XAGUSD Silver: Navigating Transition from Rally to Correction.Technical Analysis: XAGUSD (Silver)

📈 Silver (XAGUSD) is displaying bullish momentum following a significant rally. The precious metal has pushed into higher territory, creating an overextended condition on the price chart.

💹 Currently trading at a premium level, Silver appears ripe for a potential retracement. This elevated positioning suggests buyers may be exhausting their momentum, creating favorable conditions for a corrective move.

🔄 From a Wyckoff perspective, we're observing a classic distribution pattern with price action ranging sideways after the strong upward move. This horizontal consolidation often precedes a change in direction, as smart money potentially distributes positions to retail traders at these premium levels.

⚠️ Particularly noteworthy is the potential for a spring formation. If price breaks below the current range only to reverse sharply higher, this false breakdown could trap shorts and fuel further upside momentum. Conversely, a decisive break below market structure could confirm distribution is complete.

🎯 Trade Idea: Monitor the 30-minute timeframe for a clear break of market structure to the downside. Such a breakdown following this sideways ranging behavior would align with Wyckoff distribution principles and could signal the beginning of a more substantial correction.

🔍 Entry on confirmation of the breakdown with targets at key support levels would provide a measured approach to capitalizing on the potential reversal from these premium prices.

Xagusdtrade

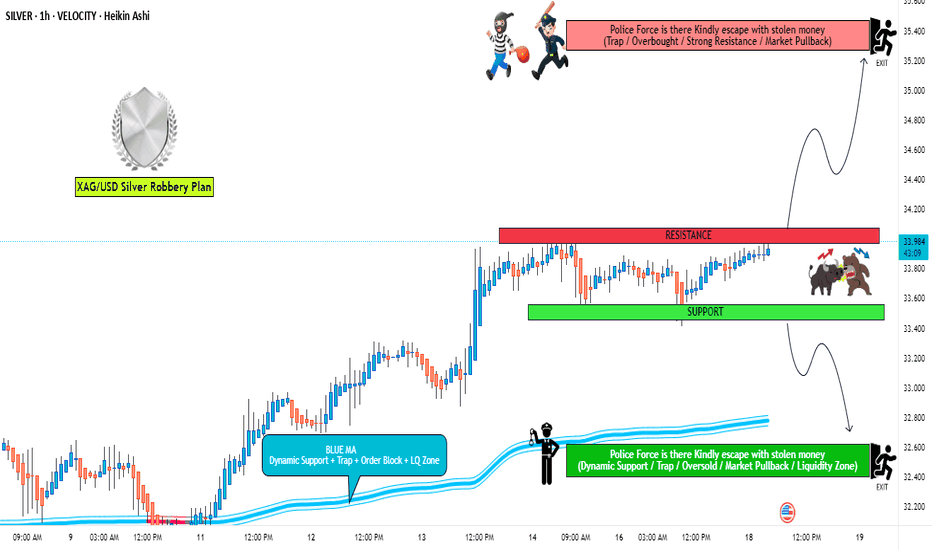

XAG/USD "The Silver" Metals Market Heist Plan (Scalping/Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metals Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (32.800) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (31.700) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 33.900 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸XAG/USD "The Silver" Metals Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets... go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAGUSD Trade Plan: 1D Support, Liquidity Grab, & Bullish Setup!Silver (XAGUSD) is currently exhibiting signs of being overextended, as evidenced by its recent price action on the daily and 4-hour timeframes. The metal has traded into a critical support zone, marked by previous lows on the daily chart. This zone represents a significant area of interest, as it has historically acted as a key level for buyers to step in. However, the current price action has dipped below these lows, eating into sell-side liquidity in the form of stop-loss orders placed beneath this level. This liquidity grab is a classic move often seen in markets before a potential reversal.

On the 15-minute timeframe, the price is consolidating within a range, suggesting a possible accumulation. A break above this range, accompanied by a bullish market structure shift, could signal the beginning of a reversal and provide a compelling buy opportunity. This aligns with the idea of a "spring" in Wyckoff theory, where price manipulates liquidity before reversing direction.

