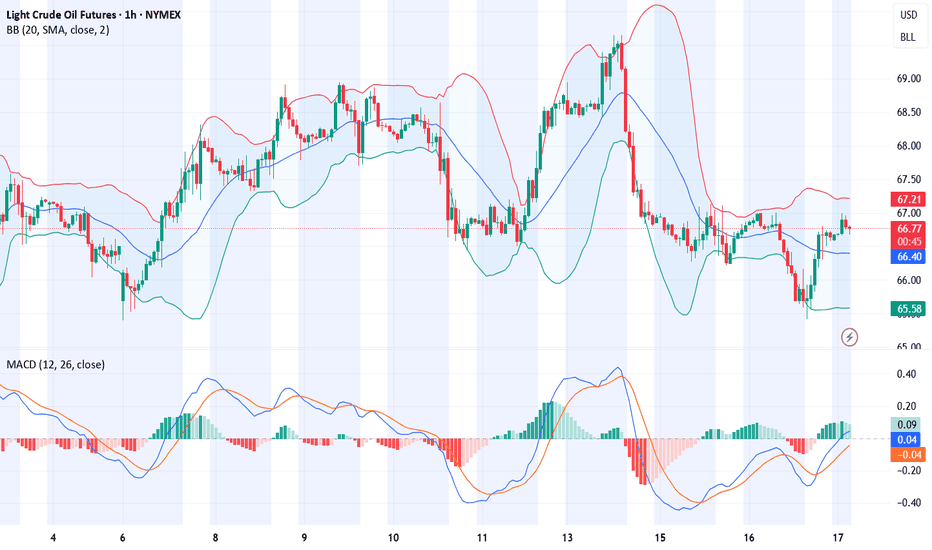

Technical analysis:

Today's buying and selling boundaries:

65.20

Support and resistance levels:

66.59

66.07

65.74

64.67

64.33

63.83

Trading strategy:

If it breaks through 65.74, consider buying in, and the first target price is 66.07

If it breaks through 65.20, consider selling in, and the first target price is 64.67

WTI Cash Bearish Divergence BearishU.S. Iran tensions, U.S. China Talks, U.S. Production capacity down,Inflation high

Techincally: Volume surges, Divergence,

Targets: See the chart.

Entries: 3 approches(red Boxes)

I am short. I stay short. At current level (above 64 risk of being bullish is higher than being short).

Mange risk tightly.

Crude OIL CRASH - OPEC & Trump - Recession Catalyst#Recession is here, Markets are bleeding.

Crude #Oil is the kicker.

I shorted TVC:USOIL on Friday.

Hunting on this trade for a while now.

Very #Bearish outlook on #WTI.

MARKETSCOM:OIL Weekly

#FundamentalAnalysis

- #OPEC+ Output Hike (411K bpd)

- #Trump #Tariffs & #TradeWar

I'm looking at a #CrudeOIL #MarketCrash, similar to the #Covid era, when NYMEX:CL1! went in minus on #Nymex #Futures.

TVC:USOIL & my BIG SHORT

#Trading EASYMARKETS:OILUSD via CFDs with #Leverage.

Executed my #Sell Position on #WTI at $64.

* DYOR before, it's not a financial advice, I just share.

#TechnicalAnalysis

- #ElliottWave Impulse Cycle a (white)

- #Correction in Primary ABC (red)

- #LeadingDiagonal in Primary A (red)

- #Descending Triangle in Primary B (red)

Why will BLACKBULL:WTI Crash?

#Bearish Primary C (red) has started.

#Break-out below the Triangle Flat Line.

Important Note:

The #Bearish #Impulse will continue lower.

After the short-lived pull-back, Sellers will dominate.

$63-64 Range is the Entry.

MARKETSCOM:OIL Daily

TVC:USOIL #Short #TradeSignal

- Entry @ $63-64 Range

- SL @ $73

- TP1 @ $40

- TP2 @ $30

- TP3 @ $20

Stay in the green and many pips ahead!

Richard (Wave Jedi)

WTI Oil Short: Bearish Setup After Sharp RallyOil prices have surged impressively, fueled by recent fundamental-driven market moves. However, this swift upside has led WTI crude to my point of interest, offering a prime opportunity to short against the trend. My trade strategy includes taking partials at the $74 price zone. Here’s why this setup is supported by bearish fundamentals:

1. Rising U.S. Fuel Inventories

Recent data shows significant growth in U.S. gasoline and distillate stockpiles, hinting at a potential oversupply in the market.

