TACO trading reappears. Gold is down.The news that Trump intends to fire Powell caused a decline in US stocks and bonds, and gold prices soared in response. But then Trump denied the news, and the market subsequently fell back to stabilize.

On Wednesday, the Asian market began to fluctuate and rise in the early trading. It rose to a high of 3343 in the European market and then fell to 3319 in the US market. Then it rose sharply due to the news. It rose to a high of 3377 and then fell to 3336. It fluctuated around 3350 in the late trading. The daily line closed with a positive line with an upper shadow line.

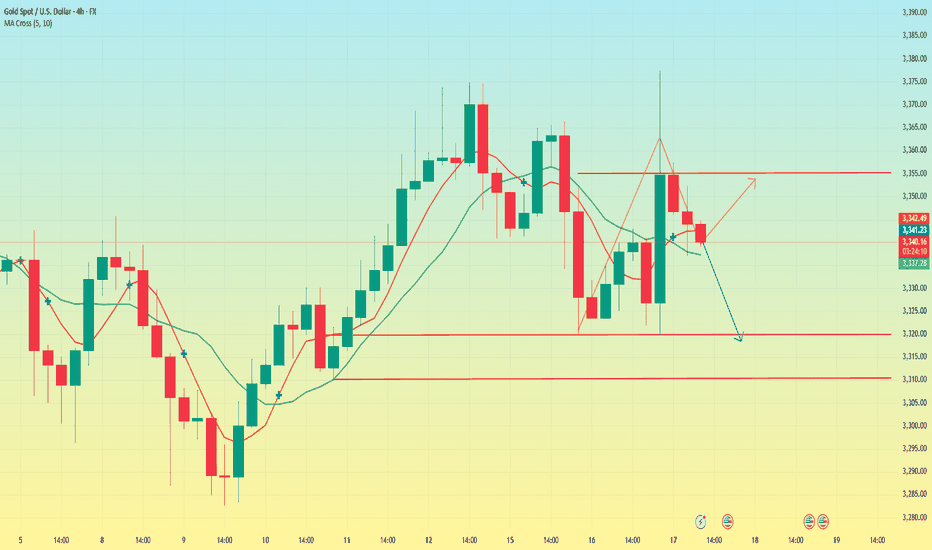

The recent market trend fluctuated violently. Since last Wednesday, there have been three consecutive positive rises. This week, there have been two consecutive negative declines on Monday and Tuesday. On Wednesday, it closed positive after washing up and down. At present, the MA5 and 10-day moving averages have formed a golden cross, but the direction is unclear. The Asian market opened above the moving average on Thursday. The overall pattern needs to pay attention to the breakthrough of the key points of long and short positions.

Today, the focus below is on the support near the low point of 3320, followed by the support near 3315 and 3310. This position is the trend line support formed by the previous low point connection. If it breaks down, we need to pay attention to the position of 3280. The upper resistance level is mainly concerned with the resistance near 3355, which is the rebound high point after the US market hit 3377.

Today, the operation needs to adjust the strategy according to the breakthrough of key points. In the volatile market, we need to be vigilant about the sudden fluctuations caused by the news. After breaking the key support or resistance, the trend direction may be further clarified.

Xauusdanaliz

The current price of gold is 3330-3335, go short directly!Gold rebounded after hitting the bottom of 3295. At present, gold is just a rebound, not enough to reverse directly. Gold rebounds and continues to be short. After all, the daily line has fallen continuously, so the short momentum of gold is still there. In the short term, the rebound of gold is just a repair after oversold. Gold is currently priced at 3330-3335 and is directly short.

The 1-hour moving average of gold continues to be arranged in a short position downward. After gold fell below the previous low of 3340 yesterday, gold has not been able to rebound again. In the short term, 3340 has become the key to long and short positions. In the short term, gold rebounds below 3340 and continues to be shorted. If gold breaks through and stabilizes at 3340 again, then gold may start to fluctuate again. Before breaking through 3340, gold is still weak and continues to maintain a short trend.

Have you seized the golden opportunity again and again?Today, the strength of gold is very weak. It only rushed up at the opening, and quickly fell below the 3400 mark. Keeping above the key point of 3400, gold continues to be bullish. Now that it has fallen below 3400, the short-term has gone out of the small-level top, and the market is no longer so strong. For our short-term operations, the short-term correction of gold prices focuses on the daily cycle MA5 support, and the weekly MA5 support is long. The rebound focuses on the 3403-3408 resistance card. The rebound can be followed by the short-term! Although gold has fallen below 3400, the short-term direction has changed, but the general direction has not changed. It is still bullish. In the future, we still have the opportunity to look at the high point of 3500, but we have to wait for the bottom to stabilize. Now we can only follow the trend. We will do what the market does.

