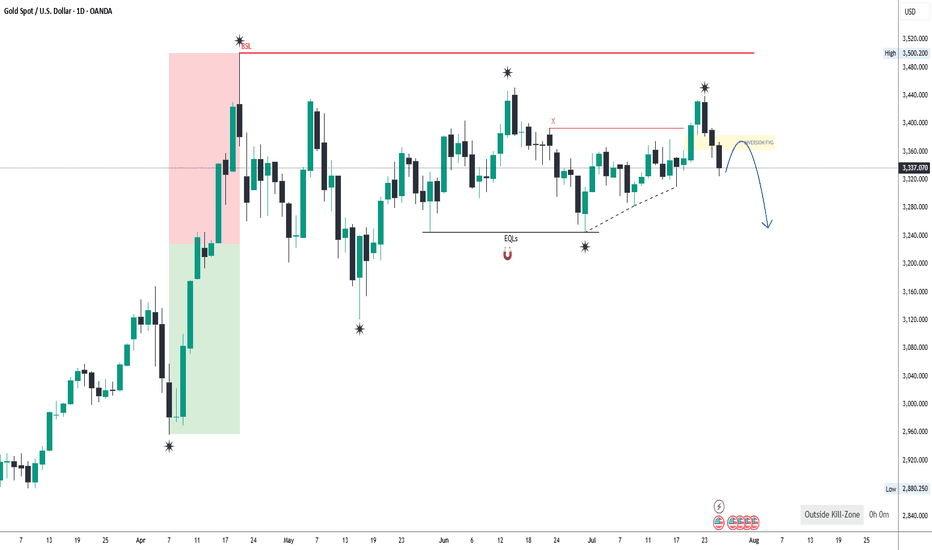

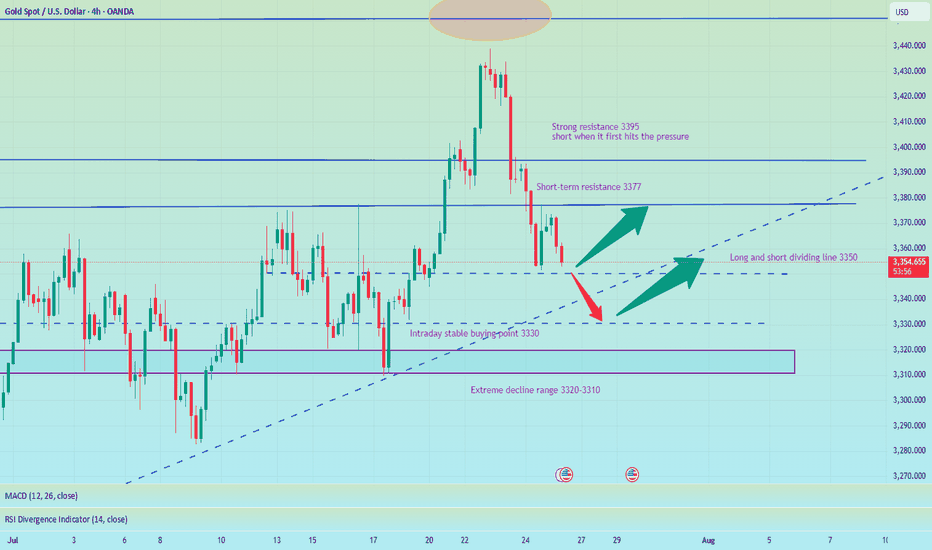

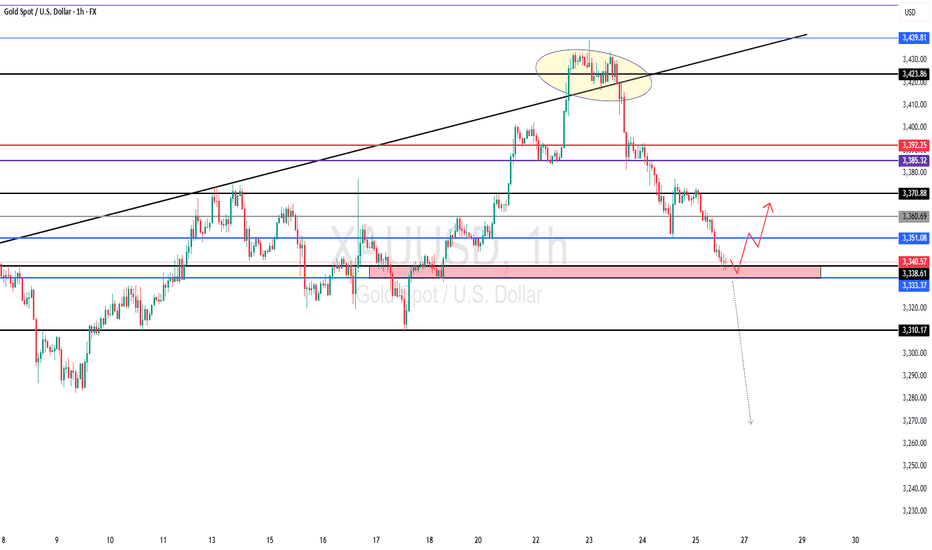

Gold is weak. It may break through next week.This week, gold rose and fell, rising for two consecutive days on Monday and Tuesday, and falling for three consecutive days from Wednesday to Friday. The weekly line finally closed with a small real body negative line with a long upper shadow.

Gold's trend this week was due to the strengthening of the US dollar and the progress in US-EU trade negotiations, which hit the safe-haven demand, leading to a decline in gold prices.

Next week, focus on multiple time points that may trigger market trends, including the Federal Reserve's decision, non-agricultural data, the August 1 tariff deadline, and the economic and trade talks between Chinese representatives in Sweden and the United States. These events may set the tone for the market in the second half of the year and need to be paid attention to.

