“Can This XAG/USD Setup Make You the Next Market Thief?”🏴☠️ Operation Silver Swipe — Thief Trading Heist Plan for XAG/USD 🪙💸

🚨 Target Locked: The Silver Vault 🧳🎯

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Hustlers & Chart Whisperers, 🕵️♂️💼📉💰

Step into the shadows with our stealth plan based on our signature Thief Trading Style—a mix of smart technicals and crafty fundamentals. Today, we’re eyeing XAG/USD (Silver) for a clean sweep. Here's how to gear up for the breakout job:

🎯 Entry Zone — “The Heist Is On!” 💥

📍Key Level: Break & Retest above 36.500 – that's your cue to act.

🔑Strategy:

Buy Stop Orders: Set above the breakout level

Buy Limit Orders: Use recent 15/30M swings for a sneaky pullback entry 🎯

🛑 Stop Loss — “Every Thief Has a Backup Plan” 🎭

Place your SL like a pro, not a panic button!

📌Recommended: Around 31.700 using the 4H swing low

⚠️Tip: Adjust based on your risk appetite, lot size, and number of entries. You’re the mastermind, not a minion.

🎯 Target — “Escape Route” 🏃♂️💸

📌 First checkpoint: 37.700

📌 Or take your loot early if the heat rises! (Overbought zones, trend traps, or reversal zones)

💡 Scalper's Shortcut 💡

Go only long for safety. If you’ve got the cash stack, jump in fast. If you’re more of a sneaky swing trader, follow the roadmap and trail your SL to secure that bag 🧳📈

🔍 Market Status

Silver’s in a Neutral Phase – but signs point to an upward getaway 🚀

Fueling this momentum:

Macro & Fundamental trends

COT Positioning

Intermarket Clues

Sentimental Signals

🔗 Read the full breakdown check there 👉🔗🔗🌏🌎!

📢 Trading Alert — News Release Caution ⚠️

Don’t get caught mid-escape during news bombs! 💣

✅ Avoid fresh entries during high-impact events

✅ Use trailing SL to lock in your gains and cover your tracks

💖 Smash the Boost Button if you vibe with this plan 💥

Support the crew and help keep the charts hot and the loot flowing. Your boost powers up our next big heist 🚁🔥

📡 Stay tuned for more street-smart setups... we rob the charts, not the rules! 🐱👤💸📊💎

Xagusdbreakout

Can You Snatch Silver’s Profits? XAG/USD Stealth Trade Plan🔥Silver Snatch Strategy: XAG/USD Stealth Trade Plan🔥

👋 Greetings, Profit Pirates & Chart Ninjas! 🕵️♂️💸

Welcome to the Silver Snatch Strategy—a sly, calculated approach to raiding the XAG/USD market with finesse. This plan fuses razor-sharp technicals with real-time fundamentals to swipe profits from silver’s wild swings.

Let’s move like shadows, strike fast, and vanish with the gains! 🌑📈

📜 The Silver Snatch Blueprint

Entry Triggers 🔑:

🔼 Bullish Ambush: Enter on a breakout above the 50-period EMA at ~$34.20, signaling a potential rally.

🔽 Bearish Strike: Dive in on a breakdown below the 200-period EMA at ~$31.50, riding the downward momentum.

💡 Pro Tip: Use price alerts to catch these levels without glued eyes! 🔔

Stop Loss (SL) 🛡️:

🟢 Bullish Trade: Set SL at $31.90 (recent daily low, cushioning against wicks).

🔴 Bearish Trade: Place SL at $33.80 (daily high, guarding against fakeouts).

📉 Stay Flexible: Adjust SL based on your risk tolerance, lot size, and market volatility. This is your safety net!

Take Profit (TP) 💰:

🚀 Bullish Raiders: Target $36.50 (Fibonacci 61.8% retracement) or exit on fading volume.

🕳️ Bearish Thieves: Aim for $28.80 (key support zone) or slip out if momentum stalls.

🚪 Escape Tactic: Watch RSI for overbought (>70) or oversold (<30) signals to dodge reversals.

🌐 Why Trade XAG/USD Now?

