ETH/USDT – Bullish Reversal Potential from Fibonacci Confluence 💡 Idea:

Ethereum is showing signs of demand absorption at a critical Fibonacci support cluster (0.5 – 0.618 retracement). VSA patterns confirm that selling pressure is being absorbed, hinting at a possible markup toward previous swing highs.

📍 Trade Setup:

Entry: Current levels near 3,551

Target: 3,937 (+10.82%)

Stop Loss: 3,338 (below last absorption zone)

R:R Ratio: ~1.79:1

📊 Technical Reasoning (VSA)

1. Stopping Volume at Fibonacci Support

ETH tested the 0.5–0.618 retracement zone from its prior bullish impulse.

Wide spread down-bars on high volume failed to produce significant downside progress, signaling professional buying.

2. No Supply Confirmation

Following the stopping volume, the market printed narrow range candles on decreasing volume, indicating supply exhaustion.

3. Demand Emergence

The recent push above short-term resistance came with increasing volume and wider up-bar spreads, suggesting the start of an accumulation-to-markup transition.

4. Structure & Fibonacci Confluence

Current rally aligns with the Fibonacci golden zone and past structural support.

📌 Trading Plan:

Enter on confirmed breakout above minor resistance with volume expansion.

Scale out partial profits near 3,800 and let remainder ride toward 3,937.

Keep stop below 3,338 to avoid being shaken out by false breakouts.

Wyckoff

Two Ranges, One Breakout: TCL’s Wyckoff-Gann ConfluenceCurrently tracking two distinct Wyckoff ranges on TCL, each color-coded for clarity. The structure is clean despite a few lines—each range tells a story.

Accumulation Zones

Key buying opportunities are emerging at the LPS (Last Point of Support), marked by higher lows. These are classic signs of strength and absorption.

Resistance & Breakout Potential

Expect notable resistance around $15.55, but a breakout is likely. We’re approaching a Gann 4th-time breakout setup, which historically carries strong momentum. If price reaches this zone with expanding volume and wide candle spreads, it adds conviction for a Sign of Strength (SOS) and a potential pullback to retest.

Targets & Confluence For take-profit zones, I’m watching:

Yearly pivots

Range extensions from both Wyckoff structures (100%, 150%, 200%)

Gann extensions for harmonic targets

This setup blends structure, volume dynamics, and time-price symmetry. If the breakout confirms, TCL could offer a textbook Phase E markup.

*please note no time analysis is done, just looking at pathing

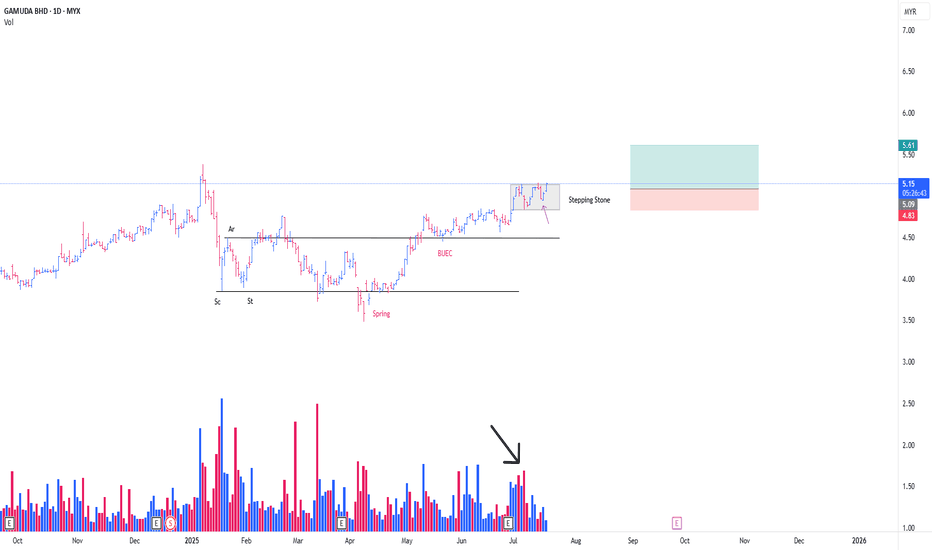

GAMUDA CONTINUING MARKING UPThis is just a continuation from my previous thesis

**pls refer to the link below

I just want to mention that there is another formation of feather's weight (FW) (**Red line) since the Stepping Stone (SS)

I would be labelling this FW as a form of SS

It would be interesting if today's Bar / Candlestick, able to commit above yesterday's Bar/Candlestick (31/7/25)

-Noticed the huge selling blocks (*Purple Arrow)

EP n SL as attached (Position Intiated @ 31/7/25)

PureWyckoff

MNHLDG CONTINUE MARKING UPThis is a continuation from my previous entry

**Refer link

Referring to the Red Box, I see it as a Stepping Stone (SS) , a mere temporary stop centre,

before continuing marking up from previous Trading Range (Red Arc Line).

