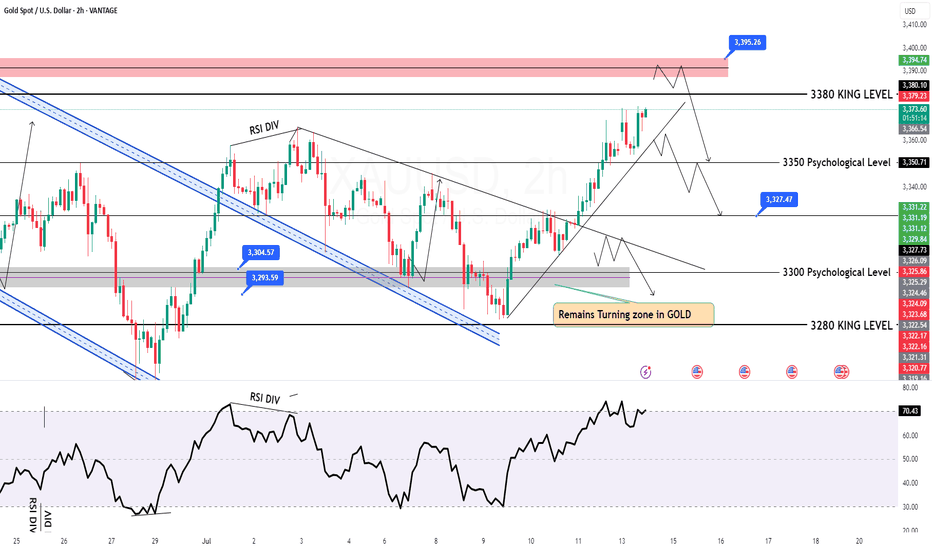

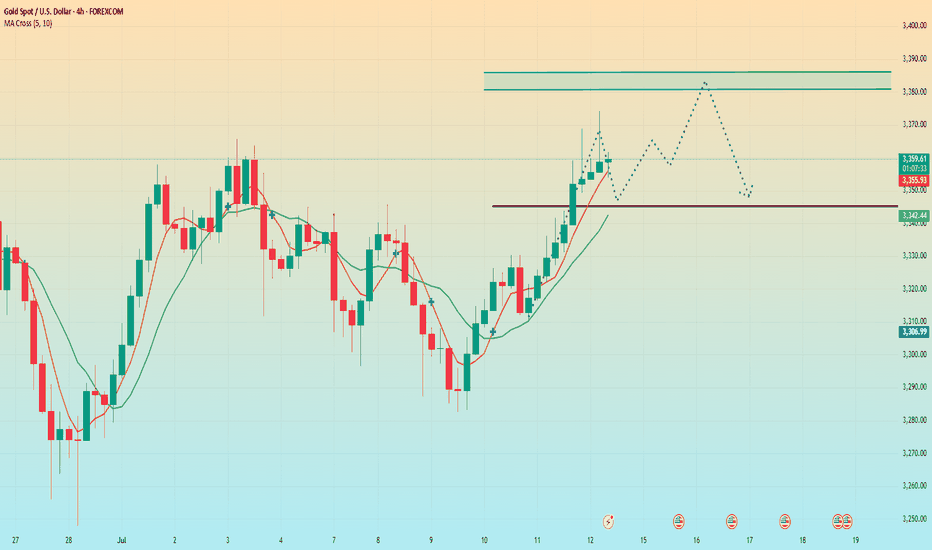

Gold Roadmap=>Short termGold ( OANDA:XAUUSD ) currently appears to have broken through the Resistance zone($3,350-$3,325) .

The Resistance zone($3,350-$3,325) was broken with the help of the Descending Broadening Wedge Pattern , the upper line of this classic pattern having served as an important resistance line for us in previous ideas .

In terms of Elliott wave theory , Gold has completed the Double Three Correction(WXY) within the Descending Broadening Wedge Pattern . It is currently completing the next five impulse waves . Wave 5 of these waves could end in the Potential Reversal Zone(PRZ) .

I expect Gold to rise to the Potential Reversal Zone(PRZ) , and of course, given the momentum of gold approaching PRZ , we can also look for Short positions in PRZ .

Note: Stop Loss (SL) = $3,329

Gold Analyze (XAUUSD), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Xauusdanalysis

XAU/USD Update: Ready for a 12% Surge?Welcome back, traders, it’s Skeptic! 😎 Is XAU/USD about to explode or crash?

