Xauusdbuy

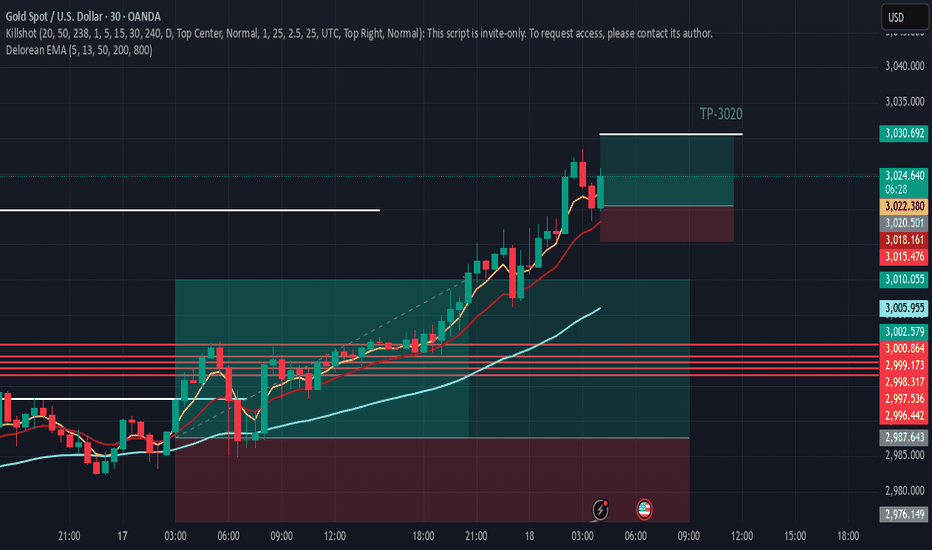

Analysis of Trading Strategies for the XAUUSD 1 - Hour ChartRecently, in the 1 - hour chart of XAU/USD, the upward channel has been broken downward, indicating that the short - term upward trend has temporarily stalled.

Currently, the price is in the buyer zone, which has certain support. If obvious signs of price stabilization emerge, such as formation of a bullish K - line combination, one can attempt to place long positions, and set the stop - loss at the key support level below this zone.

If the price rebounds to the seller zone and is blocked, short positions can be considered, with the stop - loss set above the zone.

XAUUSD

buy@3020-3030

tp:3040-3045-3050

sell@3040-3050

tp:3030-3020

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAUUSD Today's strategyThe gold price fluctuates within the range we have marked. In the short term, both long and short positions are feasible. However, you must pay attention to setting the stop-loss level and avoid taking on excessive risks

Pay attention to when the upward pressure range will be broken through. Also, keep an eye on the 3010-3020 USD range on the downside. If this range is repeatedly tested, then there might be a short-term pullback to 3000 USD

Today's xauusd trading strategy

buy@3010-3020

SL:3005

tp:3040-3050

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses

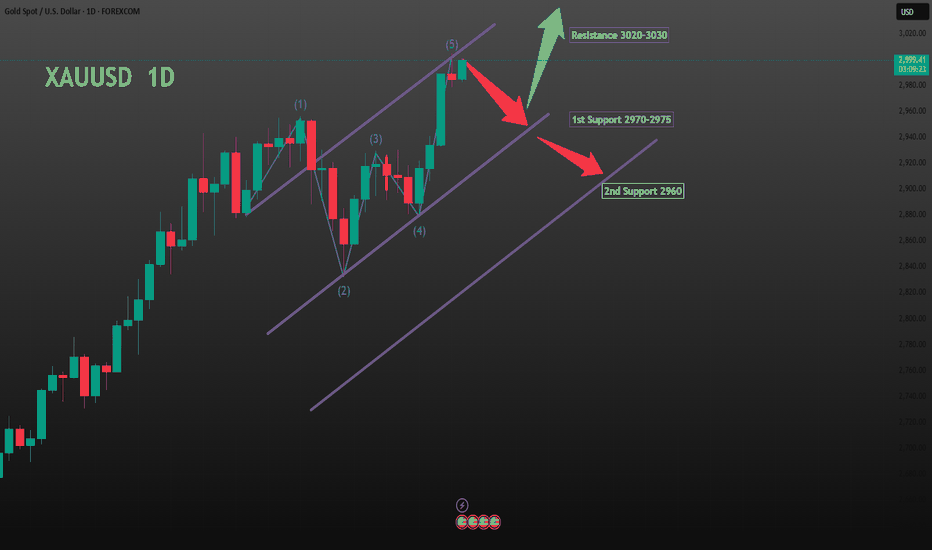

XAUUSD: Profit-Taking and Trading StrategiesThe recent substantial rise in gold prices has prompted some investors to take profits, leading to a subsequent price pullback.