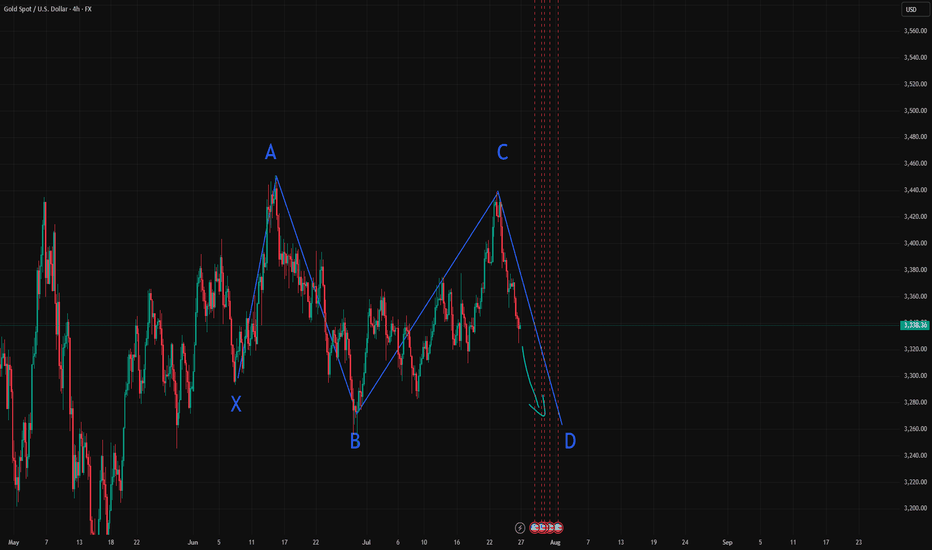

At the beginning of this week, we focused on the triangular convergence pattern formed by the high and low points since 3500 points. On Tuesday, gold broke through the pattern upward, but failed to stand firm on Wednesday. Instead, it fell to form a false breakthrough, and on Friday it fell to the lower edge of the triangular convergence range. However, from the perspective of the international futures market, the overall situation is still in the triangular convergence pattern and has not achieved an effective upward breakthrough. Based on this, we need to continue to keep a close eye on the changes in the triangle convergence pattern next week. The direction of its next breakthrough will have an important impact on the short-term trend.

Operation strategy:

Short near 3350, stop loss 3360, profit range 3320-3315. If the price continues to fall, you can hold a small position, and the area near 3300 is likely to be touched.

Xauusdanalysis

USDCAD Analysis week 31🌐Fundamental Analysis

The Canadian dollar continued to decline against the US dollar on Friday. Trump returned to threatening tariffs on Canada as trade deals remain limited. The August 1 deadline for tariffs is approaching and Canada has not made much of a move so far.

🕯Technical Analysis

USDCAD continues to rally towards the 1.4000 resistance zone. A recovery of the pair to 1.365 is a good momentum for USDCAD to break the trendline and break 1.37700. The trading strategy for next week is mainly to look for BUY points when there is a recovery of the wave structure. If the important support of the week 1.357 is broken, the uptrend will reverse.

📈📉Trading Signals

BUY USDCAD 1.365-1.363 Stoploss 1.360

BUY Break out 1.37700

GOLD (XAU/USD) MA Breakout – High-Probability Long Setup!💰🚨 GOLD HEIST ALERT! XAU/USD MASTER PLAN (Thief Trading Style) 🎯

🔥 Steal Pips Like a Pro – High-Probability Gold Breakout Strategy! 🔥

🎯 Thief Trading’s GOLD Heist Strategy (Swing/Day Trade) �💸

👋 Hey there, Market Pirates & Profit Snatchers! 🌍✨

Based on our 🔥Thief Trading Style🔥 analysis, we’re plotting a major heist on XAU/USD (GOLD). The plan? Buy the breakout, escape before the cops (resistance) arrive! 🚔💨

📈 ENTRY ZONE: The Heist Begins!

🚀 "Wait for the MA Breakout (3400) – Then Strike!"

Bullish Confirmation: Enter on a 15M/30M pullback after MA breakout.

Thief’s Trick: Use Buy Stop above MA or Buy Limit near swing lows for best risk-reward.

DCA/Layering Strategy: Deploy multiple limit orders to maximize gains.

🔔 Set an ALERT! Don’t miss the breakout – thieves move fast! ⏳

🛑 STOP LOSS: Protect Your Loot!

📍 Thief’s SL Placement: 3330.00 (4H Swing Low) – Adjust based on your risk & lot size.

⚠️ WARNING: If using Buy Stop, DO NOT set SL until after breakout – unless you love unnecessary losses! 🔥

🎯 TARGET: Escape with the Gold!

🏴☠️ Take Profit Zone: 3460.00 (or Exit Early if Bears Show Up!)

Scalpers: Only trade LONG side – use trailing SL to lock in profits.

Swing Traders: Ride the wave but watch for resistance traps!

📰 MARKET CONTEXT: Why This Heist?

Neutral Trend (But Bullish Potential! 🐂)

Key Factors: Geopolitics, COT Data, Macro Trends, Sentiment Shift

🚨 News Alert: Avoid new trades during high-impact news – trailing SL saves profits!

💥 BOOST THIS HEIST! (Like & Share for More Pips!)

💖 Hit the 👍 Boost Button to strengthen our Thief Trading Crew!

🚀 More Heist Plans Coming Soon – Stay Tuned!

⚠️ DISCLAIMER (Stay Safe, Thieves!)

This is NOT financial advice. Do your own analysis & manage risk.

Markets change fast! Adapt or get caught.

