XAUUSD Thursday Chart Market Structure & Context

Timeframe: 15-Minute (M15)

Overall Trend: Bearish after a confirmed Break of Structure (BOS) to the downside

Current Price Action: In a retracement phase toward a premium supply zone

Bias: Expecting a liquidity sweep upward, followed by a strong sell-off

🧱 Key Structure Zones

NYL.H & NYL.L: High and Low of the previous New York session

ASIA.H & ASIA.L: High and Low of the Asia session

NYPM.H & NYPM.L: High and Low of the New York PM session

🔍 Critical Levels & POIs

Breaker Block (Dark Gray Box)

Formed after price swept buy-side liquidity and then broke structure upward

Expected to act as a support zone for a temporary buy or a reaction point

BSL POI (Buy-Side Liquidity - Point of Interest)

A manipulated breakout area targeted by smart money

Expected to entice FOMO buyers before a sharp reversal downward

Sell-Side Liquidity (SSL)

Located below the current breaker block

This is the final liquidity target for a continuation sell move

📈 Expected Price Behavior

Price is currently retracing upward

Projected Scenario:

Price moves up to tap into the BSL POI zone (around 3,303–3,305)

Price rejects the POI, forming a potential distribution range

Breakdown from the range initiates a sell-off

Targeting final support / liquidity sweep around 3,268.04

🎯 Trade Setup & Plan

Bias: Sell after a liquidity sweep above key highs

Entry Trigger: Upon clear rejection from the BSL POI zone

Stop Loss: Above BSL POI (~3,307–3,309)

Take Profit: 3,268.04, yielding a Risk-to-Reward Ratio ~4.67

⏰ Killzone Timing (SMC Timing Model)

NY AM Killzone (14:00–19:00 GMT+7)

→ Ideal for entries; likely where liquidity manipulation occurs

NY Lunch & PM

→ Potential for distribution phase completion and sell-off

📌 Additional Notes

Price action reveals a clean FVG (Fair Value Gap) and a completed BSL sweep

Final downside target aims for the NYPM Low, identified as a weak low

Rejection from the breaker block is crucial; confirmation via BOS/CHoCH on lower TF is preferred

Xauusdanalysis

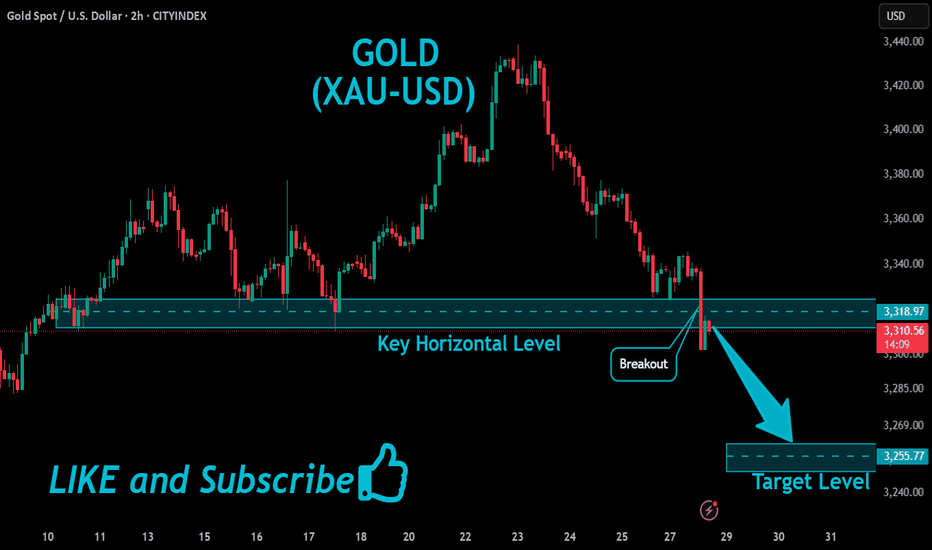

Gold 31 July – Bearish Bias Holds, Watching Supply ZonesGold (XAUUSD) Analysis – 31 July

Market structure is now aligned across both higher and lower timeframes:

H4: Bearish

M15: Bearish

This alignment strengthens the probability of trend-continuation setups in favor of the dominant downtrend.

