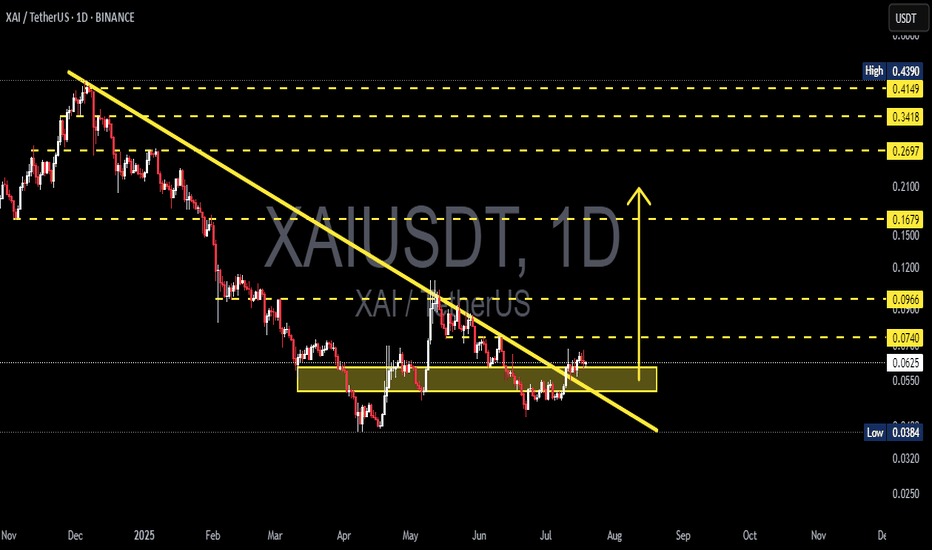

XAI/USDT Breakout from Long-Term Downtrend — Is a Major Trend?🔍 Complete Technical Analysis & Market Insight

After months of downward pressure, XAI/USDT is finally showing significant signs of life. The pair has successfully broken out of a long-standing descending trendline that has capped price action since November 2024 — potentially marking the beginning of a new bullish phase.

📐 1. Pattern & Technical Structure:

🔸 Descending Trendline Breakout:

Price has broken above the descending trendline, ending a multi-month bearish phase.

The breakout is supported by bullish candles and an uptick in volume, suggesting momentum shift in favor of the bulls.

🔸 Strong Accumulation Zone (Demand Area):

The area between $0.0550 – $0.0740 has acted as a solid accumulation/support zone.

Multiple rejections and consolidations around this zone suggest aggressive buyer interest.

🔸 Higher Low Formation & Potential Reversal Structure:

A series of higher lows is forming, indicating a potential bullish trend reversal.

The price structure hints at the possible development of a larger bullish pattern, such as an inverse head and shoulders or base formation.

📈 Bullish Scenario:

If the breakout holds and the price sustains above the key support:

Short-term target:

$0.0966 – initial resistance and psychological level.

Mid-term targets:

$0.1679 – strong historical resistance.

$0.2697 – a major reaction zone from previous breakdowns.

Long-term target if momentum continues:

$0.3418 – $0.4390

⚠️ Confirmation with volume and follow-through candles is crucial to validate a sustained bullish move.

📉 Bearish Scenario:

If the price fails to maintain above the breakout zone:

It may retest the accumulation zone between $0.0740 – $0.0624.

A breakdown below $0.0550 would invalidate the bullish thesis and could lead back to the previous low at $0.0384.

Breaching below $0.0384 could trigger a renewed bearish continuation.

📊 Market Sentiment & Context:

XAI is at a technically significant point. With selling pressure weakening and early bullish structures emerging, XAI could be positioning for a strong upside move — especially if broader market conditions improve.

However, given the speculative nature of the current breakout, risk management remains essential. False breakouts are not uncommon, especially in altcoins.

🧭 Strategic Summary:

Potential Buy Zone (on retest): $0.0624 – $0.0740

Stop Loss (conservative): Below $0.0550

Take Profit targets:

Short-Term: $0.0966

Mid-Term: $0.1679 – $0.2697

Long-Term: $0.3418 – $0.4390

Big breakouts often begin with subtle but critical structural shifts. XAI is showing early signs of such a shift — it could be the calm before a bullish storm, or just a trap. Either way, it deserves your close attention.

