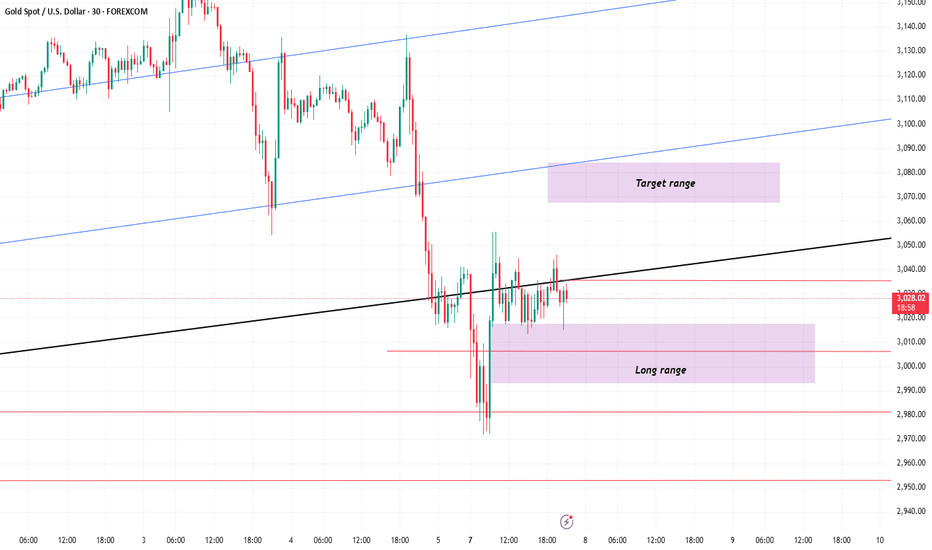

Get Rich: Buy Cheap GoldAfter a sharp decline, gold seems to have insufficient bullish momentum compared to before, but this is only in comparison. In fact, after gold hit the low point near 2957, the low and high points of gold are gradually rising. We can see that the bulls are gradually and implicitly picking up cheap chips.

So now we can't blindly short gold. According to the current gold structure, gold may continue to rebound above 3030, or even around 3050. These two positions will be the target areas for long traders and will also be the entry prices suitable for short traders.

So for short-term trading, I will adjust my trading strategy and plan in time. If gold falls back to the 3000-2990 area, I may first tend to go long on gold!

It must be noted that the current gold price fluctuates frequently and violently, so you must be particularly patient first. Because once there is no good entry price, it is difficult to set the psychological SL, and setting a relatively small SL is easy to be hit in market fluctuations!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Xauusdbuy

Gold: Economic Risks May Drive Prices UpGold Surges Amid Global Uncertainty, Testing Key Resistance

Gold has continued its impressive rebound, climbing steadily from its recent trough at $2,957 to reclaim territory above the psychological $3,000 mark. This upward momentum is being driven by a confluence of macroeconomic factors, including a softening US dollar and a pause in the previously relentless climb of US Treasury yields. With markets recalibrating their expectations around interest rate cuts by the Federal Reserve, investor appetite for safe-haven assets like gold has gained renewed strength.

At the heart of the current rally lies mounting geopolitical tension, particularly the intensifying trade standoff between the United States and China. Washington's proposal to impose 50% tariffs on a broad array of Chinese goods has rattled global markets. In response, Beijing is signaling potential retaliatory measures, further stoking fears of a prolonged economic conflict between the world's two largest economies. These developments are injecting volatility into risk assets and increasing demand for traditional hedges such as gold.

From a technical standpoint, the precious metal is currently grappling with a significant resistance level near $3,013. If the price manages to consolidate above this threshold following the current retracement, it could pave the way for a continued upward drive toward the next resistance zones at $3,033 and $3,057. These levels represent key pivot points that could dictate the short- to medium-term trajectory of gold.

On the downside, immediate support lies at $2,996, with stronger backing at $2,981. These levels may provide a cushion for any near-term pullbacks, especially as traders look for opportunities to re-enter the market during dips.

The broader narrative remains highly fluid, shaped by the ever-changing dynamics of global trade policy and monetary strategy. As the tug-of-war between Washington and Beijing intensifies, markets are left navigating a highly politicized and uncertain environment. With neither side showing signs of capitulation—China maintaining its firm stance, and the US administration likely to resist backing down—the potential for further escalation remains high.

