Gold Xauusd Analysis **Market Analysis: Pivot at 3381**

- **Bullish Scenario**: Establish long positions above the 3380–3382 range, targeting resistance levels at 3414 and 3424.

- **Bearish Scenario**: Below 3380, anticipate further downside momentum with support levels at 3362 and 3347.

- **Key Resistance Zone**: Initial resistance at 3414, followed by a secondary resistance at 3424.

Xauusdanalysis

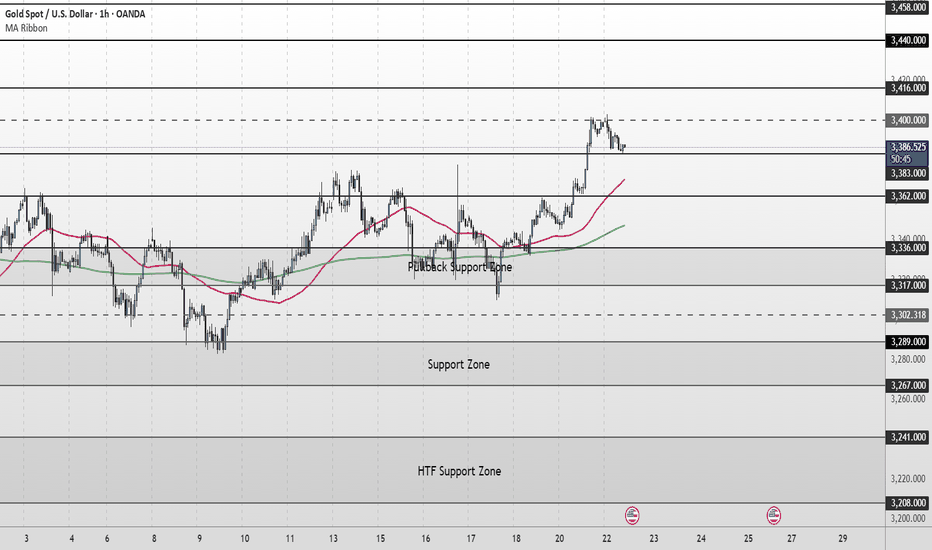

XAU/USD Intraday Plan | Support & Resistance to WatchGold broke above the 3,362 resistance and extended its rally into the 3,400 resistance zone, currently trading around 3,386. Price remains comfortably above both the 50MA and 200MA, which are sloping upward and acting as dynamic support—keeping short‑term structure bullish.

A confirmed break and hold above 3,400 would open the path toward the next upside targets at 3,416 and 3,440, with 3,458 as a higher‑timeframe extension if momentum continues.

If price fails to sustain above 3,383–3,400 and begins to fade, watch the initial pullback toward 3,362.

A deeper move below that would shift focus to the Pullback Support Zone.

Failure to hold there could expose price to the Support Zone and potentially the HTF Support Zone if bearish pressure builds.

📌 Key Levels to Watch

Resistance:

3,383 ‣ 3,400 ‣ 3,416 ‣ 3,440

Support:

3,362 ‣ 3,336 ‣ 3,317 ‣ 3,302 ‣ 3,289

🔎 Fundamental Focus –

📌 Fed Chair Powell Speaks – key event that can move USD and gold sharply.

