Wyckoffreaccumulation

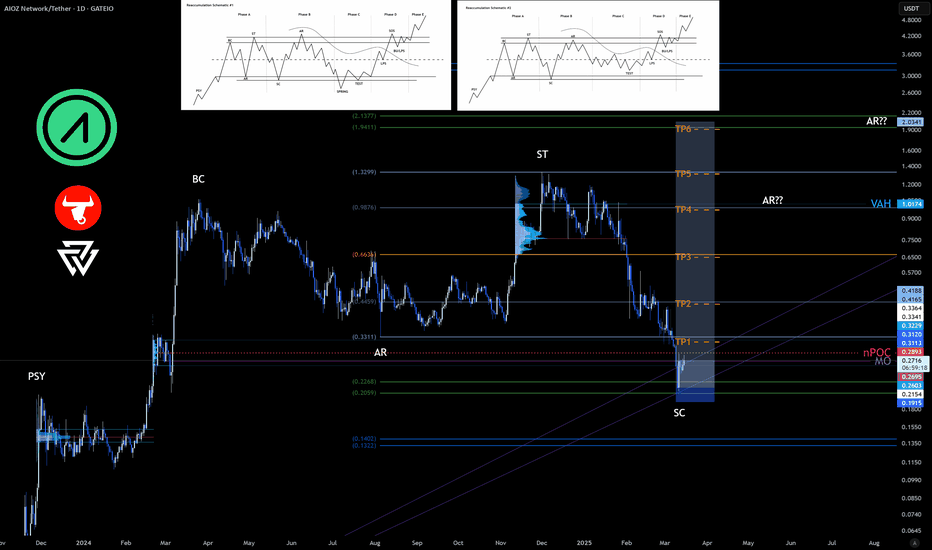

$AIOZ @AIOZNetwork Future Outlook - with Wider Range$AIOZ @AIOZNetwork ─ Wyckoff Re-Accumulation Schematic #1 or #2 scenarios.

Wider Trading Range: Range defined by Pivots from AR ─ ST

------------

------------

Note:

A long trade is the most bullish scenario possible.

As always, my play is:

✅ 50% out at TP1

✅ Move SL to entry

✅ Pre-set the rest of the position across remaining TPs

It's important to take profits along the way and not let a winning trade turn into a losing one.

Predicting Bitcoin's Cycle Using the Elliott Wave Theory, Part 3Hello Traders. With the new year upon us, I think sufficient time has passed for the charts to develop from our previous #Bitcoin analysis. Having accurately forecasted the macro trends for each pivot within a reasonable margin of error, I believe we're approaching another pivotal moment this year, aligning with our previous predictions. Please take this post with a grain of salt, and more importantly, please use it to add confluence to your personal theories.

In this post, we will be diving deeper into the Elliott Wave Theory by also integrating the Wyckoff Market Cycle Theory.

By combining the two theories, the chart below represents our current position within the final leg for what could be giving us signs of a possible reversal (again, within margin of error depending on how far wave 5 extends):

Wyckoff believed that markets move in cycles, which arguably has a direct correlation to the Elliott Wave 5-wave/3-wave cycle. Wyckoff introduced a four-stage market cycle , attributing it to the actions of institutional players who strategically influence price movements to capitalize on the behavior of uninformed traders. Simply put, the theory gives us a further understanding of 'cause and effect' within the markets.

In my view, the Wyckoff cycle also does a fantastic job of representing market psychology. And if intertwined correctly with the Elliott Wave Theory, price action tends to follow patterns in similar ways. The Elliott Wave Theory and Wyckoff Theory often overlap in their application and interpretation of market behavior, but they approach the market from different perspectives. Both theories aim to understand and predict market movements based on the behavior of market participants and price cycles, making them complementary in many ways.

Commonalities Between the Elliott Wave Theory and Wyckoff Theory:

Market Cycles

- Wyckoff Theory identifies a four-stage market cycle: Accumulation, Markup, Distribution, and Markdown. The Elliott Wave Theory also emphasizes cyclic behavior through a fractal structure of impulsive and corrective waves within broader market cycles.

- Both theories suggest that price movements are not random but follow identifiable patterns driven by market psychology.

Psychological Basis

- Wyckoff focuses on the interaction between "big players" (institutional traders) and "uninformed traders," highlighting group psychology and how institutional actions exploit public sentiment.

- Elliott Wave focuses on the crowd psychology behind price movements, suggesting that mass investor sentiment drives waves in predictable patterns.

