How will gold go? Trader Quaid explains it for youIf there is positive news on the US-China trade situation or profit-taking selling pressure breaks out, it may trigger a sell-off.

Gold prices have risen by nearly $700 this year, with tariff wars, expectations of rate cuts and strong central bank buying all helping.

The current market trend has become a little out of control and there is a risk of correction. However, the correction we have seen in more than a year has not been large, and every time the market falls back, there is buying waiting behind it.

The upward trend in gold prices remains, and buyers are paying attention to the $3,370/ounce level. If it breaks through this level, gold prices will target the $3,400/ounce mark. If gold strengthens further, bulls will further look to key psychological levels such as $3,450/ounce and $3,500/ounce.

On the contrary, if gold prices fall below $3,300/ounce, the first support level will be $3,229/ounce, followed by $3,200/ounce.

I hope this analysis can help you.

I am Quaid. After seeing my analysis strategy, no matter your past gains and losses, I hope that you can achieve an investment breakthrough with my help and turn every tide in the gold market into our wealth wave.

Xauusdbuy

Gold’s short-term correction does not change gold’s upward trendGold continues to remain strong at high levels, and gold is still in a bullish trend. The short-term correction will not change the upward trend of gold. The fall of gold will give the opportunity to go long.

The 1-hour moving average of gold is still a bullish arrangement with golden crosses diverging upwards. The strength of gold bulls is still there. Gold has found support near 3320 and is rising again. The current rhythm of gold is to fall back and continue to go long.

Trading idea: Go long near gold 3327, stop loss 3317, target 3350

"Gold Demand Zone Bounce – High R:R Long Setup!"📈 This is a bullish setup using a demand zone bounce strategy on the 15-minute timeframe.

Key Zones & Levels

🔵 Demand Zone:

The blue box is where price previously bounced strongly.

Buyers are likely to step in again here.

✳️ Entry Point:

3,292.38

Just above the demand zone – a safe place to catch the next bounce.

⛔ Stop Loss:

3,280.93

Below the demand zone to protect against a breakdown.

🎯 Target Point:

3,345.09

Near a previous resistance area.

Potential gain: +51.94 pts / 1.58%

Indicators

🟡 EMA (7):

Current value: 3,303.63

Price hovering around EMA = consolidation or setup for a bounce.

Risk-Reward Calculation

⚠️ Risk: 11.45 points

✅ Reward: 52.71 points

⭐ Risk-Reward Ratio: ~4.6:1

Very favorable!

Price Action Summary

📊 Strong uptrend into demand zone

🔁 Minor pullback = potential setup

✅ Ideal entry after bullish confirmation (e.g., bullish candle pattern)

Conclusion

This setup looks solid:

✅ Clear demand zone support

✅ High R:R ratio

✅ Clean target above

Just wait for a bullish signal inside the zone and ride it up!

#XAUUSD: Possible Easy 600+ Pips Buying OpportunityFollowing a substantial decline in gold prices, which dropped more than 1000 pips, there is a possibility that the price may experience a minor correction before resuming its downward trajectory. It is imperative to acknowledge that trading gold in the current market conditions carries significant risks, and there is a substantial likelihood of incurring substantial losses.

Good luck and trade safe!

#XAUUSD: $3400 On The Way! Get Ready For Record High! Gold has rebounded to previous highs, maintaining a bullish trend. We expect it to continue this momentum, potentially reaching $3400 in the long term. To set take profit, consider $3250, $3300, and $3400. Use accurate risk management and conduct your own research before trading gold.

Please support us by liking and commenting on this idea.

Team Setupsfx_

#XAUUSD: Last Four Analysis Helped US Gain Over 4000+ Pips!Next?Our previous four analysis has yielded a substantial gain of over 4,000 pips. Analysing the current market situation, we anticipate that the price may either experience a significant drop or continue its upward trajectory.

Should a resolution be achieved between the trade tariffs imposed by China and the United States, we anticipate a substantial decline in gold prices. Conversely, if the situation remains unchanged, which is the more probable outcome at present, we will have two potential trading opportunities.

The first entry involves the assumption that the price will remain unchanged and continue its upward trend. The second entry is contingent upon a correction in the price.

We extend our best wishes and express our gratitude for your unwavering support throughout our endeavours. We sincerely hope that this analysis will serve as a valuable guide for your own trading endeavours.