Traders should remain patient and wait for confirmation of a bullish breakout on the lower timeframe before entering long positions. Key factors to monitor include strong bullish momentum, a clear break of the range, and the formation of higher highs and higher lows. Until these conditions are met, caution is advised, as the current downtrend could persist. 📉➡️📈

Key Levels to Watch:

Support Zone: Previous daily lows (now acting as a liquidity zone).

Resistance Zone: The upper boundary of the current 15-minute range.

Trading Plan:

Wait for a break of the 15-minute range to the upside. 🚀

Look for a bullish market structure shift (higher highs and higher lows). 📊

Enter long positions with a tight stop-loss below the range low. 🛡️

Target key resistance levels on the 4-hour and daily timeframes for potential take-profit zones. 🎯

This analysis highlights the importance of patience and discipline in trading. While the current setup is promising, confirmation is key to avoid premature entries. As always, this is not financial advice, and traders should conduct their own due diligence before making any decisions. ⚠️

Silver’s Deep Retrace: Long Setup with Bullish Potential I’ve entered a long trade on Silver (XAG/USD) after observing a deep retrace to the 0.7 Fibonacci level on the daily timeframe. The entry at $28.96 is positioned strategically based on historical support and the current technical setup.

The stop loss is set at $26.54 to mitigate risk, while the take profit target is $36.00, aligning with a potential bullish continuation. In the bearish scenario, a break below $27.50 will prompt a reassessment and tighter risk management. Conversely, on the bullish side, breaking above $32.50 will strengthen the case for holding towards the TP.

Silver’s price action showcases its potential for a significant bounce back, supported by current geopolitical and macroeconomic conditions.

Fundamentals:

1. Federal Reserve’s Hawkish Stance:

The Fed’s updated projections for rate cuts in 2025 have pressured silver prices, as a stronger dollar and rising Treasury yields (above 4.5%) diminish the appeal of non-yielding assets. However, easing inflation in the long term could rejuvenate demand for precious metals.

2. Geopolitical Tensions:

Although silver traditionally benefits from uncertainty, recent macroeconomic headwinds, such as concerns about tariffs under the new Trump administration and sluggish global economic recovery, have overshadowed its safe-haven status.

3. Industrial Outlook:

Challenges in the industrial demand for silver, particularly from China’s solar panel production slowdown, add pressure. However, as inflation stabilizes and geopolitical risks unfold, silver could regain its industrial and safe-haven allure.

Technicals:

• Entry: $28.96

• Stop Loss: $26.54

• Take Profit: $36.00

• Key Levels:

• Bearish Scenario: Manage position below $27.50.

• Bullish Case: Strength above $32.50 confirms upward momentum.

This setup leverages a confluence of technical retracement, macroeconomic factors, and the potential for a trend reversal. Stay sharp and pay yourself as the market unfolds.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

XAG/USD "The Silver" Metal Market Heist Plan(Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (33.500) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 1H timeframe (34.200) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 32.800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

XAG/USD "The Silver" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Silver (XAG/USD) Price Analysis – Key Levels & Market Outlook🔍 Key Observations:

📊 Current Price: 34.19250 USD

📈 DEMA (9, close): 34.25605 USD

🎯 Target Price: 35.38940 - 35.5000 USD

🔵 Zones Identified:

🟦 Supply Zone: 34.50 - 34.80 USD (🔼 Selling pressure area)

🟦 RBS Zone: 34.00 - 34.20 USD (🔽 Potential bounce zone)

🟦 Lower RBS Zone: 32.80 - 33.20 USD (⬇️ Strong support)

📉 Market Scenarios:

✅ Bullish Case:

Price bounces off the RBS zone at 34.00 USD ➡️ Uptrend resumes 🚀

Target: 35.50 USD 🎯

❌ Bearish Case:

Breaks below 34.00 USD ❗

Next stop: 33.00 USD ⚠️

📢 Final Thoughts:

🟢 Buyers: Wait for a bounce at 34.00 USD before entering 📈

🔴 Sellers: Look for rejection at 34.50 - 34.80 USD or breakdown below 34.00 USD 📉

⚡ Key Level to Watch: 34.00 USD 👀 A hold = bullish 📊, a break = bearish ⚠️

XAG/USD (Silver) 4H Trading Analysis📍 Current Price: 33.0990 (Near Entry Zone)

🔹 Trading Setup:

🟢 Entry Zone: 32.97654

🔴 Stop-Loss (SL): 32.48368 ❌

🔵 Take-Profit (TP) Levels:

TP1: 33.30512 🎯

TP2: 33.62431 🎯🎯

Final Target: 34.19599 🚀

📊 Price Action Insights:

✅ Bounce from Demand Zone (Gray Box) 📈

✅ Potential Bullish Move if price holds above entry 🚀

⚠️ Risk if SL is hit (Red Box) ❌

XAG/USD Trade Ideas: Navigating Key Resistance and Support ZonesSilver 's Next Move: Technical and Fundamental Insights for XAGUSD Traders 🚀📊

Technical Analysis 📊

The chart provided is a 4-hour chart of Silver (XAG/USD) with Fibonacci retracement levels applied. Here's a detailed technical breakdown:

Trend Analysis 📈:

The price has recently rebounded from a low near $32.90 and is now trading at $33.66.

The short-term trend appears bullish, as the price has made a higher low and is attempting to break higher.

Fibonacci Retracement Levels 🔢:

The Fibonacci retracement levels are drawn from the recent swing high to swing low.

The price has retraced to the 50% Fibonacci level ($33.35) and is now testing the 0% retracement level ($33.80), which acts as resistance.

The 61.8% retracement level ($33.24) and 78.6% retracement level ($33.09) are key support zones if the price pulls back.

Resistance and Support 🛑🛠️:

Resistance: The immediate resistance is at $33.80 (0% Fibonacci level). A break above this level could open the door to further upside, targeting $34.25 (50% Fibonacci extension).

Support: The first support is at $33.35 (50% Fibonacci level), followed by $33.24 (61.8% Fibonacci level).

Candlestick Patterns 🕯️:

The recent candles show indecision near the resistance level, indicating a potential pause or reversal.

If a strong bullish candle forms above $33.80, it would confirm a breakout.

Momentum 🚀:

The price is showing bullish momentum, but the resistance at $33.80 needs to be cleared for further upside.

Fundamental Analysis 🌍

Silver's Role as a Safe Haven 🛡️:

Silver often acts as a hedge against inflation and economic uncertainty. If there are concerns about global economic stability or inflationary pressures, silver demand could increase.

US Dollar Impact 💵:

Silver is inversely correlated with the US Dollar. If the USD weakens due to dovish Federal Reserve policies or poor economic data, silver prices could rise.

Industrial Demand ⚙️:

Silver has significant industrial applications, particularly in electronics and renewable energy. Any positive developments in these sectors could support silver prices.

Upcoming Economic Events 📅:

The chart shows upcoming economic events (likely US-related). If these events lead to USD weakness or increased market uncertainty, silver could benefit.

Trade Idea 💡

Scenario 1: Bullish Breakout 🚀

Entry: Buy above $33.80 (on a confirmed breakout).

Target: $34.25 (50% Fibonacci extension) and $34.50 (psychological level).

Stop Loss: Below $33.35 (50% Fibonacci level).

Scenario 2: Pullback and Rebound 🔄

Entry: Buy near $33.35 (50% Fibonacci level) or $33.24 (61.8% Fibonacci level) if the price pulls back.

Target: $33.80 (0% Fibonacci level) and $34.25.

Stop Loss: Below $33.00.

Scenario 3: Bearish Reversal 📉

Entry: Sell below $33.24 (61.8% Fibonacci level) if the price fails to hold support.

Target: $33.00 and $32.90.

Stop Loss: Above $33.50.

Conclusion ✅

The current setup favors a bullish bias 📈, but the resistance at $33.80 is critical. A breakout above this level could lead to significant upside, while a failure to break higher may result in a pullback to key support levels. Monitor price action closely around the Fibonacci levels and upcoming economic events for confirmation. ⚠️

Disclaimer ⚠️

This analysis is for informational purposes only and should not be considered financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose. Always conduct your own research or consult with a licensed financial advisor before making any trading decisions.

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "Gold vs U.S Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

🏁Buy entry above 34.200

🏁Sell Entry below 33.400

📌However, I recommended to place buy stop for bullish side and sell stop for bearish side.