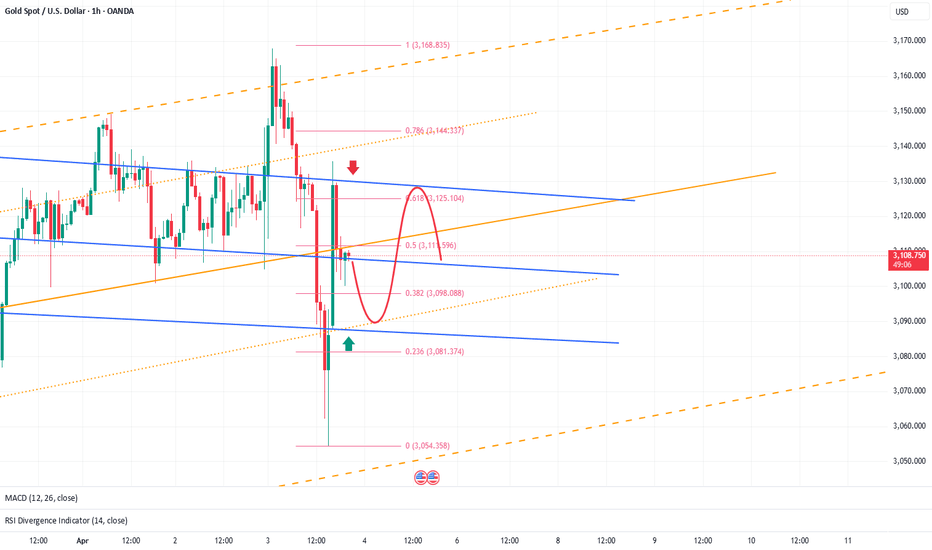

In this context, gold’s appeal as a strategic asset grows stronger. The current setup suggests that the metal may gain additional bullish traction if it finds support around the 0.5 Fibonacci retracement level or holds above $3,013. Investors are keenly watching these technical and fundamental cues, weighing the growing economic risks that could propel gold into a sustained rally.

Go long gold, target: 3030-3040Gold tested the support of 2985-2975 again during the correction process, but did not fall below this area during the test. Combined with the structural lows of gold yesterday, they were 2970 and 2956. Today, gold did not fall below 2970, so it is very likely that gold will form a head and shoulders bottom pattern at the technical level, which will help gold to continue its rebound momentum with this strong technical support!

So I think the short-term decline of gold is not a risk for us, but the best gift for us. So I advocate going long on gold from now on. After gold repeatedly tests the support, it will rise to the 3030-3040 area without hesitation.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold: Buy, Target 3004-3028On the 1H chart, the MACD is showing a bullish divergence, signaling a potential bottom. If gold can build a base around 2960-2980, bulls will have the upper hand from a technical standpoint.

While today's major macro news will hit during the U.S. session, technical analysis dominates the Asian and European sessions — which favors a buy-on-dip strategy.

The 3030 resistance, which wasn’t tested yesterday, may be reached today.

If the price drops unexpectedly, watch the 2946-2928-2916 zone for new buying opportunities — especially 2928-2916, which is a strong support zone.

Buy:2960 - 2980

TP:3004 - 3028

XAUUSD Breakdown Setup – Gold Bears Eye $2,845 Support ZoneGold (XAUUSD) has broken below its rising channel structure, signaling a shift from bullish momentum to potential bearish continuation. After a sharp rejection from the $3,167 high, price is currently consolidating just below the psychological $3,000 level, which now acts as resistance.

Key Technical Zones:

Current Price: $2,985

Resistance Zone: $3,000 – $3,005 (key rejection area)

Support Targets:

TP1: $2,923

TP2: $2,844

TP3: $2,832 (swing low)

Bearish Trade Setup:

📉 Entry Zone: If price retests and rejects the $3,000 resistance

📈 Invalidation Level: Break above $3,005

📉 Target Zones:

$2,923 – Previous structure support

$2,844 – $2,832 – Deeper support and channel base

Technical Confluence:

✅ Bearish flag formation following strong impulsive sell-off

✅ Channel break confirms shift in trend

✅ Lower highs and bearish momentum building beneath $3,000

✅ Strong psychological resistance at $3,000

Gold is Bullish, Target 3030-3060At the market open today, we signaled a buy opportunity near the 2980 level for gold. Since then, the price has surged over $30, and those who followed the strategy have already secured solid profits.

Gold is now approaching a short-term resistance, so a minor pullback may occur. However, the overall uptrend for the day remains intact, and our strategy continues to favor buying on dips.

Based on the current chart pattern, there's potential for the price to rise toward the 3030–3060 zone later today.

Stay alert for retracement opportunities, manage your position size wisely, and trade with discipline.

If you missed this entry, don’t worry — the next opportunity is just around the corner!

Full analysis of gold operation strategiesTechnically, gold rebounded quickly in the Asian session and was under pressure from the 3055 level, then fell and fluctuated. In the afternoon European session and the evening US session, it was under pressure from the 3045 level, then fell and fluctuated downward, breaking the bottom. In the early morning, the price of gold accelerated downward, broke through the 2960 level and reached around 2957, where it stabilized and rebounded. The daily K-line closed at a high and then fell back to the hanging neck middle shadow. After the overall gold price reached the high point of 3167 last week, it was suppressed and fell downward for three consecutive trading days. The hourly moving average of gold was in a volatile operation, and the strength of gold shorts had not weakened. Gold rebounded or continued to be short, and gold was still weak overall. Gold was still under important pressure near 3055, and continued to be short after the rebound was blocked. Affected by trade tariffs, the global market encountered a "Black Monday". Gold had a big intraday shock on Monday, with an intraday amplitude of nearly $100, and finally broke down in the US session. Investors turned to the US dollar for risk aversion due to tariff concerns. The gold market showed a sharp decline, continuing the downward trend at the end of last week. The daily level has closed negative for three consecutive days.