Silver’s price action is a treasure chest of opportunity, driven by:

💵 USD Strength: The US dollar is flexing due to hawkish Fed signals and robust US economic data (e.g., Q1 2025 GDP growth at 2.8% annualized). A stronger USD typically pressures silver prices.

🕊️ Geopolitical Shifts: Easing US-China trade tensions reduce safe-haven demand for silver, tilting sentiment bearish.

🎲 Speculative Bets: Speculative net-short positions on silver are rising, with traders leaning against XAG/USD.

📊 Technical Edge: RSI (14-day) at 45 signals bearish momentum, while Fibonacci retracement levels highlight resistance at $34.50 and support at $31.00.

📈 Intermarket Dynamics: Rising US Treasury yields (10-year at 4.2%) and equity market optimism divert capital from non-yielding assets like silver.

📉 Silver’s recent dip to $31.60 (May 19, 2025) reflects these pressures, but a potential rebound looms if geopolitical risks flare up.

📊 Real-Time Sentiment Snapshot (May 19, 2025)

Retail Traders:

📈 Bullish: 38% 🌟 (Eyeing silver’s safe-haven appeal amid global uncertainty).

📉 Bearish: 48% ⚡ (Swayed by USD rally and trade deal optimism).

⚖️ Neutral: 14% 🧭 (Waiting for clearer signals).

Institutional Traders:

🏦 Bullish: 25% 🏦 (Hedging with silver for recession risks).

📉 Bearish: 65% 📉 (Favoring USD assets amid higher yields).

⚖️ Neutral: 10% ⚖️ (Monitoring Fed commentary).

💥 Why This Trade?

🔥 Volatility Goldmine: XAG/USD’s recent 3% daily ranges offer quick profit potential for agile traders.

📚 Data-Backed Setup: RSI, Fibonacci, and EMA alignments provide high-probability entry/exit points.

🌬️ Macro Tailwinds: USD strength and trade optimism create a clear bearish bias, with bullish setups as contingency plans.

🛡️ Risk Control: Tight SL and dynamic TP levels keep your capital safe while chasing 2:1 reward-to-risk ratios.

🗞️ News & Risk Management ⚠️

Silver is sensitive to sudden news spikes. Stay sharp:

⏰ Avoid Entries Pre-News: Skip trades 30 minutes before major releases (e.g., Fed speeches, US CPI data on May 20, 2025).

🔁 Trailing Stops: Lock in gains as price moves your way (e.g., trail SL by 50 pips on bullish trades).

🌪️ Volatility Play: Use smaller lot sizes during high-impact events to navigate choppy waters.

Join the Silver Snatch Squad!

👉 Click that Boost button to amplify this Silver Snatch Strategy and make it a TradingView legend! 🚀

Every like and share fuels our crew to drop more high-octane trade plans.

Let’s conquer XAG/USD together! 🤜🤛

Keep your charts locked, alerts primed, and trading spirit electric.

See you in the profit zone, ninjas!

XAGUSD[SILVER] : A Start Of Swing Sell, Comment Your Views?Silver is currently consolidating in the daily timeframe, with no clear indication of where the price may move forward. Looking at the volume of the last few days or week’s candles, we can confirm that a swing sell could be imminent in the market. Fundamentals and technical data support this view, as well as our own trading experience.

This analysis predicts the future price of the XAGUSD (SILVER) but does not guarantee that the price will move exactly as described.

However, we want to emphasise that this analysis should be used for educational purposes only and should not be considered as a secondary bias.

We would love to hear your thoughts on this idea.

Additionally, please remember to like, comment, and share the idea to encourage us to bring you more trading ideas!