🎯 Happy Trading, Pirates! Let’s Steal Some Gold! 🏴☠️💛

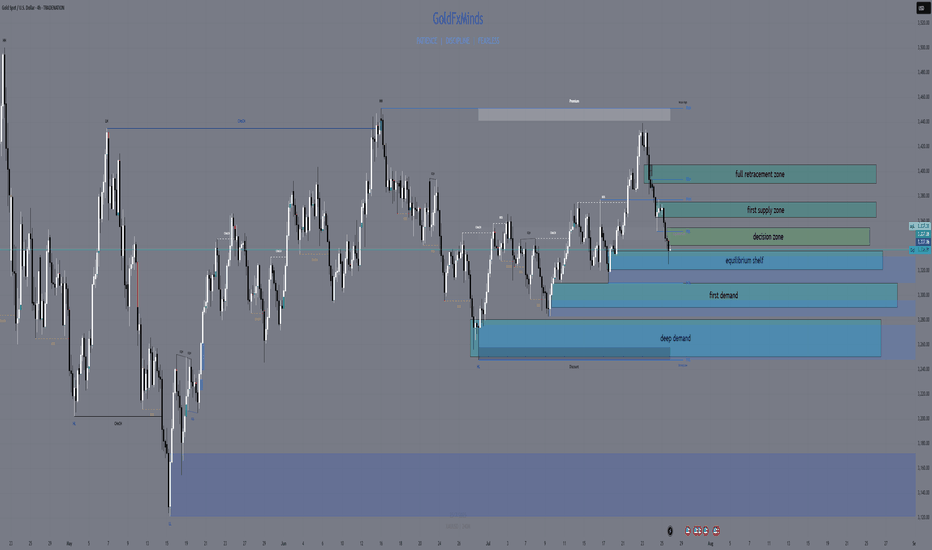

XAUUSD H4 Outlook – “Fed Week: Only the Real Zones”Hello, gold traders!

FOMC week is here, the dollar’s flexing, and gold is stuck under a fortress of supply. No fantasy, no overlaps, just your real, actionable H4 map—zones spaced, logic tight, and all fluff deleted.

⬜Bias:

Neutral to bearish while price is capped under 3,355 and the EMA cluster.

Only flip bullish if price closes and holds above 3,375 with strong confirmation after news.

Current Price: 3,336.81

Summary for your audience:

Neutral–bearish: All the EMAs (21/50/100/200) are overhead, and the primary supply and decision zones are blocking any upside.

No reason to flip bullish unless gold breaks out and holds above both the decision zone and the full supply ceiling after major news.

All bounces into supply are likely to get faded, unless the structure changes dramatically post-FOMC.

🟥 ULTRA SUPPLY ZONE: 3,390 – 3,405

127–161.8% Fib extension—liquidity grab and stop-hunt target for news-driven spikes

Only short if you see a monster upper wick and hard rejection

🟥 PRIMARY SUPPLY: 3,365 – 3,375

All EMAs (21/50/100/200) are stacked overhead; unfilled FVG at 3,370–3,375

Short on a clear rally rejection or bearish engulfing candle—this is where most breakouts get trapped

🔶 DECISION ZONE: 3,340 – 3,355

EMA100/200 straddle this level; small FVG at 3,350–3,352

Market “decides” here—fade unless price closes decisively above 3,355

🔵 EQUILIBRIUM SHELF: 3,320 – 3,335

50% Fib at 3,327; filled FVG at 3,325–3,330; SMA50 just below

Bounce/fake-break zone—wait for a clean H4 reversal, not a guess

🟢 FIRST DEMAND BASE: 3,290 – 3,310

H4 Order Block, hidden FVG (3,300–3,305), Fib 38.2% around 3,295

Longs only with strong pin-bar/engulf and quick EMA50 reclaim

🔵 DEEP PULLBACK BAY: 3,250 – 3,280

Weekly EMA21 and 61.8% Fib (~3,260), strong volume

Only consider a long on a panic flush and a powerful reversal wick

⚡️ MACRO CONTEXT

USD: On fire into ADP and FOMC; gold moves will be explosive, not logical

Events:

Tue: ADP

Wed: FOMC + Powell

Thu: Core PCE

Fri: NFP, ISM

Bias: Neutral-bearish under 3,355; only bullish if we close and hold above 3,375

EMAs: Clustered tightly overhead—bulls get no respect until this ceiling is crushed

🎯 TRADE LOGIC

Shorts:

3,390–3,405 (big wicks and clear rejection only)

3,365–3,375 (news spike or failed breakout with bearish candle)

Longs:

3,340–3,355 (only on a confirmed close above)

3,320–3,335 (strong reversal only—don’t front run)

3,290–3,310 (classic H4 pin-bar/engulf + EMA50 reclaim)

3,250–3,280 (deep panic flush and major reversal only)

NO TRADE: In the gaps—let the gamblers get chewed up, not you.

💬 Which zone will you snipe? Drop a comment and show you’re here for structure, not noise!

👍 Like & Follow for high-value, real-time sniper maps every day.

Disclosure: Chart via Trade Nation’s TradingView feed. Influencer Program participant.

GoldFxMinds 💛

"GOLD Bandit Strategy: Loot Pips Like a Pro!🏆 GOLD HEIST ALERT! 🏆 XAU/USD Bandit Strategy (Swing/Day Trade)

Steal Pips Like a Pro! 💰🔓 Bull vs. Bear Raid Plan

🌟 Greetings, Market Pirates! 🌟

"The trend is your accomplice—time to loot!"

🔮 Thief’s Technical & Fundamental Intel:

XAU/USD (The Gold Vault) is flashing BEARISH signals, but we’re ready to raid both sides! Follow the heist blueprint below 👇

🎯 ENRY POINTS (Where to Strike!)

🏴☠️ LONG RAID (Bullish Thieves):

Break & Grab: Enter above 3450.00 (Pullback Zone)

"Wait for the breakout, then ambush!"