At present, gold has fallen by $100 for three consecutive days. The daily price has hit the 30-day moving average support for three consecutive days. It is difficult for gold to hit a new low today. Gold is in the fourth trading day of decline and adjustment. Although there was a rebound in the morning, the 1-hour moving average still showed a short arrangement with a death cross downward, and the short volume has not decreased, indicating that the short-term short trend is still continuing. After the gold price fell, it is also trying to regain lost ground, but the rebound is weak. Now the bottom signal has not been confirmed. At present, given the obvious short trend, it is recommended to rebound short as the main, and callback long as the auxiliary, and pay close attention to the upper 3025-3030 resistance and the lower 2956-2950 support.

Operation strategy:

1. It is recommended to buy gold at 3025-3030 rebound, stop loss at 3040, target at 3000-2970, break at 2050.

2. It is recommended to buy gold at 3000-2994 pullback, stop loss at 2988, target at 3020-3030.

Buy gold, expect a rebound to 3000Gold just fell to 2958, but quickly rebounded to above 2965. The short-term support of 2965-2960 was not effectively broken. Gold quickly recovered above the short-term support, proving that bulls still have room to fight back. I expect gold to at least rebound and test the 3000 position again, so in short-term trading, we should not be too bearish on gold.

I actually reminded everyone in the last article update that we can buy gold when gold falls. In this extremely fierce market, with a cautious trading mentality, I actually do not expect too much about the rebound space of the bulls. Once gold touches around 3000, I will leave the market safely and lock in profits!

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

Gold Attack and Defense GuideAfter the opening of the market on Monday, the three major U.S. stock index futures all fell sharply, with the Nasdaq futures falling by more than 5.5%, the S&P 500 index and the Dow Jones Industrial Average falling by more than 4.7% and 4% respectively, and crude oil prices also falling below $60 per barrel. Although gold and silver have rebounded after a sharp drop, they still cannot escape the selling pressure as a whole. The market panic is quite similar to the outbreak of the new crown epidemic in March 2020. The U.S. tariff policy and the trade war it has triggered have caused the biggest disruption crisis in the global supply chain since the epidemic.

As the new trading week begins, global risk aversion shows a significant sign of rising, and precious metal assets have ushered in a strong performance. U.S. officials announced on Monday that they would launch reciprocal tariff measures against global trading partners the next day, completely shattering the market's previous residual expectations that negotiations might ease at the last minute. As the deadline for policy implementation approaches, the tense atmosphere in the financial market has heated up sharply.

Against this background, mainstream banks continue to hold optimistic expectations for the medium- and long-term trend of precious metals. The current price is driven by two factors: one is the unexpected demand for reserve increases by central banks of various countries, and the other is the continued inflow of funds from gold-linked ETF funds. It is worth noting that the U.S. benchmark Treasury yield fell in a gap on Monday, and the yield curve is rapidly approaching the stage low of 4.172% set in March.

Technical patterns show that gold prices continue to rise strongly after breaking through the psychological barrier of $3,100, indicating that the current main trend is still expanding upward along the line of least resistance. If the price falls back and loses this integer, it may trigger a technical correction, and long position closing operations may push gold prices back to the key support of $3,000. Short-term trading needs to focus on the upward resistance band formed in the $3,148-50 range, which may become a new battlefield for long-short games. I suggest that gold should pay attention to the suppression of the 3080 line above and the 3000 integer mark below. The news has stimulated the recent volatility, and the recent high-altitude is the main focus. Long orders must be cautious.

Operation strategy:

1. Try the 3055-3060 line above the gold short order, and make a stop loss. The target is 15 US dollars.

2. The long order below the gold can be tried at the 3000 line, looking at 10-15 US dollars, and make a stop loss. No long orders can be participated without loss. The 2980 line below can be regarded as a position for replenishment.

Gold: Focus Remains on Buy-the-Dip Strategy

Gold witnessed another round of extreme volatility today, plunging below the 3000 level before quickly rebounding. Since then, the price has repeatedly tested support in the 3030–3018 range. So far, this support zone has held up well, suggesting buyers remain active at lower levels.

However, traders should keep a close eye on the 3047 resistance area, which may temporarily cap upward momentum. In the short term, the overall strategy remains focused on buying at lower levels, with the potential for prices to revisit the 3080 region in the coming days.

That said, due to the sharp price swings recently, caution is advised for those looking to chase the rally above 3040. Unless your account has sufficient margin and risk tolerance to withstand a potential pullback toward the 3000 level, it is not recommended to enter aggressively at higher prices.

Trading Strategy Summary:

Bias: Short-term bullish (buy-the-dip)

Support zone: 3030–3018

Resistance: 3047 (short-term), 3080 (medium-term target)

Risk warning: Avoid chasing above 3040 unless risk control is well in place

Stay agile, and adjust your positions according to intraday price action. I will continue to provide real-time updates as the situation evolves.

