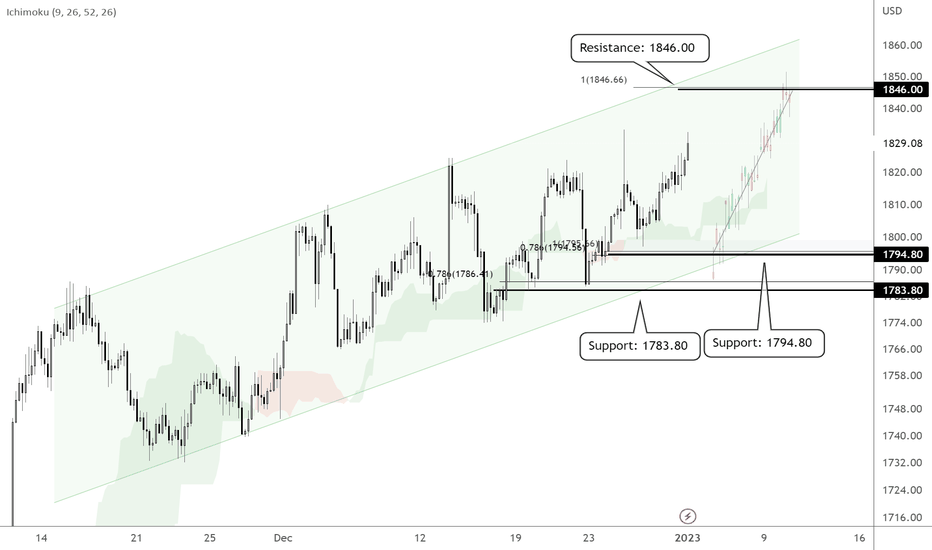

XAUUSD H4: Bullish outlook seen, further upside above 1794.80On the H4 time frame, prices are showing bullish order flow and holding in an ascending channel where a throwback to the support zone at 1794.80 in line with the Fibonacci confluence levels could present an opportunity to play the bounce to the resistance target at 1846.00. Prices are holding above the ichimoku cloud as well, supporting the bullish bias.

Xau-usd

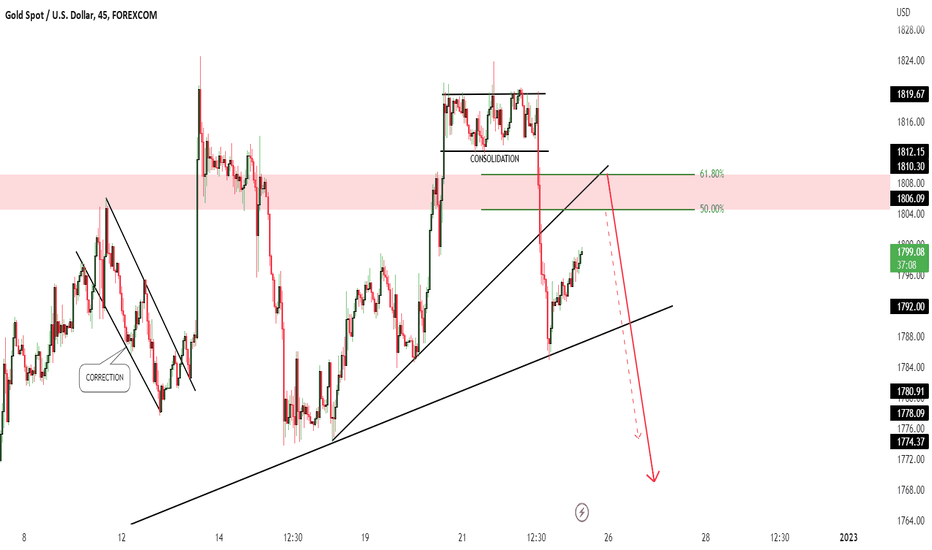

GOLD:SELL From Resistance Area For A New SHORT SetupGOLD may have a Rejection in the resistance area with a Double TOP in this or the next sessions. Our Setup is about a new SHORT impulse with tight stop loss. On Wed Jan 4 the US economic news ISM Manufacturing PMI, JOLTS Job Openings, and the FOMC Meeting will be crucial to understand the start point of this 2023.