🐻 SHORT RAID (Bearish Bandits):

Sneak Attack 1: Sell below 3300.00

Sneak Attack 2: Sell below 3260.00 (Support Wall Cracked!)

🛑 STOP-LOSS (Escape Routes)

Bullish Trade: SL at 3230.00 (Guard your loot!)

Bearish Trade 1: SL at 3360.00 (Don’t get caught!)

Bearish Trade 2: SL at 3280.00 (Risk = Reward!)

(Adjust SL based on your risk appetite & lot size!)

💰 TAKE-PROFIT (Cash Out & Flee!)

Bullish Thieves: TP at 3270.00 (Or escape early!)

Bearish Bandits (1): TP at 3270.00

Bearish Bandits (2): TP at 3210.00 (Big score!)

⚠️ WARNING: Market Traps Ahead!

News = Danger Zone! 📢 Avoid new trades during high-impact news.

Trailing SL = Your Getaway Car! Lock profits & evade reversals.

📰 FUNDAMENTAL BACKUP (Why This Heist Works)

Bearish momentum fueled by macro trends, COT data, & sentiment.

Stay sharp—markets shift fast!

💥 BOOST THIS HEIST! 💥

Like & Share to strengthen our pirate crew! 🚀 More alerts = More profits!

🚨 Next Heist Coming Soon… Stay Tuned! 🚨

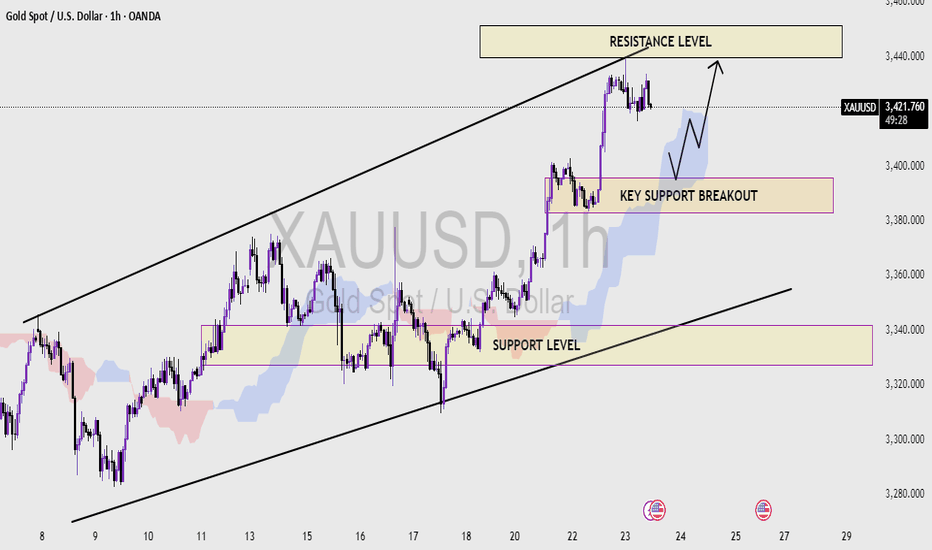

XAUUSD (1H Time frame) Read the captionXAU/USD Analysis (1H Timeframe )

This chart represents the XAU/USD (Gold vs US Dollar) price movement on a 1-hour timeframe, showcasing a well-defined ascending channel. The analysis highlights three critical zones:

1. Resistance Level (Upper Blue Zone):

This zone, located around the $3,440 - $3,450 range, marks the potential upper limit of the current bullish channel. A breakout above this level could indicate strong bullish momentum continuation.

2. Key Support Breakout Zone (Middle Purple Zone):

Around the $3,390 - $3,400 range, this area previously acted as resistance and now serves as a key support level. A price retest and bounce from this zone could confirm it as a new support base, potentially triggering a move toward the resistance zone again.

3. Support Level (Lower Purple Zone):

Found near the $3,320 level, this is the broader trendline and horizontal support zone that would be critical if the price breaks below the key support area. It acts as a major demand zone within the ascending channel.

Observations:

The price is currently in a strong uptrend within the rising channel.

A retest of the key support breakout zone is anticipated before potentially pushing higher toward resistance.

A breakdown below the key support could trigger a move toward the lower support level.

Technical Bias:

Bullish as long as the price remains above the key support level.

Bearish reversal may occur on a confirmed breakdown below the ascending channel and lower support zone.

Gold is weak. Will it explode next week?Gold prices failed to stabilize above $3,400 after a bullish breakout this week. The technical outlook highlights the recent indecision of gold bulls.

In the first two trading days of this week, spot gold prices rose by 2.4%, but the cumulative decline in the last three trading days of this week reached nearly 3%. The sharp fluctuations this week were due to the positive progress in Trump's trade negotiations, and the rebound in market risk appetite, which hit the safe-haven demand for gold.

Looking at next week, the economic calendar will provide several high-impact data releases. The Federal Reserve will announce its monetary policy decision after the policy meeting on July 29-30; the US Bureau of Labor Statistics will release the July employment report; and some important news such as the US-China trade negotiations may trigger the next major move for gold.

From a technical perspective, the current market short-term technical outlook highlights the hesitation of gold buyers. The daily chart shows that the RSI is still slightly below 50, and gold prices have difficulty staying away from the 20-day and 50-day MAs after breaking through these two levels earlier this week.

On the upside, 3450 constitutes the first resistance for gold prices. If it breaks through this resistance, gold prices will most likely hit the 3400 integer mark again.

On the downside, if gold prices remain below 3340, technical sellers may still be interested. In this case, 3310 can serve as the first support level, followed by the second support level near 3285.

A new week is about to begin, and I wish all traders good luck.

