Gold (XAU/USD) Bullish trend Demand Zone –Trend Analysis & ts🔵 Demand Zone (Support Area):

This blue zone represents a strong buying area where buyers are expected to step in.

If the price touches this zone and bounces, it confirms bullish strength.

📉 Trend Line Break:

The previous trendline has been broken ⛔, signaling a possible retest before a move up.

🛑 Stop Loss (Risk Management):

Positioned at 3,108.52 🔴, meaning if the price drops below this, the trade setup becomes invalid.

🎯 Target Point (Take Profit Level):

3,167.77 ✅ is the potential profit zone if the price moves upward from the demand area.

🟠 Expected Price Movement:

The orange dotted line 🔶 suggests a likely move:

1. Price dips into the demand zone (🔵).

2. Bounces back up 🔄.

3. Breaks minor resistance 🟦.

4. Rallies to the target zone 🎯.

Overall, bullish movement 📈 is expected if the demand zone holds! 🚀

Xauusdbuy

Gold: Soaring on Tariffs, Testing Technical WatersIn the early trading session of the Asian market on Thursday (April 3rd), spot gold continued its upward trend and once reached a new all - time high of $3,167 per ounce. This was because US President Donald Trump said on Wednesday that he would impose a benchmark tariff of 10% on all goods imported into the United States and impose higher tariffs on some of America's largest trading partners. This move will lead to an intensification of the trade war that he initiated after returning to the White House, causing the market's risk - aversion sentiment to soar sharply.

However, given the rapid increase in the gold price, one should not blindly chase after buying more gold. On the one hand, the rapid rise in the gold price has accumulated a certain amount of pressure for a correction, and there is a high probability that a pullback and subsequent recovery rally will occur. On the other hand, the highly anticipated Nonfarm Payrolls data will be released tomorrow. On the eve of its announcement, the market will not quickly break out of a well - defined trading range and price level.

On the daily chart level, gold entered a downward adjustment mode on Tuesday, breaking the previous consecutive upward trend with positive candles. However, the current moving - average system still maintains a pattern of diverging upwards. Today, the key focus is on whether the downward movement of the market is sustainable. Firstly, we need to pay attention to the support effectiveness of the short - term moving average MA5. Currently, this moving average is roughly located around 3098, which is extremely close to yesterday's low of 3100 when the price dropped. If this support level can hold, then in the short term, gold can still be regarded as being in a strong pattern.

XAUUSD

buy@3105-3115

tp:3140-3160

Gold (XAU/USD) : Bullish Setup with Key Demand Zone🔹 Trend Line & Demand Zone 📈

* The trend line shows an upward trend. 🚀

* The demand zone 🟦 acts as strong support, where buyers are likely to step in.

🔹 Price Action 🔍

* Price is bouncing off the demand zone ➡️ Bullish Signal 📊🔥

* Higher lows forming, indicating potential upward momentum.

🔹 Trade Setup 🎯

✅ Entry Point: Near the demand zone 🟦

❌ Stop Loss: 🔽 3,099.26 (Below demand zone)

🎯 Target Point: ⬆️ 3,148.58 (Key resistance area)

🔹 Expected Movement 🏆

* A slight pullback 📉 before a strong push up 📈💪

* If price holds the demand zone, 🚀 potential rally ahead!

🔹 Risk-to-Reward Ratio ⚖️

* Favorable trade setup ✅ High reward, controlled risk 🎯

🔹 Final Verdict 🔥

📊 Bullish Bias ✅ As long as demand zone holds!

🚨 Warning: If price breaks below 3,099.26, expect further downside!

Trade Idea: XAUUSD (Gold 15m Chart)Trade Idea: XAUUSD (Gold 15m Chart)

Price is holding above the short-term FVG and showing bullish intent after reacting from a higher timeframe zone. A continuation move is likely if this zone holds, targeting the next premium zone above.

Bias: Bullish

Context: Market structure is bullish; price is building a base for a potential expansion toward the upper inefficiency. A clean liquidity run is expected toward the premium zone.

