XAGUSD Trade Plan: 1D Support, Liquidity Grab, & Bullish Setup!Silver (XAGUSD) is currently exhibiting signs of being overextended, as evidenced by its recent price action on the daily and 4-hour timeframes. The metal has traded into a critical support zone, marked by previous lows on the daily chart. This zone represents a significant area of interest, as it has historically acted as a key level for buyers to step in. However, the current price action has dipped below these lows, eating into sell-side liquidity in the form of stop-loss orders placed beneath this level. This liquidity grab is a classic move often seen in markets before a potential reversal.

On the 15-minute timeframe, the price is consolidating within a range, suggesting a possible accumulation. A break above this range, accompanied by a bullish market structure shift, could signal the beginning of a reversal and provide a compelling buy opportunity. This aligns with the idea of a "spring" in Wyckoff theory, where price manipulates liquidity before reversing direction.

Traders should remain patient and wait for confirmation of a bullish breakout on the lower timeframe before entering long positions. Key factors to monitor include strong bullish momentum, a clear break of the range, and the formation of higher highs and higher lows. Until these conditions are met, caution is advised, as the current downtrend could persist. 📉➡️📈

Key Levels to Watch:

Support Zone: Previous daily lows (now acting as a liquidity zone).

Resistance Zone: The upper boundary of the current 15-minute range.

Trading Plan:

Wait for a break of the 15-minute range to the upside. 🚀

Look for a bullish market structure shift (higher highs and higher lows). 📊

Enter long positions with a tight stop-loss below the range low. 🛡️

Target key resistance levels on the 4-hour and daily timeframes for potential take-profit zones. 🎯

This analysis highlights the importance of patience and discipline in trading. While the current setup is promising, confirmation is key to avoid premature entries. As always, this is not financial advice, and traders should conduct their own due diligence before making any decisions. ⚠️

Xagusdanalysis

Silver Tested Key Resistance LevelFenzoFx—Silver tested the $30.81 resistance level today. If this holds, the downtrend may resume, targeting $28.75 and possibly $27.73 if selling pressure persists.

A bullish reversal could occur if XAG/USD exceeds and stabilizes above $30.81.

>>> Trade XAG/USD at FenzoFx Decentralized Forex Broker.

Silver’s Deep Retrace: Long Setup with Bullish Potential I’ve entered a long trade on Silver (XAG/USD) after observing a deep retrace to the 0.7 Fibonacci level on the daily timeframe. The entry at $28.96 is positioned strategically based on historical support and the current technical setup.

The stop loss is set at $26.54 to mitigate risk, while the take profit target is $36.00, aligning with a potential bullish continuation. In the bearish scenario, a break below $27.50 will prompt a reassessment and tighter risk management. Conversely, on the bullish side, breaking above $32.50 will strengthen the case for holding towards the TP.

Silver’s price action showcases its potential for a significant bounce back, supported by current geopolitical and macroeconomic conditions.

Fundamentals:

1. Federal Reserve’s Hawkish Stance:

The Fed’s updated projections for rate cuts in 2025 have pressured silver prices, as a stronger dollar and rising Treasury yields (above 4.5%) diminish the appeal of non-yielding assets. However, easing inflation in the long term could rejuvenate demand for precious metals.

2. Geopolitical Tensions:

Although silver traditionally benefits from uncertainty, recent macroeconomic headwinds, such as concerns about tariffs under the new Trump administration and sluggish global economic recovery, have overshadowed its safe-haven status.

3. Industrial Outlook:

Challenges in the industrial demand for silver, particularly from China’s solar panel production slowdown, add pressure. However, as inflation stabilizes and geopolitical risks unfold, silver could regain its industrial and safe-haven allure.

Technicals:

• Entry: $28.96

• Stop Loss: $26.54

• Take Profit: $36.00

• Key Levels:

• Bearish Scenario: Manage position below $27.50.

• Bullish Case: Strength above $32.50 confirms upward momentum.

This setup leverages a confluence of technical retracement, macroeconomic factors, and the potential for a trend reversal. Stay sharp and pay yourself as the market unfolds.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Silver is in the bullish trend after testing supportHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

XAGUSD Weekly Analysis – Double Top Formation & Breakdown🧱 Chart Pattern Identified: Double Top Formation

The chart displays a classic Double Top pattern, a bearish reversal structure typically found at the end of an uptrend. This pattern forms when price reaches a resistance level twice, fails to break above it both times, and eventually breaks the neckline/support level, confirming a shift in market sentiment.

🔍 Key Components of the Chart:

1. Resistance Level (Tops) – ~$34.25

The market formed two significant peaks around the same level — labeled Top 1 and Top 2.

This level has proven strong resistance, as price was rejected both times after testing this zone.

This zone is marked with a light orange rectangle and a horizontal blue line labeled "Resistance Level".

2. Support Level (Neckline) – ~$28.80

This level served as the neckline of the Double Top.

After the second top, the price sharply declined and is currently approaching this key support zone, highlighted again in light orange.

A clean break and close below this zone on the weekly timeframe will be a strong confirmation of the bearish reversal.

3. Trendline Break – Bearish Shift in Momentum

A rising black dashed trendline supported the prior uptrend.

Price action has now broken below this trendline with strong bearish momentum, indicating that buyers have lost control.

This trendline break adds confluence to the bearish setup, supporting the validity of the pattern.

4. Bearish Projection Target – ~$22.47

The target is projected using the height of the Double Top pattern.

Measured from the resistance level ($34.25) to the support ($28.80), the vertical distance is ~5.45 USD.

Subtracting this from the neckline gives us a projected target:

28.80 - 5.45 = ~23.35 (rounded down to ~22.47 for technical cluster support).

This target area is marked with a blue arrow and labeled "Target" near the horizontal support at $22.47.

5. Stop Loss – ~$34.25

The logical invalidation point is placed just above the resistance zone and the second top.

A move above this level would invalidate the double top pattern, signaling that bulls have regained control.

📈 Price Action and Candlestick Behavior

The strong bearish weekly candle that broke below the trendline shows a decisive shift in sentiment.

The candle's large body and long range confirm institutional selling interest.

Volume (if shown) would likely support the move, but even price structure alone is highly telling here.

🎯 Trading Strategy & Setup

Component Details

Entry On a confirmed break and retest of $28.80 support (neckline)

Stop Loss Above $34.25 (Top 2)

Target $22.47

Risk/Reward ~1:2 or better

Timeframe Weekly (Swing Trade)

Bias Bearish

🧠 Concluding Notes

This chart provides a high-probability bearish setup rooted in classical charting principles. The Double Top is one of the most reliable reversal patterns, especially when:

Formed after a prolonged uptrend (as seen here),

Confirmed with a trendline break,

Followed by strong bearish momentum toward the neckline.

Traders should monitor the support zone around $28.80 closely for a potential breakdown. If confirmed, the target near $22.47 becomes a realistic medium-term objective.

