Potential rebound for goldGold rejected the 2000 resistance level and formed a higher peak on the hourly chart. However, there is a noticeable divergence on the momentum indicator, indicating a weakening momentum. It is also worth noting that the price is approaching the upper edge of the ascending channel and the monthly trend line. We can wait for a break of the small local trend line (neckline of the two peaks) before the price starts to descend towards the previous support, which is also the lower edge of the ascending channel and the 50 and 100 moving averages on the hourly chart. It is possible for the price to rebound from there and continue to trend upwards, based on our previous analysis of gold.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!

Xau-usd

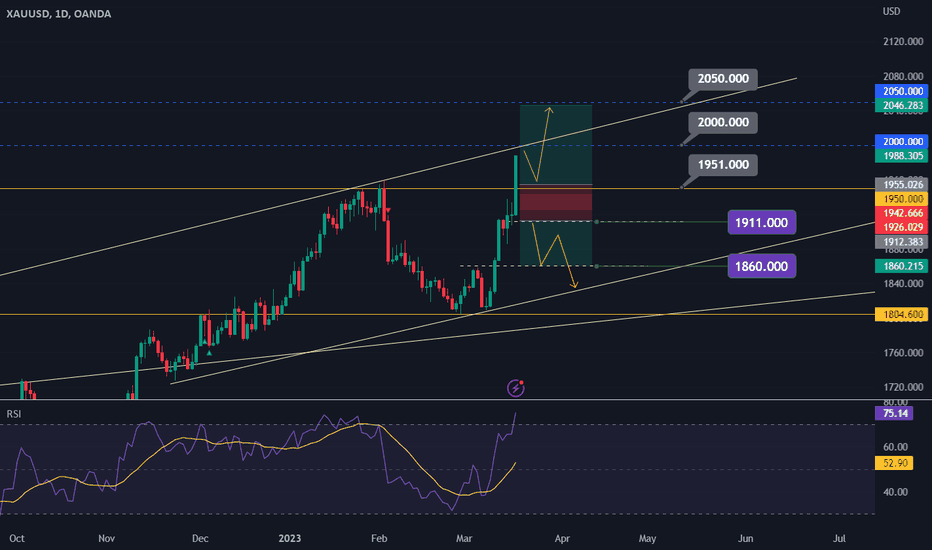

Gold faces potential correction at $2000 levelGold prices have surged to post-1988 record highs due to recent market panic and investors seeking a safe haven. As long as this panic persists, gold is likely to continue its upward trend. However, if it reaches the $2000 level, there may be a correction down to the previous resistance-turned-support level of $1951, before it resumes its upward trend towards $2000 and potentially $2050.

If it fails to rebound and breaks below $1911, there may be a bearish opportunity with a target of $1860.

But, if gold breaks and stays above the $2000 level, it could be a buying opportunity with a potential target of $2050.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!

XAUUSD Potential Forecast | 21st March 2023Fundamental Backdrop

1. Plenty of instability in the market due to the SVB crisis and other banks being heavily affected by it.

2. GOLD, as a safe haven asset, flew to the highs to 2000 and is currently rejecting.

3. This is fuelled by the instability with the USD.

Technical Confluences

1. Price could potentially retrace back to the H4 support level at 1959.24 before heading back up.

2. Price went parabolic to the 2000 regions.

3. Bullish pressure is still intact and will be looking for longs.

Idea

Looking for price to break new highs beyond 2065 and this is just the beginning.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

Gold Outlook 21 March 2023During the trading session yesterday, Gold broke above the round number level of 2000 to reach a high of 2009.55.

However, the move higher was brief as Gold quickly retraced to consolidate along the 1982 price level.

Further upside is anticipated for Gold if the price stays above the support level of 1960 which coincides with the 38.20% Fibonacci retracement level and the bullish trendline.

