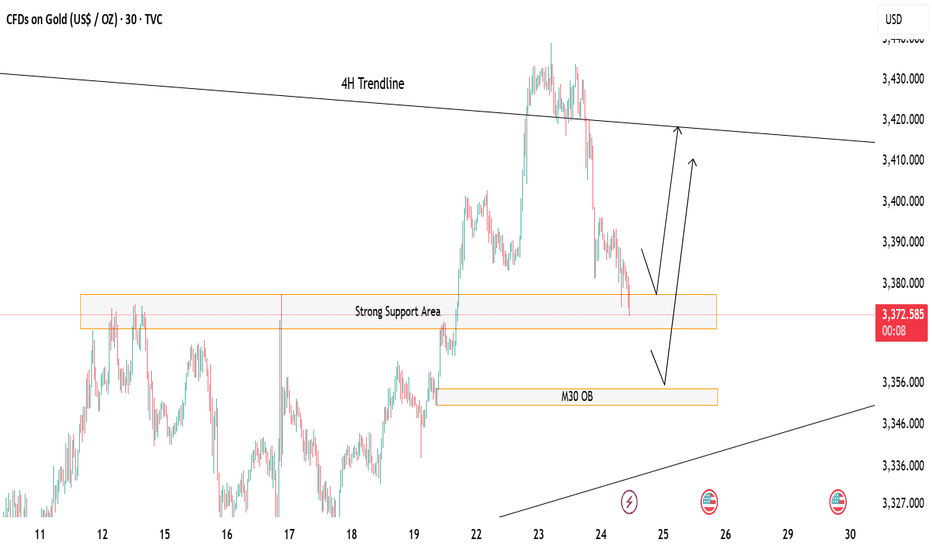

Gold at Key Decision Zone – Bounce or Break?Price is currently hovering above a strong support zone, showing potential for a short-term bounce. 🔁

If this zone holds, we could see a bullish reaction toward the 4H trendline resistance above. 📈

However, a break below may lead price to drop and tap into the M30 Order Block (OB) for a deeper mitigation before any move up. ⚠️

If this happen we could look for potential sell till the OB test otherwise the buying opportunity should focused more

🎯 Watch these key zones carefully – market is at a decision point!

Both buy and sell setups possible depending on how price reacts at these levels.

Xausud

Gold Trade Setup Eyes on 15M Demand ZonePrice is coming close to 3338, where we have a 15-Minute Order Block (OB) 📍. This is a fresh demand zone and can give a bullish reaction when price taps into it 🟢.

📌 Plan:

We will wait for price to tap the OB ✅

If we see bullish signs like rejection wicks or bullish candles, we will enter a buy 📈

Our target will be near 3366, just below the bearish FVG 🎯

XAUUSD Breakout Done , Long Entry Valid Now To Get 150 Pips !Here is my opinion on Gold On 15 Mins , we have a very good closure with breakout candle and now the price retest the broken res and new support and we can enter a buy trade as a scalping , if we have a 4H Closure Below 3326.00 this idea will be not valid anymore.

XAUUSD: Still Bullish with improved entry zones! Gold experienced a sudden drop today, falling to 3335 after briefly reaching 3391. This unexpected decline was not anticipated given the bullish price momentum. However, it has provided clarity for buyers, particularly swing traders. The price could drop to 3340 once more before reversing and hitting our first target, followed by a second target later.

Another possible scenario arises if the price continues to drop further. In this case, the second entry scenario becomes more secure, as Asian session volatility could cause the price to go sideways.

Please use accurate risk management and consider liking and commenting on this idea.

Good luck and trade safely.

Team Setupsfx_

Gold’s back on track, paying attention to momentum and hintsXAUUSD is still climbing steadily within its upward parallel channel, respecting structure beautifully as we’re now seeing early signs of bullish interest returning, right after we got a nice rejection from the support zone.

Currently I’m watching this bounce to have a target near 3,380 , somewhere around the middle line of the ascending channel. If this bullish push continues with strong volume and momentum, I’ll be locking in that bias and planning my entry accordingly.

Patience first, I always wait for price to prove itself before getting involved.

This could be a beautiful continuation…

Or just one more fakeout before a deeper drop.

Gold is likely to trend upward Gold has made a perfect V - shaped reversal today. It opened at 3,177 and declined unilaterally in the Asian session, once dropping to around 3,120, reaching a new low since April 10. Then it gradually climbed all the way, and has now completely recovered the decline, with a rising trend.👉👉👉

On Friday, we continue to anticipate a bullish daily close for gold. However, if the pullback falls below 3,200, the daily cycle may narrow again, leading to a sustained rebound to 3,235 and 3,260. Therefore, the key point is to monitor whether the price holds above or breaks below 3,200.