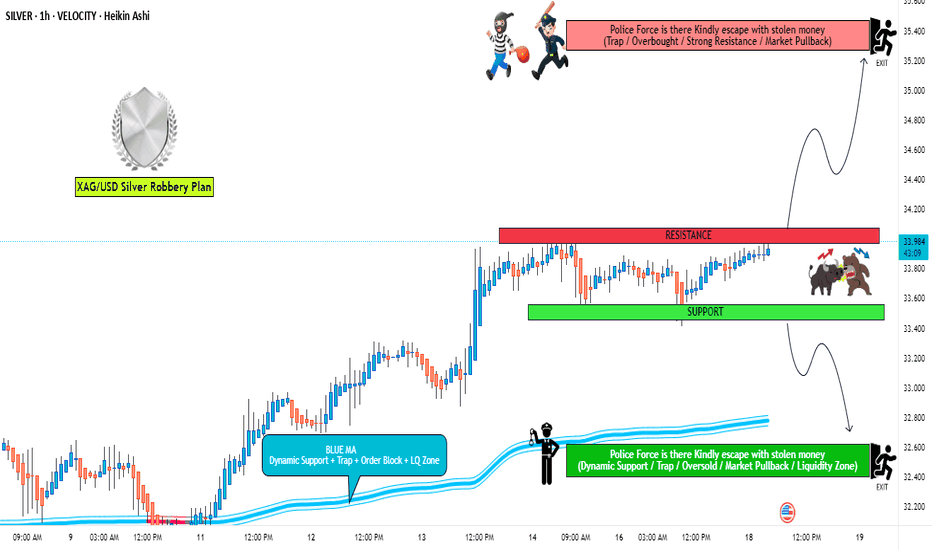

XAG/USD "The Silver" Metal Market Heist Plan(Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (33.500) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (34.200) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 32.800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAG/USD "The Silver" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Detailed Analysis of Silver (XAG/USD) – Double Top BreakoutThe chart represents a technical analysis of Silver (XAG/USD) on the daily timeframe (1D). A Double Top pattern, one of the most reliable bearish reversal formations, is developing. This signals a potential downtrend, with key price levels and trendlines confirming weakness in bullish momentum. Below is a full breakdown of the pattern, price action, and trading setup.

1️⃣ Pattern Formation: Double Top – Bearish Reversal

A Double Top pattern occurs when the price reaches a resistance level twice, failing to break higher. It indicates a shift from a bullish trend to a bearish one.

🔹 Characteristics of the Double Top in This Chart:

First Peak (Top 1 - Resistance at ~$34.57):

The price made a strong move upward, reaching a high near $34.57.

Selling pressure at this level pushed the price downward, forming a support level near $30 (Neckline).

Pullback & Temporary Support (~$30 Neckline):

Buyers stepped in at the support zone, causing a bounce back towards resistance.

This level acted as strong demand, preventing further decline temporarily.

Second Peak (Top 2 - Rejection at Resistance Again):

Price attempted to break above the previous peak but failed.

This failure to form a higher high confirms the presence of strong sellers.

The second rejection strengthens the resistance level at $34.57, signaling exhaustion in buying momentum.

Break of the Trendline Support (Bearish Shift):

A previously ascending trendline (black dashed line) was providing support for the uptrend.

Price broke below this trendline, indicating a possible trend reversal from bullish to bearish.

2️⃣ Key Technical Levels & Trading Setup

🔸 Resistance Zone (~$34.57 - Stop Loss Area)

This is the major resistance level, tested twice and confirmed as a supply zone.

A move above $34.57 would invalidate the bearish pattern, making this an ideal stop-loss level.

🔹 Support Level / Neckline (~$30 - Breakdown Confirmation)

The neckline acts as a critical level. If the price breaks below $30, the Double Top formation is confirmed.

If the price retests this level from below and rejects (fails to reclaim it as support), it becomes a strong short entry signal.

🔻 Target Price (Projected Move - $23.01)

The target is based on the measured move rule of a Double Top:

Distance from resistance ($34.57) to neckline ($30) ≈ $4.57.

Projecting this same distance downward gives a target of ~$23.01.

This aligns with historical demand zones, increasing the probability of price reaching this level.

3️⃣ Trading Plan: Short Setup Execution

🔽 Short Entry (Breakdown Confirmation Below $30)

Ideal entry point is after the neckline breaks and confirms resistance upon a retest.

A breakdown with strong volume enhances the validity of the setup.

🚨 Stop Loss Placement (Above $34.57 Resistance Level)

Placing a stop above the second peak ($34.57) ensures protection against invalidation.

If price moves back above this level, the pattern fails, indicating a potential return to bullish momentum.

🎯 Target Price ($23.01) – Measured Move Projection

The price target aligns with the pattern structure and historical support levels.

Traders can take partial profits at intermediary levels ($27–$26) before full target realization.

4️⃣ Additional Confirmation Factors – Confluence for Bearish Bias

1️⃣ Momentum Indicators: RSI & MACD Bearish Signals

If RSI (Relative Strength Index) drops below 50, it confirms weakening bullish momentum.

A MACD bearish crossover (signal line crossing below the MACD line) would further validate the downtrend.

2️⃣ Volume Analysis – Breakout Confirmation

A high volume breakout below $30 confirms selling pressure.

Low-volume breakdowns can lead to false breakouts, making volume a crucial factor to watch.

3️⃣ Fundamental Factors – Macro Outlook on Silver (XAG/USD)

Silver prices are influenced by interest rates, inflation, and USD strength.

If USD strengthens, silver could face more selling pressure, aligning with this bearish technical setup.

Any hawkish monetary policy statements could accelerate the downside movement.

5️⃣ Risk Management & Alternative Scenarios

✔️ Ideal Risk-Reward Ratio

Risk: Stop loss at $34.57 (~4.5% above entry)

Reward: Target at $23.01 (~23% move)

Risk-Reward Ratio: ~1:5 (highly favorable for short trades)

⚠️ Bullish Invalidations – When to Avoid the Trade?

If Silver reclaims $34.57 and holds above, the pattern fails.

A false breakout scenario could occur if price breaks below $30 but quickly moves back above.

Watching for bullish divergence on indicators like RSI before entering a short position is recommended.

Final Conclusion: Bearish Bias with Strong Downside Potential

📉 Summary of the Bearish Case:

✔️ Double Top pattern confirms a bearish reversal if the neckline breaks.

✔️ Break of ascending trendline signals increasing seller control.

✔️ Key levels: Stop-loss above $34.57 | Entry below $30 | Target $23.01.

✔️ Additional confluence: RSI, MACD, and volume confirmation strengthen the trade setup.

🚀 If price action aligns with this analysis, this setup presents a high-probability short opportunity.

Would you like any refinements or additional insights? 🔥

Silver Breakdown: Rising Wedge Bearish Move Towards Target1. Chart Overview

This 4-hour (H4) chart of Silver (XAG/USD) shows a clear Rising Wedge Pattern, a bearish technical formation. The price action recently broke below the lower support trendline, confirming a downside move. Several key levels, indicators, and trading strategies can be derived from this setup.

2. Identified Chart Pattern: Rising Wedge (Bearish Reversal)

A Rising Wedge is a pattern that forms when price consolidates between two upward-sloping trendlines, with the support line rising at a steeper angle than the resistance line. This pattern is considered bearish because it signals weakening buying pressure and an impending breakdown.

Uptrend Formation: The price had been moving within a wedge, forming higher highs and higher lows.

Volume Considerations: A wedge breakout is often accompanied by increasing volume, further confirming the trend shift.

Breakout Confirmation: The price has decisively broken below the lower boundary of the wedge, indicating that sellers are taking control.

3. Key Technical Levels & Trading Strategy

Resistance Level (Rejection Zone) – $34.00 - $34.50

The upper boundary of the rising wedge acted as strong resistance.