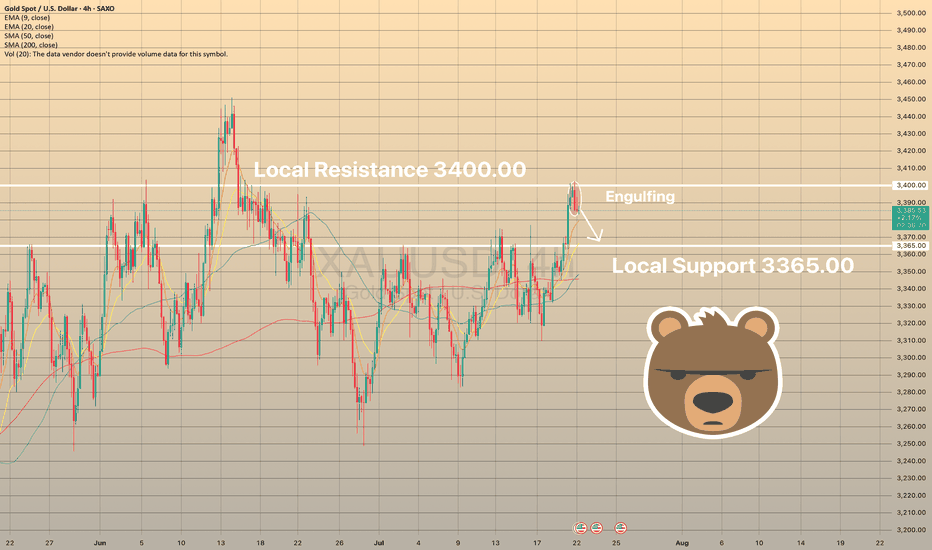

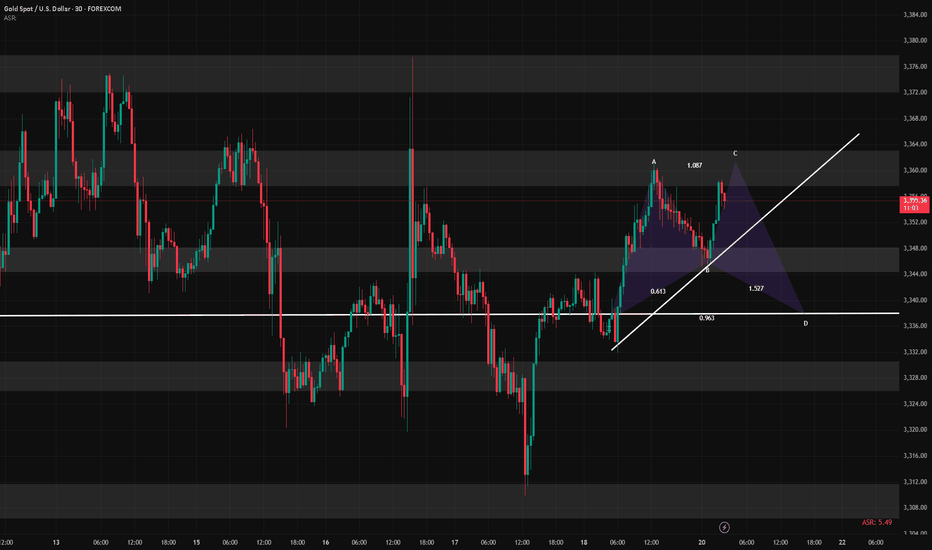

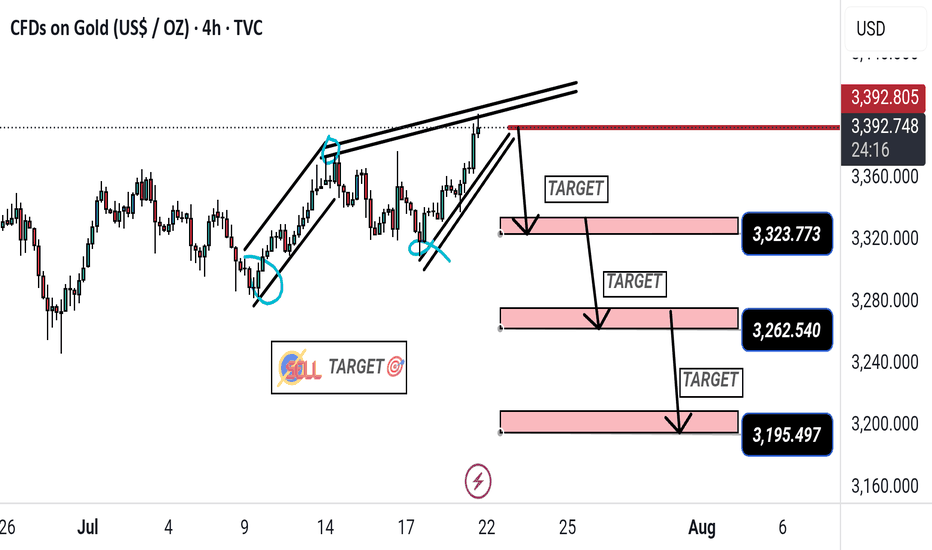

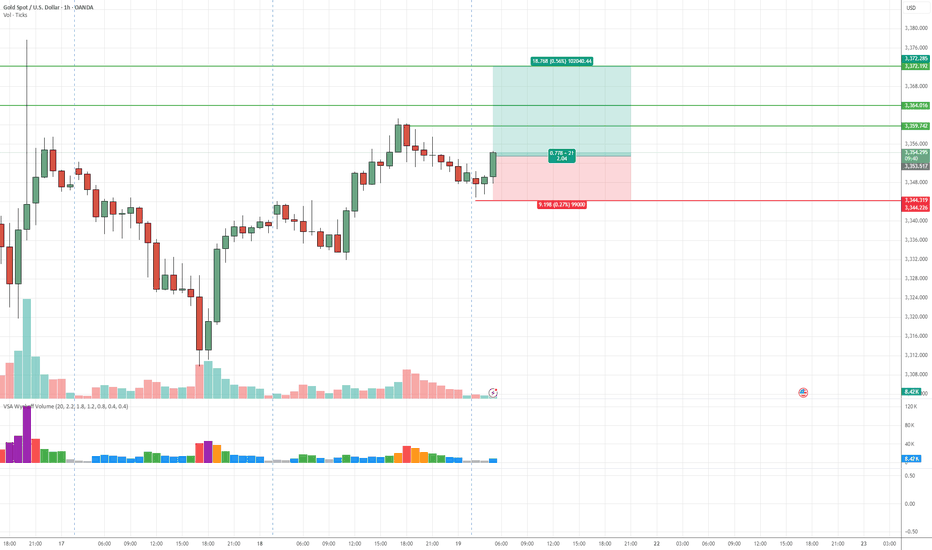

XAUUSD HAS FORMED BEARISH ENGULFING PATTERN. WHAT'S NEXT?XAUUSD HAS FORMED BEARISH ENGULFING PATTERN. WHAT'S NEXT?

XAUUSD has been trading bullish within the last day. The price touched the resistance level of 3,400.00. As a result, the bearish engulfing pattern has formed on 4-h chart.

An engulfing pattern is a two-candle reversal pattern where a smaller candle is followed by a larger one that completely covers it, indicating a potential shift in the trend. A bullish engulfing pattern, which signals a buy signal, occurs in a downtrend when a small red candle is followed by a larger green candle. A bearish engulfing pattern, which signals a sell signal, occurs in an uptrend when a small green candle is followed by a larger red candle. To trade, identify the pattern in a clear trend with high trading volume on the engulfing candle. Enter a buy position (for a bullish engulfing pattern) or a sell/short position (for a bearish engulfing pattern) after the engulfing candle closes, confirming a rebound from support or resistance. Set a stop-loss below the low of the bullish engulfing candle or above the high of the bearish engulfing candle. Aim for the next support or resistance level or aim for a 1:2 risk-reward ratio.

So, here I expect the price to move down towards local support of 3,365.00, where supposedly, the price will start to consolidate.

Gold’s Rapid Surge: A Trap Before the Drop?Gold finally showed signs of retreat. We are still holding a short position near 3400. So far, we have made a profit of 50 pips. However, I will still hold it to see if gold can fall back to the 3385-3375 area as expected. We have completed 2 transactions today, and there is still 1 transaction left to hold.

1. First, we bought gold near 3345 and ended the transaction by hitting TP: 3370, making a profit of 250 pips, with a profit of more than $12K;

2. We shorted gold near 3385 and ended the transaction by hitting SL: 3395, with a loss of 100 pips, a loss of nearly $5K;

3. We are still holding a short gold transaction order near 3400, with a current floating profit of 60 pips and a floating profit of nearly $4K;

The above is the detailed transaction situation today. To be honest, today's rebound strength far exceeded my expectations, and after our first long position hit TP, the market never gave any chance to go long on gold after a pullback, but accelerated to around 3401. But obviously, the accelerated rise of gold is suspected of catching up with the top, and in the short term it faces resistance in the 3405-3410 area, and secondly pressure in the 3420-3425 area. So I don't advocate chasing gold at the moment. On the contrary, I am still actively trying to short gold around 3400, first expecting gold to pull back to the 3385-3375-3365 area.

And I think if gold wants to continue to test the 3405-3415 area, or even sprint to the area around 3425, gold must go through a pullback to increase liquidity to accumulate upward momentum. I think it will at least pull back to the 3385-3375 area.