2. Strengthening U.S. Dollar

A stronger dollar makes oil more expensive for holders of other currencies, reducing global demand and weighing on prices.

3. Increased Non-OPEC Supply

With rising production levels from non-OPEC countries, analysts expect an oversupplied market in 2025, adding further pressure on oil prices.

4. Weakening Global Demand

Economic growth concerns in major markets like China and Germany are fostering expectations of reduced oil demand, reinforcing a bearish outlook.

These combined factors strongly support a short position on WTI crude oil. Stay strategic, take profits along the way, and manage your risk carefully in this volatile environment!

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

WTI Breakdown: Bearish Structure & Possible Trade Opportunity 👀 👉 Analyzing the WTI chart, we can observe a lower high and a lower low, indicating a bearish break in structure. I anticipate some additional downside movement. In the video, we delve into the trend, price action, market structure, and explore a potential trade opportunity. ⚠️ This content is for educational purposes only and does not constitute financial advice.

In the short and medium term, WTI is mainly bought.

Due to delays in production cuts by OPEC countries. Oil experienced a slight decline, but some Arab countries decided to reduce production. So oil formed some support after a brief decline. As a resource product. To a certain extent, supply is also lower than demand, and the other is the promotion of geopolitics, so the operation is still based on buying at low prices. The club already has live signals announced.

In the mid-term, buying is also the main focus.

WTI H1 / Opportunity for a Short Trade 💲Hello Traders!

I see a good opportunity to execute a short trade on WTI H1. I expect the BOSS at the price of 77.80 to be taken, and in case of retracement, I will look for a short trade entry.

Traders, if my proposal resonates with you or if you hold a divergent viewpoint regarding this trade, feel free to share your thoughts in the comments. I welcome the opportunity to hear your perspectives.

____________________________________

Follow, like, and comment to see my content:

www.tradingview.com

Crude Oil - Buy Zone!Hey there!

I'm selling on WTI: (Second trade)

-RMID (Range Manipulation Initiation Distribution)

-We have liquidity uptake.

-We have an interesting zone.

-We have the optimal Fibonacci.

-We have accumulation before/on the zone.

-We are with the trend.

🚀 If you liked it and want more, don't hesitate to subscribe and boost the post!

Questions? Leave a comment!

Crude Oil - Buy Zone!Hey there!

I'm selling on WTI:

-RMID (Range Manipulation Initiation Distribution)

-We have liquidity uptake.

-We have an interesting zone.

-We have the optimal Fibonacci.

-We have accumulation before/on the zone.

-We are with the trend.

🚀 If you liked it and want more, don't hesitate to subscribe and boost the post!

Questions? Leave a comment!

WTI H1/ Bearish Market Continuation, SHORT TRADE SIGNAL !💲Hello Traders!

This is my idea related to USOIL H1. According to the market structure, I expect a continuation of the bearish market, and at the moment I see a good signal for a short trade as the price reacted from the OB.

My target is the level below the BOSS.

Traders, if you liked my idea or if you have a different vision related to this trade, write in the comments. I will be glad to see your perspective.

____________________________________

Follow, like, and comment to see my content:

www.tradingview.com

WTI H4 / A KEY LEVEL FOR OIL 🛢📊Hello Traders!

This is my perspective on WTI H4. OIL is currently at a key level, and I'm waiting for a confirmation. At the moment, OIL is in a bearish channel pattern and has now reached the resistance level. I anticipate a move until the OB from the price of 78.200. Additionally, there is a significant possibility of a strong bearish move down to the price of 65.000. If there is confirmation of a retracement from the resistance level, I will execute a short trade.

Traders, if you liked my idea or if you have a different vision related to this trade, write in the comments. I will be glad to see your perspective.

____________________________________

Follow, like, and comment to see my content:

www.tradingview.com

WTI → Oil prices drop as the USD recovers, OPEC cutsThe outlook has turned bearish for the WTI. This is mainly because the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) reside deep in negative territory and as the price is seen below its 20,100 and 200-day Simple Moving Averages (SMA). This indicates that on the shorter and broader scales, the sellers are dominating.

