Silver H1 | Falling to an overlap supportSilver (XAG/USD) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 33.56 which is an overlap support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 33.15 which is a level that lies underneath an overlap support and the 50.0% Fibonacci retracement.

Take profit is at 34.18 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

XAG USD (Silver / US Dollar)

XAG/USD Trade Ideas: Navigating Key Resistance and Support ZonesSilver 's Next Move: Technical and Fundamental Insights for XAGUSD Traders 🚀📊

Technical Analysis 📊

The chart provided is a 4-hour chart of Silver (XAG/USD) with Fibonacci retracement levels applied. Here's a detailed technical breakdown:

Trend Analysis 📈:

The price has recently rebounded from a low near $32.90 and is now trading at $33.66.

The short-term trend appears bullish, as the price has made a higher low and is attempting to break higher.

Fibonacci Retracement Levels 🔢:

The Fibonacci retracement levels are drawn from the recent swing high to swing low.

The price has retraced to the 50% Fibonacci level ($33.35) and is now testing the 0% retracement level ($33.80), which acts as resistance.

The 61.8% retracement level ($33.24) and 78.6% retracement level ($33.09) are key support zones if the price pulls back.

Resistance and Support 🛑🛠️:

Resistance: The immediate resistance is at $33.80 (0% Fibonacci level). A break above this level could open the door to further upside, targeting $34.25 (50% Fibonacci extension).

Support: The first support is at $33.35 (50% Fibonacci level), followed by $33.24 (61.8% Fibonacci level).

Candlestick Patterns 🕯️:

The recent candles show indecision near the resistance level, indicating a potential pause or reversal.

If a strong bullish candle forms above $33.80, it would confirm a breakout.

Momentum 🚀:

The price is showing bullish momentum, but the resistance at $33.80 needs to be cleared for further upside.

Fundamental Analysis 🌍

Silver's Role as a Safe Haven 🛡️:

Silver often acts as a hedge against inflation and economic uncertainty. If there are concerns about global economic stability or inflationary pressures, silver demand could increase.

US Dollar Impact 💵:

Silver is inversely correlated with the US Dollar. If the USD weakens due to dovish Federal Reserve policies or poor economic data, silver prices could rise.

Industrial Demand ⚙️:

Silver has significant industrial applications, particularly in electronics and renewable energy. Any positive developments in these sectors could support silver prices.

Upcoming Economic Events 📅:

The chart shows upcoming economic events (likely US-related). If these events lead to USD weakness or increased market uncertainty, silver could benefit.

Trade Idea 💡

Scenario 1: Bullish Breakout 🚀

Entry: Buy above $33.80 (on a confirmed breakout).

Target: $34.25 (50% Fibonacci extension) and $34.50 (psychological level).

Stop Loss: Below $33.35 (50% Fibonacci level).

Scenario 2: Pullback and Rebound 🔄

Entry: Buy near $33.35 (50% Fibonacci level) or $33.24 (61.8% Fibonacci level) if the price pulls back.

Target: $33.80 (0% Fibonacci level) and $34.25.

Stop Loss: Below $33.00.

Scenario 3: Bearish Reversal 📉

Entry: Sell below $33.24 (61.8% Fibonacci level) if the price fails to hold support.

Target: $33.00 and $32.90.

Stop Loss: Above $33.50.

Conclusion ✅

The current setup favors a bullish bias 📈, but the resistance at $33.80 is critical. A breakout above this level could lead to significant upside, while a failure to break higher may result in a pullback to key support levels. Monitor price action closely around the Fibonacci levels and upcoming economic events for confirmation. ⚠️

Disclaimer ⚠️

This analysis is for informational purposes only and should not be considered financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research or consult with a licensed financial advisor before making any trading decisions.

Silver H1 | Falling to swing-low supportSilver (XAG/USD) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 32.85 which is a swing-low support.

Stop loss is at 32.54 which is a level that lies underneath an overlap support and the 61.8% Fibonacci retracement.