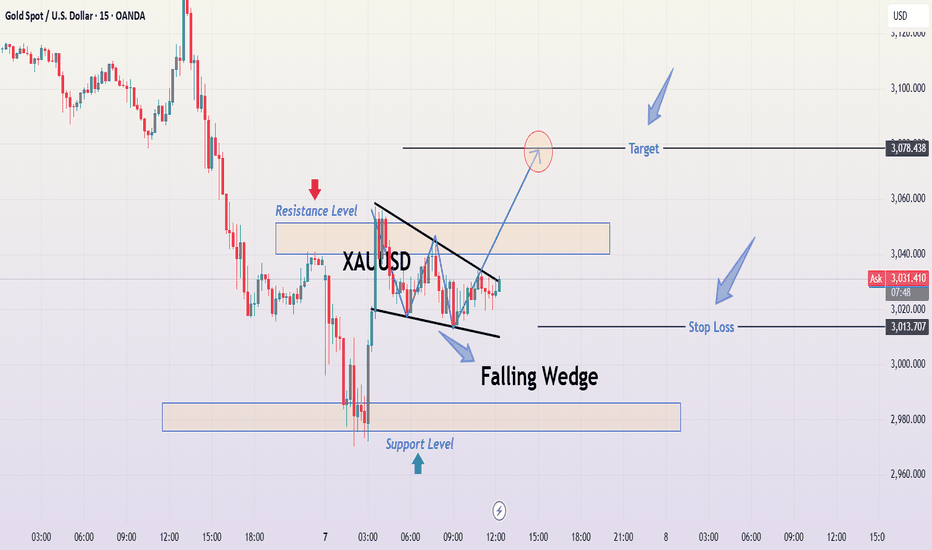

XAUUSD Analysis Falling Wedge breakout Setup to Target🔍 1. Market Context & Structure

Gold has recently experienced a sharp decline, as evident from the aggressive bearish candles leading into the consolidation phase. Following this downward momentum, the market began to consolidate, forming a Falling Wedge pattern—a bullish reversal structure that often signals an impending upside breakout, especially after a strong bearish trend.

📉 2. Falling Wedge Pattern

The wedge is formed by two downward-sloping trendlines that converge, containing price within lower highs and lower lows.

Notice how price is respecting both boundaries, confirming the validity of the pattern.

The pattern also features a series of higher lows, showing a loss of bearish momentum.

🟩 3. Support and Resistance Levels

Resistance Zone: Around $3,035 to $3,045 — This level previously acted as a strong supply zone where price was rejected multiple times.

Support Zone: Around $2,972 to $2,985 — Clearly marked area where buyers stepped in strongly during the sharp pullback.

These levels are critical to observe for any breakout or breakdown confirmation.

📊 4. Trade Plan Based on the Chart

✅ Bullish Bias:

Given the falling wedge setup and slowing bearish pressure, the trade idea favors a breakout to the upside.

🔵 Entry Point:

A confirmed breakout above the wedge’s upper boundary (around $3,030–$3,035), ideally on strong bullish volume.

🎯 Target:

The first take profit level is marked at $3,078.438, aligning with a prior resistance and measured move projection from the wedge’s height.

🔴 Stop Loss:

Positioned just below the most recent swing low and wedge boundary at $3,013.707, offering protection if the breakout fails.

🧠 5. Why This Setup Matters

Wedge patterns are high-probability when they form after a sharp move, as seen here.

Volume confirmation on the breakout would solidify this as a reliable opportunity.

Risk-to-reward ratio appears favorable, with a tight stop and a higher projected upside.

🧭 Conclusion

This is a textbook falling wedge breakout scenario. The consolidation after a bearish leg, narrowing price action, and repeated support reactions indicate that bulls are gearing up. If Gold breaks above the wedge with momentum, there’s potential to ride the move toward $3,078. Always wait for confirmation and manage your risk accordingly.

"Gold Spot (XAU/USD) -Trend Reversal or Continuation? tradesetup📊 Key Levels & Zones

🔵 Target Point: 📈 3,055.65 (Upper blue box) – The expected bullish target.

🟠 Demand Zone: 📉 3,009 - 3,019 (Orange box) – A strong support area where buyers might step in.

🔴 Stop Loss: ⛔ 3,009.47 – Safety exit if the price drops below this level.

📉 Trend Analysis

📍 Trend Line (🔽 Downward Sloping): Indicates a declining price movement.

📍 Potential Breakout (📈): If price breaks above the trend line, it may trigger an upward move toward the target point.

🛠️ Strategy

🔹 Wait for confirmation – A bullish candle above the trend line can signal a buy entry.

🔹 Watch demand zone – If price holds above this area, it could support the bullish move.

🔹 Manage risk – SL (⛔) ensures minimal losses in case of a breakdown.

