I say nothing , you say me any thing about 📌 **Gold Spot (XAU/USD) – 30m | 2h | Smart Money Perspective**

🔍 After weeks of precision tracking and structural validation, price has now tapped the **Right Shoulder** of a clean *Reverse Head & Shoulders* formation — with absolute respect to structure, liquidity, and OB zones.

💥 This wasn't just a random bounce.

It was:

- A confirmation of **previous BOS & CHoCH**

- A retest of **TLQ/ILQ liquidity zones**

- A reaction from the *Extreme OB* within a compression channel

- And a final push fueled by **inefficiency fills** on the left

🎯 The bullish intent remains strong, and if momentum follows through, we're looking at:

- **TP1** → 3345–3355 (minor OB & void fill)

- **TP2** → 3375–3390 (liquidity sweep target)

- **TP3** → 3420+ (range expansion goal)

🧠 This analysis has not just been correct.

It’s been **respected by the market.**

I take pride in every reaction the chart gives us when we respect the language of price, structure, and timing.

There’s no shortcut here — just observation, logic, and discipline.

We don’t chase the trend. We wait for it to **bow in confirmation**.

Like it just did.

— *Mohsen Mozafari Nejad* 🧭

#SmartMoney #GoldAnalysis #XAUUSD #TradingView #MarketStructure #BOS #OB #MSU #ReverseHeadAndShoulders #Forex #TechnicalAnalysis

Xauusdforecast

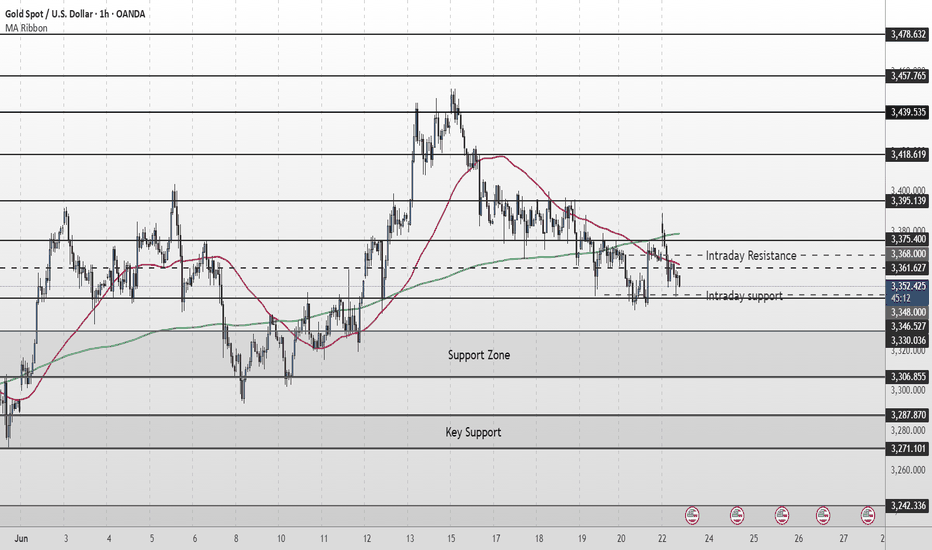

Gold Short Term OutlookYesterday, we highlighted that gold had reclaimed the 200MA and that the $3,327 support level needed to hold for further upside. Since then, price has steadily climbed and is now testing the $3,364 resistance — a level that also aligns with an unfilled gap.

Price action remains bullish for now, with price holding firmly above both the 50MA and 200MA.

If buyers manage to clear and hold above $3,364, we could see further upside toward $3,383 and $3,400, with possible extension into $3,418.

However, if price fails to break above $3,364, we may see a pullback into the $3,335–$3,327 zone. A break below there could open the door for a deeper drop into $3,298 or even $3,270.

📌 Key Levels to Watch:

Resistance:

$3,364 • $3,383 • $3,400 • $3,418

Support:

$3,352 •$3,335 - $3,327 • $3,298 • $3,270

🧠 Fundamental Focus:

📌 ADP Non-Farm Employment Change

📌 Initial Jobless Claims

📌 ISM Services PMI

📌 ISM Non-Manufacturing PMI

⚠️ With multiple red folder events on the calendar, expect elevated intraday volatility. Manage risk accordingly.