Multiple price rejections confirm sellers' dominance in this area.

Any future retest of this level may provide a new opportunity for short entries.

Support Level (Broken & Retested) – $32.50 - $32.80

This zone previously acted as strong support, preventing price from falling lower.

Now that price has broken this support level, it could act as resistance if a retest occurs.

A confirmed rejection here will further validate the bearish outlook.

Stop Loss Placement – $34.16

A logical stop-loss placement is slightly above the previous swing high and resistance area.

If price moves above this level, it would indicate that the breakdown has failed, invalidating the bearish setup.

Bearish Target – $30.76 (Measured Move Projection)

This level is derived from the height of the rising wedge pattern projected downward.

The area around $30.76 aligns with a previous support zone, making it a reasonable target for the current breakdown.

4. Price Action & Future Expectations

Current Market Sentiment: Bearish

The break below the wedge confirms a bearish sentiment.

A slight retracement to the previous support (now resistance) around $32.80 - $33.00 is possible before further downside.

If selling pressure remains strong, Silver is likely to reach the $30.76 target in the coming sessions.

Alternative Scenario: Bullish Recovery

If the price moves back above $34.16, the bearish outlook is invalidated.

A sustained move above this level could indicate a false breakdown and may push Silver toward new highs.

5. Trading Plan Based on This Setup

🔹 Entry Strategy:

Look for a retest of the broken support zone ($32.80 - $33.00) to enter short positions.

A rejection from this level with bearish confirmation (e.g., a bearish engulfing candle) strengthens the trade setup.

🔹 Stop Loss:

Placed above the wedge resistance at $34.16 to protect against false breakouts.

🔹 Take Profit Targets:

First Target: $31.50 (intermediate support level)

Final Target: $30.76 (measured move projection of the wedge)

6. Conclusion

This Rising Wedge Breakdown on Silver’s H4 chart presents a strong bearish trading opportunity with a well-defined risk-reward ratio. The break below key support signals continued downside, with $30.76 as the next major target. However, traders should monitor any retest of the broken support zone to confirm further selling momentum before entering new positions.

XAG/USD Bullish Setup - Falling Wedge Breakout Towards TargetChart Overview

Asset: Silver / U.S. Dollar (XAG/USD)

Timeframe: 1-hour (1H)

Date and Time: Published on April 2, 2025, at 11:17 UTC

Publisher: GoldMasterTraders on TradingView

Current Price (at the time of the chart):

Open: 33.82300

High: 33.89005

Low: 33.79435

Close: 33.88880

Change: -0.05780 (-0.20%)

Price on the Right Axis: The price scale ranges from approximately 32.80000 to 35.25000, with the current price around 33.88880.

Chart Elements and Technical Analysis

1. Candlestick Price Action

The chart displays a 1-hour candlestick representation of XAG/USD, showing price movements from late March to early April 2025.

Trend Context:

Prior to the formation of the pattern, the price experienced a sharp rally from around 32.80000 (March 21) to a high near 34.60000 (March 27). This indicates a strong bullish trend.

Following this rally, the price entered a consolidation phase, forming lower highs and lower lows, which is characteristic of the Falling Wedge pattern.

Recent Price Action:

On April 2, the price appears to have broken out of the wedge pattern, closing above the upper trendline with a strong bullish candle. The current price of 33.88880 is above the breakout level, suggesting a potential continuation of the uptrend.

2. Chart Pattern: Falling Wedge

Pattern Identification:

The chart highlights a Falling Wedge pattern, a bullish chart pattern that can act as either a reversal or continuation pattern. In this case, given the preceding uptrend, it’s likely a continuation pattern.

A Falling Wedge is characterized by two converging trendlines:

Upper Trendline (Resistance): Connects the lower highs, sloping downward.

Lower Trendline (Support): Connects the lower lows, also sloping downward but at a less steep angle than the upper trendline.

The wedge started forming around March 27, after the price peaked near 34.60000, and continued until the breakout on April 2.

Pattern Dynamics:

The narrowing range between the trendlines indicates decreasing selling pressure and a potential buildup of buying interest.

Falling Wedges typically resolve with a breakout to the upside, as the price breaks above the upper trendline, signaling a resumption of the prior trend (bullish in this case).

Breakout Confirmation:

The price broke above the upper trendline of the wedge on April 2, with a strong bullish candle closing at 33.88880. This breakout is a key signal for a potential upward move.

The breakout level appears to be around 33.85000–33.90000, and the price is currently holding above this level, which is a positive sign for bulls.

3. Key Support and Resistance Levels

Support Level:

A horizontal support zone is marked around 33.58553 (approximately 33.58–33.60).

This level acted as a significant support during the wedge formation, with the price bouncing off this zone multiple times (e.g., on March 28 and March 31).

The support level aligns with the lower boundary of the wedge, reinforcing its importance as a key area of buying interest.

Resistance Level:

A resistance zone is marked around 34.60000 (approximately 34.60–34.80).

This level corresponds to the high reached on March 27, before the wedge formation began. It represents a significant barrier where selling pressure previously emerged.

After the breakout, the price is expected to test this resistance as part of the bullish move.

Target Level:

The target for the breakout is projected at 34.82470 (approximately 34.82).

This target is likely calculated using the standard method for wedge patterns: measuring the height of the wedge at its widest point (from the highest high to the lowest low within the pattern) and projecting that distance upward from the breakout point.

The target of 34.82470 is just above the resistance zone, suggesting that a break above 34.60000 could lead to further upside toward this level.

4. Stop Loss and Risk Management

Stop Loss:

The stop loss is suggested below the support level at 33.58553.

Placing the stop loss below this level ensures that if the breakout fails and the price falls back into the wedge, the trade is exited with a controlled loss.

The distance from the breakout level (around 33.90000) to the stop loss (33.58553) is approximately 0.31447, which represents the risk on the trade.

Risk-Reward Ratio:

The chart indicates a risk-reward ratio of 0.9467 (2.80% / 9,469.7).

The potential reward is the distance from the breakout level (33.90000) to the target (34.82470), which is approximately 0.92470, or a 2.80% gain.

The risk is the distance to the stop loss (0.31447), making the risk-reward ratio approximately 2.94:1 (0.92470 / 0.31447), which is favorable for a trading setup.

5. Additional Annotations

Arrows and Labels:

A blue arrow labeled “Falling Wedge” points to the pattern, clearly identifying it for viewers.

A green arrow labeled “Support Level” points to the 33.58553 zone, indicating where buyers have stepped in.

A red arrow labeled “Resistance Level” points to the 34.60000 zone, highlighting the next significant barrier.

A blue arrow labeled “Target” points to 34.82470, showing the projected price objective.

A blue arrow labeled “Stop Loss” points to 33.58553, indicating the risk management level.

Price Labels on the Right Axis:

The right axis shows key price levels, with the current ask price at 33.89900 (red) and bid price at 33.88558 (black), reflecting the live market spread.

Trading Setup Breakdown

Based on the chart, here’s the detailed trading setup:

Entry:

Position: Long (buy) XAG/USD.

Entry Point: The setup suggests entering after the price breaks out above the upper trendline of the Falling Wedge, which occurred around 33.85000–33.90000 on April 2.

Confirmation: The breakout is confirmed by a strong bullish candle closing above the trendline, with the current price at 33.88880, slightly below the high of 33.89005 but still above the breakout level.