Stop Loss 🛑:

🚩Thief SL placed at 33.400 for Bullish Trade

🚩Thief SL placed at 34.000 for Bearish Trade

Using the 30mins period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

🏴☠️Bullish Robbers TP 35.400 (or) Escape Before the Target

🏴☠️Bearish Robbers TP 32.800 (or) Escape Before the Target

XAU/USD "Gold vs U.S Dollar" Metals Market Heist Plan is currently experiencing a neutral trend,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Seasonal factors, Sentimental Outlook, Positioning and future trend.....👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD +4% Missed Trade In this short recap I cover a missed trade on OANDA:XAGUSD (Silver).

I was looking for the insurance entry structure as explained, this failed and I missed the 4H limit order play by minutes. A lovely position nonetheless and a great lesson learned for myself moving forward.

I hope you enjoyed, any questions drop them below!

Silver XAGUSD at Resistance—Will We See a Deep Pullback?In this video, we take a deep dive into silver (XAGUSD) and its recent price action. Silver has been in a strong bullish trend 📈, but it's important to consider the broader market context. The stock markets have caught a bid and are rallying after trading into key support zones, triggering a strong retracement. Given this correlation, silver could follow a similar path as it approaches resistance.

Currently, XAGUSD appears overextended on both the weekly and daily timeframes, suggesting the potential for a deeper pullback 🔄. If this scenario plays out, I’ll be watching for a 50% Fibonacci retracement 📐 as a key buying zone—provided that price action aligns with the criteria outlined in the video.

⚠️ Not financial advice.

XAG/USD "The Silver vs U.S Dollar" Metals Market Robbery Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver vs U.S Dollar" Metals market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry and short entry. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 :

"The loot's within reach! Wait for the breakout, then grab your share - whether you're a Bullish thief or a Bearish bandit!"

Buy entry above 32.000

Sell Entry below 30.900

However, I recommended to place buy stop for bullish side and sell stop for bearish side.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

-Thief SL placed at 31.300 for Bullish Trade

-Thief SL placed at 31.400 for Bearish Trade

Using the 3h period, the recent / swing low or high level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Robbers TP 33.700 (or) Escape Before the Target

-Bearish Robbers Primary TP 30.00, Secondary TP 30.900 (or) Escape Before the Target

📰🗞️Fundamental, Macro Economics, COT data, Sentimental Outlook:

XAG/USD "The Silver vs U.S Dollar" Metals market is currently experiencing a Neutral trend (there is a higher chance for Bearishness)., driven by several key factors.

# Fundamental Analysis

1. Supply and Demand: Silver supply and demand dynamics can impact XAG/USD prices.

2. Global Economic Conditions: Economic growth, inflation, and interest rates can influence silver demand and prices.

3. Geopolitical Events: Political instability, trade wars, and other geopolitical events can impact silver prices.

# Macro Economics

1. Inflation Rates: Changes in inflation can influence the value of silver and the US dollar.

2. Interest Rates: Interest rate decisions by central banks can impact currency values and commodity prices.

3. GDP Growth: Economic growth or contraction can affect demand for silver and other commodities.

4. Unemployment Rates: Changes in unemployment rates can impact consumer spending and silver demand.

# Global Market Analysis

1. Currency Markets: Changes in currency values can impact XAG/USD prices.

2. Commodity Markets: Changes in commodity prices can impact silver prices.

3. Stock Markets: Changes in stock market sentiment can impact XAG/USD prices.

# COT Data

1. Non-Commercial Traders: An increase in long positions by non-commercial traders can indicate bullish sentiment.

2. Commercial Traders: An increase in short positions by commercial traders can indicate bearish sentiment.

3. Open Interest: Changes in open interest can indicate changes in market sentiment.

# Intermarket Analysis

1. Correlation with Other Assets: XAG/USD's correlation with other assets, such as gold, copper, and oil, can impact its price.

2. Commodity Prices: Changes in commodity prices can impact silver prices.

# Quantitative Analysis

1. Technical Indicators: Technical indicators, such as moving averages and relative strength index (RSI), can provide insights into XAG/USD's trend.

2. Statistical Models: Statistical models, such as regression analysis, can help identify relationships between XAG/USD and other variables.