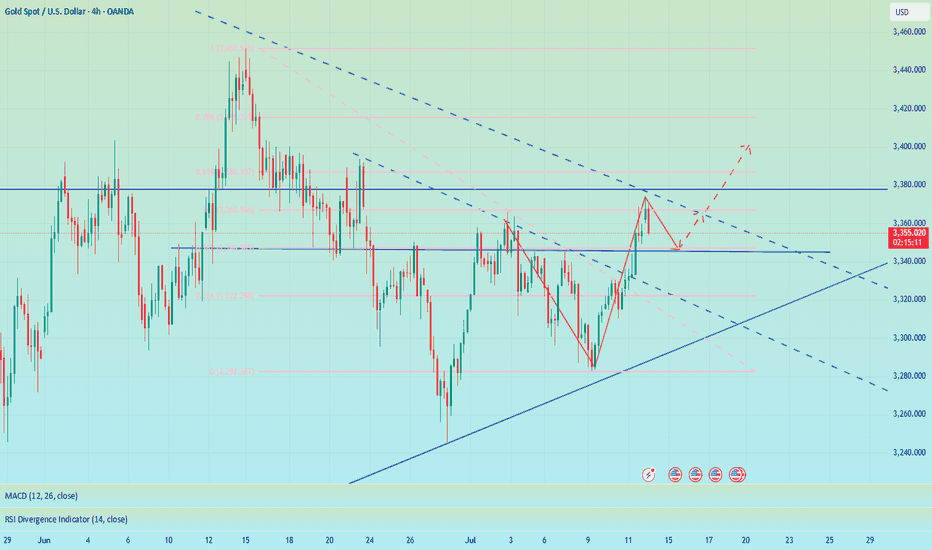

We’ve formed a symmetrical triangle pattern , and its breakout triggers could deliver solid profits for longs or shorts. Let’s dive into the details with the Daily timeframe to see the big picture.

✔️ Daily Timeframe: Our HWC is strongly bullish. After hitting $ 3,497.80 , we entered a secondary retracement phase, forming a symmetrical triangle. If we break resistance at $ 3,444.18 , my targets are the next ceiling at $ 3,494.50 and, long-term, $ 3,796.64 . But if we break support at $ 3,796.64 , it could signal a major trend change from uptrend to downtrend, opening shorts. Next supports are $ 3,206.32 and $ 3,019.31 —use these as your targets.

📊 Key Insight : Risk management is key to surviving financial markets. Stick to max 1%–2% risk per trade to stay safe.

📉 Market Context: Markets are predicting a major recession in the U.S. economy. If it happens, Gold will be the only safe-haven asset. So, I personally favor riding Gold’s uptrend.

This historic drop screams one thing: global markets are losing faith in U.S. monetary and fiscal policies, big time.

And that’s a loud wake-up call for investors: It’s time to bulletproof your portfolio. What’s that mean?

Your stocks, real estate, cash, bonds , you name it...

They’re slowly but surely turning to Gold .

💬 Let’s Talk!

Which Gold trigger are you eyeing? Hit the comments, and let’s crush it together! 😊 If this update lit your fire, smash that boost—it fuels my mission! ✌️

Gold breaks trendline towards 3390, Uptrend resumes✏️ OANDA:XAUUSD The price increase will continue today and will be even stronger. After breaking the trendline, gold has strong support. SELL strategies are only considered to find short-term reaction points waiting for the next trends.

Gold has confirmed the uptrend is back, heading to 3390 today.

📉 Key Levels

Support 3330-3314

Resistance 3345-3362-3388

Sell trigger: rejection from 3345 with bearish confirmation

Sell zone: 3362–3387 (Strong resistance)

BUY trigger: 3330-3314 support with bounce confirmation

Leave your comments on the idea. I am happy to read your views.