Mozafari Nejad ### Multi-Timeframe Analysis: 15min + 30min + 2# XAU/USD | Gold Market Outlook by Mohsen Mozafari Nejad

### Multi-Timeframe Analysis: 15min + 30min + 2h | July 2–3, 2025

---

## 🔍 Technical Overview:

| Timeframe | Structure | Efficiency | Context |

|-----------|-----------|------------|---------|

| 15min | Bullish ✅ | Efficient ✅ | Reverse H&S complete – price entering neckline zone |

| 30min | Bullish ✅ | Inefficient ❌ | Clean BOS – ready for potential continuation |

| 2H | Bullish ✅ | Inefficient ❌ | HL confirmed – clear bullish delivery range ahead |

---

## 🧠 Key Insights:

- **Left Shoulder - Head - Right Shoulder** clearly visible and now validated with neckline break

- Price is reacting from **last TLQ + ILQ zones** with MSU

- Strong **liquidity gap** above 3,380–3,405 likely to be targeted

- **Highs around 3,420–3,440** may act as liquidity magnet if clean break happens

- **BOS and CHoCH** confirmed across all LTFs — strong bullish intent

- Structure remains **bullish** as long as 3,312–3,320 HL holds

---

## 🎯 Price Zones to Watch:

| Zone | Action |

|--------------|----------------|

| 3,335–3,340 | OB Flip Support / Demand (Retest Possible) |

| 3,368–3,375 | Reaction Zone / Short-Term Take Profit |

| 3,404–3,420 | Major Liquidity Above / SH Grab |

| 3,428–3,440+ | Stop-Hunt Potential for Final Exit |

---

## 📌 Trade Scenarios:

### 🟢 Long Setup

- **Entry:** 3,340–3,348 (OB retest or continuation)

- **SL:** below 3,328

- **TP1:** 3,375

- **TP2:** 3,400

- **TP3:** 3,420+

### 🔴 Caution for Short

Only valid if price shows **CHoCH + strong rejection** from above 3,420–3,440.

Otherwise, trend continuation is dominant.

---

## 🧭 Summary:

> Gold continues its bullish structure in all LTFs.

> Reverse H&S has broken neckline cleanly.

> Momentum + inefficiency zones above = clear drive to liquidity.

> Patience is key – reentry on OB retest = high R/R setup.

---

🖋️ Prepared by: **Mohsen Mozafari Nejad**

*Smart Money | Liquidity Zones | Order Blocks | MSU/MSD Framework*

Gold Short Term OutlookYesterday, we saw gold reclaim the 200MA and push into the $3,352 resistance. Price remains supported above the $3,327 level, keeping the bullish structure intact for now.

As long as price holds above $3,327, bulls remain in control, and a breakout above $3,352 could open the path toward $3,364 and $3,383.

However, failure to hold above $3,327 may lead to another retest of $3,298, with deeper downside toward $3,270-$3,41 support zone if that level gives out.

📌 Key Levels to Watch:

Resistance:

$3,352 • $3,364 • $3,383 • $3,400

Support:

$3,327 • $3,298 • $3,270 • $3,241

Below of last update of reverse head and shoulder post XAU/USD | 30min | by Mohsen Mozafari Nejad

🔸 **Instrument:** Gold / USD (XAU/USD)

🔸 **Timeframe:** 30min

🔸 **Methodology:** Smart Money Concepts (SMC) + Liquidity + OB + Market Structure

🔸 **Focus:** New Monthly Open Setup

🔍 Market Context:

---

## 🧠 Technical Breakdown:

1. **Strong recovery** after clearing deep liquidity sweep (Head zone)