🔄 Current Market Behavior:

The M15 chart is currently in a pullback phase, retracing toward its previous lower high and approaching a key supply zone.

📍 Key Supply Zones to Watch:

Zone 1 – Immediate Supply Zone (3299 – 3305)

• First area of interest where price may react.

• If respected and followed by M1 confirmation, a short setup could be initiated.

• Watch for signs of exhaustion or sharp rejection.

Zone 2 – Higher Supply Zone (3326 – 3332)

• If the first zone fails, this becomes the next high-probability area.

• Well-aligned with the broader bearish structure — expect stronger reaction potential.

• Suitable for cleaner high RR short trades if price reaches this level.

✅ Execution Plan:

• Observe how price behaves inside the marked zones.

• Only plan short entries after M1 confirmation — this adds precision and prevents premature entries.

• Stay patient. Let the market come to you and reveal intent before acting.

📌 Summary:

Bias: Bearish

Structure: H4 and M15 both support downside bias

Zones in Focus:

– Primary: 3299–3305

– Secondary: 3326–3332

Execution: Wait for confirmation before entering.

Risk-Reward: Maintain 1:3 RR minimum (e.g., 40 pip SL, 120 pip TP).

Let the structure guide your setups — not impulse.

📘 Shared by ChartIsMirror

XAUUSD 1H AnalysisGold experienced a strong selloff, breaking multiple key S&R levels and forming a clear bearish structure. Currently, price is reacting from the PD Low + 1H demand zone (~3265) and pulling back.

🔍 Key Zones:

PD High – 3335: Major resistance / Supply

Supply Zone – 3295–3305: Key area to watch for bearish reaction

Current Resistance – 3285: Price testing this minor S&R level now

PD Low – 3265: Strong bullish reaction zone

📌 Potential Setups:

Sell Setup: If price enters 3295–3305 (Supply Zone) and forms rejection on 15M/1H → short toward 3265.

Buy Setup: If price breaks and holds above 3305, look for retest and continuation toward 3335.

Scalp Long: Small pullback toward 3275–3270 could offer intraday long up to 3295–3300.

📈 Bias: Still bearish unless price reclaims and sustains above 3305.

Patience is key — let price come to zone and wait for confirmation.

Gold - The diligent top formation!🏆Gold ( TVC:GOLD ) finished the bullrun:

🔎Analysis summary:

For the past 10 years, Gold has been trading in a very strong expected bullrun. Just like we witnessed it in 2011, a 10 year bullrun is followed by a shorter term bearmarket. Gold is starting to lose its strength, which is a clear sign of weakness and the beginning of a bearish reversal.

📝Levels to watch:

$2.800

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

Gold Slipping Lower — 3250 and 3200 in Sight!✅ Gold & DXY Update – Post-FOMC Price Action

Earlier today, before the U.S. interest rate decision, I released my outlook on both the Dollar Index and gold.

In that analysis, I highlighted the DXY’s readiness to move toward the key level of 100 — and as of now, price is actively testing that exact zone, just as expected.

As for gold, I repeatedly emphasized the visible weakness on the buy side. It was clear that there were very few remaining buy orders strong enough to hold price up in this region — and that’s exactly what played out. Price has started pushing lower, in line with our expectations.

Looking ahead, I believe the first target is 3250, followed by a deeper move toward the liquidity zone and the marked box around 3200, which could act as a key target area in the coming days.

🔁 This analysis will be updated whenever necessary.

Disclaimer: This is not financial advice. Just my personal opinion.

Be cautious with the numerous news and short sell on rebound#XAUUSD

The market is fluctuating sideways, and whether it can achieve a V-shaped reversal still needs to wait for information such as ADP and the Federal Reserve's decision.🗞 Invest lightly today and avoid letting emotions dictate your thinking.⚖️

⚠️Although the market currently predicts that the news information is bullish for gold, and most of the trading voices are centered around bulls, we still need to be wary of the resistance area above 3345-3350.

