XAGUSD: Correction May Be Over – Watch $37.60 BreakoutAfter reaching a local top around the $39.50 zone on July 24, Silver entered a normal corrective phase, with price dropping over 3,000 pips from top to bottom — roughly an 8% retracement.

📉 Despite the strength of the drop, the structure was clearly corrective, not impulsive. Even more, the move formed a descending broadening wedge, a pattern that often hints at a potential reversal.

📈 Yesterday, we saw a clean breakout above the wedge’s upper boundary — which may signal the end of the correction.

At the time of writing, price is trading at $37.45, right under a key horizontal resistance zone between $37.50 and $37.60.

A breakout above this level would confirm the low and likely initiate a new move toward the $38.70 resistance.

________________________________________

🎯 Summary & Plan:

• A break above $37.60 = bullish confirmation

• Target: $38.70 (first resistance)

• Invalidation: If price drops below $37, bulls lose control

As long as price holds above the $37 zone, the technical outlook remains constructive, and traders could consider setups aligned with the upside scenario. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Xagusdsignals

XAGUSD Technical Outlook (Silver/USD)Currently, Silver is trading inside a symmetrical triangle formation , signaling a potential breakout.

Upside Scenario:

A breakout above 36.80 resistance may trigger strong bullish momentum. The next target zone lies at 37.18 – 37.30, which is a relatively weak resistance and could potentially form a Head and Shoulders pattern . If momentum continues, Silver could extend gains toward 37.75 and 38.00 resistance levels.

Downside Scenario:

If the triangle breaks to the downside, we may see a short corrective move toward 3 6.25 – 36.20 support zone before any possible rebound.

Overall, the chart structure currently favors an upside breakout with continuation toward higher resistance zones.

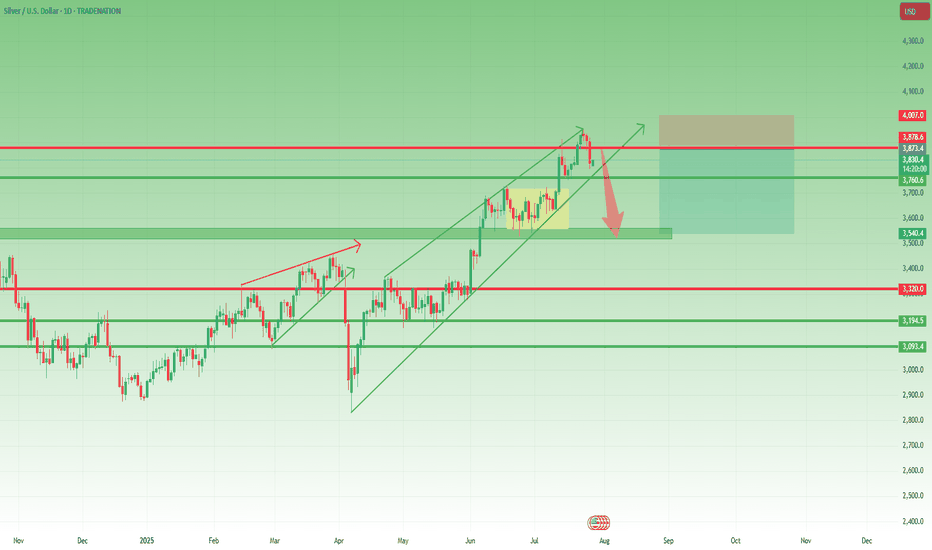

XAGUSD – Reversal Signs After the Run Toward $40Lately, I’ve been a strong advocate for a Silver rally toward $40, and indeed, we got a solid move, with price reaching as high as $39.50, not touching 40 though...

Just like with Gold, the last 3 days of last week turned bearish, and now it looks like we may be entering the early stage of a correction.

