Gold at 1680, a decision level...Despite having bounced strongly from the 1617 support level, Gold consolidates along the 1680 price level. As the price consolidates and fails to break higher, this signals the potential for a reversal.

A reversal in Gold could also be driven by a recovery in the strength of the DXY.

Look for the price to break below 1660 to indicate a downside potential, with the key support level at 1617.

Alternatively, if Gold trades higher to break above 1685, Gold could continue trading higher toward the next resistance level of 1725.

Xau-usd

XAUUSD: Bearish outlook seen, limited downside below 1687.00On the H4 time frame, prices are facing bearish pressure from the resistance at 1687.00, in line with the descending trendline and Fibonacci confluence levels where we could see a further downside below this zone to the support zone at 1651.00. This support zone lines up with the graphical support and 50% Fibonacci retracement. Stochastic is testing resistance at 95.72 as well where we could see further downside below this level.

XAUUSD 4hour Analysis November 6th, 2022Gold Bearish idea

Weekly Trend: Bearish

Daily Trend: Bearish

4Hour Trend: Bearish

Trade scenario 1: Despite last weeks’ huge bullish volume we are still overall bearish. As long as price action remains below 1675.00 bearish is our bias.

Going into this week we’re looking for reactions from 1675.00 and we can spot a couple good setups if we do head bearish again.

Look to enter short on significant rejection & lower highs after a break of support.

Trade scenario 2: For us to consider gold bullish again we would need to see a significant break above 1675.00 with a higher low above.

Only in this scenario I would consider longing gold given the current price action.

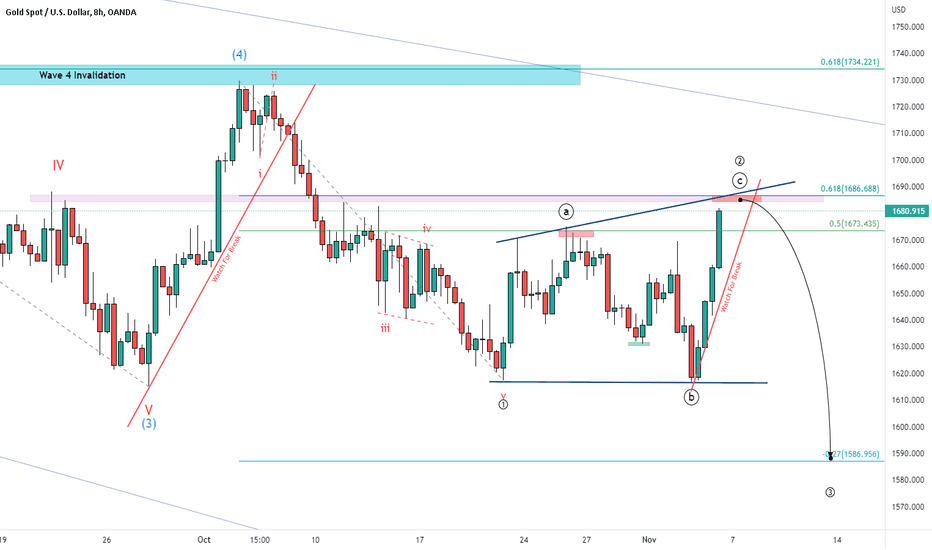

GOLD 1000PIP SHORTGOLD SHORT

Why are we entering?

- Expecting USD strength = GOLD SHORT

- We are in wave 5, subwave 5, microwave 3 in our Elliot wave analysis

- We are expecting price to reverse at our 0.618 fibonacci level

What is our confirmation?

- Rejection from our 0.618 fibonacci level

- Rejection from our trendline

- Rejection from our structure level

Entry

- Safe Entry: Rejection of our SELL zone with a break of our WFB

- Risk Entry: Rejection of our SELL zone

- Risk Entry 2: Early break of WFB

Once entered, where will our Stoploss be?

- Above our fibonacci: 1691 (50 pips)

Where do we take profits?

First TP - Previous low: 1617 (700pips)

Final TP - -0.27 fibonacci: 1587 (1000pips)

Be sure to check out my other trade ideas below!!!

XAUUSD potential Forecast POST NFP | 7th November 2022Hi there guys,

I mainly use ICT + Smart Money Concepts for my trading.

Analysis

- Last week due to the release of NFP data, price tapped swept the sellside liquidity before gaining strong bullish momentum to the upside

- I also noted out the 2 Daily Fair Value Gaps & buyside liquidity areas.

Idea

Expecting this strong bullish momentum to sweep the buyside liquidity at 1684.620 and potentially bring price to the Daily Fair Value Gaps areas at 1684.040 & 1699.915 respectively

Areas to take note of

1st Daily FVG: 1684.040

2nd Daily FVG: 1699.915

Buyside Liquidity: 1684.620

For entries, always use confirmations on the smaller timeframes! Stay safe trading!

Feel free to follow me, comment + boost this post if you guys enjoyed this!

Regards,

Chen Yongjin

Post FOMC and NFP | GOLD Potential Forecast | 5th November 2022Hi guys! Chern Yu here~

My trading methodology revolves around smart money concepts and liquidity.

This week's data releases from FOMC and NFP gave us plenty of clues as to where price will be headed to.

Fundamental COntext

- FOMC meeting: FED raised interest rates by 75bps.

