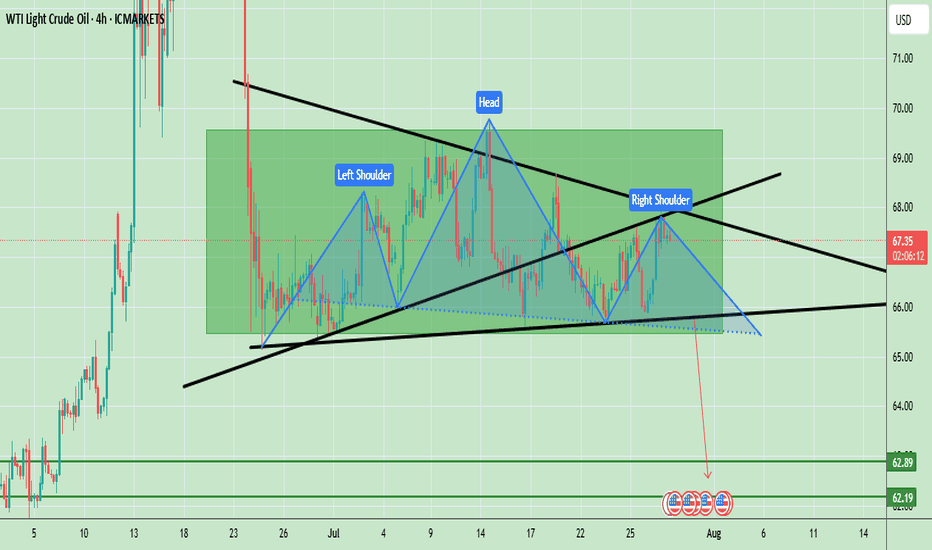

Oil Prices Form Bearish Head & Shoulders – Key Neckline in FocusWTI crude oil is showing a clear Head and Shoulders (H&S) pattern, which is a strong bearish reversal signal. The left shoulder formed in early July, followed by a higher peak forming the head in mid-July, and finally the right shoulder near the current levels, which is lower than the head. The neckline is positioned around $66.00, acting as a key support level. Currently, the price is trading at $67.34, hovering slightly above this neckline, indicating that the market is at a critical decision point. A confirmed break below the neckline could accelerate bearish momentum, targeting the $62.20 – $62.80 zone based on the pattern’s measured move. However, if the neckline holds, a possible bounce toward $68.50 – $69.00 could occur, but overall bias remains bearish unless the price can break and sustain above $69.00.

Key Price Levels:

- Resistance: $68.50 – $69.00

- Neckline Support: $66.00

- Bearish Target (if confirmed): $62.20 – $62.80

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Wtiusd

Crude oil trading reminder: triple positive support

💡Message Strategy

After three consecutive days of sluggishness, both U.S. and Brent crude oil remained above the 100-day moving average on Thursday (July 24). U.S. crude oil is currently up 0.4%, trading around 65.46; Brent crude oil is currently up 0.1%, trading around US$68.67 per barrel. The three engines of trade negotiations, unexpected decline in inventories, and geopolitical games are ignited at the same time. Oil prices showed signs of stabilizing, allowing bulls to "smell" the long-awaited rebound opportunity.

