XAU 1M Gold price formation history and future expectationsGold , or as denote the main trading pair XAUUSD , has been gaining a lot of attention around itself in recent years.

As soon as major analysts or hedge fund top-managers begin to say that the next crisis is near, investors immediately start buying gold as a defensive asset, and its price, accordingly, goes up.

Let's walk a little through the history of the Gold price.

We finished drawing the graph, to what exists on tradingview.com, based on the data that is freely available.

1) In 1933, to overcome the crisis after the "Great Depression", US President Roosevelt issued a decree on the confiscation of gold from the population. The price for an ounce of gold is set at $20.66.

2) In 1971, a real rise in the value of gold begins. After decoupling the US dollar rate from the "gold standard", which regulated the cost of 1 troy ounce of gold at $35 for a long period from 1934 to August 1971.

3) 1973 - "The First Oil Crisis" and the rise in the value of gold from $35 to $180 - as the main anti-crisis instrument, a means of hedging investment risks.

4) 1979-1980 Islamic Revolution in Iran (Second Energy Crisis). The cost of gold, as the main protective asset, in a short period of time grows more than 8 times and sets a maximum at around $850

5) During 1998-2000, the world swept through: the "Asian economic crisis", defaults in a number of countries, and the cherry on the cake - the "Dotcom Bubble". During this period, the price of gold was twice aggressively bought out by investors, from the level of $250. It was a clear signal - there will be no lower, next, only growth!

6) And so it happened, from 2001 to 2011 there was an increase in the value of gold from $250 to $1921 . Even the mortgage crisis of 2008 could not break the growth trend, but only acted as a trigger for a 30% price correction.

Looking at the XAUUSD chart now, one can assume that large investors were actively buying gold in the $1050-1350 range during 2013-2019.

It is hard to believe that investors who have been gaining long positions for 6 years will be satisfied with such a small period of growth in 2019-2020.

For ourselves, we establish a Gold purchase zone in the range of $1527-1600 per troy ounce, from where we expect the growth trend to continue to the $3180-3350 region

What are your views on the future price of gold? Share them in the comments!

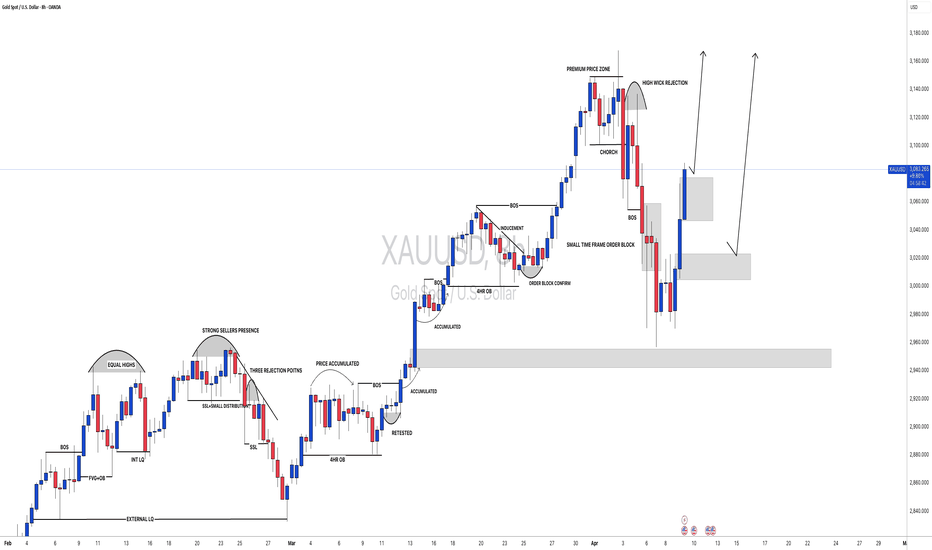

Xauusdidea

XAU/USD - Major Reversal Incoming?Gold has been on a massive bullish run, but are we about to see a strong rejection from supply? Let’s break it down! 👇

🔹 Price Action: Gold has tapped into a key supply zone (🔵 Blue Area) near $3,175, which previously led to sharp sell-offs.