📉Judging from the daily chart, I have clearly stated in the figure before that the current trend is a converging triangle. If the price hits the triangle boundary, coupled with the interference of external news, it may trigger panic selling, killing a wave of long buyers first🐂, and then trigger an upward trend when it retreats to near the 3300 support level, and may even test the support level of 3285. 🩳

The 4H chart shows that although the rebound momentum is still continuing📈, the gold price is still below the short-term moving average and has only recovered the lower support level. It is necessary to wait for a second retracement confirmation to determine whether a true trend reversal has been achieved. 📈

In addition, the price on the hourly chart continues to run in a downward channel. Combined with the previous trend pattern, after the rebound correction at the 4H level is completed, it is highly likely that the downward trend will continue to return to the lower support level of the daily level.🐻

If resistance is encountered at 3345-3350 for the first time today, consider shorting.💡

If the price currently retreats to around 3320-3315, consider a short-term long position. Long positions held yesterday can be manually closed at around 3330.💡

🚀 SELL 3340-3350

🚀 TP 3330-3320-3300

🚀 BUY 3320-3315

🚀 TP 3330-3340

Bearish Gold Outlook — Potential Flash Crash Imminent🔻 Technical Structure – Bearish Breakdown Brewing

Lower highs and lower lows forming on the daily and 4H timeframes — classic downtrend mechanics.

Price has rejected multiple times near $3,400–3,430, forming a strong resistance ceiling.

Support at $3,280–3,300 has been tested too many times— and each bounce is weaker. When support holds with less conviction, it's often about to break.

Volume spikes on red candles show smart money is exiting on down moves — signs of institutional distribution.

The **tightening consolidation range** looks like a **descending triangle** — usually resolves downward.

If $3,280 breaks, expect a **liquidity event**. Stops get swept, leading to a **sudden acceleration — possibly a flash crash** to $3,200 or lower.

🌍 **Fundamental Drivers – Macro Picture Is Turning Hostile for Gold**

1. Real Yields Are Climbing

U.S. real yields are up as inflation fades and the Fed stays hawkish.

Gold, being yieldless, suffers when investors can get positive returns from bonds.

2.The Dollar Is Gaining Strength

DXY is pushing higher, fueled by strong U.S. data and weak peers (euro, yen).

Gold priced in USD becomes more expensive globally — this suppresses demand.

3. **Rate Cuts Are Off the Table — or Delayed**

Market is pricing fewer and later rate cuts from the Fed.

This removes one of gold’s biggest bullish catalysts from earlier in the year.

4. Geopolitical Fear Is Cooling

No major escalation in Ukraine, Middle East, or Taiwan.

Without fear, gold loses its safe-haven premium.

5. Central Bank Buying May Have Peaked

Recent data from WGC shows some slowing in central bank accumulation.

If this institutional bid softens, gold could drop hard — few natural buyers remain above $3,300.

⚠️Conclusion: Gold Is Walking a Tightrope

The chart is a staircase down.

Macro fundamentals are no longer supportive.

A clean breakdown below $3,280 could trigger a **chain reaction** of automated selling and margin calls — **a flash crash is on the table**.

This isn’t just a correction — this feels like the calm before the storm.

GOLD – A Bottom in Place or Just the Calm Before the Storm?GOLD – A Bottom in Place or Just the Calm Before the Storm?

Gold has recently shed nearly $50, indicating sustained bearish pressure. But here’s the real question:

👉 Is this simply a liquidity sweep before a bullish reversal?

👉 Or are we witnessing the early stages of a broader bearish continuation?

Let’s break it all down – step by step – to map out smart, reaction-based trading opportunities.

🌍 Macro & Fundamental Overview

The US–EU trade and defence agreement has dampened gold’s role as a safe haven in the short term.

The US Dollar and equity markets remain strong, driven by solid macroeconomic data.

Overall market sentiment leans “risk-on”, pushing capital into riskier assets and away from precious metals.

📆 Upcoming Key Events:

Tuesday: ADP Employment Data

Friday: FOMC Statement & Nonfarm Payrolls (NFP)

These events could drastically shift market expectations around Fed policy, impacting gold’s direction.

📊 Technical Picture (Timeframes H1–H4)

Gold has rebounded from recent lows and is currently moving within a parallel bullish channel.