Wait for confirmation before entry. Trade with proper risk management.

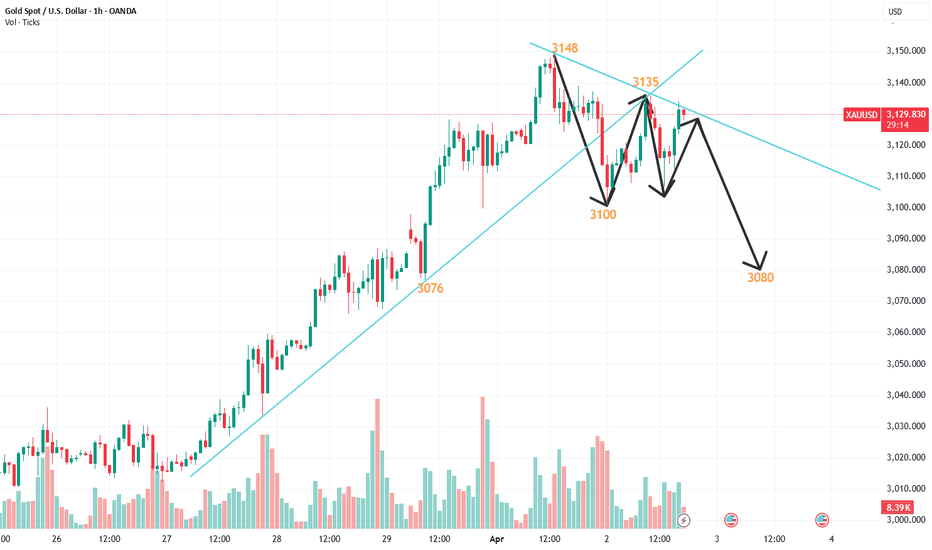

Online real-time guidance on gold trendsGold went up in the early trading, but the price fell again after rising to 3135. The fluctuation range of European trading narrowed. ADP employment data exceeded expectations. The market failed to break out of the trend. The current market is in the range of 3135-3109. The market is waiting for the details of the reciprocal tariffs and industry-specific tariffs to be announced at 3 am. The tariff policy announced by Trump is expected to have an adverse impact on the global economy, especially the United States. The current structure of gold is still bullish. After the correction, continue to go long at the key support level.

At the 4-hour level, the current market is shrinking and oscillating at a high level. The K-line is running above the middle track, and the oscillating and strong trend is maintained above the middle track. Focus on the 3100 support break. Only when it breaks below 3100 will the downward space be opened. There can be more at 3080-3060 below, and only when it stands above 3135 can it further hit a new high. Before the data, continue to see range oscillation, the small range is 3110-3135, and the large range is 3100-3150. In the short term, you can quickly enter and exit in the small range with high altitude and low long.

Gold market trend analysisGold risk aversion pushed up gold prices, but the bulls failed to continue, and gold prices fell after rising. From a technical perspective, the 4-hour gold price remained above the moving average, and the bullish trend remained unchanged. Structurally, the rise in gold prices was symmetrical in time and space, and the early decline was in line with expectations. The hourly chart showed a weak bearish signal and diverged. The upper resistance is currently at 3137-3141, and the lower support is at 3111-3106. In terms of operation, I suggest that the callback is mainly long, and the rebound is supplemented by high short.

Operation strategy 1: It is recommended to buy at 3105-3100, stop loss at 3092, and the target is 3130-3150.

Operation strategy 2: It is recommended to sell at 3139-3144, stop loss at 3150, and the target is 3120-3105.