1. The trade war breaks the ice: the US, Japan and Europe have reached a series of agreements to ignite market hopes.

2. Inventories plummeted by 3.2 million barrels! The balance of supply and demand suddenly tilted.

3. Geopolitical black swan: The war between Russia and Ukraine burns the energy supply chain

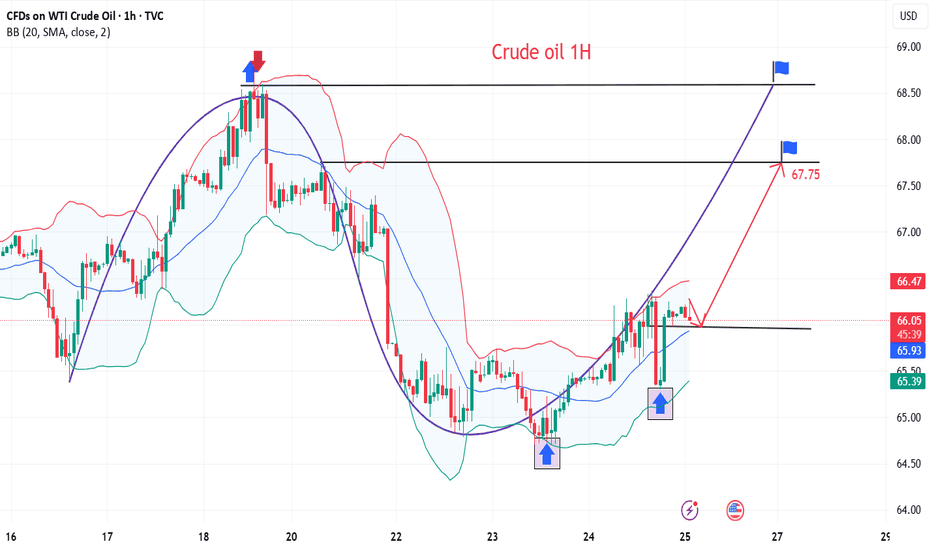

📊Technical aspects

The short-term (4H) trend of crude oil fluctuated upward slightly. The moving average system gradually formed a bullish arrangement, and the short-term objective trend direction was upward. In terms of momentum, the MACD indicator opened upward above the zero axis, and the bullish momentum was sufficient.

In terms of form, the oil price broke through the neckline, and the head and shoulders bottom reversal pattern was established. It is expected that after the intraday crude oil trend retests the neckline position, the probability of forming another upward rhythm is high.

💰Strategy Package

Long Position:65.50-66.50,SL:64.00,Target:67.75-68.00

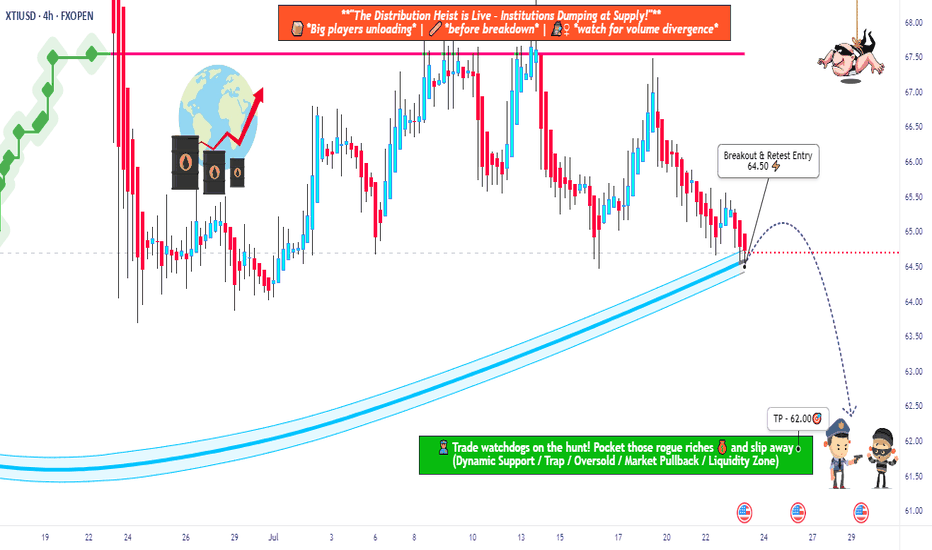

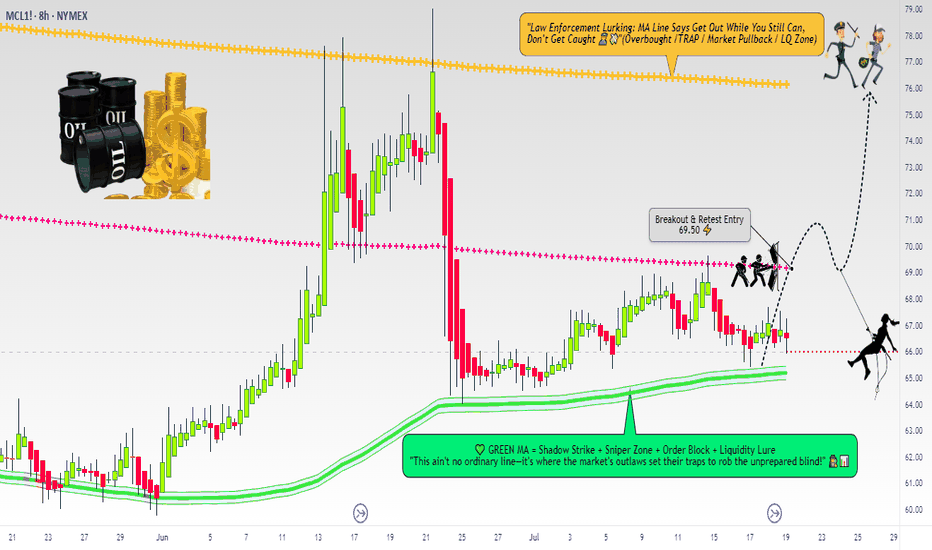

USOIL Robbery Alert! Smart Entry Plan Below Key MA Level🔐💥 “WTI Energy Heist: Thief Trader’s Bearish Master Plan” 💥🔐

The Official Robbery Blueprint for Smart Traders

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

💸 Welcome, Money Makers & Market Robbers! 💸

🚨 Get ready to break into the "US Oil Spot/WTI" market with precision-crafted bearish strategy from the one and only — Thief Trader Style!