Traders might wait for a retest of the breakout level (now acting as support) for a safer entry, though this isn’t explicitly suggested in the chart.

Stop Loss:

Level: Place the stop loss below the support level at 33.58553.

Rationale: This placement protects against a false breakout. If the price falls back below the wedge’s upper trendline and breaches the support, the bullish thesis is invalidated, and the trade should be exited.

Risk: The distance from the entry (33.90000) to the stop loss (33.58553) is 0.31447, or approximately 0.93% of the entry price.

Take Profit/Target:

Level: The target is set at 34.82470.

Rationale: This target is derived from the height of the wedge projected upward from the breakout point. It also aligns with a logical extension beyond the resistance at 34.60000.

Reward: The distance from the entry (33.90000) to the target (34.82470) is 0.92470, or approximately 2.80% of the entry price.

Risk-Reward Ratio:

The risk-reward ratio is approximately 2.94:1, which is attractive for a trading setup. For every unit of risk (0.31447), the potential reward is nearly 3 units (0.92470).

Trade Management:

Trailing Stop: Once the price approaches the resistance at 34.60000, traders might consider trailing the stop loss to lock in profits, especially if the price shows signs of stalling.

Partial Profit Taking: Some traders might take partial profits at the resistance level (34.60000) and let the remaining position run toward the target.

Broader Market Context

Trend Analysis:

The broader trend before the wedge was bullish, as evidenced by the rally from 32.80000 to 34.60000. The Falling Wedge, therefore, acts as a consolidation within this uptrend, and the breakout suggests a continuation of the bullish trend.

The price action after the breakout will be critical. A strong move toward 34.60000 with high volume would confirm the bullish momentum.

Volume and Momentum:

The chart doesn’t display volume or momentum indicators (e.g., RSI, MACD). However, a typical confirmation of a Falling Wedge breakout includes:

Volume: An increase in volume on the breakout candle, indicating strong buying interest.

Momentum: A bullish signal from indicators like RSI (e.g., moving above 50 or 70) or MACD (e.g., a bullish crossover).

Traders should check these indicators to validate the breakout’s strength.

Market Factors:

Silver prices are influenced by factors like U.S. dollar strength, interest rates, inflation expectations, and geopolitical events. On April 2, 2025, traders should consider:

U.S. Dollar Index (DXY): A weakening dollar typically supports higher silver prices.

Economic Data: Key releases like U.S. non-farm payrolls, inflation data, or Federal Reserve statements around this time could impact silver.

Geopolitical Events: Any risk-off sentiment (e.g., due to global tensions) could drive safe-haven demand for silver.

Potential Risks and Considerations

False Breakout:

If the price fails to hold above the breakout level (33.85000–33.90000) and falls back into the wedge, the setup is invalidated. The stop loss at 33.58553 mitigates this risk.

Resistance at 34.60000:

The resistance level has previously capped the price, and there’s a risk of rejection at this level. Traders should watch for bearish price action (e.g., a shooting star or bearish engulfing candle) near 34.60000.

Market Volatility:

Silver can be volatile, especially on a 1-hour timeframe. Unexpected news or economic data could lead to sharp price swings, potentially triggering the stop loss prematurely.

Timeframe Limitations:

This is a short-term setup on a 1-hour chart, so the target might be reached within hours to a couple of days. However, intraday noise could lead to choppy price action, requiring active trade management.

Conclusion

The TradingView chart by GoldMasterTraders presents a well-structured bullish trading setup for XAG/USD based on a Falling Wedge pattern. The price has broken out above the wedge’s upper trendline on April 2, 2025, signaling a potential move toward the target of 34.82470. Key levels include support at 33.58553 (where the stop loss is placed) and resistance at 34.60000, which the price must overcome to reach the target. The setup offers a favorable risk-reward ratio of approximately 2.94:1, making it an attractive trade for short-term traders.

However, traders should confirm the breakout with additional indicators (e.g., volume, RSI) and monitor broader market conditions, as this chart is a snapshot from April 2, 2025, and market dynamics may have evolved since then. If you’d like to search for more recent data on XAG/USD or check the outcome of this setup, I can assist with that!

Silver (XAG/USD) - Bearish Breakdown from Rising Wedge!Market Overview:

The Silver (XAG/USD) 1-hour chart reveals a Rising Wedge pattern, which is a well-known bearish reversal formation. This suggests that the recent bullish trend is losing momentum, and a breakdown could lead to a significant price decline.

🔹 Key Technical Analysis

1️⃣ Rising Wedge Formation & Breakdown

The price has been moving within a rising wedge, characterized by higher highs and higher lows but with weakening momentum.

A breakdown has occurred, confirming the bearish structure as the price has failed to sustain higher levels.

Historically, when a rising wedge breaks to the downside, price tends to drop by the same height as the wedge itself, which aligns with our projected target zone.

2️⃣ Price Action & Retest Possibility

After the breakdown, a retest of the broken wedge support (now resistance) around $33.50 - $33.80 could provide a potential short-selling opportunity.

If price fails to reclaim the wedge support, further downside pressure is expected.

3️⃣ Downside Target & Support Zone

The measured move suggests a decline towards the $31.00 - $30.60 region, which coincides with a strong historical support zone.

This area is highlighted as a potential profit-taking level for short trades.

📉 Trading Plan - Short Setup

🔸 Entry: Look for a rejection from the $33.50 - $33.80 zone (previous wedge support, now resistance).

🔸 Stop Loss: Above $34.00 to protect against false breakouts.

🔸 Take Profit: $31.00 - $30.60 (previous demand area).

🔸 Risk-Reward Ratio: Favorable setup, ensuring proper risk management.

🛑 Risk Factors to Consider

⚠️ If Silver regains strength and breaks back above $34.00, it could invalidate the bearish breakdown and shift momentum back to the upside.

⚠️ Macroeconomic events such as inflation data, Fed speeches, or geopolitical factors could influence price action unpredictably.

Silver (XAG/USD) Rising Wedge Breakdown – Bearish SetupMarket Overview & Context

Silver (XAG/USD) has been in a strong uptrend, forming higher highs and higher lows over the past few weeks. However, recent price action suggests a potential shift in momentum as a bearish Rising Wedge pattern emerges. This technical pattern often signals a possible trend reversal or correction.

This analysis focuses on a 4-hour (H4) chart, which provides a medium-term perspective for traders. The market has recently encountered a strong resistance zone, and multiple price rejections indicate a potential downward move.

Chart Pattern: Rising Wedge Formation

The Rising Wedge is a bearish reversal pattern that occurs when the price moves higher within two converging trendlines. This structure suggests that while buyers are still in control, their momentum is weakening.

Key Characteristics of the Rising Wedge in This Chart:

Uptrend with Weakening Momentum:

The price has been rising, but the higher highs are becoming less aggressive.

The slope of the highs is flatter compared to the lows, which indicates declining bullish strength.

Converging Trendlines:

The price is getting squeezed between support and resistance.

This tightening range typically precedes a breakout, with a higher probability of a bearish breakdown.

Bearish Implications:

A breakdown below the wedge’s lower trendline confirms bearish sentiment.

The price could drop sharply toward the next major support level if sellers gain control.

Key Technical Levels & Trading Strategy

1️⃣ Resistance Zone (Supply Area) – $34.50 to $34.60

The price has repeatedly tested but failed to break above this zone.

This confirms that sellers are active in this area, leading to multiple rejections.