XAUUSD 4hour Analysis January 1st, 2023Gold Bullish idea

Weekly Trend: Bullish

Daily Trend: Bullish

4Hour Trend: Bullish

Trade scenario 1: We have been seeing gold turn very bullish but we also noticed a consolidating pattern which usually suggests a large move is imminent.

Going into this week we’re looking to continue with the bullish trend. The safest scenario would be to see another rejection off of our 1800.00 support zone with strong bullish conviction to enter on.

Look to target higher toward 1850.00

Trade scenario 2: For us to consider gold bearish again we would need to see price action break below 1800.00 and form bearish structure below.

HUGE GOLD SHORT TO START 2023 OFF RIGHTHello Traders,

Happy New Year All!!!

I wish you all a very successful 2023!

Today we are looking at OANDA:XAUUSD where we have identified a solid zone of reversal.

Why are we entering?

- We are at the end of our subwave 2 correction. We are now expecting bearish subwave 3 to occur which is a impulsive wave.

- We are expecting a rejection from our -1 fibonacci level

What is our confirmation?

- Rejection from our -1 fibonacci level

- Break of wave C WFB (Watch For Break)

- Break of our 8HR EMA

Entry

- Safe Entry: Rejection of our SELL zone with a break of our 8HR EMA / WFB (Watch For Break)

- Risk Entry: Rejection of our SELL zone

- Risk Entry 2: Early break of 8HR EMA / WFB (Watch For Break)

Once entered, where will our Stoploss be?

- Above our fibonacci: 1850 (60 pips)

Where do we take profits?

First TP - Structure level: 1730 (1140pips)

Second TP - Previous low: 1616 (2280pips)

Final TP - -0.27 fibonacci: 1562 (2920pips)

Be sure to follow me and check out my other ideas below!

XAUUSD Potential for Bullish Rise | 30th December 2022Looking at the H4 chart, my overall bias for XAUUSD is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Price has tapped into my pullback buy entry at 1805.309, where the 50% Fibonacci line is. Stop loss will be at 1791.340, where the 20% Fibonacci line is. Take profit will be at 1823.846, where the previous swing highs are.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

GOLD:SELL From Double TOP RSI DIV for A SHORT SetupThe GOLD presents a divergence on RSI on a daily timeframe meanwhile in short term, the price is still inside a Bearish flag after a Double Top with divergence in the last sessions. The stochastic is still in the overbought area and our Forecast is about a new Bearish impulse.

DAILY TIMEFRAME

XAUUSD H4: Bullish outlook seen, limited upside above 1786.00On the H4 time frame, prices are approaching the support zone at 1786.00, in line with the ascending channel’s support and Fibonacci confluence level. A throwback to the support zone at 1786.00 could present an opportunity to play the bounce to the resistance zone at 1825.50. Prices are holding above the Ichimoku cloud as well, where we could see more upside in prices.

XAUUSD Potential for Bullish Rise | 29th December 2022Looking at the H4 chart, my overall bias for XAUUSD is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Price has tapped into my pullback buy entry at 1805.309, where the 50% Fibonacci line is. Stop loss will be at 1791.340, where the 20% Fibonacci line is. Take profit will be at 1823.846, where the previous swing highs are.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Potential for Bullish Rise | 28th December 2022Looking at the H4 chart, my overall bias for XAUUSD is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. Looking for a pullback buy entry at 1805.309, where the 50% Fibonacci line is. Stop loss will be at 1791.340, where the 20% Fibonacci line is. Take profit will be at 1823.846, where the previous swing highs are.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Gold Next Move ??XAUUSD ( Gold / U.S Dollar )

Completed Correction " ABC " and Elliot Triple Wave Combo " xyz "

After a Consolidation Phase it is Making its Correction will Reject from the Fibonacci Level ( 61.80% - 78.60% )

Short Buy and Long Selling Opportunity

Rising Wedge as a Corrective Pattern in Short Time Frame #STF

XAUUSD H1: Bearish outlook seen, further downside below 1813.00On the H1 time frame, prices are facing bearish pressure from the resistance at 1813.00, in line with the Fibonacci confluence levels. A pullback to the resistance zone at 1813.00 could present an opportunity to play the drop to the support zone at 1786.00. Stochastic is approaching the resistance at 92.91 as well, supporting the bearish bias.

