"XAG/USD: Pirate’s Treasure Trade! Bullish & Loaded"🚨 SILVER HEIST ALERT! 🚨 XAG/USD Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

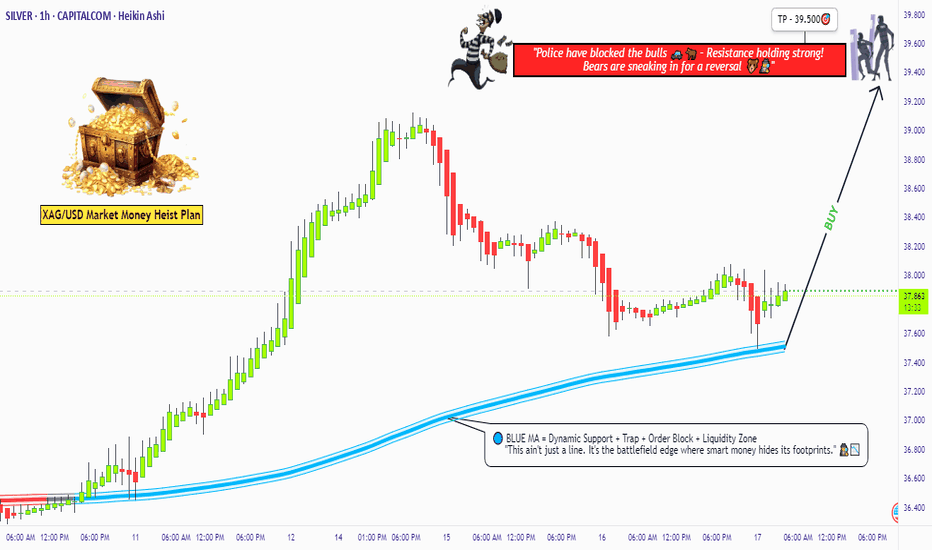

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on XAG/USD ("The Silver Market"). Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 36.900 (Nearest 1H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 39.500 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why Silver? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, COT data, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

#XAGUSD #SilverHeist #ThiefTrading #ProfitPirates #TradingViewAlerts

(🔔 Stay tuned for the next heist!) 🚀🤫

Xagusdprediction

"XAG/USD: BULL FLAG FORMING? LAST CHANCE TO JUMP IN!"🔥 XAG/USD "SILVER RAID" – Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

Based on the 🚨Thief Trading Style🚨 (a ruthless mix of technicals + fundamentals), we’re plotting a day/swing trade heist on XAG/USD (Silver). Our mission? Loot bullish gains before hitting the police barricade (resistance zone). Stay sharp—this is a high-risk, high-reward escape plan with overbought signals and bearish traps lurking!

📜 THE HEIST BLUEPRINT

🎯 Entry (Bullish Swipe):

"Vault is OPEN!" – Long at any price, but for smarter thieves:

Buy limit orders near swing lows/highs (15m-30m TF).

DCA/Layering strategy: Spread entries like a pro bandit.

🛑 Stop Loss (Escape Route):

Nearest swing low/high (1H candle body/wick) → 36.700 (adjust based on risk & lot size).

Risk management is key! Don’t get caught by the market cops.

🏴☠️ Take Profit (Escape Before Handcuffs!):

First Target: 38.500 (or bail earlier if momentum fades).

Scalpers: Only play LONG! Use trailing SL to lock profits.

💡 WHY THIS HEIST? (Market Drivers)

Bullish momentum in Silver (XAG/USD) fueled by:

Macro trends (COT report, sentiment shifts).

Intermarket moves (Gold correlation, USD weakness).

Potential breakout from consolidation.

⚠️ News Risk: Major releases can trigger volatility—avoid new trades during high-impact events!

🚨 THIEF'S PRO TIPS

✅ Trailing SL = Your getaway car.

✅ Small accounts? Ride the swing traders’ coattails.

✅ Big wallets? Go full-throttle.

✅ Boost this idea 💥 to strengthen our robbery squad!

📌 DISCLAIMER (Stay Out of Jail!)

Not financial advice! DYOR, manage risk, and adapt to market changes.

Silver is volatile—trade smart, not greedy.

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🕵️♂️

🔗 Want the Full Intel?

Check the fundamentals, COT reports, and intermarket analysis for deeper clues! (Klick the 🔗🔗).

💬 Drop a comment if you’re joining the heist! 👇

Trade idea: XAGUSD long (BUY LIMIT)1. Technical Analysis Summary:

Daily Chart (Long-Term Trend)

• Trend: Strong bullish structure, recent consolidation after breakout above $30.

• MACD: Histogram tapering but still positive — momentum cooling but bullish bias intact.

• RSI (48.70): Neutral zone, not overbought or oversold — room for upside continuation.

• Price Action: Holding near previous resistance-turned-support around $32.40.

15-Min Chart (Intraday Context)

• Trend: Pullback from recent highs, but signs of base forming near $32.40.

• MACD: Still bearish, but histogram is flattening — suggesting downside momentum weakening.

• RSI (42.98): Near oversold territory — early sign of bounce potential.

3-Min Chart (Entry Timing)

• MACD: Just flipped bullish (signal line crossover), bullish divergence spotted.

• RSI (61.34): Rebounding strongly — confirmation of short-term bullish momentum.

• Price Action: Higher lows forming; reclaiming the 20 EMA.

⸻

2. Fundamental Backdrop (as of May 2025):

• Dovish Fed stance and expectations of interest rate cuts continue to support metals.

• Global macro uncertainty (inflation, geopolitical tensions) keeps demand for silver intact.

• Industrial demand for silver remains strong due to green energy initiatives.

⸻

3. Trade Setup (Long Position):

Bias: LONG XAGUSD

• Entry: 32.43 (current price, confirming breakout on 3M chart)

• Stop Loss (SL): 31.90 (below recent intraday low and structure support)

• Take Profit (TP): 33.80 (previous swing high from April, daily resistance zone)

FUSIONMARKETS:XAGUSD

SILVER BEST BUYING ZONE !!!!HELLO TRADERS

As I can see Silver is testing now a strong support level which is a great entry zone for buying here. Silver is still not moved as like gold and other commodities has done, we expected this pair will move till design levels and this is a best zone with a very low risk and higher rewards let's see what markets bring to us. Charts always talk......

Share Ur views with us on Silver chart it help all of us Stay Tuned for more updates.