**Both theories reflect the influence of human behavior and emotions on market prices.**

Application Across Timeframes

- Both theories are applicable across multiple timeframes, from intraday trading to long-term investments. This flexibility allows traders to use them in conjunction for deeper market analysis.

Identification of Trends and Reversals

- In Wyckoff Theory, phases like Markup and Markdown align with Elliott Wave's impulsive trends, while Accumulation and Distribution phases can correspond to corrective wave patterns.

- Both approaches aim to identify key turning points in the market, helping traders anticipate trends and reversals.

-----

The Four Stages of the Market Cycle According to Wyckoff

Accumulation Phase

This is a sideways range where institutional traders accumulate positions quietly to avoid driving prices higher. During this phase, the asset remains out of the public spotlight, and uninformed traders are largely unaware of the activity. On a price chart, the phase appears as a range-bound movement between areas of support and resistance.

Markup Phase

Following the accumulation phase, the market enters a classic uptrend. As prices rise, uninformed traders begin to notice and join in, further fueling the rally. Institutional players may take partial profits or continue holding for greater gains. Short sellers caught off guard are forced to cover their positions, adding additional buying pressure and driving prices to new highs.

Distribution Phase

After the uptrend loses momentum, the market transitions into a sideways range, marking the distribution phase. Institutional players use this period to offload their holdings, while uninformed traders, still expecting higher prices, continue to buy. Some institutional traders may also initiate short positions during this phase to benefit from the subsequent price decline. On the price chart, this phase appears as a reversal of the uptrend into a sideways range.

Markdown Phase

The markdown phase is characterized by a downtrend following the distribution phase. Institutional traders add to their short positions, while uninformed traders, recognizing the decline too late, sell in panic, creating further downward pressure. The market eventually reaches new lows as selling accelerates.

The Model of Group Psychology

After the markdown phase, the cycle often repeats, moving from accumulation to markup, distribution, and markdown again. The Wyckoff cycle offers a simplified perspective on market behavior, focusing on the psychological dynamics between two groups: institutional traders (the "big players") and uninformed traders (the "small players"). It highlights how the mistakes and emotional reactions of uninformed traders often benefit institutional players.

The Wyckoff cycle provides valuable insights into market behavior but is not without limitations:

Limitations of the Wyckoff Trading Cycle

Difficulty in Identifying Phases

Distinguishing between accumulation and distribution phases can be challenging. What appears to be an accumulation phase might turn into a distribution phase, with the market unexpectedly breaking lower.

Timing Challenges

Entering trades during accumulation or distribution phases is difficult due to the lack of clear stop-loss levels. Placing stops around support and resistance often leads to being trapped.

Complexity in Trading Trends

Trading the markup and markdown phases requires skill, as they are filled with complex price action patterns. Modern markets often experience frequent trend reversals, complicating trade execution.

Irregular Cycles

The market does not always follow the textbook sequence of accumulation, markup, distribution, and markdown. Variations such as accumulation followed by markdown or other combinations are possible.

Despite its limitations, the Wyckoff cycle remains a useful framework for understanding market behavior. It is best combined with other strategies, such as price action and market dynamics, to enhance its practical applicability. While modern markets may reduce the cycle's predictive reliability, it still serves as a powerful tool for traders who know how to apply it effectively.

Proper Application of the Elliott Wave Theory and Wyckoff Overlap (in Practice):

Trend Identification:

The Markup Phase in Wyckoff often aligns with Elliott's Impulse Waves (1, 3, and 5), while the Markdown Phase aligns with corrective waves or bearish impulses.

Sideways Markets:

Wyckoff’s Accumulation and Distribution phases correspond to Elliott’s Corrective Waves (A-B-C) or sideways consolidations (Flats and Triangles).

Volume Confirmation:

Traders can use Wyckoff’s volume analysis to validate Elliott Wave patterns, especially in identifying wave 3's (typically accompanied by high volume) and wave 5's (often showing declining volume).

Timing and Execution:

Wyckoff’s emphasis on identifying support/resistance levels and trading ranges can help refine the entry and exit points suggested by the Elliott Wave Theory.

Combining the Two:

Many traders find value in combining these theories:

- Use Wyckoff to identify key price levels and market phases (e.g., when accumulation or distribution is occurring).

- Use Elliott Wave to determine the broader trend structure and anticipate the next moves within those levels.