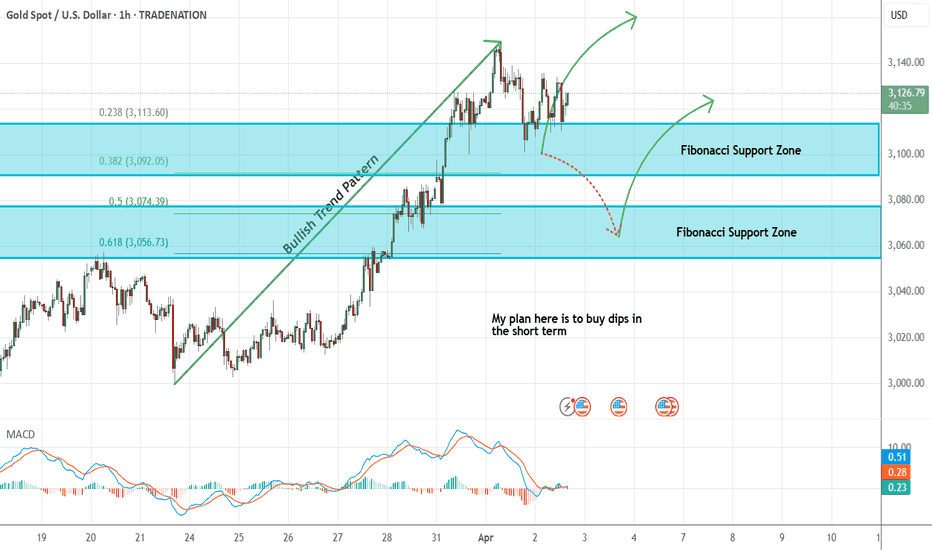

Gold - Looking To Buy Dips In The Short TermH1 - Bullish trend pattern in the form of higher highs, higher lows structure

Strong bullish momentum

Expecting retraces and further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD: May fall below 3100So far, gold has continued to fluctuate in the 3110-3136 range. Although the candle chart has many long lower shadows, the high point is moving down. If this trend is not broken, the probability of falling below 3100 today is very high, so when trading, everyone must be cautious. Personally, I suggest selling as the main method.

Gold market analysis strategyTechnical analysis of gold: From the market point of view, the trend has not changed. The negative line of the upper shadow of the single K line in the daily chart appears at a high level, which is a turning point. Whether a reversal can occur today will verify the validity of this K line. This wave of rise is caused by fundamentals and the atmosphere of the entire market. However, there is never a market that only rises and never falls. In other words, we do not go to dead short or dead long. Shorts only enter the market at important points. From a structural point of view, the rise has entered a symmetrical space in terms of time and span. It fell below the upper line in four hours, and the early high and fall were the same as expected. The structure has become weak short. The hourly chart is close to the upper line area and is currently running in a divergence, so the overall European market is still high and unchanged. It seems that gold bulls have not been able to go to a higher level with the support of the news, so gold bears may have opportunities at any time; gold is directly short at the current price of 3128 in the afternoon!

Gold fell below yesterday's low of 3124 support as expected, and came all the way to 3100. I have been emphasizing that gold will have a big retracement, but the current decline is far from enough. Gold will continue to fall. The 1-hour moving average of gold has begun to turn downward, and gold may open up room for decline. The 1-hour moving average of gold has now formed a head and shoulders top structure. Rebounds will continue to be short. The market has weakened. Gold has not yet broken through the 3100 mark for the first time, but the direction of the market has turned short. If it does not break for the first time, I believe there will be a second attempt in the future. Then the bearish situation has been finalized. Long positions must be put aside first, because it is a bearish market now. Gold rebounds and adjustments can continue to be short. Pay attention to the 3128 line of pressure above. You can go short directly when it rebounds! On the whole, today's short-term operation strategy for gold is to focus on rebound shorting and supplemented by callback long positions. The short-term focus on the upper side is the 3138-3130 line of resistance, and the short-term focus on the lower side is the 3100-3083 line of support.

Short order strategy:

Strategy 1: When gold rebounds around 3128-3130, short (buy short) 20% of the position in batches, stop loss 6 points, target around 3110-3100, break to look at 3085

Long order strategy:

Strategy 2: When gold falls back to around 3083-3085, buy (buy up) 20% of the position in batches, stop loss 6 points, target around 3100-3110, break to 3120

Gold Under Pressure In Head And Shoulders PatternGold's 1-hour moving average has gradually begun to show signs of turning, and gold's 1-hour moving average is also in the form of a head and shoulders. Even if it pulls back and forth again, gold will continue to fluctuate in a wide range. There are more data in the second half of this week, and there is news about important events, so gold still needs to wait for news or data to take gold out of a new direction.