Take profit is at 33.56 which is a swing-high resistance that aligns close to the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Silver (XAG/USD) Double Top Reversal – Bearish Trading SetupThe provided 1-hour chart for Silver (XAG/USD) presents a well-structured bearish trade setup, highlighting key price action patterns, technical indicators, and confluence factors that suggest a potential downside move. Let's analyze the chart step by step to understand the logic behind this bearish trade setup.

1. Market Structure & Trend Overview

Silver (XAG/USD) has been in a short-term uptrend, as indicated by the ascending trendline. However, the trend now shows signs of exhaustion, with a clear shift in market behavior. The price action reveals the formation of a double top at a strong resistance level, coupled with a Change of Character (CHOCH), which signals a possible reversal.

A break below the trendline suggests that the bullish momentum is losing strength, and sellers are beginning to dominate the market. The combination of these elements makes this setup a high-probability short trade opportunity.

2. Key Technical Levels & Zones

A. Resistance Zone ($33.96 - $34.20) – The Selling Pressure Area

The chart marks a clear resistance zone, where price has struggled to break higher.

Two price rejections from this level indicate that sellers are actively defending this region.

This zone serves as an ideal stop-loss area for short trades, as a breakout above this level would invalidate the bearish setup.

B. Double Top Formation – Reversal Pattern

The price tested the resistance zone twice and failed to establish new highs, forming a double top structure.

A double top is a well-known bearish reversal pattern, indicating a shift from bullish to bearish momentum.

The second top (Top 2) aligns with a downward trendline, further confirming that sellers are stepping in at lower levels.

C. Support Level ($32.60 - $32.80) – Initial Reaction Zone

This area has previously acted as a demand zone where buyers stepped in.

If the price breaks below this support, it would confirm further downside movement towards the final target.

D. Trendline Breakdown – Loss of Bullish Momentum

The dotted trendline represents the previous bullish trend, supporting price action for several days.

A break below this trendline suggests a structural shift in market dynamics, meaning buyers are losing control.

The failure to reclaim the trendline increases the probability of a deeper move downward.

E. Target Level ($32.11 - $32.20) – The Bearish Objective

The projected target is based on the double top’s measured move, which suggests a price drop to at least $32.11.

This level also coincides with previous historical price action, making it a strong confluence zone for profit-taking.

3. Trading Strategy & Execution Plan

📌 Entry Point:

Aggressive Entry: Short position around $33.40 - $33.50, near the second top where price rejected the trendline.

Conservative Entry: Wait for a confirmed break and retest of the support level at $32.80 before entering short.

📌 Stop-Loss Placement:

The stop-loss should be placed above the resistance zone at $33.96.

This level ensures that the trade is invalidated if the price breaks out higher.

📌 Take-Profit Target:

Primary Target: $32.60, which is the first support level where price may temporarily react.

Final Target: $32.11, aligning with the double top breakdown target and historical support.

📌 Risk-Reward Ratio:

A minimum 1:2 risk-reward ratio, meaning for every 1% risked, there is a potential 2%+ gain.

This makes the trade favorable in terms of risk management.

4. Confluence Factors Supporting the Bearish Outlook

✅ Double Top Formation – A classic bearish reversal pattern.

✅ Lower Highs Formation – Indicates increasing selling pressure.

✅ Trendline Breakdown – A significant loss of bullish momentum.

✅ Resistance Zone Rejection – Strong seller presence.

✅ CHOCH (Change of Character) – Confirms a shift in market sentiment.

5. Risk Management & Alternative Scenario

📌 What If Price Moves Against the Trade?

If the price breaks above $33.96, the bearish outlook becomes invalid, and a potential bullish continuation could follow. In this case:

Stop-loss is triggered, and the setup is considered invalid.

Traders should then wait for a new setup before re-entering the market.

📌 Market Conditions to Monitor:

Volatility: Ensure there is enough momentum in the market before entering.