📉 Current Setup:

- The rejection from $39.50, right below the psychological $40 level, is significant

- I’ll be monitoring for a possible short entry if we get a rebound into the $38.80–$39.00 zone

- A new high above $39.50 would invalidate this setup

📌 On the downside, if price breaks below the confluence support at $37.70–$38.00, that would confirm the reversal and could lead to an acceleration toward $35.50 support

Conclusion:

The bullish narrative on Silver is pausing here. Until a new high is made, I’m looking to sell the bounce and follow the momentum if the breakdown under support is confirmed.

Let’s see how this plays out this week. 🧭

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

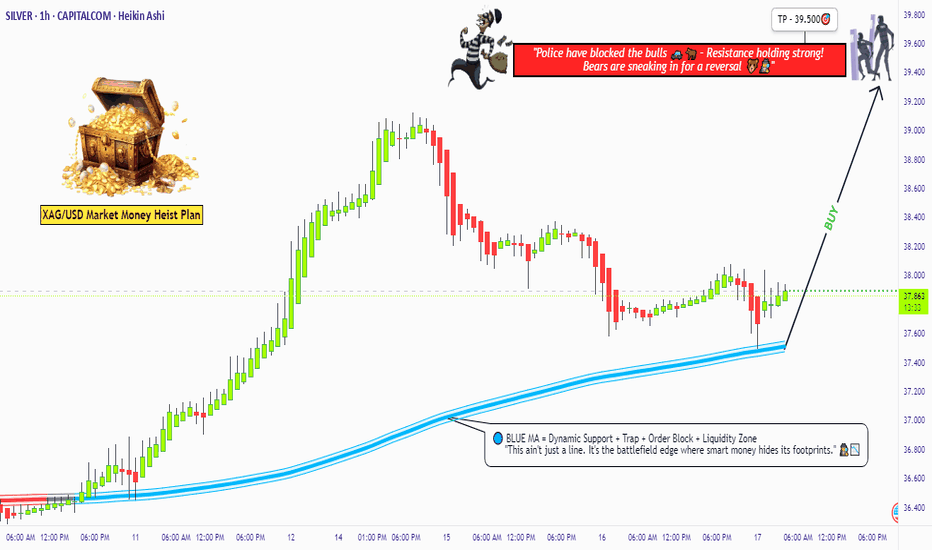

"XAG/USD: Pirate’s Treasure Trade! Bullish & Loaded"🚨 SILVER HEIST ALERT! 🚨 XAG/USD Bullish Raid Plan (Thief Trading Style) 💰🎯

🌟 Attention Market Pirates & Profit Raiders! 🌟

🔥 Thief Trading Strategy Activated! 🔥

📌 Mission Brief:

Based on our elite Thief Trading analysis (technical + fundamental heist intel), we’re plotting a bullish robbery on XAG/USD ("The Silver Market"). Our goal? Loot profits near the high-risk resistance zone before the "Police Barricade" (bear traps & reversals) kicks in!

🚨 Trade Setup (Day/Swing Heist Plan):

Entry (📈): "The vault is open! Swipe bullish loot at any price!"

Pro Tip: Use buy limits near 15M/30M swing lows for safer pullback entries.

Advanced Thief Move: Layer multiple DCA limit orders for maximum stealth.

Stop Loss (🛑): 36.900 (Nearest 1H candle body swing low). Adjust based on your risk tolerance & lot size!

Target (🎯): 39.500 (or escape early if the market turns risky!).

⚡ Scalper’s Quick Loot Guide:

Only scalp LONG!

Rich thieves? Go all-in! Broke thieves? Join swing traders & execute the plan slowly.

Use trailing SL to lock profits & escape safely!

💎 Why Silver? (Fundamental Heist Intel)

✅ Bullish momentum in play!

✅ Macro trends, COT data, & intermarket signals favor upside!

✅ News-driven volatility? Expect big moves!

⚠️ WARNING: Market Cops (News Events) Ahead!

Avoid new trades during high-impact news!

Trailing stops = Your best escape tool!

💥 BOOST THIS HEIST!

👉 Hit LIKE & FOLLOW to strengthen our robbery squad! More lucrative heists coming soon! 🚀💰

🎯 Final Note: This is NOT financial advice—just a thief’s masterplan! Adjust based on your risk & strategy!

