XAUUSD Long OpportunityXAUUSD is bullish per the 4 hour and 1 hour timeframe with continued bullish momentum coming out of the fundamentals around tariff uncertainty. There is clear bullish market structure.

XAUUSD is currently sitting on the pivot level of $3350 (Resistance turned support) after a retracement prior for the NY opening bell which gives rise for a long opportunity from this level towards the next Pivot point at $3391.

On the hour timeframe, price is trading above the 50 and 200 SMA and is currently sitting upon the 21 SMA which XAUUSD has used push point from in the past trending markets. RSI is currently sitting in a sweet spot region of the RSI between 45-55 indicating this is a valid retracement and price is looking to turn bullish again soon.

This provides 4 points of Bullish confluence within the momentum in favour of further bullish movements

Xauusdbullish

GOLD (XAU/USD) Imminent long opportunitiesThis week, my focus for GOLD is on potential long opportunities around the current price level. Price is sitting within a strong area of demand, so my plan is to wait for signs of accumulation and a clear slowdown in bearish momentum before considering any entries.

Ideally, I’d like to see the Asia low swept, which currently lies in the middle of the zone — that would offer even stronger confirmation for a buy setup.

If this current zone doesn’t hold, I have a well-defined 9H demand zone around the 3,220 level, which sits in a more discounted area and aligns well with the overall bullish trend on the higher timeframes.

Confluences for GOLD Buys:

- Clean major daily demand that caused a change of character to the upside

- Plenty of liquidity above and an unmitigated supply higher up

- This is a pro-trend trade, aligning with overall higher timeframe bullishness

- DXY has been bearish over the past few weeks, supporting gold upside

P.S. If price respects this current demand and moves higher, we may see a short-term reaction from the 3H supply zones above — but we’ll monitor price action and adjust accordingly.

Have a great trading week

XAU/USD Longs from 3,220 or 3,120 back to ATHMy Analysis this week for gold is for it to keep pushing higher, even though gold has been overbought and we could at any time expect a major correction or distribution. We will be going on. current market structure and currently we have seen another ATH breach as well as multiple break of structures to the upside.

From these demand zones that have been created we will be looking for a small correction a retracement in which price will then re accumulate in one of our POI, to cause another rally to the upside.

Confluences for GOLD Buys are as follows:

- Demand zone on the 4hr and 6hr is near by for potential long setups to formulate.

- Market structure has been very bullish on the lower and higher time frame

- There is asian high above that needs to get taken out as well

- Dollar index has been bearish which means bullish movement for GOLD

P.S. If price breaks through both demand zones i do have an extreme one at 3,020 but if it reaches that low we could expect price to just start moving temporarily bearish.

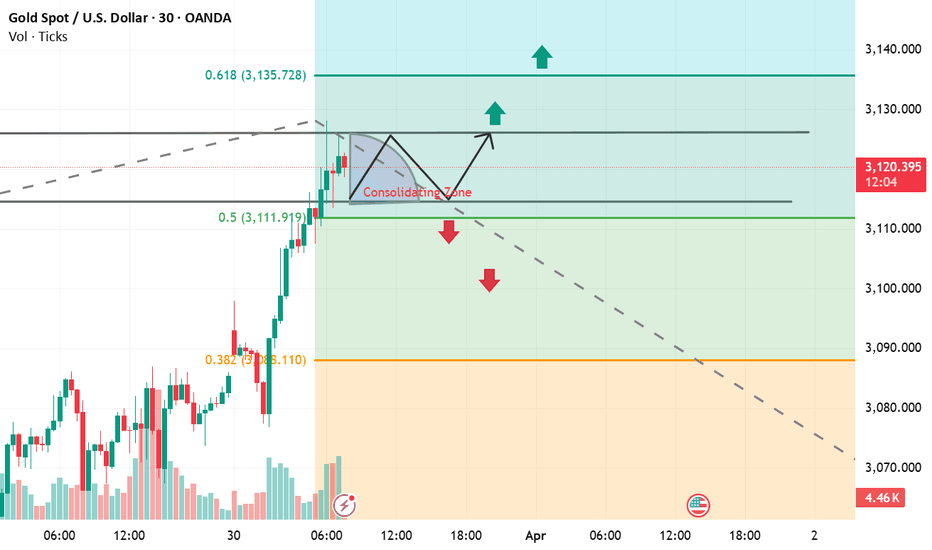

Gold (XAU/USD) 30-Minute Chart AnalysisThis chart provides a technical analysis of Gold (XAU/USD) price action using Fibonacci levels, consolidation zones, and key support/resistance levels.