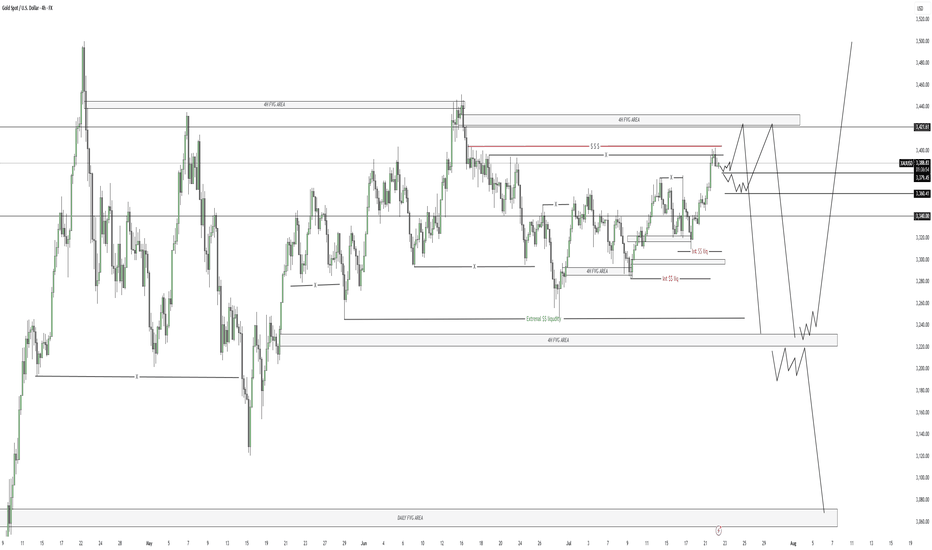

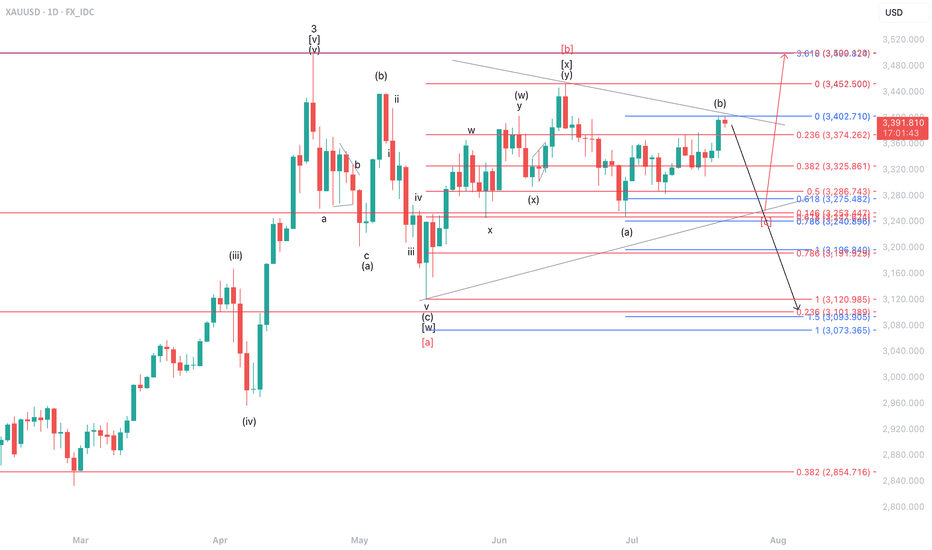

Fake Pump, Real Dump?On the daily timeframe, XAUUSD is expected to be vulnerable to a correction toward the 3253–3325 area as the minimum retracement zone to potentially form a triangle pattern. However, in the worst-case scenario, indicated by the black label, XAUUSD may experience a deeper correction toward the 3093–3191 range.

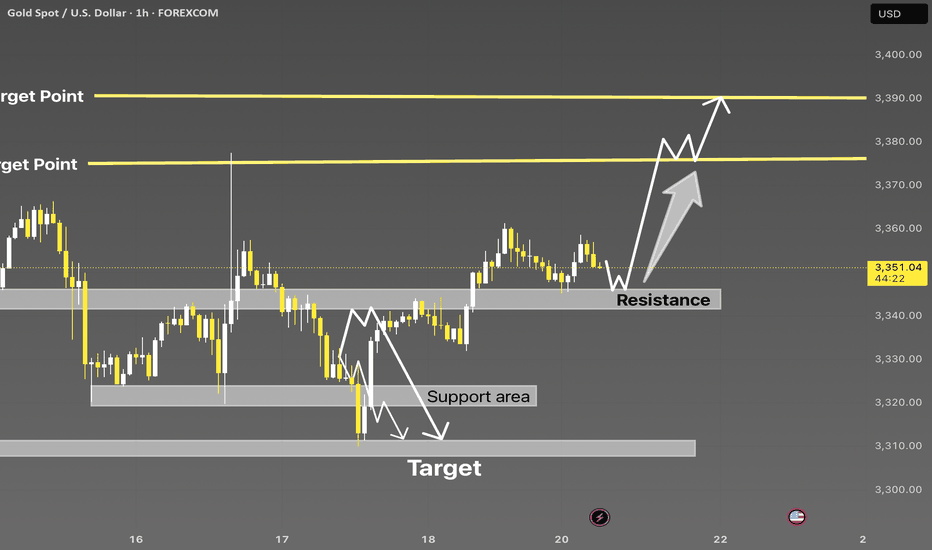

XAUUSD Bullish Setup | Liquidity Grab to Breakout📊 XAUUSD Bullish Breakout Plan | Price Action + Key Levels Analysis 🔥

Gold (XAUUSD) is currently holding above a strong support-turned-resistance zone around $3,340 - $3,345. After a clear rejection from the support area and a bullish structure forming, price is showing potential for a clean breakout toward higher targets.

🔍 Key Technical Highlights:

• Support Area: $3,310 - $3,320 held strongly

• Resistance Flip: $3,345 zone acting as new demand

• Target 1: $3,375

• Target 2: $3,390 major liquidity zone

• Structure: Bullish W pattern forming above demand

This setup favors buy on retracement, aiming for breakout above recent highs. Wait for a confirmation candle above resistance before entering.

📈 Watch for liquidity grab and strong bullish impulse.

#XAUUSD #GoldAnalysis #SmartMoney #BreakoutSetup #LiquidityHunt #ForexTrading #TechnicalAnalysis #BuySetup #PriceAction #TradingView #GoldSetup #ForYou