- By integrating Wyckoff’s volume-driven approach with Elliott’s fractal patterns, traders can gain a comprehensive view of the market and improve their ability to time trades effectively.

----

By integrating the concepts from both theories and the outlined schematics, we can now take a closer look at how Bitcoin is behaving through the lens of these frameworks.

As observed, Bitcoin appears to be nearing the completion of the potential 5th wave we've been discussing over the past year. In my view, a bear market (or at least a significant correction) may be approaching. While timing is uncertain due to the unlikely nature of extensions, we can use insights from both Wyckoff and Elliott Wave theories to gauge our current position. I believe we are likely in the Distribution phase, which aligns with the 5th wave.

The 5th wave can extend as much as it wants, but it won't change the overall conclusion of the cycle. We still anticipate the cyclical behavior that Bitcoin has shown in the past. While past price action isn't necessarily a predictor of future movements, it often follows a similar pattern.

Understanding Wyckoff Reaccumulation: A Comprehensive Guide## Introduction to Wyckoff Theory

Richard Wyckoff developed his methodology in the early 20th century, creating a systematic approach to market analysis that remains relevant today. His method is based on the principle that market movements are primarily driven by large institutional investors, whom he called "composite operators."

## The Concept of Reaccumulation

Reaccumulation is a sideways price pattern that occurs during an ongoing uptrend. Unlike basic accumulation, which occurs at market bottoms, reaccumulation represents a pause in an existing upward trend where institutional investors reload their positions before continuing higher.

### Key Characteristics of Reaccumulation

1. **Prior Uptrend**: Reaccumulation always follows a significant price advance

2. **Trading Range**: Price enters a sideways consolidation period

3. **Volume Analysis**: Typically shows declining volume during the range

4. **Price Structure**: Forms a series of higher lows and lower highs within the range

## Phases of Reaccumulation

### Phase A - Preliminary Support (PS)

- Marks the initial support level where the uptrend first pauses

- Often accompanied by increased volume

- Creates the trading range's support level

### Phase B - Secondary Test (ST)

- Price tests the trading range's support

- Usually shows decreasing volume

- May form several tests of support with springs or upthrusts

### Phase C - Last Point of Support (LPS)

- Final test of support before markup

- Often shows diminishing volume

- Can include a spring below support

### Phase D - Sign of Strength (SOS)

- Strong price move up on increased volume

- Breaks above local resistance levels

- Confirms the reaccumulation structure

### Phase E - Last Point of Supply (LPSY)

- Final pullback before sustained markup

- Generally shows lower volume than SOS

- Creates higher low compared to LPS

## Identifying Reaccumulation vs. Distribution

Understanding whether a trading range is reaccumulation or distribution is crucial for traders. Key differences include:

### Reaccumulation Characteristics:

- Forms after an uptrend

- Shows stronger support than resistance

- Springs more common than upthrusts

- Volume increases on upward price moves

### Distribution Characteristics:

- Forms after an uptrend

- Shows stronger resistance than support

- Upthrusts more common than springs

- Volume increases on downward price moves

## Volume Analysis in Reaccumulation

Volume plays a crucial role in confirming reaccumulation patterns:

- Decreasing volume during consolidation

- Higher volume on tests of support

- Strongest volume on breakouts above resistance

- Low volume on pullbacks after breakout

## Trading Reaccumulation Patterns

### Entry Strategies:

1. **Spring Entry**: Enter after a spring below support with volume confirmation

2. **SOS Entry**: Enter on the break above resistance with increasing volume

3. **LPSY Entry**: Enter on the last pullback before markup

### Stop Loss Placement:

- Below the spring low

- Below the last point of support

- Below the trading range support

### Target Setting:

- Measure the height of the trading range

- Project this distance from the breakout point

- Consider previous resistance levels

## Case Study Analysis

Examining the provided chart, we can identify several key Wyckoff elements:

- Initial trading range establishment after uptrend

- Multiple tests of support with declining volume

- Formation of higher lows within the range

- Strong volume on breakout moves

- Successful continuation of the uptrend

## Common Mistakes to Avoid

1. Misidentifying the larger trend context

2. Ignoring volume confirmation

3. Taking premature positions before pattern completion

4. Missing important support/resistance levels

5. Failing to consider market context

## Conclusion

Wyckoff reaccumulation patterns provide valuable insights into institutional behavior during uptrends. By understanding these patterns, traders can better position themselves to profit from continuation moves while managing risk effectively. Remember that successful trading requires patience, practice, and proper integration of multiple technical analysis tools alongside Wyckoff methodology.