Much Love

Team Setupsfx_

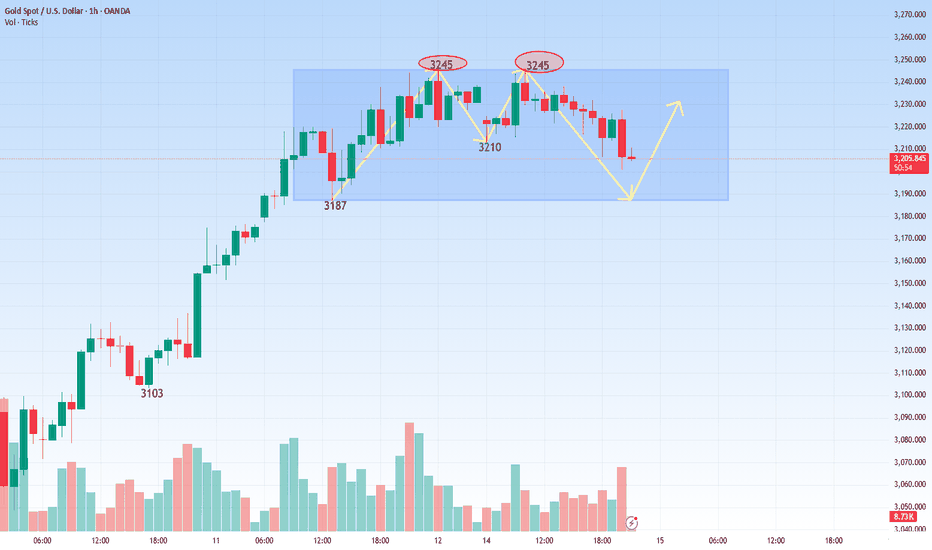

4/16 Gold Trading StrategiesYesterday, gold moved within a narrow range, as anticipated. After rising toward the 3230 level, it encountered selling pressure and pulled back, which provided us with some profitable short-term opportunities.

Currently, gold has broken above 3240 and continues to climb steadily. A conservative estimate suggests that a push toward 3250 is achievable without much resistance. However, this is a new high, and after a rapid ascent, it’s common to see profit-taking from long positions and short sellers entering the market from the sidelines. Therefore, chasing long positions at current levels carries increased risk and should be approached with caution.

Today’s Trading Recommendations:

Sell Zone: 3255 – 3270

A potential resistance zone where short positions may be considered.

Buy Zone: 3178 – 3158

Key support area for initiating long positions if the price corrects.

Range Trading Zones:

3240 – 3220

3188 – 3220

Suitable for flexible trading strategies based on real-time price action and candlestick signals.

Summary:

While gold remains in an uptrend, the market is approaching a sensitive area where both selling pressure and volatility may increase. Be cautious with chasing highs, and focus on technical levels for strategic entries and exits. The potential for a short-term reversal or pullback remains if resistance holds strong.

XAUUSD(GOLD) NEXT MOVE ?**Detailed analysis** of the Gold Spot (XAU/USD) chart, combining technical insights **with the current geopolitical market backdrop**, particularly the **Trump tariffs escalation**:

---

### 🟡 **XAU/USD (Gold) – Technical & Fundamental Outlook**

**Timeframe:** 1-Hour

**Current Price:** $3,296

**Target Price:** $3,500

---

### 📌 **Technical Chart Analysis: Bullish Breakout in Play**

From a trader’s lens, this chart illustrates a **classic bullish continuation setup**:

#### 🔺 **Triangle Breakouts**

- The chart highlights two previous **symmetrical triangle patterns**, both of which resolved **to the upside**.

- These triangles signal healthy consolidation before **impulsive bullish rallies**, indicating strong **market structure**.

#### 📈 **Price Action Strength**

- Price recently **broke out** from another mini triangle (~$3,230 zone), confirming bullish momentum.

- The breakout is **sharp and directional**, showing strong buyer interest.

#### 🧱 **Support & Structure**

- Price is respecting an **ascending trendline**, confirming **higher lows** and a consistent **bullish trend**.

- Each consolidation phase was tighter, indicating **volatility compression before explosive moves**.

#### 🎯 **Target Projection: $3,500**

- Based on **measured moves** from previous breakouts and current momentum, $3,500 is a **realistic short-term target**.

- Price remains inside a **bullish channel**, and breakout continuation aligns with the upper resistance projection.

---

### 🌍 **Current Market Context: Trump’s Tariff Shock & Safe Haven Demand**

Amid strong technicals, the **macroeconomic backdrop adds fuel to gold’s rally**:

#### 🔥 **Trump's Tariff Escalation**

- Former President **Donald Trump has reactivated aggressive tariff rhetoric**, with reports of a **104% tariff on Chinese imports**, prompting **retaliatory action from China** (an 84% counter-tariff).