However, price is now nearing a critical resistance level at 3342 – a potential turning point.

🔎 Key Technical Zones:

🔺 Short-Term Resistance: 3342

🔺 Major Supply Zone: 3369–3388 (Order Block + Fair Value Gap + Fib 0.5–0.618)

🔻 High-Liquidity Support Zone: 3293–3290

🔻 Key Demand Zone (FVG): 3275–3273

🔺 High-Level Resistance: 3416

🧭 Trading Plan – Based on Price Action (Not Prediction)

We don’t guess the market. We wait, watch, and react based on price confirmation.

✅ Scenario 1 – Buy the Dip (Scalp Setup)

Entry: 3293 – 3291

Stop Loss: 3286

Targets: 3296 → 3300 → 3304 → 3308 → 3312 → 3315 → 3320 → 3330

🟢 Ideal for intraday scalps within high-liquidity zones.

✅ Scenario 2 – Buy from Deep Demand (Swing Setup)

Entry: 3275 – 3273

Stop Loss: 3269

Targets: 3280 → 3284 → 3288 → 3292 → 3300 → 3305 → 3310 → 3320 → 3330

🟢 Great opportunity if price absorbs selling pressure at the FVG zone and reverses.

❌ Scenario 3 – Short from Key Resistance (3342)

Entry: 3340 – 3342

Stop Loss: 3346

Targets: 3335 → 3330 → 3325 → 3320 → 3310

🔴 Use if price fails to break and hold above 3342.

❌ Scenario 4 – Short from Major Supply Zone (Swing)

Entry: 3369 – 3372

Stop Loss: 3376

Targets: 3365 → 3360 → 3355 → 3350 → 3345 → 3340 → 3330 → 3320

🔴 Higher-risk setup; enter only on strong rejection or bearish candlestick confirmation.

⚠️ Risk Management Guidelines

Avoid entries during the London and NY open – fakeouts and stop hunts are common.

Always wait for clear price reaction within zones – avoid impulsive entries.

Respect your stop-loss levels, especially with this week’s major data releases.

🎯 Final Thoughts for UK & Global Traders

Let the market come to you – never chase price.

Stay disciplined, especially in volatile weeks like this one.

The best trades are reactionary, not predictive.

💬 Found this plan useful?

Feel free to comment your views or follow for more structured gold analyses throughout the week.

Gold Breakout or Pullback Ahead?Currently, price is in a correction phase within this rising channel after hitting the upper resistance near $3,438. The pullback is moving toward the mid and lower channel zones, which is healthy for a bullish continuation. Gold is in a healthy pullback phase inside a bigger bullish trend. If support at $3,358 – $3,373 holds, expect an upward push back to $3,438 → $3,487 → $3,517 in the coming sessions. Only a clean break below $3,309 would signal a deeper bearish move.

Gold is likely to consolidate or retest the lower channel support ($3,358 – $3,373). If buyers defend this zone, the price is expected to bounce back toward $3,400 – $3,420 and eventually retest $3,438.

Key Price Zones

- Main Resistance: $3,438 (if broken, potential rally toward $3,487 → $3,517)**

- Immediate Support: $3,373 (first reaction level)

- Major Support: $3,358 (key level to protect bullish structure)

- Potential Higher Low Zone: Around $3,342.44

Expected Price Behavior

- If gold holds above $3,373 – $3,358, it is likely to form a new higher low near $3,342 – $3,358 before attempting to push higher.

- A successful breakout above $3,438 would indicate continuation of the bullish momentum targeting $3,487 and $3,517 ).

- Failure to hold above $3,358 may open the door for a deeper correction toward $3,309, but the overall trend remains bullish unless that level is broken.

Trend Outlook

- Short-Term Trend: Consolidation / corrective pullback within a bullish channel

- Medium-Term Trend: Bullish (higher lows and breakout structure intact)

- Long-Term Trend: Bullish as long as the channel holds above $3,309

Gold is currently in a pullback phase after a strong bullish breakout. The market is likely forming a higher low and may resume upward momentum once the $3,373 – $3,358 zone is confirmed as support. A breakout above $3,438 would validate a bullish continuation toward $3,487 - $3,517.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Gold: ADP, Fed & Key Resistance Gold has been range-bound today—let’s focus on the impact of the ADP data and Fed rate decision ⚠️.