🔥 Ready to Raid? Let’s STEAL Some Profits! 🏴☠️💸

👇 Drop a comment & boost the plan! 👇

#XAGUSD #SilverHeist #ThiefTrading #ProfitPirates #TradingViewAlerts

(🔔 Stay tuned for the next heist!) 🚀🤫

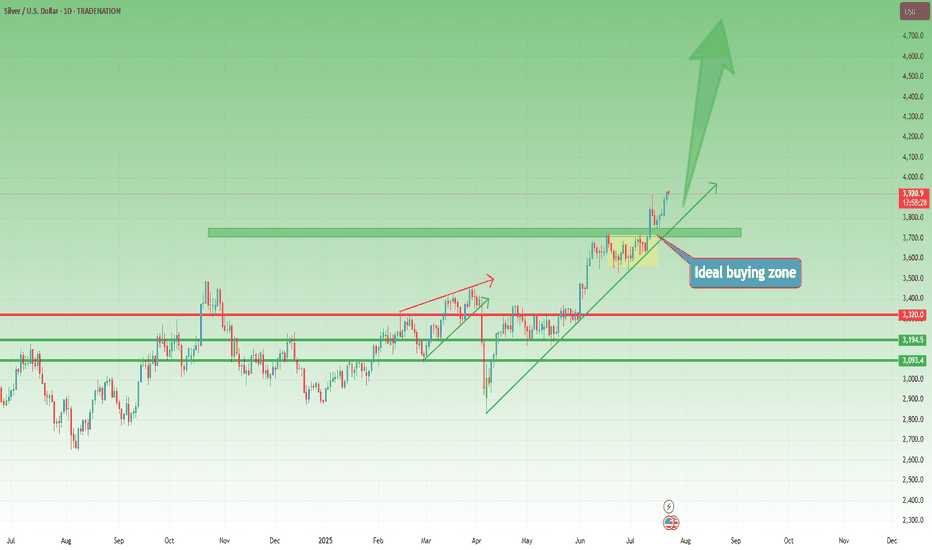

XAGUSD Outlook – 40 Remains the Next TargetIn my previous XAGUSD analysis, I argued that the trend was strongly bullish and that a move toward 40 was the next logical outcome. At the time, price was correcting, and I highlighted the 37.50 zone as a key area to look for long opportunities.

✅ Indeed, Silver respected that zone perfectly —

It retested the broken consolidation, found support, and then surged higher, marking a new multi-year high in yesterday’s session.

________________________________________

🔍 What Now?

Nothing has changed in the broader view:

• Trend: Strongly bullish

• Structure: Higher highs and higher lows remain intact

• Behavior: Dips are being bought aggressively

As long as the recent 37.50 low is not broken, the strategy remains straightforward:

Buy dips within bullish continuation

________________________________________

🎯 40 in Sight — But Don’t Be Surprised if It Goes Further

The 40 zone remains the natural next target — a major psychological level.

But based on current momentum and breakout strength, Silver could go even higher in the coming weeks and months. If buyers keep control, we might even see new ATH test by year's end (50 zone).

________________________________________

🟢 Conclusion

This breakout confirms the larger trend.

The pullback to 37.50 was bought, as expected, and now Silver is making its move.

Strategy should remain the same:

Stay long above 37.50

Buy the dips

Watch how price reacts near 40 — but keep an open mind for higher levels

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAGUSD(SILVER):To $60 the silver is new gold, most undervaluedSilver has shown remarkable bullish behaviour and momentum, in contrast to gold’s recent decline. Despite recent news, silver remains bullish and unaffected by these developments. We anticipate that silver will reach a record high by the end of the year, potentially reaching $60.

There are compelling reasons why we believe silver will be more valuable in the coming years, if not months. Firstly, the current price of silver at 36.04 makes it the most cost-effective investment option compared to gold. This presents an attractive opportunity for retail traders, as gold may not be suitable for everyone due to its nature and price.