For short-term trading of gold, the recommended strategy is to focus on going long during pullbacks and supplement with shorting during rebounds.

Short-term key resistance to watch above: 3250-3260 level

Short-term key support to focus on below: 3190-3200 level

XAUUSD trading strategy

buy @ 3210-3215

sl 3195

tp 3230-3240

If you think the analysis helpful, you can give a thumbs-up to show your support. If you have different opinions, you can leave your thoughts in the comments. Thank you for reading!👉👉👉

A larger corrective pattern is formingIn the previous analysis, a specific range was determined for the price to reverse, after reaching that price range, the price jumped upwards and the price grew by 1700 pips. However, considering that the structure of wave-c is not an impulse, the zigzag was not confirmed and it seems that a larger corrective pattern is forming.

It seems that the reverse contracting triangle pattern is forming, which is currently in wave-d of the triangle. With the completion of wave-d, we can better find the end point of wave-e.

XAU/USD Trendline Breakout (02.04.2025)The XAU/USD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 3077

2nd Support – 3048

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Navigating the Range Ahead of Tariffs Announcement📢 News 📢

President Trump is set to announce new tariffs today, April 2, 2025, at 4 p.m. Eastern Time. This initiative, dubbed "Liberation Day," aims to boost U.S. manufacturing by targeting imports like autos, steel, and pharmaceuticals. 📦💊 However, economists warn that these measures could lead to higher consumer costs and disrupt trade relations. 📉💹

This news might influence market sentiment and could have implications for gold trading. Keep an eye on how the market reacts! 📈💰

📊XAUUSD 1H Analysis (Current Situation)

Market Structure:

The market is in a clear bullish trend with strong momentum from the previous sessions.

Recent price action shows consolidation near 3,132, suggesting a potential liquidity build-up.

There is a higher high formation, but rejection from the supply zone around 3,139 - 3,150.

Key Technical Zones & Confluences:

Supply Zone / Potential Sell Area:

3,139 - 3,150: If price reacts with strong rejections here, a potential short opportunity may emerge.

3,165 - 3,182: If price breaks above 3,150, this is the next key resistance area.

Demand Zone / Potential Buy Areas:

3,110 - Strong Rejection Zone: If price pulls back here and finds bullish confirmations (e.g., bullish engulfing, liquidity grab), a long entry could be valid.

3,092 - 3,075 Potential Buy Zone: A deeper retracement into this level could provide a sniper entry opportunity.

🔴 Sell Setup

Entry Zone: $3,133 - $3,135

SL: Above $3,138 (tight protection)

TP1: $3,128 (first reaction)

TP2: $3,117 (liquidity zone)

TP3: $3,103 (full move)

📌 Reasoning:

Mid-range premium pricing (not at extreme highs but still valid)

Multiple rejections in this zone (potential shift in order flow)

Possible short-term retrace before continuation

🔴 Sell Idea

Entry Zone: $3,145 - $3,150

SL: Above $3,153 (small wick safety)

TP1: $3,132 (reaction level)

TP2: $3,128 (stronger demand)

TP3: $3,117 (full imbalance fill)

📌 Reasoning:

Liquidity grab potential above $3,145

Imbalance & order block confluence

Possible rejection from premium supply

🟢 Buy idea

Entry Zone: $3,094 - $3,089

Stop Loss (SL): Below $3,085

Take Profit (TP) Levels:

TP1: $3,117

TP2: $3,128

TP3: $3,150

📌 Reasoning:

Unmitigated demand zone

Imbalance around $3,094 suggests a reaction

Strong liquidity pockets nearby

📌 Important Notice!!!

The above analysis is for educational purposes only and does not constitute financial advice. Always compare with your own plan and wait for confirmation before taking action.

GOLD surges above $3,100 as April 2 approachesThe international OANDA:XAUUSD has jumped above 3,100 USD for the first time in this trading day, as concerns about US President Donald Trump's tariff policy and its possible economic consequences, along with geopolitical uncertainties, have prompted a new round of safe-haven investment.

As of press time, spot OANDA:XAUUSD was up 0.86% at $3,111/oz, having earlier hit an all-time high of $3,111.55, surpassing the all-time high set last Friday.

Trump signed a proclamation last week imposing a 25% tariff on imported cars, and markets are bracing for so-called “reciprocal tariffs” that the White House is expected to announce on Wednesday.