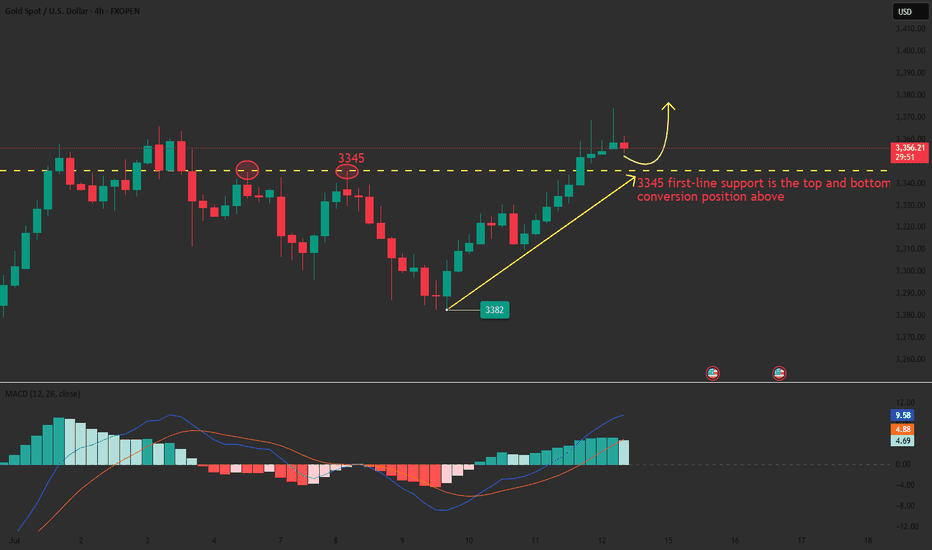

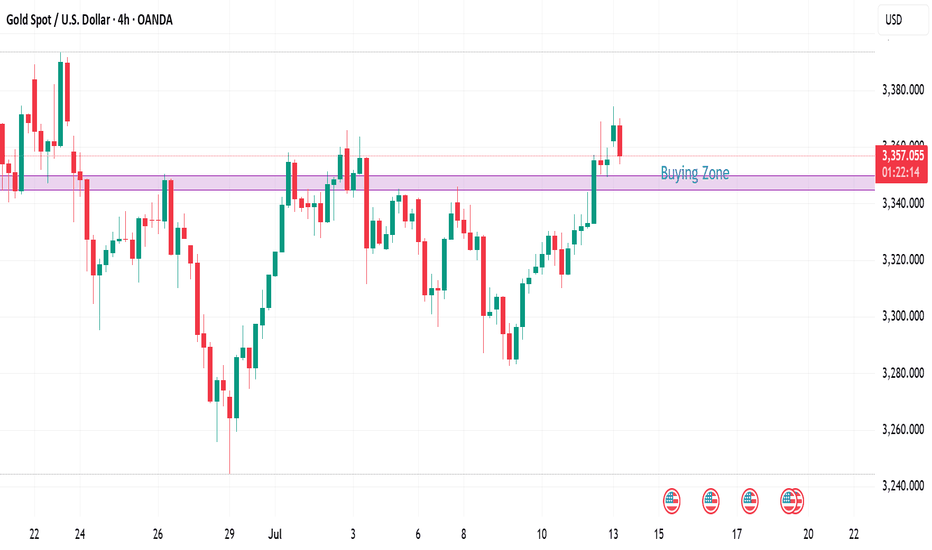

Gold gaps up and open higher,beware of going long at high levelsBros, the Asian session opened higher in the morning. Currently, gold is falling back to the SMA1O moving average. We will continue to be bullish after it falls back and stabilizes. At present, it has broken through the key resistance level of 3360. The daily line has shown a strong pattern of three consecutive positives. The gold price remains in the rising channel, and the bullish trend is obvious. As the gold price moves up, the short-term moving average moves up with it. At present, 3355-3345 constitutes an important support in the short term, and 3375-3385 above constitutes a short-term resistance area. Whether it can stand firmly above 3360 this week is the key.

Severe overbought in the short term, there are trading risks for long positions at high levels. Short-term operation suggestions for the Asian and European sessions: consider shorting when it touches 3365-3375, and stop loss when it breaks 3375. The target focuses on 3355-3345, and the breakout looks at 3330-3320. On the contrary, if it stabilizes at 3355-3345, you can consider going long.

Short position profit, focus on 3355-3345 support📰 News information:

1. Focus on tomorrow's CPI data

2. Bowman's speech at the Federal Reserve

3. Tariff information outflows and countries' responses to tariff issues

📈 Technical Analysis:

The short-term bears have successfully hit the TP to realize profits, and the trading strategy is still valid. Continue to pay attention to the 3355-3345 support during the day. If effective support is obtained here, you can consider going long. For the rebound, the first TP can focus on the 3365 line. If the gold price breaks through 3380 in the future, it will not be far from 3400. If it falls below, pay attention to the support of 3330-3320 below. It is expected that this is the limit position of short-term bearishness. The impact of tariffs is still there, and the bullish trend remains optimistic in the short term, unless Europe, Japan and other countries have a new solution to tariffs.