Silver’s price has increased from 28.47 to 36.25, indicating its potential to reach $60 in the near future. We strongly recommend conducting your own analysis before making any trading or investment decisions. Please note that this analysis is solely our opinion and does not guarantee the price or future prospects of silver.

We appreciate your positive feedback and comments, which encourage us to provide further analysis. Your continuous support over the years means a lot to us.

We wish you a pleasant weekend.

Best regards,

Team Setupsfx

Silver Update (XAGUSD): Eyeing the Next Move After the $39 SurgeAs mentioned in my Friday analysis, Silver ( TRADENATION:EURUSD XAGUSD) was preparing for an important breakout — and indeed, the market delivered. The clean break through resistance triggered a strong acceleration, pushing the metal up to $39, pretty close to the psychological $40 level.

Now, we’re seeing a healthy correction after this steep rise, and this could turn into a buying opportunity for the bulls.

📌 Key support zone:

The ideal area to watch is between $37.20 and $37.50 — this is the sweet spot where bulls might step back in.

But be aware:

👉 After strong breakouts, the broken resistance doesn’t always get retested — sometimes the price rebounds from higher levels.

🎯 Plan of Action:

• Monitor price action under $38

• Watch for reaction patterns and structure shifts

• Don’t force entries — let the market confirm

Silver remains strong as long as the structure holds, and this pullback might just be the market catching its breath before another leg up. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Silver (XAG/USD) Bullish Trade Setup from Key Support ZoneXAG/USD (Silver) Trade Analysis – 2H Chart (July 2, 2025)

🔹 Trade Setup Overview:

Entry Point: 35.84299

Target (TP): 37.32540

Stop Loss (SL): 35.59483

Current Price: 36.36350

Risk/Reward Ratio: ~5.9:1 (Very favorable)

🔹 Technical Insights:

Support Zone:

Price recently tested and respected a strong demand zone between 35.60 – 35.84, which has now acted as a bounce level.

Multiple wicks and rejections at this zone highlight buyer interest.

Moving Averages:

50 EMA (red) is starting to flatten, possibly hinting at momentum reversal.

200 EMA (blue) held as dynamic support during the last dip — a bullish signal.

Breakout Potential:

Price has bounced off the entry zone and is approaching minor resistance near 36.40–36.60.

A clean break above this area can trigger momentum toward the 37.30s.

Volume & Momentum:

The latest candle shows strong bullish momentum, validating the bounce setup.

No sign of exhaustion yet.

🔹 Strategy Suggestion:

Entry has already occurred or is slightly above entry zone — ideal for aggressive traders to ride the momentum.

Conservative traders may wait for a pullback near 36.00–36.10 before entering.

SL is well-placed below previous lows and structure — reasonable protection.

🔹 Conclusion:

This setup reflects a bullish continuation trade from a strong support zone. Given the risk/reward profile and recent bullish action, this trade is technically sound as long as price stays above 35.84. A close below this level could invalidate the setup

Silver Analysis – Strong Bulls and a Clean Setup AheadLast month, Silver printed a new multi-decade high, a major technical milestone.

Since then, price has entered a sideways consolidation, forming a rectangle — but what stands out is this:

👉 Silver bulls have absorbed every dip, even when Gold dropped.

That’s strength. And strength usually precedes breakout.

🔍 Current Situation

At the time of writing, price is trading around 37.20,

and from the current structure, it looks like nothing is standing in the way of an upside break.

We don’t predict — we prepare...

And this chart looks ready.

🎯 Next Target: 40.00 USD?

A push to 40.00 looks like the next “normal” target.

But don’t forget: that’s a 3,000 pip move.

This type of move will require patience

Plan your trade.

Respect your risk.

Let the bulls work. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

"XAG/USD: BULL FLAG FORMING? LAST CHANCE TO JUMP IN!"🔥 XAG/USD "SILVER RAID" – Bullish Loot Grab Before the Cops Arrive! 🚨💰

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

Based on the 🚨Thief Trading Style🚨 (a ruthless mix of technicals + fundamentals), we’re plotting a day/swing trade heist on XAG/USD (Silver). Our mission? Loot bullish gains before hitting the police barricade (resistance zone). Stay sharp—this is a high-risk, high-reward escape plan with overbought signals and bearish traps lurking!