Much love ❤️

Team Setupsfx_

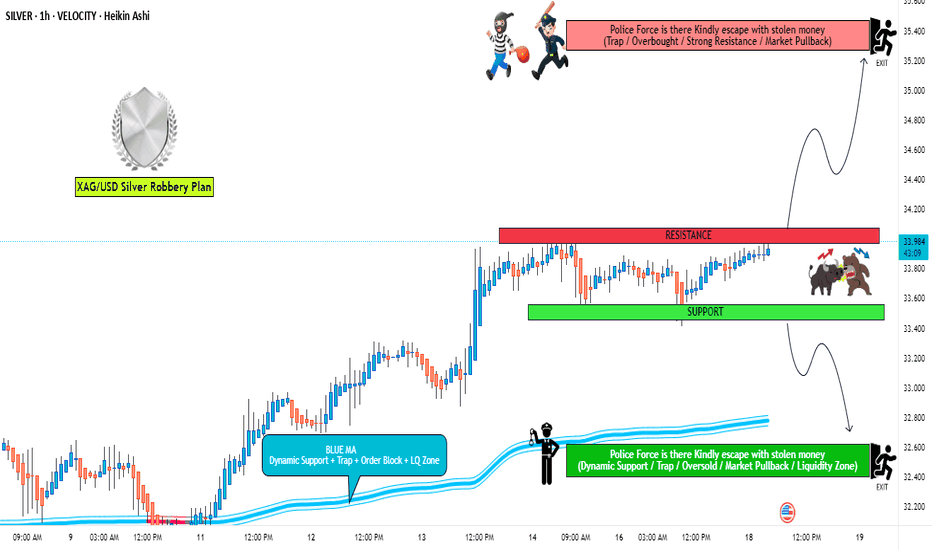

XAG/USD "The Silver" Metals Market Heist Plan (Swing/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe nearest or swing low or high level for pullback entries.

Stop Loss 🛑:

📍 Thief SL placed at the recent/swing low level Using the 1H timeframe (31.800) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 34.400 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAG/USD "The Silver" Metals Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "The Silver" Metal Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 1 Day timeframe (32.000) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 27.000 (or) Escape Before the Target

⚙💿XAG/USD "The Silver" Metal Market Heist Plan (Swing/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

Detailed Point Explanation 📋

Fundamentals 🌟: Silver’s dual role ensures resilience, but USD and rates cap gains ⚖️.

Macro 📊: Inflation aids 🔥, but growth and policy risks create volatility ⚡.

Geopolitics 🌐: Safe-haven demand helps 🛡️, though trade wars hurt industrial use 🚨.

Supply/Demand ⚖️: Deficit is a strong bullish driver 📉, despite short-term fluctuations ⚡.

Technicals 📉: Near-term weakness 🐻 within a broader uptrend 🐮.

Sentiment 😊: Balanced ⚖️, with cautious optimism prevailing 🌟.

Seasonal 🍂: Neutral ⚖️, with minor weather-related disruptions ❄️.

Intermarket 🔗: Gold supports 🥇, USD resists 💵 – a tug-of-war ⚔️.

Investors/Traders 👥: Long-term bulls 🐮 vs. short-term bears 🐻 reflect split views ⚖️.

Trends 🔮: Short-term dip 📉, medium/long-term rally potential ⬆️.

Outlook 📝: Mildly bullish ⭐, favoring longs over 6-12 months 🐮.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "The Silver" Metals Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (32.800) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (31.700) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 33.900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAG/USD "The Silver" Metals Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "The Silver" Metal Market Heist Plan(Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (33.500) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (34.200) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 32.800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAG/USD "The Silver" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "Gold vs U.S Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 34.200

🏁Sell Entry below 33.400

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 33.400 for Bullish Trade

🚩Thief SL placed at 34.000 for Bearish Trade

Using the 30mins period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 35.400 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 32.800 (or) Escape Before the Target

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Seasonal factors, Sentimental Outlook, Positioning and future trend.....👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "The Silver vs U.S Dollar" Metals Market Robbery Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver vs U.S Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 32.000

Sell Entry below 30.900

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 31.300 for Bullish Trade

-Thief SL placed at 31.400 for Bearish Trade

Using the 3h period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 33.700 (or) Escape Before the Target

-Bearish Robbers Primary TP 30.00, Secondary TP 30.900 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

XAG/USD "The Silver vs U.S Dollar" Metals market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