- This **reignites U.S.-China trade tensions**, increasing **global market uncertainty**.

#### 🛡️ **Flight to Safety**

- Investors are rapidly **rotating into safe-haven assets**, especially gold, due to:

- Trade war concerns

- Recession expectations

- Dollar instability fears

#### 💬 **Market Sentiment**

> “In times of uncertainty, gold shines brightest. Trump's economic aggression has global investors hedging risks, and XAU/USD is the first in line to benefit.”

---

### 💼 **Trading Strategy Summary**

| Component | Details |

|------------------|-------------------------------|

| 📈 Bias | Bullish |

| 💰 Entry Zone | Breakout above $3,230 |

| 🎯 Target | $3,500 |

| 🛑 Stop-Loss | Below $3,180 (tight structure)|

---

### ✅ **Conclusion**

With **Trump’s trade war** rhetoric back in motion and **technical confirmation of a breakout**, gold is positioned for another **major rally**. A push toward **$3,500** is not just possible — it’s probable, as long as the structure holds. This is a time to **ride the momentum**, not fight it.

--

Will gold fall today?Hello everyone. Let's discuss the trend of gold this week. From the current daily chart, gold is currently in a five-wave upward trend.

You can see that the low point of gold last week was near 2955, which is exactly the top position of the first wave of this wave.

The retracement from 3167 to 2955 is the retracement of the fourth wave, and the retracement did not break the top position of the first wave near 2950.

So, the current trend from near 2955 is running in the fifth wave of rise.

I also drew it in the picture, and it may eventually reach the high point near 3308-3328.

Today's highest point reached near 3275, and then it retreated sharply to near 3256.

Maybe you think this is a high and fall, but I don't think so from the trend.

Gold opened at 3230. If you look at the trend of 3230-3275, you can find that 3255 is exactly the 618 support position of this trend.

If the retracement does not break 618, then there will definitely be a new high.

Using 123 to find 4, we can see that if the high point of 3290 continues to break, the subsequent high point will be around 3300, followed by 3328.

And 3300 coincides with the daily high above.

Therefore, if gold can reach around 3300 next, we must be careful of the possibility of a high fall.

"Gold Bullish Setup: From Demand Zone to 3280 Target!"🟦 Key Zones

🔵 Demand Zone (Support):

📍 Around 3,210 – 3,200

🟢 Buyers stepped in here previously, forming a base for a potential upmove.

🔴 Resistance Zone:

📍 Around 3,240 – 3,250

🚫 Sellers have rejected price from this level several times.

🎯 Target Point:

📍 3280

🚀 If price breaks resistance, this is the expected move.

❌ Stop Loss:

📍 3,195.52

🛡️ Placed just below the demand zone to minimize downside risk.

📊 Price Action & Indicators

* 🟠 Current Price: 3,225.32

* 📉 EMA (7): 3,223.57 – providing dynamic support

* 🔼 Trend: Short-term uptrend with higher lows

🧠 Trade Idea

* ✅ Entry: Around 3,220–3,225

* ❌ Stop Loss: 3,195.52

* 🎯 Take Profit: 3,280

* 📌 Risk-Reward: Favorable if resistance breaks

📈 Possible Scenarios

🔸 Scenario 1:

✨ Immediate breakout through resistance → target 3,280

🔸 Scenario 2:

🔁 Pullback to demand zone → bounce → then move toward 3,280

Continue to buy at the lower levels.Today, XAU/USD has been in a sideways consolidation phase😶, oscillating within the narrow range of 3,200 to 3,230. From a technical analysis perspective📊, the price action is currently trapped between these two key levels, with the moving averages showing a lack of clear direction. The Relative Strength Index (RSI) is hovering around the 50 mark, indicating a state of equilibrium between bullish and bearish forces.

In terms of trading strategy🧐, considering the current market dynamics, going long at the lower end of this range presents an opportunity😃. The lower bound of 3,200 has proven to be a relatively strong support level in recent sessions, as evidenced by multiple price bounces from this point. However, it is ill - advised to go short at the higher end😒.

This is because the current international situation is rather gloomy😟, fraught with numerous unstable factors. Geopolitical tensions are on the rise, and economic uncertainties are clouding the outlook. In particular, if the tariff issue escalates once more😡, given the robust safe - haven function of XAU/USD, its price is highly likely to surge again📈. Historically, during times of economic and geopolitical turmoil, gold has consistently attracted investors seeking refuge, leading to significant price appreciations.