Gold has hit a record high and is up more than 18% this year, cementing its status as a hedge against economic and geopolitical uncertainty.

Earlier this month, gold prices broke through the psychological $3,000 mark for the first time, a milestone that reflects growing market concerns about economic uncertainty, geopolitical tensions and inflation that will continue to drive gold higher.

Since taking office, Trump has pushed through a series of new tariffs to protect U.S. industry and reduce the trade deficit, including a 25% tariff on imported cars and parts and an additional 10% tariff on all imports from China. He plans to announce a new round of reciprocal tariffs on April 2.

In addition to trade tensions, strong central bank demand for gold and inflows into exchange-traded funds (ETFs) will continue to support the incredible rally in gold prices this year.

In short, until there is a resolution to this back-and-forth tariff war, the tariff issue will continue to push prices higher in the near term.

Technical Outlook Analysis OANDA:XAUUSD

On the daily chart, gold has achieved a key bullish target at the confluence of the 0.50% Fibonacci extension with the upper edge of the price channel. Once gold breaks this level (3,113 USD), it will be eligible for further upside with the next target around 3,139 USD in the short term, which is the price point of the 0.618% Fibonacci extension.

In the meantime, the steep RSI remains active in the 80-100 area but shows no signs of weakening or correction, so in terms of momentum, the bullish momentum remains very strong.

As long as gold remains within the channel, it has a medium-term bullish outlook, otherwise the channel will become a short-term bullish trend channel.

During the day, the bullish outlook for gold will be highlighted by the following technical levels.

Support: 3,086 – 3,057 – 3,113 USD

Resistance: 3,139 USD

SELL XAUUSD PRICE 3140 - 3138⚡️

↠↠ Stoploss 3144

→Take Profit 1 3132

↨

→Take Profit 2 3126

BUY XAUUSD PRICE 3085 - 3087⚡️

↠↠ Stoploss 3081

→Take Profit 1 3093

↨

→Take Profit 2 3099

Why GBPJPY is bullish ?? Detailed Technical and FundamentalsGBPJPY is currently trading around 193.000, with technical analysis indicating a potential bullish breakout that could yield gains exceeding 300 pips, targeting the 198.000 level. This anticipated movement is supported by the pair’s recent behavior, where it edged higher to 194.89 before a slight retreat, suggesting consolidation ahead of a possible upward surge. A strong breakout from the current resistance zone could trigger an aggressive bullish wave.

Fundamentally, the British pound has shown resilience, bolstered by stable economic indicators and a proactive monetary policy stance from the Bank of England. Meanwhile, the Japanese yen has experienced depreciation, influenced by the Bank of Japan’s commitment to maintaining ultra-loose monetary policies. The widening interest rate differential between the UK and Japan favors a stronger GBP, adding bullish momentum to the pair.

Technical indicators further reinforce the bullish outlook for GBP/JPY. The pair has been trading within a consolidation range, and a breakout above the current resistance level could signal the continuation of the prevailing uptrend. Moving averages and oscillators are aligning to support this bullish scenario, with the potential to reach the 198.000 target. Volume analysis also suggests growing buying pressure, which could accelerate the upward move once resistance is breached.

Traders should monitor key resistance levels closely, as a confirmed breakout could present a lucrative opportunity to capitalize on the anticipated 300-pip movement. Implementing robust risk management strategies, such as setting appropriate stop-loss orders, is essential to mitigate potential market volatility. Staying informed about upcoming economic data releases and central bank communications will also be crucial in navigating this trading opportunity effectively.

GOLD, massive rise awaits here... Seed at 2880 level, 3k next.TRADE SEED Signal:

BUY GOLD / XAUUSD.

After our successful trade on GOLD short yesterday registering a whopping 300 pips gain, we are now looking to be on the other side -- as initial shift in behavior has been spotted.

We are now at a higher pre basing zone area. Expect some weighty rise from here on target ATH levels anew with a possible break/

LONG at 2880

Target 3000.

TAYOR.

Trade safely.

Sharing a strategyFor my scalping or Intraday trade, I created this pine script combining various indicator (namely the famous Alphatrend by @KivancOzbilgic, Previous Day Close and 52WeeksHigh/Low) into one indicator.

If price goes above the PDC and Alphatrend is a buy then I will make quick long trade. If price goes below the PDC and Alphatrend is a sell then I will make quick short trade. I added a percentage based on PDC to give me where I need to put my stoploss. Not really important as I always have proper risk reward ratio but it comes handy most of the time.