# Fundamental Analysis

1. Supply and Demand: Silver supply and demand dynamics can impact XAG/USD prices.

2. Global Economic Conditions: Economic growth, inflation, and interest rates can influence silver demand and prices.

3. Geopolitical Events: Political instability, trade wars, and other geopolitical events can impact silver prices.

# Macro Economics

1. Inflation Rates: Changes in inflation can influence the value of silver and the US dollar.

2. Interest Rates: Interest rate decisions by central banks can impact currency values and commodity prices.

3. GDP Growth: Economic growth or contraction can affect demand for silver and other commodities.

4. Unemployment Rates: Changes in unemployment rates can impact consumer spending and silver demand.

# Global Market Analysis

1. Currency Markets: Changes in currency values can impact XAG/USD prices.

2. Commodity Markets: Changes in commodity prices can impact silver prices.

3. Stock Markets: Changes in stock market sentiment can impact XAG/USD prices.

# COT Data

1. Non-Commercial Traders: An increase in long positions by non-commercial traders can indicate bullish sentiment.

2. Commercial Traders: An increase in short positions by commercial traders can indicate bearish sentiment.

3. Open Interest: Changes in open interest can indicate changes in market sentiment.

# Intermarket Analysis

1. Correlation with Other Assets: XAG/USD's correlation with other assets, such as gold, copper, and oil, can impact its price.

2. Commodity Prices: Changes in commodity prices can impact silver prices.

# Quantitative Analysis

1. Technical Indicators: Technical indicators, such as moving averages and relative strength index (RSI), can provide insights into XAG/USD's trend.

2. Statistical Models: Statistical models, such as regression analysis, can help identify relationships between XAG/USD and other variables.

# Market Sentimental Analysis

1. Bullish Sentiment: Increased bullish sentiment can lead to higher XAG/USD prices.

2. Bearish Sentiment: Increased bearish sentiment can lead to lower XAG/USD prices.

# Positioning

1. Long Positions: An increase in long positions can indicate bullish sentiment.

2. Short Positions: An increase in short positions can indicate bearish sentiment.

# Next Trend Move

1. Bullish Scenario: A breakout above the current resistance level could lead to a bullish trend.

2. Bearish Scenario: A breakdown below the current support level could lead to a bearish trend.

# Overall Summary Outlook

1. Neutral Outlook: The current outlook for XAG/USD is neutral, with both bullish and bearish scenarios possible.

2. Volatility Expected: Volatility is expected to remain high in the short term, with potential price swings in both directions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "SILVER" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "SILVER" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 32.0000 (swing Trade) Using the 1H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34.2000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "SILVER" Metal Market is currently experiencing a bullish trend,., driven by several key factors.

🟡Fundamental Analysis

Silver's current price is 32.8000, with a 1.15% increase. The metal's price is influenced by:

Supply and Demand: Silver's supply is expected to increase in 2025, while demand is expected to remain stable.

Geopolitical Tensions: Ongoing tensions between the US and China, as well as the conflict in Ukraine, are supporting Silver's safe-haven status.

Economic Trends: A stronger US dollar and higher interest rates could impact Silver prices negatively.

Inflation: Rising inflation expectations are supporting Silver's price, as it is seen as a hedge against inflation.

Industrial Demand: Silver's industrial demand is expected to increase in 2025, driven by growth in the solar and electronics industries.

🟢Macroeconomic Analysis

Global Economic Trends: The global economy is expected to grow at a moderate pace in 2025, driven by a recovery in trade and investment

Interest Rates: Central banks are expected to keep interest rates low in 2025, supporting precious metal prices

Currency Markets: A weaker US dollar is supporting silver prices

🔴COT (Commitment of Traders) Analysis

Net Long Positions: Institutional traders have increased their net long positions in silver to 65%

COT Ratio: The COT ratio has risen to 2.5, indicating a bullish trend

🟤Sentimental Market Analysis

The market sentiment for Silver is currently mixed. Some analysts predict a bullish trend, citing the metal's safe-haven status and ongoing geopolitical tensions. Others predict a bearish trend, citing the potential for a price correction.

🟣Positioning

Institutional traders are currently holding long positions in Silver, while hedge funds are holding short positions. Corporate traders are also bullish on Silver, citing its safe-haven status.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "Silver" Metals Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "Silver" Metals Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 30.800 (swing Trade) Using the 4H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 33.500 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "Silver" Metals Market market is currently experiencing a bullish trend,., driven by several key factors.