#XAIUSDT #XAI #AltcoinBreakout #CryptoBreakout #TrendReversal #CryptoAnalysis

#TechnicalAnalysis #SupportResistance #BullishBreakout

XAI

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0476.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0472, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0483

First target: 0.0502

Second target: 0.0517

Third target: 0.0532

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

XAI breakout Buy breakout, #XAI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 4.78, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 4.60.

Entry price: 4.88

First target: 5.047

Second target: 5.19

Third target: 5.35

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel, which is support at 0.0448.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We have a trend of consolidation above the 100 moving average.

Entry price: 0.0466

First target: 0.0477

Second target: 0.0493

Third target: 0.0514

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0570.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.0686

First target: 0.0620

Second target: 0.0650

Third target: 0.0686

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0600, acting as strong support from which the price can rebound.

Entry price: 0.0610

First target: 0.0660

Second target: 0.0686

Third target: 0.0722

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0812, acting as strong support from which the price can rebound.

Entry price: 0.0850

First target: 0.0890

Second target: 0.0931

Third target: 0.0978

#XAI/USDT#XAI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.0680

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.0800

First target 0.0840

Second target 0.0886

Third target 0.0946

Xai Bullish ContinuationThere is continuation written all over this chart. Remember that Bitcoin situation when it stopped in the 94-98,000 resistance zone? The level that worked as support on the way down, later worked as resistance on the way up. The situation here is the same.

As XAIUSDT was moving down, it found support in the current price range and this same range is now working as resistance on the way up. Just as it broke on the way down, it will break on the way up. a Bullish continuation.

Namaste.

An important bifurcation point in the market, we are reducing poTo date, the market has shown itself quite positively, but, as I wrote earlier, it will be possible to talk about a trend change only after the opening of the second half of the quarter. The first half is so far only a pullback and retest of the broken key levels in the first quarter. Today and tomorrow we are passing an important bifurcation point. At the moment, 2500 for ether and 100k for bitcoin are only retest levels. However, over the past two weeks, the chances of a trend change have increased significantly, where the targets may be 210k for bitcoin and up to 7500k for ether. This scenario is possible when the second half of the quarter opens above 2500 and 100k, respectively. Oil growth in the new week, weak statistics on the United States in the second half of the week, or strong GDP in Europe and Britain, as well as a possible temporary truce in Ukraine, which will give impulses to the stock market and the cryptocurrency market, including.

The seasonal sales wave begins on May 11-12. In a positive scenario, today and tomorrow, the ether will be able to take 2500 and the new week will open above the level. In this case, in the first half of the week, we will only see sales within the shadow of a new weekly candle, and from Tuesday to Wednesday, the altcoin market will begin to return to growth, which may last until the end of the half–year if the second half of the quarter also opens above 2500. In this scenario, most coins will additionally show an increase of up to 50-150% from current levels.

In a more negative and technically more likely scenario, the new week will open below 2500, which will lead to a significant drop in the altcoin market at the beginning of the week and a return of ether to 1900-2000 with a further struggle for a new test of 2500 before the end of the month or continued sales to 1400-1500.

Due to the dangerous situation, it is worthwhile to carefully weigh the amount of funds in the work and reduce positions with further additions to coins in the event of a week opening above 2500 on ether. The most undervalued today are only fantokens, which can show good growth even in a negative market, as they will remain the most interesting option for speculators in the event of a drawdown of ether. Among them, I am primarily considering atm city and acm. It is also worth keeping an eye on coins with the monitoring tag, as they are sold most actively when the market correction is approaching. They can also contribute to the overall drawdown of altcoins.

Xai's Downtrend Ends With A High Volume BreakoutThe Cryptocurrency market is entering a very interesting period right now. Unless you've been around for more than 4 years in this market, you haven't seen anything like it.

There was strong growth in late 2023 into early 2024 and also in late 2024 into 2025, but nothing compared to what you are about to experience, this is different.