My hypothesis is that, this box are forming a mini Trading Range , in which the formation of local spring , prompted me to initiate position.

The 3 Bars (Or Candlesticks, whatever you prefer), are basically a SpringBoard [/b ] in the form of Absorption.

For Non Wyckoffian, this might be confusing.

Different POV produce different meaning & context/subcontext.

I intiated my position @ 31/7/25, added position today

PureWyckoff

KGB CONTINUE MARKING UPI have been monitoring KGB since my last entry

*Link given

This is a typical Schematic #1 of Re-Accumulation Trading Range

I initiated my position today in the background of Stepping Stone (Red Line)

Based on the influx of buying demand for the past few days, looks like the on going,

Feather's weight & SpringBoard **Purple line, are forming in the theme of Absorption.

Tight risk for this one, im expecting, to get in back, if my current position got knocked out

*(only if low risk entry is formed)

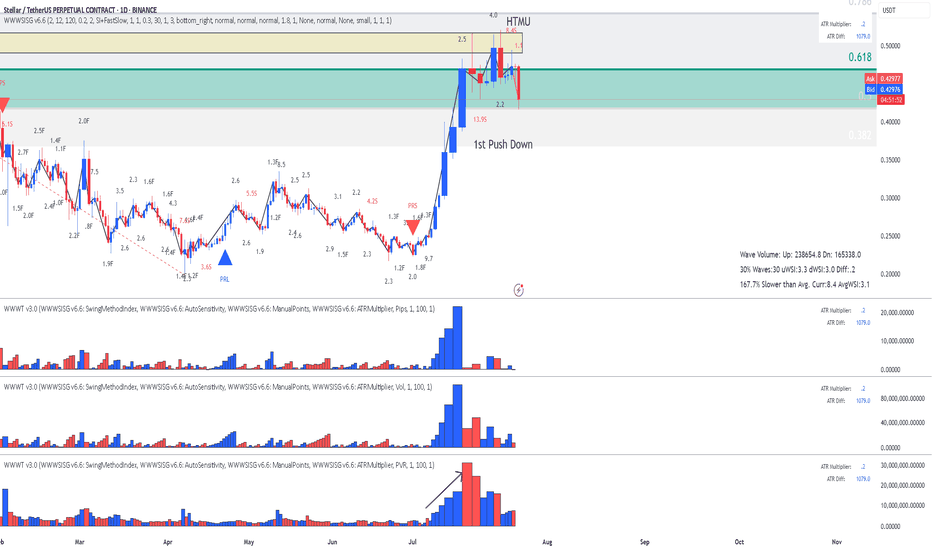

BNB Binance Coin: Lesson 15 methodology did the job again

Lesson 15 methodology (annotations in sync with the chart):

1. Largest up volume wave after a while - sellers might be in there.

2. Placed AVWAP and waited for price to cross downwards and pullback again on AVWAP

3. HTMU (hard to move up) - Abnormal Speed Index 4.6S at the top

4. Entry short signal PRS with abnormal SI 4.8.2 (price has a hard time to move up - absorption)

Simple as that. Enjoy!

Simple Psychology Tips Using Volume for Better TradingMany newer traders assume that when someone says "psychology" in trading, they are referring to mindset.

It is also widely believed that trading is about the BEST entries.

Now, think of it this way. It is not about winning trades, it is actually about managing losses well to allow you to take the winners over and over again. You might think that a 3 to 1 risk-to-reward strategy is boring, you might have gone all in on your favourite crypto project. But what makes the difference between gambling and trading is actually very, very simple. So simple, in fact, many overlook it or simply ignore it.

Most seek a silver bullet - high win rates and perfectly timed entries, then they overleverage and move stops on the one "good trade" they are seeking to make.

Whilst doing this, they tend to overload the 6 monitors they have purchased to trade with a thousand indicators, which they don't really need.

The candlesticks tell a story, volume supports that story. When you learn any technique from Elliott Waves to Wyckoff, they all have a dependence on volume - even if the correlation is not apparent.

Look at this first image.

Price had moved down since the vertical line, the AD line also moved down - sell-off, in full swing. But then volume starts to shift before the AD line starts to increase.

Now, look at what happens next...

As we move forward and the new vertical line shows where volume spiked, the AD line starts to decrease as the price continues to rise.

This is enough of a story to start your analysis.