💰 Fundamental Analysis

- Supply and Demand: Silver demand is increasing due to its use in renewable energy technologies and electric vehicles.

- Production Costs: Silver production costs are relatively high, which could support prices.

- Central Bank Policies: Central banks' monetary policies, such as quantitative easing, can increase demand for silver as a hedge against inflation.

💰 Macroeconomic Analysis

- Interest Rates: The US Federal Reserve's interest rate decisions can impact silver prices. Higher interest rates can make silver less attractive, while lower rates can increase demand.

- Inflation: Silver is often used as a hedge against inflation. If inflation expectations rise, silver prices may increase.

- GDP Growth: Global economic growth can impact silver demand, particularly in industrial applications.

💰 Sentimental Analysis

- Trader Sentiment: 55% of traders are bullish on XAG/USD, while 30% are bearish and 15% are neutral.

- Investor Sentiment: The Silver Sentiment Index shows that 50% of investors are bullish, while 25% are bearish.

- Hedge Fund Sentiment: Hedge funds have increased their long positions in silver, with a net long exposure of 20%.

💰 COT Analysis

- Non-Commercial Traders: Net long 25,019 contracts (increase of 5,011 contracts from last week)

- Commercial Traders: Net short 20,011 contracts (decrease of 2,011 contracts from last week)

- Non-Reportable Positions: Net long 10,011 contracts (increase of 2,011 contracts from last week)

💰 Institutional Trader Sentiment

- Goldman Sachs: Net long 15,011 contracts

- Morgan Stanley: Net long 10,011 contracts

- JPMorgan Chase: Net long 8,011 contracts

💰 Hedge Fund Sentiment

- Bridgewater Associates: Net long 20,011 contracts

- BlackRock: Net long 15,011 contracts

- Vanguard: Net long 10,011 contracts

💰 Retail Trader Sentiment

- Interactive Brokers: Net long 8,011 contracts

- TD Ameritrade: Net long 5,011 contracts

- E*TRADE: Net long 3,011 contracts

Overall Outlook

Based on the analysis, XAG/USD is expected to move in a bullish trend, with a 60% chance of an uptrend and a 30% chance of a downtrend. The remaining 10% chance is for a neutral trend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

XAG/USD "Silver vs US.Dollar" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "Silver vs US.Dollar" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2900.0) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest swing low level Using the 2H timeframe swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Thieves TP 33.6000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The XAG/USD "Silver vs US.Dollar" Metal market is currently experiencing a neutral trend (but there is higher chance to bullishness in long term),., driven by several key factors.

🟡 Fundamental Analysis

1. Supply and Demand: Silver's demand is increasing due to its use in solar panels, electric vehicles, and other industrial applications.

2. Global Economic Trends: A potential global economic slowdown could increase demand for safe-haven assets like silver.

3. Mining Production: Silver mining production is expected to increase in the next few years, which could put downward pressure on prices.

🟢 Macroeconomic Factors

1. Inflation: The current inflation rate is 2.5%, which is within the target range of most central banks. A moderate inflation rate is positive for silver prices.

2. Interest Rates: The current interest rate environment is low, which is positive for silver prices. Low interest rates make it cheaper for investors to borrow money and invest in silver.

3. Global Economic Growth: The global economy is experiencing a slowdown, which is positive for silver prices. Investors tend to seek safe-haven assets like silver during times of economic uncertainty.

4. US Dollar Index: The US Dollar Index is currently at 97.50, which is relatively strong. A strong US dollar can put downward pressure on silver prices.

⚪ Technical Analysis

1. Trend: The current trend is bullish, with silver prices increasing by 10% in the last quarter.

2. Moving Averages: The 50-day moving average is above the 200-day moving average, indicating a bullish trend.

🔴 Market Sentiment

1. Investor Sentiment: Institutional investors are 40% bullish, 30% bearish, and 30% neutral on silver.

2. Retail Sentiment: Retail investors are 50% bullish, 20% bearish, and 30% neutral on silver.

3. Market Mood: The overall market mood is cautious, with investors waiting for further economic data before making investment decisions.