Some pairs grew thousands of percentages of points in the last few years, I shared many charts for these so they don't need to be mentioned again. Really strong and yet, what you are about to experience is something completely different.

The best example for comparison is the last bullish wave. The build up phase took three months and then at the end there was a bullish period lasting 3-4 weeks. That's it. The bottom was hit August 2024 and the Altcoins went sideways. They were not really rising but more sideways than anything and in late November a strong advanced happened. This advance ended just as fast as it started and a long corrective phase developed.

This is the second part, after each bullish wave there was always a strong correction after the 2021 bull market, this time it will be different.

First, imagine that the build up period instead of sideways consist of up. Prices start to grow... Up, up, up slowly and then a major advance. Imagine the pair you hold growing for months and then a strong advance on top of all that growth.

The second part is the correction. Each bullish wave for several years would be followed by a strong correction and boring period, not this time. The strong advanced will be corrected but the correction will lead to a strong resumption and then months of additional growth, a completely different dynamic. This is it.

So you are about to experience something great.

» Here XAIUSDT is making a strong breakout from a bearish-downtrend on high volume. This is the start of the 2025 bull market for this pair. The same is true for many other Altcoins.

Do not try to catch the ones that are already moving, buy the ones trading low near support, before the breakout, and wait. In this way, you can enjoy the entire wave when the breakout happens.

I am wishing you tons of profits, great luck, health, wealth and success.

Thank you for reading.

Namaste.

Xai Becomes Extremely Bullish, Additional 1085% Profits PossibleThis is an update for a trade setup from late April that initial had more than 1,000% potential for growth. I will share the link in the related publications.

» XAIUSDT is now extremely bullish. What makes this chart different to others is the really high volume. This high volume, from a technical analysis perspective, works to support any bullish signal already present on the chart while at the same time reveals lots of interest for this project and trading pair.

It is still early and there is huge potential for growth here. The targets shown on the chart are easy targets, there will be more long-term. Actually, I added some more targets...

Thanks a lot for your support. This is a good choice if you looking for a pair that is strong and safe, based on the chart. The bullish action is starting now, intensifying, but should go on for months.

You can easily approach this pair with a buy and hold strategy. Please remember, after buying prices can start to decrease, at this point, we simply hold rest easy, waiting for the resumption of the bullish trend.

When lots of people become active and join the market, normally it is right at the time when most pairs are about to take a break. If a break does happen, just know that the action will resume in a matter of weeks or days. Weeks if it is a long retrace/consolidation, most of the time the pause will only last days.

Long-term growth. Higher highs and higher lows.

You can read everything I publish daily, also the articles I published since 7-April, and you will get a good picture as to what is happening with the market and what to expect. @MasterAnanda

Thanks a lot for your continued support.

Namaste.

XAIUSDT — profit protection, risk management, area of interestXai (XAI) - is a cryptocurrency designed to revolutionize the gaming industry by enabling real economies and open trade within video games. Developed by Offchain Labs, Xai operates on the Arbitrum platform, a layer-2 scaling solution for Ethereum, which enhances its efficiency and scalability.

One of the standout features of Xai is its integration of Explainable AI techniques. These techniques make automated trading bot systems more transparent and trustworthy, addressing a significant concern in the cryptocurrency space. This transparency is crucial for fostering trust among users, particularly in the context of in-game economies where players trade valuable items.

📍 CoinMarketCap: #373

📍 Twitter(X): 308.5K

___________________________________________

🛡️ Risk Management and Approach:

When trading low-liquidity coins , I allocate a specific portion of my portfolio in advance for such trades.

These funds are split across different projects , which allows for diversification and helps mitigate potential scams .

If one coin pair dies — it's not critical , as long as the portfolio is structured properly.

📉 Current Situation:

On the broader view, the price is moving within a large descending channel .

Right now, it's near the outer support of the inner channel.

Since I’ve already allocated funds for this coin, I’ve taken a small entry near the support of the inner channel , and I plan to add more in the lower marked zone .

There’s a high probability of price chop due to news (tariffs, rates, debt ceiling, refinancing), and I take that into account.