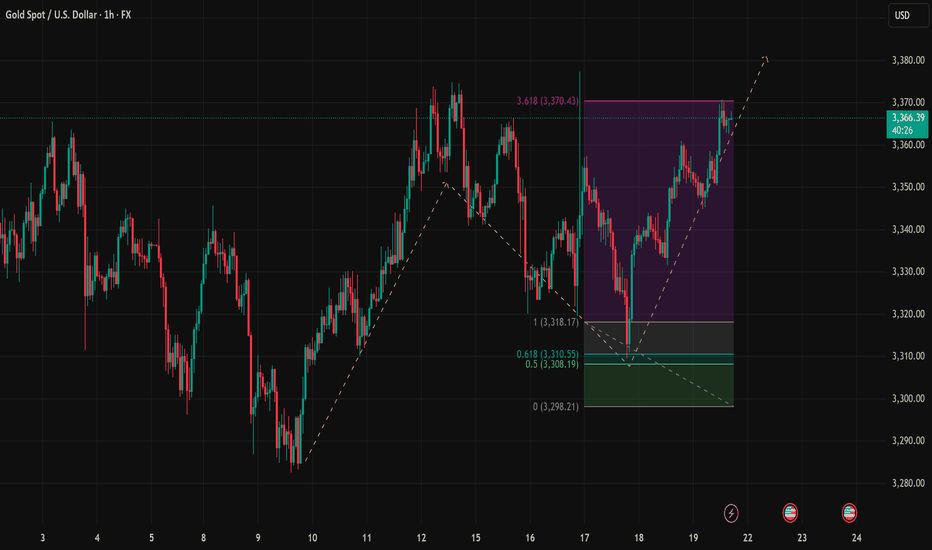

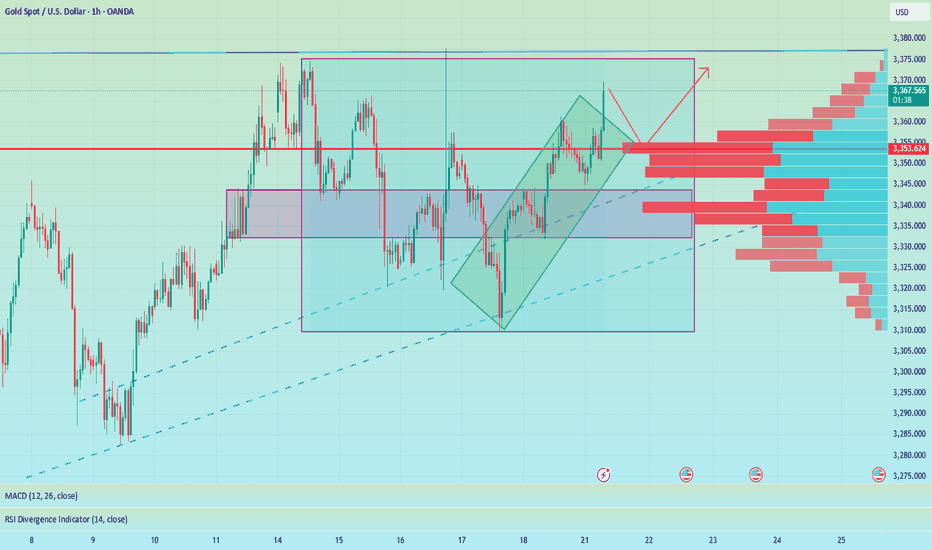

Gold Approaches 3,370 Resistance – Watch for Short-Term PullbackIn the July 21st trading session, gold (XAUUSD) on the H1 timeframe continues to push higher and is now testing a key resistance zone around 3,370 USD, which aligns with the 3.618 Fibonacci extension level. This zone is considered a high-probability area for profit-taking after a strong rally from the 3,308–3,310 USD support zone (aligned with the 0.5 and 0.618 Fibonacci retracement levels). The short-term bullish structure remains intact as long as price stays above the rising trendline from July 18th, with dynamic support currently sitting near 3,350 USD.

From a price action perspective, the latest candles are showing upper wicks near the 3,370 resistance, suggesting early signs of selling pressure. If combined with an overbought RSI condition (often seen in such extended moves), this increases the probability of a short-term retracement.

Key intraday levels to watch:

– Resistance: 3,370.43 (Fibonacci 3.618 extension)

– Dynamic Support: 3,350 (ascending trendline)

– Major Support: 3,310 – 3,308 (Fibonacci 0.618 – 0.5)

– Trend Reversal Level: 3,298.21 (recent swing low)

XAUUSD Trading Strategy for Today:

Primary Scenario – Short Setup near 3,370 if bearish confirmation appears:

Entry: 3,370 – 3,372

Stop Loss: 3,378

Take Profit: 3,350 → 3,330 → 3,310

Alternative Scenario – Buy the dip at trendline support if bullish price action confirms:

Entry: 3,350

Stop Loss: 3,340

Take Profit: 3,370 → 3,380+

In summary, gold is trading at a critical short-term resistance zone. A rejection from 3,370 could trigger a healthy correction toward support zones, while a clean breakout above it would signal strength and open the path toward 3,380–3,390. Traders should stay alert and wait for clear confirmation before entering positions.

Follow for daily gold strategies and save this post if you found it useful for your trading setup.

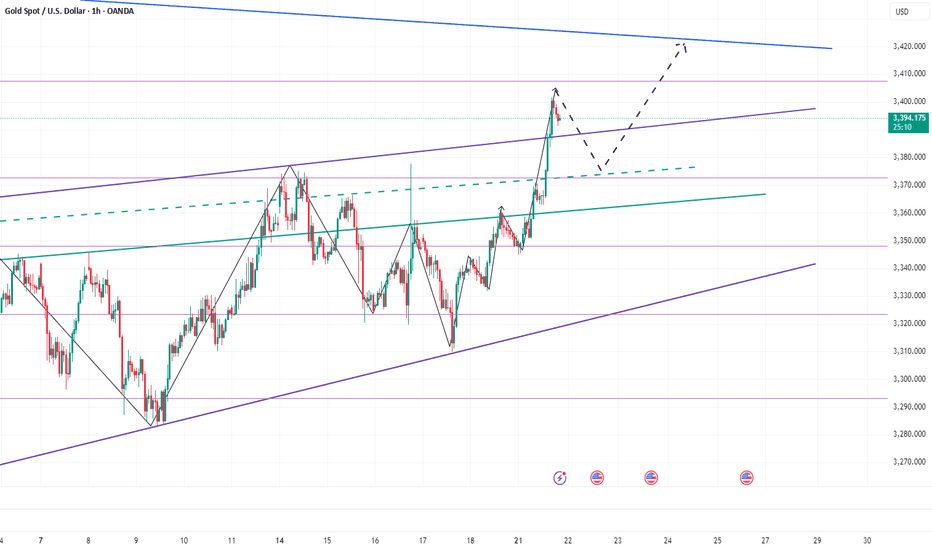

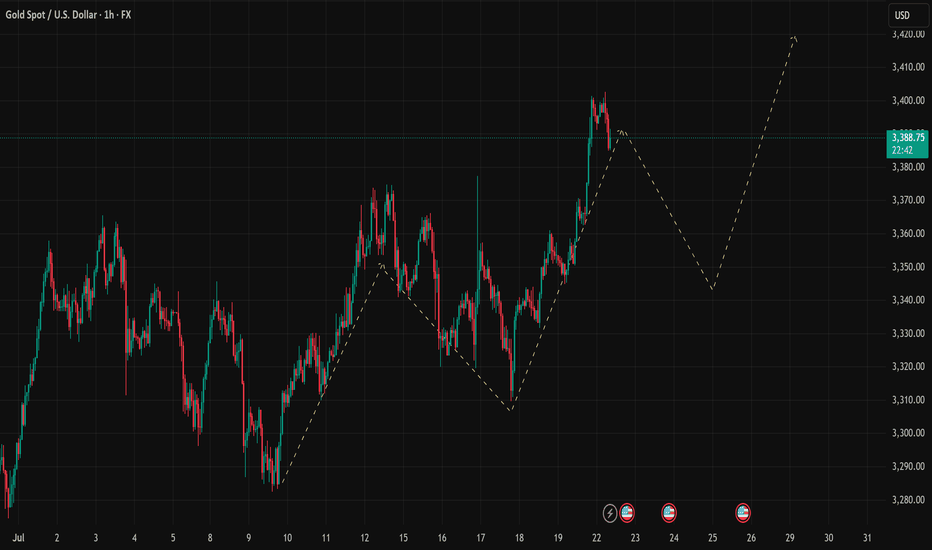

XAUUSD Continues Bullish Structure With Key Retracement OpportunTechnical Outlook – 22/07/2025