Trading ideas: short gold around 3130, sl: 3140, tp: 3115

The above is purely a personal opinion sharing. Investment involves risks and you are responsible for your profits and losses.

4/2 Gold Trading StrategiesAfter yesterday's upward movement, gold experienced a deeper pullback, testing the 3100 area before rebounding to around 3120. However, based on technical indicators, the bullish outlook remains uncertain.

The key resistance to watch is around 3125—if the price fails to break through, we shouldn't expect higher levels today. In that case, the main trading direction will be short positions, with a possible drop to 3086 before tomorrow’s data release.

However, if 3125 resistance is broken and sustained, bulls may attempt another rally towards 3138-3150. On the bearish side, support in the 3103-3096 region is crucial.

Trading Recommendations:

📌 Main Trades:

Buy in the 3098-3086 range

Sell in the 3138-3148 range

📌 Short-Term Scalping:

Sell in the 3124-3131 range

Buy in the 3109-3103 range

4/1 Gold Analysis & Trading SignalsThe combination of fundamental influences and technical patterns led to a sharp surge in gold prices after the market opened yesterday. The upward momentum only slowed during the New York session, but prices remained above 3100. However, after this rally, the technical setup is not particularly favorable for bulls. That said, if fundamental factors continue to support the market, any technical pullback could provide another buying opportunity for bulls.

Key Considerations:

🔸 Besides technical factors, we need to monitor geopolitical tensions—if the situation eases, demand for gold as a safe haven could decrease.

🔸 If tensions escalate further, gold is likely to rise, making it unwise to blindly short the top. Instead, we should adjust our trading strategy based on market developments while using technical patterns for entry and exit points.

🔸 If a pullback occurs, support is seen around 3109.

🔸 If the price continues upward, given current market conditions, a single rally is unlikely to exceed $30, so the first resistance zone is estimated at 3136-3145.

Trading Strategy for Today:

📈 Buy in the 3111-3101 range

📉 Sell in the 3135-3145 range

Stay flexible, follow the market closely, and adjust strategies accordingly. Let me know if you need further insights!

GOLD-Sell in the 3128-3138 rangeThe buy orders placed at 3121-3124 yesterday successfully reached the take-profit zone of 3132-3138 today, after which the price also entered the short-selling zone of 3135-3145, leading to another profitable trade.

As of now, the 3124 support remains intact, but bullish momentum has significantly weakened. Without further fundamental catalysts, a technical-based approach suggests prioritizing short positions, as the recent surge of over $130 makes a technical correction increasingly imminent.

Trading Strategy for Today:

📉 Sell in the 3128-3138 range

📈 Buy in the 3103-3093 range

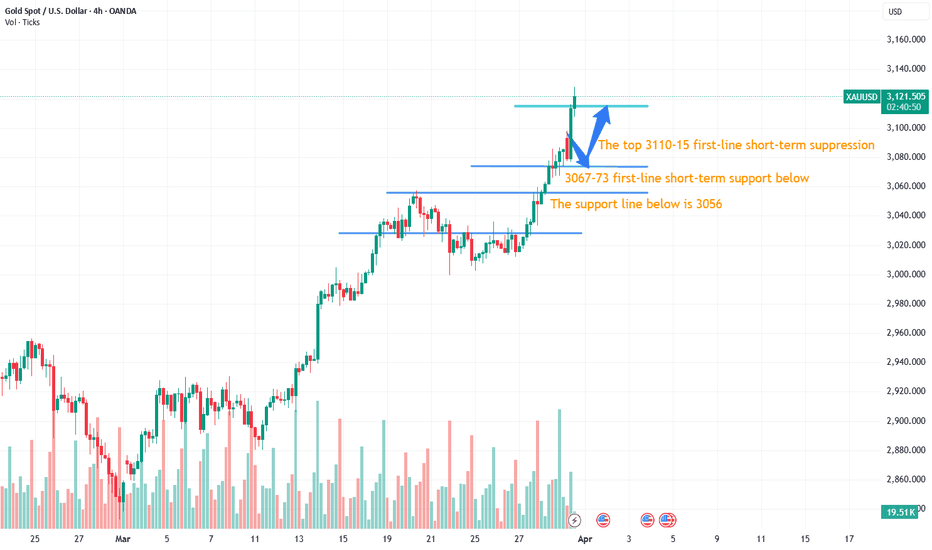

Gold intraday trading strategyGold continued to rise strongly on Friday, breaking the high and closing. The U.S. gold price stabilized at the 3067 mark and continued to rise, and finally closed back above 3085, almost the highest point of the day. The daily K-line closed with two consecutive positive days of shock and breaking the high. The overall gold price firmly stood above the 3050 mark, continuing the strong unilateral rhythm of the bulls. However, after the opening of today, the gold price continued to accelerate and pierced the 3097 mark, and then fell back under pressure and adjusted rapidly. In the short term, the gold price is expected to usher in repeated long and short fluctuations at the 3100 integer mark. Don’t chase more near 3100 at present. Although it rebounded near 3097 at the opening and then rebounded after touching the lowest level of 3077, this wave of technical adjustments is far from reaching the target. We continue to maintain the idea of retreating and going long.

From the 4-hour analysis, the support below is around 3065-73, with a focus on the 3056 first-line support below. The short-term pressure above is 3100-3106. Relying on this range during the day, the main tone of the high-altitude low-multiple cycle remains unchanged.

Gold operation strategy:

1. Buy when gold falls back to 3065-3073, add more when it falls back to 3056, stop loss at 3045, target at 3105-3108, continue to hold if it breaks

Gold 100% Profit SignalThis week, multiple factors intertwined to affect the gold price. The tariff policy was settled on Wednesday, and the ADP data also caused market turmoil; the non-farm data on Friday will test the market again, with risks and opportunities coexisting. Against this background, gold has shown its charm as a safe-haven asset. The decline of the US economy, the intensification of the US debt crisis, and the geopolitical tensions in the Middle East have all provided impetus for the rise in gold prices.

From a technical perspective, gold fell back quickly after opening high in the morning, but then stabilized and rebounded. The weekly, daily and 4-hour lines all showed a bullish trend, with strong upward momentum. On the hourly chart, gold maintained a good upward trend, with previous highs and lows rising continuously, and bulls dominated. The current upper resistance is in the 3135-3138 range, and the lower support is in the 3111-3107 range. In terms of operation, it is recommended to do more on the callback and supplement it with high rebound.

Operation strategy 1: It is recommended to buy at 3105-3100, stop loss at 3093, and the target is 3120-3140.

Operation strategy 2: It is recommended to sell at 3130-3135, stop loss at 3142, and the target is 3110-3100.

Gold continues to move lower today!Gold is running fast in small steps above 3100, and the strong bull market has been rising again and again, with no intention of stopping. Yesterday, it opened directly and broke the high. The European market was under pressure and corrected sideways at 3130, and the US market bottomed out and rebounded to close near the high point.

This kind of strong market closed strongly at a high level, especially the market that rose in the early morning. In any case, there must be more in the morning of the second day, and generally there will be continued rises. The same time cycle is true on Monday.

At present, gold bulls are rising strongly, and you can just go with the trend and be bullish. Don't guess the top easily. There may be a small correction in the process of rising, but it does not change the overall upward trend. It mostly appears in the form of bottoming out and rebounding, which is also a kind of correction.

The real big top needs a certain amount of time to brew, or there is an obvious top signal. If there is a large-scale high-rise fall and close with a large cross, you should pay attention; or if there is a large decline, it is not appropriate to continue to be bullish.

For now, gold can still continue to see more. After all, there is no previous high to refer to, so the risk area can only be judged by the increase.