📜 THE HEIST BLUEPRINT

🎯 Entry (Bullish Swipe):

"Vault is OPEN!" – Long at any price, but for smarter thieves:

Buy limit orders near swing lows/highs (15m-30m TF).

DCA/Layering strategy: Spread entries like a pro bandit.

🛑 Stop Loss (Escape Route):

Nearest swing low/high (1H candle body/wick) → 36.700 (adjust based on risk & lot size).

Risk management is key! Don’t get caught by the market cops.

🏴☠️ Take Profit (Escape Before Handcuffs!):

First Target: 38.500 (or bail earlier if momentum fades).

Scalpers: Only play LONG! Use trailing SL to lock profits.

💡 WHY THIS HEIST? (Market Drivers)

Bullish momentum in Silver (XAG/USD) fueled by:

Macro trends (COT report, sentiment shifts).

Intermarket moves (Gold correlation, USD weakness).

Potential breakout from consolidation.

⚠️ News Risk: Major releases can trigger volatility—avoid new trades during high-impact events!

🚨 THIEF'S PRO TIPS

✅ Trailing SL = Your getaway car.

✅ Small accounts? Ride the swing traders’ coattails.

✅ Big wallets? Go full-throttle.

✅ Boost this idea 💥 to strengthen our robbery squad!

📌 DISCLAIMER (Stay Out of Jail!)

Not financial advice! DYOR, manage risk, and adapt to market changes.

Silver is volatile—trade smart, not greedy.

🤑 NEXT HEIST COMING SOON… STAY TUNED! 🕵️♂️

🔗 Want the Full Intel?

Check the fundamentals, COT reports, and intermarket analysis for deeper clues! (Klick the 🔗🔗).

💬 Drop a comment if you’re joining the heist! 👇

“Can This XAG/USD Setup Make You the Next Market Thief?”🏴☠️ Operation Silver Swipe — Thief Trading Heist Plan for XAG/USD

🚨 Target Locked: The Silver Vault 🧳🎯

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Hustlers & Chart Whisperers, 🕵️♂️💼📉💰

Step into the shadows with our stealth plan based on our signature Thief Trading Style—a mix of smart technicals and crafty fundamentals. Today, we’re eyeing XAG/USD (Silver) for a clean sweep. Here's how to gear up for the breakout job:

🎯 Entry Zone — “The Heist Is On!” 💥

📍Key Level: Break & Retest above 37.000 – that's your cue to act.

🔑Strategy:

Buy Stop Orders: Set above the breakout level

Buy Limit Orders: Use recent 15/30M swings for a sneaky pullback entry 🎯

🛑 Stop Loss — “Every Thief Has a Backup Plan” 🎭

Place your SL like a pro, not a panic button!

📌Recommended: Around 35.660 using the 4H nearest candle wick swing low place after the breakout entry.

⚠️Tip: Adjust based on your risk appetite, lot size, and number of entries. You’re the mastermind, not a minion.

🎯 Target — “Escape Route” 🏃♂️💸

📌 First checkpoint: 38.800

📌 Or take your loot early if the heat rises! (Overbought zones, trend traps, or reversal zones)

💡 Scalper's Shortcut 💡

Go only long for safety. If you’ve got the cash stack, jump in fast. If you’re more of a sneaky swing trader, follow the roadmap and trail your SL to secure that bag 🧳📈

🔍 Market Status

Silver’s in a Neutral Phase – but signs point to an upward getaway 🚀

Fueling this momentum:

Macro & Fundamental trends

COT Positioning

Intermarket Clues

Sentimental Signals

🔗 Read the full breakdown check there 👉🔗🔗🌏🌎!