We then get a move with a lower high formed.

As this plays out, the sell-side volume rises, creating momentum for the short position.

Look a little closer and you will see, that the volume on the move up just before the drop was also decreasing. Making a divergence to price.

You might feel that the market is against you, or that the big players are single-handedly seeking your stops. But the truth is, the psychology in moves such as this one shown is where most retail traders either have greed that markets will only go up for ever or the fear that they are missing out on a market that only goes up forever.

It is that herd mentality that generates the liquidity for the professionals.

Losing 1% on a trade, is part of the process, risking 80%> on a single move will make you paper rich for about 10 minutes before the real losses set in.

This is where the psychology and the basic techniques such as risk management and understanding what candlesticks and volume bars are telling you, will make a world of difference to your results.

A/D line and volume are free on @TradingView and to be fair you don't need to overcomplicate it more than that!

Stay safe, have a great weekend all!!!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

GAMUDA CONT MARKING UP PHASEThis is a continuation from my prev post

**Refer to the link below

This is a play coming from the Stepping Stone (SS)

-SS is a term, in wcykoff methode , particularly describing a momentarily 'pause' in between, consecutive mark up phase.

Absoprtion detected from the on going SS

*Black arrow

with the possibility of Trigger Bar today, in the background of SpringBoard Schematic #2 *Purple arrow

-Position initiated as attached

PureWyckoff

SCGBHD WILL CONTINUE MARKING UPThis is just a continuation from my previous trading idea for SCGBHD

**Refer below

I was liquidated from the position yesterday

Now, looks like at the minimum, i was too early for this stock previously.

With the formation of Spring-Type Action ,

And the On-Going absoprtion especially supply from 28/5 (Black arrow)

I initiated my position as attached

PureWyckoff

MNHLDG GOING TO CONT MARK UPI maintained my previous thesis for MNHLDG

**please refer to my previous

Just need an addition, for the formation of new 'Local Spring' *black color word

i was knocked out on last position for this

market environment dragged MNHDLG despite with a positive surrpise earning

Based on Spring Setup,

looks like Test Of The Spring success at the moment

i initaited position as attached with tight cut loss

PureWyckoff

PEKAT CONT MARKING UPThis is a continuation of my prev thesis for Pekat

**Refer prev post

Since my previous position, Pekat has been always under my radar.

(This is a Stepping Stone Zone, Continuation from previous Mark Up Phase)

what caught my attention, the formation of BUEC consistenly unfolding in the background of reducing supply (red arrow)

With the formation : type #2 schematic of feather's weight (black line)

*No springboard here. difficult to see this kind of setup

although the entry point, a bit extended comparing to my average price entry, but it was still contained within the limit (not more than 2%)