A strong supply zone, making it an ideal stop-loss placement for short trades.

2️⃣ Support Level (Demand Area) – $30.50 to $30.60

This level has acted as major support in previous price action.

If the breakdown occurs, this is the primary downside target for sellers.

3️⃣ Stop Loss – $34.61

Positioned just above resistance to minimize risk exposure.

Ensures that if price moves against the trade, losses are contained.

Trading Plan & Execution

📉 Short (Sell) Setup – Bearish Breakdown Expected

✅ Entry: A confirmed breakout below the rising wedge’s support trendline (~$33.50 - $33.80).

✅ Stop Loss: Placed slightly above $34.61, ensuring risk control.

✅ Target: $30.56, aligning with previous support zones and technical projections.

Risk-Reward Analysis

Entry at breakdown (~$33.50)

Stop loss (~$34.61) – Risk: ~1.1 points

Target (~$30.56) – Reward: ~2.9 points

Risk-to-Reward Ratio: ~1:3, making this a highly favorable short setup.

Confirmation Signals to Watch Before Entering a Trade

📉 Break and Retest of Support as Resistance

If price breaks below wedge support and retests it as new resistance, it strengthens the bearish case.

📉 Volume Spike on Breakdown

A sharp increase in volume when breaking support confirms strong selling pressure.

📉 RSI Divergence (Bearish Signal)

If the Relative Strength Index (RSI) shows lower highs while the price makes higher highs, it suggests momentum weakness and a pending breakdown.

Potential Trading Scenarios

📌 Bearish Scenario (High Probability) – Breakdown Confirmation

If the price breaks below the wedge’s lower trendline and closes below $33.50, it will likely accelerate downward toward $30.56. Traders should enter short positions and hold for the target while managing risk with stop-loss levels.

📌 Bullish Scenario (Low Probability) – Invalidating the Pattern

If the price breaks above $34.60 and holds, the rising wedge pattern is invalidated. This would signal continued bullish strength, and traders should avoid short positions.

Conclusion & Final Thoughts

✅ The Rising Wedge Pattern suggests a potential bearish reversal in Silver (XAG/USD).

✅ If the price breaks the lower trendline, a drop toward $30.56 is highly probable.

✅ Traders should wait for confirmation signals before entering a trade.

✅ Risk management is crucial, with a stop-loss above $34.61 to minimize exposure.

🔹 This setup presents a strong risk-to-reward opportunity, making it ideal for traders seeking short positions in Silver.

Silver (XAG/USD) Price Analysis – Key Levels & Market Outlook🔍 Key Observations:

📊 Current Price: 34.19250 USD

📈 DEMA (9, close): 34.25605 USD

🎯 Target Price: 35.38940 - 35.5000 USD

🔵 Zones Identified:

🟦 Supply Zone: 34.50 - 34.80 USD (🔼 Selling pressure area)

🟦 RBS Zone: 34.00 - 34.20 USD (🔽 Potential bounce zone)

🟦 Lower RBS Zone: 32.80 - 33.20 USD (⬇️ Strong support)

📉 Market Scenarios:

✅ Bullish Case:

Price bounces off the RBS zone at 34.00 USD ➡️ Uptrend resumes 🚀

Target: 35.50 USD 🎯

❌ Bearish Case:

Breaks below 34.00 USD ❗

Next stop: 33.00 USD ⚠️

📢 Final Thoughts:

🟢 Buyers: Wait for a bounce at 34.00 USD before entering 📈

🔴 Sellers: Look for rejection at 34.50 - 34.80 USD or breakdown below 34.00 USD 📉

⚡ Key Level to Watch: 34.00 USD 👀 A hold = bullish 📊, a break = bearish ⚠️

XAG/USD Rising Wedge Breakdown To Bearish Trade Setup1. Overview of the Chart

This chart represents Silver (XAG/USD) on the 4-hour timeframe from the OANDA exchange. The price action has formed a Rising Wedge pattern, which is a classic bearish reversal formation. This suggests that a potential breakdown could lead to a significant decline in price.

2. Chart Pattern: Rising Wedge Formation

A Rising Wedge consists of a narrowing price range with higher highs and higher lows, but the slope of the support line (bottom trendline) is steeper than the resistance line (top trendline).

This signals weakening bullish momentum, as buyers are struggling to push the price higher, and sellers are stepping in.

Rising Wedges typically break downward due to the loss of buying strength.

3. Key Technical Levels and Market Structure

A. Resistance Level (Highlighted in Beige Box - $34.50 to $34.80)

This zone has acted as a supply area, where price struggles to break higher.

The price touched this level multiple times, failing to hold above it, which increases the probability of a reversal.

B. Support Level (Highlighted in Blue Box - Around $33.50)

This is a critical short-term support where buyers previously stepped in.

A break below this zone would indicate a confirmation of the wedge breakdown and further downside potential.

C. Stop Loss Level (Marked at $34.80)

Placed above the resistance zone, ensuring protection if price invalidates the pattern and moves higher instead.

This aligns with a logical risk-management strategy to minimize losses if the setup fails.

D. Bearish Breakdown Projection & Target (Marked at $30.46)

The projected target aligns with previous structure support, meaning price may find buyers around this level.

This level is determined by measuring the height of the wedge and projecting it downward from the breakout point.

4. Trading Strategy & Execution Plan

📌 Short (Sell) Trade Setup:

Entry:

Enter a short position once price breaks below the lower trendline of the wedge with strong bearish momentum (e.g., a big red candle closing below support).

A possible retest of the broken support could provide a second entry opportunity.

Stop Loss:

Set at $34.80, above resistance, to ensure the trade is protected against invalidation.

Take Profit (Target):

First target: $32.50 (psychological level and minor support).

Final target: $30.46 (major support and full pattern breakdown projection).

5. Market Psychology & Confirmation Signals

Why This Setup is Bearish?

Price action shows higher highs but with decreasing strength, signaling bull exhaustion.

The Rising Wedge is a well-known bearish structure, and its breakdown typically leads to a strong sell-off.

Volume confirmation: If the breakdown happens with high volume, it strengthens the bearish case.

What to Watch For?

A decisive bearish candle closing below the wedge support confirms the short setup.

If price retests the broken trendline and fails to reclaim it, it provides a second opportunity for entry.

Avoid entering if price consolidates near resistance instead of breaking down.

6. Conclusion: Bearish Bias & Trading Edge

The Rising Wedge formation suggests that Silver is losing bullish momentum and could break down.

Key levels and structure provide a well-defined trade setup, ensuring a good risk-to-reward ratio.

Traders should wait for a confirmed breakdown before entering a short position.

📉 Bearish Outlook – Price likely to drop toward $30.46 target

⚠️ Risk Management is crucial – Stop Loss at $34.80

🎯 Breakdown confirmation needed before entering short positions

Would you like me to refine any part or add more insights? 😊

(XAG/USD) weekly Forcast – Double Top Breakdown & Bearish SetupThis detailed technical analysis of Silver (XAG/USD) on the daily timeframe highlights a potential bearish reversal forming through a Double Top pattern. This setup suggests that Silver could be gearing up for a major decline, provided key confirmation levels are met. Let’s break it down thoroughly.

📌 1. Understanding the Chart Pattern – Double Top Formation

A Double Top is a bearish reversal pattern that forms after an extended uptrend, signaling that buyers are losing strength and sellers are taking control.