2. **Bullish BOS** structure confirmed on LTF → Multiple HH and HL formed

3. Price now testing **Key Supply/OB zone at 3300–3315**

4. Above this zone lies a **Strong High (SH) around 3,350**, a potential liquidity magnet

5. Overall bias is bullish unless strong rejection appears from upper OB

---

## 📌 Trade Plan:

| Position | Entry Confirmation Zone | Stop Loss (SL) | Take Profit (TP) |

|----------|--------------------------|----------------|------------------|

|

| Short (scalp only) | Bearish reaction from 3,345–3,350 | Above 3,353 | TP1: 3,310 / TP2: 3,290 |

---

## ⚠️ Risk Factors to Watch:

- 🔺 High-impact USD news (July 1st releases: Manufacturing PMI / employment preview)

- 🔺 Overextension above supply zone without support → trap risk

- 🔺 Bull trap risk if price spikes above 3,340 then sharply reverses

---

## ✅ Summary:

> **Start of July** could fuel volatility and directional momentum.

> The structure is clearly bullish short-term, but upper liquidity zones remain **highly reactive**.

> Smart traders will wait for reaction at the 3,340–3,350 SH zone before overcommitting.

**Structure:** 🔴 bearish momentum

**Efficiency:** ✅ Clean

**Liquidity:** 🔺 Above SH & Below recent HL

📊 Prepared by: **Mohsen Mozafari Nejad**

Gold Short Term OutlookYesterday, we noted that gold was attempting a recovery from the Support Zone but remained below both the 50 and 200 MAs, meaning bearish pressure was still intact.

Since then, price has broken and held above $3,298, and is now trading around $3,330, just beneath the 200MA.

This marks a shift in short-term momentum — gold has reclaimed the 50MA and is now challenging the 200MA.

If bulls manage to break and hold above the $3,327 resistance, it could open the path toward $3,352 - $3,364 and potentially higher resistance zones.

However, if price rejects the 200MA and fails to hold above $3,327, we may see a pullback toward $3,298 or deeper into $3,270, where bulls could look to reload.

📌 Key Levels to Watch:

Resistance:

$3,327 • $3,364 • $3,383 • $3,400

Support:

$3,298 • $3,270 • $3,241

🧠 Fundamental Focus:

📌 Fed Chair Powell speaks today at the ECB Forum in Portugal.

Markets will closely watch for any shift in tone on inflation or rate outlook. His comments may influence USD direction and gold volatility.

📌 ISM Manufacturing PMI – a key gauge of economic activity. A strong print may pressure gold; a weak reading could support it.

📌 JOLTS Job Openings – offers insight into labor market strength. A tighter market could delay rate cuts and weigh on gold.

With multiple risk events packed into today, expect increased volatility across the board.

Gold Market Outlook – 1st of July | XAU/USD | 30min | by Mohsen # Gold Market Outlook – 1st of July | XAU/USD | 30min | by Mohsen Mozafari Nejad

🔸 **Instrument:** Gold Spot / USD (XAU/USD)

🔸 **Timeframe:** 30min

🔸 **Methodology:** Smart Money Concepts (SMC) + Liquidity + OB + Market Structure

🔸 **Focus:** New Monthly Open Setup

---

## 🔍 Market Context:

- **Structure:** Bullish on LTF (MSU)

- **Efficiency:** ✅ Clean & Efficient Delivery

- **Recent Activity:** Reverse H&S completed + double BOS + CHoCH confirmed

- **Price Level:** Trading near key Supply zone (3300–3315)

- **Monthly Context:** July begins with bullish momentum & previous session showed aggressive buy-side pressure

---

## 🧠 Technical Breakdown:

1. **Strong recovery** after clearing deep liquidity sweep (Head zone)

2. **Bullish BOS** structure confirmed on LTF → Multiple HH and HL formed

3. Price now testing **Key Supply/OB zone at 3300–3315**

4. Above this zone lies a **Strong High (SH) around 3,350**, a potential liquidity magnet

5. Overall bias is bullish unless strong rejection appears from upper OB

---

## 📌 Trade Plan:

| Position | Entry Confirmation Zone | Stop Loss (SL) | Take Profit (TP) |

|----------|--------------------------|----------------|------------------|

| Long | Above 3,303–3,310 (structure hold) | Below 3,294 | TP1: 3,325 / TP2: 3,340 / TP3: 3,348 |

| Short (scalp only) | Bearish reaction from 3,345–3,350 | Above 3,353 | TP1: 3,310 / TP2: 3,290 |