Key Observations:

Price Level & Consolidation Zone

The price is currently around $3,119.525, experiencing a consolidation phase (marked in the gray box).

The market is indecisive, moving within a range, waiting for a breakout.

Fibonacci Levels (Support & Resistance)

0.5 Fibonacci Retracement Level ($3,111.919) is acting as support.

0.618 Fibonacci Level ($3,135.728) is acting as resistance, a potential target if the price breaks upward.

Breakout Scenarios:

Bullish Breakout (Up Move) 🚀

If the price breaks above the consolidation zone, the next resistance level is around $3,135-$3,140.

An uptrend continuation could be expected.

Bearish Breakdown (Down Move) 📉

If the price drops below $3,111, it may head towards the $3,100-$3,090 area.

This is confirmed by the downward arrows, showing potential price movement.

Volume & Trendline Considerations

Volume has increased significantly, indicating strong market interest.

A dotted downward trendline suggests a potential bearish scenario if the price fails to break above resistance.

Trading Plan:

Bullish Bias: Wait for a breakout above $3,125-$3,130 before entering long trades.

Bearish Bias: A breakdown below $3,110 could signal short opportunities.

Neutral Stance: If consolidation continues, wait for a clearer direction.

Gold (XAU/USD) Sell-Off Continues | Bearish Target insightGold Spot (XAU/USD) indicates a potential continuation of the current downtrend.

🔹 Sell Limit at 3082: A significant level where a sell order was placed, marking the start of the recent decline.

🔹 Strong Downtrend: After rejecting the 3082 level, gold has been making lower highs and lower lows, confirming bearish momentum.

🔹 Support & Target Zone: Price is approaching a key support area near 2880-2900, which aligns with the marked target level.

📉 Bearish Outlook:

If the price breaks below the current support, further downside is expected.

A potential bounce could occur at the target zone before a trend reversal.

💡 Key Levels to Watch:

Resistance: 3082

Support/Target: 2880-2900

Traders should monitor price action at support to determine if further downside is likely or if buyers step in for a potential reversal.

What’s your outlook on gold? Will the bearish trend continue? 📉💰

XAU/USD (Gold Spot / U.S. Dollar) 4-hour analysis,XAU/USD (Gold Spot / U.S. Dollar) 4-hour analysis with various technical indicators:

• Ascending Channel: Price is moving within an upward channel, highlighted in blue.

• Black Dots: Indicate possible resistance or swing high points.

• Blue Dots: Represent potential support levels or swing low points.

• Red Zone: Around 2,883.157, acting as a key support area where price might bounce.

• Entry Zone: Around 2,942.206, where a breakout or rejection could occur.

• Targets:

• 3,001.973

• 3,025.000

• 3,050.210

This chart suggests that gold is trading within a rising channel, moving towards resistance. A breakout above the channel could signal further bullish momentum, while a move downward might test the red zone as a support level.

XAU.USD Longs from 2.820 back up I expect gold to continue pushing higher due to strong bullish momentum and the consistent bullish market structure. Now that price has taken last week's all-time high (ATH), a correction is likely this week before further upside movement.

The previous low was mitigated and showed a small reaction, but I anticipate it may fail, leading to a deeper retracement into the 6-hour demand zone that previously caused a Break of Structure (BOS). If price accumulates well in this area, we can expect a strong bullish rally.

Confluences for Gold Buys:

- Gold has been consistently bullish, forming strong higher highs and higher lows.

- Clean demand zones remain unmitigated below, which may need to be tapped before further upside.

- Fundamentals: Rising geopolitical tensions and policy shifts by Trump have increased uncertainty, strengthening gold as a safe-haven asset.

- There is still liquidity above that price may target.

Note: If price breaks the low and forms a clean supply zone, we could see the start of a short-term bearish trend, as the recent ATH sweep has taken a significant amount of liquidity.

Weekly Gold chart is super-positioned for cont. strength!

This chart I have displaying is the Weekly for XAUUSD, notice this is not overbought, in fact that's a nice cross up on a handy weekly chart.

It's the same on the daily chart for gold and consider a look for long postions on XAUAUD & XAUGBP which are also a great Buy at the moment due to momentum swings to support higher prices and this is also despite them being underbought currently.

MARKET LAST 2 DAYS Over the last two days, XAU/USD (gold against the US dollar) has experienced a relatively stable trading range. The price hovered around $2,640–$2,642 per ounce. The slight movement reflects cautious sentiment among investors. Factors influencing gold include geopolitical developments and mixed signals about economic conditions globally. Recent news of a temporary ceasefire in the Middle East exerted downward pressure on gold as geopolitical risks eased slightly, though the metal remains sensitive to changes in the U.S. dollar and Federal Reserve policy.