Volume Confirmation: A break below support should have strong volume.

News Events: Watch out for fundamental catalysts, such as US Dollar strength, economic data, and geopolitical events, which could influence Silver’s price movement.

6. Final Thoughts & Summary

This chart setup provides a clear bearish trade opportunity based on technical analysis. The combination of double top formation, resistance rejection, trendline breakdown, and lower highs strongly supports the idea of further downside movement.

💡 Key Takeaways:

Bearish bias is valid as long as price stays below $33.96.

Target is set at $32.11, with an intermediate support at $32.60.

Risk-to-reward is favorable, making it an ideal short trade setup.

If the market follows this expected scenario, this trade has the potential to yield significant profit while maintaining disciplined risk management. However, always stay alert to market conditions and adjust strategies accordingly.

Potential bullish rise?The Silver (XAG/USD) has bounced off the pivot and could rise to the 1st resistance which aligns with the 61.8% Fibonacci retracement.

Pivot: 32.67

1st Support: 31.91

1st Resistance: 33.58

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📊 Overview of the Chart

This 4-hour chart of Silver (XAG/USD) provides a classic example of a Rising Wedge Breakdown, a bearish reversal pattern. The price initially followed a strong uptrend, forming a series of higher highs and higher lows, but failed to sustain momentum at the key resistance zone (~$34.00 - $34.50). This led to a breakout to the downside, which has now confirmed a shift in market sentiment from bullish to bearish.

This analysis will break down each key level, the technical indicators supporting this trade setup, and how traders can approach it effectively.

🛠️ Breakdown of the Chart Components

1️⃣ Rising Wedge Formation (Bearish Pattern Identified)

The price action created a Rising Wedge, which is a bearish pattern characterized by an uptrend where the higher highs and higher lows start converging into a narrowing range.

This shows that while buyers were pushing prices higher, their strength was gradually fading.

The breakdown of this structure signaled a loss of bullish momentum, leading to a shift in trend.

2️⃣ Resistance Level & Sell Zone Identified

The resistance level at $34.00 - $34.50 has acted as a supply zone where sellers stepped in, preventing further upside.

A bearish rejection at this zone confirms that sellers are still dominant.

3️⃣ Retest of the Broken Support (Key Confirmation)

After the breakout from the wedge, the price made a retest of the broken trendline, a classic move before further downside.

Retesting this area confirms that it is now acting as resistance rather than support, further strengthening the bearish case.

4️⃣ Trendline Breakout – Shift in Market Structure

The dashed trendline was previously supportive, but now that the price has broken below it, it has turned into a resistance level.

This shift in market structure is a strong bearish signal.

5️⃣ Key Support Levels & Target Projection

The next major support level is at $32.00, a level where price previously found demand.

The ultimate target price is around $31.18, which aligns with historical support and Fibonacci retracement levels.

📉 Trading Strategy – How to Trade This Setup?

✅ Entry Point (Short/Sell Setup)

A good shorting opportunity arises if the price retests the resistance at $33.50 - $34.00 and shows bearish confirmation (like a rejection candlestick or a bearish engulfing pattern).

📍 Stop Loss (SL) Placement

SL should be above $34.20 to avoid getting stopped out by potential fakeouts.

🎯 Take Profit (TP) Levels

TP1: $32.00 (First support level)

TP2: $31.18 (Final bearish target)

📊 Risk-Reward Ratio

Entry at $33.50 - $34.00 with SL at $34.20 and TP at $31.18 provides an excellent risk-to-reward ratio (~1:4).

📌 Market Sentiment & Conclusion

🔴 Bearish signals are dominant, suggesting further downside potential.

📉 A strong bearish move is expected if the price fails to reclaim $34.00.

🎯 Targeting $31.18 in the upcoming sessions.