---

## ⚠️ Risk Factors to Watch:

- 🔺 High-impact USD news (July 1st releases: Manufacturing PMI / employment preview)

- 🔺 Overextension above supply zone without support → trap risk

- 🔺 Bull trap risk if price spikes above 3,340 then sharply reverses

---

## ✅ Summary:

> **Start of July** could fuel volatility and directional momentum.

> The structure is clearly bullish short-term, but upper liquidity zones remain **highly reactive**.

> Smart traders will wait for reaction at the 3,340–3,350 SH zone before overcommitting.

**Structure:** 🟢 Bullish

**Trend:** 📈 MSU

**Efficiency:** ✅ Clean

**Liquidity:** 🔺 Above SH & Below recent HL

---

📊 Prepared by: **Mohsen Mozafari Nejad**

Gold Short To Medium Term OutlookGold bounced from the lower Support Zone after briefly breaching $3,270. Price is now attempting a recovery, currently trading near $3,290, but remains below both the 50 EMA and 200 EMA — confirming bearish pressure is still intact.

For bulls to gain momentum, we need to see a clean break and hold above $3,298–$3,327which would open the path toward $3,352 and possibly higher resistance levels like $3,364 and $3,383.

Until then, this move may simply be a short-term pullback within a broader downtrend. If price fails to reclaim $3,327, watch for a drop back toward $3,270, with a deeper correction targeting the $3,241–$3,211 zone.

📌 Key Levels to Watch:

Resistance:

$3,298 • $3,327 • $3,352 • $3,364 • $3,383

Support:

$3,270 • $3,241 • $3,211 • $3,179

🧠 Fundamental Focus:

This week is packed with high-impact events — including Non-Farm Payrolls on Thursday. These could trigger sharp moves in gold, so stay cautious and manage risk wisely.

Gold Short to Medium Term Outlook

Last week, gold bounced from the lower Support Zone after briefly breaching $3,270. Price is now attempting a recovery, currently trading near $3,290, but remains below both the 50 EMA and 200 EMA — confirming bearish pressure is still intact.

For bulls to gain momentum, we need to see a clean break and hold above $3,298–$3,327which would open the path toward $3,352 and possibly higher resistance levels like $3,364 and $3,383.

Until then, this move may simply be a short-term pullback within a broader downtrend. If price fails to reclaim $3,327, watch for a drop back toward $3,270, with a deeper correction targeting the $3,241–$3,211 zone.

📌 Key Levels to Watch:

Resistance:

$3,298 • $3,327 • $3,352 • $3,364 • $3,383

Support:

$3,270 • $3,241 • $3,211 • $3,179

🧠 Fundamental Focus:

This week is packed with high-impact events — including FOMC minutes on Wednesday and Non-Farm Payrolls on Friday. Both events could trigger sharp moves in gold, so stay cautious and manage risk wisely.

Reverse Head & Shoulders Setup | Gold Spot | 15min | by Mohsen M

🔸 **Chart:** Gold Spot / USD (XAU/USD)

🔸 **Timeframe:** 15min

🔸 **Method:** Smart Money Concepts (SMC) + Pattern Recognition

🔸 **Focus:** Reverse H&S, Order Blocks, TLQ, BOS

---

## 🔍 Market Context:

- **Market Structure:** Bearish on higher TF

- **Short-Term Trend:** MSU (Market Structure Up)

- **Efficiency:** ✅ Confirmed — clean price delivery

- **Key Pattern:** Bullish **Inverse Head & Shoulders**

---

## 🧠 Technical Breakdown:

1. **Left Shoulder – Head – Right Shoulder** perfectly forming within a high-value demand zone

