XAUUSD Potential for Bearish Drop | 28th February 2023Looking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. To add confluence to this bias, price is also along a descending trendline.

Looking for a sell entry at 1818.975, where the overlap resistance and 23.6% Fibonacci line is. Stop loss will be at 1844.870, where the recent high is. Take profit will be at 1786.545, where the overlap support and -61.8% Fibonacci expansion line is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Xau-usd

XAUUSD Potential for Bearish Drop towards overlap supportLooking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. To add confluence to this bias, price is also along a descending trendline.

Looking for a sell entry at 1818.975, where the overlap resistance and 23.6% Fibonacci line is. Stop loss will be at 1844.870, where the recent high is. Take profit will be at 1786.545, where the overlap support and -61.8% Fibonacci expansion line is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Gold under pressureAs the DXY strengthened, Gold broke the 1819 support level to trade lower, also resisted by the downward trendline.

Currently consolidating along the 1812 level, Gold is likely to continue sliding lower to test the round number level of 1800. If the price breaks below 1800, the next key support level is at 1785.

Overall, it is hard to anticipate sustained upside moves on Gold. Any retracements to the upside could be seen as a setup for further selling opportunities.

Gold Futures ( GC1! ), H4 Potential for Bearish ContinuationTitle: Gold Futures ( GC1! ), H4 Potential for Bearish Continuation

Type: Bearish Continuation

Resistance: 1854.9

Pivot: 1827.7

Support: 1791.8

Preferred Case: Looking at the H4 chart, my overall bias for GC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. To add confluence to this bias, price is also along a descending trendline. Expecting price to possibly drop from the pivot at 1827.7 which is the overlap resistance before heading towards the support at 1791.8, where the overlap support and -61.8% Fibonacci expansion line is.

Alternative scenario: Price may head back up towards the resistance at 1854.9, which is the overlap resistance.

Fundamentals: There are no major news.

XAUUSD Potential for Bearish Drop towards overlap supportLooking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. To add confluence to this bias, price is also along a descending trendline.

Looking for a sell entry at 1818.975, where the overlap resistance and 23.6% Fibonacci line is. Stop loss will be at 1844.870, where the recent high is. Take profit will be at 1786.545, where the overlap support and -61.8% Fibonacci expansion line is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

XAUUSD Potential for Bearish Drop | 27th February 2023Looking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. To add confluence to this bias, price is also along a descending trendline.

Looking for a sell entry at 1818.975, where the overlap resistance and 23.6% Fibonacci line is. Stop loss will be at 1844.870, where the recent high is. Take profit will be at 1786.545, where the overlap support and -61.8% Fibonacci expansion line is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD: DXY Running out of steam?Pretty decent RR here, based on great level of support, and DXY slow down.

Even though everything about USD is positive (consistent green fundamental data, likely avoiding recession, hawkish FOMC attitude to interest rates), it's still not firing - this tells me it's already over-priced.

I'm going long on GOLD, Buy 1810, SL 1788, TP 1946, RR 1:6.3

XAUUSD Potential for Bearish Drop to overlap supportLooking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. To add confluence to this bias, price is also along a descending trendline.

Price is currently retesting the overlap support at 1824.515.

Looking for a sell stop entry at 1816.137, to ride the bearish momentum. Stop loss will be at 1844.870, where the overlap resistance is. Take profit will be at 1786.545, where the overlap support is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

XAUUSD Potential for Bearish Drop | 24th February 2023Looking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. To add confluence to this bias, price is also along a descending trendline.

Price is currently retesting the overlap support at 1824.515.

Looking for a sell stop entry at 1816.137, to ride the bearish momentum. Stop loss will be at 1844.870, where the overlap resistance is. Take profit will be at 1786.545, where the overlap support is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Potential for Bearish Drop | 23rd February 2023Looking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market.

Looking for a sell stop entry at 1818.975, to ride the bearish momentum. Stop loss will be at 1844.870, where the overlap resistance is. Take profit will be at 1786.545, where the overlap support is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Gold Futures ( GC1! ), H4 Potential for Bearish ContinuationTitle: Gold Futures ( GC1! ), H4 Potential for Bearish Continuation

Type: Bearish Continuation

Resistance: 1854.9

Pivot: 1827.7

Support: 1787.2

Preferred Case: Looking at the H4 chart, my overall bias for GC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. Expecting price to possibly drop from the pivot at 1827.7 before heading towards the support at 1787.2, where the overlap support is.

Alternative scenario: Price may head back up towards the resistance at 1854.9, which is the overlap resistance.

Fundamentals: There are no major news.