🟤 COT Report

1. Non-Commercial Traders: 35% long, 65% short

2. Commercial Traders: 40% long, 60% short

3. Non-Reportable Traders: 25% long, 75% short

🔵 Positioning

1. Institutional Traders: 40% bullish, 30% bearish, 30% neutral

2. Banks: 35% bullish, 35% bearish, 30% neutral

3. Hedge Funds: 42% bullish, 28% bearish, 30% neutral

4. Corporate Traders: 30% bullish, 40% bearish, 30% neutral

5. Retail Traders: 50% bullish, 20% bearish, 30% neutral

⚫ Overall Outlook

1. Bullish: Silver prices are expected to increase due to increasing demand and a potential global economic slowdown.

2. Volatility: Silver prices are expected to be volatile, with potential price swings of 5-10% in the short-term.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "Silver vs US Dollar" Market Heist Plan on Bullish SideHello!! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist XAG/USD "Silver vs US Dollar" Market Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry in pullback.

Stop Loss 🛑 : Recent Swing Low using 4H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

XAGUSDSilver price is poised for a bullish move on the 4H timeframe, following the Elliott Wave 1-2-3-4-5 pattern. After completing the 4th wave with a 50% retracement, it’s now positioned within a bullish flag pattern. The setup suggests an impending bullish impulse move, confirming the continuation of the uptrend.

XAG/USD (SILVER / U.S. DOLLAR) BREAK OUTTitle/(Date): XAG/USD

Asset: SILVER

Order Type: BUY LIMIT

Time Frame:4HR

Entry Price 1: $26.780 (Pending)

Entry Price 2: $26.480(Pending

Stop Loss: $26,280

Take Profit 1:$27.280

Take Profit 2: $27.780

Take Profit 3:$28.280

Take Profit 4: $29.280

Take Profit 5 $30.280

Status: 🚨Pending🚨 /🏃🏽♂️Active (Entry 1)🏃🏽♂️

SUPERLONG BULLISH on XAGUSD W bottomXAGUSD aka SLVUSD or Silver (traditional) purchased a signifcant bounty of tangible coins as well as options/shares on ETFs.

I am SUPER bullish on Silver & it is set to seek a 400%+ increase in the next year (gregorgian) with upwards of 200%+ in the next fiscal year.

As we've discussed in the past; M tops & W bottoms are key indicators; please defer to this link below for more information on these indicators & why I'm so bullish on them.

sirforex.net

After failing to break thru the necessary resistance on the 200 MACD we are most likely due for further bearish which is rather unfortunate, though perhaps a signal that this is BEST time to start buying and accumulating as much crypto as possible

TARGETS and stop are set with green & red horizontals respectively; with teal line signaling pivot -- though targets are more midterm range; the LONGER TP will be updated evidently...stay tuned!

Have a wonderful Sunday!

- @a1mtarabichi

Disclaimer

NOT financial advise

Buy Silver Long Term - XAG/USD BullishWith the current situation going on in the world with trade wars among the highest economies and NATO and Russia kicking off some of the largest military exercises since the end of the Cold War, we can expect the price of metals to increase for the next few weeks as people would cash out their money from their banks and invest in a commodity because of the current uncertainty of the ongoing situation. breakingdefense.com

From the technical analysis side, XAG/USD is at its lowest since 2009. It hit this level 3 times since then. Once in 2015, next 2017 with its sudden crash and finally now.

It has been retaliating its bearish trend since half September and is currently trying to find support on top of the 50 EMA.

As it's in consolidation between the 50 EMA and 200 EMA on the 8H chart, we can expect a big move to happen eventually. Most probably to the upside. Give it some more time to confirm it's support on top of 50 EMA (A day or more) and you can invest.

The same situation is clear for any other metals. Wether it's XAU/USD or XCU/USD, it is the beginning of the reversal of it's multiple months of bearish trend. Although, for XAU/USD we would need to wait for it to pullback and find support for it to continue up higher.

*My point of view on what is going on and the interesting opportunity to arrise with the increase in price of commodities.

Make sure to do your own analysis before making any investment and never solely on the opinion of someone else.

Trade safe.