📢 Final Advice: Traders should watch for confirmation before entering trades. A successful retest and rejection at $33.50 - $34.00 will be a high-probability short setup. 🚀

🔥 Follow price action and risk management principles for a successful trade! 🔥

GOLD H1 Update: Pullback in Progress BUY DIPS TP 3 100 USD🏆 Gold Market Update (March 24th 2025)

📊 Technical Outlook update

🔸Bullish OUTLOOK

🔸Broke out and set new ATH

🔸Strong UPTREND: Sequence of Higher Lows

🔸Recommend to BUY DIPS 2950 USD

🔸Price Target BULLS: 3075 USD - 3100 USD

📈 Market Performance & Price Action

🚀 Gold Hits All-Time High – Reached $3,057.21/oz this week

📊 Driven by: Geopolitical tensions + economic uncertainty

🏦 Federal Reserve Impact

🛑 Fed Keeps Interest Rates Steady at 4.25%–4.50%

🔮 Signals 2 rate cuts likely in 2025 due to slowing growth

📉 Lower rate outlook supports bullish gold sentiment

💹 Gold Investment Trends

📈 Gold ETFs Outperform Physical Gold

GDX (Gold Miners ETF) ↑ 32%

GLD (SPDR Gold Shares) ↑ 15.5%

📊 Investors leaning toward mining stocks & ETF exposure for higher returns

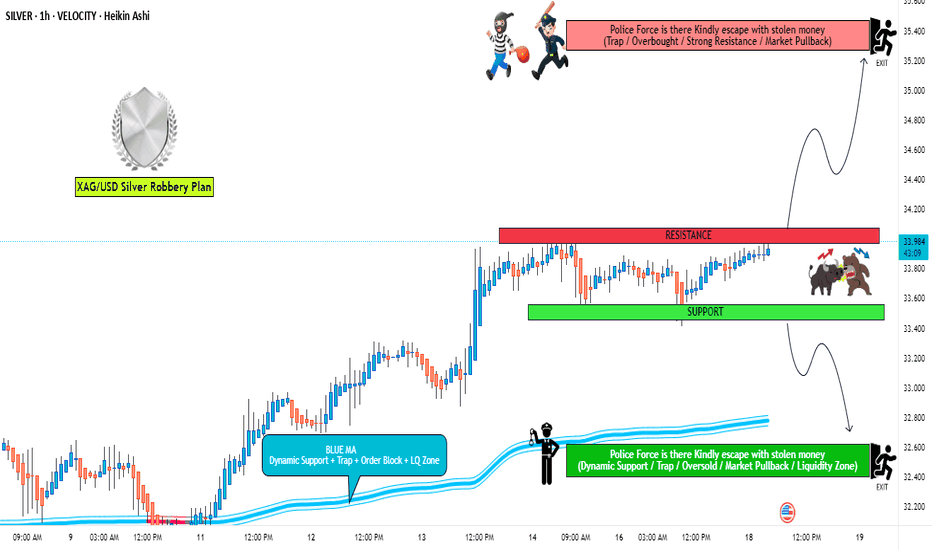

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "Gold vs U.S Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 34.200

🏁Sell Entry below 33.400

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 33.400 for Bullish Trade

🚩Thief SL placed at 34.000 for Bearish Trade

Using the 30mins period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 35.400 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 32.800 (or) Escape Before the Target

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Seasonal factors, Sentimental Outlook, Positioning and future trend.....👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Bullish bounce?The Silver (XAG/USD) is falling towards the pivot which has been identified as a pullback support and could bounce to the 1st resistance which acts as a pullback resistance.

Pivot: 32.70

1st Support: 31.91

1st Resistance: 34.46

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

GOLD SILVER PLATINUM COPPER: Metals Are Bullish! Wait For Buys!This is a FUTURES market outlook for the Metals, for the week of March 24-28th.

In this video, we will analyze the following markets:

GC | Gold

SIL | Silver

PL | Platinum

HG | Copper

The USD continues its bearish ways this upcoming weak. It's currency counterparts will likely see some upside this week. Especially the JPY.