Gold operation strategyGold plummeted at the opening of Monday, reaching the lowest point of 2972, and then rebounded to 3055. We successfully placed a short order at 3052, and have already made a profit to the target. The hourly moving average of gold crosses downward and the short position is arranged, and it continues to open downward. So gold is now the home of the short position. Whether gold rebounds or continues to be short, gold is now in a short trend below the gap. We continue to pay attention to the short-term suppression at 3055.

From the 4-hour analysis, today's upper short-term resistance is 3055, and the lower line is 3000-3008. In terms of operation, the rebound pressure at this position continues to be short and follow the trend to fall. It is necessary to rely on the rebound to rely on 3055-60 to go short once, and the lower target continues to break the bottom.

Gold operation strategy:

1. If gold rebounds to 3055-3058, short it, stop loss at 3066, target 3015-3020, continue to hold if it breaks;

2. If gold falls back to 3000-3006 but does not break, you can buy it, stop loss at 2993, target 3045-53, continue to hold if it breaks

Golden Horizons on the PrecipiceGold on the Brink of a Downturn: A Shift in Market Sentiment

Gold, once a shining symbol of financial security and prosperity, now finds itself on the cusp of a significant bearish turn. The precious metal, which has long been a safe haven for investors during times of economic uncertainty, is entering a new phase that could see its value dwindle in the face of shifting global financial conditions.

The Russian central bank, historically one of the major players in the gold market, is currently at the forefront of this market retreat. By liquidating a significant portion of its gold reserves, Russia is not just participating in the market shift, but may be sending a signal to other nations and financial institutions. Their decision to sell is not an isolated move; it could well be the beginning of a broader trend.

As the Russian central bank offloads its holdings, it's highly probable that other central banks, which have long viewed gold as an essential asset for economic stability, may soon follow suit. These institutions, often holding vast quantities of the precious metal, could begin liquidating their reserves in an effort to take advantage of the currently elevated prices. The global economic landscape is constantly in flux, and with many countries facing mounting fiscal pressures, the temptation to cash in on gold's recent price surge could become too great to resist.

Hedge funds and private investors, always looking for opportunities to capitalize on price movements, may also jump on the bandwagon. They have the flexibility and agility to react swiftly to market shifts, and with a growing consensus that gold may have reached its peak, it would not be surprising if they decide to sell off their positions in the metal. With such a large portion of the market potentially pulling away from gold, the selling pressure could intensify, leading to a sharp drop in prices.

If this trend gains momentum, we could witness a rapid and dramatic decline in gold’s value. The metal, which has been the go-to asset for many investors during times of economic uncertainty, could soon lose its appeal as a safe haven. The factors driving this potential downturn are multifaceted, ranging from shifting monetary policies and global inflationary pressures to geopolitical tensions and central bank strategies.

The impact of this market shift could be far-reaching. Not only would it affect the price of gold, but it could also send shockwaves through the broader commodities and financial markets. If the sell-off gathers pace, it could have a cascading effect, causing investors to rethink their positions in other assets traditionally viewed as safe havens, such as silver or even government bonds.

The question on many investors’ minds is whether this bearish trend is a temporary correction or the beginning of a longer-term downturn. Only time will tell, but one thing is certain: the dynamics of the gold market are shifting, and the once steady climb of the metal may now be facing a downward spiral.

For those who are closely following the market, it is essential to stay updated on the latest developments. A deeper analysis of the factors driving this potential gold sell-off and the broader market implications can offer valuable insights into the direction of this volatile asset.

As we continue to monitor the situation, I encourage you to stay informed and consider how these developments could impact your own investments. While gold may still hold value in the eyes of many, its future trajectory is now uncertain, and the risk of significant price fluctuations looms large.

Thank you for your attention, and I wish you the best of luck navigating these turbulent financial waters!

Geopolitical Tensions, Supporting Bullish Outlook for GoldOver the weekend, geopolitical tensions remained elevated:

A mortar attack targeted the vicinity of Aden Adde International Airport in Mogadishu, Somalia.

U.S. forces launched airstrikes on key targets in Saada, a city in northern Yemen.

Ukrainian forces conducted multiple strikes on Russian energy infrastructure.

Massive protests erupted across dozens of U.S. cities, marking the first large-scale demonstrations since former President Trump returned to office. Trump described the recent U.S. stock market plunge as “intentional” and urged Americans to “stay strong.”

In Europe, Germany is reportedly considering repatriating 1,200 tons of gold reserves currently stored in the United States—signaling potential mistrust in global financial stability.

Fundamental Outlook

Given the ongoing geopolitical uncertainty, investor demand for safe-haven assets like gold is expected to remain strong. As risk sentiment continues to deteriorate, buyers are likely to dominate the market, especially on price dips. We anticipate increased buying interest next week, which could support gold prices and potentially lead to a breakout from the current consolidation zone.

Additionally, macroeconomic data releases will play a crucial role. The U.S. CPI report, due Thursday, will be the most closely watched indicator. A higher-than-expected CPI could cause markets to reassess the timing and scale of potential Fed rate cuts, resulting in a temporary rebound in the U.S. dollar and Treasury yields. However, sustained higher borrowing costs would intensify recession risks, limiting any dollar strength. This dynamic continues to favor gold in the medium to long term.