Key resistance lies around 3345-3350 📍: a breakout could fuel further upside 📈, while a rejection may trigger an oscillating pullback 📉

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Buy@ 3325

🚀 TP 3333 - 3339 -3344

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

GOLD - Near Current Resistance? holding or not??#GOLD... so market perfectly holds our expected bottom and bounced back and now market just near to his current Resistance region.

that is around 3328 to 3332

keep close that region because if market hold it in that case we can see again drop towards our ultimate support 3310

NOTE: we will go for cut n reverse above 3332 on confirmation.

good luck

trade wisely

Gold’s Biggest Day of 2025: Collapse or New High Incoming?🟡 Gold Pre-FOMC Update | Patience Paid Off

In my previous analysis released on Monday, we highlighted the significance of the 3310 key red level on gold. I mentioned that if we got a daily candle close below this zone, it could trigger further downside.

That scenario didn’t play out — price closed above 3310, and that’s exactly why we stayed out of any short positions. No guessing, no forcing. Just patience.

On the flip side, I also said we need a daily close above 3350 to even consider going long. And as you can see, for the past two days, price has been ranging tightly between 3310 and 3330 — with relatively low trading volume across the board.

After 9 years of optimizing this strategy, one core principle remains unchanged:

🛡️ Capital protection and maximum risk control always come first.

And I can confidently say — those filters are working beautifully. I hope you’re benefiting from this approach too.

Now technically speaking, everything is lining up for a bullish DXY and bearish gold —

But tonight’s FOMC meeting and Powell vs. Trump drama will be the final trigger.

Let’s watch closely. Smart trading is patient trading. 🧠⚖️

🔁 This analysis will be updated whenever necessary.

Disclaimer:This is not financial advice. Just my personal opinion.

XAUUSD: July 30th Market Analysis and StrategyGold Technical Analysis:

Daily Chart Resistance: 3351, Support: 3300

4-Hour Chart Resistance: 3340, Support: 3310

1-Hour Chart Resistance: 3334, Support: 3315.

Trading risk will increase today. We will focus on the Federal Reserve's interest rate decision and the ADP employment data, which are expected to increase market liquidity. If trading, please avoid news releases.

On the daily chart: Bollinger Bands are moving horizontally, with gold prices trading above the lower band. The MACD indicator has formed a downward death cross, indicating a release of bearish momentum. The RSI indicator has fallen back into the overbought range of 50-40, indicating a clear bottoming out and rebound in gold prices.

On the 4-Hour Chart: Bollinger Bands are narrowing, with gold prices trading near the middle band. The MACD indicator is beginning to turn upward, and the RSI is showing an oversold rebound. Gold prices are poised for an upward rebound! The NY market is focusing on the $3351 resistance level above and the $3308 support level below.

SELL: 3351near

BUY: 3315near

Gold (XAU/USD) 1H Chart AnalysisGold (XAU/USD) 1H Chart Analysis

**Current Trend:** Consolidation within a range

**Price:** \$3,335–\$3,336

**Indicators:**

* EMA 7: \$3,336.92

* EMA 21: \$3,339.36

* Price trading slightly below both EMAs – **short-term bearish pressure**

---

### 🔍 **Key Levels**

* **Resistance Zone:** \$3,344–\$3,348

* **Support Zone:** \$3,324–\$3,328

---

### 📊 **Trade Scenarios**

#### **Bullish Breakout Scenario**

* **Confirmation:** Clean breakout and candle close above **\$3,348**

* **Buy Entry:** Above \$3,348

* **Targets:**

* TP1: \$3,360

* TP2: \$3,372+

* **Invalidation:** Price falls back below \$3,344 after breakout (fakeout risk)

#### **Bearish Breakdown Scenario**

* **Confirmation:** Break and close below **\$3,324**

* **Sell Entry:** Below \$3,324

* **Targets:**

* TP1: \$3,312

* TP2: \$3,296

* **Invalidation:** Reclaim above \$3,328

---

### ⚖️ **Bias**

Neutral to Bearish until a clear breakout occurs. Monitor volume and candle strength near the support/resistance zones for trade confirmation.