Remember: All technical analysis methods, including Wyckoff theory, should be used as part of a comprehensive trading strategy that includes proper risk management and consideration of multiple timeframes and market contexts.

Does SOLANA will break ATH within the current November?!!Solana has broken a very strong resistance that not visit before since November 2021 , this is an strong sign along with high volume and ease of movement.

All time high has marked yellow , and if able to cross it and staying above , we may be able to see the marked targets.

Wyckoff ReAccumulation Schematic AnalysisPrevious chart got messed up on TV, so reposting with more detailed information..

This daily BTCUSDT chart illustrates a classic Wyckoff Accumulation Schematic, showcasing various phases and key levels critical to understanding the potential market movements.

Phases and Key Levels:

Preliminary Supply (PSY): This is the initial point where substantial selling begins, but the downtrend is still intact. Marked near 67,579 USDT.

Buying Climax (BC): This indicates the point where aggressive buying meets resistance, leading to the initial sell-off. Positioned at approximately 73,777 USDT.

Automatic Rally (AR): Following the selling climax, an automatic rally occurs due to the cessation of aggressive selling and some buying interest.

Secondary Test (ST): The price retests the BC level, confirming the resistance and further defining the trading range.

Phase B - Up-Thrust (UT): This phase is characterized by false breakouts above the resistance level, aimed at trapping buyers before the price reverses.

Creek : A metaphorical line representing minor resistance levels that the price needs to jump across to indicate strength.

Spring : This phase is where the price dips below the support level to shake out weak hands before reversing upwards. The spring is tested to confirm the bottom.

Test : After the spring, the price tests the support level to ensure that the bottom is established.

Last Point of Support (LPS): Following the test, the price action shows higher lows, indicating strong support and the beginning of the markup phase.

Jump Across The Creek: A significant movement where the price crosses above the minor resistance levels (creek), signaling the start of a new uptrend.

Sign of Strength (SOS): Demonstrates strong upward momentum with increased demand, validating the bullish trend.

Current Status:

BTCUSDT is showing a strong bullish movement after completing the spring and test phases. The price has recently jumped across the creek and is currently at the Last Point of Support (LPS). The expectation is for a Sign of Strength (SOS) as BTC continues its upward trajectory towards the upper resistance levels around 73,777 USDT.

Measured Move Strategy:

Using a measured move strategy on a higher time frame, we identify breakout targets based on the height of the accumulation range projected upwards.

Potential Breakout Targets:

Short-term target at 71,997.02 USDT (100% Fibonacci level).

Medium-term target at 90,000 USDT, considering the height of the accumulation range added to the breakout level.

Higher time frame target at 180,000 USDT, aligning with the measured move strategy and long-term bullish projections.

Summary:

This chart provides a comprehensive view of the Wyckoff Accumulation pattern, highlighting key phases and potential bullish outcomes for BTCUSDT. Traders should watch for sustained strength above the LPS and look for SOS confirmation to validate further upside. The higher time frame breakout targets using a measured move strategy suggest significant bullish potential, with a long-term target of 180,000 USDT.

BTC in a reaccumulation phase BTC is probably in a reaccumulation phase, which is confirmed by the volume for me. There was more trading at the local bottoms, which is why we assume accumulation. I also marked these accumulations with red ranges.

There are two options, one is the blue faster way, the other is the slower but more likely option (purple).

Wyckoff Reaccumulation PatterThe current patter which started development since the end of January, is almost complete. If it is true, BTC will pump probably to ATH within days.

On the chart you can see a blue path, there is still possibility of a shake-off strategy aimed to scare people.

Of course, DYOR ! A probability of invalidation of this idea is marked on chart by a stop loss placement.

This is not financial advice, you do your own research and you take all your own responsibility for any loses.

SOL 4HR REACCUMULATION Solana has almost left it's 4hr reaccumulation trading range.

The expectation now, if it is to continue bullish will be a break of structure to the upside,

a short continuation above the BC(buying climax) and AR(automatic rally) before a slow pullback to mitigate the AR area.

If solana achieves these steps we will expect an explosive move from the AR region on the lower timeframes and a large move on the 4hr to at least $144.

We must bear in mind that all of these steps need to occur and that there is no guarantee that the "composite man" will not initiate a sharp move back down into the trading range to shake out more retail.