🔹 Key Phases of the Double Top:

1️⃣ First Top (Top 1)

Silver initially rallied to a major resistance zone ($34.5 - $35).

The price failed to break higher, leading to a correction.

This rejection signals heavy selling pressure at this level.

2️⃣ Pullback to the Neckline ($28.5 - $29)

After the first peak, the price retraced to a critical support area known as the neckline.

This level acts as a decision point—either price bounces or breaks lower.

3️⃣ Second Top (Top 2) – Bull Trap?

Silver made another attempt to break through $34.5 - $35, but once again, sellers defended this level.

The failure to set a new higher high confirms weakness, forming the second peak.

This second rejection adds credibility to the Double Top pattern, increasing the likelihood of a bearish move.

4️⃣ The Crucial Neckline Test

The neckline around $28.5 - $29 is the most critical level to watch.

A clean daily close below this level would confirm the breakdown and trigger a strong bearish trend.

📍 2. Key Technical Levels & Market Structure

🔴 Resistance Level ($34.5 - $35) – Strong Selling Zone

This area has repeatedly rejected price advances, indicating high supply.

A breakout above this level would invalidate the bearish setup.

🔵 Support & Neckline ($28.5 - $29) – The Make-or-Break Zone

A break below this level would complete the Double Top pattern and confirm the bearish trend.

If buyers defend this area, Silver could see short-term consolidation before another breakout attempt.

🎯 Target Price ($22 - $23) – Where Silver Could Be Headed

The measured move (distance from top to neckline) suggests a potential drop to $22 - $23.

This aligns with historical support zones, making it a reasonable target.

🚨 Stop Loss Area ($35.2 - $35.5) – Risk Management

If Silver invalidates the pattern and closes above $35.2 - $35.5, the bearish setup is no longer valid.

Traders should cut losses early if price regains bullish momentum.

📊 3. Trading Setup & Execution Plan

🔻 Bearish Trading Plan (Short Entry):

✅ Entry Point:

Enter a short position after a confirmed neckline break below $28.5 - $29.

Wait for a break-and-retest of this level to confirm the bearish move.

✅ Stop Loss:

Place stop loss above $35.2 - $35.5, just beyond the resistance level.

This protects against false breakouts and sudden bullish reversals.

✅ Take Profit Targets:

Primary target: $24.5 - $25 (first support zone).

Final target: $22 - $23 (measured move completion).

📉 4. Market Sentiment & Technical Outlook

📌 Why This Setup is Important:

The Double Top pattern is a well-established bearish signal.

Price failed to create a new high, showing that buying momentum is fading.

The neckline breakdown will confirm that sellers are in control, pushing price lower.

📌 What Could Invalidate This Setup?

If Silver breaks and closes above $35.5, it would signal that bulls have regained strength.

A strong rally above this level could send Silver towards $37 - $38 instead.

🔎 Final Thoughts – Will Silver Collapse or Hold?

The chart suggests a bearish bias, but confirmation is key!

A breakdown below $28.5 - $29 would activate the Double Top pattern, leading to a potential drop.

If Silver bounces off the neckline, then we might see consolidation or a reversal instead.

🚀 What’s your view? Will Silver break down or bounce back? Share your thoughts below! 🚀

Silver (XAG/USD) Rising Wedge – Bearish Breakdown Setup!A rising wedge is a pattern that typically forms when the price makes higher highs and higher lows, but the upward momentum starts weakening. The narrowing structure of the wedge indicates that buyers are losing strength, and a breakout to the downside is likely.

Key Characteristics of the Rising Wedge:

✔ Higher highs & higher lows – but with reduced momentum

✔ Trendline support (lower boundary) & resistance (upper boundary)

✔ Volume decline – suggests a potential reversal

Expected Scenario:

If the price breaks below the lower trendline, it signals bearish pressure, and Silver could see a strong decline.

2. Key Levels & Trading Setup

📌 Resistance Level ($34.50 - $34.80)

The upper boundary of the wedge is acting as strong resistance.

Historically, this zone has rejected price action multiple times, indicating sellers are defending this area.

📌 Support Level ($30.20 - $30.50)

A major demand zone where buyers previously stepped in.

If the wedge breaks down, this is the most likely target for the decline.

📌 Stop Loss ($34.81)

Placed just above the recent high and resistance zone to limit risk in case of an unexpected upside breakout.

📌 Target ($30.20)

Measured move from the wedge breakdown projects a sharp decline toward the next strong support at $30.20.

3. Trade Execution Strategy

🔴 Bearish Breakdown Scenario

If the price breaks below the lower trendline (around $33.00), we expect a strong move downward.

📉 Short Entry: Below $33.00 (after confirmation)

🎯 Target: $30.20

❌ Stop Loss: $34.81 (above resistance)

Confirmation Needed:

✅ Strong bearish candle close below support

✅ Increased volume during breakdown

✅ Retest of broken support turning into resistance

🟢 Bullish Alternative (Invalidation)

If price breaks and holds above $34.81, the bearish setup will be invalidated, and a breakout towards $36.00 - $37.00 could be expected.

4. Additional Considerations

📌 Fundamental Factors: Keep an eye on macroeconomic news, Fed decisions, and USD strength, as these impact Silver prices.

📌 Risk Management: Avoid overleveraging and use a proper risk-reward ratio (1:3 or higher).

📌 Market Sentiment: Watch volume trends and confirm breakout or fakeout before entering trades.

Conclusion

This chart presents a high-probability short trade setup based on the rising wedge breakdown.

If the breakdown occurs, Silver could drop toward the $30.20 support zone. However, traders should wait for confirmation before entering to avoid fakeouts.

Would you like me to refine this further for a TradingView post? 🚀

XAG/USD (Silver) 4H Trading Analysis📍 Current Price: 33.0990 (Near Entry Zone)

🔹 Trading Setup:

🟢 Entry Zone: 32.97654

🔴 Stop-Loss (SL): 32.48368 ❌

🔵 Take-Profit (TP) Levels:

TP1: 33.30512 🎯

TP2: 33.62431 🎯🎯

Final Target: 34.19599 🚀

📊 Price Action Insights:

✅ Bounce from Demand Zone (Gray Box) 📈

✅ Potential Bullish Move if price holds above entry 🚀

⚠️ Risk if SL is hit (Red Box) ❌

XAG/USD Trade Ideas: Navigating Key Resistance and Support ZonesSilver 's Next Move: Technical and Fundamental Insights for XAGUSD Traders 🚀📊

Technical Analysis 📊

The chart provided is a 4-hour chart of Silver (XAG/USD) with Fibonacci retracement levels applied. Here's a detailed technical breakdown:

Trend Analysis 📈:

The price has recently rebounded from a low near $32.90 and is now trading at $33.66.

The short-term trend appears bullish, as the price has made a higher low and is attempting to break higher.

Fibonacci Retracement Levels 🔢:

The Fibonacci retracement levels are drawn from the recent swing high to swing low.

The price has retraced to the 50% Fibonacci level ($33.35) and is now testing the 0% retracement level ($33.80), which acts as resistance.

The 61.8% retracement level ($33.24) and 78.6% retracement level ($33.09) are key support zones if the price pulls back.

Resistance and Support 🛑🛠️:

Resistance: The immediate resistance is at $33.80 (0% Fibonacci level). A break above this level could open the door to further upside, targeting $34.25 (50% Fibonacci extension).