XAUUSD Potential for bearish drop to overlap supportLooking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a sell stop entry at 1818.975, to ride the bearish momentum. Stop loss will be at 1844.870, where the overlap resistance is. Take profit will be at 1786.545, where the overlap support is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

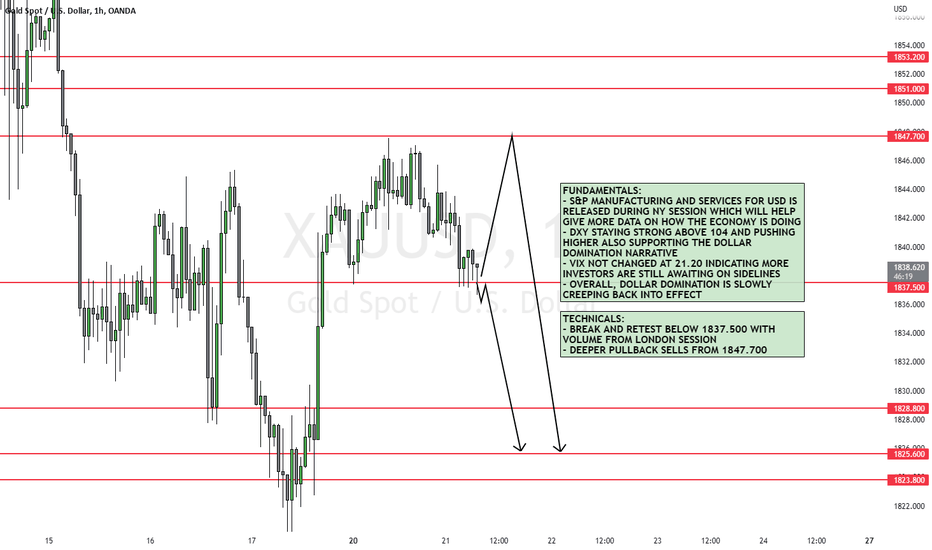

XAUUSD Potential Forecast | Wednesday 22nd February 2023Hi everyone!

Chern Yu back here again with another GOLD forecast/trade idea.

This is based on smart money concepts and structure which forms the basis of technical analysis in FX.

As you can see from the chart above, I have marked out the multiple break of structures present, signifying lower highs and lower lows being formed.

Do take note that this week is still riddled with multiple news release such as the prelim GDP for USD and the upcoming FOMC meeting minutes publication.

I am looking for potential short entries on GOLD.

Fundamental context

1. Given the extremely strong economic data such as the NFP and inflation coming in more resilient, the Fed require a longer runway for their restrictive policy to take effect and I believe that this will prompt the Fed to take on a more hawkish tone to combat the resilient economy of US.

2. Preliminary GDP release looks set to print a positive figure.

Technical context

1. Blue demand zone marked at 1828.5 odds is a potential point of target for short take profits.

2. GOLD is currently on a bearish market.

3. Price most recently cleared buyside liquidity and has since continued bearish.

4. Price also rejected a key H1 resistance level marked by the lighter blue zone.

Personally, GOLD has further bearish potential to tap into the blue demand zone at 1828.5 which will give us a decent ~80 pips.

Trade safe everyone! This week is full of important key news.

Regards,

Chern Yu

XAUUSD H1: Bullish outlook seen, further upside above 1830.50On the H1 time frame, prices are facing bullish pressure from the Ichiomku cloud and a throwback to the support zone at 1830.50, in line with the graphical support and 61.8% Fibonacci retracement could present an opportunity to play the bounce to the resistance zone at 1855.00. Failure to hold above the 1830.50 support zone could see prices push lower to the next support area at 1819.50.

XAUUSD potential Forecast | Tuesday 21st February 2023Hello,

I rely on ICT concepts for my trading. I would like to share a trade idea for Tuesday, February 21st, 2023.

Recap on yesterday 20th Feb Monday

There wasn't much movement yesterday due to the bank holidays for US and CAD. I'm expecting volatility to pick up for today with more major news events coming up such as the USD Flash Services PMI.

Idea

I'm expecting price to possibly head towards the overlap resistance at 1850.710, which is in line with the 61.8% Golden Fibonacci ratio.

For entries, it's important to use confirmations on smaller timeframes and to always exercise caution while trading.

Thank you,

Chen Yongjin

New Bearish setup on XAUUSDThe quick rejection that precedes the breakout of the bearish channels indicated on the chart reveals a possible downward movement on XAUUSD.

However, it is advisable to wait for the price to step back inside the channel comfortably, before looking in a short position.

Watch out, for the alternative bullish run of price retesting the OB at the previous supply area.

j.Hejazi | Gold CorrectionGold is currently in a corrective movement towards the 1850 level, which is a previous support level that has turned into resistance. Additionally, the upper trendline of the descending channel, the local trendline (in yellow), the 23.6% Fibonacci level, and the 50-period moving average on the 4-hour timeframe all converge in this area.

It is possible to see a rebound towards the 1825 level from the current support zone, based on the factors mentioned above, such as the former support level turning into resistance and the convergence of multiple technical indicators.

-------------------------------------------------------------------------

Let me know your thoughts in the comments, and show your support by liking the idea.

Please follow if you're interested in more ideas like this.

Your support is greatly appreciated!