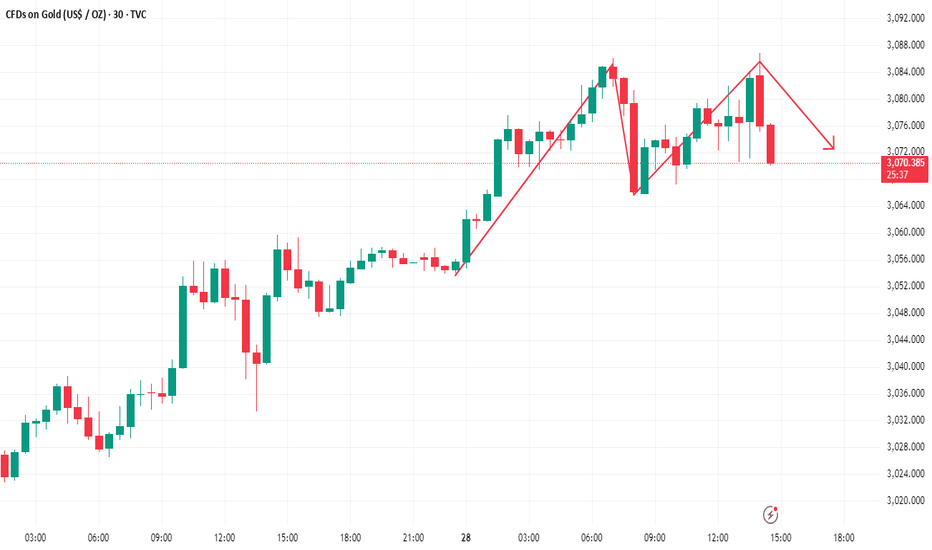

XAUUSD 4H SHORTPrice broke out of the bearish trend line and moved sideways in a range forming two tops or a double top.

Fundamentally, US jobs data came out positive keying into hawkish tone on interest rate and influenced CPI.

Price broke the neckline after 4H closure giving signal for bearish move to $3250 support.

Here’s my little idea on GOLD. Follow for more.

Xausudanalysis

Gold’s 3200 mark is the key!Due to the ceasefire between India and Pakistan and the easing of the Sino-US trade war, gold opened directly and fell below 3280 and 3260 successively, so the decline of gold will continue.

From the gold hourly chart, the focus below is on the 3200 integer mark. If it falls below 3200 and cannot effectively stabilize, then gold will have a big double top here, and the next decline will extend to around the 3000 integer mark. On the contrary, if the 3200 mark is not broken, then the bulls will fight back, at least they will fill the gap again

So in terms of operation, it is not recommended to chase the short now. If you want to go long on gold, you can wait for it to fall back to the 3200-3210 area and stabilize before buying

The golden earthquake storm is coming!In terms of news: Major events over the weekend include the conflict between Russia and Ukraine, the sudden change in the situation between India and Pakistan, and the progress of Sino-US negotiations: Although India and Pakistan announced a truce, India's surprise attack turned the agreement into a joke. The high-level economic and trade talks between China and the United States are still continuing in Geneva, and it is difficult to have clear results in the short term. The war between Russia and Ukraine is still in a stalemate. The superposition of multiple events has injected uncertainty into the market.

Technical aspects:

Pay attention to the pressure in the 3360-3380 area. If it stands firm at 3346, it can fall back to arrange long orders. If it directly breaks below 3300 at the opening, pay attention to the support near 3280 - this position is likely to be lost, and effective support depends on the downward pattern formed after the 3260 break, and the ultimate target is 3200.

Gold is still in a short-term bearish trendGold's 1-hour moving average continues to turn downward. If it crosses below to form a downward death cross, then gold's room for decline may further open up. The short-term short position of gold has not ended yet. Gold has a trend of falling again. The short-term trend of gold is still short.

Trading ideas: short gold near 3325, stop loss 3340, target 3290

Gold breaks through 3400, the upward trend will continue

The Federal Reserve's interest rate decision will keep the interest rate unchanged, which is in line with the psychological expectations of most people in the market. The current price of gold still continues to fluctuate at high levels, but in terms of the general direction, gold bulls have actually not changed, and bulls are still in a strong phase.

If gold breaks through 3400 strongly in the short term, then you can go long gold on dips above 3400. If gold rebounds, focus on the pressure near 3430.

Gold is under pressure at 3400, with a short-term decline expectGold is under pressure around 3400. Today we will have the Fed's interest rate decision and Powell's speech. If gold is under pressure at 3400, it is expected to fall. Before the data, we need to be cautious.

In terms of trading ideas, we can short short-term, pay attention to the short near 3393-96, stop loss 3403, take profit 3360/3350

The gold shorts aren’t over yet

The 1-hour moving average of gold continues to turn downward. If the 1-hour moving average of gold forms a death cross downward, then there is still room for gold to go down in the 1-hour period. Gold has been under pressure from the 3340 resistance line for many times in the US market and has fallen. Gold has hit a new low again in the US market, falling to the 3260 line. The lows of gold continue to hit new lows, so the gold short position has not ended yet. The resistance of the 1-hour moving average of gold has moved down to around 3366. Gold continues to be shorted at highs below 3366.