📢 Trading Alert — News Release Caution ⚠️

Don’t get caught mid-escape during news bombs! 💣

✅ Avoid fresh entries during high-impact events

✅ Use trailing SL to lock in your gains and cover your tracks

💖 Smash the Boost Button if you vibe with this plan 💥

Support the crew and help keep the charts hot and the loot flowing. Your boost powers up our next big heist 🚁🔥

📡 Stay tuned for more street-smart setups... we rob the charts, not the rules! 🐱👤💸📊💎

SILVER (XAGUSD): Correction is Over?!

It looks like Silver has finally completed a consolidation within

a wide horizontal parallel channel on a daily.

A new higher high formation today indicates coming growth.

Because if its Friday, I suggest looking for trend-following buy from Monday.

Let the market close above the underlined resistance to let it set a Higher Close

as well.

Look for buying after a pullback, aiming at 38.0 as the first goal.

❤️Please, support my work with like, thank you!❤️

XAGUSD Strong accumulation waiting for a break-out. Silver (XAGUSD) has been trading within a 3-month Channel Up pattern and since the June 18 Higher High, it has entered a Descending Triangle.

This has previous been an Accumulation pattern, which after broken to the upside, it led to June's High. Similarly, we expect a bullish break-out once the 4H RSI breaks above its MA, and as long as the 4H MA200 (orange trend-line) holds, we expect a +15.50% minimum rise (like the first Bullish Leg of the Channel Up), with our Target se at 40.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XAGUSD – Bullish Setup for a Move Toward 40 1. What happened recently

After the massive selloff in early April, Silver (XAGUSD) reversed aggressively — gaining nearly 10,000 pips and breaking into multi-decade highs near 38. That kind of move is not noise. It’s power.

The month of June brought consolidation, with price slowly correcting and stabilizing. But this doesn’t look like distribution — it looks like new accumulation.

2. The key question

Is Silver building a base for the next breakout, or has the rally run out of steam?

3. Why I expect another leg up

- 35.00 is now acting as a solid support — tested, respected

- The correction has been shallow, typical for a bull rectangle structure

- Momentum remains on the buyers’ side — no major breakdown signs

- If buyers step in strongly, the next target is clearly the 40.00 psychological level

- This is a textbook bullish continuation setup.

4. Trading plan

Swing traders should watch the 35.00–35.20 zone for buying opportunities.

The risk/reward is attractive — with a potential for +5000 pips on a move toward 40, while keeping stops under the base.

Buy the dips — not the breakouts.

5. Final thoughts 🚀

Silver is shining again. The trend is up, the structure supports further gains, and the chart is offering a clean setup. Until 35 fails, the bias remains bullish.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

SILVER (XAGUSD): Buyers Show Strength

Silver is going to rise more, following a strong bullish sentiment this morning.

The price violated a strong falling trend line and an intraday horizontal resistance.

These 2 breakouts indicate a strong buying pressure.

The price may grow more today and reach 37.14 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

XAG/USD (Silver) Monthly Analysis – Major Resistance Test Incomi🔍 XAG/USD (Silver) Monthly Analysis – Major Resistance Test Incoming 💥🪙

📊 Overview:

This monthly chart of XAG/USD (Silver vs. US Dollar) reveals a critical technical juncture, where price action is testing a multi-year resistance-turned-support zone around $36.27. The chart is structured with major zones of support and resistance, and it includes a potential bullish extension followed by a bearish correction scenario.

📌 Key Technical Levels:

🟧 Support Zone: $22.50 – $24.00

🟨 Resistance-Turned-Support Zone: $34.00 – $36.50

🟪 Major Resistance: $43.60 – $48.80

🔼 Bullish Scenario (Preferred Path):

Current Price: ~$36.27 is at the upper edge of a crucial S/R flip zone.

📈 A breakout above this zone could propel silver toward the next resistance target at $43.60, with a potential full extension to $48.80.

✨ Momentum and historical breakout behavior from this region suggest strong buying interest if breached convincingly.

🔽 Bearish Scenario (Rejection Path):

🔄 If silver faces rejection at the $36.27 zone, it may retrace towards:

🟥 $28.31 minor support (intermediate target),

🔻 followed by a deeper correction to the $22.50–$24.00 support zone.