Position intiated as attached

PureWyckoff

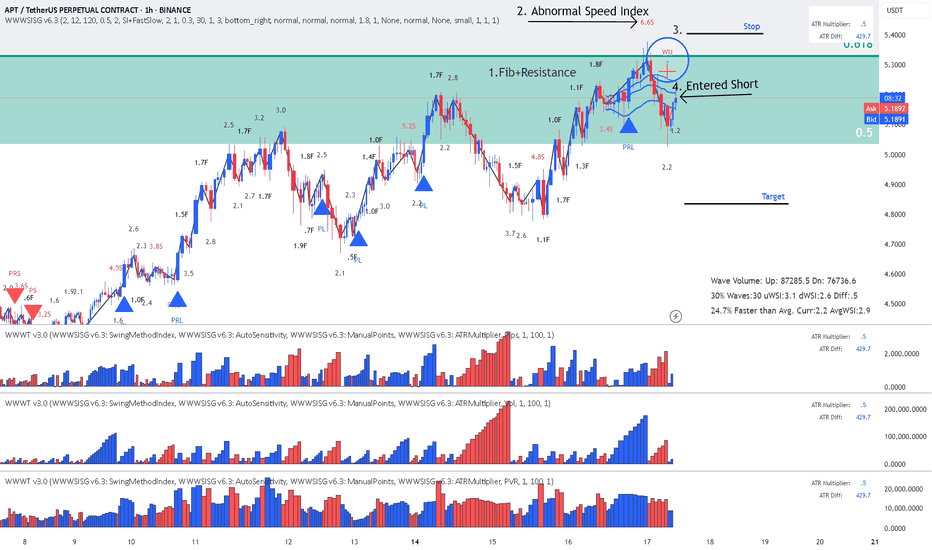

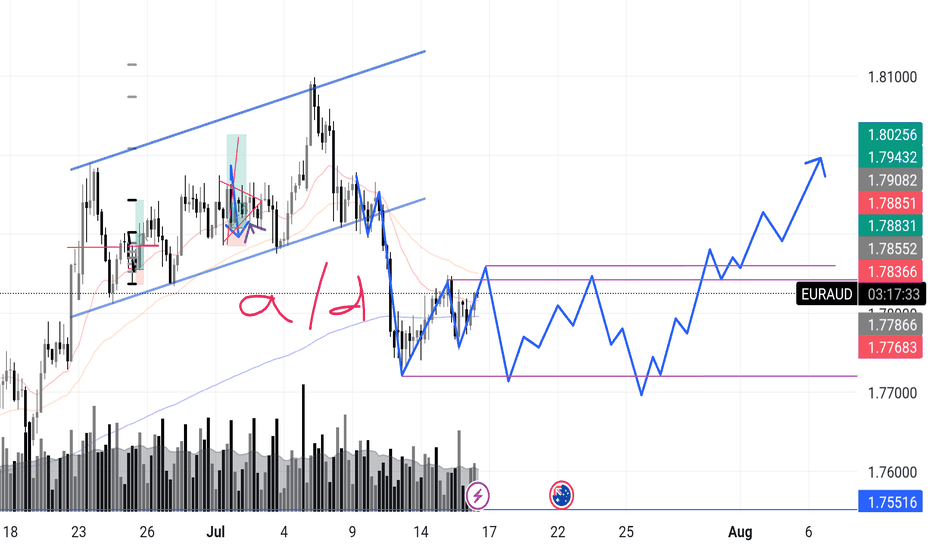

EURAUD – Incoming Upthrust? Accumulation or Distribution? Chart Context:

EURAUD recently completed a sharp markdown after a textbook rising channel break. What’s interesting now is that price has entered what looks like a potential box range between 1.7768 and 1.7885.

I'm anticipating a possible upthrust move into the 1.788x zone — and what follows will reveal the true intent.

Here’s the internal debate:

Are we looking at reaccumulation — smart money trapping shorts before driving higher in line with broader money flow?

Or is this a distribution — where the market builds a false sense of support before deeper downside?

🔍 What tips the scale for now is this:

>The overall money flow direction (via volume patterns + structure) has leaned bullish, so I’m favoring accumulation with a shakeout scenario.

Signs I’m watching:

✅ Absorption volume near the bottom of the range

✅ Higher lows inside the zone

✅ Fake breakout / upthrust into prior structure

❌ Failure to hold above 1.7855 could flip the bias short-term

📉 Expecting one more dip to test demand, followed by range tightening, and if buyers show up strong — the breakout can get explosive.

What’s your take?

Are we prepping for a markup or will this fakeout and roll over?

"I go long or short as close as I can to the danger point, and if the danger becomes real, I close out and take a small loss"

KJTS CONT MARKING UPThis is just a continuation of my prev thesis

**please refer to the link below

Turned out, KJTS formed Type #2 Schematic of Reaccmulation (Rising Bottom)

As it looks now, current price action seems to be confirming BUEC

**Buec is part of Phase D of Wyckoff Event

Noticed the formation of Feather's Weight (Yellow Line), coincided with BUEC

Bought a position today in view of Trigger Bar

Ep + SL as attached

PureWcykoff

BTC Massive SetupConsolidation for months between 91k and 106k

- Classic Wyckoff setup as an accumulation/distribution

- Price targets of: 121.878 (122k is the popular target) to the upside with 75,827 on the down

- Saylor today put out news to be raising another $2 billion to buy BTC. Either he is going to be able to hold the floor or get washed out

- Trade can be taken with confirmation of breakout on either side pretty easily as momentum will be so strong that being on the wrong side will most likely be an immediate stop out

KLCI BULLISH

This year, 2025, has been another challenging time in Bursa KLCI.

I have been on the sideline most of the time, since August 2024

We initiated our real positions on 14-17/3/2025, following the follow-through day ,

however some of the positions knocked out n some thriving (e.g ecomate, profit taken)

We then resumed our buying on 11/4/2025, as few stocks setting up with low risk

entry point.

Up until now, our portfolio has been growing up to total ROI of around 14-20%,

with the heavy use of Margin. (e.g scgbhd, mnhldg, gamuda, suncon, pekat)

Based on our current analysis of KLCI Index, we concluded that :

1/ Market probably has discounting all the possible worst case scenarios

-Bottoming process is ongoing to complete .

(A complete type 2 #Schematic Accmulation trading range? probably)

-Tradingview does not provide the Volume data for KLCI Index, need to refer other sources

2/ Market is going for the markup phase

3/ Market is still in the hard-ringgit environment

Our Bottom-Top approach, is purely based on the performance of individual stocks.