💭 General Thoughts:

Diversification is key. You can never rule out the possibility that any project might end up as a scam. But with proper portfolio structure, that’s not a major issue .

There’s nothing to fear if you have a clear plan and tactics for different scenarios.

Like many other coins right now, I see the current accumulation zones as solid .

🔁 Additional Observation:

The recent mass delistings on Binance mainly target projects listed during the 2021–2022 distribution phase.

There’s a chance the exchange is cleaning up future risks , while “fresh” coins listed under the new conditions may stay longer.

📌 This post is not financial advice. It reflects my observations, actions, and logic in managing the position.

XAIUSDT | One of Today’s Highest Volume Gainers – +257% in 24hXAIUSDT just saw an extraordinary surge in activity—trading volume jumped over 256.9% in the last 24 hours. That level of interest tells us smart money was active, but price action hasn’t confirmed a sustained move higher.

🔴 Key Resistance Zones

The red boxes on the chart mark areas where XAI has struggled before. Each time price has approached these zones, sellers stepped in decisively.

Right now, price is once again testing those levels and showing signs of hesitation.

📉 What I’m Watching for Shorts

Lower Time Frame Breakdowns: I’ll look for clear downside structure on a 5‑ or 15‑minute chart inside the red box.

CDV and Volume Confirmation: If selling volume spikes and CDV shifts negative at resistance, it’s a strong signal to short.

🟢 What Could Flip My Bias

I won’t cling to a bearish view if the market shows real strength. If XAI breaks above the red boxes with conviction—backed by rising volume—and then retests those zones as support, I’m ready to switch gears and look for a long entry.

🤝 Why You Can Trust This Setup

I focus on coins leading in volume for the day—these are the assets where big moves originate. Every level I share is battle‑tested in live markets, and you can see my success rate in my profile. Most traders react emotionally. We wait for the market to confirm. That’s how you stay ahead.

Remember: I will not insist on my short idea. If the levels suddenly break upwards and do not give a downward break in the low time frame, I will not evaluate it. If they break upwards with volume and give a retest, I will look long.

Stay patient, trade with confirmation, and let the market speak.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#XAI (SPOT) IN ( 0.1700- 0.2100) T.(0.8300) SL(0.1666)BINANCE:XAIUSDT

#XAI / USDT

Entry ( 0.1700- 0.2100)

SL 1D close below 0.1666

T1 0.3800

T2 0.5300

T3 0.8300

______________________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

**********************************************************************************************

#Manta #OMNI #DYM #AI #IO #XAI #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #VOXEL #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH #AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #PORTAL #GRT #GMT #IDEX #NEAR #ICP #ETH #QTUM #VET #QNT #API3 #BURGER #MOVR #SKL #BAND #ETHFI #SAND #IOTX #T #GTC #PDA #GMX #REZ #DUSK #BNX #SPELL #POWR #JOE #TIA #TFUEL #HOT #AVAX #WAXP #OGN #AXS #GALA #ONE #SYS #SCRT #DGB #LIT #QI #FIL #GLMR #ATOM #LTC #MANA #ONT #TLM #SLP

#XAI (SPOT) entry range (0.17- 0.19) T.(0.8390) SL (0.1655)entry range ( 0.17- 0.19)

Target1 (0.5360) - Target2 (0.8390)

SL .4H close below (0.1655)

*** Breakout is done in 1H Frame & this entry will be in the retest *****

************************************

#XAI

#XAIUSDT

#XAIUSD

BINANCE:XAIUSDT

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY ****

#bitcoin

#BTC

#BTCUSDT

#XAI/USDT#XAI

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at 0.2170

Entry price 0.2240

First target 0.2330

Second target 0.2463

Third target 0.2584

Could BA be a wrinkle in the market?BA seems to be facing challenges. However, advancements in technology, along with opportunities in space and defense spending, present a gap that could benefit the company. While I don't have a specific time horizon, I see an opportunity to profit by going against the grain. It's a difficult path, but the potential is there.

#XAI/USDT Ready to go higher#XAI

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.2540

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2660

First target 0.2771

Second target 0.2935

Third target 0.3150