📉💣 THE HEIST IS ON: SHORT PLAN LOADED! 💣📉

We’ve analyzed the charts using Thief Technicals + Fundamental Lockpick Tools and spotted a high-risk GREEN zone – a consolidation trap where greedy bulls usually get caught. This is where we strike.

🔑 ENTRY:

"Wait for the Neutral Moving Average to Break — Then Make Your Move!"

🎯 Focus zone: 64.50

☠️ Wait for the breakout – do NOT enter before it happens.

✅ Use sell stop orders above the MA line or place sell limit orders on the pullback after the breakout (target within the 15–30 min candle near swing high/low).

🧠 Thief Tip: Layer in entries using the DCA (layered attack strategy) to catch price on its way down. Set a chart alert so you don’t miss the strike moment.

🛑 STOP LOSS:

"Set it smart or don’t set it at all — you choose the fire you want to play with!"

📍 SL only gets placed AFTER breakout.

🎯 Recommended SL at 66.00 on the 4H swing level.

☠️ DO NOT place any orders or SL before confirmation breakout.

📊 Your SL depends on your risk %, lot size, and number of entries stacked.

🎯 TARGET ZONE: 62.50

💸 Lock profits before the bulls wake up. This level is based on market exhaustion zones and historical bounce areas.

🧠 WHY WE'RE SHORTING THIS?

This isn’t just a chart move — it’s backed by full-scale robbery research:

📰 COT Reports

📈 Macro & Seasonal Trends

🛢️ Crude Oil Inventories

💹 Sentiment & Intermarket Correlation

📉 Supply-Demand Dynamics

📚 Before pulling the trigger, educate yourself with the fundamentals. Dive into COT, Seasonal, and Macro reports. Don’t rob blindly — rob smart.

⚠️ Risk Management Alert:

Major news releases? Step back.

Trailing stops? Lock it in.

Position sizing? Know your risk.

Trade like a professional robber, not a street pickpocket.

💥💖 SUPPORT THE ROBBERY PLAN 💖💥

🧨 Smash that BOOST button to support this trading style and help more traders rob the market clean. Every like, every boost makes this community stronger.

💬 Drop a comment, share your entry levels, or post your winning trades.

This is a trading crew – we rob together, we profit together.

🔔 Stay tuned — more heist plans dropping soon.