🎯 Trading Points:

BUY 3355-3345

TP 3365-3380-3400

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

OANDA:XAUUSD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD TVC:GOLD FXOPEN:XAUUSD

Market Analysis: Gold Climbs Higher Amid Market OptimismMarket Analysis: Gold Climbs Higher Amid Market Optimism

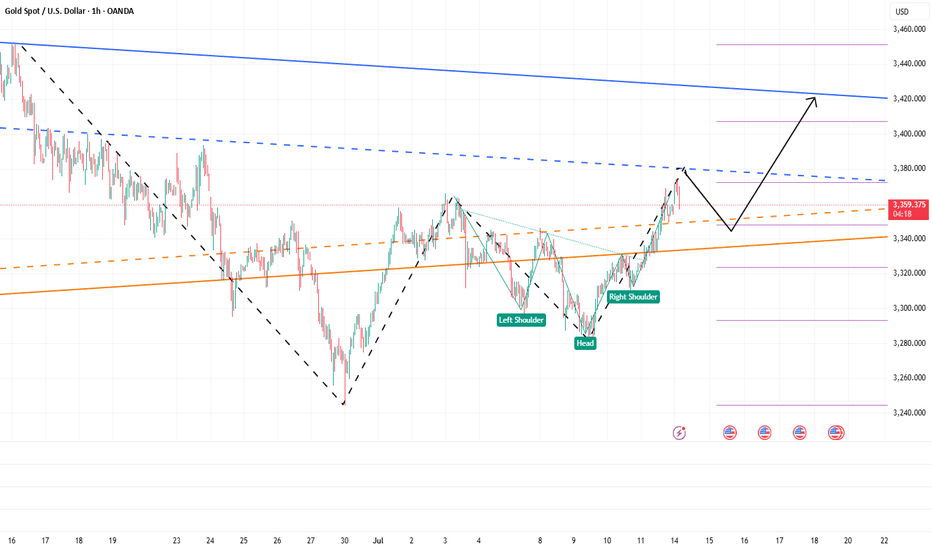

Gold price started a fresh increase above the $3,350 resistance level.

Important Takeaways for Gold Price Analysis Today

- The gold price started a fresh surge and traded above $3,330.

- A key bullish trend line is forming with support at $3,350 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of Gold at FXOpen, the price formed a base near the $3,280 zone. The price started a steady increase above the $3,330 and $3,350 resistance levels.

There was a decent move above the 50-hour simple moving average and $3,360. The bulls pushed the price above the $3,365 resistance zone. A high was formed near $3,373 and the price is now consolidating.

On the downside, immediate support is near the $3,350 level and the 23.6% Fib retracement level of the upward move from the $3,282 swing low to the $3,373 high.

Besides, there is a key bullish trend line forming with support at $3,350. The next major support sits at $3,330 and the 50% Fib retracement level.

A downside break below the $3,330 support might send the price toward $3,300. Any more losses might send the price toward the $3,280 support zone.

Immediate resistance is near the $3,370 level. The next major resistance is near $3,380. An upside break above $3,380 could send Gold price toward $3,400. Any more gains may perhaps set the pace for an increase toward the $3,420 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAU/USD: Analysis and Strategy Amid Trade ConflictsA rate cut this month is highly unlikely, with the earliest possible delay to September. Currently, the gold market trend is still dominated by tariff factors. Although the tariff war was extended for 90 days in April, the 10% base tariff imposed on all trading countries during this period has already made the total tax revenue of these three months reach 70% of that in previous years.

Trump's launch of the tariff war has clear core goals: first, to directly increase U.S. fiscal revenue; second, to boost exports through policy inclination, while helping enterprises increase profits to expand the tax base; third, to promote the growth of domestic employment. Just last weekend, his administration announced that it would impose a 30% tariff on the European Union and Mexico, and the new regulations will take effect on August 1.

Against this backdrop, the escalation of trade conflicts has become increasingly obvious. For gold, this means continuous and strong support, and the certainty of its upward logic has been further enhanced. From a long-term perspective, the gold market is not expected to see a deep correction in the second half of the year.

After pulling back to around $3,280 last week, the price has embarked on a sustained upward trajectory and now fluctuates within the range of $3,345-$3,380. For this interval, a strategy of buying low and selling high would be appropriate.

I am committed to sharing trading signals every day. Among them, real-time signals will be flexibly pushed according to market dynamics. All the signals sent out last week accurately matched the market trends, helping numerous traders achieve substantial profits. Regardless of your previous investment performance, I believe that with the support of my professional strategies and timely signals, I will surely be able to assist you in breaking through investment bottlenecks and achieving new breakthroughs in the trading field.

XAU/USD 14 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

The bulls have started, aiming at 3400!Gold rose as soon as the market opened, and the highest has now reached above 3374. The upward momentum of gold is strong. It can be seen that after breaking through the recent high of 3365, its morphological structure has obviously tended to a bullish structure, and the technical form shows a "W" double bottom structure and an inverted head and shoulder resonance. The resonance of this technical structure will continue to support the continued rise of gold.