From a technical point of view, the current macd high dead cross in 4 hours has a large volume, and the smart indicator sto is oversold, which represents the 4-hour shock trend. The current bollinger band three-track shrinkage in 4 hours also represents the range compression. At present, the upper pressure of 4 hours is located at the adhesion point of the middle rail and the moving average MA10 at 3404-3409, while the support corresponds to the moving average MA30 and MA10 near the 3380-3363 line. From the current 4 hours, if the price is to fall directly, the rebound will not exceed the 3420-3422.5 line. The current macd dead cross of the gold 1-hour line is shrinking and sticking, and the smart indicator sto is running downward, indicating that the hourly line continues to fluctuate weakly. What we need to pay attention to now is the adhesion pressure of the upper moving average MA60 and MA30 corresponding to the 3412 line. Pay attention to the resistance of 3403 in the short term. Today's short-term operation of gold recommends rebound shorting as the main, and callback long as the auxiliary, and pay attention to the support of 3380-3370 in the short term.

Go with the flow and seize the gold trading opportunityGold rose and fell yesterday due to the influence of CPI data, and fluctuated violently during the session. There were obvious signs of a wash. In the evening, it rose again driven by the news, closed positive on the daily line, continued its strong upward trend at the opening and set a new high, showing an obvious bullish pattern. The overall structure maintains the bullish idea of low-long and trend-following.

From the 4H cycle, gold rose continuously after stepping back and stabilizing the middle track. The moving average system showed a bullish arrangement, and the Bollinger band opened and expanded, further confirming the continuation of the strong pattern. However, the current price is still running within the triangle convergence range, and has not yet effectively broken. It is not advisable to blindly chase more in the short term.

In terms of operation, it is recommended to take the step back and do more. Pay attention to the short-term support below the 3360-3358 range, and focus on the 3350-3340 range. You can rely on the support to arrange long orders in batches. Pay attention to the 3389 and 3400 areas on the upper short-term pressure. If the high is weak, you can try short-selling in combination with the actual trend.

Operation suggestion: It is recommended to buy gold near 3340-3350, and the target is 3366 and 3382. If it is strong, it is recommended to buy gold at the support of 3358-3360!

All recent trading strategies and ideas have been realized, and the point predictions are accurate. If your current gold operation is not ideal, we hope to help you avoid detours in your investment. Welcome to communicate with us!

With bulls and bears in a stalemate, where will gold go?Gold fell under pressure around 3384 in the early trading on Thursday, and then rebounded after falling to 3361. The highest in the European session reached around 3403, and then fell back due to resistance. The US session accelerated its decline, reaching a minimum of 3339, and then rebounded in the late trading, closing in the negative on the daily line. The daily trend continued to fluctuate in a positive and negative cycle. On Thursday, it rose and fell, closed in the negative and fell below the 5-day moving average.

Today, we will focus on the resistance position of 3405. Whether it can break through will determine the strength of the bulls in the future market. The risk of continuous negative daily lines cannot be ruled out. The support below is the key points of 3330 and 3300. The 4-hour fluctuation range is locked at 3385-3335. The fluctuation space in the Asian and European sessions is limited. It is recommended to sell high and buy low. For stable trading, it is recommended to go long in the 3340-3350 area. The overall bullish trend has not changed, and the impact of non-agricultural data is limited. It is expected that gold will most likely rise and fall. Remember not to chase the rise and sell the fall, and wait patiently for opportunities.

Steady trading, precise attack!

XAUUSD:Go long in batches

Gold in recent two days of strong performance in Asia and Europe, the US is slightly weak, the shock range expanded, below 3340-45 is the rise point of these two times, currently back to around 3365, although the price back before, but the income did not expand. At present, gold is not a strong one-sided rise, is still volatile up, near this position into the long order to hold, is expected to break the probability of today's data is small.