Meaning, the stock itself dictate our tactics.

And as always, my focus would be on the leaders, which granting me further leverage.

I need to keep reminding myself,

that in bull market, key is not to fight the market but to execute with precision n risk management.

And I need to keep reminding myself again,

that, it is ok to form an opinion.

But always be ready to adapt to the portals of possibility.

As.. I am in the 'responding business' . Not 'Predicting business'

BTC – Textbook Pullback. New ATHs. What’s Next?Back in mid-June, I published a BTC update calling for a local correction into HTF demand while most were screaming bear market and waiting for deeper breakdowns.

Price action played out exactly as forecasted.

BTC swept the $100k swing low, front-ran my first demand zone by $400, and launched into a powerful reversal — just like it did back in April, where it also front-ran the key HTF demand before rallying.

That move took us straight into new all-time highs (ATHs) — now trading comfortably around $118k.

🧠 What Happened?

✅ Liquidity sweep of the prior low

✅ Front-run demand zone (perfect HTF structure)

✅ Strong bullish reaction and higher high

✅ Confluence from USDT.D rejection at 5.25%

✅ Alts showing signs of strength as BTC rallies

The entire setup aligned perfectly across BTC, USDT.D, TOTAL, and OTHERS.D — all of which I’ve been tracking in tandem.

🔮 What Now?

With BTC now in price discovery, I expect continuation higher — but not without the possibility of a short-term pullback.

📉 A potential retest of the $108k zone isn’t off the table. This level aligns with:

- Prior breakout structure

- Range high retest

- Local demand before continuation

But even if we go straight up — I remain HTF bullish into the final phase of this cycle, supported by:

- USDT.D structure still bearish

- BTC.D showing signs of distribution

- ETH.D and OTHERS.D gaining momentum

- Altseason rotation already starting to pick up

🧭 The Macro Outlook

The 4-year cycle projection still points to a Q3 2025 top — likely between August late and September based on historical cycle timing, but this could deviate.

That gives us a window of 2–3 months for this final leg to unfold — and it’s already in motion.

Stay focused. Stick to your plan. Ride the trend, don’t chase it.

Let me know what levels you're watching next, and whether you think we get that $108k retest — or we go vertical from here.

1D:

3D:

4D:

1W:

1M:

— Marshy 🔥

ZTS Investment 1D Long Conservative Trend TradeConservative Trend Trade

+ long impulse

+ volumed expanding T2

+ support level

+ 1/2 correction

+ volumed Sp

+ weak test

+ first bullish bar close entry

Calculated affordable stop limit

1 to 2 R/R take profit

Monthly trend

"+ long impulse

+ ICE level

+ support level

+ 1/2 correction

+ volumed 2Sp

+ weak test?"

Yearly trend

"+ long impulse

- correction"

Wyckoff Structure Targets 92K–94K Retest Before Continuation!A rare and highly instructive market structure is currently unfolding, presenting a textbook case of Wyckoff pattern integration across multiple timeframes.

Over the past weeks, I’ve been tracking a series of smaller Wyckoff accumulation and distribution patterns nested within a larger overarching Wyckoff structure. Each of these smaller formations has now successfully completed its expected move — validating the precision of supply/demand mechanics and the theory’s predictive strength.

With these mini-cycles resolved, the spotlight now shifts to the final, dominant Wyckoff structure — a larger accumulation phase that encompasses the full breadth of recent market activity. According to the logic of Phase C transitioning into Phase D, price appears poised to revisit the key retest zone between 92,000 and 94,000, a critical area of prior resistance turned demand.

📉 Current Market Behavior:

📐 Multiple minor Wyckoff patterns (accumulations/distributions) have played out as expected, both upward and downward — lending high credibility to the current macro setup.

🧩 All formations are nested within a major accumulation structure, now in the final phase of testing support.

🔁 The expected move is a pullback toward the 92K–94K zone, before the markup phase resumes with higher conviction.

📊 Wyckoff Confidence Factors:

✅ All Phase C spring and upthrust actions respected

✅ Volume behavior aligns with Wyckoff principles (climactic action → absorption → trend continuation)

✅ Clean reaccumulation signs within current structure

✅ Institutional footprint visible through shakeouts and well-defined support/resistance rotations

💬 Observation / Call to Action:

This setup is a rare opportunity to witness multi-layered Wyckoff theory in motion, offering not only a high-probability trading setup but also an educational blueprint. I invite fellow traders and Wyckoff analysts to share their interpretations or challenge the current thesis.

➡️ Do you see the same structural roadmap?

Let’s discuss in the comments.