Until then... Rob Smart. Trade Hard. Take Profits. 💰💪🎯

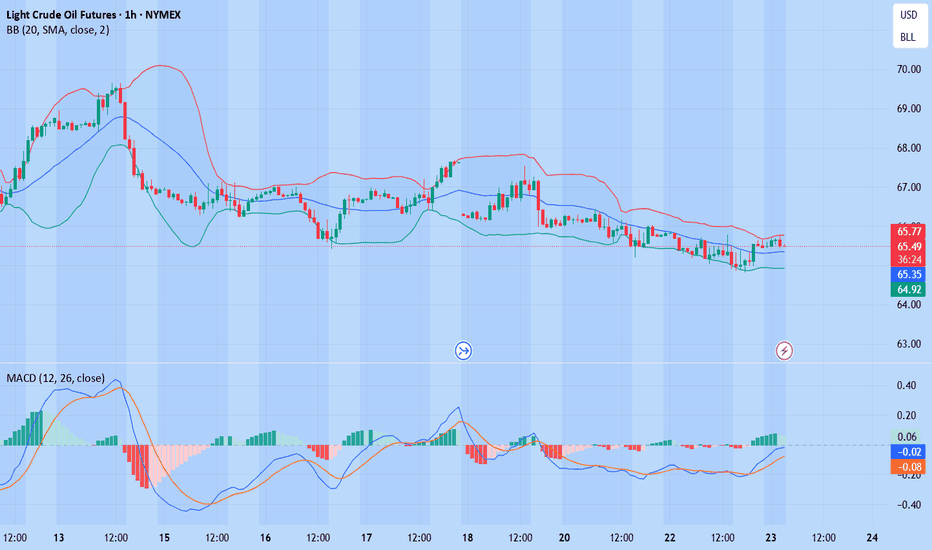

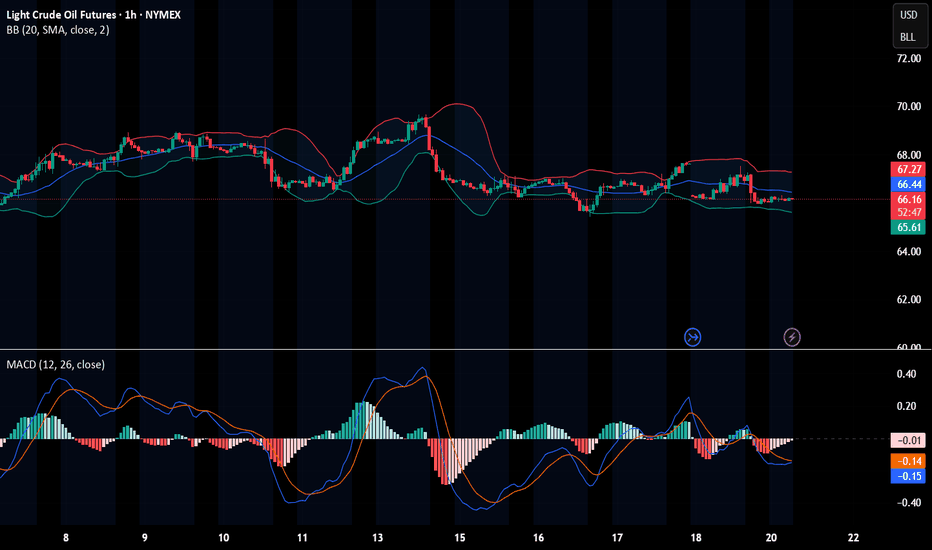

WTI(20250723)Today's AnalysisMarket news:

White House officials plan to visit the Federal Reserve headquarters on Thursday local time.

Technical analysis:

Today's buying and selling boundaries:

65.22

Support and resistance levels:

66.22

65.85

65.61

64.84

64.60

64.22

Trading strategy:

If the price breaks through 65.61, consider buying, the first target price is 65.85

If the price breaks through 65.22, consider selling, the first target price is 64.84

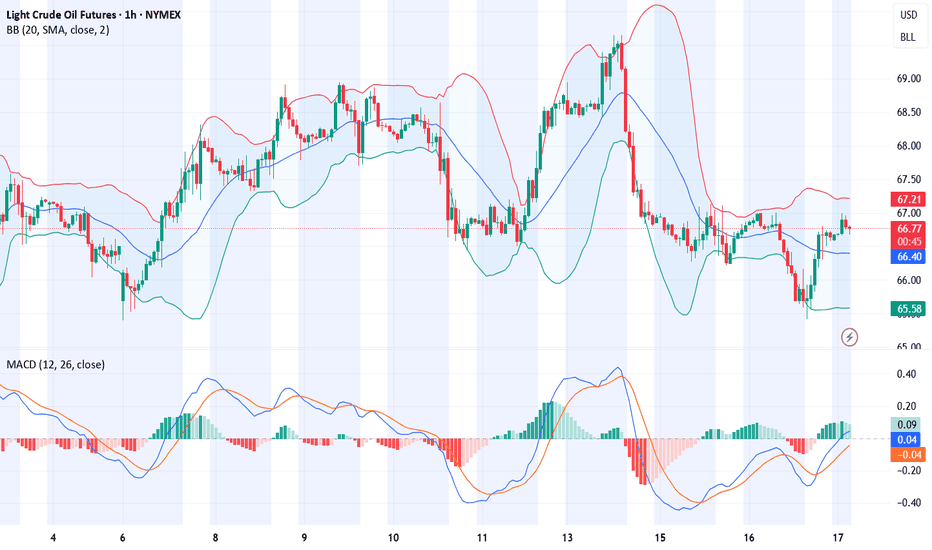

WTI(20250721)Today's AnalysisMarket news:

Waller refused to comment on whether he would dissent at the July meeting, saying that the private sector was not performing as well as people thought, and said that if the president asked him to be the chairman of the Federal Reserve, he would agree.