2. Price reacted strongly from **Order Block (OB)** + TLQ marked at the bottom wick (Head zone)

3. BOS confirms bullish attempt to shift structure

4. Anticipating neckline break at ~3345 level for further upside

5. Potential resistance and liquidity resting above 3400 (HH region)

---

## 📌 Trading Plan (Pre-London Open / Monday 1:30 AM UTC+3:30):

- **Entry Idea:**

Watch for bullish confirmation after price stabilizes above Right Shoulder zone (~3300–3320)

Or re-entry on a retest of neckline after breakout

- **Stop Loss:**

Below "Head" and OB zone (~3260)

- **Take Profits:**

- TP1: Neckline break zone (~3345)

- TP2: 3400 – Liquidity pool

- TP3: Final HH sweep (~3420+)

---

## ⚠️ Alternate Bearish Case:

> If price breaks below the "Head" zone and OB fails to hold,

> → Expect bearish continuation to the next liquidity zone near **VTA @ 3200**

---

## ✅ Summary:

This is a clean **bullish reversal setup** using SMC logic and a classic H&S pattern:

**OB + TLQ + BOS + Efficient Market + Clear Pattern ➝ High-Probability Setup**

Structure: 🟥 Bearish (macro)

Trend: 🔼 MSU (micro)

Efficiency: ✅ Efficient

Pattern: 🟩 Inverse Head & Shoulders

---

📊 Prepared by: **Mohsen Mozafari Nejad**

Scalping Strategy Using BOS & OB | Gold Spot | by Mohsen MozafarDescription:

> This is a 30-minute scalping setup on Gold Spot (XAU/USD), based on Smart Money Concepts (SMC) — focusing on Break of Structure (BOS) and Order Blocks (OB).

Analysis and strategy are prepared by Mohsen Mozafari Nejad.

---

📊 Market Context:

Current Structure: Bearish

Short-Term Market Structure: MSU (Market Structure Up)

Efficiency: Confirmed (clean price action & response zones)

---

🧠 Technical Highlights:

1. Double BOS confirms recent shifts in momentum

2. TLQ (Top Liquidity Quest) formed after HH (Higher High) and liquidity sweep

3. Key Demand OB identified (labeled A) — valid based on BOS confirmation

4. Expecting a bounce from OB (A) towards (B) as a reaction to unfilled imbalance

5. Potential drop from TLQ zone (B) to (C) if liquidity is fully absorbed

---

🎯 Scalping Plan:

Entry Zone:

Order Block at (A), waiting for CHoCH or bullish price action confirmation

(preferably on lower timeframe like M5)

Stop Loss:

Just below OB (around 3327)

Take Profits:

TP1: Near TLQ / Extreme zone (B)

TP2: Further liquidity grab or possible continuation above previous HH

---

❗ Alternative Bearish Scenario:

If price fails to hold at OB (A) and breaks below 3327 with BOS,

→ short opportunity opens toward new lows at 3314–3310 (labeled C).

---

✅ Summary:

This is a clean scalping setup following SMC principles:

BOS → OB → Liquidity → Reaction

Focus on structure, precision, and quick confirmation signals.

Prepared by:

📌 Mohsen Mozafari Nejad

Gold Short Term OutlookYesterday’s chart analysis played out well.

Price broke above the MA50 and tested the $3,346 resistance zone. However, this zone failed to hold, and gold dropped aggressively toward the $3,306 support.

Once again, price is trending below both the 50 and 200 moving averages, indicating continued bearish pressure.

For now, the $3,306 support is holding. Bulls need to break above $3,330-$3,346 for higher levels to open up.

🔑 Key Levels:

Resistance:

$3,346 • $3,361 • $3,375

Support:

$3,306 • $3,287 • $3,271 • $3,242

Gold Builds Bullish Momentum After $3,294.0 ReboundGold bounced from $3,294.0, forming a double bottom pattern as XAU/USD consolidates near $3,330.0. Stochastic has exited oversold territory, signaling strengthening bullish momentum.

If $3,294.0 holds as support, the uptrend may continue toward the $3,393.0 target.

Gold Short Term OutlookYesterday, we noted that gold needed to close and hold above the $3,330 resistance to open the path toward $3,346 and potentially $3,375.