Gold adjusts at a high level, continues to be short on rebound

Gold risk aversion eased, and gold fell directly. After gold fills the gap, if gold cannot continue to rise, then the gold shorts will continue to exert their strength. The current gap resistance of gold is at 3382, but the market is volatile now. If the gap is filled, gold may have momentum to repair in the short term, so you can pay attention to the suppression of 3400.

Trading ideas: Short gold near 3400, stop loss 3410, target 3370

Gold has an adjustment trend, shorting is the main trendGold has begun to fluctuate in a wide range. The gold high has been suppressed frequently in the past two days and will fall back. Don't chase too much after the gold high. Even if you are long, you must patiently wait for the opportunity to fall back and adjust.

The gold 1-hour moving average has begun to show signs of turning, so the volume of gold bulls has begun to weaken, and gold bulls may have adjustments. In the short term, the confidence in further rising gold is not very strong. The structure of the double top of gold 1 hour.

Trading ideas: short gold near 3221, stop loss 3231, target 3200

Will gold first fall and then rise today?

The gold 1-hour moving average is still in a bullish arrangement with a golden cross. Now the price is gradually approaching the moving average, but the gold bull trend has not changed for the time being. Patiently wait for the opportunity to adjust. Pay attention to the support near the previous low of 3185. The moving average support has now moved up to the line near 3177. Overall, gold may form a strong support near 3180. For today's gold trend, I personally think it will fall first and then rise.

Gold is strong, wait for a pullback to go longThe 1-hour moving average of gold has formed a bullish arrangement with a golden cross upward, and gold is now supported near 3100. If gold can stand firm at 3100 after the data, then we can continue to go long on dips.

Trading ideas: Buy gold near 3100, stop loss 2990, target 3130

Gold has won two consecutive games, continue to short?Gold continued to be in a dead cross downward short position at 1 hour. The strength of gold short positions has not diminished. Gold fell near the resistance of 3017, and the gold moving average resistance has now moved down to near 3021. After gold rebounds, it is still mainly short selling.

Trading ideas: short gold near 3015, stop loss 3025, target 2990

The above is only a sharing of personal opinions and does not constitute investment advice. Investment is risky and you are responsible for your profits and losses.

You can't make money from such a simple market?After gold stepped back, it hit a new high again. Gold bulls continued to be strong. Gold broke through 3127 again, so the bulls are even better.

The gold 1-hour moving average continues to cross upwards and diverges. The support of the gold 1-hour moving average has moved up to 3096, but gold is now far away from the moving average, so wait patiently for adjustments and then step back to continue to buy. The gold 1-hour lowest yesterday fell to around 3100 and then stabilized again, so today gold will continue to buy on dips above 3100.

Trading ideas for reference:

Go long near gold 3110, sl: 3100, tp: 3130

A real correction for gold could be comingGold 30-minute chart is beginning to have the possibility of a double top, so don't chase long for now. If you want to go long, wait patiently for a pullback, otherwise the high adjustment may also be large. Gold can be shorted on rallies. If gold falls below 3060, then the real adjustment of gold may come.

The market is changing rapidly. Since the strength of gold has been insufficient after breaking through new highs, don't chase too much.

Risk aversion pushes gold higher againFrom the perspective of gold trend, after three trading days of shocks and consolidation, this trading day also chose to break upward. After breaking through the pressure near 3030/32, it inertially rushed up to 3056, which is only one step away from the historical high.

Gold broke out of the upward trend mainly driven by risk aversion. Russia, Ukraine and Gaza opened fire again. The originally planned peace talks did not achieve substantial results, so the current market risk aversion pushed gold upward again. Gold strengthened again after breaking through the convergence triangle.

Gold can be shorted in the short term, sl: 3063 tp: 3042

XAUUSD: Bullish trendToday, gold has tested the support at the 2732-2728 range again. So far, the support remains intact, and the short-term trend is still leaning towards a bullish outlook. Based on this, the primary trading direction in the current session remains bullish.

From a technical perspective, gold is likely to continue its upward momentum in the near term. The key resistance zone to watch on the upside is between 2750 and 2758. It is worth noting that a resistance level has emerged around 2745 since the market opened yesterday.

However, given the overall trend, this resistance does not pose a strong technical barrier at the moment, and a breakout above this level is not expected to face significant difficulty.

Therefore, if gold can break above the 2745 level, there is a high likelihood of further gains towards the 2750-2758 range.

WEEKLY FOREX FORECAST SEPT 7-11th: GOLD | XAUUSDGOLD | XAUUSD is in consolidation currently. I am waiting for it to touch down at the Weekly +FVG and move higher. I'm interested more in long setups versus shorts. Patience usually pays, so I wait and watch for valid setups to form this week.

Check the comments section below for updates regarding this analysis throughout the week.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAUUSD ShortConsidering that this commodity has a strong resistance zone (2400 - 2420) and it has failed to break it, it means that the bears are dominant.

I am anticipating that the price will continue to form the falling flag pattern so that the bulls may finally gain momentum and break the resistance.

Target Profit - 2280, Stop Loss - 2390, Trade Entry - 2375

Risk-Reward Ratio - 1 : 6