Technical analysis:

Today's buying and selling boundaries:

66.42

Support and resistance levels

68.00

67.41

67.02

65.81

65.43

64.84

Trading strategy:

If the price breaks through 66.42, consider buying, and the first target price is 67.02

If the price breaks through 65.81, consider selling, and the first target price is 65.43

Micro WTI Swing Breakout Setup – Robbing Liquidity the Smart Way🛢️ "Crude Ops: The WTI Energy Vault Breakout Plan" 🛢️

(A Thief Trader Swing Setup | MA Breakout Trap Heist 💰💥)

🌍 Hola! Bonjour! Marhaba! Hallo! Hello Robbers & Market Movers! 🌟

Welcome to another high-voltage heist mission straight from the Thief Trading Den. This ain’t just a chart—this is an Energy Market Extraction Plan based on real smart money footprints 🔎.

🔥 Master Robbery Setup: MICRO WTI CRUDE OIL FUTURES 🎯

We got a bullish breakout alert from the shadows! This is not a drill.

💣 ENTRY STRATEGY

💼 "The Heist Begins Above 68.50"

Watch the Moving Average (MA) zone closely—this is where weak hands get trapped and we slide in with stealth limit or breakout orders:

🛠️ Plan of Entry:

Buy Stop Order: Just above 68.500 (after confirmation of breakout ✅).

Buy Limit Layering (DCA): On pullbacks around 15m/30m swing lows for precision entries.

🧠 Pro Tip: Use alerts to catch the exact entry ignition spark—don't chase, trap with patience like a true thief.

🛑 STOP LOSS (SL)

⚠️ "No SL? That’s a rookie mistake."

SL should only be placed post-breakout using the 8H wick-based swing low (around 66.50).

💡 SL is your personal vault door—set it according to:

Lot size

Risk appetite

Layered entry strategy

📌 Reminder: No SL or order placement before breakout. Let the market show its hand first.

🎯 TARGET ZONE (Take Profit)

Primary Target: 76.00 🏁

But hey... the smartest robbers escape before alarms ring — so trail that stop, secure your profits, and vanish like smoke 🥷.

💥 FUNDAMENTAL & SENTIMENT CATALYSTS

🔥 Current bullish energy comes from:

📉 USD weakness

🏭 Crude inventory drawdowns

⚖️ Geopolitical supply shocks

🐂 Hedge funds scaling long per latest COT data

📊 Intermarket cues from risk-on assets

🧠 Do your diligence: Go check fundamentals, COTs, and macro narratives before entering. Info = Edge.

📢 RISK MANAGEMENT NOTE

🚨 Don't go wild. Market is volatile, especially around:

News drops 📉

Fed or OPEC speeches 🎙️

Crude inventory reports 🛢️

Pause entries during news events. Use trailing SLs to lock the vault behind you.

❤️ SUPPORT THE ROBBERY MISSION

💣 Smash that BOOST button if this plan hits your nerve.

Let’s keep robbing liquidity zones together and growing the Thief Trader Brotherhood 🕵️♂️💰.

📡 Stay tuned for the next stealth heist drop. We rob the market with class. 💎🚀

WTI(20250717)Today's AnalysisMarket news:

The annual rate of PPI in the United States in June was 2.3%, lower than the expected 2.5%, the lowest since September 2024, and the previous value was revised up from 2.6% to 2.7%. Federal Reserve Beige Book: The economic outlook is neutral to slightly pessimistic. Manufacturing activity declined slightly, and corporate recruitment remained cautious.

Technical analysis:

Today's buying and selling boundaries:

65.20

Support and resistance levels:

66.59

66.07

65.74

64.67

64.33

63.83

Trading strategy:

If it breaks through 65.74, consider buying in, and the first target price is 66.07

If it breaks through 65.20, consider selling in, and the first target price is 64.67

WTI(20250715)Today's AnalysisMarket news:

Sources said that after Trump's latest trade tax threat, the European Central Bank will discuss a more negative scenario next week than expected in June. The ECB is still expected to keep interest rates unchanged at its meeting on July 24. Discussions on rate cuts are still postponed to September.

Technical analysis:

Today's buying and selling boundaries:

66.63

Support and resistance levels:

69.20

68.24

67.62

65.65

65.02

64.06

Trading strategy:

If it breaks through 66.63, consider buying in, the first target price is 67.62

If it breaks through 65.65, consider selling in, the first target price is 65.02

WTI Oil – From Conflict to StrategyBack on April 24, I marked a short zone. On June 11, price broke above that level, giving a long opportunity — which I took.

Unfortunately, it coincided with the tragic military strike by Israel on Iran, pushing oil sharply higher. I’ve pinned that analysis.

Following the ceasefire, price dropped again — just a reminder that geopolitics can shake the charts.

As traders, we stay prepared to act, even while acknowledging the deep sadness of lives lost.

Now I wait for price to reach my marked level again. If I get a valid signal, I’ll short.