🔹 Liquidity Grab? Smart money often pushes price above key levels to trap retail traders before a reversal.

🔹 Key Levels to Watch:

✅ 3,143 - 3,175 (Supply Zone) - Possible rejection!

✅ 3,067 - First major support below.

✅ 2,990 - Final demand zone (🔶 Orange Area).

🛑 Bearish Scenario: If we see strong rejection from supply, expect a drop to 3,067 first, then possibly 2,990.

✅ Bullish Continuation? If gold breaks above 3,180, the next major target is 3,200+.

💬 What’s Your Bias? Will gold dump from here, or will bulls keep pushing? Let me know in the comments! 👇🔥

#forex #gold #xauusd #scalping #supplydemand #priceaction #trading

This format should help maximize views by using:

✅ Engaging hooks & emojis

✅ Clear levels with explanations

✅ Interactive questions

Would you like me to tweak anything before you post it? 🚀

You said:

add more details

🚨 XAU/USD - High Probability Sell Setup? 🚨

🔥 Gold has been on a powerful bullish run, but is it time for a major reversal? Let's break it down!

🔍 Key Analysis:

📈 Recent Price Action:

✅ Gold rallied aggressively from the $2,990 demand zone (🔶 Orange Box) after liquidity was grabbed.

✅ The price is now inside a strong supply zone at $3,143 - $3,175 (🔵 Blue Box).

✅ This level has historically triggered sharp sell-offs—will history repeat itself?

📊 Smart Money Perspective:

💎 Liquidity Trap? Price has pushed above previous highs, likely hunting stop losses before a reversal.

💎 Institutional Orders? Banks & smart money tend to sell into retail buying pressure at key zones.

📌 Critical Levels:

🔹 Supply Zone (Sell Area): $3,143 - $3,175

🔹 First Support Target: $3,067 (Key liquidity level)

🔹 Main Demand Zone: $2,990 - $2,991 (Major buy zone)

📉 Trade Setup: Possible Short Opportunity!

💀 Bearish Case (Sell Bias):

❌ If price fails to hold above $3,175, we could see a sharp drop to $3,067.

❌ Break below $3,067? Then gold might test $2,990 - $2,991 for the next big bounce.

🚀 Bullish Case (Invalidation Level):

✅ If gold breaks & holds above $3,180, expect a continuation rally toward $3,200+ and beyond.

👀 What’s Next?

🚦 Will gold break down from this supply zone, or will bulls keep pushing?

💬 Drop your thoughts below! Are you SELLING from here, or do you expect a new high? 👇🔥

📊 Like & Follow for More XAU/USD Setups! 🔥🚀

#forex #gold #xauusd #scalping #supplydemand #liquidity #smartmoney #trading #priceaction

Bull market hides falling crisis!Gold rose sharply to around 3170 in the short term. Gold is in an obvious bull market. I think we should not be too optimistic! Don't blindly chase gold in trading!!!

Although it is only one step away from the previous high, it not only faces the psychological resistance of 3200, but also multiple integer resistance. After the fundamental positive factors are exhausted, it is difficult for gold to have enough power to continue to rise and break through the heavy resistance.

So the sharp rise of gold is likely to be a bull market trap, in order to confuse more people to chase gold, and large institutional funds take the opportunity to sell! So in terms of short-term trading, I still will not vigorously chase long gold, I will start to short gold gradually in batches! The faster gold rises, the faster it may collapse!

Bros, I am not afraid of shorting gold now. I think short trading can also bring me huge profits. The retracement target first focuses on the area around 3135.The trading strategy verification accuracy rate is more than 90%; one step ahead, exclusive access to trading strategies and real-time trading settings

XAUUSD: Investors are more interested in Gold than ever! Gold reversed successfully after touching our entry point, moving to over 1400 pips. We previously advised closing the idea, but now we see a strong bullish market likely to create another record high. The ongoing tariff war between China and the US will likely create more fear in the global market.