XAU/USD 30 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on three separate occasions which has now formed a triple top, this is a bearish reversal pattern and proving this zone is a strong supply level. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4: Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

GOLD (XAUUSD) Analysis : Major Break + Bullish Setup + Target🟩 Today’s GOLD Analysis based on Volume Behavior, Smart Money Traps & Market Structure (MMC)

🔍 Chart Breakdown and MMC Concepts Explained:

1. Preceding Downtrend – Smart Money Trap Initiated

The chart begins with an extended downtrend, marking significant bearish pressure. However, deeper into the move, we notice price entering a Volume Absorption (VA) Zone — a key MMC signal where institutional orders quietly absorb aggressive retail selling.

This Volume Absorption Zone is highlighted on the left of the chart.

Smart money quietly positions longs here while inducing panic-selling from retail traders.

Wicks and indecision candles show early signs of sell exhaustion.

2. QFL Breakdown & Liquidity Sweep

The breakdown from the QFL (Quick Flip Level) is another hallmark of MMC behavior. The market intentionally breaks previous lows to trigger stop-loss clusters — known as a liquidity sweep or stop-hunt.

Price aggressively drops to a well-marked demand zone.

Massive bullish reaction from this zone confirms that smart money has completed accumulation.

The QFL move is not a true breakout, but a trap, designed to mislead retail into chasing shorts.

3. Demand Zone Reaction – Shift in Momentum

Price finds support at the demand zone (highlighted in green) and starts forming higher lows. This transition from lower lows to higher lows is a structural confirmation of market reversal.

Buyers have regained control.

Large bullish candles and wick rejections at key levels signal institutional entry.

4. SR Interchange Zone – Key MMC Confirmation

One of the most important zones on this chart is the SR Interchange area.

This level was previously resistance and is now acting as support — a concept known as support-resistance flip.

MMC teaches us that this is where smart money re-tests the breakout zone to trap late sellers and confirm the trend.

This zone is reinforced by:

Previous rejections

Retest with wicks

Alignment with ascending trendline support

5. Minor & Major Resistance Levels

Currently, price is attempting to break above a minor resistance at ~$3,330–3,332.

If it breaks, the next major target lies at the ~$3,340–3,345 level, marked on the chart.

This zone is crucial for short-term targets and may act as a profit-taking zone for early bulls.

Once this major resistance is cleared, the trendline projection suggests a continuation toward higher highs.

📐 Trendline Analysis

An ascending trendline is supporting price action. Each bounce off this line has led to higher lows — a clear sign of bullish intent.

Trendline + SR Interchange = Confluence zone

Traders should watch for bullish engulfing candles or strong wick rejections at this trendline area for re-entry or add-ons.

🧠 MMC Strategy Interpretation (Mirror Market Concepts)

This chart perfectly follows the MMC logic:

Trap retail sellers during the downtrend.

Absorb their volume at a key zone (Volume Absorp).

Sweep liquidity below QFL level.

Reverse structure with a shift to higher highs and higher lows.

Interchange SR zone to test buyers' strength.

Continue trend post-confirmation with breakout above resistance.

This is the classic "trap-to-trend" sequence smart money uses repeatedly in gold and other volatile markets.

✅ Trade Setup Summary:

Bias: Strongly Bullish (based on market structure shift)

Entry #1: Pullback into SR Interchange (ideal if price rejects 3,326–3,328)

Entry #2: Break and retest of Minor Resistance (3,332–3,334)

Targets:

TP1: 3,340 (Major Resistance)

TP2: 3,345–3,350 (Projection based on breakout path)

Invalidation: Clean break below trendline and demand zone (~3,318)

🧭 Final Words for Traders:

Gold is currently positioned at a critical junction where structure, volume, and institutional behavior all align. If you're following MMC strategies, this is a textbook scenario:

Trap ✅

Absorption ✅

Structure Shift ✅

Trendline Support ✅

SR Interchange ✅

Now, we wait for confirmation and execute with discipline.