On the trade, buy long in batches around 3365 and 3340-45, and look above the target at 3390-92 first

Trading Strategy:

Long orders near 3365 continue to hold

3340-45 can buy long orders twice

TP:3390-92

↓↓↓ More detailed strategies and trading will be notified here ↗↗↗

↓↓↓ Keep updated, come to "get" ↗↗↗

Today’s gold strategy: go long on support and short on pressure!Today, there is a high probability that the volatile bullish trend will continue. In terms of operation, we should seize the opportunity of short-term bullish. The key support level of the daily line is around 3350-3355. If it falls back to this level, you can arrange short-term bullish with a light position. If the market is strong and there is no obvious correction, you can enter the long position in advance at the 3370 line. Pay attention to the upper resistance level of 3400-3405. Once it breaks through effectively, wait for the opportunity to arrange short positions after the surge. In the volatile market, both long and short positions have opportunities. Don't chase the rise and sell the fall. Be sure to wait patiently for the right time to enter the market and strictly control the position.

Gold operation suggestions: short gold rebounds around 3400-3405. Go long gold when it falls back to around 3350-3360. Go long at 3370 first if it is strong and does not pull back.

Double top pressure appears Gold short-term bearishThe current price shows a sign of hesitation after experiencing a sharp rise. The bulls hit a high of 3384 twice and then pulled back. The high point and yesterday's high point formed a double top suppression. Two attempts to test Monday's high of 3392 failed, indicating that the bullish momentum has weakened. The short-term high-altitude strategy for gold is mainly used. Pay attention to the key support of 3340-3345 below. If it is effectively broken, it may fall to the 3325 trend line conversion support level below. In terms of operation, it is recommended to rely on the double top pressure of 3384-3392 to arrange short orders at highs. Market volatility may intensify before the release of non-agricultural data.

Gold operation suggestions: short gold near 3384-3392, target 3370-3360.

Although the market fluctuates, the rhythm is not chaotic.Today's public strategy suggested shorting gold at 3365, and accurately predicted the retracement of the resistance level again. The brothers who followed up again reaped good rewards. Then arranged long orders in the 3344-3345 range, and exited the market at 3360 after the market fell and rebounded; then arranged short orders at 3360-3361, and fell again under pressure, and successfully took profits at the target of 3350. Although the short-term fluctuations were large, we finally managed to grasp the rhythm steadily and reaped ideal profits.

Judging from the current trend, as long as the short-term gold market is above 3330, gold will still be in a strong bullish trend. On the contrary, if it falls below the closing line near 3330, it will break the trend line, and the subsequent market will most likely form a weak shock pattern. Therefore, the current operation is actually very simple. As long as the 3330 position is not broken, you can rely on the 3330 area to enter the market and do more. Pay attention to the support near yesterday's low point of 3333 below, and pay attention to the resistance near 3380-3390 above.

Gold operation suggestions: It is recommended to short gold with a light position near 3380-3385, with a target of 3370-3360, and go long near 3345-3350 when gold falls back, with a target of 3360-3370.

Short position opportunity at 3366 suppression pointAt present, the focus of gold is on the previous high point of 3360-3366. If the rebound fails to effectively break through this range, you can consider entering a short position. Although gold is in a high-level oscillation stage, you should not blindly chase more. If the upper suppression continues to be effective, there is a risk of a technical correction. If you encounter confusion in operation, please feel free to communicate at any time; if the current gold operation is not ideal, I hope to help you avoid risks and reduce investment detours. I look forward to your contact.

From the perspective of the 4-hour cycle, the upper resistance focuses on the 3360-3366 line, and the short-term support below focuses on the 3320-3325 area. It is recommended to keep operating in line with the trend and follow the main trend unchanged.

Operation strategy: When gold rebounds to the 3360-3366 line and fails to break through, arrange short positions, and target the 3320-3325 range.

The golden range strategy continues to workGold bottomed out and rebounded as expected today. Friends who follow me should be able to clearly feel that I have been insisting on analyzing the trend of "bottoming out and rebounding" recently. Today, gold opened at 3300, and rebounded after the lowest price fell to around 3291. So far, the highest price has reached 3325. Overall, the support below gold is still strong, but the suppression above cannot be ignored. Therefore, the market performance yesterday and today was relatively stable, with small fluctuations as the main trend.

In terms of operation ideas, continue to pay attention to the support level of 3290-3295. If it falls back and does not break, maintain a bullish mindset. At present, the long orders in the 3290-3295 range have been notified to enter the market as planned, and are currently in the profit stage. If you encounter difficulties in the current gold market operation, I hope my analysis can help you. Welcome to communicate at any time.

From the 4-hour cycle chart, the support below gold is around 3290-3295, and the pressure above is concentrated in the 3330-3340 range. In the short term, the watershed between long and short is around 3275-3283. Before the daily level effectively falls below the watershed, it is still in a long-short shock pattern, maintaining the main theme of "high-altitude and low-multiple" cycle participation.