💰💰💰 XAUUSD 💰💰💰

🎯 Buy@3200 - 3210

🎯 TP 3230 -3250

Traders, if you're fond of this perspective or have your own insights regarding it, feel free to share in the comments. I'm really looking forward to reading your thoughts! 🤗

👇The accuracy rate of our daily signals has remained above 98% throughout a month 📈! You are warmly welcome to follow us and join in on the success 🌟.👉

4/15 Gold Trading StrategyYesterday, gold experienced a mild pullback and found support near the 3200 level. As mentioned during intraday updates, as long as 3188 holds, it remains a good opportunity to consider buying. Currently, the price has rebounded above 3220. From the candlestick formation, the trend remains strong, and there is still room for further upside. The previous high near 3245 is likely to be tested again, and there’s potential for a move towards 3260.

However, it’s important to pay close attention to the 3230–3240 zone, which was a key area of trapped long positions from last week. This supply zone hasn’t been fully tested since the last drop, and as prices revisit this area, those looking to break even may create significant selling pressure. If this pressure leads to a rejection, we could see a sharp pullback.

Structurally, a failure to break above this resistance could signal the formation of a short-term top, presenting a tactical opportunity for the bears. Conversely, if gold manages to break and hold above 3245, short-term bullish momentum may continue, though the 3250–3270 region remains a strong resistance zone.

On the downside, if prices retreat again and break below 3188, it will likely confirm a deeper correction. Key support then shifts to the 3158–3147 range, which represents a significant medium-term support zone.

Today’s Trading Recommendations:

Sell Zone: 3250-3270 – A strong resistance area, suitable for initiating short positions for aggressive traders.

Buy Zone: 3158 - 3147 – A technical support region ideal for light long entries if price pulls back.

Range Trading: 3240 -3200 and 3178 -3220 – These zones are suitable for flexible trading strategies based on real-time momentum and price behavior.

Summary:

Gold remains in a short-term bullish trend, but significant resistance lies ahead. Caution is advised when chasing long positions at higher levels. If holding short positions from the 3230+ area, avoid emotional stop-losses—patience could offer better exit opportunities as the market corrects. A bearish setup is brewing, and once a clear direction emerges, volatility may increase rapidly. Be prepared with a solid plan in advance.

Gold Bullish Structure Intact – Breakout Imminent Amid Tight RanAs of now, gold is consolidating around $3,231/oz, maintaining a tight range near recent highs. Despite short-term fluctuations, the medium-term bullish trend remains intact, supported by both macro fundamentals and technical structure.

🔮 Trend Outlook:

Medium-Term Bias: Bullish. Maintain a "buy-on-dip" strategy supported by geopolitical risk, monetary easing expectations, and sustained central bank demand.

Short-Term Focus: Key levels to watch are $3,180 support and $3,245 resistance. A breakout from this range is likely to trigger directional momentum.

🎯 Trade Setup:

🟢 Long Strategy (Primary Idea):

Buy Entry: $3,185–$3,175

Stop Loss: Below $3,165

Targets: $3,220 / $3,245

🔴 Short Setup (Tactical Counterplay):

If price fails to break above $3,245, consider shorting on rejection

Targets: $3,190 / $3,180

Stop Loss: Above $3,252

XAU LONG LIVE TRADE AND EDUCATIONAL BREAK DOWN Gold embarks on a consolidative move around $3,200

Gold is holding its own on Tuesday, trading just above $3,200 per troy ounce as it bounces back from earlier losses. While a more upbeat risk sentiment is bolstering the rebound, lingering concerns over a deepening global trade rift have prevented XAU/USD from rallying too aggressively.

Gold Third Scenario , Depend On Breakout , What`s Your Opinion ?Here is the update for the last idea i post for Gold , if we take a look now we will see that he price moving in sideway and still not touch my support , so do yo uthink the price will go up without retest it ? or should we keep the first analysis ?