🔁 This would complete a classic retest of broken support, allowing accumulation before any further long-term rally.

🧠 Strategic Notes:

⚠️ Macro-driven: Silver is highly sensitive to inflation, Fed policy, and industrial demand.

📅 Long-term chart suggests cyclical behavior, with consolidation phases followed by aggressive trends.

📌 Traders should monitor weekly closes around $36.27 to confirm breakout or rejection.

✅ Conclusion:

Silver is at a make-or-break zone 🧨. A breakout may lead to a multi-year high, but failure here opens the door for a healthy pullback. The next few candles will be decisive for long-term positioning.

📉 Watch for rejection wicks at resistance

📈 Monitor volume on breakout attempts

📊 Plan for both outcomes: breakout or retest

Psst… Wanna Rob the Silver Market? XAG/USD Trade Inside!"🔥 "SILVER HEIST ALERT! 🚨 XAG/USD Bullish Raid Plan (Thief Trading Style)" 🔥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Money Makers & Market Robbers! 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting a heist on XAG/USD "The Silver" Market. Follow the strategy on the chart—LONG ENTRY is key! Aim to escape near the high-risk Red Zone (overbought, consolidation, bear traps). 🏆 Take profits & treat yourself—you’ve earned it! 💪🎉

📈 ENTRY: "The Heist Begins!"

Wait for MA breakout (33.700)—then strike! Bullish profits await.

Options:

Buy Stop above Moving Average OR

Buy Limit near pullback zones (15-30min timeframe, swing lows/highs).

📌 Pro Tip: Set an ALERT for breakout confirmation!

🛑 STOP LOSS: "Listen Up, Thieves!"

For Buy Stop Orders: DO NOT set SL until after breakout!

Place SL at recent/swing low (4H timeframe)—adjust based on your risk, lot size, & order count.

Rebels, be warned: Set it wherever, but you’re playing with fire! 🔥⚡

🏴☠️ TARGET: 34.700

Scalpers: Only trade LONG. Use trailing SL to protect gains.

Swing Traders: Join the robbery squad & ride the trend!

📰 FUNDAMENTAL BACKUP:

Bullish drivers in play! Check:

Macro trends, COT reports, sentiment, intermarket analysis.

🔗 Linkks in bio/chart for deep dive.

⚠️ TRADING ALERTS:

News = Volatility! Avoid new trades during releases.

Lock profits with trailing stops. Stay sharp!

💥 BOOST THE HEIST!

Hit 👍 "LIKE" & "BOOST" to fuel our robbery team!

More heists coming—stay tuned! 🚀🤩

🎯 Let’s steal the market’s money—Thief Trading Style! 🏆💵

SILVER (XAGUSD): Where is the Next Resistance?!

What a rally on Silver this week.

The market easily violated a resistance cluster

based on the last year high.

Analyzing a historic price action, the next strong resistance

that I found is around 37.4

It is based on an important high of 2012.

That can be the next mid-term goal for the buyers.

❤️Please, support my work with like, thank you!❤️

Precision Pays Off: Learn, Trade, Win — Results Speak Louder🎯 Analysis On Point Again!

My recent analysis played out exactly as expected. 📉📈 Those who followed my instructions not only gained profits but also improved their trading knowledge and decision-making skills.

Success in trading isn't just about luck — it's about learning to read the market with precision and discipline. 📚💡

To those who’ve been riding along — congratulations on your gains! 🥂 And to the new followers, stay tuned. The next winning setups are just around the corner.

Let’s grow, learn, and earn — together. 🚀💸

Silver Consolidates After Huge Drop – Breakout Ahead?At the beginning of April, XAGUSD experienced a dramatic decline, losing over 5,000 pips in just three trading days — a drop of more than 15% of its value.

However, after bottoming out on Monday, April 7, the price staged a sharp rebound and, within a week, was back around the 33.00 level.

📉➡️📈 From Panic to Pause – What’s Next?