But if price breaks and holds above, I’ll buy the pullback — with no bias, just pure execution.

Risk-managed. Emotion-neutral. Opportunity-focused.

WTI Oil Heist: Bullish Breakout Plan for Big Gains!🚨 Ultimate WTI Oil Heist Plan: Bullish Breakout Strategy for Big Profits! 🚀💰

🌟 Hello, Wealth Chasers & Market Mavericks! 🌟

Hola, Bonjour, Hallo, Marhaba! 🗺️

Get ready to execute the Ultimate WTI / US Oil Spot Heist using our 🔥 Thief Trading Style 🔥, blending sharp technicals with powerful fundamentals! 📈💡 This swing trade plan targets the energy market’s bullish potential, but stay sharp—volatility lurks! 🚨 Follow the chart setup for a long entry, and let’s aim for those juicy profits while dodging the high-risk ATR zone where the market “police” might trap overzealous traders. 🏦⚠️

📊 The Heist Plan: WTI / US Oil Spot (Swing Trade)

Entry 📈:

The breakout is your signal! 🎯 Wait for the Moving Average crossover and a confirmed pullback at $68.00 on the 2H timeframe. Once it triggers, go long and ride the bullish wave! 🐂 Set an alert to catch the breakout in real-time. 🚨

Stop Loss 🛑:

Protect your capital like a pro! 💪 Place your stop loss below the recent swing low at $65.00 (2H timeframe, candle body wick). Adjust based on your risk tolerance, lot size, and number of positions. Rebels, beware—straying too far from this level could burn you! 🔥

Target 🎯:

Aim for $73.80 or exit early if momentum fades. Scalpers, stick to long-side trades and use a trailing stop to lock in gains. 💰 Swing traders, follow the plan and secure profits before the market consolidates or reverses. 🏴☠️

📊 Market Context & Key Drivers

The WTI / US Oil Spot market is currently consolidating with a bullish bias 🐂, driven by:

Fundamentals: Check macroeconomic data, seasonal trends, and intermarket correlations. 📉

COT Report: shows net-long positions increasing, signaling bullish sentiment. 📅

Sentiment & Quantitative Analysis: Market mood leans positive, but overbought risks loom near the ATR zone. ⚠️

Stay informed! 📰 Monitor news releases, as they can spike volatility. Avoid new trades during major announcements and use trailing stops to protect open positions. 🔒

📊 Pro Tips for the Heist

Scalpers: Go long with tight trailing stops to safeguard profits. 💸

Swing Traders: Stick to the plan, adjust stops based on risk, and exit before the high-risk ATR zone ($73.80+). 🚪

Risk Management: Never risk more than you can afford. Tailor your lot size and stop loss to your account size. 🛡️

Stay Updated: Market conditions shift fast—keep an eye on fundamentals and sentiment to stay ahead. 👀

📊 Why Join the Heist?

This Thief Trading Style plan is your ticket to navigating the WTI market with confidence! 💪 Boost this idea to strengthen our trading crew and share the wealth-making vibe. 🚀💥 Like, follow, and stay tuned for more high-octane strategies! 🤑🐱👤

Disclaimer: This is a general market analysis, not personalized investment advice. Always conduct your own research and consider your risk tolerance before trading. Markets are dynamic—stay vigilant and adapt to new developments. 📡

Let’s make this heist legendary! 🌟💰 See you at the next breakout! 🤝🎉

Bulls on the Loose: US Oil Spot/WTI Heist Strategy! 🚨💰 THE OIL VAULT HEIST: US OIL SPOT/WTI TRADING STRATEGY 💸🔫

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers 🤑💰💸✈️

Based on our 🔥Thief Trading style analysis🔥 (both technical and fundamental), here’s the master plan to heist the US Oil Spot/WTI Energy Market. Follow the blueprint carefully—this strategy focuses on long entries, with a daring escape planned near the high-risk Red ATR line Zone where bearish robbers and consolidation traps await. 🏆💸 Take your profit and treat yourself, fellow traders—you earned it! 💪🏆🎉

🕵️♂️ Entry 📈

💥 The vault is wide open! Time to swipe that bullish loot—heist is on!

Place buy limit orders within the 15 or 30-minute timeframe, near swing lows/highs for pullback entries.

🛑 Stop Loss 🛑

📍 Thief’s SL—recent swing low and below the moving average (4H timeframe) for day/swing trades.

📍 Adjust SL based on risk, lot size, and number of orders.