At present, gold is under pressure near the 3380 area in the short term, followed by the area near 3405. At present, gold has a technical retracement near 3380, but it is difficult to destroy the already formed rising structure based on the current retracement strength. Once gold rises again, 3380 will definitely be conquered! It will even continue to the 3400-3410 area; and the area with obvious short-term support is concentrated in the 3350-3340-3330 area, so gold may still rebound again with the support of this area after the decline, and continue to rise.

So for short-term trading, I would consider buying gold in batches based on the support of the 3350-3330 area, with the first target looking at 3380, followed by the 3400-3410 area.

XAUUSD - POSSIBLE BIG LONG MIDTERM TRADESAXO:XAUUSD

XAUUSD - POSSIBLE BIG LONG MIDTERM TRADE📈

XAUUSD has gone the half of my take profit, so I decided to close 1/2 of my position here and put my stop loss at an entry price. Still, we have good chance to go towards upper border of the triangle, just want to reduce the risk.

XAUUSD has been trading sideways and has formed a Triangle pattern since April 23d. Looks like the price found a balance between supply and demand. Currently the price is sitting on a lower border of a triangle and potentially is forming the Wave D, according to Elliot Triangle Wave formation.

Trade cautiously!

Early Week Pullback Ahead of Key Economic ReleasesGold Outlook – 14 July | Early Week Pullback Ahead of Key Economic Releases

🌍 Market Sentiment & Macro Overview

Gold has started the week with a sharp retracement after filling prior liquidity gaps (FVG) from the past two weeks.

This early weakness signals a risk-off tone as traders adopt a cautious stance ahead of a heavy macroeconomic calendar and geopolitical trade discussions.

This week’s high-impact events include:

📌 US CPI (Inflation Data)

📌 US PPI (Producer Prices)

📌 Unemployment Claims

📌 Retail Sales Figures

These data points will likely set the tone for price action through the second half of the week, with potential for sharp moves in gold.

📉 Technical Snapshot – M30 Chart Structure

Price swept minor liquidity above recent highs

Pulled back by more than $15 from the short-term top

Currently trading below the intraday VPOC (~3358), suggesting short-term bearish momentum

If the selling pressure holds, we may see a move toward:

⚠️ 333x zone — initial liquidity pool

❗ 332x zone — deeper liquidity grab before any bullish reversal

🧭 Trading Plan – Key Zones and Setup

📥 Buy Setup: 3331 – 3329 (Zone of Interest)

Stop Loss: 3325

Target Levels:

TP1: 3335

TP2: 3340

TP3: 3344

TP4: 3350

TP5: 3360 – 3370

✅ A highly reactive zone — ideal for intraday long setups if price sweeps into this area and shows bullish confirmation (e.g., volume spike or rejection wick).

📤 Sell Setup: 3393 – 3395 (Resistance Re-Test)

Stop Loss: 3399

Target Levels:

TP1: 3390

TP2: 3386

TP3: 3382

TP4: 3378

TP5: 3374 – 3370 – 3360

📉 Potential scalp zone if price retests resistance with signs of exhaustion. Monitor closely for bearish structure confirmation.

📊 Key Support & Resistance Levels

Resistance Zones:

3358

3368

3374

3394

Support Zones:

3349

3340

3331

3318

These zones remain relevant for both momentum trades and reversion setups.

⚠️ Strategy Considerations

At the time of writing, gold is trading indecisively around the M30 VPOC. No clear breakout has occurred yet.

⏳ Wait for volume confirmation during the London session

🚫 Avoid impulsive entries based on emotions or FOMO

✅ Stick to your risk parameters and let price come to your level

🧠 Summary & Bias

Gold is experiencing an early-week technical correction after recent strength.

The market is in "wait-and-see" mode, with macro drivers likely to dictate direction from mid-week onwards.

📍 Watch the 3331–3329 zone closely — it remains the most attractive level for long setups.

📍 The 3393–3395 zone is a key area to fade strength if price struggles at resistance.

Patience and precision are key this week. Let the market reveal its intention, and trade accordingly.

XAUUSD Analysis – July 14, 2025: Gold Tests Critical Resistance Gold (XAUUSD) is currently trading around $3,373, rebounding strongly from the recent low at $3,294. Price is now testing the key resistance zone at $3,372–3,375, which aligns with the 0.0 Fibonacci retracement of the previous downtrend and a significant supply zone on the H4 timeframe.

1. Technical Analysis (H4 Chart):

🔹 Fibonacci & Price Action:

The price found strong support at $3,294, where previous demand and Fibonacci levels converge.

A sharp bullish move has pushed price above the 0.5 (at $3,316) and 0.618 (at $3,322) Fibonacci levels – signaling strong buyer interest.

The $3,372 zone is now acting as short-term resistance, matching the previous swing high.