Patience and an ear to the news will be the best way to approach the equity markets. The same would also apply to news sensitive commodity markets like US OIL, Gold and Silver.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAGUSD - Hunting for Bullish Entries on Smaller TFThe Silver/USD 4-hour chart displays a significant retracement from recent highs around $3,420, with price currently rebounding near the $3,300 level. This correction has brought price to test both the ascending trendline and the horizontal support at $3,275 (marked by the red line), creating a potential buying opportunity. Given the overall uptrend structure and the recent bounce from this dual support zone, we need to prepare for finding buy setups on smaller timeframes. Traders should shift to lower timeframe charts (15-minute, 30-minute, or 1-hour) to identify precise entry signals. The price action suggests a potential retest of the upper blue reaction zone after completing the current zigzag correction, as indicated by the directional arrow on the chart. Monitoring these smaller timeframes will help capture optimal entry points with tighter stop-losses while maintaining the broader bullish bias shown on this 4-hour chart.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SILVER: Bullish Forecast & Outlook

Remember that we can not, and should not impose our will on the market but rather listen to its whims and make profit by following it. And thus shall be done today on the SILVER pair which is likely to be pushed up by the bulls so we will buy!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📌 Overview

This 1-hour chart of Silver (XAG/USD) presents a textbook Rising Wedge pattern, which is known as a bearish reversal signal. The price was in a strong uptrend but started showing signs of buyer exhaustion, leading to a breakdown from the wedge formation.

The chart clearly identifies:

✅ A Rising Wedge formation

✅ Resistance Level where price faced multiple rejections

✅ Breakdown Confirmation and shift in trend direction

✅ Projected Target & Stop Loss Zones

This setup suggests a strong potential for further downside movement in silver prices. Now, let’s break it down step by step like a professional trader.

🔹 Key Technical Analysis Breakdown

1️⃣ Rising Wedge Pattern – The Bearish Setup

The Rising Wedge is a bearish reversal pattern that forms when price action moves higher within two converging trendlines. The slope of the lower trendline is steeper than the upper trendline, meaning that buyers are getting weaker.

This pattern suggests that even though the price is rising, bullish momentum is fading.

Once the price breaks below the wedge, it confirms a bearish trend.

🔸 Characteristics of this Wedge:

📌 Multiple Higher Highs & Higher Lows – But with decreasing strength

📌 Narrowing Price Action – Indicates weaker buying power

📌 Breakdown Below Support Line – Confirms the bearish move

2️⃣ Resistance Level – Key Price Rejection Zone

The price tested the Resistance Level multiple times before breaking down. This area is where sellers overpowered buyers, preventing further upside movement.

The resistance zone was a liquidity area, meaning large institutional traders likely placed sell orders here.

The price attempted to push higher but failed, showing that demand was exhausted.

Once rejection happened, selling pressure increased, and the breakdown followed.

3️⃣ Breakdown Confirmation – Bearish Momentum Kicks In

After the wedge broke down, the price started moving in a structured downtrend, forming lower highs and lower lows. This confirms that the breakdown was valid and that the trend has shifted.

🔹 Signs of Breakdown Strength:

✅ Strong Bearish Candles – Indicating aggressive selling

✅ No Immediate Recovery – Suggests sellers are in control

✅ Lower Highs Forming – Bearish trend structure confirmed

4️⃣ Risk Management – Stop Loss & Target Zones

A well-planned trade must include a Stop Loss and a Target to manage risk effectively.

📌 Stop Loss Placement (33.95)

Placing a Stop Loss just above the resistance level protects against false breakouts.

If the price goes back above 33.95, it would invalidate the bearish setup.

📌 Profit Target (31.96)

The target is based on the measured move projection, meaning the expected price drop is equal to the height of the wedge at its widest point.

If the price reaches 31.96, traders can lock in profits.

📌 Risk-Reward Ratio (RRR)

The setup offers a favorable risk-to-reward ratio, making it a high-probability trade.