We are entering a phase where the fundamental and technical landscapes are increasingly aligned in favor of the bulls. The recent pullback in prices presents a strategic opportunity for medium- to long-term buyers to accumulate positions.

Those already holding long positions—whether currently in profit or facing temporary drawdowns—are advised to remain patient and avoid emotional exits. The broader structure remains supportive of higher prices in the coming sessions.

I will continue to provide real-time updates, entry/exit suggestions, and risk control strategies during market hours. Be sure to stay connected and follow the guidance closely.

4/7 Gold Trading StrategiesGold opened with a massive gap down today due to growing market panic, plunging below the $3000 psychological level. Although it briefly rebounded to $3030+, selling pressure intensified again, dragging prices back below $3000 and continuing to test lower support levels.

This sharp sell-off wiped out almost two months of previous gains. While the panic is real, it’s important not to be ruled by fear. Lower prices offer entry opportunities for long-term bullish capital. In such moments, we need courage as much as caution.

Rather than following fear blindly, we suggest looking for buy opportunities at lower support zones, with a combination of scalping tactics for short-term trades.

📌 Trading Strategy:

🟢 Buy Zone: $2980 – $2950

🔴 Sell Zone: $3040 – $3060

🔁 Scalping Zone: $3021 – $2996

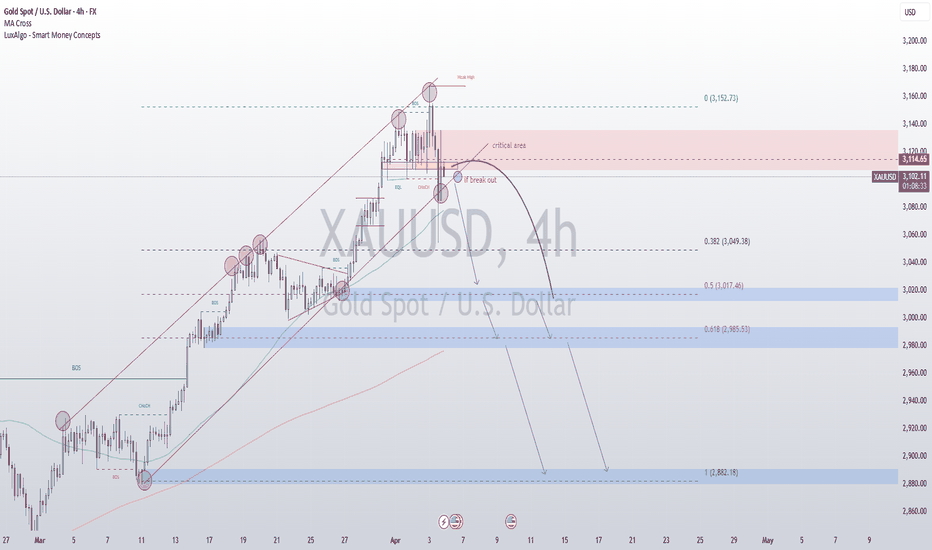

XAU/USD Bullish Pennant Breakout - Trade Setup Toward Target📊 Overview:

This 4-hour chart of Gold Spot (XAU/USD) presents a clean bullish pennant breakout followed by a corrective pullback to key support, offering a high-probability trading setup for bullish continuation traders.

Gold recently surged above the psychological $3,000 level, but after testing the previous resistance zone / ATH, it retraced back into a critical confluence of support. From a technical perspective, the structure remains bullish, supported by strong trendline dynamics, clean price action, and a well-defined pennant formation.

🔍 Step-by-Step Breakdown:

1. Bullish Pennant Formation

A bullish pennant is a continuation pattern that typically occurs after a strong upside rally (the "flagpole"). In this chart:

The flagpole began around March 13, with gold moving vertically from ~$2,630 to ~$2,950.

This was followed by consolidation between March 19–27, forming a symmetrical triangle pattern with converging trendlines (the pennant body).

Volume (if added) would typically decrease during this consolidation phase.

On March 27–28, price broke above the pennant, confirming the bullish bias.

📌 This breakout signals that buyers are ready to resume control after taking a breather.

2. Rally & Retest Phase

Following the breakout:

Price surged to challenge the resistance zone and all-time high (ATH) area, marked between $3,150 – $3,160.

A natural pullback occurred due to profit-taking and overbought conditions.

This retracement brought price back into the support zone at ~$3,000, intersecting perfectly with:

The rising trendline from the pennant breakout

A horizontal demand zone (former resistance turned support)

A key psychological level ($3,000)

💡 This zone acted as a confluence area, attracting buyers and creating a strong bounce — visible as a bullish engulfing candle.