🔹 EMA & RSI:

EMAs are trending upward, confirming short-term bullish momentum.

RSI is approaching overbought territory, suggesting a potential pullback in the short term.

🔹 Trendline & Structure:

Price remains above the rising trendline, indicating sustained bullish momentum.

The nearest support zone is now at $3,322 – $3,333, which overlaps with key Fibonacci and previous structure levels.

2. Key Price Levels:

Price Zone

Significance:3,372 – 3,375

Short-term resistance – Fibo 0.0:3,345 – 3,333

First support – pullback zone:3,322 – 3,316

Strong support – EMA + Fibo 0.5:3,294 – 3,287

Major support – recent swing low

3. Suggested Trading Strategies:

Strategy 1 – Take Profit for Existing Longs:

If you entered long positions near $3,295–$3,300, consider taking partial profits at the current resistance zone ($3,372–$3,375).

Strategy 2 – Short-Term Sell Opportunity:

Consider a short entry near $3,372–$3,375, with a stop-loss above $3,383.

Target profit: $3,333 – $3,322

Strategy 3 – Buy on Dip (Trend Continuation):

If price pulls back to the $3,333 – $3,322 support and holds, this is a good zone to enter long.

Stop-loss below $3,316, with potential target back to $3,385 – $3,400 if a breakout occurs.

Gold is showing a solid recovery after a sharp decline, but it is now testing a key resistance zone around $3,373. Caution is advised in the short term, as a pullback may occur. Priority should be given to "Buy on Dip" strategies if support zones hold.

XAUUSD 1H | Bullish BOS & OB Retest | Targeting 3390+🚀 Gold (XAUUSD) 1H Timeframe is showing a clean Bullish Market Structure with multiple Breaks of Structure (BOS ↑) confirming upside momentum.

🔹 Price retraced back into a strong Demand Zone (OB) and has started pushing upward again, indicating strong buyer interest.

🔹 Clear Order Block Retest after BOS confirms Smart Money Entry.

🔹 Target is marked around 3390+, based on previous liquidity and imbalance zones.

📈 Expecting continuation of bullish trend until the marked Target Point is reached.

💡 This setup follows pure SMC principles: BOS → OB Retest → Expansion.

🟢 Buy Bias Active | 📊 High Probability Trade Setup

#XAUUSD #Gold #SMC #BreakOfStructure #OrderBlock #LiquidityGrab #TrustTechnicallyAnalysis

Gold – M15 Bias Within POI Zone | July 14 Analysis🟡 Gold – M15 Bias Within POI Zone | July 14 Analysis

As discussed in our previous H4 analysis, Gold opened the week with a gap above the spinning top candle, effectively skipping seller pressure and breaking above the H4 swing high ( 3366 ).

This Break of Structure (BoS) confirmed the H4 bullish continuation , and now price may be preparing for a pullback toward the 3320 Order Block (OB) before resuming its upward trend.

🔍 M15 Intraday Bias:

📍 Price is currently trading inside the 3355 M15 POI zone — a potential continuation zone

🔄 On Lower Timeframes ( M1 ), a micro ChoCH has already occurred — an early signal of possible bullish interest

However, we're still waiting for a micro BoS to validate the reversal and confirm that the POI is being respected

Until that confirmation is in place, we continue to observe market behavior and remain patient

🧭 High-Probability Scenario:

If the current zone fails to hold or doesn’t provide clean M1 confirmation , we will shift focus to the 3320 OB , which remains the most reliable zone for a long setup in line with the H4 trend

A pullback to this level, combined with confirmation, would provide a strong case for continuation trades

🎯 Observational Trade Plan:

✅ Plan 1 (Aggressive Option):

→ If M1 micro BoS occurs from 3355 zone , a short-term long setup may be considered based on internal structure

✅ Plan 2 (Conservative Option):

→ If price pulls back to 3320 OB and M1 confirms , the setup aligns with higher timeframe trend continuation

🛑 Avoid counter-trading — structure remains bullish, and there's no confirmation for shorts at this point

🧠 Final Thoughts:

Let the market do the work. Structure is already pointing up — all we need is confirmation and timing.

No need to rush. Wait, observe, and only execute when the market invites you in with clarity.

📖 Structure leads, emotion misleads. Follow the flow — trade the mirror, not the noise.

📘 Shared by @ChartIsMirror

Gold Weekly Analysis | Will $3,360 Break or Hold? [July 14–18]In this video, I break down the recent gold price action and what to expect in the coming week. We’ll review how gold responded to last week’s FOMC minutes, why $3,360 remains a key decision zone, and what upcoming U.S. economic data (CPI, PPI, Retail Sales) could mean for price movement.