For more than a month now, Silver has been trading in a tight range, between just under 32.00 and slightly above 33.00.

This consolidation forms a rectangle pattern, which is typically a continuation structure in technical analysis.

With this in mind, I expect further upside from Silver. A clean breakout above the current range could send the price toward the 35.00 zone — and possibly beyond this psychological level.

📊 Trading Plan:

As long as the 32.00 support holds, I remain bullish and will look to buy dips, aiming for a positive risk-reward setup, ideally around 1:2.

🧠 Consolidation breeds momentum — don’t sleep on Silver. If the genuine breakout comes, it could be explosive. 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

XAG/USD Rejection Looming at Key Resistance – Bearish Reversal 🔍 Chart Analysis – XAG/USD

1. Trend & EMAs:

The chart shows two key exponential moving averages:

📈 EMA 50 (Red): 33.1940

📉 EMA 200 (Blue): 32.8684

Price is currently above both EMAs, indicating a short-term bullish trend, but a possible bearish rejection is forming near resistance.

2. Key Zones:

🟥 Resistance Zone: 33.45 – 33.60

Price has repeatedly tested this zone and reversed, suggesting strong selling pressure.

Multiple wicks into this zone show buyer exhaustion.

🟩 Support Zone: 32.60 – 32.85

Strong demand observed here with consistent bounces.

The EMA 200 also aligns with this support, reinforcing its strength.

3. Price Behavior & Pattern:

🧱 Repetitive Bearish Drops: Marked by blue rectangles, suggesting a pattern of sharp sell-offs after touching resistance.

🔁 Potential Double Top Pattern forming near the resistance zone, a classic bearish reversal signal.

🧭 The projected path suggests:

A short-term retest of the resistance.

Followed by a pullback toward the support zone around 32.60.

Breakdown below support could open further downside potential.

📌 Summary:

⚠️ Short-Term Outlook: Bearish bias if resistance holds.

📍 Key Level to Watch: 33.60 (breakout) and 32.60 (breakdown).

🔄 Trade Plan:

Consider short entries near 33.45–33.60 resistance zone with stops above 33.65.

Target around 32.65–32.60 support zone.

📊 Indicators in Play:

EMA confluence supports trend analysis.

Price structure and rejection patterns suggest likely mean reversion to support.

“Silver on the Edge – Is Wave 5 Loading?”📈 This daily analysis of Silver (XAGUSD) begins from the impulsive move starting in September 2022 at $17.535. Based on Elliott Wave Theory, the market appears to be entering the early stages of a potential Wave 5.

🔹 **Conservative Scenario:** Wave (2) within Wave 5 may be developing. As long as price holds above the 23.6%–50% Fibonacci retracement zone ($31.674 – $29.556), we expect Wave 3 of 5 to launch toward the $37.60 – $41.94 targets.

🔹 **Aggressive Scenario:** If the correction has already completed, Wave 3 of 5 might be underway. Any corrective pullback can be viewed as a continuation opportunity within the bullish trend.

🔻 **Invalidation Levels:**

▫️ First: $31.674

▫️ Second: $27.942

As long as price remains above these levels, the bullish count stays valid.

📌 The current wave structure remains aligned with the bullish channel, supporting further upside potential into Wave 5.

– Patterns whisper. I listen.

– Mr. Nobody 🎧📊

XAGUSD[SILVER] : A Start Of Swing Sell, Comment Your Views?Silver is currently consolidating in the daily timeframe, with no clear indication of where the price may move forward. Looking at the volume of the last few days or week’s candles, we can confirm that a swing sell could be imminent in the market. Fundamentals and technical data support this view, as well as our own trading experience.

This analysis predicts the future price of the XAGUSD (SILVER) but does not guarantee that the price will move exactly as described.

However, we want to emphasise that this analysis should be used for educational purposes only and should not be considered as a secondary bias.

We would love to hear your thoughts on this idea.

Additionally, please remember to like, comment, and share the idea to encourage us to bring you more trading ideas!

Much love ❤️

Team Setupsfx_