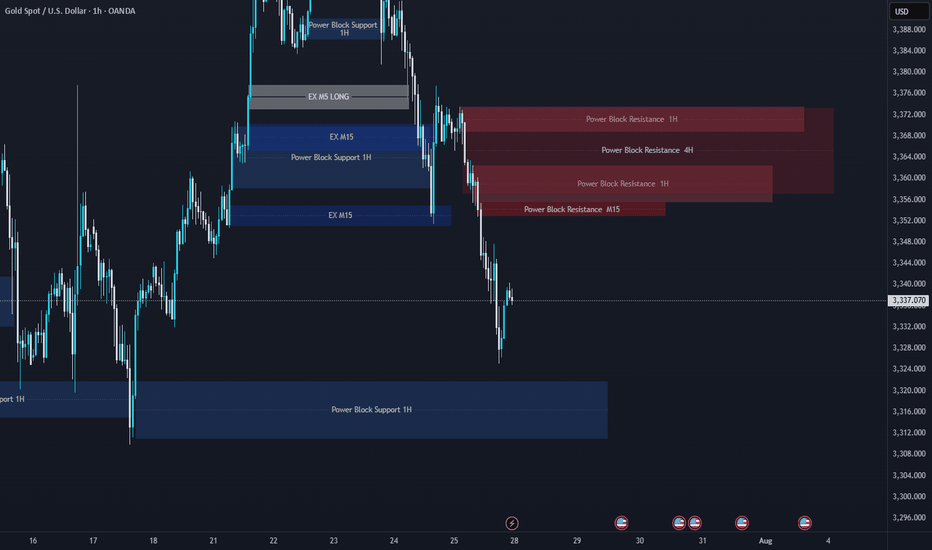

XAUUSD Support & Resistance Levels🚀 Here are some key zones I've identified on the H1/M15/M5 timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

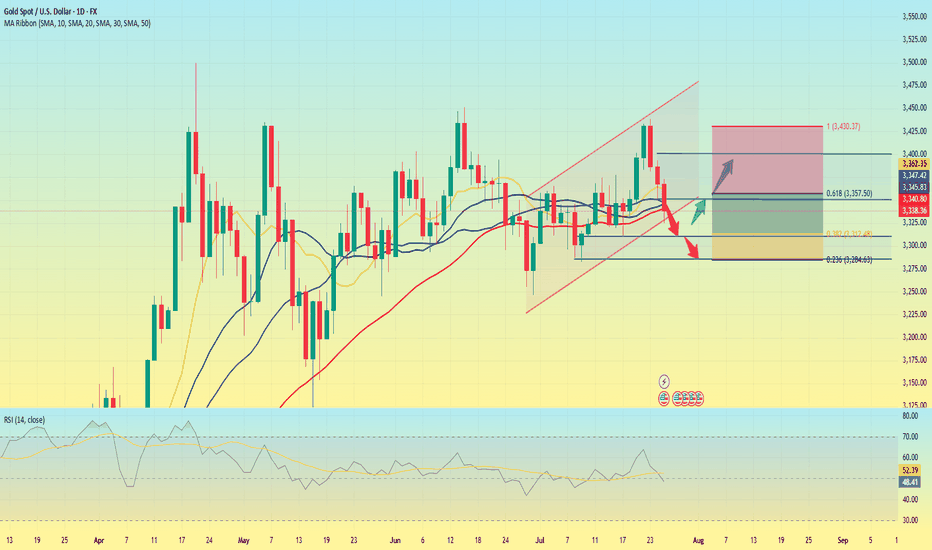

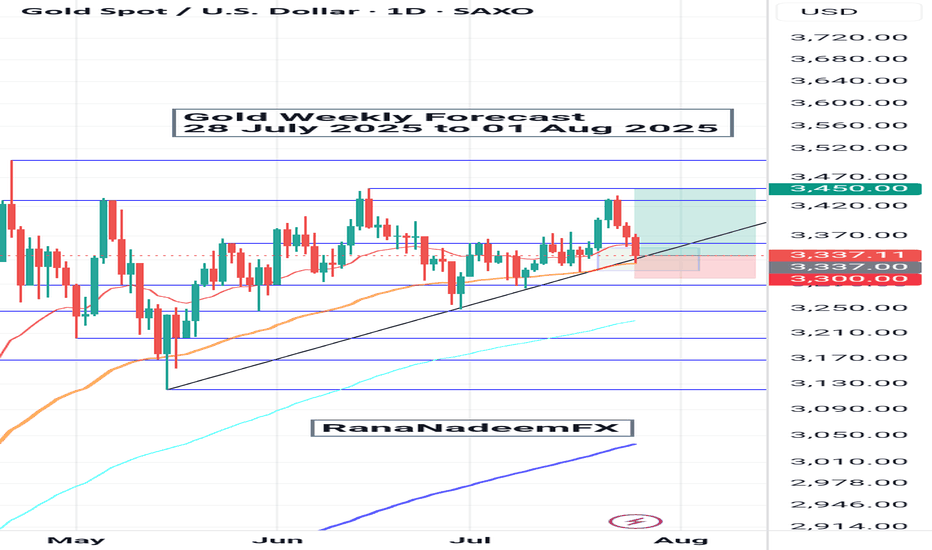

Gold Weekly Forecast (28 July – 01 Aug 2025)📈 Gold Weekly Forecast (28 July – 01 Aug 2025)

By: RanaNadeemFX

🔍 Technical Overview:

Gold (XAUUSD) is currently trading around $3,337, showing rejection near the previous resistance zone of $3,430–$3,450. The market has recently pulled back after testing this resistance and is now approaching a confluence support area formed by:

Dynamic trendline support (ascending black line)

Horizontal support zone around $3,300–$3,320

50-day EMA providing additional support

This zone is critical and likely to act as a bullish demand area, provided no major fundamental risk-off event occurs.