We also must consider the monthly, weekly and daily possible targets and the supply regions on these timeframes. There are so many factors to consider because so many unmitigated areas and liquidity zones remain below the trading range.

We must be mindful that traps are how the big players take us out so wait for these traps to occur before we enter in line WITH these big players. To be too early or too late is going to be a loss. Watch the institutional candles and enter after the mitigation of these.

Don't chase the pump or you will be the liquidity to fuel their move higher. For now their intention is up once they break this structure upwards. As always, wait for their moves first, keep risk low and remember this is their business and they do not want you to participate. Taking all retail out to fuel their moves is how they play. Always backtest Wyckoff thoroughly before trading it.

ETH - Recurring Wyckoff "Jumping The Creek"CRYPTOCAP:ETH

This patten has unfolded consistently, multiple times, across ETH and many other ERC-20 pairs.

It's a simple Wyckoff accumulation/reaccumulation schematic, sweeping liquidity then double bottoming, followed by a flag at the DB neckline (w/volume) then breaking higher.

The best part of watching this unfold is from a macro bottom into the expansion phase clearly illustrates the lessening amount of resistance PA has to grind through and the angle of acceleration once it breaks.

This is where people get left behind, this phase illustrates the exponential nature of what this space is.

It's beautiful IMO 🥹

MATIC - Beautiful Wyckoff Reaccumulation Flag w/SpringCRYPTOCAP:MATIC

This Matic flag w/spring has played out many times before within this pair with the same volume profile after sweeping the highs and the lows.

What we love to see is reclaiming support, with declining volume from the highs then coiling into an ABC flag after sweeping the most recent highs prior to the spring is spectacular...

Number Go Up IMO

MATIC - Wyckoff Reaccumulation Schematic#MATIC

This looked like a simple flag initially, which is a great bullish continuation pattern, but since has evolved into a #Wyckoff Reaccumulation Schematic. The latter is actually a healthier option, and one which usually warrants less pullbacks vs the simple flag, that very often comes with sharp retraces.

The Volume is perfect, the OBV is perfect, the pattern is perfect, the timing during Trad Fi market close and end of year standard low volume is perfect...

Have you placed your bets?

MATIC - Probably Nothing...#MATIC

As noted before, the rocket fuel has now been loaded at the LPS (Last Point of Supply).

Now it's time, Number go up...

Gold Long term Wyckoff Re-Accumulation.Gold is currently inside a daily/4h bear channel correction to lower 1800 weekly/monthly demand levels.

Overall trend for gold is still bullish on the weekly/monthly, so a buy in the 1800s is a very good opportunity, which would mean forming a Wyckoff Phase C LPS for a potential rally to 2000 by December or next year.

Failing 1800s or holding 2000 level would mean gold is looking to correct much deeper for the range on the monthly, and potentially an area of 1550 would be a likely target to fill all orders from 1660.

Wyckoff Reaccumulation: Bitcoin's Market Phases 📊🚀🔄 Unveiling the Stages: Reaccumulation encompasses distinct phases – from a markdown phase marked by price corrections, to a trading range phase characterized by consolidation. Each phase reveals the intricate maneuvers of institutional players.

🚀 The Climactic Transition: The culmination of this pattern lies in the breakout phase – a moment where Bitcoin's price experiences a surge. This juncture signifies the conclusion of the reaccumulation process, often ushering in a substantial upward trend.

📈 Insights for Strategic Navigation: Profoundly understanding Wyckoff Reaccumulation offers strategic advantages. It enables the anticipation of potential trends and the identification of opportune entry and exit points.

💡 For Discerning Traders: Wyckoff Reaccumulation transcends conventional pattern analysis; it is a comprehensive methodology that grants traders an enhanced comprehension of market cycles. It's akin to deciphering the intricate narrative of Bitcoin's evolution.

In summary, the essence of Wyckoff Reaccumulation within the context of Bitcoin's trajectory is this: beneath the seemingly complex realm of price fluctuations lie decipherable patterns that serve as navigational beacons for informed trading decisions. Proficiency in this methodology empowers you to navigate the crypto landscape with heightened foresight.

Wyckoff Accumulation & DistributionThe Wyckoff Method, pioneered by Richard Wyckoff, a prominent figure in the early 1900s stock market, remains a powerful technical analysis-based trading approach. This article delves into the intricacies of the Wyckoff Accumulation and Distribution phases, fundamental to this method.