“ XAUUSD 15M | High-Probability Short from Key Supply Zone ”🔻 XAUUSD 15M – Precision Short Setup 🔻

Spotted a high-probability short opportunity on XAUUSD using a clean market structure and supply zone analysis. After a bullish retracement, price tapped into the supply zone at 2869.88, showing signs of rejection and potential for a downward move. This aligns with the current bearish momentum on the lower timeframes.

📈 Entry: 2869.35

❌ Stop-Loss: 2873.00 (Above the supply zone to protect against false breakouts)

✅ Take-Profit: 2856.00 (Targeting recent lows for optimal risk-to-reward)

Analysis:

Price is reacting to a key supply area, indicating a possible shift in momentum. The rejection at this level suggests that liquidity above the recent highs has been grabbed, paving the way for a move lower. With a solid risk-to-reward setup, this trade targets the next significant support zone.

Risk Management:

Maintaining a disciplined stop-loss to protect capital while allowing room for price fluctuations. The trade offers a favorable R:R ratio, aligning with my trading strategy based on smart money concepts.

💬 Drop your thoughts below and let me know how you see this playing out! 👇

XAUUSD going for new ATH!⭐After a beautifull double top pattern & a good correction GOLD seems to be ready for a new ATH this year!

📈XAUUSD is in a medium uptrend with obvious correction and momentum movements forming new LH(Lower High) & HH(Higher Highs) which further strengthens the upward trend! 📊After the FIB Retracement applied behind the representation, gold does not seem to change its trend anytime soon, but although it is close to a pullback in the 38.20 area, it does not represent such a strong upward trend that it does not try to go down at least in the GOLDEN ZONE (50%-61,80%)

📍US PPI and CPI data due later in the week

📍Dollar at its highest level in over two years

📍Market sees 25 bps reduction in rate cuts this year

💥Position Recommendations💥

Entry: 2650

Stop Loss: 2630

Take Profit 1: 2680

Take Profit 2: 2700

Take Profit 3: 2750 (I do not recommend only with subsequent confirmations)

XAUUSD ANALYSIS IS READY TO DROP DOWN MUST READ THE CAPTION This chart depicts the price action of Gold (XAU/USD) on the 1-hour timeframe using Heikin Ashi candles. Below is the description:

1. Key Levels:

Stop Loss (Red Line): Positioned at 2671.01, this represents the level to exit the trade if the market moves against the position.

Break Level (Gray Zone): Around 2660.28, this acts as a potential confirmation area for a trend change or continuation.

Target (Blue Line): Set at 2630.71, indicating the take-profit level.

2. Trend Analysis:

The price has been fluctuating within an upward green channel before breaking downward.

The yellow highlighted zone shows consolidation or a potential pullback area before the expected move.

3. Prediction:

Blue arrows suggest an anticipated bearish movement.

The price is expected to retest the break level (2660.28) before dropping toward the target of 2630.71.

4. Trading Plan:

Short position from the break level with a target at 2630.71.

Risk management with a stop loss at 2671.01.

This chart appears to focus on a bearish setup, with the assumption that the price will follow the outlined downward movement after retesting resistance.

XAUUSD SELLING ?? FIB REJECTION=PRICE DELFLECTIONIt seems that gold is struggling to break key Fibonacci levels. I think this is partly due to the volatility in the cryptocurrency market. In my opinion, there is a distinct correlation between Bitcoin rising and gold falling. While I don’t believe this trend will be permanent, in an uncertain financial climate, I think investors are still determining their "best bet." My bias is that gold will reject the 0.23 Fibonacci level and end up retesting support. This play could take a few days to set up.

ENTRY: 2685

TP1: 2653

TP2: 2618

TP3: 2584

TP4: 2561

SL: 2708

Signature Analysis and Trade Plan for XAU/USD (Gold)

This analysis incorporates the GOLDontheNILE strategy, using Ichimoku Kinko Hyo, Chikou Span, Fibonacci levels, Bollinger Bands, Stochastic RSI, and volume dynamics to provide a comprehensive outlook across multiple time frames. It integrates higher time frame trends with actionable intraday setups.

Daily Chart (1D) Analysis

Outlook: Bearish Consolidation with Key Resistance

- Trend: Downtrend intact with price hovering below key Fibonacci 61.8% resistance at 2,610.00.

- Indicators:

- ADX: Strong trend with value at 83.48, favoring bearish continuation.

- RSI: Neutral at 35.33, approaching oversold but without divergence signals.

- Ichimoku: Chikou Span remains below the cloud, confirming bearish dominance.