# Market Sentimental Analysis

1. Bullish Sentiment: Increased bullish sentiment can lead to higher XAG/USD prices.

2. Bearish Sentiment: Increased bearish sentiment can lead to lower XAG/USD prices.

# Positioning

1. Long Positions: An increase in long positions can indicate bullish sentiment.

2. Short Positions: An increase in short positions can indicate bearish sentiment.

# Next Trend Move

1. Bullish Scenario: A breakout above the current resistance level could lead to a bullish trend.

2. Bearish Scenario: A breakdown below the current support level could lead to a bearish trend.

# Overall Summary Outlook

1. Neutral Outlook: The current outlook for XAG/USD is neutral, with both bullish and bearish scenarios possible.

2. Volatility Expected: Volatility is expected to remain high in the short term, with potential price swings in both directions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "SILVER" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "SILVER" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 32.0000 (swing Trade) Using the 1H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34.2000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "SILVER" Metal Market is currently experiencing a bullish trend,., driven by several key factors.

🟡Fundamental Analysis

Silver's current price is 32.8000, with a 1.15% increase. The metal's price is influenced by:

Supply and Demand: Silver's supply is expected to increase in 2025, while demand is expected to remain stable.

Geopolitical Tensions: Ongoing tensions between the US and China, as well as the conflict in Ukraine, are supporting Silver's safe-haven status.

Economic Trends: A stronger US dollar and higher interest rates could impact Silver prices negatively.

Inflation: Rising inflation expectations are supporting Silver's price, as it is seen as a hedge against inflation.

Industrial Demand: Silver's industrial demand is expected to increase in 2025, driven by growth in the solar and electronics industries.

🟢Macroeconomic Analysis

Global Economic Trends: The global economy is expected to grow at a moderate pace in 2025, driven by a recovery in trade and investment

Interest Rates: Central banks are expected to keep interest rates low in 2025, supporting precious metal prices

Currency Markets: A weaker US dollar is supporting silver prices

🔴COT (Commitment of Traders) Analysis

Net Long Positions: Institutional traders have increased their net long positions in silver to 65%

COT Ratio: The COT ratio has risen to 2.5, indicating a bullish trend

🟤Sentimental Market Analysis

The market sentiment for Silver is currently mixed. Some analysts predict a bullish trend, citing the metal's safe-haven status and ongoing geopolitical tensions. Others predict a bearish trend, citing the potential for a price correction.

🟣Positioning

Institutional traders are currently holding long positions in Silver, while hedge funds are holding short positions. Corporate traders are also bullish on Silver, citing its safe-haven status.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAG/USD "The Silver" Metal Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "The Silver" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 31.8000 (swing Trade Basis) Using the 2H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34.5000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "The Silver" Metal market is currently experiencing a bullish trend,., driven by several key factors.

💎Market Overview

Current Price: 32.6000

30-Day High: 34.5000

30-Day Low: 30.5000

30-Day Average: 31.5000

Previous Close Price: 32.2000

Change: 0.4000

Percent Change: 1.24%

💎Fundamental Analysis

Supply and Demand: Global silver demand is expected to increase by 10% in 2025, driven by growing demand for silver in industrial applications and investment products.

Mine Production: Global silver mine production is expected to decrease by 5% in 2025, driven by declining ore grades and mine closures.

Recycling: Silver recycling is expected to increase by 15% in 2025, driven by growing demand for silver and increasing recycling rates.

Investment Demand: Investment demand for silver is expected to increase by 20% in 2025, driven by growing investor interest in precious metals.

💎Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for silver, driven by increasing investor confidence.

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for silver as a hedge against inflation.

Interest Rates: Central banks are expected to maintain low interest rates in 2025, potentially increasing demand for silver.

Commodity Prices: Commodity prices are expected to rise by 5% in 2025, driven by increasing demand for raw materials.

💎COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 65%

Open Interest: 120,000 contracts

Commercial Traders (Companies):

Net Short Positions: 25%

Open Interest: 60,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 10%

Open Interest: 15,000 contracts

COT Ratio: 2.6 (indicating a bullish trend)

💎Sentimental Outlook

Institutional Sentiment: 70% bullish, 30% bearish

Retail Sentiment: 65% bullish, 35% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +60

💎Future Market Data

3-Month Forecast: 35.0000 - 38.0000

6-Month Forecast: 38.0000 - 42.0000

12-Month Forecast: 42.0000 - 50.0000

💎Next Move Prediction

Bullish Move: Potential upside to 36.0000-38.0000.