3. Support & Resistance Analysis

✅ Support Level:

$2,990 – $3,010

Marked by previous highs before the breakout

Validated by the trendline and price reaction

🚫 Resistance / ATH Level:

$3,150 – $3,160

Historic resistance zone that capped the recent rally

Price must break this level for further continuation toward the target

4. Trendline Dynamics

The dotted trendline acts as a rising support structure.

Trendlines in bullish continuations are crucial as they confirm upward momentum.

As seen on the chart, price respected the trendline during the recent dip and bounced with strong momentum — a bullish signal.

5. Trade Setup & Risk Management

A trade based on this structure should follow strict risk-to-reward discipline.

🛒 Entry Zone:

Ideal re-entry lies between $3,030 – $3,040, after confirming the bounce from support.

❌ Stop Loss:

Below $2,976, which is under the support zone and trendline. If price breaches this level, the pattern is invalidated.

🎯 Target:

Measured move (height of the flagpole) projected from breakout zone gives us a target of around $3,221.

The chart also marks this clearly as the "Target" zone.

📈 Risk-to-Reward Ratio: Approximately 1:3, which is attractive for swing trades.

6. Market Psychology & Trader Sentiment

The bullish pennant represents temporary indecision, but ultimately market confidence remains strong.

The pullback to support reflects healthy profit-taking, not bearish reversal.

The bounce from support shows buy-the-dip mentality, a sign that bulls remain in control.

7. Macro & Fundamental Backdrop

While the chart is technical, it's wise to factor in macro catalysts:

🏦 Federal Reserve policy: If the Fed holds or cuts rates, gold typically rallies due to lower opportunity cost.

📉 Inflation Data: Rising inflation or expectations can push gold higher as a hedge.

🌍 Geopolitical tensions: Conflicts or economic instability drive safe-haven flows into gold.

Staying updated on these events can help validate or hedge your technical outlook.

✅ Conclusion:

This chart presents a technically sound bullish continuation setup backed by:

A breakout from a bullish pennant

A retest and bounce from a confluence support zone

A clearly defined risk (stop loss) and reward (target)

Traders looking for medium-term opportunities in XAU/USD can consider this as a high-probability setup with logical structure and strong momentum potential.

🔔 TradingView Tag Suggestions:

#XAUUSD #Gold #TechnicalAnalysis #BullishPennant #PriceAction #SwingTrade #Forex #TradingSetup #Commodities #GoldBreakout

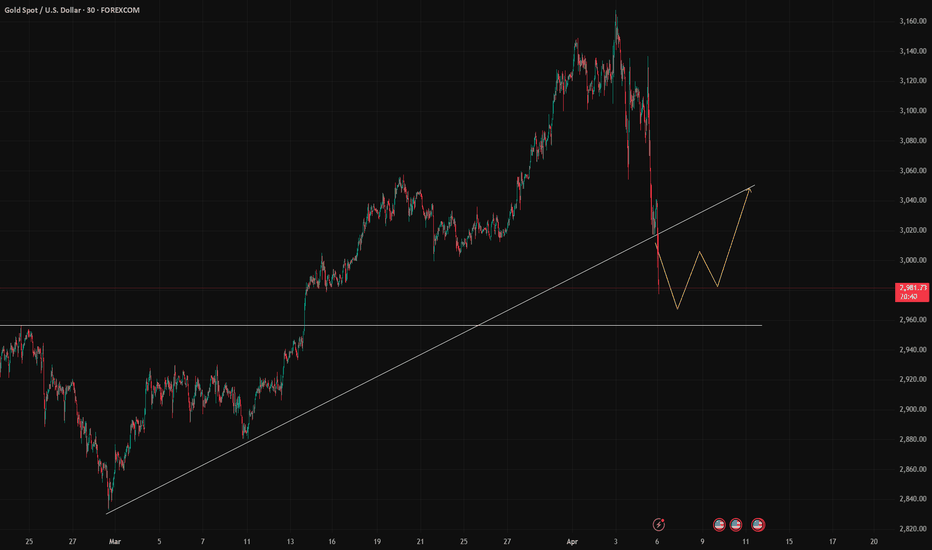

XAU/USD potential Longs from 2990 back up to 3,100This week, I’m considering both short- and long-term opportunities on gold. We’ve recently seen a change of character to the downside, and there’s a clean 1-hour supply zone that could trigger a short-term bearish reaction.

That said, there’s also a lot of nearby liquidity resting below, which I expect price to sweep first. If that happens, I’ll be watching the 20-hour demand zone—a strong area that could spark a new bullish rally from the lows.

Confluences for GOLD Buys:

- Price has recently cleared a new all-time high (ATH), indicating continued bullish strength.

- Market structure remains overall bullish, suggesting this move down may be a temporary correction.

- The 20-hour demand zone sits just below key liquidity and looks highly valid.

- Untouched Asia session highs remain above, which price is likely to target.

- The DXY is moving bearish, aligning with a bullish outlook on gold due to their inverse correlation.

Note: If price reacts from the current demand zone (which is also valid), we could see Scenario B play out first—a rally followed by a short move to clear liquidity before heading higher.

Stay patient and trade safe, everyone!