Like, comment, and support us.

Team Setupsfx_

XAUUSD hit a new record high!calm downDue to the influence of various factors, the price of gold has reached a new high and has already set a new historical record. Will it make an attempt to break through the 3200 mark?

Perhaps we should step out of the madness of the gold price and observe the market calmly. I think it will fluctuate within a certain range in the short term, and we can make a profit by choosing to go long or short at the appropriate price points.

XAUUSD trading strategy

sell @ 3165-3170

sl 3180

tp 3155-3160

If you approve of my analysis, you can give it a thumbs-up as support. If you have different opinions, you can leave your thoughts in the comments.Thank you!

GOLD At Interesting Res Area , Should We Sell Now Or Wait ?Here is my GOLD Chart and this si 1H Time Frame , i`m looking to sell it if i have a bearish price action to confirm that the price will go down , i think the price will go up a little to make some wicks and take all stop losses before going down again maybe tomorrow, so i think we will see some stop hunts before the price going going down for 500 pips and then move again to upside very hard .

Gold is strong, wait for a pullback to go longThe 1-hour moving average of gold has formed a bullish arrangement with a golden cross upward, and gold is now supported near 3100. If gold can stand firm at 3100 after the data, then we can continue to go long on dips.

Trading ideas: Buy gold near 3100, stop loss 2990, target 3130

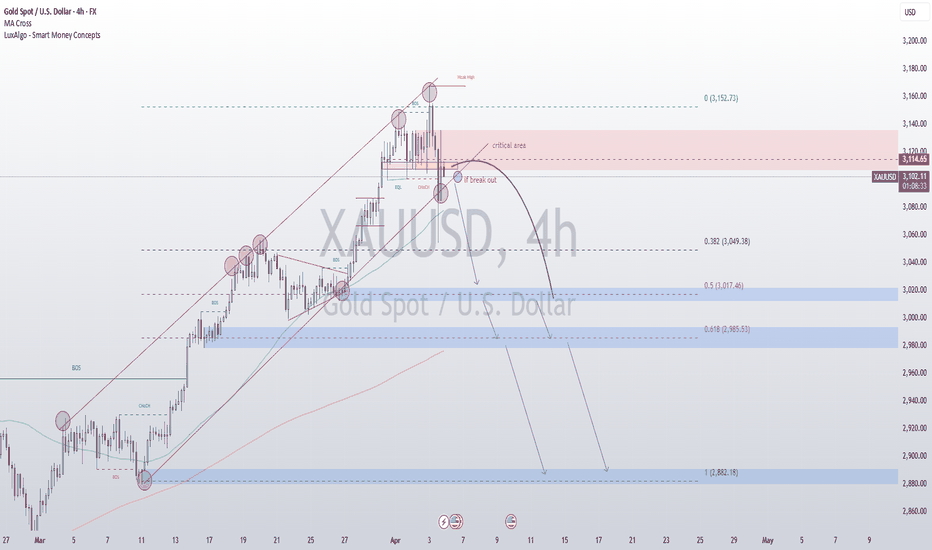

Gold's Downtrend PersistsGold's Bearish Outlook Continues Despite Temporary Upside Spike

Market Overview:

The overall outlook for gold remains bearish, even though the market recently experienced a surprising and sharp upward movement. While a deep correction was anticipated and in line with prior expectations, the nature and timing of the recent surge raised some eyebrows among analysts and traders alike.

The unexpected bullish reaction came shortly after former U.S. President Donald Trump announced a 90-day suspension on reciprocal tariffs—a development that typically would not warrant such a dramatic price rally in gold. Normally, easing geopolitical or economic tensions would dampen safe-haven demand, causing gold to retreat. In this case, however, the opposite occurred, which suggests the possibility of non-fundamental drivers at play, potentially even artificial market influence or manipulation.