Who was Richard Wyckoff?

Richard Wyckoff, a highly successful American stock market investor of his time, stands as a pioneer in technical analysis. He transitioned from accumulating personal wealth to addressing what he perceived as market injustices, devising the Wyckoff Method to empower traders against market manipulation. Through various platforms like his own Magazine of Wall Street and Stock Market Technique, Wyckoff disseminated his insights.

The Wyckoff Method:

Wyckoff proposed that markets undergo distinct phases: Accumulation and Distribution. These phases guide traders on when to accumulate or distribute their positions, forming the core of the method.

The Wyckoff Accumulation Phase:

This phase materializes as a sideways, range-bound period subsequent to a prolonged downtrend. During this stage, significant players seek to establish positions without causing dramatic price drops. The accumulation phase comprises six integral components, each serving a vital role:

Preliminary Support (PS): As signs of the downtrend ending emerge, high volume and wider spreads surface. Buyers initiate interest, suggesting the end of selling dominance.

Selling Climax (SC): Characterized by intense selling pressure and panic selling, this phase represents a sharp price decline. Often, price closes well above the lowest point.

Automatic Rally (AR): Late sellers experience a reversal, driven by short sellers covering positions. This phase sets the upper range limit for subsequent consolidation.

Secondary Test (ST): Controlled retesting of lows with minimal volume increase indicates potential reversal.

Spring: A deceptive move resembling a downtrend resumption, designed to deceive and shakeout participants.

Last Point of Support, Back Up, and Sign of Strength (LPS, BU, SOS): Clear shifts in price action mark the transition into the range's start. A rapid, one-sided move signifies buyer control, often following the spring.

Wyckoff Distribution Cycle:

Following Accumulation, the Wyckoff Distribution phase unfolds. This cycle consists of five phases:

Preliminary Supply (PSY): Dominant traders initiate selling after a notable price rise, leading to increased trading volume.

Buying Climax (BC): Retail traders enter positions, driving further price increase. Dominant traders capitalize on premium prices to sell.

Automatic Reaction (AR): The end of the BC phase brings a price drop due to decreased buying. High supply causes a decline to the AR level.

Secondary Test (ST): Price retests the BC range, assessing supply and demand balance.

Sign of Weakness, Last Point of Supply, Upthrust After Distribution (SOW, LPSY, UTAD): SOW signals price weakness, LPSY tests support, and UTAD might occur near cycle's end, pushing the upper boundary.

Wyckoff Reaccumulation and Redistribution Cycles:

Reaccumulation occurs during uptrends, as dominant traders accumulate shares during price pauses. Redistribution, during downtrends, begins with sharp price rallies as short sellers capitalize.

Dominant traders strategically enter positions during these rallies.

Wyckoff's Foundational Concepts:

Law of Supply and Demand:

Prices rise when demand is high and supply is low. Prices fall when supply is high and demand is low. Balanced supply and demand lead to stable prices.

Law of Cause and Effect:

Price changes are driven by specific underlying factors. Price rises result from accumulation phases, while drops arise from distribution phases.

Law of Effort vs. Result:

Trading volume should match price movement. Deviations signal potential shifts in market sentiment or upcoming opportunities.

The Wyckoff Method is relevant to all markets, including cryptocurrencies like Bitcoin, where supply and demand play a crucial role in influencing price movements.

Nas100 OutlookNas is looking like it is re-accumulating atm but it could turn on a dime and all of a sudden become a distribution schematic so pivot areas are indicated in the annotations on the chart. Just watch out for what price action does in the next coming weeks along the key areas and levels as it will be pretty telling if we are going to start a meltdown soon or if we are going to have a last push to the top most quarter key level.

A H&S pattern looking formed atm. Could melt, could not, we will see.

CHZUSDT !! ARE WE GOING FOR A STRONG UPTREND ?!Ok Traders !

hope you enjoying your life !

first of all what do we want to see in phase c ?

-strong rejection:

point of fear : traders start to panic in downtrend and close their positions and open a

new short positions to take gains .

participation of buyers : for fundamental reason market makers and other whales see an

opportunities to buy in the deep .

-average volume :

if we have a reasonable volume in phase A & B at lows and highs volume does not matter

that much in our analysis

CHZ/USDT : we do not have requirement yet but we are getting close to one of the most important key level ! beside of fundamental analysis that key level is between chaos and live in the dream . im gonna keep in touch with you guys and give you updates