On the 1-hour chart, XAUUSD is maintaining a clear bullish market structure with a sequence of higher highs and higher lows. The projected price path drawn on the chart suggests a potential retracement before a continuation toward the 3,420 USD region. Let’s break down the key technical zones and strategies for today:

Key Levels to Watch

Immediate Resistance: 3,390 – 3,400 USD

This is the recent high. A breakout above this area could trigger momentum toward the projected 3,420 USD extension.

Support Zone: 3,345 – 3,350 USD

This zone aligns with the potential pullback as illustrated on the chart, offering a high-probability buy-the-dip opportunity. It coincides with previous structure resistance now turned support.

Trendline Support: The ascending yellow trendline has been respected multiple times and should act as dynamic support on any intraday retracements.

Indicators & Tools Used

EMA: Price is currently trading above the short-term EMA (not shown), suggesting intraday bullish bias remains intact.

RSI (Recommended Use): Look for RSI near 40–50 on the pullback for confluence at support.

Fibonacci Tool (suggested): If measuring from the swing low near 3,320 to the high of 3,390, the 0.618 Fib lies close to 3,345 – an ideal area to look for long entries.

Suggested Trading Strategies

🔹 Buy the Dip Strategy:

Wait for a corrective move into the 3,345–3,350 area. Confirm with bullish reversal candles or RSI support, then enter long targeting 3,400–3,420. Stop-loss ideally below 3,335 (structure break).

🔹 Breakout Continuation Strategy:

If price breaks cleanly above 3,390 with volume, a momentum trade toward 3,410–3,420 is viable. Use tight trailing stops to protect gains.

🔹 Avoid chasing highs – Patience at support zones or confirmation above resistance will offer better reward/risk setups.

Conclusion

Gold is respecting bullish market behavior on the 1H chart, and while a short-term correction is expected, the broader trend favors upside continuation. The 3,345–3,350 area will be critical for today's trading decisions.

Remember to follow for more updates and strategy insights. Save this post if you find it useful.

If you’d like, I can also add a version using RSI or Fib levels directly plotted. Let me know.

Gold (XAUUSD) – 22 July Outlook | Reversal Zones in FocusGold (XAUUSD) – 22 July Outlook | Three Key Reversal Zones to Watch

Yesterday, Gold gave a strong breakout above the key resistance level at 3377 , shifting the M15 structure bullish and confirming upside strength.

Today, the market is likely entering a retracement phase on both the H4 and M15 timeframes — a healthy pullback after a breakout, which may lead to the next leg of the uptrend.

So where should we focus for long opportunities?

We are observing three key zones as potential bases for the continuation move:

📍 Zone 1 – 3377.6–3373.5 (Breaker Block):

This is the immediate structure zone — previous resistance which may now flip into support.

→ If price respects this area, we can anticipate a classic S&R Flip setup.

📍 Zone 2 – 3367.5–3363 (Demand Block):

If the first level doesn’t hold, this zone becomes critical. It lies just under the breakout base and could act as the next level of defense by bulls.

📍 Zone 3 – 3358.5–3350.5 (H4 Order Block):

This is the most significant support zone for the day. It aligns with a higher-timeframe order block, making it a high-probability POI for a deeper pullback and reversal.

But remember, we do not predict blindly .

Plan of Action:

– Observe price behavior at each zone

– Wait for confirmation via M1 internal structure shifts + BoS

– Trade only when all conditions align

– SL: 40 pips | TP: 120 pips

Risk-Reward: Always 1:3

Summary:

✅ Structure is now bullish on M15 and H4

✅ We’re in a pullback phase — ideal for continuation trades

✅ Three clear POIs mapped — now we wait for the market to speak

Patience. Precision. Discipline.

Let the trade come to you — not the other way around.