Additionally, the Federal Reserve has maintained the benchmark interest rate within the 4.25%-4.50% range. Projections suggest two rate cuts are likely in 2025.

The Fed's interest rate decision has once again disappointed the bears. Contrary to expectations of a decline, gold has surged to a new all-time high of $3056.

XAUUSD

buy@3035-3040

tp:3050-3055-3060

sell@3060-3070

tp:3055-3050-3045

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

XAUUSD Today's strategyAccording to the content of the FOMC meeting of the Federal Reserve, the Fed kept the target range of the federal funds rate unchanged at 4.25% - 4.5%. The market had already had certain expectations for this, which to a certain extent provided a stable environment for the gold price and prevented the gold price from being pressured due to a significant strengthening of the US dollar.

From a technical perspective, the current bullish structure of gold is obvious. However, indicators show that a divergence has emerged after the continuous rise, and the price has entered a risky area for bulls after reaching $3040. Nevertheless, in the current market environment, the bullish trend remains relatively strong. Without a clear reversal signal, the gold price may continue to follow the upward trend.

Today's xauusd trading strategy

buy@3025-3030

SL:3020

tp:3050-3060

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses.

XAU/USD Bullish Breakout Setup – Gold Price Analysis🔍 Key Observations:

🟢 Support Zone:

H1 Support Area 📉: $3,036.67 - $3,044

Price is currently testing this zone (🔵).

🔴 Resistance Level:

$3,053.45 (🛑 Immediate Barrier)

📈 Trade Setup:

✅ Potential Buy Entry near support (🟢)

🎯 Target Zone: $3,080 - $3,090 (📍🚀)

❌ Stop-loss: Below $3,036.67 (⚠️🔴)

📊 Price Action:

If support holds 🟩, price could move UP (⬆️) toward the target 🎯

If it breaks down ⬇️, price may fall further (⚠️📉).

📌 Conclusion:

Bullish 📈 if the price respects support (🟢)

Bearish 📉 if it breaks below stop-loss (⚠️).

Gold (XAU/USD) Trade Setup – Bullish Momentum Ahead?Gold Spot (XAU/USD) 1H Chart Analysis

🔹 Entry Point: 3,026.90 🔵

🔹 Stop Loss: 3,019.58 - 3,019.07 ❌ (Risk Zone)

🔹 Take Profit Levels:

TP1: 3,034.64 🎯

TP2: 3,041.72 🚀

Final Target: 3,053.04 🏆

📈 Trend Analysis:

🔸 The market has been in a strong uptrend 📈 before pulling back to the entry zone.

🔸 The trade setup suggests a buy (long) position, aiming for higher levels.

🔸 If momentum continues, price may reach TP1 → TP2 → Final Target.

⚠️ Risk-Reward Ratio:

✅ Potential Reward: ~27 points 🏅

❌ Risk: ~7-8 points 🚨

💰 Risk-to-Reward Ratio: 1:3 (Favorable setup)

🔻 Risk Factor:

If price drops below 3,019.58, the trade will hit stop loss and may indicate a trend reversal 🔄.

📢 Conclusion:

Bullish trade setup looking promising if price holds above the entry point and moves towards TP targets! 🚀🔥

Short - selling Strategy for XAUUSDGold has been on a sustained upward run, yet the bullish momentum is largely spent. Thus, extreme prudence is of utmost importance when contemplating long positions.

After surging to approximately 3045, the gold price plummeted sharply and then rebounded vigorously. Nevertheless, it fell short of breaking through the 3045 level in one attempt. If it fails to break through rapidly, a significant correction is highly likely.

XAUUSD

sell@3030-3040

tp:3015-3020

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

XAUUSD Today's strategyToday, gold rose again to its latest high of $3,045, an increase of $165 from last week's lowest point of $2,880. Such an increase is rare in the history of gold, indicating that the recent geopolitical factors and international situation have caused market risk aversion to heat up again.

Investors are closely awaiting the Federal Reserve's policy statement and the press conference of Federal Reserve Chairperson Jerome Powell. If the Federal Reserve sends a hawkish signal, it may have some suppression on the price of gold. If the policy is more dovish or the economic outlook is concerned, the price of gold is expected to rise further.

Today's xauusd trading strategy

sell@3040-3050

SL:3055

tp:3025-3030

There are risks in trading. If you are not sure about the timing, it is best to leave me a message. This will better confirm the timing of the transaction, It can also better expand profits and reduce losses.