- Jerome Powell mentioned to increase the terminal rate and seemingly raising rates for a longer period despite saying rate hikes will slow down.

- NFP: prints 261k vs 197k (better than forecast but decreased from last month)

- Unemployment rate: 3.7% vs 3.5% (Rate hikes taking effect, market pricing in the bearish economic outlook for USD)

ALL EYES IS ON CPI PRINT ON 10th NOVEMBER

Forecast

- I believe that next week will be CRUCIAL in telling the direction of price action in GOLD.

- If CPI prints lower and shows it has improved, I anticipate a more risk on environment and USD will depreciate against GOLD or other currencies.

- If CPI prints higher and shows it needs time to get back lower, I believe market will still remain sidelined and USD will still continue to come out the winner. (GOLD appreciates in this case)

I will be giving an update next week so please stay tuned!

It will be an interesting week and there are swing set ups and opportunities waiting on GOLD or EURUSD.

Stay relentless.

XAUUAS REACHED OUR aimXauusd reached our position in long action from yesterday

But to be honest my first action for buying gold was field but i wrote a comment on my past idea that i will get in at new position for long as you saw in chart but there is NP at this cause all of trading stands on risk management….

Stay tuned for more trades as this (400pips)

Follow for more…

XAU/USD is in descending channel, expect 1616 Globally, XAU/USD is in a downtrend in the Month, Week, and Day timeframes.

Locally, XAU/USD is inside a descending channel. XAU/USD got rejected from 1656 with a bearish engulfing in 2-hrs timeframe.

So, in short term (next 2-3 days), I expect the price will be down further to 1616. It's weekly support.

XAUUSD H1: Bullish outlook seen, further upside above 1627.20 On the H1 time frame, prices are approaching the support zone at 1627.20, in line with the 100% Fibonacci extension where we could see further upside to the resistance zone at 1645.50. The 1645.50 resistance zone coincides with the graphical resistance and 38.2% Fibonacci retracement. Stochastic is approaching support as well where we could see a bounce above this level, in line with prices.

Educational Series - Smart Money Concepts ( Liquidity )Hi there guys!

I will be doing a short tutorial on Smart Money Concept's liquidity.

What is it?

- Liquidity acts as a driver to move the market in a specific price range.

- We can find liquidity in areas where many people place stop losses and buy/sell stops.

- Market makers will manipulate the price in order to break through these obvious zones and seize the liquidity.

How to look for them

- You will be looking for areas where price are of relative equal highs/lows.

- Areas where price has not gone to swept the "stop losses"

Why is it useful?

- Helps to forecast where price might potentially head to

- Potential areas for take profits upon clearing of liquidity

- Avoid placing your stop loss at liquidity areas

It takes some time to learn how to spot liquidity.

If you do enjoy this tutorial, feel free to follow me and boost this post! :)

Regards,

Chen Yongjin

XAUUSD Potential Forecast | 31st October 2022Hi there guys,

I mainly use ICT + Smart Money Concepts for my trading.

With a very rangy market today. I'm moving to the H4 timeframe for gold and spotted 2 different areas where gold might head to after the range breakout.

1.) Long to the H4 Fair Value Gap at 1653.120

2.) Short to the H4 Fair Value Gap at 1629.335

Always use confirmation entries on the lower timeframe for entries! Stay safe trading guys!

Please comment + boost this post if you guys enjoyed this!

XAUUSD 4hour Analysis October 30th, 2022Gold Bearish idea

Weekly Trend: Bearish

Daily Trend: Bearish

4Hour Trend: Bearish

Trade scenario 1: Overall we are still bearish on gold but we did see a push up to our 1675.00 area for another test.

We did see some rejection from 1675.000 after and price action turned bearish. Going into this week we’re looking to continue with the bearish trend.

Look for another test of 1660.00 with good bearish rejection to enter short on.

Trade scenario 2: It’s hard to find a quality bullish setup to offer until we break above 1675.00

#XAUUSD THE TABLE NOW HAS TURNEDThe uptrend has taken a pause naturally as it is struggling to break above the 4H MA200 (1,668.71), having failed to close a candle above it.

This is a strong sign of (short-term at least) profit taking.

As mentioned yesterday, the 4H MA50 (1,648.31) is the short-term Support, there is also a Higher Lows trend-line involved (1,653.90) starting from the October 21 Low.

In any case, the 1D MA50 (my end target on this week's buy) is now even lower at 1,686.73, so I am moving the SL even higher in profit (1,653.80) in order to considerably limit the risk.

If either the 1D MA50 or the SL are hit, I will be in no rush to re-enter either with a Sell or a Buy ahead of today's ECB Rate Decision and U.S. GDP.

1D remains borderline neutral (RSI # 48.291, MACD # -10.580, ADX # 21.918) and only a break above the 1D MA100 (1,731.55) can reverse the trend into long-term bullish.

If we close today below the 4H MA50 (i.e. news are digested), I will sell (TP # 1,620).

XAUUSD H4: Bullish outlook seen, further upside above 1643.00On the H4 time frame, prices are approaching the support zone at 1643.00, in line with the Fibonacci confluence levels where a throwback to this area presents an opportunity to play the bounce to the next resistance zone at 1687.00. This resistance zone coincides with the descending trend line, 61.8% Fibonacci retracement and 100% Fibonacci extension level. Stochastic is testing support at 1.91 as well, where we could see more upside, in line with prices.