📘 Shared by @ChartIsMirror

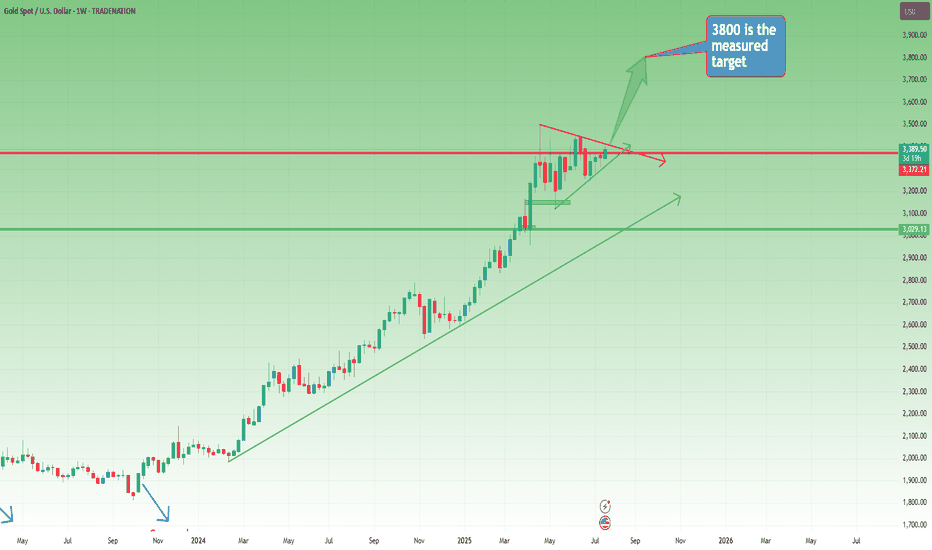

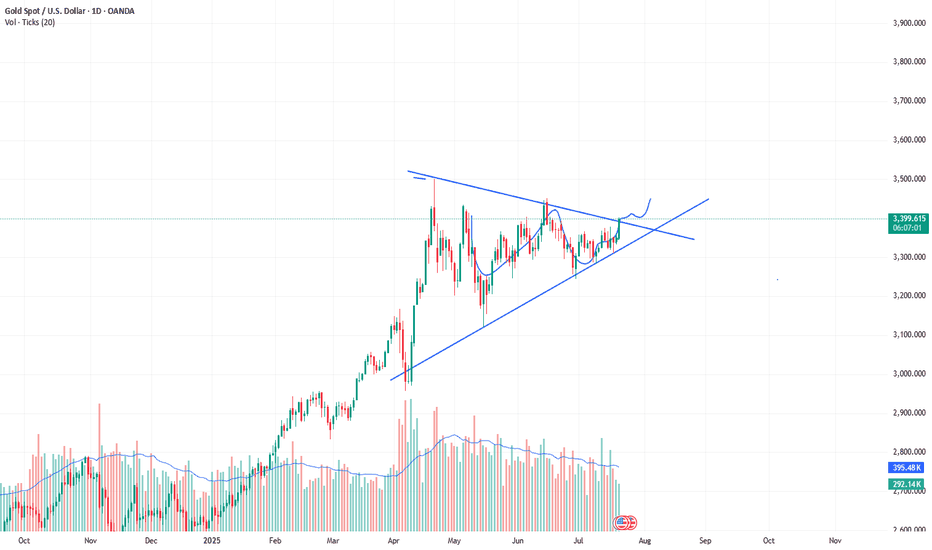

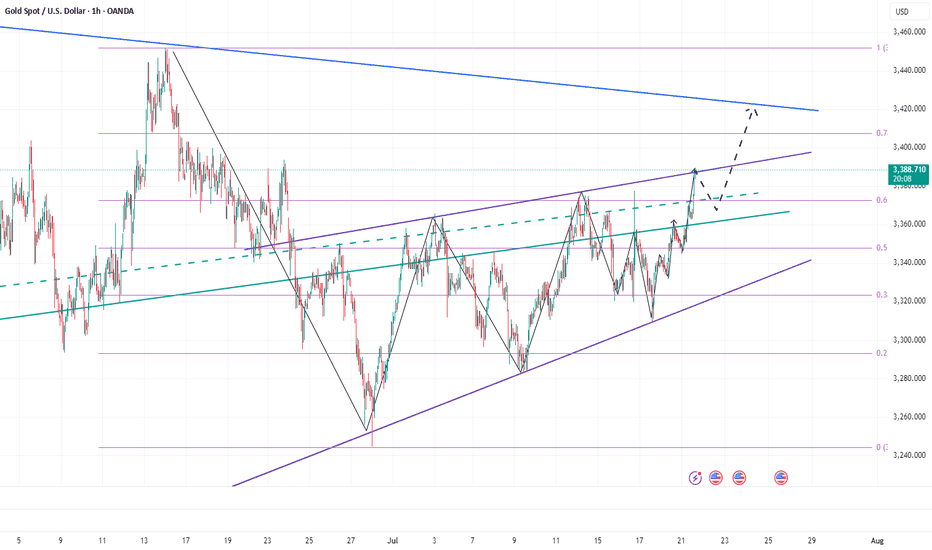

Weekly Outlook: Gold Builds Pressure – Is the Big Move Coming?📆 Big Picture View

Since the start of 2024, Gold has been moving in a well-defined long-term bullish trend.

Yes, there were meaningful pullbacks along the way — but the direction was never in doubt. Step by step, Gold climbed over 15,000 pips in just over a year, reaching a new all-time high in late April.

📉 Post-ATH: A Period of Stabilization

After peaking, Gold shifted into consolidation mode, with price gravitating around the 3300 zone.

This sideways movement has been ongoing for the past three months, but it’s not a sign of weakness — it’s the market catching its breath.

On the weekly chart, this consolidation is now forming a symmetrical triangle, a classic continuation pattern that often appears mid-trend.

📐 The Technical Setup

- The symmetrical triangle shows compression of volatility

- Buyers and sellers are slowly converging toward a decision point

- A breakout is approaching, and when it comes, it could be explosive

🎯 What’s the Trigger?

- A confirmed break above 3450 would validate the triangle breakout

- That opens the door to quickly test the 3500 round figure

- The measured target for the triangle sits at 3800

Given the time Gold has spent consolidating (3+ months), this target could realistically be reached by year’s end

🧭 Strategic Takeaway

- As long as Gold holds above 3300, the bullish structure remains valid

- Breakout above 3450 is the green light for the next leg up

- Until then, the consolidation continues, and smart money prepares

📌 Conclusion:

Gold is building pressure. The weekly triangle is maturing.

This isn’t the end — it’s the pause before the next move.

Stay patient. Stay focused.

Because if 3450 breaks… 3800 is not a dream — it’s a destination. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

P.S: Here you have a short term analysis on Gold

Gold (XAU/USD) Bullish Outlook Based on Price ActionGold (XAU/USD)**, showing a bullish outlook based on price action and support zones.

**Chart Analysis:**

* **Current Price:** \$3,359

* **EMA Signals:**

* EMA 7: \$3,353

* EMA 21: \$3,345

* EMA 50: \$3,341

**Bullish EMA alignment** (short EMAs above long) signals upward momentum.

* **Support Zones:**

* **S1**: \~\$3,345 (strong short-term demand area)

* **S2**: \~\$3,325 (deeper support zone)

* **Volume:** Spikes in green bars signal strong buyer interest near support, especially during the bounce.

* **Projected Move (Green Arrow):**

* A potential retest of the breakout zone (\~\$3,350) could happen before gold targets the **next key resistance** near **\$3,410**.

**Summary:**

Gold broke above a consolidation range supported by EMA alignment and strong volume. As long as the price stays above S1 (\$3,345), the trend remains bullish with upside potential toward \$3,400–\$3,410. A pullback may occur first, offering re-entry opportunities.

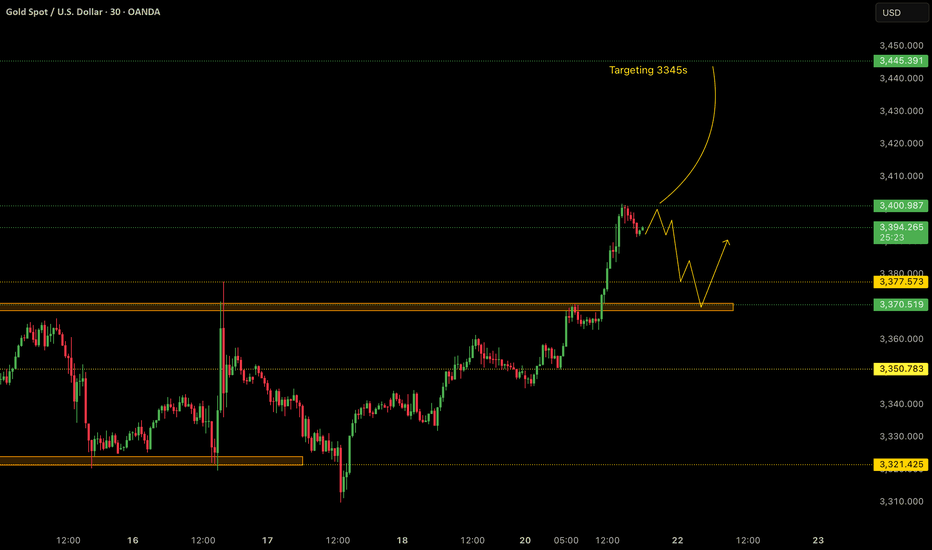

July 21: Key Resistance at 3358–3366, Breakout Targets 3378–3388Good morning, everyone!

