Xau-usd

XAUUSD Potential for Bearish Momentum | 18th November 2022On H4, the price has broken out of the descending channel and is now above the ichimoku cloud , indicating a bullish bias. Looking to play the pullback. Price has tapped into my sell entry at 1765.050, which corresponds to the 78.6% Fibonacci line. The stop loss will be set at 1807.960, the previous swing high. The take profit point will be at 1727.850, which is the 61.8% Fibonacci line.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Potential for Bearish Momentum | 17th November 2022On H4, the price has broken out of the descending channel and is now above the ichimoku cloud , indicating a bullish bias. Looking to play the pullback. Price has tapped into my sell entry at 1765.050, which corresponds to the 78.6% Fibonacci line. The stop loss will be set at 1807.960, the previous swing high. The take profit point will be at 1727.850, which is the 61.8% Fibonacci line.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

Gold Daily analysis 17.11.2022Gold failed to sustain above the 1780 level and did not even attempt to test the 1800.

Since gold closed below the bullish channel formed last week now bears are on ride.

Gold should test the 1748 and 1730 levels which will also be healthy corrections in Fib.

I am still bullish and I suggest to prefer buying

BUY 1748 SL 1742 TP 1758

BUY 1730 SL 1722 TP 1748

XAUUSD H4: Bearish outlook seen, further downside below 1767.00On the H4 time frame, prices are facing bearish pressure from the resistance at 1786.50, in line with the graphical resistance zone. A break below the downside confirmation level at 1767.00 could provide a bearish acceleration to the next support zone at 1731.80, which coincides with the graphical resistance-turned-support level and 100% Fibonacci extension. Stochastic is testing resistance at 96.02 as well where we could see a reversal below this level.

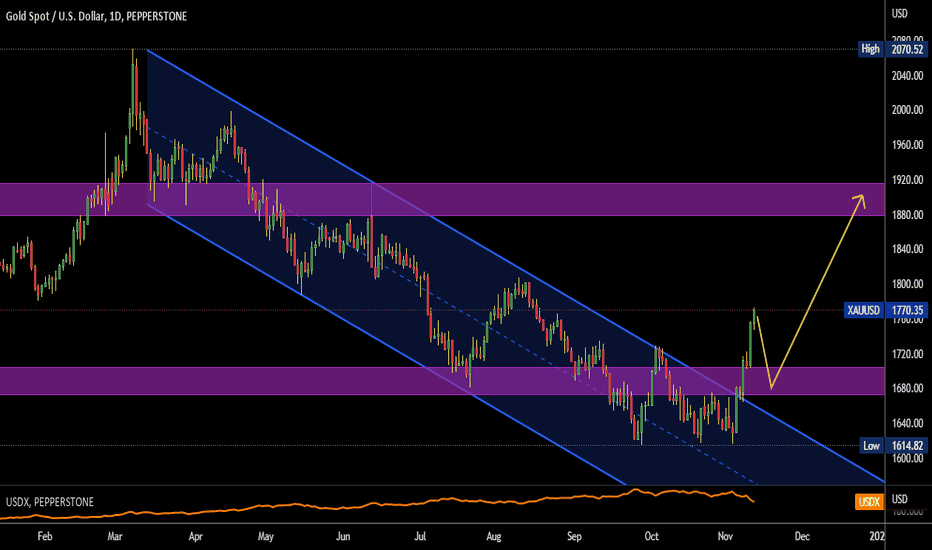

GOLD:BUY From Retest FIBO 61.8% for a new LONG SetupGOLD: The XAU comes from a long Bearish trend, and started to grow again after the triple Bottom around 1615. From that point, the price started a long bullish impulse with high volatility ( look at the raising Angle of the trend ), and looking at our analysis we think about a new Long setup. We are sure about an imminent retracement but only when the price will reach the resistance area around 1807.960

XAUUSD Potential for Bearish Momentum | 16th November 2022On H4, the price has broken out of the descending channel and is now above the ichimoku cloud, indicating a bullish bias. Looking to play the pullback with a sell entry at 1765.050, which corresponds to the 78.6% Fibonacci line. The stop loss will be set at 1807.960, the previous swing high. The take profit point will be at 1727.850, which is the 61.8% Fibonacci line.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Potential for Bearish Momentum | 15th November 2022On H4, we have a bullish bias with the price breaking the descending channel and above the ichimoku cloud . Looking to play the pullback with a sell entry at 1765.050, where the 78.6% Fibonacci line is located. Stop loss will be at 1807.960, where the previous swing high is. Take profit will be at 1727.850, where the 61.8% Fibonacci line is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD Potential for Bullish Continuation | 14th November 2022On H4, we have a bullish bias with the price breaking the descending channel and above the ichimoku cloud. Looking for a pullback buy entry at 1727.850, where the 23.6% Fibonacci line is located. Stop loss will be at 1680.935, where the 61.8% Fibonacci line is. Take profit will be at 1802.641, where the previous swing high is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website.

XAUUSD 4hour Analysis November 13th, 2022Gold Bullish idea

Weekly Trend: Bullish

Daily Trend: Bullish

4Hour Trend: Bullish

Trade scenario 1: After last week we can now see that gold is bullish on all major timeframes.

Going into this week we’re ideally looking for gold to continue bullish, we just need to see some structure first.

Look for a higher low as close to 1675.00 as possible before entering long.

Trade scenario 2: The other likely scenario is that gold keeps rallying without structure formation. If this happens we can’t do anything yet.

💡GOLD (XAUUSD) - Weekly Technical Analysis UpdateMidterm forecast:

1674.85 is a major support, while this level is not broken, the Midterm wave will be uptrend.

We will close our open trades, if the Midterm level 1674.85 is broken.

Technical analysis:

The RSI downtrend #1 is broken, so the probability of continuation of uptrend is increased.

A trough is formed in daily chart at 1616.52 on 11/03/2022, so more gains to resistance(s) 1807.13, 1850.71, 1878.75 and more heights is expected.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index ( RSI ) is 70.

Take Profits:

1658.96

1688.79

1708.45

1730.00

1765.00

1807.13

1850.71

1878.75

1914.23

1980.16

2074.89

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Forex / Crypto trader?

Now, It's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

💡GOLD (XAUUSD) - Weekly Technical Analysis UpdateMidterm forecast:

1674.85 is a major support, while this level is not broken, the Midterm wave will be uptrend.

We will close our open trades, if the Midterm level 1674.85 is broken.

Technical analysis:

The RSI downtrend #1 is broken, so the probability of continuation of uptrend is increased.

A trough is formed in daily chart at 1616.52 on 11/03/2022, so more gains to resistance(s) 1807.13, 1850.71, 1878.75 and more heights is expected.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 70.

Take Profits:

1658.96

1688.79

1708.45

1730.00

1765.00

1807.13

1850.71

1878.75

1914.23

1980.16

2074.89

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Forex / Crypto trader?

Now, It's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Trade well, ❤️

ForecastCity English Support Team ❤️

XAUUSD | Potential Forecast | 13 November 2022Hi guys, Chern Yu here.

I use smart money concepts (SMC) in analysing charts and price.

Confluences used:

1. Demand/Supply zones

2. Liquidity

3. Structure

4. Market inefficiencies

Analysis:

- Gold is hovering around 1771 area currently.

- Possibility of tapping into H4 supply zone.

- Price is structurally bullish and will look for longs next week.

- Higher highs and higher lows being formed.

- Will be identifying possible short term reversals once it taps into supply zone above.

Let's smash the next week!

Do make sure to leave a comment and give a boost!

I will be more than happy to answer any questions there are!

Cheers,

CY