XAUUSD (GOLD)XAUUSD

if can't break the demand zone 1941-1937

we can

BUY at 1945

TP1 1955

TP2 1964

TP3 1973

SL 1937

.............

XAUUSD

if can't Break supply zone 1976-1983

we can

SELL at 1974

TP1 1965

TP2 1955

TP3 1945

SL 1980

.............

XAUUSD

if can break supply zone 1976-1983

we can

BUY at 1985

TP1 1992

TP2 2001

TP3 OPEN

SL 1978

Xau-usd

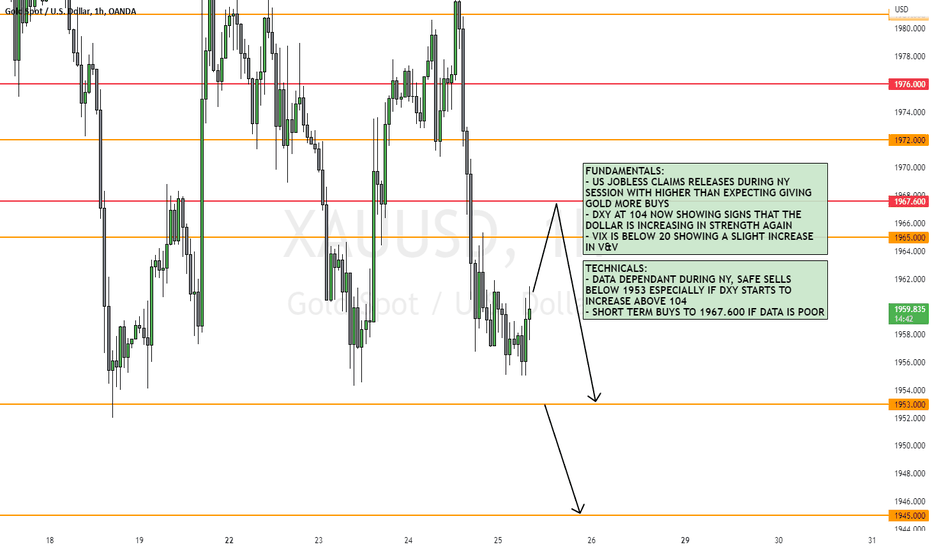

XAUUSD Potential Forecast | 5th June 2023 Fundamental Backdrop

ISM Services PMI forecast at 52.6 with 51.9 previous.

Technical Confluences

Resistance level at 1983

Support level at 1946

Price is currently hovering around the support level and we could potentially see rejection off this level

Idea

Monday asian session, hence will wait for price to stabilise before entering onto any trade.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

XAUUSD Sell BiasAfter watching gold close during Asian session I began to build a sell bias on Gold due to price movement and structure on higher timeframe and I had my Sell Limit in position to fill me into a Sell when Price pulled back into my point of interest. NFP helped push the price further to the bottom

XAUUSD Weekly Forecast | 29th May 2023Fundamental Backdrop

The key takeaways of last week's FOMC meeting show that the FEDs agreed on the need for more rate hikes after May's meeting was 'less certain'. We will likely be seeing strength in the USD.

We could see investors shift their money from GOLD to USD instead, weakening it.

Technical Confluences

Near-term resistance level at 1948

Next support at 1904

Idea

Price could head towards the next major key support level at 1904.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

Gold Downside Potential👋 Hey Traders! For Day 11 of our 100-day challenge, we're looking at XAUUSD/Gold downside risks.

- Major support at 1980 was broken last week

- Made a low at demand/support zone

- And now we're retesting 1980 area as resistance

We're looking to go short around this area if LTF gives clear sell signals.

We're looking to re-target 1955 recent low. SL could be above 1995 (conservative).

Purely technical analysis, fundamentals have not been considered on this trade idea.

See you guys tomorrow! 👋🥂

XAUUSD Weekly Forecast | 22nd May 2023Fundamental Backdrop

The USD is expected to pause interest rates, causing investors to shift their money to Gold.

Technical Confluences

Resistance at 2001

Current support at 1981

Major support at 1960

Idea

We could possibly see price retrace back up to retest the resistance at 2001.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

XAUUSD Potential Forecast | 17th May 2023Fundamental Backdrop

US Retail Sales comes out at 0.4% compared to previous print of -0.7%, highlighting the continued resilience of the US economy. This further supports the hawkish stance from Fed and is bearish for GOLD.

Technical Confluences

Liquidity building at 1970 where price can potentially tap into

H4 support level at 1960 which can serve as a potential target zone

Idea

With the DXY expected the strengthen in the short term, we are anticipating XAUUSD to continue its bearish momentum to test the support at 1960.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

XAUUSD Potential Forecast | 15th May 2023Fundamental Backdrop

In light of the strong bullish sentiments surrounding the USD recently, price has made a bearish case for GOLD.

Sentiments surrounding USD continues to be bullish with Fed maintaining its hawkish stance in the most recent FOMC meeting.

Technical Confluences

Daily support level at 1959.7 where price can potentially tap into before continuing bullish.

Idea

With the DXY expected the strengthen in the short term, GOLD is anticipated to continue its bearish stance in the market and we will be looking out for shorts over the new week.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

Xau/Usd Gold probable sell setup Hello traders gold after recording a new high we have what looks like reversal after a sharp drop from the newly high we was a on pull back that probably will be a distribution in price we seen yesterday the market was trying to balance sell side imbalance now we might see a drop on gold to get to the less resistance liquidity areas lets see how it play out let me know what you think