For gold today, the price rose from 3120 to 3148 in the morning, an increase of nearly 30 US dollars. So the afternoon adjustment continues to be bullish, focusing on the 3133 first-line support, the watershed is at 3120, and the upper pressure is 3150-3160! If the European session fluctuates sideways without rising, beware of the bottoming out and rebounding at night, repeating yesterday's trend.

In terms of trading, a total of four orders were operated yesterday, and one order was loss-making:

1. The 3073 long market was not given a slight difference, so I directly aggressively long at 3081, and stopped profit at 3110 after reducing positions at 3100;

2. After the rise, there will be a correction in the afternoon, and the stop loss at 3120 is 3122;

3. The European session continued to be lightly short at 3124, and the target position of 3100 was reached after reducing positions at 3110;

4. There were many orders at 3100, and the stop profit was 3124 before the break.

GOLD: Potential RisksIf the price reaches the 3136-3148 range, there is no need to hesitate, just sell. This is the gold trading strategy for today provided to you before yesterday's closing. I wonder if any friends have grasped this profit?

After getting support near 3125, the price rebounded again. It is still in the rising stage. The resistance continues to focus on the vicinity of 3148.

Here is a reminder for everyone: During the trading process, the technical pattern of the 2H and above cycle level has a turning point. This is not a joke, so everyone must be cautious when chasing highs.

Even if there is news supporting the market now, news is something we cannot control. Once there is news of easing the situation, the risk aversion of gold will subside, and the decline will definitely not be small.

So while we follow the trend, we must also learn to think against the trend!

#XAUUSD: Smaller Time Frame With More Accurate Entry Areas! We currently have several active ideas in the Gold analysis section. However, we would like to share a comprehensive chart analysis that clearly demonstrates a market trend and potential entry points. The analysis identifies two entry types: “safe” and “risky.” A “safe” entry is only valid if the “risky” entry is invalidated. You may choose to take either entry if it aligns with your trading bias and chart analysis.

If you find this analysis valuable, please consider liking and commenting on it, as this feedback will help us post more detailed analyses in the future.

As always, we express our sincere gratitude for your unwavering support.

Team Setupsfx_

Another Good Trade for GOLD (XAUUSD) Today

My overall forecast for this week is that Gold will do classic expansion week where monday will go up then tuesday will most likely go up to sweep mondays high then do the reversal so that wednesday and thursday will be expansion going down and target the daily imbalances below. For today i was expecting a bullish push upwards for GOLD before it will reverse so i followed my steps by combining my multi timeframe analysis. From daily for the overall bias to 1H for that confirmation and alignment then 5m for my entry timeframe. Once i saw those 3 timeframes align with combination confirmation that i saw with the price action then i entered the trade. My original target was 1:3R but then i saw the weakness after price came to my 1:2R level so i manually pulled out with a 1:2R gain for today....

You can't make money from such a simple market?After gold stepped back, it hit a new high again. Gold bulls continued to be strong. Gold broke through 3127 again, so the bulls are even better.

The gold 1-hour moving average continues to cross upwards and diverges. The support of the gold 1-hour moving average has moved up to 3096, but gold is now far away from the moving average, so wait patiently for adjustments and then step back to continue to buy. The gold 1-hour lowest yesterday fell to around 3100 and then stabilized again, so today gold will continue to buy on dips above 3100.

Trading ideas for reference:

Go long near gold 3110, sl: 3100, tp: 3130

3/31 Gold Trading StrategiesThe five-wave upward movement in gold has been completed. Next, we expect a period of consolidation around 3130, forming a short-term top before a potential pullback. However, during this consolidation phase, there is a possibility of a price surge, though the probability is low.

Trading Suggestions:

For conservative traders: Avoid rushing into positions. It’s better to wait for a pullback and the confirmation of a secondary top before entering trades.

For aggressive traders: You may enter at the current price, but be cautious with your position sizing and leave room for potential additions.

Based on the magnitude of the previous upward movement, the expected retracement zone is around 3110-3096, where a minor support level may form.

Trading Strategy:

📉 Sell in the 3121-3131 range

📈 Buy in the 3105-3090 range

Trade carefully