5️⃣ Expected Price Movement – Bearish Outlook

From here, we can expect the following price movement:

📉 Scenario 1: Continuation of Downtrend (High Probability)

The price will likely form lower highs and lower lows on its way to 31.96.

Each small rally should be met with selling pressure.

📈 Scenario 2: False Breakdown (Low Probability but Possible)

If the price moves back above 33.95, the wedge breakdown will be invalid.

This could lead to a bullish reversal instead.

6️⃣ Final Thoughts – How to Trade This Setup?

This Rising Wedge Breakdown provides an excellent short-selling opportunity. Here’s how a professional trader would approach it:

✅ 🔹 Entry Strategy:

Short after a retest of the broken wedge support

Confirmation of lower highs ensures trend continuation

✅ 🔹 Risk Management:

Place Stop Loss above 33.95

Take profits around 31.96

✅ 🔹 Confirmation Signals to Watch:

Lower highs forming after breakdown

Increased selling volume on bearish candles

Price respecting the downtrend structure

🔔 Conclusion – Bearish Bias Confirmed

🔻 Trend Shift: The breakdown signals a potential trend reversal in silver.

🔻 Bearish Targets: The price is expected to fall toward 31.96 in the coming sessions.

🔻 High-Probability Trade: Strong technical reasons support a bearish outlook.

🚨 Watch for further confirmations and manage risk effectively! 📊💰

Silver The Week Ahead 24th March '25Silver bullish & overbought, the key trading level is at 3194

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SILVER Bullish Bias! Buy!

Hello,Traders!

SILVER went down and

Retested a horizontal

Support of 32.60$ from

Where we are seeing a

Bullish rebound so as we

Are bullish biased and we

Will be expecting a further

Bullish move up

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAG/USD (Silver) – 1H Technical Analysis & Trade SetupThis analysis presents a high-probability bullish trade setup based on key price action principles, market structure, and technical indicators. The chart illustrates a potential reversal from a support zone, a descending channel breakout, and an overall shift in trend dynamics.

1. Market Structure & Key Price Levels

Before placing any trade, it's essential to analyze the bigger picture, including support and resistance levels, trend structure, and liquidity zones. Let's break down the key areas:

A. Resistance Area (Supply Zone) – $34.20 to $34.60

This horizontal resistance zone has historically acted as a selling pressure area where price faced rejection.

It represents a profit-taking zone for bulls and a possible reversal point for bears.

If price successfully breaks and closes above this resistance, it could signal further upside potential.

B. Support Level (Demand Zone) – $32.90 to $33.10

The price has consistently bounced from this region, indicating strong buying interest.

This level has acted as a demand zone, where institutions or large traders are likely accumulating positions.

A strong bullish reaction from this zone strengthens the reversal scenario.

C. Change of Character (CHoCH) – Key Structural Shift

A Change of Character (CHoCH) is marked on the chart, indicating a potential shift from a bearish to a bullish trend.

This is one of the most reliable signals when transitioning from a downtrend to an uptrend.

2. Chart Pattern & Price Action Analysis

A. Descending Channel Formation (Bullish Reversal Pattern)

The market has been forming a descending channel, which is a corrective pattern rather than a continuation pattern.

This structure consists of lower highs and lower lows, indicating short-term selling pressure.

However, when such a pattern forms near strong support, it often precedes a breakout and trend reversal.

A confirmed break above the channel's upper trendline will serve as a bullish breakout signal.

B. Liquidity Grab & Stop Hunt Consideration

Many retail traders place stop-loss orders below the support zone, making it an area of liquidity accumulation.

The market may attempt to sweep these stops before moving up, which aligns with institutional trading behavior.

If price momentarily dips below the support and then quickly reverses with strong bullish momentum, it confirms a stop hunt and a possible reversal setup.

3. Trading Strategy & Setup

To maximize profits while managing risk, we need a well-structured entry, target, and stop-loss strategy.