📌 Key Levels to Watch:

Support Zones: $3,300 / $3,270

Resistance Zones: $3,430 / $3,450

📊 Trade Setup Highlighted on Chart:

A buy opportunity is marked from current price levels with a potential bounce back towards $3,430–$3,450.

Entry Zone: Around $3,330 to 37

Target: $3,450

Stop Loss: Below $3,300

This setup offers a favorable risk-reward ratio, assuming price respects the support and resumes the upward trend.

🧠 Bias: Bullish (as long as price stays above $3,300 support zone)

⚠️ Note: Keep an eye on upcoming US economic data releases and geopolitical developments which could add volatility to gold prices.

📌 Follow for more: @RanaNadeemFX

#GoldAnalysis #XAUUSD #WeeklyForecast #TechnicalAnalysis #TradingView #ForexTrader #PriceAction #GoldOutlook #SmartMoneyConcepts

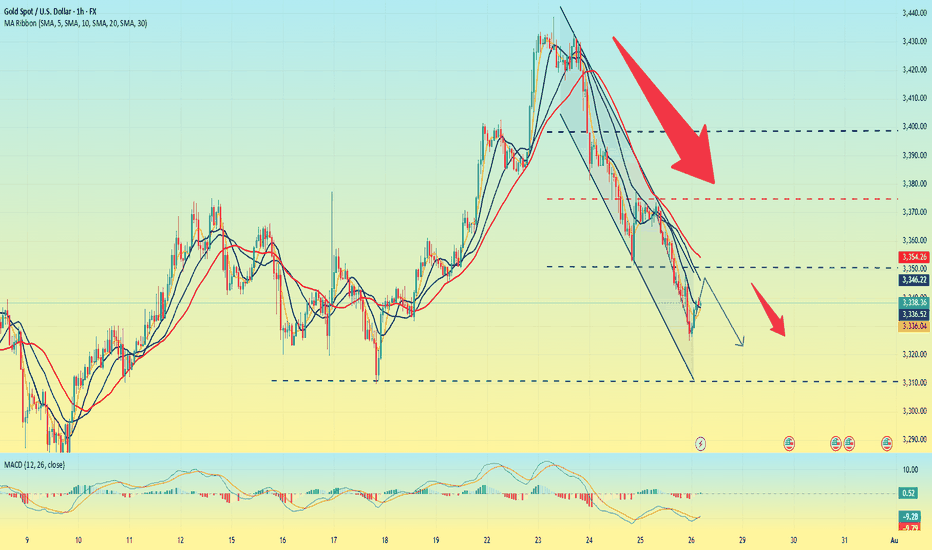

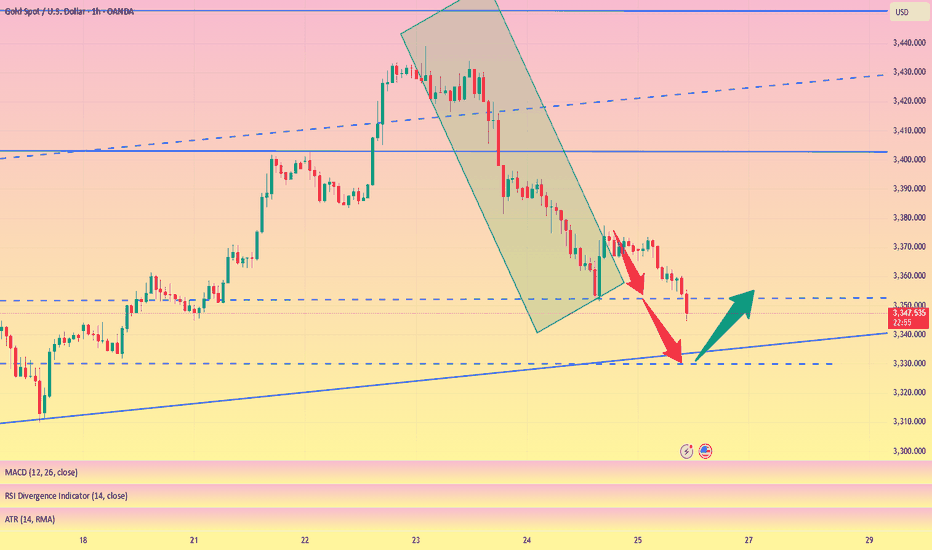

Gold is going down. It may continue next week.On the last trading day of this week, the bears attacked strongly and continued to refresh the recent lows, reaching the lowest point near 3325 before stopping.

From Monday's 3345 to 3440, it closed near 3337. This week, it also walked out of the large range roller coaster pattern, and all the strengths in the previous period did not exist. Under the continuous downward trend, the bulls were also vulnerable, and there was not even a strong rebound, which indirectly explained the strength of the bears in the short term.

As for the current trend, the bears are likely to continue to be strong, and before there is a symbolic upward breakthrough, we still need to maintain the idea of shorts to operate. The current upper pressure is maintained near 3350, which is also the bottom position touched for the first time in the previous period. It is possible that it will be transformed into a top-bottom conversion pattern; and the strong support level below is near 3310.

When the Asian market opens next Monday, we need to pay close attention to whether there is a gap problem on both the bulls and bears. After three consecutive negative daily lines, all the moving average systems have been broken, and it is also likely to form a resonance pressure pattern. On Monday, gold will first touch around 3350 and continue to short. The profit range will be around 3330-3320, and the stop loss will be 3360. If the European session is stronger, you can adjust the point before the US session.

XAUUSD Analysis : Reversal Zone & Trendline Break Setup 🧠 Market Breakdown (Based on MMC Concepts)

Gold (XAU/USD) recently touched an All-Time High, followed by a sharp correction respecting a clean descending trendline — confirming strong selling pressure in the short term.

After price completed a Channel Supply zone (highlighted), it dropped significantly and created a 2x Supply Structure along with a QFL (Quasimodo Failure Level) — a strong indication of liquidity engineering by smart money.