👉 If you find this content valuable, don’t forget to Vote, Comment, and Subscribe for weekly market breakdowns.

Disclaimer:

Based on experience and what I see on the charts, this is my take. It’s not financial advice—always do your research and consult a licensed advisor before trading.

#GoldAnalysis, #XAUUSD, #ForexTrading, #GoldForecast, #MarketOutlook, #TechnicalAnalysis, #FundamentalAnalysis, #GoldPrice, #FOMC, #CPIData, #PPIdata, #DollarIndex, #TradingStrategy, #WeeklyOutlook, #GoldTechnicalAnalysis, #TradeSmart, #Darcsherry

XAUUSD on retest (swing ready)Gold is currently holding Rangebound 3345-3375.Also market has potential of buying towards 3400 then Drop again.

What's possible scanarios we have?

▪️I'm looking for Buying at 3340-3345 support area ,if we found 3340-3345 as correction and H4-H1 remains above then keep buy set targets at 3365 then 3375.

Additional TIP:

Below 3330 I will Activate my resell and hold till 3315 then 3305.

All the entries should be taken if all the rules are applied

#XAUUSD

Adjust after shock and then go longNews: In the early Asian session, spot gold rose slightly, reaching a high of $3,372.65/ounce, the highest since June 23. Trump announced last weekend that he would impose a 30% tariff on goods imported from the EU from August 1, which further heated up the market's concerns about international trade and provided momentum for gold prices to rise. In the early Asian session, spot gold rose slightly, reaching a high of $3,373.99/ounce so far, the highest since June 23. Trump announced last weekend that he would impose a 30% tariff on goods imported from the EU from August 1, which further heated up the market's concerns about international trade and provided momentum for gold prices to rise.

Analysis of gold trend: Today it hit a new high at around 3373. From the daily chart, gold has closed three consecutive positive days. The K-line pattern is a bullish signal. From the indicators, the RSI turned upward from a low level, and the Stoch indicator formed a golden cross at a low level. It is currently running in the middle. The indicators show that gold is still likely to rise in the short term. At the same time, we should also pay attention to the suppression of the 3400 area on the upper track of the daily Bollinger band. In the short term, pay attention to the breakthrough of this level. Once 3400 is not broken through for multiple times, gold will still fall back to test the 3280 support in the future. Once it breaks through 3400, gold will test the 3450 area. In the short term, it is still likely to rise. The operation strategy remains unchanged.

Gold Price Analysis July 14Gold confirmed a break above the key 3330 level on Friday, opening a clear uptrend. The reaction at the 3368 GAP zone further strengthens the current bullish momentum. With the current market structure, the bias is leaning towards buying on corrections around support zones.

🔍 Technical levels to watch:

Support: 3345 – 3331 (potential buying zone)

Resistance: 3387 – 3400 (bullish target)

📌 Trading strategy:

BUY Trigger 1: Price tests and rejects the 3345 support zone

BUY Trigger 2: Buy around 3331 – strong support zone

🎯 Target: 3400

The current trend favors a buying strategy on reasonable price correction conditions. It is necessary to monitor price action around support zones to confirm effective entry points.

Affected by tariffs, gold rose again.On Saturday, Trump announced that he would impose a 30% tariff on goods imported from the European Union and Mexico from August 1. This news triggered a rise in risk aversion in the market. As a traditional safe-haven asset, gold was once again sought after. The price continued the rise on Friday and continued to open high in the early Asian session. As of now, the highest price reached around 3373.

From the current market point of view, after breaking through the triangle pattern last Friday, there was a sharp rise. The price successfully stood on the short-term moving average, showing an overall bullish trend. However, it should be noted that the short-term moving average has not yet formed an upward cross, which means that there is a high possibility of a confirmation process in the future. Looking back at the trend in the past two months, gold rarely opens high and then continues to rise. Most of them open high and go low. Therefore, under the current situation, although it is bullish overall, it is not advisable to blindly chase more. It is more suitable to wait for a decline before arranging more orders. The key lies in grasping the decline position.

From the perspective of pressure level, 3380-3385 is the first pressure level, and the second pressure level is 3395-3400. The support level below is around 3345, which is also the pressure level that has been emphasized in the early stage, and the top and bottom conversion position. For today's operation, Quaid recommends low-to-long.

Operation strategy:

Short near 3380, stop loss 3390, profit range 3360-3345

Long near 3345, stop loss 3335, profit range 3360-3380

Market Structure & Technical Context 14 July 20241. Price Action & Market Structure

Gold has broken recent swing highs above ~$3,360, marking a bullish Break of Structure (BOS) and signaling upward momentum continuity

Recent pullback zones around $3,350–$3,340 formed a clear Higher Low (Change of Character) — textbook price action confirmation.