XAUUSD Potential for Bearish Drop | 27th December 2022Looking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price crossing below the Ichimoku cloud , indicating a bearish market. Looking for a pullback sell entry at 1805.309, where the 38.2% Fibonacci line is. Stop loss will be at 1823.865, where the previous swing high is. Take profit will be at 1773.845, where the previous swing low is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Gold#XAUUSD Gold

After the Consolidation Phase at the Daily S / R Level it has Breakout the Lower Trend Line #LTL and making its Retracement that will be Completed at Fibonacci Level ( 50.00% / 61.80% )

We have Break of Structure #BOS

Buying Divergence

BULLISH CHANNEL in Long Time Frame #LTF and Leading Diagonal in Short Time Frame #STF

Completed " ABC " Correction Again Following Impulsive Waves

XAUUSD Potential for Bearish Drop | 23rd December 2022Looking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. Looking for a pullback sell entry at 1805.309, where the 38.2% Fibonacci line is. Stop loss will be at 1823.865, where the previous swing high is. Take profit will be at 1773.845, where the previous swing low is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Potential for Bullish Continuation | 22nd December 2022Looking at the H4 chart, my overall bias for XAUUSD is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Looking for a pullback buy entry at 1807.835, where the 23.6% Fibonacci line is. Stop loss will be at 1798.775, where the 50% Fibonacci line is. Take profit will be at 1824.515, where the previous swing high is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD M30: Bearish outlook seen, further downside below 1817.50On the M30 time frame, prices are facing bearish pressure from the resistance at 1817.50 and a pullback to the resistance zone presents an opportunity to sell to the support zone at 1799.00. The 1799.00 support zone coincides with the 50% Fibonacci retracement. Prices are holding below the 20MA as well, supporting the bearish bias.

XAUUSD Potential for Bullish Continuation | 21st December 2022Looking at the H4 chart, my overall bias for XAUUSD is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. Looking for a pullback buy entry at 1807.835, where the 23.6% Fibonacci line is. Stop loss will be at 1798.775, where the 50% Fibonacci line is. Take profit will be at 1824.515, where the previous swing high is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Potential Forecast | 20th December 2022Hi everyone, today I will be talking about a possible XAUUSD long trade using Smart Money Concepts for this week.

Trade idea

1. Price is forming higher highs and higher lows as seen by the multiple BOS (break of structure) to the upside

2. Demand zones are validated and we can see that current price action just broke structure on LTF

3. Upon drawing the fibonacci retracement tool, 0.5-0.618 level coincides nicely with a breaker block zone on the left (marked by green zone)

4. We will look for entries upon a retracement on GOLD/XAUUSD and enter longs

Things to look out for:

- Price could just continue to head up further given NY session and strong bullish momentum.

- Trade will be invalidated if price continues to break HTF structure at ~1824.

Trade safe guys!

Regards,

Chern Yu

XAUUSD Potential for Bearish Drop | 20th December 2022Looking at the H4 chart, my overall bias for XAUUSD is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. Looking for a sell entry at 1786.116, where the 23.6% Fibonacci line is. Stop loss will be at 1798.775, where the recent high is. Take profit will be at 1774.276, where the previous swing low is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

How to use HIGH IMPACT NEWS as a confluence!During deflation investors prioritize investment-grade bonds, defensive stocks (those of consumer goods companies), dividend-paying stocks, and cash.

Current asset flows, including the slide in oil indicates this regime allocation is in play (see attached image - below)

In terms of XAU:

- It has already been repriced higher after less-hawkish comments from Powell. The new rate of change (lower) can now be established for the overall down trend

- Going into DEFLATION, your gold is likely to be “deflate” in price because the logic is: hard times cause people to sell their assets (gold, silver etc.) to make ends meet

- There is a greater incentive for people who understand what's happening (like us!) to shot XAU at these higher prices or get in cash/bonds in order to buy the dip in equities down the road once Fed policy actually hints towards loosening.

The current narrative around interest rates is “higher for longer” = still no signal they will stop hiking which = it's still valid to look for shorts on XAU and stocks