Gold operation strategy: If gold falls back to the 3290-3295 line, you can try to go long. If it further falls back to the 3280-3285 line, you can consider covering long orders, and the target is around 3316-3320.

Golden Jedi counterattack! Key support ignites the bull engine📌 Gold Technical Analysis & Operation Strategy Update

Gold bottomed out and rebounded as expected, and the trend basically met recent expectations - oscillating upward around the support range below.

💡 Key Point Review

Today, gold opened at around 3300, with a minimum of 3291, and then rebounded, reaching a maximum of 3325. The overall trend still fluctuates within the range, with strong support below and obvious suppression above, and the overall performance is a narrow range of fluctuations.

📉 4-hour chart analysis

Support focus: 3285-3295 area

Pressure focus: 3330-3340 area

Short-term long-short watershed: 3275-3283 line

🔎 Before effectively falling below the watershed, it is still mainly seen as range fluctuations, and the high-altitude low-multiple strategy continues to be implemented.

📈 Operation strategy suggestions

1️⃣ Try to go long with a light position if the price falls back to 3295-3300

2️⃣ If the price falls back to 3280-3285, you can add to your position appropriately

🎯 Target focus: 3316-3320, and look to 3330-3340 after breaking through

⚠️ Risk control suggestions: strictly set stop loss, control position, and prevent the risk of range breakout.

How to seize this golden short-term opportunity!Yesterday, gold continued to fall from its highs, and the short-term trend was in line with our expectations. The lowest price of gold yesterday hit around 3285, which was also the long area given in yesterday's analysis. In addition, the secondary layout of long orders in yesterday's analysis brought us good returns.

At present, gold is in a rebound stage as a whole. Although the momentum and amplitude of the rebound have not increased significantly, this trend has shown signs of a gradual recovery in the market. In terms of short-term operations, it is recommended to follow the trend and wait for the price to fall back before choosing an opportunity to go long. Yesterday, the gold price fell again to around the 3285 mark and received effective support. Today, we still need to focus on the support performance of this area.

From the perspective of the 4-hour cycle, today's gold price relies on this area as a short-term strength and weakness dividing line for long and short layout. The lower support focuses on the 3275-3283 range, and the upper pressure is around 3316-3320. The short-term key watershed is around 3275-3280. As long as the daily level does not effectively fall below this area, the overall judgment of the long and short shock range is still maintained. In terms of operation, the "high-altitude and low-multiple" rotation idea will continue to be the main focus. If the market situation or rhythm changes, the strategy will be adjusted in time according to the actual market situation and will be notified separately.

Gold operation strategy reference:

1. If gold falls back to the 3275-3285 area, you can consider placing long orders, with the target at 3316-3320.

2. If gold rebounds to the 3316-3321 area, you can try to short with a light position, with the target at 3288-3290.

3278-3320 key position is mainly high sell low buyAt present, gold rebounded after falling back to 3287, and fluctuated around 3300 in the short term. Pay attention to the support area of 3278-3283 below. If it does not break this area, you can still try to go long in the short term. After all, from a technical point of view, the decline during the day is a correction and adjustment to the previous rise.

From the 4-hour chart, the upper short-term focus is on the suppression of the 3316-3320 area, and the lower focus is on the support of 3278-3283. In terms of operation ideas, continue to maintain the interval strategy of "high-altitude and low-multiple", rely on key positions to sell high and buy low, and wait patiently for effective signals before entering the market. If the structure or rhythm of the market changes, the strategy will be adjusted in time and notified separately.

How will the short-term trend of gold develop?From a technical perspective, the overall volatility is limited. In the near future, the upper side is under pressure from the trend line, and the lower side is affected by the 4-hour middle track support. The overall trend is maintained in the range of 3365-3322. The current monthly line is approaching its closing, and the short-term market is temporarily in a high-level oscillation stage. In the 4-hour cycle, the price range is gradually narrowing, waiting for a directional breakthrough. The lower support focuses on the 3325-3320 middle track position and the previous top and bottom conversion support of the 3308 line; the upper pressure focuses on the 3352 and 3365 areas. After a slight high opening, it weakened. The overall idea is still to treat it as a wide range of fluctuations. It is recommended to be long and short in operation, and adjust the strategy after breaking through.

Operation suggestion: Go long near 3330-3323, and the target is 3340 and 3352;

If the pressure near 3352 is not broken, consider shorting, and the target is to fall back to the 3330 line.