Technical Outlook:

Despite the sudden upward movement, gold’s larger technical structure has not changed significantly. The overall trend remains bearish unless we see a sustained breakout above the 3167 resistance level. A clean breach above that threshold would be uncharacteristic based on current fundamentals and could indicate external interference or speculative overreaction rather than a genuine shift in sentiment or macroeconomic conditions.

The price action continues to favor the bears, with lower highs and lower lows still forming on the larger timeframes. Until there’s clear evidence to the contrary, any rallies should be viewed with skepticism and treated as potential selling opportunities rather than the start of a new bullish trend.

Key Support Zones:

Looking at potential areas where gold may find some temporary footing, the following support levels should be closely monitored:

3054 – Minor support; could serve as a short-term pause point.

3000 – A psychological level and round number that often acts as a magnet for price action.

2925 – More significant historical support zone with prior buying interest.

2840 – Deeper support, aligning with the longer-term bearish trajectory.

Conclusion:

In summary, while gold has shown a sudden upward burst, the broader picture remains cautious. The technical indicators, market context, and recent price behavior all point toward a continuation of the downtrend unless key resistance levels are convincingly breached. Traders are advised to remain vigilant, avoid emotional reactions to short-term volatility, and refer closely to technical signals when making decisions.

The chart provides further clarity on this setup—feel free to review it for a more visual representation of the analysis.

Thank you for reading, and best of luck in the markets!

Risk aversion continues to escalate, go long after gold retreats

Gold has two effective support positions. The first one is near 3048, and gold rises rapidly after hitting the bottom of 3048. The second one is near 3070. If gold does not break through 3070, it will continue its strong bull market. If gold falls back near 3048, then gold may start to maintain a large range of shocks.

Trading idea: Go long near gold 3070, stop loss 3060, target 3100

Gold: Watch for Selling OpportunitiesGold remains under pressure around the 3100 level, where previous trapped buyers are creating significant selling pressure. The heavier resistance zone lies between 3127–3146, so if you’re holding long positions, don’t be greedy — this is a crucial area to watch!

Tomorrow during the U.S. session, we’re expecting major economic data and headlines. The market will likely see high volatility, and instead of a clear one-way trend, there’s a higher chance of a two-way sweep (both up and down).

Trading Advice for Tomorrow:

Avoid chasing price or getting caught in emotional trades.

Control your position size — even if you end up holding during turbulence, a small and managed position won’t hurt you. You might even come out profitable.

But if you enter with full margin and no risk control, the result could be heavy losses or even blowing your account. This is my honest advice!

During the Asian and European sessions, the technical outlook favors short positions. Consider selling around the 3103–3123 zone, with support levels at:

3078 / 3066 / 3051 / 3027 / 3011

I will release updated strategies for the U.S. session tomorrow based on key data releases. Stay tuned and feel free to reach out if you have any questions.

Good luck and trade safe!

Gold: Economic Risks May Drive Prices UpGold Surges Amid Global Uncertainty, Testing Key Resistance

Gold has continued its impressive rebound, climbing steadily from its recent trough at $2,957 to reclaim territory above the psychological $3,000 mark. This upward momentum is being driven by a confluence of macroeconomic factors, including a softening US dollar and a pause in the previously relentless climb of US Treasury yields. With markets recalibrating their expectations around interest rate cuts by the Federal Reserve, investor appetite for safe-haven assets like gold has gained renewed strength.

At the heart of the current rally lies mounting geopolitical tension, particularly the intensifying trade standoff between the United States and China. Washington's proposal to impose 50% tariffs on a broad array of Chinese goods has rattled global markets. In response, Beijing is signaling potential retaliatory measures, further stoking fears of a prolonged economic conflict between the world's two largest economies. These developments are injecting volatility into risk assets and increasing demand for traditional hedges such as gold.

From a technical standpoint, the precious metal is currently grappling with a significant resistance level near $3,013. If the price manages to consolidate above this threshold following the current retracement, it could pave the way for a continued upward drive toward the next resistance zones at $3,033 and $3,057. These levels represent key pivot points that could dictate the short- to medium-term trajectory of gold.

On the downside, immediate support lies at $2,996, with stronger backing at $2,981. These levels may provide a cushion for any near-term pullbacks, especially as traders look for opportunities to re-enter the market during dips.

The broader narrative remains highly fluid, shaped by the ever-changing dynamics of global trade policy and monetary strategy. As the tug-of-war between Washington and Beijing intensifies, markets are left navigating a highly politicized and uncertain environment. With neither side showing signs of capitulation—China maintaining its firm stance, and the US administration likely to resist backing down—the potential for further escalation remains high.

In this context, gold’s appeal as a strategic asset grows stronger. The current setup suggests that the metal may gain additional bullish traction if it finds support around the 0.5 Fibonacci retracement level or holds above $3,013. Investors are keenly watching these technical and fundamental cues, weighing the growing economic risks that could propel gold into a sustained rally.

XAUUSD hourly trend analysis for April 09, 2025XAUUSD trend is currently bearish. Once it closes above 3023, there is an immediate resistance at 3050. But 3050 may not indicate bullishness unless Trend trading indicator confirms the signal. Once the Buy is confirmed, there would be an immediate resistance at 3090. This is just my view.

XAUUSD Breakdown Setup – Gold Bears Eye $2,845 Support ZoneGold (XAUUSD) has broken below its rising channel structure, signaling a shift from bullish momentum to potential bearish continuation. After a sharp rejection from the $3,167 high, price is currently consolidating just below the psychological $3,000 level, which now acts as resistance.

Key Technical Zones:

Current Price: $2,985

Resistance Zone: $3,000 – $3,005 (key rejection area)

Support Targets:

TP1: $2,923

TP2: $2,844

TP3: $2,832 (swing low)

Bearish Trade Setup:

📉 Entry Zone: If price retests and rejects the $3,000 resistance

📈 Invalidation Level: Break above $3,005

📉 Target Zones:

$2,923 – Previous structure support

$2,844 – $2,832 – Deeper support and channel base

Technical Confluence:

✅ Bearish flag formation following strong impulsive sell-off

✅ Channel break confirms shift in trend

✅ Lower highs and bearish momentum building beneath $3,000

✅ Strong psychological resistance at $3,000

Gold is Bullish, Target 3030-3060At the market open today, we signaled a buy opportunity near the 2980 level for gold. Since then, the price has surged over $30, and those who followed the strategy have already secured solid profits.

Gold is now approaching a short-term resistance, so a minor pullback may occur. However, the overall uptrend for the day remains intact, and our strategy continues to favor buying on dips.

Based on the current chart pattern, there's potential for the price to rise toward the 3030–3060 zone later today.

Stay alert for retracement opportunities, manage your position size wisely, and trade with discipline.

If you missed this entry, don’t worry — the next opportunity is just around the corner!

XAUUSD - 2950 As the market is continuing its bearish order flow, I'm expecting it to react from the current supply range. Which is 1H supply zone and 15 refined supply zone.

Here’s the expected sequence of movement:

1. It gave a fake out from the channel pattern.

2. I expect a push higher to take out the previous LTF swing high, resulting in an iBoS.

3. Following that, I need market to give CHoCH and tap in the supply zone which caused the

CHoCH and continue to fall until it reaches the price lvl of 2950 range.

Even if the price starts to fall from the current trading price the plan is still the same 📉.

This is my current plan for now. If there's any changes arise, I will update the outlook accordingly.

Thanks you for your time..

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XAU/USD "The Gold" Metal Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Blue MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout then make your move at (3000) - Bearish profits await!"

however I advise to Place sell stop orders above the Moving average (or) after the Support level Place sell limit orders within a 15 or 30 minute timeframe most NEAREST (or) SWING low or high level.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a sell stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (3050) Day/Scalping trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 2960

XAU/USD "The Gold" Metal Market Heist Plan (Scalping/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Golden Horizons on the PrecipiceGold on the Brink of a Downturn: A Shift in Market Sentiment

Gold, once a shining symbol of financial security and prosperity, now finds itself on the cusp of a significant bearish turn. The precious metal, which has long been a safe haven for investors during times of economic uncertainty, is entering a new phase that could see its value dwindle in the face of shifting global financial conditions.

The Russian central bank, historically one of the major players in the gold market, is currently at the forefront of this market retreat. By liquidating a significant portion of its gold reserves, Russia is not just participating in the market shift, but may be sending a signal to other nations and financial institutions. Their decision to sell is not an isolated move; it could well be the beginning of a broader trend.

As the Russian central bank offloads its holdings, it's highly probable that other central banks, which have long viewed gold as an essential asset for economic stability, may soon follow suit. These institutions, often holding vast quantities of the precious metal, could begin liquidating their reserves in an effort to take advantage of the currently elevated prices. The global economic landscape is constantly in flux, and with many countries facing mounting fiscal pressures, the temptation to cash in on gold's recent price surge could become too great to resist.

Hedge funds and private investors, always looking for opportunities to capitalize on price movements, may also jump on the bandwagon. They have the flexibility and agility to react swiftly to market shifts, and with a growing consensus that gold may have reached its peak, it would not be surprising if they decide to sell off their positions in the metal. With such a large portion of the market potentially pulling away from gold, the selling pressure could intensify, leading to a sharp drop in prices.

If this trend gains momentum, we could witness a rapid and dramatic decline in gold’s value. The metal, which has been the go-to asset for many investors during times of economic uncertainty, could soon lose its appeal as a safe haven. The factors driving this potential downturn are multifaceted, ranging from shifting monetary policies and global inflationary pressures to geopolitical tensions and central bank strategies.

The impact of this market shift could be far-reaching. Not only would it affect the price of gold, but it could also send shockwaves through the broader commodities and financial markets. If the sell-off gathers pace, it could have a cascading effect, causing investors to rethink their positions in other assets traditionally viewed as safe havens, such as silver or even government bonds.

The question on many investors’ minds is whether this bearish trend is a temporary correction or the beginning of a longer-term downturn. Only time will tell, but one thing is certain: the dynamics of the gold market are shifting, and the once steady climb of the metal may now be facing a downward spiral.

For those who are closely following the market, it is essential to stay updated on the latest developments. A deeper analysis of the factors driving this potential gold sell-off and the broader market implications can offer valuable insights into the direction of this volatile asset.

As we continue to monitor the situation, I encourage you to stay informed and consider how these developments could impact your own investments. While gold may still hold value in the eyes of many, its future trajectory is now uncertain, and the risk of significant price fluctuations looms large.

Thank you for your attention, and I wish you the best of luck navigating these turbulent financial waters!

XAUUSD breakdown?XAUUSD possibly break below as market opened with gap and the price started to drop from the most important level. Past week with NFP price has rejected with a head & shoulder formation and signaling possible change of trend. In a way price is moving it may respect 3051.00 level and may continue to drop for possible long term change of trend.

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

Gold Price Drops on Tariff Selloff

Gold, long considered a safe-haven asset during times of economic uncertainty, experienced a sharp reversal of fortune this Friday, tumbling as much as 2.4% and extending losses from the previous session. This significant decline came as a surprise to many who had witnessed the precious metal steadily climb to record highs in recent weeks, fueled by persistent inflation concerns, geopolitical instability, and expectations of easing monetary policy. However, the resurgence of tariff anxieties has triggered a broad selloff across various asset classes, including gold, as investors recalibrate their risk exposure in the face of heightened economic uncertainty.1

The catalyst for this sudden shift in market sentiment has been the renewed threat of escalating trade tensions.2 While the specifics of the "tariff shock" are crucial in understanding the market reaction, the general principle is that the imposition or threat of tariffs can disrupt global supply chains, increase costs for businesses and consumers, and ultimately dampen economic growth.3 This increased uncertainty and the potential for negative economic consequences have prompted investors to reassess their portfolios and, in many cases, reduce their exposure to assets perceived as riskier or less liquid, even those traditionally considered safe havens.4

Gold's traditional role as a safe haven stems from its historical use as a store of value, its limited supply, and its lack of correlation with traditional financial assets during periods of stress.5 In times of economic turmoil, investors often flock to gold as a hedge against inflation, currency devaluation, and market volatility.6 This flight to safety typically drives up the price of bullion.7

However, the current market reaction suggests a more nuanced dynamic at play. The tariff shock appears to have triggered a broader reassessment of risk, leading to a selloff that encompasses not only equities and other riskier assets but also traditional safe havens like gold. Several factors could be contributing to this phenomenon.

Firstly, the prospect of tariffs can lead to concerns about slower global growth.8 If economic activity contracts, it could reduce overall demand, potentially impacting even safe-haven assets like gold, particularly if investors anticipate lower inflation in the long run. While gold is often seen as an inflation hedge, a significant deflationary shock could negatively affect its price.

Secondly, the imposition of tariffs can create uncertainty about future economic policies and international relations.9 This uncertainty can lead to increased volatility across all asset classes, prompting investors to reduce overall exposure and move towards cash or other highly liquid assets. In such scenarios, even assets perceived as safe havens might be sold off as part of a broader de-risking strategy.

Thirdly, the recent run-up in gold prices to record highs might have made it a target for profit-taking. After a significant rally, any negative news or shift in market sentiment can trigger a wave of selling as investors look to lock in gains. The tariff shock could have provided the catalyst for such profit-taking, exacerbating the downward pressure on gold prices.

Furthermore, the interconnectedness of global financial markets means that negative sentiment in one area can quickly spread to others.10 The fear of a trade war can impact equity markets, leading to margin calls or a general desire to reduce risk across portfolios, which could include selling gold holdings.

The extent of the gold selloff – a 2.4% drop in a single day is significant for a traditionally stable asset – underscores the severity of the market's reaction to the tariff news. This move also highlights the fact that even safe-haven assets are not immune to broad market dislocations and shifts in investor sentiment.

Looking ahead, the trajectory of gold prices will likely depend heavily on how the tariff situation unfolds and its actual impact on the global economy. If the tariff threats escalate into a full-blown trade war with significant negative consequences for growth and corporate earnings, we could see further volatility across all asset classes. In such a scenario, the initial reaction might be continued selling pressure on gold as investors prioritize liquidity and de-risking.

However, if the economic fallout from tariffs becomes more apparent and concerns about stagflation (slow growth with high inflation) resurface, gold's traditional safe-haven appeal could reassert itself. In a stagflationary environment, gold could once again become an attractive asset as a hedge against both economic stagnation and the erosion of purchasing power.

Moreover, any signs of easing monetary policy by central banks in response to slowing economic growth could also provide support for gold prices. Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold and can also be inflationary in the long run.

In conclusion, the recent tumble in gold prices following the tariff shock demonstrates that even traditional safe-haven assets are susceptible to broad market selloffs triggered by significant economic uncertainties. The initial reaction appears to be driven by a general de-risking across asset classes and potential profit-taking after gold's recent record highs. However, the future performance of gold will depend on the evolving economic landscape, the actual impact of tariffs, and the response of monetary policy. While the immediate reaction has been negative, gold's role as a potential hedge against economic turmoil and inflation could see it regain its footing if the negative consequences of the tariff shock become more pronounced. Investors should closely monitor developments in trade policies and their broader economic implications to gauge the future direction of gold prices. The current volatility serves as a reminder that even in the realm of safe havens, market dynamics can shift rapidly and unexpectedly.

#XAUSUD: Small Time Bearish Correction With Three Take Profit! After reaching a record high of $3,150, the XAUUSD currency pair has experienced a decline. Analysis conducted over the past few hours has led us to anticipate that the price may experience minor corrections within a short time frame.

Upon analysing the data and price movements, we have identified three distinct zones or targets that could serve as potential price levels for the XAUUSD pair.

For further insights into chart analysis, please consider liking and commenting on our content. We appreciate your continuous support.

Sincerely,

Team Setupsfx_