Last Friday, gold tested the support around 3332 but did not break below it. The price then rebounded to the 3358 zone, where it encountered selling pressure and pulled back. At today's open, the price retraced to the 3343 level, where support held well, prompting another rally back toward 3358.

It’s important to note that since the 3358 resistance was already tested on Friday, some of the selling pressure has likely been absorbed. As a result, there is a higher probability of a breakout today. If a breakout occurs, the next key resistance lies at 3366/3372–3378. In the case of strong bullish momentum, the price may extend further toward the 3386–3392 resistance zone.

However, if the price continues to be capped below 3358–3366, we may see a consolidation or short-term pullback. In this case, watch support at 3348–3343. Should the price successfully break above 3378, then support on pullbacks will shift higher to 3363 and 3358–3352.

🔺 Key Warning: The 3358 resistance zone is technically crucial. If the price repeatedly fails to break through, watch out for a potential double-top pattern on the 30-minute chart, which could signal a near-term bearish reversal.

7/ 22: Focus on Selling at Highs, Key Support at 3378–3372Good morning, everyone!

I’ve unfortunately injured my lower back and will need to rest in bed for a while, so I’ll keep today’s market commentary brief.

Yesterday, gold rallied to test the 3400 level, a key psychological and technical resistance area that naturally triggered notable selling pressure. Given this, chasing long positions at current levels is not recommended.

On the downside, support is seen near 3378. If this level holds, the price may attempt another rebound. On the upside, key resistance levels to watch are:

3407 as the initial resistance

3416–3423 as the stronger resistance zone

For today’s trading strategy, consider focusing on selling into strength near resistance levels. Once the selling pressure is absorbed, there may be an opportunity to re-enter on the long side at lower levels, allowing for better risk management and entry conditions.

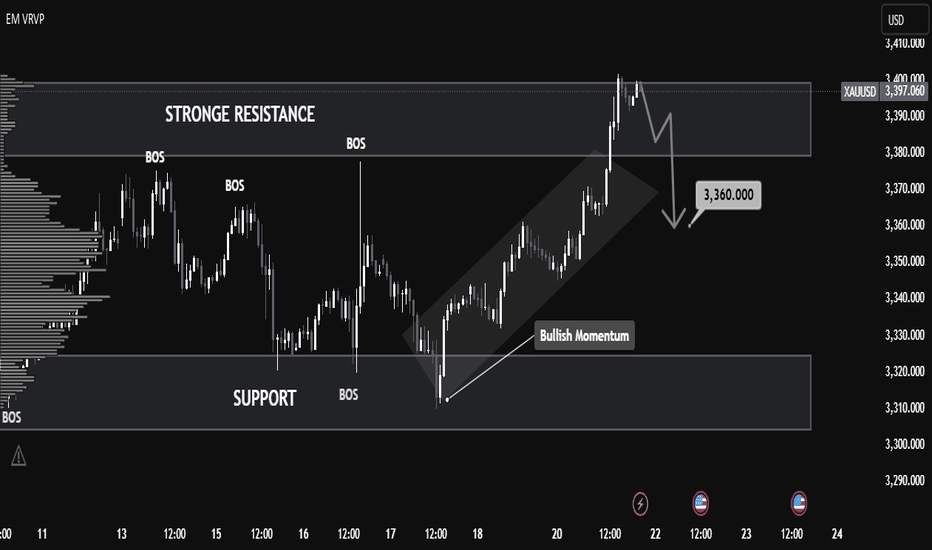

XAUUSD Analysis – Smart Money Perspective XAUUSD Analysis – Smart Money Perspective

🧠 Market Structure & BOS (Break of Structure):

The chart clearly shows multiple Break of Structure (BOS), confirming bullish intent.

After the final BOS around 3,370, price aggressively broke above resistance, forming a new high at 3,397.

This indicates bullish market momentum backed by strong demand.

🔎 Key Zones Identified:

🔼 Strong Resistance (3,390 – 3,400 Zone)

This level has been tested and now shows potential exhaustion, possibly trapping late buyers.

Price currently rejecting this zone with a bearish reaction.

🔽 Support Zone (3,300 – 3,320)

Prior consolidation and BOS originate from here.

Strong bullish OB and demand lie here—key area for future long setups.

📉 Expected Short-Term Move:

The projection arrow indicates a potential retracement toward 3,360, a previous BOS + potential FVG area.

This aligns with Smart Money's tendency to rebalance inefficiencies before continuation.

🔺 Volume Analysis (VRVP - Volume Profile):

Notice how high volume nodes align with the support and resistance zones.

Price is currently sitting in a low-volume gap, supporting the idea of a retracement to a more balanced area.

⚡ Momentum Shift Signal:

The steep angle of the last move up suggests possible liquidity grab above resistance.

Expectation: Price may dip to mitigate demand or OB before resuming the uptrend.

✅ Conclusion:

This chart illustrates a textbook SMC scenario:

Bullish BOS confirms structure shift.

Liquidity sweep above resistance may lead to a retracement.

3,360 is a key price point to watch for FVG fills or bullish continuation.

Accurate prediction, continue to buy after retracement to 3353📰 News information:

1. The Trump administration puts pressure on the Federal Reserve to cut interest rates

2. The continued impact of tariffs and the responses of various countries

📈 Technical Analysis:

Gold is currently rising rapidly, reaching a high near 3368, and the overall bullish trend has not changed yet. It is not recommended to continue chasing the highs at present. Those who are long at 3345 can consider exiting the market with profits. The technical indicators are close to the overbought area and there is a certain risk of a correction. Be patient and wait for the pullback to provide an opportunity. At the same time, 3353 has become the position with relatively large trading volume at present, and the top and bottom conversion in the short term provides certain support for gold longs. If it retreats to 3355-3345, you can consider going long again, with the target at 3375-3385. If it falls below 3345, look to 3333, a second trading opportunity within the day. If it falls below again, it means that the market has changed, and you can no longer easily chase long positions.