Flexible response is the best strategyGold rose sharply in the morning and continued to rise slowly during the day. Because of the divergence of indicators in the short cycle, it is difficult to exert further force. Today's market has been fluctuating between 3285 and 3320. In the evening, we will first look at the space for decline and repair, and then fall back to accumulate strength to stabilize and attack. The lower support will remain at 3285-3280, and then look at the low point of 3274. The upper resistance level will look at the existing high point of 3320. If it breaks through 3320, then pay attention to around 3345. Short positions will be entered when the pressure situation is met. Continue to remain bullish in the evening. In terms of operation, wait for a decline and gradually look up to 3320 and 3345.

Gold operation suggestions: go long on gold around 3290-3285, and look at 3315 and 3325.

Perfect grasp of key points Insight into market trendsWith the downgrade of the U.S. credit rating and the recent weak U.S. economic data, market expectations for a U.S. interest rate cut have increased. The U.S. dollar index has plummeted and is once again facing the 100 mark. Risk aversion sentiment has rebounded again, and gold has once again been sought after. It opened higher in the Asian session. However, we have mentioned the repetitiveness of sentiment many times recently, so we remind you not to chase the rise too much. We remind you to short near 3245, long at 3209, and short again near 3245. Both long and short positions are very accurate, giving perfect entry opportunities and successfully taking profits.

Judging from the current trend, gold is under pressure again in the European session near 3248, and the US session has fallen back. The short-term strength has turned into a wide sweep again. Focus on the gains and losses of 3230. If it falls below or looks at the gap area of 3206-3203, go long if it falls back and does not break. The upper pressure is still focused on the area near 3253-60. Short-term fluctuations are increasing. If there is any adjustment, we will notify you in time.

Operation suggestion: Go long in gold near 3206-03, look at 3230 and 3252!

Beware! Gold Falls

📌 World Situation

Gold prices fell more than 1.5% on Friday and are on track to close the week with a loss of more than 4% as improving risk sentiment drove investors away from safe-haven assets and into stocks and other riskier investments. At the time of writing, XAU/USD was trading around $3,187, retreating from a daily high of $3,252.

The precious metal started the week lower following a reported significant de-escalation in the US-China trade conflict, including an agreement by both sides to reduce tariffs by 115%. Despite trading between $3,120 and $3,265 throughout the week, gold prices struggled to maintain bullish momentum, with weakening buyer interest becoming increasingly apparent against the backdrop of stronger risk appetite and encouraging US economic data.

📊Comment Analysis

Will be greatly affected by tariff news and Russia-Ukraine peace talks

💰Strategy Package

Resistance: $3265, $3357

Support: $3160, $3112

In this range, you can enter the market in batches in real time to flexibly grasp the market changes.

⭐️ Note: Labaron hopes that traders can properly manage their funds

- Choose the number of lots that matches your funds

- Profit is 4-7% of the capital account

- Stop loss is 1-3% of the capital account

Perfectly hold the pullback and continue to buy.Gold opened at around 3240 and then rushed to 3252 and then retreated. In the evening, we also gave a short position near the rebound to 3240. After all, there is a lot of pressure from above, and the technical side also needs to repair the strategy, so we gave a short position entry near 3237-38, and the target is 3215. As of the retracement, it reached the lowest point near 3206, which also successfully reached our target position. Today's Asian session high and retreat is completely a technical adjustment. It bottomed out and rebounded yesterday, with an increase of more than one hundred US dollars. The technical bulls are weak and need to pull back. This is why I gave the short position. Be a steady trader.

The gold market showed a V-shaped reversal pattern of bottoming out and rebounding yesterday. The daily line closed with a hammer-shaped positive line with an extremely long lower shadow, indicating that the support below is strong, but the overall high-level oscillation pattern is still maintained. Technical indicators show that short-term correction pressure still exists: the stochastic indicator is blunted at a high level, the MACD double-line dead cross is downward, and the Bollinger band opens downward. The gold price is likely to fluctuate around the middle and lower tracks.

The 4-hour level oscillates to the short side, and the 3200 line becomes the watershed between long and short. If it effectively falls below this level, the shorts will regain the initiative; on the contrary, the longs need to break through the strong resistance area of 3265-3270 to reverse the decline. At the close of the weekly line, the market has a demand for a restorative decline. If it falls below the 3200 integer mark, the target below will look at the 3180-3170 area. Focus on the effectiveness of the 3265-3270 resistance and the strength of the 3200 support, and be alert to the violent fluctuations in the closing market on Friday.