Since then, price rejected the intraday support and is now trending above the $3,330 level.

Currently, the 50MA is acting as dynamic resistance. A clean break above it could trigger a move toward $3,346 and possibly higher resistance zones.

However, if bullish momentum fades, price may drop back toward the key support area, where buyers could look to step in again.

🔑 Key Levels:

Resistance:

$3,330 • $3,346 • $3,361 • $3,375

Support:

$3,306 • $3,287 • $3,271 • $3,242

XAUUSD Ready bounce back?XAUUSD 3295.00 is an important weekly and daily key level price has just bounced back from the key level with double bottom formation. It is possible for the price to continue to bounce back to daily resistance level?

While was in down trend price has left significant imbalance in the market showing possible uptrend with the filling of FVG.

A buy trade with strong liquidity grab is high probable.

Gold Short Term OutlookGold dipped into the Support Zone but failed to sustain the breakdown below it. After briefly breaking below the zone, price has rebounded and is now attempting a short-term recovery.

However, structure remains bearish, with price trading below both the 50MA and 200MA, signalling continued downside pressure unless momentum shifts.

For bullish momentum to continue, we need to see a clean break and hold above $3,330, which may open the path toward $3,346, then $3,361.

If the move up doesn’t hold, the next reaction is expected near key support.

🔑 Key Levels:

Resistance:

$3,330 • $3,346 • $3,361 • $3,375

Support:

$3,306 • $3,287 • $3,271 • $3,242

📌 Stay patient and wait for confirmation before committing to a direction.

Gold Short Term OutlookYesterday’s chart idea is playing out as analysed.

Gold failed to break above the $3,395 resistance and has now pulled back, currently testing the first support zone — aligned with the 4H 200MA and Daily 50MA.

If this area fails to hold, price is likely to head toward the next key support zone, where we expect a potential reaction.

To resume bullish momentum, we need to see a strong close above $3,346. Key bullish zones remain $3,375 and $3,395.

📌 Key Levels to Watch:

Resistance:

$3,375 • $3,395 • $3,418 • $3,439

Support:

$3,361 • $3,346 • $3,330 / $3,306

$3,287 – Critical demand zone

🧠 Fundamental Focus:

All eyes are on Fed Chair Powell’s testimony today, which may offer clues about the Fed’s rate outlook and inflation stance. Any hint of continued hawkishness could weigh on gold, while dovish commentary may trigger renewed upside interest.

Expect heightened intraday volatility around his remarks — stay cautious.

Gold, Will USA-Iran-Israel conflict affect it? The USA-Iran-Israel conflict can significantly impact gold prices. Gold is a safe-haven asset, so demand often rises during geopolitical tensions, pushing prices up

3406 gonna be first target for me, if it breaks this lvl with huge volume and FVG on 1h+ then most likely we will see ATH in near future

bearish scenario(lest likely) - price breaks down 3340 and close with nice volume and fvg on 1h+ which will open move all the way down to MO

Gold Short Term OutlookGold is currently trading around $3,368, caught between dynamic moving average resistance and an intraday resistance zone.

Price must break and hold above the $3,378 resistance to open the path toward $3,395. A confirmed break above the key $3,395 level could signal the start of the next bullish leg.

However, repeated failure to break above $3,395 — or even $3,378 — may drag gold lower into key support zones.

📌 Key Levels to Watch:

Resistance:

$3,375 • $3,395 • $3,418 • $3,439

Support:

$3,361 • $3,346 • $3,330 / $3,306

$3,287 – Critical demand zone

🧠 Fundamental Insight:

Gold remains supported amid rising geopolitical tensions. Over the weekend, U.S. airstrikes targeted Iranian nuclear sites, escalating concerns over a broader conflict in the Middle East. This has reignited safe-haven demand, with gold catching a bid despite recent technical pullbacks.

Meanwhile, traders are weighing softer U.S. inflation signals against the Fed’s cautious stance. If tensions persist and economic data weakens, gold could benefit from both risk-off flows and increased speculation around potential rate cuts.