Support: The first support is at $33.35 (50% Fibonacci level), followed by $33.24 (61.8% Fibonacci level).

Candlestick Patterns 🕯️:

The recent candles show indecision near the resistance level, indicating a potential pause or reversal.

If a strong bullish candle forms above $33.80, it would confirm a breakout.

Momentum 🚀:

The price is showing bullish momentum, but the resistance at $33.80 needs to be cleared for further upside.

Fundamental Analysis 🌍

Silver's Role as a Safe Haven 🛡️:

Silver often acts as a hedge against inflation and economic uncertainty. If there are concerns about global economic stability or inflationary pressures, silver demand could increase.

US Dollar Impact 💵:

Silver is inversely correlated with the US Dollar. If the USD weakens due to dovish Federal Reserve policies or poor economic data, silver prices could rise.

Industrial Demand ⚙️:

Silver has significant industrial applications, particularly in electronics and renewable energy. Any positive developments in these sectors could support silver prices.

Upcoming Economic Events 📅:

The chart shows upcoming economic events (likely US-related). If these events lead to USD weakness or increased market uncertainty, silver could benefit.

Trade Idea 💡

Scenario 1: Bullish Breakout 🚀

Entry: Buy above $33.80 (on a confirmed breakout).

Target: $34.25 (50% Fibonacci extension) and $34.50 (psychological level).

Stop Loss: Below $33.35 (50% Fibonacci level).

Scenario 2: Pullback and Rebound 🔄

Entry: Buy near $33.35 (50% Fibonacci level) or $33.24 (61.8% Fibonacci level) if the price pulls back.

Target: $33.80 (0% Fibonacci level) and $34.25.

Stop Loss: Below $33.00.

Scenario 3: Bearish Reversal 📉

Entry: Sell below $33.24 (61.8% Fibonacci level) if the price fails to hold support.

Target: $33.00 and $32.90.

Stop Loss: Above $33.50.

Conclusion ✅

The current setup favors a bullish bias 📈, but the resistance at $33.80 is critical. A breakout above this level could lead to significant upside, while a failure to break higher may result in a pullback to key support levels. Monitor price action closely around the Fibonacci levels and upcoming economic events for confirmation. ⚠️

Disclaimer ⚠️

This analysis is for informational purposes only and should not be considered financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research or consult with a licensed financial advisor before making any trading decisions.

Silver (XAG/USD) Double Top Reversal – Bearish Trading SetupThe provided 1-hour chart for Silver (XAG/USD) presents a well-structured bearish trade setup, highlighting key price action patterns, technical indicators, and confluence factors that suggest a potential downside move. Let's analyze the chart step by step to understand the logic behind this bearish trade setup.

1. Market Structure & Trend Overview

Silver (XAG/USD) has been in a short-term uptrend, as indicated by the ascending trendline. However, the trend now shows signs of exhaustion, with a clear shift in market behavior. The price action reveals the formation of a double top at a strong resistance level, coupled with a Change of Character (CHOCH), which signals a possible reversal.

A break below the trendline suggests that the bullish momentum is losing strength, and sellers are beginning to dominate the market. The combination of these elements makes this setup a high-probability short trade opportunity.

2. Key Technical Levels & Zones

A. Resistance Zone ($33.96 - $34.20) – The Selling Pressure Area

The chart marks a clear resistance zone, where price has struggled to break higher.

Two price rejections from this level indicate that sellers are actively defending this region.

This zone serves as an ideal stop-loss area for short trades, as a breakout above this level would invalidate the bearish setup.

B. Double Top Formation – Reversal Pattern

The price tested the resistance zone twice and failed to establish new highs, forming a double top structure.

A double top is a well-known bearish reversal pattern, indicating a shift from bullish to bearish momentum.

The second top (Top 2) aligns with a downward trendline, further confirming that sellers are stepping in at lower levels.

C. Support Level ($32.60 - $32.80) – Initial Reaction Zone

This area has previously acted as a demand zone where buyers stepped in.

If the price breaks below this support, it would confirm further downside movement towards the final target.

D. Trendline Breakdown – Loss of Bullish Momentum

The dotted trendline represents the previous bullish trend, supporting price action for several days.

A break below this trendline suggests a structural shift in market dynamics, meaning buyers are losing control.

The failure to reclaim the trendline increases the probability of a deeper move downward.

E. Target Level ($32.11 - $32.20) – The Bearish Objective

The projected target is based on the double top’s measured move, which suggests a price drop to at least $32.11.

This level also coincides with previous historical price action, making it a strong confluence zone for profit-taking.

3. Trading Strategy & Execution Plan

📌 Entry Point:

Aggressive Entry: Short position around $33.40 - $33.50, near the second top where price rejected the trendline.

Conservative Entry: Wait for a confirmed break and retest of the support level at $32.80 before entering short.

📌 Stop-Loss Placement:

The stop-loss should be placed above the resistance zone at $33.96.

This level ensures that the trade is invalidated if the price breaks out higher.

📌 Take-Profit Target:

Primary Target: $32.60, which is the first support level where price may temporarily react.

Final Target: $32.11, aligning with the double top breakdown target and historical support.

📌 Risk-Reward Ratio:

A minimum 1:2 risk-reward ratio, meaning for every 1% risked, there is a potential 2%+ gain.

This makes the trade favorable in terms of risk management.

4. Confluence Factors Supporting the Bearish Outlook

✅ Double Top Formation – A classic bearish reversal pattern.

✅ Lower Highs Formation – Indicates increasing selling pressure.

✅ Trendline Breakdown – A significant loss of bullish momentum.

✅ Resistance Zone Rejection – Strong seller presence.

✅ CHOCH (Change of Character) – Confirms a shift in market sentiment.

5. Risk Management & Alternative Scenario

📌 What If Price Moves Against the Trade?

If the price breaks above $33.96, the bearish outlook becomes invalid, and a potential bullish continuation could follow. In this case:

Stop-loss is triggered, and the setup is considered invalid.

Traders should then wait for a new setup before re-entering the market.

📌 Market Conditions to Monitor:

Volatility: Ensure there is enough momentum in the market before entering.

Volume Confirmation: A break below support should have strong volume.

News Events: Watch out for fundamental catalysts, such as US Dollar strength, economic data, and geopolitical events, which could influence Silver’s price movement.

6. Final Thoughts & Summary

This chart setup provides a clear bearish trade opportunity based on technical analysis. The combination of double top formation, resistance rejection, trendline breakdown, and lower highs strongly supports the idea of further downside movement.

💡 Key Takeaways:

Bearish bias is valid as long as price stays below $33.96.

Target is set at $32.11, with an intermediate support at $32.60.

Risk-to-reward is favorable, making it an ideal short trade setup.

If the market follows this expected scenario, this trade has the potential to yield significant profit while maintaining disciplined risk management. However, always stay alert to market conditions and adjust strategies accordingly.

SILVER PROJECTION Here's my projection for Xag this week.

PS: price would do what it wants to do regardless

We cleared the high of the second week of the Month 34.067 and close bearish last week. Hence my anticipation that price is going to clear the los of the second week as well which is 31.789 taking that as my draw of Liquidity 🧲.

Shuffling down to H4, everything now depends on confirmation. Price may react from 33.302 and continue to the downside or price may decide to go and test that 33.597 zon before the sell continuation.

Watch out for these zone for trade opportunity.