Gold Rebound Looms: Don’t Miss the $50 OpportunityDuring his ongoing speech, Powell mentioned that tariffs may push inflation higher in the coming quarters. While inflation is currently close to the 2% target, it still remains above it. The market has already begun to anticipate a Fed rate cut, which is a potential bullish signal for gold.

From a technical perspective, the recent drop has partially corrected the previous bearish divergence. However, the divergence on the 1D chart still requires more time to be fully resolved.

At the current level, gold appears oversold. I do not recommend chasing short positions here. A short-term rebound is very likely, with a potential upside target between 3078-3096. If you manage the trade well, there’s an opportunity to capture at least $50 in profit.

If you’re currently holding long positions that are under pressure, stay strong. Don’t give up before the dawn — yesterday was a great example of why persistence matters.

4/4 Gold Trading StrategiesAfter yesterday’s sharp drop, gold quickly rebounded, and by the end of the session, prices had returned close to the opening level. I’m not sure if anyone is currently stuck in unfavorable positions. Under normal circumstances, if your account has sufficient margin and risk tolerance, such volatility shouldn’t cause major damage. However, for those with weak positions or who bought at the top or sold at the bottom, losses may have occurred—especially common among newer traders who are often influenced by emotions.

If you are currently holding short positions and hoping to wait for a price pullback, you'll need both time and sufficient margin. Based on current candlestick patterns, gold may attempt to test the 3128–3136 resistance zone again. Whether it moves higher will depend on the strength of the bulls.

Importantly, there are several key U.S. economic data releases during the New York session today. Based on preliminary expectations, the data appears to favor the bears, which could put additional pressure on gold prices.

📉 Today’s Trading Strategy:

Sell within the 3133–3152 zone

Buy within the 3065–3032 zone

📊 Scalping/Short-Term Trades:

Be flexible in the 3128–3088 range

Gold Price Analysis:Key Supply & Demand Zones with Potential Bkl🔥 Key Levels & Zones

🔵 Supply Zone (3,135-3,140 USD) 📉

Acts as resistance where selling pressure increases.

If price reaches here, expect a potential pullback.

🟢 Demand Zone (3,085-3,095 USD) 📈

Strong support area with buying interest.

Price has tested this zone multiple times = accumulation.

🎯 Target Point (~3,167 USD) 🚀

If price breaks out, it may rally towards this level!

❌ Stop Loss (~3,080 USD) ⛔

Marked below demand zone to limit risk.

---

📊 Trend Analysis

🔹 Trend Line Break ⚡

The price broke the previous uptrend = potential reversal or deeper correction.

🔹 Market Structure 🏗️

Price consolidating inside the demand zone = possible bullish move ahead.

🔹 Double Bottom Formation (DBF) at Supply Zone 🔄

Shows failed breakout attempts = strong resistance.

---

🔍 Indicators & Insights

📌 DEMA (9 close) at 3,099 USD 📈

Price hovering around this moving average = market indecision.

---

🚦 Possible Scenarios

✅ Bullish Scenario:

If price holds the demand zone & breaks above 3,110 USD, it could rally to supply zone (~3,135 USD).

A breakout above 3,140 USD could lead to the target zone (~3,167 USD) 🚀.

❌ Bearish Scenario:

If price breaks below 3,085 USD, it may hit stop loss (3,080 USD) and continue lower.

---

🎯 Trading Plan

🟩 Long Entry ➡️ Around 3,090-3,100 USD 📊

🛑 Stop Loss ➡️ Below 3,080 USD 🚨

🎯 Target ➡️ 3,135-3,167 USD 🎉

NFP - Shorting GoldThe gold market experienced huge fluctuations on Thursday, which created very good profits for us. During the entire trading process, we seized the profits of fluctuations of more than $50.

The unemployment rate and NFP data during the US trading session on Friday, as well as Powell's speech on the economic outlook, are the focus of Friday's trading.

Judging from the data released in March, the unemployment rate and NFP are more likely to be bearish for gold, so when trading data, my plan is to focus on short positions.

At present, in terms of technical form, the indicators show that the bulls have not ended. In this case, the transaction needs to pay attention to the 3123/3136 resistance. If it cannot break through, the price is expected to fall again to 3103 or even 3086.

Overall, today's trading focus is to sell at high levels.

XAUUSD: Buy or Sell?Today's gold market can be said to have the largest intraday volatility since 2025! After experiencing violent fluctuations, the current trend of gold has once again become anxious.

However, from the perspective of range conversion, it is certain that gold is currently operating in a weak position, and after the brutal and violent fluctuations, the market also needs to recuperate. And there will be NFP tomorrow. It is expected that before NFP, it will be difficult for gold to form a new unilateral market again. So in the process of shock, I think both long and short sides have a certain profit space.

First of all, pay attention to the resistance of 3125-3135 area on the top. If gold touches this area during the shock process, we can still short gold;

And the first focus on the 3095-3085 area on the bottom is that if gold touches this area during the shock process, we can still consider going long on gold.

The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings