Gold Third Scenario , Depend On Breakout , What`s Your Opinion ?Here is the update for the last idea i post for Gold , if we take a look now we will see that he price moving in sideway and still not touch my support , so do yo uthink the price will go up without retest it ? or should we keep the first analysis ?

Xauusdidea

Gold Consolidates Below Key Resistance — Awaiting Breakout from Gold has entered a phase of subdued volatility, currently trading around $3,221/oz. This stands in sharp contrast to the previous week’s triple-digit swings, with recent intraday ranges tightening to under $20 — a sign of market indecision and volatility compression.

From a technical perspective:

$3,245/oz remains a critical resistance level, representing the recent swing high.

Support levels are observed at $3,200, with $3,190 acting as the key bull/bear pivot zone.

🎯 Trading Strategy:

Watch for rejection near $3,245 to consider tactical short positions.

If price retraces and holds above $3,190, look for long opportunities on rebound setups.

In the current range-bound environment, traders are advised to stay patient, avoid overtrading, and wait for a decisive breakout to establish conviction positions.

Strategic Analysis of Gold for the Next WeekOn Friday, the gold price continued its slow upward trend. Subsequently, it experienced a slight pullback, but still maintained an overall upward trend. This indicates that the current sentiment of the bulls is quite high, while the bears are unable to achieve decisive suppression in the short term. Due to the relatively obvious recent trend of fluctuating upward movement, there is still a great deal of uncertainty as to whether the price will continue to rapidly reach a peak. Therefore, for trend trading, one may need to patiently wait for the market to make its own choice.

Judging from the current situation, the gold market still has a strong bullish momentum. Whether it is the market's risk aversion sentiment, the impetus given by economic data to the market expectations of the Federal Reserve's interest rate cuts, or the bullish trend at the technical level, all of these factors provide support for the rise in the price of gold.

In terms of short-term trading ideas for gold, it is still recommended to mainly go long on pullbacks and go short on rebounds as a supplement. For next Monday, focus on the two support levels of 3200 and 3170. If the gold price remains above 3220, it is expected to continue to challenge higher prices. The upper resistance is roughly in the range of 3245 - 3255. If this resistance level can be effectively broken through, the gold price is expected to further reach the range of 3280 - 3300.

XAUUSD trading strategy

buy @ 3205-3215

sl 3195

tp 3230-3240

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

Strategic Analysis of GoldAlthough Trump has announced the exclusion of smartphones and computers from the list of reciprocal tariffs, which has alleviated some market concerns, due to the uncertainty of the overall tariff policy, the gold price still remains above $3,200 after falling from the intraday all - time high of $3,245 on Monday.

Judging from the current trend of gold, we should still pay attention to the resistance level in the range of 3240 - 3245. In the short term, focus on the support level in the range of 3185 - 3190. Currently, the trend has not reversed. It is likely that the bulls are pulling back to accumulate strength and move in a volatile pattern. In terms of trading operations, it is advisable to mainly go long during pullbacks.

XAUUSD trading strategy

buy @ 3195-3205

sl 3180

tp 3218-3223

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

Gold Faces Resistance at $3,220 — Short Setup Targeting $3,180 SEarlier, gold prices surged to an all-time high of $3,245/oz, but soon encountered selling pressure, triggering a pullback that briefly broke below the $3,200 psychological level, touching intraday lows near $3,193. As of now, the price is consolidating around $3,210, with short-term momentum appearing to fade.

From a technical perspective:

$3,220 represents the right shoulder resistance of a potential short-term head-and-shoulders pattern.

$3,190 acts as a secondary support level.

The $3,180–$3,160 zone marks the lower bound of the intraday base on the hourly chart.

If price action remains capped below $3,220, there is a high likelihood of a downside retest toward the $3,180–$3,170 support band.

📌 Trading Strategy:

Initiate short positions near $3,220, with a protective stop above $3,228. Downside targets lie at $3,180–$3,170, in line with the hourly support range.

Gold: It may Fall below 3180 todayOver the weekend, Trump announced a pause on tariffs for popular consumer electronics, prompting gold to gap down to 3210 at today’s open;

✅ Our recommended short entries at 3230–3260 are already in profit;

New semiconductor tariff announcements are due during the U.S. session today — the key driver for gold’s next move;

Given the fragile U.S. political/economic backdrop, escalating tariff conflict is unlikely, increasing the chance of bearish impact on gold;

With gold already trading at a premium, any "tariff relief" narrative will likely trigger speculative sell-offs;

If you're holding short positions, consider being patient — avoid premature exits due to emotional reaction to minor pullbacks.

Maintain key short entry zone: 3230 – 3260;

Expect gold to test below 3180 if market sentiment shifts

US debt crisis forces tariff shiftFrom a technical perspective, gold encountered double top suppression at the 3245 line, and the price showed a fluctuating downward trend. The 4-hour moving average system began to weaken, and the hourly arc top pattern suggested short-term adjustment needs. However, the US dollar market is brewing a counterattack. If the joint intervention of the United States and Japan in the foreign exchange market triggers a turning point, gold and silver may reappear in violent fluctuations. Everyone needs to be alert to the resonance effect of policy mutations and the trend of the US dollar. At present, the upper resistance is at 3227-3233, and the lower support is at 3193-3188. The late trading operation is recommended to rebound shorting as the main, and callback long as the auxiliary.

Operation strategy 1: It is recommended to rebound 3215-3220 short, stop loss 3229, and the target is 3190-3175.

Operation strategy 2: It is recommended to pull back 3155-3150 long, stop loss 3142, and the target is 3190-3200 and break 3240.

Gold price hits new high, 3216 as the dividing lineGold prices rose strongly by nearly $276 in three trading days, and broke through historical highs one after another. There is no highest, only higher.

There are many similar points in the rise, which can be summarized into five points. The first is the continued rise in the early trading and breaking through the new high. The second is the 0.382 position of the space adjustment and the same amplitude switching of the space. The third is the wandering back and forth sweep of the European session. The fourth is the flash of good points. The fifth is to learn to stop when you are ahead.

Combining these five points to look at the market situation, the gold price continues to rise. Last Friday, it closed directly at the high of 3237-3238 area.

Today The price opened lower in the morning and touched 3210, and hit a new high of 3245.6. But this time it was different. After the high, it fell back. The rise was 30 US dollars, and the high fell back 25 US dollars. Basically, the rise was as much as the fall. In the afternoon, the resistance of 3238 was confirmed for the second time, and it fell 22 US dollars again to find 3216, which was basically recovered.

The overall trend will be more adjusted. The cooperation between the high fall and the bottom recovery will provide momentum for the start of a new round of market.

Specifically, the key points to note are:

1. The correction range of the market space is at least 30 US dollars, and the start is at least 60 US dollars. Instead of focusing on the high and low issues, we should grasp the present.

2. The daily and weekly lines are rising strongly, and the indicators and patterns are overloaded. At present, only the direction is referenced; the four-hour pattern opening situation, the lifeline position is slightly far away, 3154 is close to the support point 3151 area that was stepped back late at night, and together they become the spatial dividing line. The resistance above is 3270-3275 and 3299.

3. The hourly chart pattern closed and flattened. Today's white market has been running back and forth around the upper and lower rails. The current pattern further closed the range of 3242-3216. Break through this space and then look at the space switch, and then cooperate with the small cycle double-line upper rail position 3194 area. If the price breaks the early low of 3210, it will switch space downward.

4. As shown in the figure, the price last week accelerated the rise and broke through 3190, and last Friday, it repeatedly broke through the new high around 3210, first the new high of 3238 (looking for 3210), then the new high of 3245 (looking for 3210), and then the new high of 3245.6

Now the price is down to 3216, which is also the starting point of the Asian session

Using 3216 as the switching point, the current sweeping space is about 30 US dollars, and the subsequent price breakthrough will switch the space of 30 US dollars

Focus on 3276-3278 upwards and 3186-3188 downwards

And it is very interesting that the 0.382 position of the latest wave of rise is also at 3187-3188

So, here we need to focus on the key points , with 3246-3216 as the range sweep, breaking through and switching to 30 US dollars, focusing on the support of the 3186-3188 area, and then looking at the upward switching space

In addition, it is necessary to remember that the online position is the 3131-3129 area, the top and bottom conversion position, and it is also a strong resistance level that turns into a strong support level after breaking through. After breaking through, it directly rises unilaterally

In summary, for gold at the beginning of the week, we treat it with a biased adjustment and sweeping idea. Referring to this idea, we have deployed high altitude twice in the 3236-3238 area. As of press time, the price fell to 3216, and all short orders were closed at 3217, waiting for the next plan. Now the price has risen again to 3230, and it continues to sweep, rushing high and falling, bottoming out and rising, which is in line with the above-mentioned biased sweeping and adjustment method.

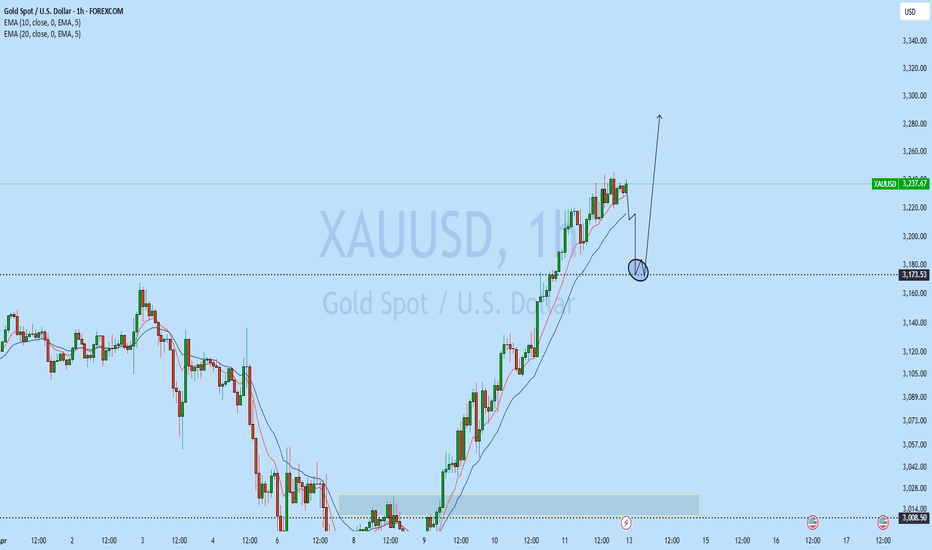

GOLD 2 Excepted Scenarios Very Clear , Which One You Prefer ? Here is my opinion on GOLD Chart , the price broke the highest Res , and continue to upside , so i think we have 2 ways in this pair right now , if the price go back to retest the broken res area and give us a good bullish Price Action we can enter a buy trade with smal lot size cuz the price at very high price , and if we have a clear closure below it , we can enter a sell trade with 500 pips target .

Gold Maintains Weekly Bullish Structure Amid PullbackGold Weekly Technical Outlook

Gold (XAU/USD) remains in a clear bullish trend on the weekly chart, currently trading around $3,230. After marking a new high, price action suggests a potential pullback—a healthy retracement that could set the stage for further gains.

Key Levels to Watch:

Current Price: $3,230

Retracement Zone:

First support at $3,100, a recent consolidation level

Deeper support between $2,950 – $2,900, aligned with prior breakout structure and strong demand from earlier in the trend

These levels are key for a potential bounce, as they mark high-probability zones for buyers to re-enter the market.

Upside Targets:

Short-term resistance: $3,280

Primary target (by mid-May): $3,400

This level aligns with the projected extension of the ascending structure and continuation of bullish momentum

Technical Outlook:

As long as gold holds above $2,900, the weekly bullish trend remains intact. A rebound from the retracement zone would likely lead to a renewed rally targeting the $3,400 region.

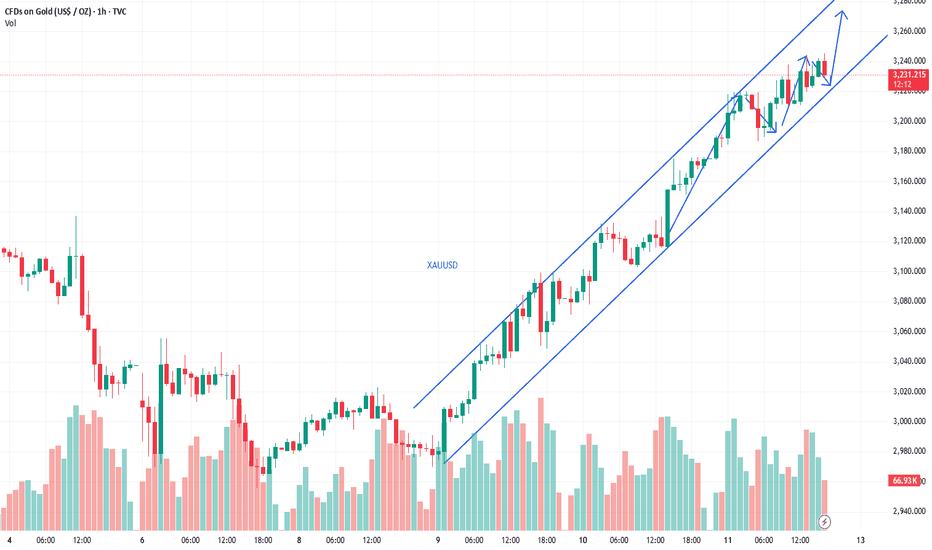

XAUUSD buy zone in 1h break of structureLast 3 days of past week XAUUSD had a strong uptrend with bullish momentum. From 1h perspective we have seen price had a bounce, and there is no significant break of structure on the lower timeframe, which means, as with the new market open, any break of structure is an opportunity to go long. Expecting to test the previous swing low is a zone where we can look for for potential entry to ride the trend.

Will wait for price action confirmation on market opening.

Gold Market Insight: Impact of U.S.-China Trade DevelopmentsGold has been consolidating within a rising wedge pattern since September 2023, facing resistance along a key trendline. Recent geopolitical developments, particularly the intensifying U.S.-China trade tensions, have acted as a catalyst for a significant breakout. The imposition of a 145% tariff on Chinese imports by the U.S., followed by China's retaliatory 125% tariff on U.S. goods, has heightened market uncertainties. These actions have led to a surge in safe-haven demand, propelling gold prices to record highs above $3,200 per ounce

In the past three trading sessions, gold has advanced over 2,500 pips, reflecting strong bullish momentum. However, to sustain this upward trajectory towards the $3,400 level, a period of consolidation or a corrective pullback may be necessary. Such a phase would allow for the absorption of selling pressure and the liquidation of short positions, providing a foundation for further gains.

The current market dynamics suggest that while buyers are in control, the presence of residual selling interest necessitates caution. A decisive breach above recent highs, accompanied by increased volume and momentum, would confirm the continuation of the bullish trend.\

Should the U.S. implement further tariff relaxations, particularly in sectors like technology, we may witness a retracement in gold prices towards the $3,000 level. This zone aligns with multiple Fair Value Gaps (FVGs) identified between $2,990 and $3,000, suggesting a potential area for price stabilization. Such policy shifts could alleviate some market uncertainties, reducing the demand for gold as a safe-haven asset.

Conversely, if trade negotiations between the U.S. and China remain stalled or further deteriorate, gold could resume its upward momentum, potentially targeting the $3,400 mark. This scenario would be driven by continued safe-haven demand amid escalating geopolitical uncertainties.

In summary, gold's near-term movements are contingent upon the progression of U.S.-China trade discussions. Traders should monitor these developments closely, as they will likely dictate gold's direction in the coming sessions.

Gold's main rise is not over yet, long is still the core strategHeading into next week, we maintain a bullish medium-term outlook on gold, with a continued preference for trend-following long positions.

Although short-term bearish attempts persist, the broader upward structure remains intact, with pullbacks presenting tactical buying opportunities.

Key support is observed around $3,200/oz, which serves as a strategic level for initiating low-risk long entries within the ongoing uptrend.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

XAUUSD Daily Analysis📈 XAUUSD Daily Analysis – 12/04/2025

🔥 Strong bullish move after a clear Market Structure Shift (MSS) and liquidity grab below the Previous Daily Low.

📉 A significant Fair Value Gap (FVG) remains between 3,100,000 and 3,175,000 – a potential pullback zone.

📍 Price could revisit this FVG before continuing the bullish momentum towards 3,300,000+.

🔹 PDL = Previous Daily Low

🔴 BAG = Breakaway Gap

🧠 Patience is key – wait for price reaction in the zone of interest.

📌 For educational purposes only – not financial advice.

💬 Drop your thoughts in the comments ⬇️

🔁 Like if you found this helpful!

XAUUSD Weekly Forecast: Probable Price Range and Trade PlanAs of April 12, 2025, gold (XAU/USD) has experienced significant volatility, reaching record highs amid global economic uncertainties. Here's an analysis based on the latest data:

📅 Economic Calendar Highlights (April 2025)

Key upcoming events that could influence gold prices include:

April 15: U.S. Consumer Price Index (CPI) release

April 17: U.S. Initial Jobless Claims

April 18: University of Michigan Consumer Sentiment Index

📈 XAU/USD Technical Overview

Trend & Momentum: Current Price: Approximately $3,236.21 per ounce.

Trend: Strong uptrend, with prices surging past the critical $3,200 mark.

RSI (14): 64.826 – approaching overbought territory, suggesting strong buying pressure.

MACD (12,26): Positive value of 21.21 – indicating bullish momentum.

ADX (14): 33.482 – confirming a strong trend.

Moving Averages: All major moving averages (MA5 to MA200) are signaling a 'Buy,' reinforcing the bullish outlook.

Support & Resistance Levels:

Immediate Resistance: $3,245.69 – recent intraday high.

Next Resistance Target: $3,300 – as projected by analysts amid ongoing market dynamics.

Immediate Support: $3,174.14 – recent intraday low.

Key Support Levels: $3,048 and $2,953 – potential pullback zones if a correction occurs.

Candlestick Patterns:

A “shooting star” pattern has emerged, which may signal a short-term reversal or consolidation phase.

Price Projection for April 14–18, 2025

Considering the current technical indicators and market conditions:

Projected Minimum Price: $3,180 – accounting for potential short-term corrections.

Projected Maximum Price: $3,280 – if bullish momentum continues without significant resistance.

XAUUSD will it break through 3200?At present, the price of gold is just one step away from its all-time high. Will it break through to a new high?

3,168 is a strong resistance point. Once this level is broken through, gold may have a chance to surpass the 3,200 mark.

Leave your opinions in the comments, and let's discuss them together.

Gold Shows Downward Correction, Short Strategy Timely EnteredIn the previous trading signal, it was advised to take profits around $3235. Based on the latest market analysis, gold prices are expected to experience a downward correction. Therefore, it is recommended to open short positions around $3230. Investors should closely monitor market trends and adjust stop-profit levels in response to price fluctuations to secure profits. Please remain flexible and responsive to market changes, capturing every trading opportunity with precision.

Gold Prices Decline, Short Strategy Successfully Captures ProfitCurrently, gold prices are showing a clear bearish trend, previously fluctuating around $3240. Based on market predictions, there is a potential for further downward movement in gold. A short position was suggested around the $3240 level, and as the market corrected, gold prices have indeed dropped, allowing short-positioned investors to lock in profits. Congratulations to those who successfully capitalized on this short opportunity and secured gains. Stay alert to market developments and carefully adjust your stop-profit levels to ensure the stability of your returns.

Gold's safe-haven demand surgesThis week, concerns over a global economic slowdown have swept across Wall Street, becoming the dominant market sentiment. In this context, U.S. President Trump's erratic messaging on tariff policies has triggered a panic sell-off in U.S. stocks, bonds, and the dollar, highlighting gold's position as a safe-haven asset. Gold prices have surged sharply, breaking through all previous resistance levels and maintaining an upward trend. Given the ongoing risk-off sentiment, the bullish momentum in gold remains strong, and the market may continue to trend higher in the near term.

In this market environment, it is recommended that investors take long positions near $3220 and consider taking profits around $3230 to fully capitalize on the current uptrend in gold. For additional trading signals, Please stay tuned.

Gold Breaks $3240, Shorting Opportunity EmergesGold prices have now surged to around $3240, continuing the recent strong upward momentum. Based on the previous trading signal, a long position at $3220 was suggested; however, due to the high volatility, many investors may have missed the opportunity to go long at that level. At this point, with prices approaching $3240, it may be an opportune time to establish short positions, with a target profit around $3225. Please note that this is just personal advice, and actual trading decisions should be made with attention to changes in key price levels.