Kindly boost if you find this insightful 🫴

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📊 Overview of the Chart

This 4-hour chart of Silver (XAG/USD) provides a classic example of a Rising Wedge Breakdown, a bearish reversal pattern. The price initially followed a strong uptrend, forming a series of higher highs and higher lows, but failed to sustain momentum at the key resistance zone (~$34.00 - $34.50). This led to a breakout to the downside, which has now confirmed a shift in market sentiment from bullish to bearish.

This analysis will break down each key level, the technical indicators supporting this trade setup, and how traders can approach it effectively.

🛠️ Breakdown of the Chart Components

1️⃣ Rising Wedge Formation (Bearish Pattern Identified)

The price action created a Rising Wedge, which is a bearish pattern characterized by an uptrend where the higher highs and higher lows start converging into a narrowing range.

This shows that while buyers were pushing prices higher, their strength was gradually fading.

The breakdown of this structure signaled a loss of bullish momentum, leading to a shift in trend.

2️⃣ Resistance Level & Sell Zone Identified

The resistance level at $34.00 - $34.50 has acted as a supply zone where sellers stepped in, preventing further upside.

A bearish rejection at this zone confirms that sellers are still dominant.

3️⃣ Retest of the Broken Support (Key Confirmation)

After the breakout from the wedge, the price made a retest of the broken trendline, a classic move before further downside.

Retesting this area confirms that it is now acting as resistance rather than support, further strengthening the bearish case.

4️⃣ Trendline Breakout – Shift in Market Structure

The dashed trendline was previously supportive, but now that the price has broken below it, it has turned into a resistance level.

This shift in market structure is a strong bearish signal.

5️⃣ Key Support Levels & Target Projection

The next major support level is at $32.00, a level where price previously found demand.

The ultimate target price is around $31.18, which aligns with historical support and Fibonacci retracement levels.

📉 Trading Strategy – How to Trade This Setup?

✅ Entry Point (Short/Sell Setup)

A good shorting opportunity arises if the price retests the resistance at $33.50 - $34.00 and shows bearish confirmation (like a rejection candlestick or a bearish engulfing pattern).

📍 Stop Loss (SL) Placement

SL should be above $34.20 to avoid getting stopped out by potential fakeouts.

🎯 Take Profit (TP) Levels

TP1: $32.00 (First support level)

TP2: $31.18 (Final bearish target)

📊 Risk-Reward Ratio

Entry at $33.50 - $34.00 with SL at $34.20 and TP at $31.18 provides an excellent risk-to-reward ratio (~1:4).

📌 Market Sentiment & Conclusion

🔴 Bearish signals are dominant, suggesting further downside potential.

📉 A strong bearish move is expected if the price fails to reclaim $34.00.

🎯 Targeting $31.18 in the upcoming sessions.

📢 Final Advice: Traders should watch for confirmation before entering trades. A successful retest and rejection at $33.50 - $34.00 will be a high-probability short setup. 🚀

🔥 Follow price action and risk management principles for a successful trade! 🔥

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "Gold vs U.S Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 34.200

🏁Sell Entry below 33.400

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 33.400 for Bullish Trade

🚩Thief SL placed at 34.000 for Bearish Trade

Using the 30mins period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 35.400 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 32.800 (or) Escape Before the Target

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Seasonal factors, Sentimental Outlook, Positioning and future trend.....👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Silver (XAG/USD) – Rising Wedge Breakdown & Bearish Setup📌 Overview

This 1-hour chart of Silver (XAG/USD) presents a textbook Rising Wedge pattern, which is known as a bearish reversal signal. The price was in a strong uptrend but started showing signs of buyer exhaustion, leading to a breakdown from the wedge formation.

The chart clearly identifies:

✅ A Rising Wedge formation

✅ Resistance Level where price faced multiple rejections

✅ Breakdown Confirmation and shift in trend direction

✅ Projected Target & Stop Loss Zones

This setup suggests a strong potential for further downside movement in silver prices. Now, let’s break it down step by step like a professional trader.

🔹 Key Technical Analysis Breakdown

1️⃣ Rising Wedge Pattern – The Bearish Setup

The Rising Wedge is a bearish reversal pattern that forms when price action moves higher within two converging trendlines. The slope of the lower trendline is steeper than the upper trendline, meaning that buyers are getting weaker.

This pattern suggests that even though the price is rising, bullish momentum is fading.

Once the price breaks below the wedge, it confirms a bearish trend.

🔸 Characteristics of this Wedge:

📌 Multiple Higher Highs & Higher Lows – But with decreasing strength

📌 Narrowing Price Action – Indicates weaker buying power

📌 Breakdown Below Support Line – Confirms the bearish move

2️⃣ Resistance Level – Key Price Rejection Zone

The price tested the Resistance Level multiple times before breaking down. This area is where sellers overpowered buyers, preventing further upside movement.

The resistance zone was a liquidity area, meaning large institutional traders likely placed sell orders here.

The price attempted to push higher but failed, showing that demand was exhausted.

Once rejection happened, selling pressure increased, and the breakdown followed.

3️⃣ Breakdown Confirmation – Bearish Momentum Kicks In

After the wedge broke down, the price started moving in a structured downtrend, forming lower highs and lower lows. This confirms that the breakdown was valid and that the trend has shifted.

🔹 Signs of Breakdown Strength:

✅ Strong Bearish Candles – Indicating aggressive selling

✅ No Immediate Recovery – Suggests sellers are in control

✅ Lower Highs Forming – Bearish trend structure confirmed

4️⃣ Risk Management – Stop Loss & Target Zones

A well-planned trade must include a Stop Loss and a Target to manage risk effectively.

📌 Stop Loss Placement (33.95)

Placing a Stop Loss just above the resistance level protects against false breakouts.

If the price goes back above 33.95, it would invalidate the bearish setup.

📌 Profit Target (31.96)

The target is based on the measured move projection, meaning the expected price drop is equal to the height of the wedge at its widest point.

If the price reaches 31.96, traders can lock in profits.

📌 Risk-Reward Ratio (RRR)

The setup offers a favorable risk-to-reward ratio, making it a high-probability trade.

5️⃣ Expected Price Movement – Bearish Outlook

From here, we can expect the following price movement:

📉 Scenario 1: Continuation of Downtrend (High Probability)

The price will likely form lower highs and lower lows on its way to 31.96.

Each small rally should be met with selling pressure.

📈 Scenario 2: False Breakdown (Low Probability but Possible)

If the price moves back above 33.95, the wedge breakdown will be invalid.

This could lead to a bullish reversal instead.

6️⃣ Final Thoughts – How to Trade This Setup?

This Rising Wedge Breakdown provides an excellent short-selling opportunity. Here’s how a professional trader would approach it:

✅ 🔹 Entry Strategy:

Short after a retest of the broken wedge support

Confirmation of lower highs ensures trend continuation

✅ 🔹 Risk Management:

Place Stop Loss above 33.95

Take profits around 31.96

✅ 🔹 Confirmation Signals to Watch:

Lower highs forming after breakdown

Increased selling volume on bearish candles

Price respecting the downtrend structure

🔔 Conclusion – Bearish Bias Confirmed

🔻 Trend Shift: The breakdown signals a potential trend reversal in silver.

🔻 Bearish Targets: The price is expected to fall toward 31.96 in the coming sessions.

🔻 High-Probability Trade: Strong technical reasons support a bearish outlook.

🚨 Watch for further confirmations and manage risk effectively! 📊💰