🎯 Trading Points:

BUY 3355-3345

TP 3375-3385

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

NordKern - XAUUSD InsightNordKern | Simplified Insight OANDA:XAUUSD possible scenarios

Gold saw some upside today, primarily driven by softer TVC:DXY and trade deadlines ahead. To be specific:

1. Softer U.S. Dollar (DXY)

The U.S. Dollar Index fell ~0.1–0.2% today, making gold more attractive for international buyers

Kitco confirms the decline in USDX, paired with weaker Treasury yields, is fueling bullion demand.

2. Cautious Market Ahead of Trade Deadlines

Markets are bracing for the August 1 U.S. tariff deadline, especially involving the EU. Investors are positioning defensively, increasing safe-haven interest in gold.

Heightened trade tensions and uncertainty including possible Trump-Xi talks boost demand for safe assets.

3. Falling Treasury Yields & Fed Policy Expectations

The U.S. 10‑year Treasury yield has slipped (~4.37%), reducing gold’s opportunity cost and supporting its attractiveness.

Market pricing shows increasing odds of a Fed rate cut at next week’s FOMC meeting, something analysts like Christopher Waller suggested.

4. Geopolitical & Trade Risk Premiums

Escalating trade risk (tariffs looming) and geopolitical uncertainty are prompting safe-haven inflows into gold.

India’s MCX mirror those sentiments: gold rose ~0.5% on local contracts amid global trade nerviness.

To sum it up:

Gold is rallying today primarily because of the softer dollar, lower yields, and elevated trade risks ahead of the August 1 tariff deadline all of which reinforce its safe-haven allure.

Trade Setup - Shorts; if we retest 3370s

- We would primarily look to enter into lower risk buys on gold at more preferable levels such as 3370. After breaking to the upside from the consolidation area, a pullback and a retest to that area would not be out of the ordinary.

Trade Setup - Buys; if we break above 3400

- In case of the dollar remaining soft, we can expect gold to continue its upside rally without any major pullbacks. In this case, we would be looking for the breaks of 3400 and continue to hold until around 3345s.

Key Notes:

- Softer Dollar

- Possible retest of 3370s

- Watch for potential breaks of 3400

This remains a tactically driven setup. Manage risk appropriately and stay alert for any renewed political developments.

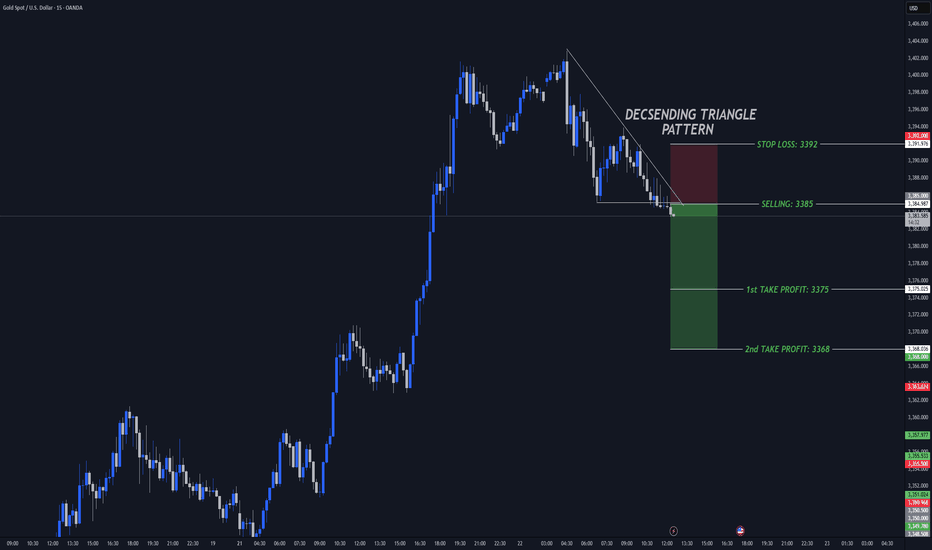

"Gold Price Bearish Reversal: Key Sell Targets Identified"This 4-hour chart of Gold (XAU/USD) shows a potential bearish reversal pattern forming after a rising wedge breakout. The chart indicates a SELL signal near the $3,392 resistance zone, with three downside targets at:

1. $3,323.773

2. $3,262.540

3. $3,195.497

Highlighted support zones suggest possible price retracements to these levels.

XAUUSD:The next target is 3430.The market is developing completely in accordance with the expectations of the band trading center. Today is a day of sharp rise. As Monday, this increase is quite considerable.

The three reminders to buy are all at a lower position. The post clearly points out that the market has reached 3400. 3400 is a controversial position. It needs to fluctuate in the New York market, and then there will be some breakthroughs. If it is stronger, it will directly break through the New York market. In the short term, you can pay a little attention to the retracement position of 3390-3395. Then continue to buy. The next target is 3430.

Warning Signs After Gold’s Sharp Rise — Is a Pullback Coming?Today, gold rebounded from around 3345, and has now rebounded to around 3389, which is only one step away from the 3400 mark. Gold has hardly retreated during the rise, and the rise is strong. However, we can see from the small-level candle chart that gold suddenly accelerated its rise after consolidating around 3365, and continued to around 3390, and is now oscillating near the recent high trend line.

After gold accelerated its rise and oscillated near the recent high trend line, this made me have to be more cautious, because we must be careful that the acceleration of gold's rise in the short term is a trap for buyers, so even if we are bullish on gold in the short term, we should not directly chase gold at a high level; according to the current structure of gold, I think it is necessary for gold to retest the 3370-3360 area support before continuing to rise and hitting 3400. Only after verifying that the support in this area is effective can it be conducive to a better rise in gold!

So for short-term trading, I think we can still try to short gold now, and then wait patiently for gold to retest the 3370-3360 area.

Gold (XAUUSD) Bullish SetupGold is maintaining its bullish momentum, with price action respecting key support levels. The chart highlights three target levels (TP1, TP2, TP3) marked with green lines, indicating potential zones for profit-taking as the uptrend progresses. A stop-loss is defined below the recent swing low, marked with a red line, to manage downside risk. This setup aligns with the prevailing trend and favors continuation traders.

GOLD Breakout Done , Long Setup Valid To Get 200 Pips !Here is My 30 Mins Gold Chart , and here is my opinion , we finally above 3377.00 and we have a 30 Mins Candle closure above this strong res , so i`m waiting the price to go back and retest this res and new support and give me a good bullish price action to can enter a buy trade and we can targeting 200 pips , and if we have a 4H Closure Above This res this will increase the reasons for buyers , just wait the price to back a little to retest it and then we can buy it . if we have a daily closure below it this idea will not be valid anymore .