Gold recommendation: Go long when it falls back to around 3215-3205. Target 3230-40-50 first line

Gold short sellers hit the 3,000 mark in a bloodbath?News: The gold market has been experiencing violent fluctuations recently, with a significant correction from historical highs, triggering heated discussions in the market. Its price decline is mainly driven by two major factors: First, global trade tensions have eased. China and the United States have significantly reduced tariffs and suspended some tariffs for 90 days, which has greatly boosted market risk appetite. Investors have evacuated safe-haven assets and the demand for gold has declined. Second, the U.S. dollar index has bottomed out, and U.S. Treasury bond yields have also hit a six-week high. The 10-year Treasury bond yield has exceeded 4.5%. The Fed's adjustment in interest rate cut expectations has made non-interest-bearing assets such as gold less attractive. However, geopolitical risks have not completely dissipated, and the US-EU trade negotiations have progressed slowly, which may re-boost gold's safe-haven demand in the future. In the short term, trade optimism and a stronger US dollar may continue to suppress gold prices; but in the medium and long term, geopolitical uncertainty, inflationary pressures and central bank demand for gold purchases will provide support for gold prices.

From the four-hour level, a double top is formed at the 3500 and 3440 positions above. Gold continued to fall after breaking below 3200. The continued decline has released a clear short signal.The focus below is on the weekly 3100 area support.The ultimate goal of this round of adjustment is to look at the 3030-2980 range

Start buying gold and wait for a rebound.At the 4-hour level, the overall market judgment remains unchanged. In terms of the lower support level, 3208-3207 is the key support area. This position is not only the low point on Monday, but also an important support level formed by the previous starting point line extending to the present. As for the upper resistance level, first of all, we need to focus on yesterday's high point of 3265, which is also the previous shock low point. Secondly, the 3290-3293 area formed by the rebound after the gap-down opening on Monday is also a resistance range that cannot be ignored. In the short term, pay attention to the resistance line of 3260-3270 above, and pay attention to the support line of 3220-3210 below in the short term. Further support focuses on the 3200 mark.

Gold operation strategy: 3220-3210 long, target 3230-3250; gold rebounds to 3260-3265 short, target 3240-3220.

How to plan a gold short selling strategyOn Monday, as China and the United States reached an agreement to reduce tariffs, market concerns about a U.S. recession eased, and the U.S. dollar index once approached 102, and finally closed up 1.37% at 101.80. U.S. bond yields both rose, and the interest rate market cut the Fed's pricing for rate cuts this year, boosting demand for the U.S. dollar. However, although the U.S. dollar is bullish in the short term, it faces key resistance, and the U.S. CPI data is coming. If inflation is lower than expected, bulls may take a break.

Today's market rose slightly first, then fell strongly to 3216, and then rose strongly to 3260 in the Asian session before being under pressure. The market is currently in the repair stage, and CPI data is attracting much attention. If the European session does not continue to rise but falls, the bulls may end at 3270. Technically, the upper resistance is 3268-3274, and the lower support is 3244-3237. In terms of operation, it is recommended to rebound high and short as the main, and to pull back and long as the auxiliary.

Operation strategy 1: It is recommended to short near the rebound 3268-3274, with a target of 15-20 points.

Operation strategy 2: It is recommended to pull back near 3244-3237 and long, with a target of 10-15 points.

CPI-Inflation Assessment, Gold Accumulation

📌 Drivers

In geopolitics, Indian Prime Minister Narendra Modi said on Monday that military action against Pakistan was only paused, warning that future actions would depend on Islamabad's position. Meanwhile, Ukrainian President Volodymyr Zelensky expressed his willingness to meet with Russian President Vladimir Putin later this week after U.S. President Donald Trump called on Zelensky to "immediately" accept an invitation to a peace summit in Turkey. These developments have heightened geopolitical risks, which could boost demand for safe-haven assets such as gold, thereby enhancing the appeal of gold amid continued global uncertainty.

📊Comment Analysis

CPI evaluates the inflation level of the US economy, and the price of gold continues to strive to maintain a price range of around 3200

💰Strategy Package

🔥Selling gold area: 3281-3283 SL 3288

TP1: $3270

TP2: $3260

TP3: $3250🔥

Buying gold area: $3176 - $3174 SL $3169

TP1: $3185

TP2: $3198

TP3: $3210⭐️

Labaron believes

Guaranteeing the principal is the bottom line for survival, controlling risks is the armor for survival, earning profits is a stage medal, and long-term stable and continuous profits are the only proof that can finally stand up from the sea of corpses and blood.