- Volume: Elevated bearish volume supports potential downside acceleration.

- Key Levels:

- Resistance: 2,610.00 (Fibonacci 61.8%) and 2,630.00 (upper resistance).

- Support: 2,578.00 (pivot support) and 2,554.00 (Fibonacci 50%).

Daily Scenario:

1. Bearish Continuation:

- Sell Entry: Below 2,578.00.

- Stop Loss: 2,585.00.

- Take Profit 1: 2,554.00.

- Take Profit 2: 2,547.00 (critical low).

2. Bullish Reversal (Low Probability):

- Buy Entry: Above 2,610.00.

- Stop Loss: 2,600.00.

- Take Profit 1: 2,630.00.

4-Hour Chart (4H) Analysis

Outlook: Bearish with Temporary Retracement

- Trend: Price remains in a bearish structure, with minor retracement stalling near 2,596.00 (Ichimoku resistance and Fibonacci 23.6%).

- Indicators:

- ADX: Declining trend strength at 31.78 indicates short-term consolidation.

- RSI: Overbought at 67.19, signaling a potential retracement.

- Volume: Bullish volume unable to break key resistance, hinting at bearish dominance.

- Key Levels:

- Resistance: 2,596.00 (Ichimoku & EMA).

- Support: 2,578.00 and 2,560.00.

4H Scenario:

1. Bearish Continuation:

- Sell Entry: Below 2,578.00.

- Stop Loss: 2,585.00.

- Take Profit 1: 2,570.00.

- Take Profit 2: 2,560.00.

2. Bullish Retracement:

- Buy Entry: Above 2,596.00.

- Stop Loss: 2,590.00.

- Take Profit 1: 2,610.00.

1-Hour Chart (1H) Analysis

Outlook: Short-Term Consolidation Below Resistance

- Trend: Consolidation with price struggling near 2,593.00–2,596.00 resistance cluster.

- Indicators:

- RSI: Overbought with Stochastic RSI showing a downward cross, signaling pullback potential.

- Ichimoku: Price remains below the cloud, maintaining bearish bias.

- Volume: Sideways, indicating indecision but favoring downside on rejection.

- Key Levels:

- Resistance: 2,593.00–2,596.00.

- Support: 2,587.00 and 2,582.00.

1H Scenario:

1. Bearish Scalping:

- Sell Entry: 2,595.00.

- Stop Loss: 2,600.00.

- Take Profit 1: 2,588.00.

- Take Profit 2: 2,582.00.

2. Bullish Scalping:

- Buy Entry: 2,588.00.

- Stop Loss: 2,582.00.

- Take Profit 1: 2,593.00.

15-Minute Chart (15M) Analysis

Outlook: Intraday Volatility with Bearish Bias

- Trend: Sideways with Bollinger Band compression signaling upcoming volatility.

- Indicators:

- RSI: Overbought, warning of potential pullback.

- Bollinger Bands: Compression suggests breakout, likely to the downside.

- Key Levels:

- Resistance: 2,594.50–2,596.00.

- Support: 2,590.00 and 2,587.00.

15M Scenario:

1. Sell Scalping:

- Sell Entry: 2,594.50.

- Stop Loss: 2,597.00.

- Take Profit 1: 2,590.00.

- Take Profit 2: 2,587.00.

2. Buy Scalping:

- Buy Entry: 2,588.00.

- Stop Loss: 2,585.00.

- Take Profit 1: 2,592.00.

Confidence Assessment

1. Bearish Continuation:

- Daily Confidence: 85% (multi-timeframe alignment with Ichimoku, ADX, and bearish volume).

- Intraday Confidence: 70% (temporary retracement but overall trend intact).

2. Bullish Reversal:

- Daily Confidence: 40% (only valid above 2,610.00).

- Intraday Confidence: 50% (short-term scalping opportunities exist).

Justification for Analysis

- Ichimoku Alignment: Bearish across all timeframes, with Chikou Span and price below the cloud.

- Fibonacci & Resistance Levels: Strong confluence at 2,610.00 and 2,596.00.

- Volume Profile: Bearish dominance with weak retracement attempts.

- Multi-Timeframe Consistency: Daily, 4H, and lower timeframes all align toward bearish continuation with intraday pullback opportunities.

XAUUSD: From $2720 To $2500 A Move of 2200+ Pips ! Comment DownOANDA:XAUUSD

Price dropped after creating a record high at 2790$, price dropped as mainly due to US Elections and aftermath of the election. We can see price to drop further after filling up the fair value gap within the market. Please do your own research before taking any decision. Good Luck.