Resistance Levels: $75.00, $76.15 (20-day SMA), $77.00

Support Levels: $72.80, $72.30, $71.00

WTIUSD short position analysisIn weekly TF we have a CHoCH to the up.

In daily TF we're in the pull back of the weekly TF, so we're in a down trend.

In 4H TF we had a BOS of previous low and now we're in a pull back to the up.

I think these two areas have the most potential to go short.

We can set sell limit orders but for more confirmation we can wait for a CHoCH in lower TF(Like 5min TF) and then dive into it ;)

Let see what will happen...

Good luck.

OIL MIGHT BE GETTING INTO FURTHER SELL-OFFOil prices have continued to decline, marking the third consecutive session of losses. This decline is attributed to a series of sluggish economic data releases from Germany, the eurozone, and Britain, which have raised concerns about energy demand. Brent crude futures dropped by 2%, down $1.76 to $88.07 per barrel, while U.S. West Texas Intermediate crude futures fell by 2.2%, down $1.91 to $83.58 per barrel.

The eurozone's business activity data showed an unexpected downturn this month, raising fears of a potential recession in the region. Germany, one of Europe's economic powerhouses, appeared to be slipping into a recession, and Britain reported another monthly decline in economic activity, increasing concerns of a recession ahead of the Bank of England's interest rate decision. These economic uncertainties, along with other global factors, have contributed to the downward pressure on oil prices.

Despite the economic concerns in Europe, the U.S. recorded an uptick in business output in October, which helped boost the U.S. dollar, making dollar-denominated oil more expensive for holders of other currencies. Additionally, concerns surrounding the situation in the Middle East, where diplomatic efforts are underway to contain the Israel-Hamas conflict, have also impacted oil prices. Overall, the oil market remains on edge, with a focus on potential supply disruptions and geopolitical tensions.

If this trend continues, the price might reach levels of 81.53. In the opposite scenario, as a pivot point might be considered 86.38, from where the price might reach levels of 89.32.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

USOIL: Range shock, high Sell opportunitySince I expressed my opinion, I have published a total of 3 articles, all of which have ended in profit. The winning rate currently remains at 100%. I hope it can continue to be maintained and point out a clear direction for everyone.

Recently, crude oil has been fluctuating within the range of 86.10-87.9. This oscillating trend has lasted for several days, and there is no sign of a breakthrough for the time being. The only way to achieve a breakthrough is to see how tomorrow's EIA data performs. Before that, we can just keep selling high and buying low.

At present, crude oil has reached a high of 87.9 again, and the opportunity to short is rare, so I am prepared to sell here and set two targets, 86.8 and 86.1.

Oil BearishMarket Structure: Oil is in a downtrend making lower highs and lower lows and approaching a key level (resistance, downtrend line, swing high) and there is likely an accumulation of buy orders which are made up of breakout traders and stop losses of short positions. This accumulation of orders creates enough liquidity for the market to match orders at this high point before positioning to go lower.

Trade: Wait for price to close above the swing high point and enter short on a sell stop @ 84.518

WTI TRADE IDEAHi all

Can the price remain above weekly resistance once the market closes on Friday?

Good Luck to all

Let me know what you think In the comments!

**My trading strategy is not intended to be a signal. It's a process of learning about market structure and sharpening my trading skills**

Thanks a lot for your support

🚨 WTI HIGH PROBABILITY SELL SETUP SOON 🚨🚨 WTI HIGH PROBABILITY SELL SETUP SOON 🚨

* Here we can see clearly the next potential moves for West Texas Intermediate Crude Oil, in coming days or week.

* Im thinking there might be a Down Trend Move happening FIRST to form the Inverse Head & Shoulder Reversal Pattern before the Huge Bullish Move to Up Trend.

* I've labelled where i can see the Inverse Head & Shoulder that MIGHT happen or not.

* I've got Multiple SELL trades to look at.

* First SELL position is going to be a quick SCALPING move to execute.

* EP(SELL): 70.263

* TP: 69.910

* No SL provided for this trade, use your own discretion.

* Nest EP(SELL) is for the Next potential Big Drop to form the Shoulder.

* EP(SELL): 69.623

* TP: 68.951

* TP2: 68.016.

* No SL provided for this trade, use your own discretion.

* Keep your eye close on your trading positions.

* Happy pip hunting traders.

* FXKILLA *