XAUUSD trading strategy: Keep going longThe 1-hour moving average of gold is still in a bullish arrangement with a golden cross pointing upwards, and it is still diverging upwards without any signs of turning.

Therefore, the bullish momentum of gold remains. The support level of gold on the 4-hour chart is in the 3028 area. Today's trading strategy is to go long directly when the price retracts to the 3028 area.

XAUUSD trading strategy:

buy@3028

TP:3045-3050

I always firmly believe that profit is the sole criterion for measuring strength. I will share accurate trading signals every day. Follow my lead and wealth will surely come rolling in. Click on my profile for your guide

The current strategy for XAUUSDTraders can seize a high-reward trading opportunity with an attractive risk-to-reward ratio by patiently waiting for the price to reach the golden pocket and support zone. As with all trading scenarios, implementing robust risk management strategies is essential to effectively navigate inevitable market volatility.

XAUUSD

buy@3025-3030

tp:3040-3050

sell@3035-3045

tp:3005-3015

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates

The Current Trading Strategy for GoldCurrently, AXUUSD is oscillating in the vicinity of 3030. A thorough market appraisal uncovers a distinct bullish impetus. Amid the global economic uncertainties, such as trade disputes and erratic monetary policies, market participants are increasingly flocking to gold as a haven asset, driving the upward trajectory of AXUUSD. Technically, pivotal indicators such as moving averages and the Relative Strength Index (RSI) suggest the sustenance of the ongoing uptrend.

For investors, a judicious course of action is to establish a long position of suitable size when the price retraces to the 3025 - 3030 support band, with a profit - taking target set at 3040 - 3050. In light of the market's inherent volatility, it is essential to closely monitor geopolitical events and key economic data in order to adeptly adjust trading strategies.

XAUUSD

buy@3025-3030

tp:3040-3050

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

XAUUSD Continue to Long or Start to Short?Gold witnessed a substantial upward surge today, showing no chance of a pullback. When the market becomes overly fervent, caution is necessary as gold may stage its final speculative spree.

Gold trading strategy:

sell @:3030-3034

buy @:3000-3005,2983-2987

My current gold trading strategies and signals have been consistently accurate. If you also want free, precise signals, you can visit my profile to access them.

#XAUUSD is Poised For Further Gains Gold is still on the move and is currently sitting around 3021.44 at the time of this analysis.

Geopolitical events continue to cause havoc in the middle east, While Europe faces economical uncertainties due to monetrary policy and trade agreements pushing #GOLD to new highs. I expect gold to continue on its path to 3030.

Today's Strategy Analysis for XAUUSDThe current global landscape is highly complex, significantly impacting XAUUSD dynamics. Recently, the unpredictable tariff policies of the United States have heightened tensions in international trade, leading to a surge in economic uncertainty. Simultaneously, ongoing instability in the Middle East and the lack of progress in Russia-Ukraine peace negotiations are amplifying risk aversion in financial markets.

From a fundamental perspective, trade tensions have severely disrupted global economic growth. In response, investors are increasingly turning to safe-haven assets, driving the demand for gold to unprecedented levels.

XAUUSD

buy@2995-2985

tp:3010-3015

sell@3010-3020

tp:2995-3000

Traders, if this concept fits your style or you have insights, comment! I'm keen to hear. For those pursuing financial goals, click below for daily strategy updates.

For those who are seeking professional guidance in trading trend analysis, strategy formulation, and risk management, please click below to get the daily strategy updates.

XAUUSD Today's strategyYesterday, the price of gold fluctuated within our marked range, so in the short term, both bulls and bears are feasible. However, you must be careful to set the SL level and not take excessive risks.

Today's xauusd trading strategy

buy@2985-2990

SL:2980

tp:3000-3010

sell@3010-3000

SL:3015

tp:2990-2985

If you don't know how to do it, you can refer to my transaction.

XAUUSD Analysis of TodayToday, the price of gold has been fluctuating between the support and resistance levels I analyzed.

Therefore, in the short term, both long and short positions are viable. However, you must pay attention to setting the SL level and must not take excessive risks.

XAUUSD

🎁 Buy@2983 - 2985

🎁 SL 2980

🎁 TP 2993 - 2995

🎁 Sell@3000 - 2997

🎁 SL 3002

🎁 TP 2988 - 2985

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad

If you also aspire to achieve financial freedom,Follow the link below to get my daily strategy updates

Can gold continue to go long?

The 1-hour moving average of gold continues to spread upward, and the strength of gold bulls is still relatively strong. Gold's moving average support has now moved up to around 2983, and today's low for gold is around 2982, so gold still forms a strong support around here. I think gold can be shorted first, and then it can continue to go long if gold falls back around 2985