Now, price has entered the Major Reversal Zone, which aligns with a key minor structural demand level. The reaction here becomes highly important, as it could mark the beginning of a new bullish leg.

📌 Technical Conditions

Trendline (Condition 1): Still active; breakout confirmation required for bullish entry.

Reversal Zone (Demand Area): Price currently reacting; signs of rejection forming.

Smart Money Behavior: Liquidity sweep + QFL zone = potential institutional accumulation.

Momentum Watch: Look for bullish engulfing or strong pin bar as confirmation.

🎯 Price Levels to Watch

Upside Targets:

🔹 TP1: 3,360 – 3,380

🔹 TP2: 3,420 – 3,440

Invalidation Zone:

🔻 Break and close below 3,300 = bearish continuation likely.

💡 Conclusion

Gold is approaching a decision point. If this reversal zone holds and we break the trendline, we could see a strong rally back toward previous supply zones. However, failure to hold could bring price lower for further liquidity grabs.

Stay patient. Let price confirm.

Gold - The clear top formation!🪙Gold ( TVC:GOLD ) just created a top formation:

🔎Analysis summary:

Over the past four months, Gold has overall been moving sideways. Following a previous blow-off rally of about +25%, this cycle is very similar to the 2008 bullish cycle. Bulls are starting to slow down which will most likely result in the creation of at least a short term top formation.

📝Levels to watch:

$3.000

🙏🏻#LONGTERMVISION

Philip - Swing Trader

GOLD Melted , 2 Best Places To Sell Clear , Don`t Miss 200 Pips Here is My 30 Mins Gold Chart , and here is my opinion , we Again Below 3377.00 and we have a 30 Mins Candle closure below this strong res , so i`m waiting the price to go back and retest this res and new support and give me a good bearish price action to can enter a sell trade and we can targeting 200 pips , and we have a good res @ 3365.00 we can sell from it also if the price didn`t reach 3377.00 and targeting from 100:200 pips , and if we have a Daily Closure below This res this will increase the reasons for us , just wait the price to back a little to retest it and then we can sell it . if we have a daily closure aboveit this idea will not be valid anymore .

Wait for 3330 to buy the bottom and reduce unnecessary operation#XAUUSD

We have made good profits from short selling yesterday. Currently, gold has fallen to 3350📎. The 4HMACD death cross has increased in volume and is expected to continue to decline. Consider going long near 3330📈. I don’t think it is prudent to bottom out at 3340. Move forward steadily on Friday and reduce unnecessary operations⚖️.

🚀 BUY 3335-3330

🚀 TP 3345-3362

Be alert to new lows, pay attention to 3350 and go long at 3330📰 News information:

1. Tariff issues

2. Next week's NFP data

📈 Technical Analysis:

Last night, gold rebounded to only around 3377 before starting to fall back. Our judgment that the current rebound is weak is completely correct. 3350 is the support point of the bottoming out and rebounding to nearly $20 last night. Whether the European session can go down to 3350 will determine the trend of gold.

From the daily chart, the daily line has fallen for two consecutive days, suggesting that the price may continue to fall today. At present, we need to pay attention to this week's starting point of 3344-3345, and then the 3330 line below. The extreme decline is 3320-3310. At the same time, the narrowing of the daily Bollinger Bands is also paving the way for next week's NFP data.

From the 4H chart, the current MACD indicator crosses and increases in volume, and the middle track of the Bollinger Bands and SMA30 basically overlap near 3388. As for the hourly chart, the upper pressure is mainly concentrated near 3375-3377, which is also the high point of the rebound last night. If gold rebounds directly upward and encounters pressure and resistance at 3375-3385 for the first time, you can consider shorting and strictly implement stop loss.

Overall, if the current market falls to 3350-3345 for the first time and gets effective support, you can consider going long with a light position, defend 3340, and look to 3356-3362; if the decline is strong and continues to fall below 3350, the best stable long point for the day is 3330-3320, defend 3310, and earn $10-20 to leave the market.

🎯 Trading Points:

BUY 3350-3345

TP 3356-3362

BUY 3330-3320

TP 3345-3360

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD

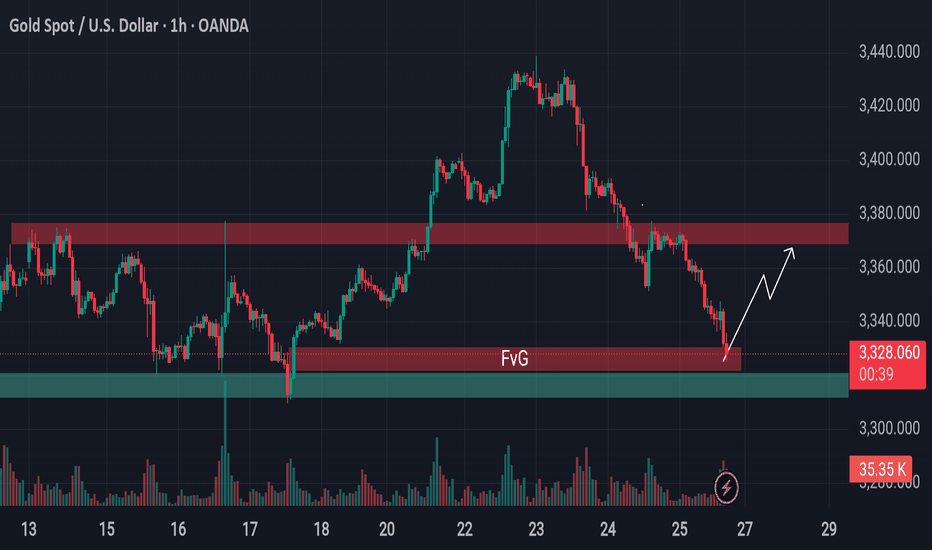

From Breakdown to Breakout? Gold Eyes Support Based Reversal!Gold is approaching a critical support area.