2. Fibonacci Retracement / Extension

Measuring from the last swing low near ~$3,326 to swing high ~3,374:

38.2% retracement at ~$3,352 coincides with the current bounce zone.

50% retracement at ~$3,350 aligns with key structure support.

Upside extension targets: 1.272 at ~$3,396, 1.618 at ~$3,425 — overlapping major resistance zones

3. ICT & Smart Money Concepts (SMC)

Order Blocks (OBs) identified near $3,340–$3,342 (prior resistance turned support) — ideal demand zone.

A recent Buy-side liquidity grab eclipsed above $3,360, sweeping stops and gathering liquidity before the breakout — classic ICT setup .

A Fair Value Gap (imbalance) lies around $3,345–$3,350 — zone to expect value-driven retracement.

Higher timeframe has clear SMC alignment: BOS above 3,360 with CHoCH already formed.

4. Major Supply / Demand & Support / Resistance Zones

Demand: $3,340–$3,352 (OB + Fib + BOS confluence).

Supply: $3,380–$3,385 (intraday swing high resistance), followed by zone at $3,396–$3,400.

Key resistance at $3,360–$3,362 — confirmed supply pocket that needs to be reclaimed

5. Moving Average Confirmation

The 4‑hour SMA/EMA 100–200 band is sloping up just below current price (~$3,340–$3,350), reinforcing the bullish context .

1‑Hour Intraday Setups (Aligned with HTF Bullish Bias)

Setup A: Pullback into 4‑Hour OB / Fair Value Gap

Entry: Limit buy at $3,345–$3,350.

Stop: Below $3,335 (below imbalance & BOS).

TP1: $3,362 (former resistance).

TP2: $3,380 (next supply block).

Setup B: Breakout Retest of 3,360

Entry: Buy on retest of broken resistance at $3,360.

Stop: Below $3,356.

TP1: $3,380.

TP2: $3,396 (Fib extension confluence).

Setup C: Momentum Continuation Fresh Breakout

Entry: Market buy on clear H1 BOS above $3,365.

Stop: Below breakout candle low (~$3,360).

TP: $3,396 (1.272 Fib) – extend to $3,425 if momentum strong.

The Golden Setup:

Setup A—buy from $3,345–$3,350—has strong confluences:

4‑hour demand OB + fair value gap,

38.2–50% Fib retracement,

SMC BOS/imbalance alignment,

ICT-style order block zone.

This offers high edge with confluence clusters.

✔ Summary Report: Direction & Key Zones

Directional Bias:

Medium-term (4H): Bullish, confirmed by BOS above 3,360, higher lows, OB and Fibonacci alignment.

🔹 Primary Buy Zones:

$3,345–$3,350 — 4H OB + fair value gap + Fib.

$3,360 on retention — breakout retest zone.

Momentum entry >$3,365.

🔹 Key Target Zones:

First resistance: $3,360–$3,362.

Next supply: $3,380–$3,385.

Extension target: $3,396 (1.272 Fib), then $3,425 (1.618 Fib).

🔻 Watchdownside Risk:

Daily invalidation if drop below $3,335 (4H OB break).

Next support at $3,326–$3,330.

📋 Consolidated Table: Setups at a Glance

Setup Entry Zone Stop Targets

Golden $3,345–$3,350 $3,335 TP1: $3,362 / TP2: $3,380

Breakout Pullback $3,360 retest $3,356 $3,380 → $3,396

Momentum BOS >$3,365 (H1 BOS) < $3,360 $3,396 → $3,425

Final Thoughts

On the 4‑hour chart, price is firmly in a bullish regime, supported by price structure, SMC, ICT concepts, and Fibonacci confluence. The $3,345–$3,350 zone is the highest‑probability entry for buyers, offering excellent risk/reward. The Golden Setup targets ~$3,380 and beyond, combining structure, gap fill, and liquidity strategy.

Gold trend forecast for next week, continue to go longAfter the gold broke through on Friday, we started to turn long, and gold rose strongly. Gold finally rose as expected, and the gold bulls are still strong. If there is no major change in the news over the weekend, the decline next week will not be large, and we can continue to buy. The gold 1-hour moving average continues to cross upward and the bulls are arranged and diverge. The strength of gold bulls is still there, and the gold moving average support has also moved up to around 3330. After gold broke through 3330 yesterday, gold fell back to 3330 and stabilized and rose twice. The short-term gold 3330 has formed a strong support. Gold will continue to buy on dips when it falls back to 3330 next week.