XAUUSD Gold in Overdrive: Awaiting a Critical Pullback for a BuyDaily Chart Analysis

On the daily chart, XAUUSD has surged to new highs, signaling an overextended market as gold rallies far above previous price swings. The price is now trading at a premium, which indicates that much of the bullish momentum may already be priced in. As a result, there is potential for a pullback toward a more attractive entry area. Specifically, a retracement into a discounted zone—ideally below the 50% level of the previous swing—may offer a better long opportunity rather than entering at these extended levels. 📈⚠️

4-Hour Chart Analysis

Examining the 4-hour timeframe reveals more granular price action that aligns with the daily trend. Here, gold displays signs of potential exhaustion with the recent impulsive moves. The market structure hints at the possibility of a short-term setup if the price begins to reverse, aligning with basic Wyckoff theory principles. This suggests that while there might be an interim short play if the reversal is confirmed, the expectation remains that a healthy pullback will eventually pave the way for a new long opportunity once the price finds support. 🔻🤔

Integrating Price Action, Market Structure & Wyckoff Theory

Using elements of Wyckoff theory, it's clear that the current rally has pushed the market into an overbought state.

• The price action indicates a likely initiation of a distribution phase, where selling pressure might temporarily take over.

• A pullback into the discounted zone (particularly under the 50% retracement of the prior range) would be an ideal opportunity to look for a buying setup.

• On the flip side, if the shorter-term setup solidifies, a conservative short play could be considered until signs of accumulation emerge.

This dual perspective underscores the importance of disciplined risk management and monitoring short-term reversals while keeping an eye on the broader trend. 🔍📉💡

Summary of Key Takeaways

XAUUSD is currently overextended with a strong rally to new highs. While the momentum is robust, the premium pricing compared to previous swings suggests caution. A pullback into a discounted zone, specifically below the 50% retracement level, could provide a more enticing entry point for those looking to go long. Concurrently, the 4-hour chart offers potential setups for a short play should price action indicate a reversal. Coupling these observations with Wyckoff theory fundamentals can allow for a balanced, dynamic trading strategy. 🔄

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a professional before making any trading decisions.

Gold: Directional Break ImminentYesterday’s market remained calm without any significant swings, unlike the strong movements we’ve seen previously. Today, however, appears to be a critical turning point as the market prepares for a directional breakout.

📊 Technical Overview:

Gold is showing signs of retesting the resistance around 3240, while short-term support lies at 3194–3188. If this resistance holds and the price fails to break above, a double-top pattern may form—potentially triggering a major drop between Wednesday and Thursday.

If the price breaks above 3240, there may be around $30 of additional upside, but this is likely to mark the formation of a short-term top, followed again by a decline.

🎯 Key Bearish Target Zones: 3137-3106

Whether it breaks upward or downward, a bearish opportunity is building. Stay patient, follow the price action, and avoid emotional decisions to catch the move at the right moment.

Strategic Analysis of Gold for the Next WeekOn Friday, the gold price continued its slow upward trend. Subsequently, it experienced a slight pullback, but still maintained an overall upward trend. This indicates that the current sentiment of the bulls is quite high, while the bears are unable to achieve decisive suppression in the short term. Due to the relatively obvious recent trend of fluctuating upward movement, there is still a great deal of uncertainty as to whether the price will continue to rapidly reach a peak. Therefore, for trend trading, one may need to patiently wait for the market to make its own choice.

Judging from the current situation, the gold market still has a strong bullish momentum. Whether it is the market's risk aversion sentiment, the impetus given by economic data to the market expectations of the Federal Reserve's interest rate cuts, or the bullish trend at the technical level, all of these factors provide support for the rise in the price of gold.

In terms of short-term trading ideas for gold, it is still recommended to mainly go long on pullbacks and go short on rebounds as a supplement. For next Monday, focus on the two support levels of 3200 and 3170. If the gold price remains above 3220, it is expected to continue to challenge higher prices. The upper resistance is roughly in the range of 3245 - 3255. If this resistance level can be effectively broken through, the gold price is expected to further reach the range of 3280 - 3300.

XAUUSD trading strategy

buy @ 3205-3215

sl 3195

tp 3230-3240

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

Strategic Analysis of GoldAlthough Trump has announced the exclusion of smartphones and computers from the list of reciprocal tariffs, which has alleviated some market concerns, due to the uncertainty of the overall tariff policy, the gold price still remains above $3,200 after falling from the intraday all - time high of $3,245 on Monday.

Judging from the current trend of gold, we should still pay attention to the resistance level in the range of 3240 - 3245. In the short term, focus on the support level in the range of 3185 - 3190. Currently, the trend has not reversed. It is likely that the bulls are pulling back to accumulate strength and move in a volatile pattern. In terms of trading operations, it is advisable to mainly go long during pullbacks.

XAUUSD trading strategy

buy @ 3195-3205

sl 3180

tp 3218-3223

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

Can we continue to go long on gold?The 1-hour moving average of gold is still in a bullish arrangement with a golden cross, and there is still no sign of a turnaround, so the gold bulls are still strong, and now gold is just falling back. The short-term support of gold is 3193, and the gold US market continues to be bullish.