🎯 Target

🏴☠️💥 69.000 (Aim for the big loot!) OR escape before the target

🔥 Market Heist Overview

The UK Oil Spot/Brent market is currently showing bullishness 🐂, driven by key factors—perfect for a day/scalping trade robbery! ☝☝☝

📰 Additional Tools & Analysis

📊 Get the Fundamental, Macro, COT Report, Quantitative Analysis, Sentiment Outlook, Intermarket Analysis, Future Targets—check our bi0 liinks 👉👉👉🔗🔗

⚠️ Trading Alert: News Releases & Position Management

📰 News can rattle the vault! 💥

✅ Avoid new trades during news releases.

✅ Use trailing stop-loss orders to protect profits.

💖 Supporting our heist plan?

💥 Smash the Boost Button 💥 to empower the robbery team.

Let’s make money every day in this market with the Thief Trading Style! 🏆💪🤝❤️🎉🚀

👀 Stay tuned for the next robbery plan, thieves! 🤑🐱👤🤗🤩

USOIL HEIST ALERT: Thief Entry Loaded – Target Locked!🚨 The Ultimate US OIL / WTI Heist Plan – Thief Trading Style 🎯💸

Hey Money Makers, Hustlers, Market Bandits! 🌍

Hola, Ola, Bonjour, Hallo, Marhaba! 👋🌟

We’re back with a slick WTI energy market heist based on our 🔥Thief Trading Style🔥—powered by a mix of technical & fundamental strategies. The vault is wide open and the bullish loot awaits!

🗺️ Strategy Brief:

We’re aiming for a clean bullish getaway near the high-risk MA zone—where traps are set and bearish robbers lurk. Watch out for overbought zones, trend reversals, and consolidation ambushes.

📈 Entry Point:

“The vault is open! Enter the bullish heist at will.”

Look to place Buy Limit Orders around swing highs/lows or pullback levels on the 15m–30m timeframe.

🛑 Stop Loss:

Set your Thief SL around the recent swing low using the 3H timeframe (example: 60.300).

Adjust based on your risk appetite, lot size, and number of entries.

🎯 Target: 65.200

That's where we celebrate the score, traders! 🥂💸

📊 Heist Justification (Fundamentals + Sentiment):

The WTI market is currently bullish, fueled by a mix of:

✅ Macro economics

✅ COT data

✅ Seasonal trends

✅ Intermarket signals

✅ Inventory & storage dynamics

📌 For full analysis and future target breakdowns, check the linkk in our profilee 🔗👀

⚠️ Important Alert – Manage Your Risk During News:

🚫 Avoid fresh entries during major news releases

✅ Use trailing stops to protect running gains

Stay sharp, stay safe.

💥 Hit the Boost Button if you support the Thief Strategy!

Join the crew, ride the wave, and let’s rob the market like pros 💼🕶️💰

📅 Stay tuned for the next master plan. Another heist is always around the corner.

Until then – steal smart, win big! 🐱👤🔥

WTI(20250620)Today's AnalysisMarket news:

The Bank of England kept interest rates unchanged at 4.25%, and the voting ratio showed that internal differences were increasing. Traders expect the bank to cut interest rates by another 50 basis points this year.

Technical analysis:

Today's buying and selling boundaries:

74.33

Support and resistance levels:

77.40

76.25

75.51

73.15

72.40

71.26

Trading strategy:

If it breaks through 73.15, consider buying, and the first target price is 75.00

If it breaks through 72.40, consider selling, and the first target price is 71.26

WTI - ANALYSIS BUY AREA This week the ongoing conflict seems to bring more uptrend to this commodity

I believe that the last broken resistance now turning support at 67.300 will be tested prior to the OIL raising again

If the conflict doesn’t end and we don’t have a ceasefire we could see this commodity running to the 78.000 and 82.000 levels

WTI(20250616)Today's AnalysisMarket news:

Trump: The United States may still intervene in the Iran-Israel conflict. If Iran launches an attack on the United States, the United States will "fight back with all its strength on an unprecedented scale." Iran and Israel should reach an agreement.

Technical analysis:

Today's buying and selling boundaries:

71.11

Support and resistance levels:

78.59

75.79

73.98

68.24

66.43

63.64

Trading strategy:

If the price breaks through 73.98, consider buying in, the first target price is 75.79

If the price breaks through 71.11, consider selling in, the first target price is 68.24

WTI(20250612)Today's AnalysisMarket news:

① The EU hopes that the trade negotiations will be extended beyond the suspension period set by Trump. ② Bessant: As long as "sincerity" is shown in the negotiations, the Trump administration is willing to extend the current 90-day tariff suspension period beyond July 9. ③ Trump will hold multiple bilateral talks during the G7 summit. ④ The total customs revenue of the United States in May reached a record high of US$23 billion, an increase of nearly four times year-on-year. ⑤ Lutnick: One deal after another will be reached.