XAU/USD imminent buys or rally from 2,460.000I anticipate that gold is gearing up for another rally to sweep the liquidity pool formed along the trendline. Price could either break past the 10-hour supply zone, potentially reaching a new all-time high, or we might see a short-term decline from this zone, pushing the price down to the 19-hour demand level.

If the price reaches this demand zone, I expect it to consolidate on the lower time frames, after which gold may expand to the upside. While we're currently seeing a reaction at the present demand zone, I believe it might eventually fail due to the significant liquidity on both sides.

Confluences for GOLD Buys:

- There is significant liquidity to the upside that remains untapped.

- Price shows strong bullish momentum on both higher and lower time frames.

- A clean, unmitigated 19-hour demand zone is present.

- There are equal lows above the demand zone, suggesting a potential liquidity sweep before price expands.

P.S. As the price has already reacted to the current demand zone, I will be holding off for now and either wait for a short-term sell from the supply zone or until the price reaches the 19-hour demand zone.

Have a great trading week, everyone!

XAUUSD Longs from 2,490.000 back upMy analysis for gold this week focuses on buying from the 17-hour demand zone, where I expect price to create a new impulsive move to the upside that could potentially take out the previous all-time high (ATH) again. Currently, we see price sweeping a lot of liquidity and family supply zones from last week, which may slow down price and lead it into my 30-minute supply zone.

I will approach this zone cautiously, as it involves counter-trend selling from that point of interest (POI). However, it's an extreme zone at a premium price that remains unmitigated, so I'll watch the price action closely on Monday's open to see if price starts retracing or enters the supply zone.

Confluences for GOLD Buys are as follows:

- Liquidity above that needs to be taken.

- The market is very bullish on both lower and higher time frames, making this a pro-trend trade idea.

- Fundamental and sentiment-driven news also suggests that price will remain bullish.

- Price failed to hold two new supply zones last week.

- A 17-hour demand zone has been created, which looks promising for possible buys.

P.S. If the ATH is taken out and my 30-minute supply zone fails, I will wait for a new demand zone to form closer to the price before looking for a new supply. Ideally, we get that retracement before continuing the bullish move.

Have a great trading week, guys!

XAU/USD Imminent gold buys from current price back upCurrently, gold remains very bullish, and this idea aligns with the pro-trend approach. I'm particularly interested in the 16-hour demand zone that caused a break of structure. I will be watching for a Wyckoff accumulation at this level or possibly at a lower demand zone. Regardless, we are approaching strong demand zones.

The plan is to take the price back up to a newly marked supply zone on the 15-hour chart. From there, I might consider possible sells, but for now, I’m focused on buys.

Confluences for GOLD Buys:

Price has broken structure to the upside and is continuing a bullish trend.

There is still a lot of imbalance and liquidity to the upside.

The 16-hour demand zone has been mitigated, and I'm awaiting a Wyckoff accumulation.

This is a pro-trend idea on both the higher and lower time frames.

Price has completed a retracement and appears poised to make a new leg to the upside.

P.S. If the price breaks this demand zone, I will expect it to mitigate a deeper demand level, such as the one on the 23-hour chart.

GOLD Imminent buys towards 2390 sell idea This week, my analysis for GOLD involves seeking immediate buying opportunities from the 12-hour demand zone where price is currently situated. My strategy is to initiate buys with the aim of targeting the 6-hour supply zone above for potential selling opportunities. Despite the significant drop on Friday, price still appears bullish based on last week's performance, but we might anticipate a reversal in the near future.

In case the current zone fails to hold, there's a demand zone below where we could consider another buying opportunity. This scenario is possible given the substantial liquidity present below my point of interest (POI). With ongoing news about geopolitical tensions, gold could potentially rally further, but we'll closely monitor unfolding events and adjust our approach accordingly this week.

Confluences for GOLD Buys are as follows:

- Price has been very bullish for the past couple of weeks and multiple BOS have taken place.

- War news is happening and as we have seen before gold usually has a bullish reaction from it.

- Price has recently broken structure and is now in a 12hr demand zone.

- Price looking like it's slowing down on lower time frames could get a wyckoff accumulation.

P.S. Gold may experience a decline from the 6-hour supply zone, given the substantial rejection indicated by the long wick on the higher time frame. This downward movement could signal the beginning of a potential bearish trend. Gold presents compelling opportunities for trading this week, with various potential entry points to capitalize on. Let's aim to seize these trading opportunities and capture profitable movements in the market!