Trading ideas:Gold long around 3208 sl:3193 tp:3225

4/14 Gold Trading StrategiesLast Friday, gold showed a strong unidirectional rally followed by tight-range consolidation at high levels. Our bearish-biased strategy yielded limited profits, and some traders may still be holding trapped positions due to delayed exits. However, structurally, gold’s current posture signals early signs of exhaustion, and a pullback remains likely.

🔥【Key Headlines to Watch】

🇺🇸 The U.S. has suspended tariffs on popular consumer electronics, causing gold to gap down by $30 at today’s open.

🛠️ Trump is expected to unveil details on semiconductor tariffs — a reduction or pause will likely pressure gold lower.

💬 Two Fed officials speak today:

Barkin: Speech on “Navigating Through Economic Fog”

Cook: Remarks on the Fed’s evolving role in the economy.

📊 The NY Fed 1-Year Inflation Expectations report will be released — market expectations are bearish for gold.

🔍【Technical Outlook】

Gold remains near historic highs, trading at an extended premium;

The recent rally has been largely driven by speculative inflows, not solid demand;

If sentiment flips or profit-taking begins, a sharp sell-off could follow;

Structurally, gold appears to be forming a top — favor short setups at elevated levels.

🎯【Trade Setup for Today】

🔻Sell Zone: 3230 – 3250

Look to short near resistance on failed breakouts

🔺Buy Zone: 3128 – 3104

Consider long entries only on healthy pullbacks to strong support

🔄Range Zones:

3220 – 3195

3158 – 3206

Tactical range trading — adapt to intraday momentum shifts

Gold fluctuates at high levels and is under pressure to adjust!Gold gapped down and opened low, bottomed out and rebounded without breaking the 3245 line. Today's trend is biased towards decline and adjustment. Intraday trading can be kept high and low! The upper 3245 suppression retracement is expected to gamble the small double top suppression deep retracement, and the lower support is first maintained near the morning retracement low point 3210. This first determines the strength of the European session. Only after breaking can we continue to chase the short position. If gold rebounds to 3240-43 during the day, we can short it. Today, we will focus on the previous high-altitude suppression. Pay attention to whether it can effectively stabilize at 3200-3190 below. If it stabilizes, we will continue to look at the integer 3300 mark. The bulls are still strong overall, but the intraday volatility of gold is large. If the position ratio is not done well, both long and short positions are easily damaged. Therefore, the recent trading is mainly to lock the area and position control ratio, strictly stop loss in the short term during the day, and do not hold positions and carry orders overnight!

On the whole, today's short-term operation of gold suggests that callbacks should be the main focus, and rebound shorts should be supplemented. The top short-term focus is on the first-line resistance of 3240-3245, and the bottom short-term focus is on the first-line support of 3210-3187.

Short position strategy:

Strategy 1: Short 20% of the gold position in batches when it rebounds to around 3240-3243, stop loss 6 points, target around 3210-3200, and look at 3190 if it breaks;

Long position strategy:

Strategy 2: Long 20% of the gold position in batches when it pulls back to around 3187-3190, stop loss 6 points, target around 3215-3235, and look at 3245 if it breaks;

Gold will rebound strongly if it does not break 3200The technical aspects of the gold market remain strong during the day. The weekly line closed positively for consecutive days, and the daily line remained intact for four consecutive positive lines, and the medium-term upward trend remained unchanged. At present, we need to pay attention to the possible technical correction at the beginning of the week, but as long as there is no single negative swallowing positive or continuous negative pattern, the trend direction is still bullish. The key support level is at 3200, of which 3180 is the short-term long-short watershed. If it is effectively broken, the upward momentum will be weakened; 3150 is the critical point of the medium-term trend, and a break may trigger a deeper adjustment.

H4 cycle shows that the price stabilized after falling back to the 10-day moving average near 3200, and this position became the focus of intraday long-short game. Operation strategy suggestion: If the price falls back to the 3200-3205 area without breaking, you can choose to go long, and the target is the 3245-3255 resistance zone. After breaking through, you can follow the trend. Be careful that if the 3200 support is lost, you need to adjust the strategy and pay attention to the 3180 line. Overall, keep the idea of going long on the pullback, and pay attention to controlling the position to prevent short-term volatility risks.

Gold suggestion for the evening: Go long on the 3210-3205 area, stop loss 3200, target 3235