Technical analysis:

Today's buying and selling boundaries:

66.02

Support and resistance levels:

69.56

68.23

67.38

64.66

63.80

62.47

Trading strategy:

If the price breaks through 67.38, consider buying in, and the first target price is 68.23

If the price breaks through 66.02, consider selling in, and the first target price is 64.66

USOIL LETS MAKE OIL GREAT AGAIN TO 80$HELLO TRADERS

As i can see USOIL it formaing H & S pattrent and now trading above a strong Weekly horizontal Support zone if prices hold above 65$ then given Tp can be easy target if we see a higher demand and tight supply with the War going on around the world its a huge possibilty that pricce can shoot up we have to monitor the 65$ price zone which is importat to hold bull cycle on smaller TF 4HR it is creating Wickoff pattren too and we can see Fibo levels golden ratio can hit our targers or risk reward is great for us becaus we was buying the dip in May it is just starting chart is crystal clear its just a trade idea share your thoughts we appriciate ur comments and support Stay tuned for more updates

Potential bullish rise?WTI Oil (XTI/USD) has bounced off the pivot and could rise the 1st resistance which is a pullback resistance.

Pivot: 61.68

1st Support: 60.72

1st Resistance: 63.49

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

WTI - Bullish Momentum Targets $65US Light Crude has demonstrated remarkable resilience after experiencing a significant correction from March highs around $72 down to the $55 support zone in late April. The commodity has since staged an impressive recovery, climbing steadily from those April lows to current levels near $62, effectively reclaiming more than half of the previous decline. This recovery pattern suggests strong underlying demand and buying interest at lower levels, with crude oil successfully breaking above key resistance areas during its ascent. The current price action shows the market consolidating near recent highs while maintaining an upward bias, with the technical structure indicating further upside potential toward the resistance zone highlighted around $65. Given the strong bounce from support, sustained momentum, and the overall recovery trajectory, the higher probability scenario favors a continuation of the bullish move targeting the upper resistance band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

WTIUSD Building a Base – Bullish Reversal Setup Above $58?# WTIUSD

**Instrument:** WTIUSD

**Current Price:** Around $60

**Bias:** Bullish (Reversal)

---

**Analysis:**

WTI is showing signs of a potential **trend reversal** after forming a solid base near the $53.8 level, marked as the **invalidation zone**. Price has reclaimed the $58.3 support level and appears to be preparing for a bullish continuation, especially if it forms a higher low near this level.

A sustained move above $58.3 followed by bullish structure could open the door toward **$70.0** and possibly even **$75.0** in the medium term.

---

**Key Levels:**

- **Support:** $58.292

- **Invalidation:** $53.828 (price closing below would negate the setup)

- **Bullish Targets:** $70.0 – $75.0

---

**Trade Idea (Not Financial Advice):**

Look for confirmation of support holding above $58.3 and potential bullish momentum for entries. Invalid if price breaks and closes below $53.8.

---

> **Disclaimer:**

> This analysis is for educational purposes only and should not be taken as financial advice. Trading commodities involves significant risk. Always do your own research and use proper risk management.

"US Oil Spot/WTI" Energy Market Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US Oil Spot/WTI" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk Red Zone Level. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (59.700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 3H timeframe (57.400) Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 63.000 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸"US Oil Spot / WTI" Energy Market Heist Plan (Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.☝☝☝

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"US Oil Spot/ WTI" Energy Market Heist Plan (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US Oil Spot/ WTI" Energy Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk GREEN Zone. It's a Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the Neutral Level breakout then make your move at (59.90) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 (or) 30 minute timeframe most NEAREST (or) SWING low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (63.00) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 57.50

🔥🛢"US Oil Spot/ WTI" Energy Market Heist Plan (Scalping/Day Trade) is currently experiencing a Bearish trend.., driven by several key factors.👇👇👇

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it. go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XTI/USD "WTI LIGHT CRUDE OIL" Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XTI/USD "WTI LIGHT CRUDE OIL" Energy market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (64.00) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (59.00) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 68.70

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

🛢️ XTI/USD "WTI LIGHT CRUDE OIL" Energy Market Heist Plan (Scalping/Day) is currently experiencing a bullishness,., driven by several key factors. ☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Inventory and Storage Analysis, Sentimental Outlook, Future trend targets and Overall outlook score..., Go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