📌 Entry Strategy

Aggressive Entry:

Enter a buy position within the support zone ($33.00 - $33.10) if bullish price action (e.g., bullish engulfing candle) confirms buying pressure.

Conservative Entry:

Wait for a clear breakout from the descending channel’s upper trendline, then buy on a retest.

This reduces the risk of a fakeout and provides higher confirmation.

🎯 Target Levels (Take Profit Zones)

First Target (TP1) – $34.26

This is a key resistance level where price previously reversed.

Partial profit-taking is recommended here to secure gains.

Second Target (TP2) – $34.60

If momentum continues, price could reach this extended target.

Strong breakout volume would support this move.

🛑 Stop Loss (SL) Placement

Stop-loss should be set below the support zone ($32.45).

This ensures adequate risk management and avoids premature stop-outs.

If price breaks below this level with strong selling volume, the bullish setup is invalidated.

4. Risk Management & Trade Considerations

📌 Risk-to-Reward Ratio (RRR):

The trade setup offers an RRR of at least 1:3, making it a high-probability trade.

📌 Possible Fakeouts & Confirmation Signals:

If price breaks above the descending channel but fails to hold above support, it's a sign of a fake breakout.

Watch for strong bullish volume and clear break of previous lower highs before entering long.

📌 Fundamental Factors:

Keep an eye on economic reports, Federal Reserve speeches, and USD strength, as they heavily influence Silver prices.

5. Conclusion – High-Probability Bullish Setup

Descending channel breakout, strong support level, and CHoCH indicate a potential bullish reversal.

If buyers successfully defend the support zone, price is likely to target $34.26 – $34.60.

Risk management is crucial – waiting for confirmation reduces chances of a failed trade.

🚀 Watch for bullish confirmation before entering!

Silver Steadies Near $33.20 After PullbackSilver hovered near $33.20 on Friday morning after two consecutive sessions of decline. The recent upward momentum, initially fueled by China’s stimulus measures, has temporarily stalled. Nevertheless, the potential for further gains remains intact amid persistent uncertainty surrounding former President Trump’s tariff policies and escalating geopolitical risks. In addition, the Federal Reserve’s soft approach to interest rates, even if temporary, continues to support interest in non-yielding assets like silver.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Gold Nears $3,030 on Fed Cut HopesGold hovered near $3,030 on Friday, close to record highs and heading for a third straight weekly gain. The rally is driven by dovish Fed signals and strong safe-haven demand. The Fed reaffirmed plans for two rate cuts in 2025 amid rising economic uncertainty, while Powell downplayed Trump’s proposed tariffs as temporarily inflationary but saw no urgency to cut rates.

Geopolitical tensions also supported gold, with Israel escalating operations in Gaza, Hamas striking Tel Aviv and the U.S. continuing airstrikes in Yemen. Markets are also watching the April 2 deadline for Trump’s reciprocal tariffs, fueling trade concerns. Gold is up over 15% year-to-date.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Silver Approaching Critical 32.95 Support LevelSilver has broken below the 33.50 support and is retreating quickly. The main support lies around the 32.95 area, where both the uptrend line and the 38.2% Fibonacci retracement level converge. This zone could potentially offer a buying opportunity, provided the support holds.

However, if Silver breaks below 32.95 and retests it from underneath, it could also present a selling opportunity. In both scenarios, a high risk/reward trade setup with well-placed stops may form.

Caution is advised, as Silver is known for sudden price spikes, especially around key support and resistance levels.

WILL SILVER DIP BELOW 32.6 BEFORE ITS RALLY TO TEST RECENT HIGH?Silver Price Movement...

N.B!

- XAGUSD price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#silver

#xagusd

SILVER LONG SIGNAL|

✅SILVER has retested a key

Support level of 33.39$

After a bearish correction

While trading in an uptrend

So we can enter a long trade

With the Take Profit of 33.89$

And the Stop Loss of 33.08$

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.