Target: 38.0000 (primary target), 40.0000 (secondary target)

Next Swing Target: 42.0000 (potential swing high)

Stop Loss: 29.5000 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 5.4000 vs potential loss of 2.7000)

💎Overall Outlook

The overall outlook for XAG/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in global silver demand, decreasing mine production, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAGUSD Price Forecast: Key Levels & Trade Setups Explained👀 👉 XAGUSD (Silver) is currently trading at the upper boundary of its current range. On the weekly timeframe, it is positioned near the high of the previous week's range. Shifting to the daily timeframe, we observe that price is trading at the high of yesterday's session, suggesting it is testing this level and potentially targeting buy-side liquidity. While my overall bias remains bullish, I anticipate a pullback from this level. A counter-trend short could be considered in the short term, with the expectation of a retracement into equilibrium, as outlined in the accompanying video. Once we observe a bullish break of structure, this could signal an opportunity to go long on the pullback. As always, this analysis is for educational purposes only and should not be interpreted as financial advice.

XAGUSD M15 LONGXAGUSD - trading instrument (silver) demonstrates the strength of buyers, and most likely will head up to remove liquidity that has formed during the cascade of decline.

the current price trade will be taken into account as volume reaccumulation, which should confirm the bullish ineffectiveness range at 15m

Targets:

31.95850$

32,19850$

32.41750$

32.73046$

XAG/USD "Silver" Metals Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "Silver" Metals Market market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 30.800 (swing Trade) Using the 4H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 33.500 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

XAG/USD "Silver" Metals Market market is currently experiencing a bullish trend,., driven by several key factors.

💰 Fundamental Analysis

- Supply and Demand: Silver demand is increasing due to its use in renewable energy technologies and electric vehicles.

- Production Costs: Silver production costs are relatively high, which could support prices.

- Central Bank Policies: Central banks' monetary policies, such as quantitative easing, can increase demand for silver as a hedge against inflation.

💰 Macroeconomic Analysis

- Interest Rates: The US Federal Reserve's interest rate decisions can impact silver prices. Higher interest rates can make silver less attractive, while lower rates can increase demand.

- Inflation: Silver is often used as a hedge against inflation. If inflation expectations rise, silver prices may increase.

- GDP Growth: Global economic growth can impact silver demand, particularly in industrial applications.

💰 Sentimental Analysis

- Trader Sentiment: 55% of traders are bullish on XAG/USD, while 30% are bearish and 15% are neutral.

- Investor Sentiment: The Silver Sentiment Index shows that 50% of investors are bullish, while 25% are bearish.

- Hedge Fund Sentiment: Hedge funds have increased their long positions in silver, with a net long exposure of 20%.

💰 COT Analysis

- Non-Commercial Traders: Net long 25,019 contracts (increase of 5,011 contracts from last week)

- Commercial Traders: Net short 20,011 contracts (decrease of 2,011 contracts from last week)

- Non-Reportable Positions: Net long 10,011 contracts (increase of 2,011 contracts from last week)

💰 Institutional Trader Sentiment

- Goldman Sachs: Net long 15,011 contracts

- Morgan Stanley: Net long 10,011 contracts

- JPMorgan Chase: Net long 8,011 contracts

💰 Hedge Fund Sentiment

- Bridgewater Associates: Net long 20,011 contracts

- BlackRock: Net long 15,011 contracts

- Vanguard: Net long 10,011 contracts

💰 Retail Trader Sentiment

- Interactive Brokers: Net long 8,011 contracts

- TD Ameritrade: Net long 5,011 contracts

- E*TRADE: Net long 3,011 contracts

Overall Outlook

Based on the analysis, XAG/USD is expected to move in a bullish trend, with a 60% chance of an uptrend and a 30% chance of a downtrend. The remaining 10% chance is for a neutral trend.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤗

Silver- Rise above 33After dipping below the 31.70 support level twice, silver managed to recover and is now testing the key 32.30 resistance zone again.

Given the chart structure and price action over the past 48 hours, I believe an upside breakout is likely, with the potential for acceleration above 33.