Previously, the price was holding above a key support level, but that zone has now been breached and is likely to act as resistance going forward. However, just beneath the current price, there's a well-established support level still intact—reinforced further by the presence of a bullish Fair Value Gap (FVG).

This setup hints at a possible reversal or a short-term surge from this zone. If market conditions align, gold may stage a pump from here. Keep this level on your radar—it could turn into a decisive point for price direction.

🛡 Always conduct your own analysis before taking any trades. DYOR.

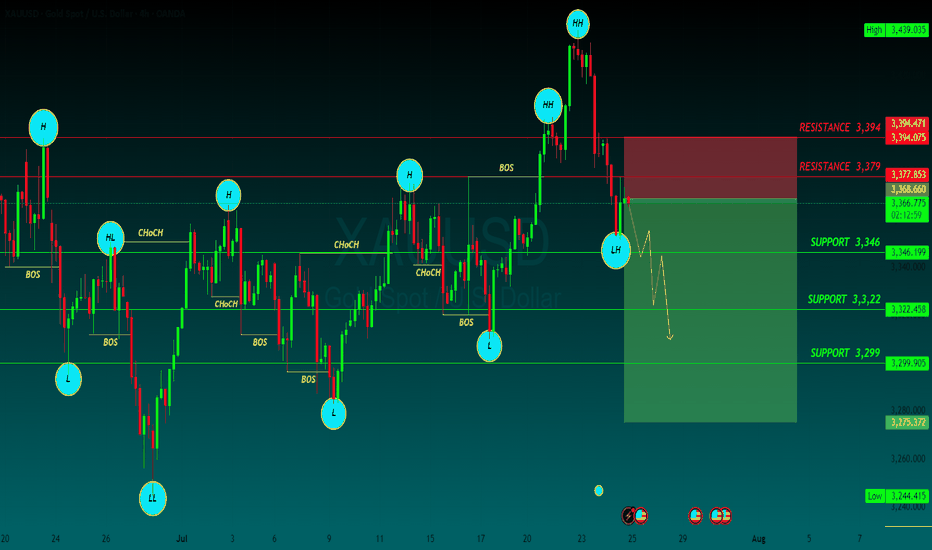

GOLD SELLGold price bears retain control amid fading safe-haven demand, rebounding USD

US President Donald Trump announced late Tuesday that his administration had reached a trade deal with Japan. Furthermore, reports that the US and the European Union are heading towards a 15% trade deal boost investors' confidence and weigh on the safe-haven Gold price for the second straight day on Thursday.

The markets do not expect an interest rate cut from the US Federal Reserve in July despite Trump's continuous push for lower borrowing costs. In fact, Trump has been attacking Fed Chair Jerome Powell personally over his stance on holding rates and repeatedly calling for the central bank chief's resignation.

Moreover, Fed Governor Chris Waller and Trump appointee Vice Chair for Supervision Michelle Bowman have advocated a rate reduction as soon as the next policy meeting on July 30. This keeps the US Dollar depressed near a two-and-a-half-week low and could offer some support to the non-yielding yellow metal.

Traders now look forward to the release of flash PMIs, which would provide a fresh insight into the global economic health and influence the safe-haven commodity. Apart from this, the crucial European Central Bank policy decision might infuse some volatility in the markets and drive the XAU/USD pair.

Meanwhile, the US economic docket features Weekly Initial Jobless Claims and New Home Sales data, which, in turn, would drive the USD and contribute to producing short-term trading opportunities around the commodity. Nevertheless, the fundamental backdrop warrants caution for aggressive traders.

SUPPORT 3,346

SUPPORT 3,322

SUPPORT 3,399

RESISTANCE 3,394

RESISTANCE 3,379

Gold Spot / U.S. Dollar (XAUUSD) - 4 Hour Chart (OANDA)4-hour chart from OANDA displays the price movement of Gold Spot (XAUUSD) from late July to early August 2025. The current price is $3,332.775, reflecting a decrease of $35.935 (-1.07%) as of 07:54 PM PKT on July 25, 2025. Key levels include a sell price of $3,332.480 and a buy price of $3,333.050. The chart shows recent volatility with a shaded support zone around $3,312.314 to $3,367.326, indicating potential price stabilization or reversal areas.

7/25: Key Levels to Watch Closely for Next Week's TradingGood evening, everyone!

Due to health reasons, I had to take a short break from updates — thank you all for your understanding and support.

This week, gold rallied to the 3440 level, forming a double-top pattern, and has since entered a phase of consolidation with a downward bias, currently retracing back to the key 3337-332 support area.

While a short-term rebound is possible from the 30-minute chart perspective, the weekly structure is not favorable to the bulls. On the daily chart, price has once again reached the MA60 support, and is currently forming three consecutive bearish candles, which suggests that bearish momentum may continue.

Unless there is significant bullish news next week, the market may remain under pressure. Key levels to monitor:

Upside resistance zones: 3343, 3352, 3358, 3366, 3372, 3378, and 3386–3392

Downside support zones: 3337, 3332, 3323, 3312

If the weekly chart breaks down, watch for: 3300 psychological level and 3260 (weekly MA20)

Additionally, during this week's decline, a price gap has been left between 3395–3398. If the market starts to rebound on the 2-hour chart, there is a chance this gap will be filled. However, this area also serves as strong resistance, and any approach toward it could result in heavy selling pressure. Caution is advised in the event of a sharp rally.

I'm still recovering and unable to monitor the markets for extended periods. Once my health improves, I’ll resume regular updates. In the meantime, feel free to leave any questions, and I’ll do my best to respond. Thanks again for your continued support, and I wish everyone success and strong profits in the market!