However, before the price trades higher, Gold price could consolidate/retrace first. In addition, an upward move in Gold could require either further downside on the DXY or increasing market uncertainty, driving investors toward the safe haven commodity.

If the price breaks above the recent high, the next key resistance level is at 2070.

Gold Outlook 20th March 2023Gold traded significantly higher last week, due to several key events;

1) gross market uncertainty increased as banks collapse (SVB and Credit Suisse).

2) flight toward the reserve commodity

3) weakness in the DXY

Currently, the price is retracing and is trading along the 1973 price level, with further downside expected. The price is likely to test the support level of 1956 which sits between the 23.60% and 38.20% Fibonacci retracement levels.

However, as the uptrend of Gold remains strong, anticipate the retracement to be brief with the price likely to rebound from the support to trade higher again.

The next key resistance level is at the round number level of 2,000 which was last visited in April 2022

#Xau | #UsdIn the one-hour time frame, gold is in an ascending channel, which is currently trying to break a dynamic resistance in the area of 1980.09. If this resistance is broken, the price can rise up to the key area of 2029.99 to 2071.77. The area can be entered into a short trade with different setups

XAUUSD Potential Forecast | 15th March 2023Fundamental Backdrop

1. Market sentiments has shifted bearish for the USD

2. With the ongoing Silicon Valley Bank crisis, USD has been very volatile and there has been plenty of fear with the USD.

3. This sets the path for further bearish pressure on the USD.

Technical Confluences

1. Extremely strong bullish pressure can be noticed on the GOLD chart.

2. Price has already came up >800 pips since the lows.

3. Previous bearish structure has all been shifted bullish.

4. Price can potentially break the previous high at 1959.6.

Idea

Anticipating price to form a new higher high at 1959.6.

NOT FINANCIAL ADVICE DISCLAIMER

The trading related ideas posted by OlympusLabs are for educational and informational purposes only and should not be considered as financial advice. Trading in financial markets involves a high degree of risk, and individuals should carefully consider their investment objectives, financial situation, and risk tolerance before making any trading decisions based on our ideas.

We are not a licensed financial advisor or professional, and the information we are providing is based on our personal experience and research. We make no guarantees or promises regarding the accuracy, completeness, or reliability of the information provided, and users should do their own research and analysis before making any trades.

Users should be aware that trading involves significant risk, and there is no guarantee of profit. Any trading strategy may result in losses, and individuals should be prepared to accept those risks.

OlympusLabs and its affiliates are not responsible for any losses or damages that may result from the use of our trading related ideas or the information provided on our platform. Users should seek the advice of a licensed financial advisor or professional if they have any doubts or concerns about their investment strategies.

Gold Bearish reversal off major resistanceWe're seeing a massive resistance level at 1913 which is a strong overlap resistance. We could potentially see prices reverse off here to drop towards the support level of 1804.

The intermediate support to take note of is at 1881 which is also an overlap support - breaking that level should trigger a downside acceleration towards the TP level.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD H4: Bullish outlook seen, further upside above 1864.00 On the H4 time frame, prices are showing bullish order flow with higher lows and higher highs seen and a throwback to the support zone at 1864.00, which coincides with the 100% Fibonacci extension and 50% Fibonacci retracement could present an opportunity to play the bounce to the resistance zone at 1957.00. Prices are holding above the 20 EMA and MACD is showing bullish momentum, supporting the bullish bias.

Gold Daily Analysis 13.03.23Gold made a high of 1894 and faced resistance here. This high is caused due to weakness of USD and market will be volatile this week.

So we shall see for small trades and enter in trades only when price reaches near strong support or resistance levels.

The value zone is bullish trending upwards. The next resistance levels are at 1900-1924

The support levels are 1848-1868.

I suggest to prefer BUY trades only.

BUY 1868 SL 1840 TP 1888

BUY 1848 SL 1840 TP 1888

SELL 1900 SL 1908 TP 1888

SELL 1924 TP 1888