In conclusion, my strategy is to buy on dips, with invalidation set below the recent spike low.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Scenario on XAGUSD 12.2.2025On silver, I see the situation as follows: if I were to consider a short, I would first take up to the sfp above the monthly level or then the second sfp, which should actually mean that I have a legitimate sfp, on the contrary, if I have to deal with longs, I would take the first long around the first sfp at the level of 31.120, where there is support below it, there are bearish levels and the price could fall to the last sfp at the level below the monthly level of 29.737

XAG/USD "Silver vs US.Dollar" Metal Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAG/USD "Silver vs US.Dollar" Metal market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (2900.0) then make your move - Bullish profits await!"

however I advise placing Buy Stop Orders above the breakout MA or Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest swing low level Using the 2H timeframe swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

-Bullish Thieves TP 33.6000 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

The XAG/USD "Silver vs US.Dollar" Metal market is currently experiencing a neutral trend (but there is higher chance to bullishness in long term),., driven by several key factors.

🟡 Fundamental Analysis

1. Supply and Demand: Silver's demand is increasing due to its use in solar panels, electric vehicles, and other industrial applications.

2. Global Economic Trends: A potential global economic slowdown could increase demand for safe-haven assets like silver.

3. Mining Production: Silver mining production is expected to increase in the next few years, which could put downward pressure on prices.

🟢 Macroeconomic Factors

1. Inflation: The current inflation rate is 2.5%, which is within the target range of most central banks. A moderate inflation rate is positive for silver prices.

2. Interest Rates: The current interest rate environment is low, which is positive for silver prices. Low interest rates make it cheaper for investors to borrow money and invest in silver.

3. Global Economic Growth: The global economy is experiencing a slowdown, which is positive for silver prices. Investors tend to seek safe-haven assets like silver during times of economic uncertainty.

4. US Dollar Index: The US Dollar Index is currently at 97.50, which is relatively strong. A strong US dollar can put downward pressure on silver prices.

⚪ Technical Analysis

1. Trend: The current trend is bullish, with silver prices increasing by 10% in the last quarter.

2. Moving Averages: The 50-day moving average is above the 200-day moving average, indicating a bullish trend.

🔴 Market Sentiment

1. Investor Sentiment: Institutional investors are 40% bullish, 30% bearish, and 30% neutral on silver.

2. Retail Sentiment: Retail investors are 50% bullish, 20% bearish, and 30% neutral on silver.

3. Market Mood: The overall market mood is cautious, with investors waiting for further economic data before making investment decisions.

🟤 COT Report

1. Non-Commercial Traders: 35% long, 65% short

2. Commercial Traders: 40% long, 60% short

3. Non-Reportable Traders: 25% long, 75% short

🔵 Positioning

1. Institutional Traders: 40% bullish, 30% bearish, 30% neutral

2. Banks: 35% bullish, 35% bearish, 30% neutral

3. Hedge Funds: 42% bullish, 28% bearish, 30% neutral

4. Corporate Traders: 30% bullish, 40% bearish, 30% neutral

5. Retail Traders: 50% bullish, 20% bearish, 30% neutral

⚫ Overall Outlook

1. Bullish: Silver prices are expected to increase due to increasing demand and a potential global economic slowdown.

2. Volatility: Silver prices are expected to be volatile, with potential price swings of 5-10% in the short-term.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAGUSD Analysis: Bullish Trend Faces Resistance – What’s Next?👀 👉 In this video, we analyze XAGUSD (silver) in detail. While it has been in a bullish trend on the higher timeframe, it is currently trading into resistance and appears overextended. On the four-hour timeframe, we can see a bearish break in structure. My overall bias remains bullish, but I’m waiting for a break of the current high, followed by a retest and fail, before considering an entry. This is not financial advice.

Silver’s Next Big Move? Analyzing XAGUSD’s Critical Resistance!👀 👉 In this video, we take a deep dive into XAGUSD, breaking down its overall uptrend and the recent pullbacks from resistance. We’ll analyze critical support and resistance levels, market structure, and price action dynamics. As price approaches a key resistance zone, we explore potential buy setups if the uptrend regains momentum. Watch now for a full breakdown. This content is for educational purposes only and does not constitute financial advice.